(UNAUDITED IFRS FIGURES)

GOOD RESULTS GROWTH WITHIN A MACROECONOMIC

ENVIRONMENT THAT REMAINS LACKLUSTER

ANNUAL OBJECTIVES CONFIRMED

* DOWN 1.7% AT CONSTANT SCOPE AND

EXCHANGE RATES TO €6,089 MILLION

* UP 1.6%1 EXCLUDING

IMPACT OF ENERGY PRICES (-€90 MILLION) & CONSTRUCTION (-€117

MILLION)

- EBITDA INCREASED 5.0%1

TO €840 MILLION

- COST REDUCTIONS AMOUNTED TO €58

MILLION

- CURRENT EBIT IMPROVED

7.5%1 TO €413 MILLION

- CURRENT NET INCOME AMOUNTED TO €173

MILLION, AN INCREASE OF 16% EXCLUDING CAPITAL GAINS

- NET FINANCIAL DEBT DECLINED €705

MILLION COMPARED TO MARCH END 2015 TO €8,265 MILLION

Regulatory News:

Antoine Frérot, Veolia’s Chairman and Chief Executive Officer

declared: “The 2016 fiscal year has started out on a

satisfactory note with 5% growth in EBITDA and 16% growth in our

current net income excluding capital gains. As evidence of improved

operational management, our margins have also continued to improve.

Revenue is down in the first quarter, mainly due to the impact of

lower energy prices, but also related to our intent to accelerate

the recovery in our construction business. Excluding these two

elements, which had little impact on our profits, revenue increased

by 1.6%. This good start to the year allows us to be confident in

the achievement of our full year objectives.”

- Revenue declined 3.4% (-1.7% at

constant consolidation scope and exchange rates) from €6,305

million to €6,089 million in the first quarter of 2016. Excluding

construction revenue and the impact of the decline in energy

prices, revenue increased by 1.6% at constant consolidation scope

and exchange rates.

Exchange rate movements negatively impacted first quarter

revenue by €84 million, or -1.3%. The decline in energy prices also

weighed on revenue to the tune of €90 million (-1.4%), while lower

construction activity negatively impacted revenue by €117 million

(or -1.9%).

- In France, revenue was stable in Water,

with flat volumes compared to the prior year and indexation of

+0.2%. Regarding commercial development, the start of the Lille

contract offset the impact of contract renegotiations. In the Waste

business, revenue declined by 1%. The decline in scrap metal

activity was partially offset by good performance in treatment

activities (incineration and landfill). Overall, the France segment

recorded quasi-stable revenue performance of -0.5% at constant

consolidation scope compared to the prior year quarter.

- Europe excluding France revenue

declined slightly (-0.7% at constant consolidation scope and

exchange rates) but increased 1.2% excluding the impact of lower

energy prices and construction revenue. Central Europe revenue was

stable, with a slightly favorable weather impact compared to 1Q

2015 for heating, good water volumes, and offset by the decline in

energy prices as well as lower electricity volumes sold. Revenue in

the United Kingdom was lower by 2.2% due to lower landfilled

volumes, partially offset by the startup of the new incinerator in

Leeds. Revenue in Germany was stable (-0.7%) with higher revenue in

the Waste business (+4.3%), offset by the impact of lower energy

prices.

- Revenue in the Rest of the World

segment declined by 2.5% at constant consolidation scope and

exchange rates. Excluding the impact of energy prices and

construction revenue, segment revenue increased 1.5%. Revenue in

the United States fell 14.7%, penalized by a very mild winter and

lower energy prices, as well as a challenging start to the year in

industrial services. At constant consolidation scope and exchange

rates, Latin America revenue grew 5.4%, Asia grew 2.6% and revenue

in Africa and the Middle East increased 8.5% in particular due to

higher electricity demand in Gabon.

