UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September

30, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 001-38767

DATASEA INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 45-2019013 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| 20th Floor, Tower B, Guorui Plaza 1 Ronghua South Road, Technological Development Zone Beijing, People’s Republic of China | | 100176 |

| (Address of principal executive offices) | | (Zip Code) |

| +86 10-56145240 |

| (Registrant’s telephone number, including area code) |

N/A

(Former name, former address and former fiscal

year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.001 par value | | DTSS | | NASDAQ Capital Market |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☐ | Large accelerated filer | ☐ | Accelerated filer |

| ☒ | Non-accelerated filer | ☒ | Smaller reporting company |

| | | ☐ | Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November

11, 2024, 7,087,002 shares of common stock, $0.001 par value per share, were outstanding.

DATASEA INC.

TABLE OF CONTENTS

PART

I - FINANCIAL INFORMATION

ITEM

1. FINANCIAL STATEMENTS

DATASEA INC.

CONSOLIDATED BALANCE SHEETS

| | |

SEPTEMBER 30,

2024 | | |

JUNE

30,

2024 | |

| | |

(UNAUDITED) | | |

| |

| ASSETS | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash | |

$ | 937,606 | | |

$ | 181,262 | |

| Accounts

receivable | |

| 18,445 | | |

| 718,546 | |

| Inventory,

net | |

| 208,062 | | |

| 153,583 | |

| Value-added

tax prepayment | |

| 128,430 | | |

| 107,545 | |

| Subscription

receivables - related parties | |

| 3,980,382 | | |

| - | |

| Prepaid

expenses and other current assets | |

| 1,908,999 | | |

| 1,486,956 | |

| Total

current assets | |

| 7,181,924 | | |

| 2,647,892 | |

| | |

| | | |

| | |

| NONCURRENT

ASSETS | |

| | | |

| | |

| Property

and equipment, net | |

| 43,680 | | |

| 48,466 | |

| Intangible

assets, net | |

| 518,306 | | |

| 546,001 | |

| Right-of-use

assets, net | |

| 212,740 | | |

| 49,345 | |

| Total

noncurrent assets | |

| 774,726 | | |

| 643,812 | |

| | |

| | | |

| | |

| TOTAL

ASSETS | |

$ | 7,956,650 | | |

$ | 3,291,704 | |

| | |

| | | |

| | |

| LIABILITIES

AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT

LIABILITIES | |

| | | |

| | |

| Accounts

payable | |

$ | 284,140 | | |

$ | 1,075,641 | |

| Unearned

revenue | |

| 1,312,317 | | |

| 49,239 | |

| Accrued

expenses and other payables | |

| 691,792 | | |

| 596,714 | |

| Due

to related parties | |

| 231,551 | | |

| 654,560 | |

| Operating

lease liabilities | |

| 90,794 | | |

| 53,530 | |

| Bank

loan payable | |

| 1,148,786 | | |

| 1,170,298 | |

| Total

current liabilities | |

| 3,759,380 | | |

| 3,599,982 | |

| | |

| | | |

| | |

| NONCURRENT

LIABILITIES | |

| | | |

| | |

| Operating

lease liabilities | |

| 132,541 | | |

| - | |

| Total

noncurrent liabilities | |

| 132,541 | | |

| - | |

| | |

| | | |

| | |

| TOTAL

LIABILITIES | |

| 3,891,921 | | |

| 3,599,982 | |

| | |

| | | |

| | |

| COMMITMENTS

AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| STOCKHOLDERS’

EQUITY (DEFICIT) | |

| | | |

| | |

| Common stock, $0.001 par value, 25,000,000 shares authorized, 7,087,002 and 3,589,620 shares issued and outstanding as of September 30, 2024 and June 30, 2024 , respectively | |

| 7,087 | | |

| 3,589 | |

| Additional

paid-in capital | |

| 45,268,415 | | |

| 38,957,780 | |

| Accumulated

comprehensive income | |

| 229,054 | | |

| 242,208 | |

| Accumulated

deficit | |

| (41,402,311 | ) | |

| (39,440,322 | ) |

| TOTAL

COMPANY STOCKHOLDERS’ EQUITY (DEFICIT) | |

| 4,102,245 | | |

| (236,745 | ) |

| | |

| | | |

| | |

| Noncontrolling

interest | |

| (37,516 | ) | |

| (71,533 | ) |

| | |

| | | |

| | |

| TOTAL

STOCKHOLDERS’ EQUITY (DEFICIT) | |

| 4,064,729 | | |

| (308,278 | ) |

| | |

| | | |

| | |

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | |

$ | 7,956,650 | | |

$ | 3,291,704 | |

The accompanying notes are an integral part of these consolidated financial

statements.

DATASEA INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS

(UNAUDITED)

| | |

THREE MONTHS ENDED

SEPTEMBER 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | 21,081,094 | | |

$ | 6,880,743 | |

| Cost of revenues | |

| 20,884,113 | | |

| 6,806,008 | |

| | |

| | | |

| | |

| Gross profit | |

| 196,981 | | |

| 74,735 | |

| | |

| | | |

| | |

| Operating expenses | |

| | | |

| | |

| Selling | |

| 996,049 | | |

| 84,447 | |

| General and administrative | |

| 1,128,403 | | |

| 693,060 | |

| Research and development | |

| 103,079 | | |

| 155,004 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 2,227,531 | | |

| 932,511 | |

| | |

| | | |

| | |

| Loss from operations | |

| (2,030,550 | ) | |

| (857,776 | ) |

| | |

| | | |

| | |

| Non-operating income (expenses) | |

| | | |

| | |

| Other income (expenses), net | |

| 55,826 | | |

| (7,864 | ) |

| Interest income | |

| 4,055 | | |

| 106 | |

| | |

| | | |

| | |

| Total non-operating income (expenses), net | |

| 59,881 | | |

| (7,758 | ) |

| | |

| | | |

| | |

| Loss before income tax | |

| (1,970,669 | ) | |

| (865,534 | ) |

| | |

| | | |

| | |

| Income tax | |

| - | | |

| - | |

| | |

| | | |

| | |

| Loss before noncontrolling interest from continuing operations | |

| (1,970,669 | ) | |

| (865,534 | ) |

| Income before noncontrolling interest from discontinued operations | |

| - | | |

| 833,546 | |

| | |

| | | |

| | |

| Less: loss attributable to noncontrolling interest from continuing operations | |

| (8,680 | ) | |

| (9,932 | ) |

| Less: loss attributable to noncontrolling interest from discontinued operations | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net loss attribute to noncontrolling interest | |

| (8,680 | ) | |

| (9,932 | ) |

| | |

| | | |

| | |

| Net loss to the Company from continuing operations | |

| (1,961,989 | ) | |

| (855,602 | ) |

| Net income to the Company from discontinued operations | |

| - | | |

| 833,546 | |

| | |

| | | |

| | |

| Net loss to the Company | |

| (1,961,989 | ) | |

| (22,056 | ) |

| | |

| | | |

| | |

| Other comprehensive item | |

| | | |

| | |

| Foreign currency translation loss attributable to the Company | |

| (13,154 | ) | |

| (161,216 | ) |

| Foreign currency translation gain (loss) attributable to noncontrolling interest | |

| 41,306 | | |

| (8 | ) |

| | |

| | | |

| | |

| Comprehensive loss attributable to the Company | |

$ | (1,975,143 | ) | |

$ | (183,272 | ) |

| | |

| | | |

| | |

| Comprehensive income (loss) attributable to noncontrolling interest | |

$ | 32,626 | | |

$ | (9,940 | ) |

| | |

| | | |

| | |

| Basic and diluted net loss per share | |

$ | (0.49 | ) | |

$ | (0.01 | ) |

| | |

| | | |

| | |

| Weighted average shares used for computing basic and diluted loss per share * | |

| 4,041,052 | | |

| 1,963,066 | |

The accompanying notes are an integral part of these consolidated financial

statements.

