Baillie Gifford Japan Trust

05/18/2005

Baillie Gifford Japan Trust

baillie-gifford-japan-trust

Japan remains one of our preferred investment destinations, as we believe the government has finally addressed the structural deficiencies that have plagued the economy in the past. We believe that the Baillie Gifford Japan Trust (BGFD) is an excellent investment vehicle with which to gain exposure to a potential recovery in the country's economy and equity markets.

BGFD recently announced interim results to 28 February 2005. Over this period, the Trust out-performed its benchmark index (TOPIX) by 3 percentage points. Net asset value per share rose by 5.5 percent, while the benchmark index gained 2.5 percent. The use of gearing and astute stock selection aided the out-performance, particularly within the electricals, retail and financial sectors. Net gearing at the interim period stood at 15.4 percent of shareholders' funds.

The Japanese economy exhibited signs of a slowdown towards the end of 2004. We are therefore encouraged by recent economic releases which suggest that confidence and real economic indicators are improving. Current GDP growth estimates for the year to March 2006 are around 1.5 percent.

We continue to believe that growth in Japanese property prices will permeate throughout the wider economy with positive effects. As property values rise and home owners perceive their wealth to be increasing, they will have a greater propensity to spend. We are also heartened that after three years of falling wages, workers' pay has recently shown signs of stabilising, and even rising in some sectors. A recovery in salary growth will further underpin consumer demand.

We believe that the outlook for Corporate Japan remains encouraging. The Manager reports that profits for Japanese companies will have risen strongly in the year to March 2005. So far this year, over one third of companies in the main TOPIX index have reinstated or increased dividend payments. This trend is expected to continue over the next few years. As such, overall equity valuations are attractive. The average forward price-to-earnings ratio stands at around 16 times - the lowest level in 30 years.

With an improving market environment the stock and sector picking abilities of the Fund Manager, Ms Sarah Whitley should shine. BGFD has historically performed impressively compared to other Japanese investment trusts. The Trust has been ranked first in its peer group in terms of net asset value gains over one, three, five and ten years.

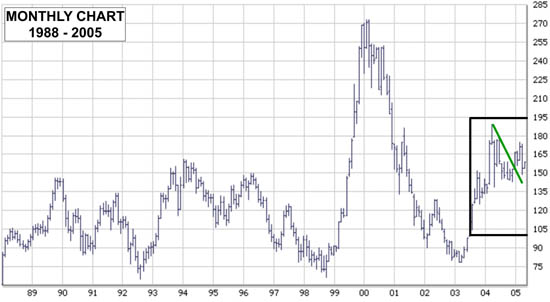

We believe that the Trust's portfolio of small to medium sized companies provides significant leverage to an economic recovery in Japan. At the current price, the listed units provide a 9.4 percent discount to current net asset backing of 174p, and offer excellent value in our opinion.

Baillie Gifford Japan Trust Charts :

|