- The Global Businesses segment revenue

fell 4.3% at constant consolidation scope and exchange rates, with

strong growth in hazardous waste (+11.3% in the SARPI business),

and a decline in engineering revenue (-6.4%) due to lower

construction revenue related to the Sadara and Az Zour North

contracts, as well as the cancellation of the Shell Carmon Creek

project, and lastly due to lower revenue in the Sade business

(-6.8%) due to a delay in international projects.

- By business, and at constant

consolidation scope and exchange rates, Water revenue declined

2.2%, with on one hand good activity in the concessions business

and on the other hand a decline in revenue from construction

activities. The Waste business recorded satisfactory revenue, with

growth of 1.2%, while Energy revenue declined by 4.7% mainly due to

the decline in energy prices.

- Solid EBITDA improvement driven by

cost reductions, with an increase of 3.0% (+5.0% at constant

consolidation scope and exchange rates) from €816 million to €840

million in 1Q 2016.

- The unfavorable variation in exchange

rates negatively impacted EBITDA growth by 1.4% (€11 million).

- Cost savings contributed to EBITDA

growth in the amount of €53 million, in particular due to

purchasing savings and operational efficiency.

- By segment: in France, EBITDA declined

in the Water business given weak tariff indexation and further

provisions related to the Brottes Law, as well as in Waste due to

non recurring favorable items in 1Q 2015. EBITDA in the Rest of

Europe segment increased significantly due to cost savings and good

performance in Central and Eastern Europe. Rest of the World EBITDA

declined due to the impact of the mild winter in the US, partially

offset by good performance in Asia.

- Current EBIT increased 4.2% (+7.5%

at constant consolidation scope and exchange rates) to €413 million

in 1Q 2016 compared with €397 million in the prior year period.

- Growth in current EBIT was driven by

the increase in EBITDA. The contribution of joint ventures and

associates amounted to €17.4 million in 1Q 2016 compared with €22.4

million in the prior year period due to diverse scope and currency

effects.

- Current net income amounted to €173

million in 1Q 2016 a decrease of 18% compared to €212 million in 1Q

2015. Excluding capital gains, current net income increased

16%.

- Current net income in 1Q 2015 included

€65 million in financial capital gains compared with only €3

million in 1Q 2016. Excluding these capital gains, growth in

current net income was 16%. Current net income in 1Q 2016 includes

€41 million in costs related to the application of IFRIC 21

compared with €43 million in 1Q 2015.

- Net financial debt significantly

improved to €8,265 million as of March 31, 2016, compared with

€8,970 million as of March 31, 2015.

- Net financial debt amounted to €8,265

million, a significant decline compared to net financial debt at

March 31, 2015 due to strong free cash flow generation over the

prior 12 months. Net financial debt increased slightly from

December 31, 2015 levels (€8,170 million), due to seasonality in

working capital requirements, and includes a favorable exchange

rate impact of €252 million.

Following the satisfactory start to 2016, the Group confirms its

outlook.