DATASEA INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

THREE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

(UNAUDITED)

| | |

Common Stock | | |

Additional paid-in | | |

Accumulated | | |

Accumulated other comprehensive | | |

| | |

Noncontrolling | |

| | |

Shares | | |

Amount | | |

capital | | |

deficit | | |

income | | |

Total | | |

interest | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at July 1, 2024 | |

| 3,589,620 | | |

$ | 3,590 | | |

$ | 38,957,780 | | |

$ | (39,440,322 | ) | |

$ | 242,208 | | |

$ | (236,745 | ) | |

$ | (71,533 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (1,961,989 | ) | |

| - | | |

| (1,961,989 | ) | |

| (8,680 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Noncontrolling interest disposal at closure of the entity | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,391 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for equity financing | |

| 692,308 | | |

| 692 | | |

| 1,958,059 | | |

| - | | |

| - | | |

| 1,958,751 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for equity financing - related parties | |

| 1,932,224 | | |

| 1,932 | | |

| 3,978,449 | | |

| - | | |

| - | | |

| 3,980,381 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for stock compensation expense | |

| 75,000 | | |

| 75 | | |

| 374,925 | | |

| - | | |

| - | | |

| 375,000 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for purchase of intangible assets from the Company’s major shareholders | |

| 797,850 | | |

| 798 | | |

| (798 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation gain (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (13,154 | ) | |

| (13,154 | ) | |

| 41,306 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at September 30, 2024 | |

| 7,087,002 | | |

$ | 7,087 | | |

$ | 45,268,415 | | |

$ | (41,402,311 | ) | |

$ | 229,054 | | |

$ | 4,102,245 | | |

$ | (37,516 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at July 1, 2023 | |

| 1,889,315 | | |

$ | 1,889 | | |

$ | 24,148,868 | | |

$ | (28,063,258 | ) | |

$ | 393,252 | | |

$ | (3,519,249 | ) | |

$ | (60,848 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (22,056 | ) | |

| - | | |

| (22,056 | ) | |

| (9,932 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for equity financing | |

| 685,940 | | |

| 686 | | |

| 8,060,600 | | |

| - | | |

| - | | |

| 8,061,286 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for stock compensation expense | |

| - | | |

| - | | |

| 20,100 | | |

| - | | |

| - | | |

| 20,100 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (161,216 | ) | |

| (161,216 | ) | |

| (8 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at September 30, 2023 | |

| 2,575,255 | | |

$ | 2,575 | | |

$ | 32,229,568 | | |

$ | (28,085,314 | ) | |

$ | 232,036 | | |

$ | 4,378,865 | | |

$ | (70,788 | ) |

The accompanying notes are an integral part of these consolidated financial

statements.

DATASEA INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

THREE MONTHS ENDED

SEPTEMBER

30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | |

| |

| Loss including noncontrolling interest | |

$ | (1,970,669 | ) | |

$ | (31,988 | ) |

| Adjustments to reconcile loss including noncontrolling interest to net cash used in operating activities: | |

| | | |

| | |

| Gain on disposal of subsidiary | |

| - | | |

| (833,546 | ) |

| Bad debt reversal | |

| (7,026 | ) | |

| - | |

| Depreciation and amortization | |

| 85,635 | | |

| 137,873 | |

| Loss on disposal of fixed assets | |

| 2,815 | | |

| - | |

| Operating lease expense | |

| 38,932 | | |

| 74,181 | |

| Stock compensation expense | |

| 375,000 | | |

| 20,100 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 701,384 | | |

| (21,436 | ) |

| Inventory | |

| (51,064 | ) | |

| 137 | |

| Value-added tax prepayment | |

| (18,760 | ) | |

| (14,121 | ) |

| Prepaid expenses and other current assets | |

| (384,177 | ) | |

| (5,692,660 | ) |

| Accounts payable | |

| (794,504 | ) | |

| (179,875 | ) |

| Unearned revenue | |

| 1,242,820 | | |

| (45,332 | ) |

| Accrued expenses and other payables | |

| 79,650 | | |

| (56,515 | ) |

| Payment on operating lease liabilities | |

| (32,691 | ) | |

| (101,231 | ) |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (732,655 | ) | |

| (6,744,413 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisition of property and equipment | |

| (2,752 | ) | |

| (330 | ) |

| Acquisition of intangible assets | |

| (44,768 | ) | |

| - | |

| Cash disposed due to disposal of subsidiary | |

| - | | |

| (35 | ) |

| | |

| | | |

| | |

| Net cash used in investing activities | |

| (47,520 | ) | |

| (365 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Repayment to related parties | |

| (426,944 | ) | |

| (675,828 | ) |

| Proceeds from loan payables | |

| - | | |

| 879,422 | |

| Repayment of loan payables | |

| (40,815 | ) | |

| (184,425 | ) |

| Net proceeds from issuance of common stock | |

| 1,958,751 | | |

| 8,061,286 | |

| | |

| | | |

| | |

| Net cash provided by financing activities | |

| 1,490,992 | | |

| 8,080,455 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash | |

| 45,527 | | |

| (136,657 | ) |

| | |

| | | |

| | |

| Net increase in cash | |

| 756,344 | | |

| 1,199,020 | |

| | |

| | | |

| | |

| Cash, beginning of period | |

| 181,262 | | |

| 19,728 | |

| | |

| | | |

| | |

| Cash, end of period | |

$ | 937,606 | | |

$ | 1,218,748 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 9,214 | | |

$ | 5,551 | |

| Cash paid for income tax | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Supplemental disclosures of non-cash financing activities: | |

| | | |

| | |

| Right-of-use assets obtained in exchange for operating lease liabilities | |

$ | 197,347 | | |

$ | - | |

The accompanying notes are an integral part of these consolidated financial

statements.

DATASEA INC.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

SEPTEMBER 30, 2024

(UNAUDITED) AND JUNE 30, 2024

NOTE

1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

Datasea Inc. (the “Company,”

“Datasea,” or “we,” “us,” “our”) was incorporated in the State of Nevada on September

26, 2014 under the name Rose Rock Inc. and changed its name to Datasea Inc. on May 27, 2015. On May 26, 2015, the Company’s founder,

Xingzhong Sun, sold 6,666,667 shares of common stock, par value $0.001 per share, of the Company (the “Common Stock”)

to Zhixin Liu (“Ms. Liu”), an owner of Shuhai Skill (HK) as defined below. On October 27, 2016, Mr. Sun sold his remaining 1,666,667 shares

of Common Stock of the Company to Ms. Liu. As a holding company with no material operations, the Company conducts a majority of its business

activities through organizations established in the People’s Republic of China (“PRC), primarily by variable interest entity

(the “VIE”). The Company does not have any equity ownership of its VIE, instead it controls and receives economic benefits

of the VIE’s business operations through certain contractual arrangements.

On October 29, 2015, the

Company entered into a share exchange agreement (the “Exchange Agreement”) with the shareholders (the “Shareholders”)

of Shuhai Information Skill (HK) Limited (“Shuhai Skill (HK)”), a limited liability company (“LLC”) incorporated

on May 15, 2015 under the laws of the Hong Kong Special Administrative Region of the People’s Republic of China (the “PRC”).

Pursuant to the terms of the Exchange Agreement, the Shareholders, who own 100% of Shuhai Skill (HK), transferred all of the issued

and outstanding ordinary shares of Shuhai Skill (HK) to the Company for 6,666,667 shares of Common Stock, causing Shuhai Skill

(HK) and its wholly owned subsidiaries, Tianjin Information Sea Information Technology Co., Ltd. (“Tianjin Information” or

“WOFE”), an LLC incorporated under the laws of the PRC, and Harbin Information Sea Information Technology Co., Ltd., an LLC

incorporated under the laws of the PRC, to become wholly-owned subsidiaries of the Company; and Shuhai Information Technology Co., Ltd.,

also an LLC incorporated under the laws of the PRC (“Shuhai Beijing”), to become a VIE of the Company through a series of

contractual agreements between Shuhai Beijing and Tianjin Information. The transaction was accounted for as a reverse merger, with Shuhai

Skill (HK) and its subsidiaries being the accounting survivor. Accordingly, the historical financial statements presented are those of

Shuhai Skill (HK) and its consolidated subsidiaries and VIE.

Following the Share Exchange,

the Shareholders, Zhixin Liu and her father, Fu Liu, owned approximately 82% of the Company’s outstanding shares of Common

Stock. As of October 29, 2015, there were 18,333,333 shares of Common Stock issued and outstanding, 15,000,000 of

which were beneficially owned by Zhixin Liu and Fu Liu.

After the Share Exchange, the

Company, through its consolidated subsidiaries and VIE provide smart security solutions primarily to schools, tourist or scenic attractions

and public communities in China.

On October 16, 2019, Shuhai Beijing

incorporated a wholly owned subsidiary, Heilongjiang Xunrui Technology Co. Ltd. (“Xunrui”), which develops and markets the

Company’s smart security system products.

On December 3, 2019, Shuhai Beijing

formed Nanjing Shuhai Equity Investment Fund Management Co. Ltd. (“Shuhai Nanjing”), a joint venture in PRC, in which Shuhai

Beijing holds a 99% ownership interest with the remaining 1% held by Nanjing Fanhan Zhineng Technology Institute Co. Ltd, an

unrelated party that was supported by both Nanjing Municipal Government and Beijing University of Posts and Telecommunications. Shuhai

Nanjing was formed for gaining the easy access to government funding and private financing for the Company’s new technology development

and new project initiation.

In January 2020, the Company

acquired ownership in three entities for no consideration from the Company’s management, which set up such entities on the Company’s

behalf (described below).

On January 3, 2020, Shuhai Beijing

entered into two equity transfer agreements (the “Transfer Agreements”) with the President, and a Director of the Company. Pursuant

to the Transfer Agreements, the Director and the President, each agreed, for no consideration, to (i) transfer his 51% and 49%

respective ownership interests, in Guozhong Times (Beijing) Technology Ltd. (“Guozhong Times”) to Shuhai Beijing; and (ii)

transfer his 51% and 49% respective ownership interests, in Guohao Century (Beijing) Technology Ltd. (“Guohao Century”)

to Shuhai Beijing. Guozhong Times and Guohao Century were established to develop technology for electronic products, intelligence equipment

and accessories, and provide software and information system consulting, installation and maintenance services.

On January 7, 2020, Shuhai Beijing

entered into another equity transfer agreement with the President, the Director described above and an unrelated individual. Pursuant

to this equity transfer agreement, the Director, the President and the unrelated individual each agreed to transfer his 51%, 16%, 33%

ownership interests, in Guozhong Haoze (Beijing) Technology Ltd. (“Guozhong Haoze”) to Shuhai Beijing for no consideration.

Guozhong Haoze was formed to develop and market the smart security system products.

On August 17, 2020, Beijing Shuhai

formed a new wholly-owned subsidiary Shuhai Jingwei (Shenzhen) Information Technology Co., Ltd (“Jingwei”), to expand the

security oriented systems developing, consulting and marketing business overseas.

On November 16, 2020, Guohao

Century formed Hangzhou Zhangqi Business Management Limited Partnership (“Zhangqi”) with ownership of 99% as an ordinary

partner. In November 2023, the Company dissolved Zhangqi as a result of disposal of Zhuangxun in July 2023, Zhangqi had no

operations but only serves as a holding company of Zhagnxun. In November 2023, the Company dissolved Zhangqi.

On November 19, 2020, Guohao

Century formed a 51% owned subsidiary Hangzhou Shuhai Zhangxun Information Technology Co., Ltd (“Zhangxun”) for research

and development of 5G Multimodal communication technology. Zhangqi owns 19% of Zhangxun; accordingly, Guohao Century ultimately owns 69.81%

of Zhangxun. On December 20, 2022, Guohao Century acquired a 30% ownership interests of Zhangxun from Zhengmao Zhang at the price

of $0.15 (RMB 1.00). After the transaction, Guohao Century owns 81% of Zhangxun, and Zhangqi owns 19% of Zhangxun;

On February 15, 2023, Guohao Century acquired a 9% ownership interests of Zhangxun from the Zhangqi at the price of $130,434 (RMB 900,000).

After the transaction, Guohao Century owns 90% of Zhangxun, and Zhangqi owns 10% of Zhangxun; as a result, Guohao Century ultimately

owns 99.9 % of Zhangxun. On July 20, 2023, the Company sold Zhangxun to a third party for RMB 2 ($0.28).

On February 16, 2022, Shuhai

Jingwei formed Shenzhen Acoustic Effect Management Limited Partnership (“Shenzhen Acoustic MP”) with 99% ownership interest,

the remaining 1% ownership interest is held by a third party.

On February 16, 2022, Shuhai

Jingwei formed Shuhai (Shenzhen) Acoustic Effect Technology Co., Ltd (“Shuhai Shenzhen Acoustic Effect”), a PRC Company, in

which Shuhai Jingwei holds 60% ownership interest, 10% ownership interest is held by Shenzhen Acoustic MP, and remaining 30%

ownership interest is held by a third party. On October 18, 2022, Shuhai Jingwei acquired 30% ownership interest of Shuhai Acoustic

Effect, a PRC Company from the third party at the price of approximately $0.15 (RMB 1.00). After the transaction, Shuhai Jingwei

owns 90% of Shuhai Shenzhen Effect, and Shenzhen Acoustic MP still owns 10% of Shuhai Shenzhen Effect; accordingly, Shuhai Jingwei

ultimately owns 100% of Shuhai Acoustic Effect. The book value of 30% interest acquired from the third party was $(26,993) due

to its accumulated deficit.

On March 4, 2022, Shuhai Beijing

formed Beijing Yirui Business Management Development Center (“Yirui”) with 99% ownership interest as an ordinary partner,

the remaining 1% ownership interest is held by Zhixin Liu.

On March 4, 2022, Shuhai Beijing

formed Beijing Yiying Business Management Development Center (“Yiying”) with 99% ownership interest as an ordinary partner,

the remaining 1% ownership interest is held by Zhixin Liu.

On July 31, 2023, Datasea established

a wholly owned subsidiary Datasea Acoustic, LLC (“Datasea Acoustic”) in the state of Delaware for expanding the products to

the market in North America.

On October 24, 2023, Guozhong

Times formed Shuhai Yiyun (Shenzhen) digital technology Co, Ltd (“Yiyun”) with 66% ownership interest, the remaining 34%

ownership interest is held by a third party. As of the report date, Yiyun did not have any operations.