- 2016 Objectives*

- Revenue and EBITDA growth

- Net Free Cash Flow before divestments

and acquisitions of at least €650 million

- Current net income of at least €600

million

*at constant exchange rates

- Two main objectives for 2018

- Current net income greater than €800

million

- Net Free Cash Flow of €1 billion

- 2016-2018 Outlook

- The Group expects a progressive

increase in revenue growth to achieve average annual revenue growth

between 2% and 3%, based on the current economic environment

- Average annual EBITDA growth of around

5% per year

- More than €600 million in cost savings

over the period

Veolia group is the global leader in optimized resource

management. With over 174,000 employees worldwide, the Group

designs and provides water, waste and energy management solutions

that contribute to the sustainable development of communities and

industries. Through its three complementary business activities,

Veolia helps to develop access to resources, preserve available

resources, and to replenish them. In 2014, the group Veolia

supplied 96 million people with drinking water and 60 million

people with wastewater service, produced 52 million megawatt hours

of energy and converted 31 million metric tons of waste into new

materials and energy. Veolia Environnement (listed on Paris

Euronext: VIE) recorded consolidated revenue of €25.0 billion in

2015. www.veolia.com

Important disclaimerVeolia

Environnement is a corporation listed on the Euronext Paris. This

press release contains “forward-looking statements” within the

meaning of the provisions of the U.S. Private Securities Litigation

Reform Act of 1995. Such forward-looking statements are not

guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are outside our

control, including but not limited to: the risk of suffering

reduced profits or losses as a result of intense competition, the

risk that changes in energy prices and taxes may reduce Veolia

Environnement’s profits, the risk that governmental authorities

could terminate or modify some of Veolia Environnement’s contracts,

the risk that acquisitions may not provide the benefits that Veolia

Environnement hopes to achieve, the risks related to customary

provisions of divesture transactions, the risk that Veolia

Environnement’s compliance with environmental laws may become more

costly in the future, the risk that currency exchange rate

fluctuations may negatively affect Veolia Environnement’s financial

results and the price of its shares, the risk that Veolia

Environnement may incur environmental liability in connection with

its past, present and future operations, as well as the other risks

described in the documents Veolia Environnement has filed with the

Autorités des Marchés Financiers (French securities regulator).

Veolia Environnement does not undertake, nor does it have, any

obligation to provide updates or to revise any forward looking

statements. Investors and security holders may obtain from Veolia

Environnement a free copy of documents it filed (www.veolia.com)

with the Autorités des Marchés Financiers.

This document contains "non‐GAAP financial measures". These

"non‐GAAP financial measures" might be defined differently from

similar financial measures made public by other groups and should

not replace GAAP financial measures prepared pursuant to IFRS

standards.

QUARTERLY FINANCIAL INFORMATION FOR THE

PERIOD ENDING MARCH 31, 2016

A] KEY

FIGURES

Group results break down as follows:

(in € million)

Three Three

months months Δ at

constant

ended ended Δ consolidation

March 31, March

31, scope &

2016 2015

exchange rates Revenue 6,089 6,305

-3.4% -1.7% EBITDA 840 816 3.0% 5.0% EBITDA margin

13.8% 12.9% +90bp Current EBIT (1)

413 397 4.2% 7.5% Current net income –

Group share 173 212 -18.4% Current net income

– Group share, excluding capital gains and losses on financial

disposals net of tax 170 147 16.0% Industrial

investments 246 267 Net free cash flow (2)

(343) (317) Net financial debt 8,265 8,970

(1) Including the share of current net income of joint ventures

and associates viewed as core Company activities.

(2) Net free cash flow corresponds to free cash flow from

continuing operations, and is equal to the sum of EBITDA, dividends

received, operating cash flow from financing activities, and

changes in operating working capital requirements, less net

industrial investments, current cash financial expense, cash taxes

paid, restructuring charges and renewal expenses.

B] INCOME STATEMENT

1. Revenue

Group consolidated revenue for the three months ended March 31,

2016 was €6,089 million, compared with €6,305 million for the same

period in 2015, down -3.4% at current consolidation scope and

exchange rates and -1.7% at constant consolidation scope and

exchange rates (-2.1% at constant exchange rates).

Excluding the Construction business and the impact of energy

prices, revenue increased +1.6% at constant consolidation scope and

exchange rates.

The foreign exchange impact on

revenue totaled -€84.1 million (-1.3% of revenue) and mainly

reflects fluctuations in the value of the euro against the

Argentine peso (-€21.0 million), the pound sterling (-€19.0

million), the Australian dollar (-€15.7 million), the US dollar

(+€12 million), the Polish zloty (-€12.5 million) and the Brazilian

real (-€7.6 million).

The consolidation scope impact was

largely due to transactions performed in 2015: divestiture of the

Group’s activities in Israel (-€36.0 million), acquisition of

Altergis in the Energy sector in France (+€14.5 million) and the

divestiture of Waste activities in Poland (-€4.5 million).