On January 10, 2024, the Company’s

Board of Directors approved a reverse stock split of its authorized and issued and outstanding shares of common stock, par value $0.001 per

share (the “Common Stock”), at a ratio of 1-for-15, which become legal effective on January 19, 2024. After the reverse stock

split, every 15 issued and outstanding shares of the Company’s Common Stock was converted automatically into one share

of the Company’s Common Stock without any change in the par value per share. The total number of shares of Common Stock authorized

for issuance was then reduced by a corresponding proportion from 375,000,000 shares to 25,000,000 shares of Common

Stock. All share amounts have been retroactively restated to reflect the reverse stock split for all periods presented.

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

GOING

CONCERN

The accompanying consolidated

financial statements (“CFS”) were prepared assuming the Company will continue as a going concern, which contemplates

continuity of operations, realization of assets, and liquidation of liabilities in the normal course of business. For the three months

ended September 30, 2024 and 2023, the Company had a net loss of approximately $1.96 million and $22,056, respectively. The Company

had an accumulated deficit of approximately $41.40 million as of September 30, 2024, and negative cash flow from operating activities

of approximately $0.73 million and $6.74 million for the three months ended September 30, 2024 and 2023, respectively. The historical

operating results including recurring losses from operations raise substantial doubt about the Company’s ability to continue as

a going concern.

If deemed necessary, management

could seek to raise additional funds by way of admitting strategic investors, or private or public offerings, or by seeking to obtain

loans from banks or others, to support the Company’s research and development (“R&D”), procurement, marketing and

daily operation. While management of the Company believes in the viability of its strategy to generate sufficient revenues and its ability

to raise additional funds on reasonable terms and conditions, there can be no assurances to that effect. The ability of the Company

to continue as a going concern depends upon the Company’s ability to further implement its business plan and generate sufficient

revenue and its ability to raise additional funds by way of a public or private offering. There is no assurance that the Company

will be able to obtain funds on commercially acceptable terms, if at all. There is also no assurance that the amount of funds the Company

might raise will enable the Company to complete its initiatives or attain profitable operations. If the Company is unable to raise additional

funding to meet its working capital needs in the future, it may be forced to delay, reduce or cease its operations.

BASIS

OF PRESENTATION AND CONSOLIDATION

The CFS were prepared in accordance

with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and applicable rules and regulations

of the SEC regarding CFS. The accompanying CFS include the financial statements of the Company and its 100% owned subsidiaries

Shuhai Information Skill (HK) Limited (“Shuhai Skill (HK)”), and Tianjin Information sea Information Technology Co., Ltd. (“Tianjin

Information”), and its VIE, Shuhai Beijing, and Shuhai Beijing’s 100% owned subsidiaries – Heilongjiang Xunrui

Technology Co. Ltd. (“Xunrui”), Guozhong Times (Beijing) Technology Ltd. (“Guozhong Times”), Guohao Century (Beijing)

Technology Ltd. (“Guohao Century”), Guozhong Haoze, and Shuhai Jingwei (Shenzhen) Information Technology Co., Ltd. (“Jingwei”),

and Shuhai Beijing’s 99% owned subsidiary Nanjing Shuhai Equity Investment Fund Management Co. Ltd. (“Shuhai Nanjing”).

During the year ended June 30, 2022, the Company incorporated two new subsidiaries Shuhai (Shenzhen) Acoustic Effect Technology Co., Ltd

(“Shuhai Acoustic”) and Shenzhen Acoustic Effect Management Partnership (“Shenzhen Acoustic MP”). All significant

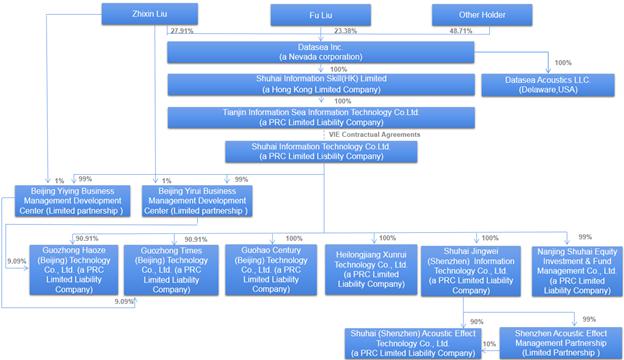

inter-company transactions and balances were eliminated in consolidation. The chart below depicts the corporate structure of the

Company as of September 30, 2024.

VARIABLE

INTEREST ENTITY

Pursuant to the Financial Accounting

Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Section 810, “Consolidation” (“ASC

810”), the Company is required to include in its CFS, the financial statements of Shuhai Beijing, its VIE. ASC 810 requires a VIE

to be consolidated if the Company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the

VIE’s residual returns. A VIE is an entity in which a company, through contractual arrangements, bears the risk of, and enjoys the

rewards of such entity, and therefore the Company is the primary beneficiary of such entity.

Under ASC 810, a reporting entity

has a controlling financial interest in a VIE, and must consolidate that VIE, if the reporting entity has both of the following characteristics:

(a) the power to direct the activities of the VIE that most significantly affect the VIE’s economic performance; and (b) the obligation

to absorb losses, or the right to receive benefits, that could potentially be significant to the VIE. The reporting entity’s determination

of whether it has this power is not affected by the existence of kick-out rights or participating rights, unless a single enterprise,

including its related parties and de - facto agents, have the unilateral ability to exercise those rights. Shuhai Beijing’s actual

stockholders do not hold any kick-out rights that affect the consolidation determination.

Through the VIE agreements, Tianjin

Information, an indirect subsidiary of Datasea is deemed the primary beneficiary of Shuhai Beijing and its subsidiaries. Accordingly,

the results of Shuhai Beijing and its subsidiaries were included in the accompanying CFS. Shuhai Beijing has no assets that are collateral

for or restricted solely to settle their obligations. The creditors of Shuhai Beijing do not have recourse to the Company’s general

credit.

VIE

Agreements

Operation and Intellectual

Property Service Agreement – The Operation and Intellectual Property Service Agreement allows Tianjin Information Sea Information

Technology Co., Ltd (“WFOE”) to manage and operate Shuhai Beijing and collect an operating fee equal to Shuhai Beijing’s

pre-tax income, per month. If Shuhai Beijing suffers a loss and as a result does not have pre-tax income, such loss shall be carried forward

to the following month to offset the operating fee to be paid to WFOE if there is pre-tax income of Shuhai Beijing the following month.

Furthermore, if Shuhai Beijing cannot pay off its debts, WFOE shall pay off the debt on Shuhai Beijing’s behalf. If Shuhai Beijing’s

net assets fall lower than its registered capital balance, WFOE shall provide capital for Shuhai Beijing to make up for the deficit.

Under the terms of the Operation

and Intellectual Property Service Agreement, Shuhai Beijing entrusts Tianjin Information to manage its operations, manage and control

its assets and financial matters, and provide intellectual property services, purchasing management services, marketing management services

and inventory management services to Shuhai Beijing. Shuhai Beijing and its stockholders shall not make any decisions nor direct the activities

of Shuhai Beijing without Tianjin Information’s consent.

Stockholders’ Voting

Rights Entrustment Agreement – Tianjin Information has entered into a stockholders’ voting rights entrustment agreement

(the “Entrustment Agreement”) under which Zhixin Liu and Fu Liu (collectively the “Shuhai Beijing Stockholders”)

have vested their voting power in Shuhai Beijing to Tianjin Information or its designee(s). The Entrustment Agreement does not have an

expiration date, but the parties can agree in writing to terminate the Entrustment Agreement. Zhixin Liu, is the Chairman of the Board,

President, CEO of DataSea and Corporate Secretary, and Fu Liu, a Director of the DataSea (Fu Liu is the father of Zhixin Liu).

Equity Option Agreement –

the Shuhai Beijing Stockholders and Tianjin Information entered into an equity option agreement (the “Option Agreement”),

pursuant to which the Shuhai Beijing Stockholders have granted Tianjin Information or its designee(s) the irrevocable right and option

to acquire all or a portion of Shuhai Beijing Stockholders’ equity interests in Shuhai Beijing for an option price of RMB0.001 for

each capital contribution of RMB1.00. Pursuant to the terms of the Option Agreement, Tianjin Information and the Shuhai Beijing Stockholders

have agreed to certain restrictive covenants to safeguard the rights of Tianjin Information under the Option Agreement. Tianjin Information

agreed to pay RMB1.00 annually to Shuhai Beijing Stockholders to maintain the option rights. Tianjin Information may terminate the

Option Agreement upon prior written notice. The Option Agreement is valid for a period of 10 years from the effective date and

renewable at Tianjin Information’s option.

Equity Pledge Agreement –

Tianjin Information and the Shuhai Beijing Stockholders entered into an equity pledge agreement on October 27, 2015 (the “Equity

Pledge Agreement”). The Equity Pledge Agreement serves to guarantee the performance by Shuhai Beijing of its obligations under the

Operation and Intellectual Property Service Agreement and the Option Agreement. Pursuant to the Equity Pledge Agreement, Shuhai Beijing

Stockholders have agreed to pledge all of their equity interests in Shuhai Beijing to Tianjin Information. Tianjin Information has the

right to collect any and all dividends, bonuses and other forms of investment returns paid on the pledged equity interests during the

pledge period. Pursuant to the terms of the Equity Pledge Agreement, the Shuhai Beijing Stockholders have agreed to certain restrictive

covenants to safeguard the rights of Tianjin Information. Upon an event of default or certain other agreed events under the Operation

and Intellectual Property Service Agreement, the Option Agreement and the Equity Pledge Agreement, Tianjin Information may exercise the

right to enforce the pledge.

As of this report date, there

were no dividends paid from the VIE to the U.S. parent company or the shareholders of the Company. There has been no change in facts and

circumstances to consolidate the VIE.

The following

financial statement amounts and balances of the VIE were included in the accompanying CFS as of September 30, 2024 and June 30, 2024,

and for the three months ended September 30, 2024 and 2023, respectively.

| | |

September 30,

2024 | | |

June 30,

2024 | |

| Cash | |

$ | 199,085 | | |

$ | 93,154 | |

| Accounts receivable | |

| 18,445 | | |

| 718,546 | |

| Inventory | |

| 207,662 | | |

| 119,053 | |

| Other current assets | |

| 1,582,860 | | |

| 295,305 | |

| Total current assets | |

| 2,008,052 | | |

| 1,226,058 | |

| Property and equipment, net | |

| 31,537 | | |

| 30,934 | |

| Intangible asset, net | |

| 459,040 | | |

| 441,485 | |

| Right-of-use asset, net | |

| 197,021 | | |

| 11,045 | |

| Total non-current assets | |

| 687,598 | | |

| 483,464 | |

| Total assets | |

$ | 2,695,650 | | |

$ | 1,709,522 | |

| | |

| | | |

| | |

| Accounts payable | |

$ | 79,937 | | |

$ | 765,998 | |

| Accrued liabilities and other payables | |

| 806,736 | | |

| 713,827 | |

| Lease liability | |

| 73,753 | | |

| 11,981 | |

| Loans payable | |

| 1,148,786 | | |

| 1,170,298 | |

| Other current liabilities | |

| 1,329,090 | | |

| 150,835 | |

| Total current liabilities | |

| 3,438,302 | | |

| 2,812,939 | |

| Lease liability - noncurrent | |

| 132,541 | | |

| - | |

| Total non-current liabilities | |

| 132,541 | | |

| - | |

| Total liabilities | |

$ | 3,570,843 | | |

$ | 2,812,939 | |

| | |

For the

Three Months

Ended

September 30,

2024 | | |

For the

Three Months

Ended

September 30,

2023 | |

| Revenues | |

$ | 21,081,094 | | |

$ | 6,880,743 | |

| Gross profit | |

$ | 238,134 | | |

$ | 74,735 | |

| Net loss | |

$ | 452,170 | | |

$ | (419,473 | )* |

USE OF

ESTIMATES

The preparation of CFS in conformity

with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure

of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during

the reporting periods. Actual results could differ from those estimates. The significant areas requiring the use of management estimates

include, but are not limited to, the estimated useful life and residual value of property, plant and equipment, provision for staff benefits,

recognition and measurement of deferred income taxes and the valuation allowance for deferred tax assets. Although these estimates are

based on management’s knowledge of current events and actions management may undertake in the future, actual results may ultimately

differ from those estimates and such differences may be material to the CFS.

CONTINGENCIES

Certain conditions may exist

as of the date the CFS are issued, which may result in a loss to the Company but which will only be resolved when one or more future events

occur or fail to occur. The Company’s management and legal counsel assess such contingent liabilities, and such assessment

inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the

Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of

any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought. If

the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can

be estimated, the estimated liability would be accrued in the Company’s CFS.

If the assessment indicates that

a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, the nature of

the contingent liability, together with an estimate of the range of possible loss if determinable and material, would be disclosed. As

of September 30, 2024 and June 30, 2024, the Company has no such contingencies.

CASH

Cash includes cash on hand and

demand deposits that are highly liquid in nature and have original maturities when purchased of three months or less.

ACCOUNTS RECEIVABLE

The Company’s policy is

to maintain an allowance for potential credit losses on accounts receivable. The Company adopted Accounting Standards Update (“ASU”)

2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit losses on financial instruments later

codified as Accounting Standard codification (“ASC”) 326 (“ASC 326”), on July 1, 2023. The guidance introduces

a revised approach to the recognition and measurement of credit losses, emphasizing an updated model based on expected losses rather than

incurred losses. There was no significant impact on the date of adoption of ASC 326.

Under ASC 326, accounts receivable

are recorded at the invoiced amount, net of allowance for expected credit losses. The Company’s primary allowance for credit losses

is the allowance for doubtful accounts. The allowance for doubtful accounts reduces the accounts receivable balance to the estimated net

realizable value. The Company regularly reviews the adequacy of the allowance for credit losses based on a combination of factors. In

establishing any required allowance, management considers historical losses adjusted for current market conditions, the Company’s

customers’ financial condition, the amount of any receivables in dispute, the current receivables aging, current payment terms and

expectations of forward-looking loss estimates.

All provisions for the allowance

for doubtful accounts are included as a component of general and administrative expenses on the accompanying consolidated statements of

operations and comprehensive loss. Accounts receivable deemed uncollectible are charged against the allowance for credit losses when identified.

Subsequent recoveries of amounts previously written off are credited to earnings in the period recovered. As of September 30, 2024 and

June 30, 2024, the Company had a $0 bad debt allowance for accounts receivable.

INVENTORY

Inventory is comprised principally

of intelligent temperature measurement face recognition terminal and identity information recognition products, and is valued at the lower

of cost or net realizable value. The value of inventory is determined using the first-in, first-out method. The Company periodically estimates

an inventory allowance for estimated unmarketable inventories when necessary. Inventory amounts are reported net of such allowances. There

were $54,564 and $53,650 allowances for slow-moving and obsolete inventory (mainly for Smart-Student Identification cards) as

of September 30, 2024 and June 30, 2024, respectively.