The decrease in Construction

revenue (-1.9%) was mainly due to application of a more selective

growth strategy and the end of major projects at Veolia Water

Technologies and lackluster activity levels in SADE.

Group revenue was affected by the decline in energy prices (-1.4%), primarily in the United

States and to a lesser extent in Germany and Central Europe.

The positive commercial momentum (Commerce/Volumes impact) of +€98 million was due

to:

- favorable weather conditions in Central

Europe, tempered by a negative weather effect in the United

States;

- the limited negative impact of

contractual renegotiations in the Water business in France;

- the commissioning of the Leeds

incinerator in the United Kingdom and of two cogeneration plants in

Hungary;

- continued strong international

performance (primarily in Asia and the Africa / Middle East

region);

- the good momentum of hazardous waste

activities.

1.1 Revenue by segment

Revenue (in € million)

Three

months Three months Foreign

ended March

ended March Change Internal External exchange

31,

2016 31, 2015 2015/2016 growth

growth impact

France 1,322.9 1,320.1

0.2% -0.5% 0.7% -

Europe

excluding France 2,265.3 2,312.0

-2.0% -0.7% -0.2% -1.1%

Rest of the

World 1,426.1 1,509.6 -5.5%

-2.5% - -3.1%

Global businesses

1,067.7 1,111.9 -4.0% -4.3% 1.3%

-1.0%

Other 6.8 51.2 -86.7% 2.2%

-88.8% -

Group 6,088.8

6,304.8 -3.4% -1.7%

-0.4% -1.3%

Revenue in France for the three months ended March 31, 2016 was

€1,322.9 million, down -0.5% at constant consolidation scope

compared to the prior year period.

- Water business revenue was stable at

constant consolidation scope compared to the first three months of

2015. The positive commercial impact of new contracts (particularly

the Ileo contract in Lille) and tariff indexation of +0.2% were

mitigated by unfavorable contractual renegotiations and reduced

Construction activity. Volumes sold for the three months ended

March 31, 2016 were stable vs. the prior year period;

- Waste business revenue slipped -1.0% at

constant consolidation scope. Despite the good level of

incineration activities and landfill volumes, revenue was impacted

by a drop in municipal collection volumes and a decrease in

recycled material prices and volumes (plastic and ferrous and

non-ferrous scrap metal).

Revenue in the Europe excluding France segment for the three

months ended March 31, 2016 amounted to €2,265.3 million, down

-2.0% at current consolidation scope and exchange rates and -0.7%

at constant consolidation scope and exchange rates compared to the

prior year period.

Excluding the impact of Construction activities and energy

prices, revenue increased +1.2% at constant consolidation scope and

exchange rates.

This overall decrease breaks down as follows:

- Central Europe: revenue was stable. The

increase in water volumes invoiced in the Czech Republic, the

commissioning of two cogeneration plants in Hungary and favorable

weather conditions in Lithuania and Poland were offset by the drop

in electricity sales volumes and the decline in heating and

electricity prices.

- United Kingdom and Ireland: revenue

declined 2.3% at constant consolidation scope and exchange rates.

Revenue was impacted by a decline in landfill volumes, despite the

growth of commercial collection activities and the commissioning of

the Leeds incinerator.

- Northern Europe: revenue increased

+2.7% at constant consolidation scope and exchange rates, despite a

slight downturn in Germany (-0.7% at constant consolidation scope)

in line with the decrease in the price of gas and electricity,

partially offset by an increase in gas volumes sold. The other

Northern Europe countries reported an increase in revenue, driven

by growth in recycling activities, construction activities in

Benelux and new contracts in Sweden.

- Italy: Energy business revenue fell

7.9% at constant consolidation scope due to the restructuring of

the commercial portfolio.

- Rest of the

World

Revenue in the Rest of the World segment for the three months

ended March 31, 2016 was €1,426.1 million, down 5.5% at current

consolidation scope and exchange rates (-2.5% at constant

consolidation scope and exchange rates) compared to the prior year

period. Excluding the impact of Construction activities and energy

prices, Rest of the World segment revenue increased +1.5% at

constant consolidation scope and exchange rates.