PROPERTY AND EQUIPMENT

Property and equipment are stated

at cost, less accumulated depreciation. Major repairs and improvements that significantly extend original useful lives or improve productivity

are capitalized and depreciated over the period benefited. Maintenance and repairs are expensed as incurred. When property and equipment

are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any

gain or loss is included in operations. Depreciation of property and equipment is provided using the straight-line method over estimated

useful lives as follows:

| Furniture and fixtures | |

3-5 years |

| Office equipment | |

3-5 years |

| Vehicles | |

5 years |

| Leasehold improvement | |

3 years |

Leasehold

improvements are depreciated utilizing the straight-line method over the shorter of their estimated useful lives or remaining lease term.

INTANGIBLE

ASSETS

Intangible assets with finite

lives are amortized using the straight-line method over their estimated period of benefit. Evaluation of the recoverability of intangible

assets is made to take into account events or circumstances that warrant revised estimates of useful lives or that indicate that impairment

exists. All of the Company’s intangible assets are subject to amortization. No impairment of intangible assets has been identified

as of the balance sheet date.

Intangible assets include licenses,

certificates, patents and other technology and are amortized over their useful life of three years.

FAIR VALUE (“FV”)

OF FINANCIAL INSTRUMENTS

The carrying value of the Company’s

short-term financial instruments, such as cash, accounts receivable, prepaid expenses, accounts payable, unearned revenue, accrued expenses

and other payables approximates their FV due to their short maturities. FASB ASC Topic 825, “Financial Instruments,” requires

disclosure of the FV of financial instruments held by the Company. The carrying amounts reported in the balance sheets for current liabilities

qualify as financial instruments and are a reasonable estimate of their FV because of the short period of time between the origination

of such instruments and their expected realization and the current market rate of interest.

FAIR

VALUE MEASUREMENTS AND DISCLOSURES

FASB ASC Topic 820, “Fair

Value Measurements,” defines FV, and establishes a three-level valuation hierarchy for disclosures that enhances disclosure requirements

for FV measures. The three levels are defined as follows:

| ● | Level

1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| ● | Level

2 inputs to the valuation methodology include other than those in level 1 quoted prices for similar assets and liabilities in active

markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of

the financial instrument. |

| ● | Level

3 inputs to the valuation methodology are unobservable and significant to the FV measurement. |

As of September 30, 2024 and

June 30, 2024, the Company did not identify any assets or liabilities required to be presented on the balance sheet at FV on a recurring

basis.

IMPAIRMENT OF LONG-LIVED ASSETS

In accordance with FASB ASC 360-10,

“Accounting for the Impairment or Disposal of Long-Lived Assets”, long-lived assets such as property and equipment are reviewed

for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable, or it

is reasonably possible that these assets could become impaired as a result of technological or other changes. The determination of recoverability

of assets to be held and used is made by comparing the carrying amount of an asset to future undiscounted cash flows expected to be generated

by the asset.

If such assets are considered

impaired, the impairment to be recognized is measured as the amount by which the carrying amount of the asset exceeds its FV. FV generally

is determined using the asset’s expected future undiscounted cash flows or market value, if readily determinable. Assets to be disposed

of are reported at the lower of the carrying amount or FV less cost to sell. For the three months ended September 30, 2024 and 2023, there

was no impairment loss recognized on long-lived assets.

UNEARNED REVENUE

The Company records payments

received in advance from its customers or sales agents for the Company’s products as unearned revenue, mainly consisting of deposits

or prepayment for 5G products from the Company’s sales agencies. These orders normally are delivered based upon contract terms and

customer demand, and the Company will recognize it as revenue when the products are delivered to the end customers.

LEASES

The Company determines if an

arrangement is a lease at inception under FASB ASC Topic 842. Right of Use Assets (“ROU”) and lease liabilities are recognized

at commencement date based on the present value of remaining lease payments over the lease term. For this purpose, the Company considers

only payments that are fixed and determinable at the time of commencement. As most of its leases do not provide an implicit rate, it uses

its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments.

The Company’s incremental borrowing rate is a hypothetical rate based on its understanding of what its credit rating would be. The

ROU assets include adjustments for prepayments and accrued lease payments. The ROU asset also includes any lease payments made prior to

commencement and is recorded net of any lease incentives received. The Company’s lease terms may include options to extend or terminate

the lease when it is reasonably certain that it will exercise such options.

ROU assets are reviewed for impairment

when indicators of impairment are present. ROU assets from operating and finance leases are subject to the impairment guidance in ASC

360, Property, Plant, and Equipment, as ROU assets are long-lived nonfinancial assets.

ROU assets are tested for impairment

individually or as part of an asset group if the cash flows related to the ROU asset are not independent from the cash flows of other

assets and liabilities. An asset group is the unit of accounting for long-lived assets to be held and used, which represents the lowest

level for which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities. The Company

recognized no impairment of ROU assets as of September 30, 2024 and June 30, 2024.

REVENUE RECOGNITION

The Company follows Accounting

Standards Codification Topic 606, Revenue from Contracts with Customers (ASC 606).

The core principle underlying

FASB ASC 606 is that the Company will recognize revenue to represent the transfer of goods and services to customers in an amount that

reflects the consideration to which the Company expects to be entitled in such exchange. This will require the Company to identify contractual

performance obligations and determine whether revenue should be recognized at a point in time or over time, based on when control of goods

and services transfers to a customer. The Company’s revenue streams are identified when possession of goods and services is transferred

to a customer.

FASB ASC Topic 606 requires the

use of a five-step model to recognize revenue from customer contracts. The five-step model requires the Company (i) identify the contract

with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable

consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price

to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies each performance

obligation.

The Company derives its revenues

from product sales and 5G messaging service contracts with its customers, with revenues recognized upon delivery of services and products.

Persuasive evidence of an arrangement is demonstrated via product sale contracts and professional service contracts, with performance

obligations identified. The transaction price, such as product selling price, and the service price to the customer with corresponding

performance obligations are fixed upon acceptance of the agreement. The Company recognizes revenue when it satisfies each performance

obligation, the customer receives the products and passes the inspection and when professional service is rendered to the customer, collectability

of payment is probable. These revenues are recognized at a point in time after each performance obligations is satisfied. Revenue is recognized

net of returns and value-added tax charged to customers.

The following

table shows the Company’s revenue by revenue sources:

| | |

For the Three Months

Ended

September 30,

2024 | | |

For the Three Months

Ended

September 30,

2023 | |

| 5G AI Multimodal communication | |

$ | 21,075,584 | | |

$ | 6,880,463 | |

| 5G AI Multimodal communication | |

| 21,075,584 | | |

| 6,880,463 | |

| Cloud platform construction cooperation project | |

| - | | |

| - | |

| Acoustic Intelligence Business | |

| 2,464 | | |

| 280 | |

| Ultrasonic Sound Air Disinfection Equipment | |

| 2,464 | | |

| 280 | |

| Other | |

| - | | |

| - | |

| Smart City business | |

| 3,046 | | |

| - | |

| Smart community | |

| 3,046 | | |

| - | |

| Smart community broadcasting system | |

| - | | |

| - | |

| Smart agriculture | |

| - | | |

| - | |

| | |

| | | |

| | |

| Other | |

| - | | |

| - | |

| Total revenue | |

$ | 21,081,094 | | |

$ | 6,880,743 | |

| * | include the

revenue from discontinued entities |

SEGMENT

INFORMATION

FASB ASC Topic 280, “Segment

Reporting,” requires use of the “management approach” model for segment reporting. The management approach model

is based on the method a company’s management organizes segments within the company for making operating decisions and assessing

performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other

manner in which management disaggregates a company. Management determined the Company’s current operations constitutes a single

reportable segment in accordance with ASC 280. The Company’s only business and industry segment is high technology and advanced

information systems (“TAIS”). TAIS includes smart city solutions that meet the security needs of residential communities,

schools and commercial enterprises, and 5G messaging services including 5G SMS, 5G MMCP and 5G multi-media video messaging.

All of the Company’s customers

are in the PRC and all revenues for the three months ended September 30, 2024 and 2023 were generated from the PRC. All identifiable assets

of the Company are located in the PRC. Accordingly, no geographical segments are presented.

INCOME

TAXES

The Company uses the asset and

liability method of accounting for income taxes in accordance with FASB ASC Topic 740, “Income Taxes.” Under this method,

income tax expense is recognized for the amount of: (i) taxes payable or refundable for the current period and (ii) deferred tax consequences

of temporary differences resulting from matters that have been recognized in an entity’s financial statements or tax returns.

Deferred tax assets also include the prior years’ net operating losses carried forward. Deferred tax assets and liabilities are

measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to

be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the results of operations

in the period that includes the enactment date. A valuation allowance is provided to reduce the deferred tax assets reported if based

on the weight of the available positive and negative evidence, it is more likely than not some portion or all of the deferred tax assets

will not be realized.

The Company follows FASB ASC

Topic 740, which prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken

or expected to be taken in a tax return. FASB ASC Topic 740 also provides guidance on recognition of income tax assets and liabilities,

classification of current and deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions,

accounting for income taxes in interim periods, and income tax disclosures.

Under the provisions of FASB

ASC Topic 740, when tax returns are filed, it is likely some positions taken would be sustained upon examination by the taxing authorities,

while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately

sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available

evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution

of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that

meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent

likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions

taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the accompanying

balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Interest

associated with unrecognized tax benefits is classified as interest expense and penalties are classified in selling, general and administrative

expenses in the statement of income. As of September 30, 2024 and June 30, 2024, the Company had no unrecognized tax positions and

no charges during the three months ended September 30, 2024 and 2023, and accordingly, the Company did not recognize any interest or penalties

related to unrecognized tax benefits. The Company files a U.S. and PRC income tax return. With few exceptions, the Company’s U.S.

income tax returns filed for the years ending on June 30, 2018 and thereafter are subject to examination by the relevant taxing authorities;

the Company uses calendar year-end for its PRC income tax return filing, PRC income tax returns filed for the years ending on December

31, 2018 and thereafter are subject to examination by the relevant taxing authorities.

RESEARCH AND DEVELOPMENT EXPENSES

Research and development expenses

are expensed in the period when incurred. These costs primarily consist of cost of materials used, salaries paid for the Company’s

development department, and fees paid to third parties.

NONCONTROLLING

INTERESTS

The Company follows FASB ASC

Topic 810, “Consolidation,” governing the accounting for and reporting of noncontrolling interests (“NCIs”)

in partially owned consolidated subsidiaries and the loss of control of subsidiaries. Certain provisions of this standard indicate, among

other things, that NCI (previously referred to as minority interests) be treated as a separate component of equity, not as a liability,

that increases and decreases in the parent’s ownership interest that leave control intact be treated as equity transactions rather

than as step acquisitions or dilution gains or losses, and that losses of a partially-owned consolidated subsidiary be allocated to non-controlling

interests even when such allocation might result in a deficit balance.

The net Income (loss) attributed

to NCI was separately designated in the accompanying statements of operations and comprehensive income (loss). Losses attributable to

NCI in a subsidiary may exceed a non-controlling interest’s interests in the subsidiary’s equity. The excess attributable

to NCIs is attributed to those interests. NCIs shall continue to be attributed their share of losses even if that attribution results

in a deficit NCI balance. On December 20, 2022, Guohao Century acquired a 30% ownership noncontrolling interests of Zhangxun from

Zhengmao Zhang at the price of $0.15 (RMB 1.00). The Company recognized a paid in capital deficit of $982,014 from this

purchase due to continued loss of Zhangxun. Subsequent to this purchase, the Company ultimately holds a 99.9% ownership of Zhangxun.

On July 20, 2023, the Company sold Zhangxun to a third party for RMB 2 ($0.28).

Zhangqi was 1% owned by

noncontrolling interest, in November 2023, the Company dissolved Zhangqi. As of December 31, 2023, Shuhai Nanjing was 1% owned by

noncontrolling interest, Shenzhen Acoustic MP was 1% owned by noncontrolling interest, Shuhai Shenzhen Acoustic was 0.1% owned

by noncontrolling interest, Guozhong Times was 0.091% owned by noncontrolling interest, and Guozhong Haoze was 0.091% owned

by noncontrolling interest. During the three months ended September 30, 2024 and 2023, the Company had loss of $8,680 and $9,932 attributable

to the noncontrolling interest from continuing operations, respectively.

CONCENTRATION OF CREDIT RISK

The Company maintains cash in

accounts with state-owned banks within the PRC. Cash in state-owned banks less than RMB500,000 ($76,000) is covered by insurance.

Should any institution holding the Company’s cash become insolvent, or if the Company is unable to withdraw funds for any reason,

the Company could lose the cash on deposit with that institution. The Company has not experienced any losses in such accounts and believes

it is not exposed to any risks on its cash in these bank accounts. Cash denominated in RMB with a U.S. dollar equivalent of $645,916 and

$100,788 as of September 30, 2024 and June 30, 2024, respectively, was held in accounts at financial institutions located in the

PRC‚ which is not freely convertible into foreign currencies.

Cash held in accounts at U.S.

financial institutions is insured by the Federal Deposit Insurance Corporation or other programs subject to certain limitations up to

$250,000 per depositor. As of September 30, 2024 and June 30, 2024, cash of $290,077 and $79,225 was maintained at

U.S. financial institutions. Cash was maintained at financial institutions in Hong Kong, and was insured by the Hong Kong Deposit Protection

Board up to a limit of HK $500,000 ($64,000). As of September 30, 2024 and June 30, 2024, the cash balance of $1,613 and $1,249 was

maintained at financial institutions in Hong Kong. The Company, its subsidiaries and VIE have not experienced any losses in such accounts

and do not believe the cash is exposed to any significant risk.

FOREIGN CURRENCY TRANSLATION

AND COMPREHENSIVE INCOME (LOSS)

The accounts of the Company’s

Chinese entities are maintained in RMB and the accounts of the U.S. parent company are maintained in United States dollar (“USD”).

The financial statements of the Chinese entities were translated into USD in accordance with FASB ASC Topic 830 “Foreign Currency

Matters.” All assets and liabilities were translated at the exchange rate on the balance sheet date; stockholders’ equity

is translated at historical rates and the statements of operations and cash flows are translated at the weighted average exchange rate

for the period. The resulting translation adjustments are reported under other comprehensive income (loss) in accordance with FASB ASC

Topic 220, “Comprehensive Income.” Gains and losses resulting from foreign currency transactions are reflected in the statements

of operations.

The Company follows FASB ASC

Topic”220-10, “Comprehensive Income (loss).” Comprehensive income (loss) comprises net income (loss) and all changes

to the statements of changes in stockholders’ equity, except those due to investments by stockholders, changes in additional paid-in

capital and distributions to stockholders.