Rest of the World revenue reflects solid growth across the

region, with the exception of North America:

- Latin America (+5.4% at constant

consolidation scope and exchange rates) with growth driven

particularly by Argentina (increase in volumes under the Buenos

Aires contract accompanied by a price increase) and Mexico;

- Asia (+2.6% at constant consolidation

scope and exchange rates), where revenue increased across most of

the region with the exception of Singapore and India. In China,

revenue grew 2.2% at constant consolidation scope and exchange

rates, mainly in line with the increase in volumes sold in the

Energy business (Harbin and Jiamusi heating networks) and despite a

decrease in energy prices;

- Africa and the Middle East, where

revenue growth (+8.5% at constant consolidation scope and exchange

rates) was boosted by increased electricity sales in Gabon.

The strong revenue growth in the Rest of the World segment was

tempered by a slump in North American revenue (-14.9% at constant

consolidation scope and exchange rates), mainly due to a fall in

energy prices, a drop in heating volumes sold (due to a very mild

winter) and a decrease in industrial cleaning and industrial water

activities.

Revenue in the Global Businesses segment for the three months

ended March 31, 2016 amounted to €1,067.7 million, down -4.0% at

current consolidation scope and exchange rates (-4.3% at constant

consolidation scope and exchange rates) compared to the prior year

period.

Excluding the impact of Construction activities and energy

prices, revenue increased +4.8% at constant consolidation scope and

exchange rates.

This change mainly reflects:

- good growth in hazardous waste

activities (+5.7% at constant consolidation scope and exchange

rates), tied particularly to treatment and landfill activities and

an increase in industrial clean-up services;

- a decrease in SADE construction

activities outside France, with certain projects pushed back to the

second quarter of 2016 (Jordan). The downturn in construction

activity in France was offset by the strong performance of telecom

activities;

- the completion of major Veolia Water

Technologies projects (Sadara and Az Zour North) despite increased

bookings.

1.2. Revenue by business

Revenue (in € million)

Three

months Three months Change Internal

External

Foreign

ended ended March 2015/2016 growth

growth

exchange

March 31, 31, 2015 impact

2016

Water 2,633.5 2,705.7 -2.7%

-2.2% 0.0% -0.5%

Waste 2,012.1

2,077.1 -3.1% +1.2% -1.7% -2.6%

Energy 1,443.2 1,522.0 -5.2%

-4.7% +0.6% -1.1%

Group 6,088.8

6,304.8 -3.4% -1.7%

-0.4% -1.3%

Water revenue declined 2.2% at constant consolidation scope and

exchange rates for the three months ended March 31, 2016 compared

to the prior year period. Excluding the impact of construction

activities, Water revenue increased +2.6% at constant consolidation

scope and exchange rates, reflecting:

- In France, the positive commercial

impact of new contracts wins (Lille), which offset the unfavorable

impact of contact renewals;

- An increase in volumes sold, primarily

in Central and Eastern Europe ;

- Progressive downsizing of the

construction activities at Veolia Water Technologies: revenue was

impacted by the completion of the large Az Zour North and Sadara

contracts in 2015.

- Waste

Waste revenue increased +1.2% at constant consolidation scope

and exchange rates for the three months ended March 31, 2016

compared to the prior year period. This rise reflects:

- Positive volume impact +1.6%, and price

impact +0.9%;

- Good resilience in France and in the

United Kingdom, and good growth in Germany;

- Lower recycled raw material prices and

volumes;

- Strong growth in hazardous waste

activities (+5.7% at constant consolidation scope and exchange

rates);

- Challenging environment in Industrial

services in the United States.