The exchange

rates used to translate amounts in RMB to USD for the purposes of preparing the CFS were as follows:

| | |

September 30, | | |

September 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | |

| Period-end date USD: RMB exchange rate | |

| 7.0074 | | |

| 7.1798 | | |

| 7.1268 | |

| Average USD for the reporting period: RMB exchange rate | |

| 7.1169 | | |

| 7.1729 | | |

| 7.1326 | |

BASIC

AND DILUTED EARNINGS (LOSS) PER SHARE (EPS)

Basic EPS is computed by dividing

income available to common shareholders by the weighted average number of common shares outstanding for the period. Diluted EPS is computed

similarly, except that the denominator is increased to include the number of additional common shares that would have been outstanding

if the potential common shares had been issued and if the additional common shares were dilutive. Diluted EPS is based on the assumption

that all dilutive convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock

method. Under this method, options and warrants are assumed to have been exercised at the beginning of the period (or at the time of issuance,

if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

STATEMENT OF CASH FLOWS

In accordance with FASB ASC Topic

230, “Statement of Cash Flows,” cash flows from the Company’s operations are calculated based upon the local

currencies. As a result, amounts shown on the statement of cash flows may not necessarily agree with changes in the corresponding asset

and liability on the balance sheet.

RECENT ACCOUNTING PRONOUNCEMENTS

In November 2023, the FASB issued

ASU 2023-07, the amendments in the ASU are intended to improve reportable segment disclosure requirements, primarily through enhanced

disclosures about significant segment expenses that are regularly provided to the chief operating decision maker and included within each

reported measure of segment profit or loss. In addition, the amendments enhance interim disclosure requirements, clarify circumstances

in which an entity can disclose multiple segment measures of profit or loss, provide new segment disclosure requirements for entities

with a single reportable segment, and contain other disclosure requirements. The purpose of the amendments is to enable “investors

to better understand an entity’s overall performance” and assess “potential future cash flows.” The amendments

in ASU 2023-07 are effective for all public entities for fiscal years beginning after December 15, 2023, and interim periods within fiscal

years beginning after December 15, 2024. The Company’s management does not believe the adoption of ASU 2023-09 will have a material

impact on its financial statements and disclosures.

In December 2023, the FASB issued

ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (ASU 2023-09), which requires disclosure of incremental

income tax information within the rate reconciliation and expanded disclosures of income taxes paid, among other disclosure requirements.

ASU 2023-09 is effective for fiscal years beginning after December 15, 2024. Early adoption is permitted. The Company’s management

does not believe the adoption of ASU 2023-09 will have a material impact on its financial statements and disclosures.

The Company does not believe

other recently issued but not yet effective accounting standards, if currently adopted, would have a material effect on the Company’s

consolidated financial position, statements of comprehensive income and cash flows.

NOTE

3 – PROPERTY AND EQUIPMENT

Property

and equipment are summarized as follows:

| | |

September 30,

2024 | | |

June 30,

2024 | |

| Furniture and fixtures | |

$ | 69,024 | | |

$ | 77,281 | |

| Vehicle | |

| 499 | | |

| 491 | |

| Leasehold improvement | |

| 223,693 | | |

| 219,945 | |

| Office equipment | |

| 246,333 | | |

| 241,543 | |

| Subtotal | |

| 539,549 | | |

| 539,260 | |

| Less: accumulated depreciation | |

| 495,869 | | |

| 490,794 | |

| Total | |

$ | 43,680 | | |

$ | 48,466 | |

Depreciation

for the three months ended September 30, 2024 and 2023 was $5,463 and $10,662, respectively.

NOTE

4 – INTANGIBLE ASSETS

Intangible

assets are summarized as follows:

| | |

September 30,

2024 | | |

June 30,

2024 | |

| Software registration or using right | |

$ | 1,866,254 | | |

$ | 1,809,548 | |

| Patent | |

| 14,980 | | |

| 14,729 | |

| Software and technology development costs | |

| 11,970 | | |

| 11,770 | |

| Value-added telecommunications business license | |

| 15,853 | | |

| 15,587 | |

| Subtotal | |

| 1,909,057 | | |

| 1,851,634 | |

| Less: Accumulated amortization | |

| 1,390,751 | | |

| 1,305,633 | |

| Total | |

$ | 518,306 | | |

$ | 546,001 | |

Software registration or using

right represented the purchase cost of customized software with its source code from third party software developer.

Software and technology development

cost represented development costs incurred internally after the technological feasibility was established and a working model was produced

and was recorded as intangible asset.

Amortization for the three months

ended September 30, 2024 and 2023 was $80,172 and $127,211, respectively. The amortization expense for the next five years as of

September 30, 2024 will be $261,379, $174,020, $82,907, $0 and $0.

NOTE

5 – PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid

expenses and other current assets consisted of the following:

| | |

September 30,

2024 | | |

June 30,

2024 | |

| Security deposit | |

$ | 84,556 | | |

$ | 64,041 | |

| Prepaid expenses | |

| 474,229 | | |

| 1,225,612 | |

| Prepaid 5G Cost | |

| 1,239,516 | | |

| - | |

| Other receivables – Heqin | |

| 468,077 | | |

| 467,250 | |

| Advance to third party individuals, no interest, payable upon demand | |

| 106,330 | | |

| 154,345 | |

| Others | |

| 4,368 | | |

| 42,958 | |

| Total | |

| 2,377,076 | | |

| 1,954,206 | |

| Less: allowance for other receivables – Heqin | |

| 468,077 | | |

| 467,250 | |

| Total | |

$ | 1,908,999 | | |

$ | 1,486,956 | |

As of September 30, 2024, prepaid

expenses mainly consisted of prepayment of 5G messaging service fee recharge of $134,628, prepaid professional fee of $229,471, prepayment

for inventory purchase of $67,385, prepaid rent and property management fee of $3,568 and other prepayments of $39,177.

As of June 30, 2024, prepaid

expenses mainly consisted of prepaid marketing expense of $946,954, prepaid telecommunication service fee (mainly including SMS and MMS

services) of $198,559, prepaid rent and property management fees of $3,508 and other prepayments of $76,591.

Prepaid

marketing expense

On September 16, 2023, Tianjin

Information entered an Operation Cooperation Agreement with an unrelated company, Beijing Jincheng Haoda Construction Engineering Co.,

Ltd (“Jincheng Haoda”), for marketing and promoting the sale of 5G messaging and acoustic intelligence series products in

oversea market. The cooperation term is from September 16, 2023 through September 15, 2026. Jincheng Haoda is committed to complete RMB 200 million

sales performance in the first year, RMB 300 million sales performance in the second year, and RMB 400 million sales

performance in the third year. The Company will pay 25% of the sales amount to Jincheng Haoda as marketing fee upon receipt of the

sales amount, on monthly basis. As of September 30, 2024, the Company made a prepayment of RMB 14,997,000 ($2,088,777) to Jincheng

Haoda for facilitating the quick capture of the market for the Company’s products, the prepayment was the 30% of marketing

service fee of first year’s target sales to be completed by Jincheng Haoda. During the service term, the Company will perform the

annual assessment, if Jincheng Haoda was not able to achieve the target annual sales, and did not reach 30% of target annual sales

amount, Jincheng Haoda shall return the Company’s prepayment after deducting the marketing service fee of the actual sales. In addition,

under the circumstance Jincheng Haoda did not complete the 30% of the annual target sales, Jincheng Haoda will indemnify the Company 20%

of marketing service fee of unachieved sales amount from the 30% of the annual target sales. For the three months ended September

30, 2024, the Company recorded an amortization of prepaid expense of $0.53 million in the selling expense; this prepaid marketing

expense was fully amortized as of September 30, 2024.