- Energy

Energy revenue fell 4.7% at constant consolidation scope and

exchange rates for the three months ended March 31, 2016 compared

to the prior year period. Excluding the impact of the decline in

energy prices, revenue increased +0.4% at constant consolidation

scope and exchange rates. This change reflects:

- Overall slightly favorable weather

impact of +0.5% (+€20 million in Europe, but -€13 million in the

United States);

- Positive impact of the start up of

cogeneration facilities in Hungary.

2. Other Income Statement Items

2.1 EBITDA

Group consolidated EBITDA for the three months ended March 31,

2016 was €840 million, up 3.0% at current consolidation scope and

exchange rates and 5.0% at constant consolidation scope and

exchange rates compared with the same period in 2015. EBITDA margin

increased from 12.9% in the three months ended March 31, 2015 to

13.8% in the same period ended March 31, 2016.

This increase in EBITDA was mainly due to cost savings of €53 million over the first three

months of 2016. The annual cost savings objective of €200 million

is confirmed.

The foreign exchange impact on

EBITDA was -€11.3 million and mainly reflects fluctuations in the

value of the euro against South American currencies (-€4.0 million,

primarily the Brazilian real and the Argentine peso), the Polish

zloty (-€3.8 million) and the pound sterling (-€2.4 million).

The consolidation scope impact

(-€5.4 million) mainly concerns the divestiture of Group activities

in Israel (-€3.6 million).

The negative price impact reflects

low tariff indexation net of the cost of inflation. Note that the

decline in energy prices is neutralized at the EBITDA level due to

savings realized on the purchase of fuel.

Cost-saving plans contributed €53

million to the increase in EBITDA, mainly with respect to

purchasing and organizational efficiency.

By segment:

- EBITDA declined in France:

- in the Water business, cost savings

only partially offset the negative impact of price effects, net of

inflation and the impairment of receivables pursuant to the Brottes

law;

- in the Waste business, cost savings and

the fall in fuel prices were offset by the fall in the price of

scrap metal and an unfavorable comparison effect due to

non-recurring items in 2015.

- Strong EBITDA growth in the Europe

excluding France segment, boosted by significant cost savings,

the positive impact of commercial wins and the commissioning of

assets (Leeds incinerator in the United Kingdom, cogeneration

plants in Hungary, etc.), a positive weather effect in Central

Europe and solid performance in Germany.

- The Rest of the World segment

reported a downturn in EBITDA, due to lower activity levels in the

United States.

- United States: the municipal sector was

impacted by the mild winter. Lower activity levels in the

industrial sector were partially offset by significant productivity

gains.

- Continued strong performance in

Asia.

- Conversely, Global Businesses

EBITDA improved significantly, mainly thanks to growth in

hazardous waste activities and to improved profitability of

construction activities.

2.2 Current EBIT

Group consolidated Current EBIT for the three months ended March

31, 2016 amounted to €413 million, up by +4.2% at current

consolidation scope and exchange rates and +7.5% at constant

consolidation scope and exchange rates compared with the same

period in 2015.

This increase in Current EBIT is mainly due to:

- an improvement in Group EBITDA,

particularly in the Europe excluding France and Global Businesses

segments;

- stable depreciation and amortization

expense at constant exchange rates;

- a slightly favorable variation in the

net charges to provisions, particularly for Construction activities

in Latin America due to provision charges recognized in 2015.

- the slightly negative impact (change in

consolidation scope and foreign exchange impact) of the

contribution of equity-accounted entities.

The foreign exchange impact on Current EBIT was -€6.8 million

and mainly reflects fluctuations in the value of the euro against

South American currencies (-€3.4 million, including the Argentine

peso) and the Polish zloty (-€2.8 million)

Reconciling items between EBITDA and Current EBIT for the three

months ended March 31, 2016 and 2015 are as follows:

(in € million)

Three months Three months

ended March 31, ended March 31,

2016

2015

EBITDA 840.3 815.9

Renewal expenses (67.4) (65.0) Depreciation & amortization (1)

(379.6) (371.8) Share of current net income of joint ventures and

associates 17.4 22.4 Provisions, fair value adjustments &

other: 2.5 (4.8)

- Current impairment of property, plant and equipment, intangible

assets and operating financial assets

(4.8) 0.7

- Capital gains (losses) on industrial divestitures

5.3 4.4

- Net charges to operating provisions, fair value adjustments and

other

2.0 (9.9)

Current EBIT 413.2

396.7

(1) Including principal payments on operating financial

assets.

2.3 Current net income

Current net income attributable to owners of the Company fell to

€173 million for the three months ended March 31, 2016 from €212

million for the same period in 2015.

Excluding capital gains and losses on financial divestitures net

of tax, current net income attributable to owners of the Company

rose 16.0% to €170 million from €147 million for the three months

ended March 31, 2015.

C] FINANCING

Three months Three months (in €

million)

ended March 31, ended

2016 March 31, 2015 EBITDA

840 816 Net industrial investments

(230) (238) Change in operating WCR (730)

(660) Dividends received from equity-accounted entities and joint

ventures 3 7 Renewal expenses (67) (65)

Restructuring charges (7) (24) Financial items

(current cash financial expense, and operating cash flow from

financing activities) (98) (104) Taxes paid

(54) (49)

Net free cash flow before dividend payment,

financial investments and financial divestitures

(343) (317) Opening Net financial debt

8,170 8,311

Closing Net financial debt

8,265 8,970

Net free cash flow was -€343

million for the three months ended March 31, 2016, compared with

-€317 million for the same period in 2015.

The change in net free cash flow year-on-year mainly

reflects:

- the improvement in EBITDA;

- solid industrial investment discipline,

with the decrease primarily due to a reduction in maintenance

expenditure in Poland;

- the decrease in restructuring

charges;

- the negative impact of operating

working capital requirements of -€730 million compared with -€660

million in the first three months of 2015, due to a more

substantial seasonal effect in 2016 and numerous customer payments

at the end of 2015.

Overall, net financial debt fell to

€8,265 million, compared with €8,970 million as of March 31,

2015.

In addition to the change in net free cash flow, net financial

debt was favorably impacted by exchange rate fluctuations in the

amount of €252 million in the first three months of the year (€381

million compared to March 31, 2015). Net financial debt was also

impacted by:

- an increase in financial investments,

including the acquisition of Kurion in the amount of -€330 million

on March 31, 2016 (including acquisition costs). Financial

investments did not warrant any particular comment as of March 31,

2015;

- repayment of the Transdev Group

intercompany loan in March 2016 in the amount of €345 million;

- a decrease in financial divestitures to

€26 million in the three months ended March 31, 2016, mainly

comprising the divestiture of a municipal water entity in China. In

the three months ended March 31, 2015, financial divestitures

totaled €299 million and included the divestiture of the Group’s

40% stake in S.D.C PTE in Singapore (enterprise value of €47

million) and the divestiture of activities in Israel contributing

to an overall reduction in net financial debt of €226 million.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160503007233/en/

VEOLIA ENVIRONNEMENTGroup Media

RelationsLaurent ObadiaSandrine Guendoul+ 33 (0)1

71 75 12 52sandrine.guendoul@veolia.comorAnalyst & Investor

RelationsRonald Wasylec - Ariane de Lamaze+ 33 (0)1

71 75 12 23 / 06 00orTerri Anne Powers (United

States)+ 1 312 552 2890

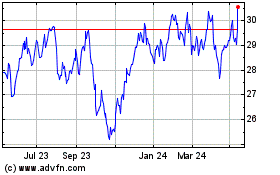

Veolia Environnement (EU:VIE)

Historical Stock Chart

From Mar 2024 to Apr 2024

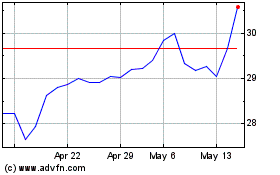

Veolia Environnement (EU:VIE)

Historical Stock Chart

From Apr 2023 to Apr 2024