London open: FTSE flat amid Middle East woes, ahead of payrolls

London stocks were flat in early trade on Friday as Israel’s strikes against Lebanon intensified and as investors eyed the latest US non-farm payrolls report.

At 0900 BST, the FTSE 100 was unchanged at 8,286.14.

Patrick Munnelly at Tickmill Group said: “Escalating tensions in the Middle East have cast a shadow over global markets ahead of the weekend, and oil prices are on the brink of their largest weekly gain in over a year on Friday. Despite the fact that the majority of equity indexes and stock futures are in positive territory, investors are speculating about the possibility of imminent retaliatory strikes by Israel against Iran, which is limiting their gains.

“Brent crude futures are anticipated to experience a weekly increase of approximately 8%, which would be the most significant since February 2023. Conversely, US crude futures are expected to experience a weekly increase of 8.2%, which would be the largest since March of last year. Despite the fact that US President Joe Biden has stated that he does not anticipate a ‘all-out war’ in the Middle East, he has previously suggested that the US was considering strikes on Iran’s oil facilities as a response to Tehran’s missile attack on Israel.

“In spite of the fact that oil prices have returned to the levels they were at just one month ago and oil has recovered from a low base, the pressure on world stocks and investors’ risk appetite is beginning to mount. Should oil prices continue to increase and geopolitical tensions persist, investors may need to reevaluate their inflation forecasts.”

Looking ahead to the rest of the day, attention will turn to the US non-farm payrolls report for September, which is due at 1330 BST, along with the unemployment rate and average earnings.

The market is expecting payrolls to grow by 146,000 for September, up a touch from the 140,000 jump seen in August. The unemployment rate is expected to be steady at 4.2% and average hourly earnings are also expected to be steady, at 3.8% year-on-year.

On the UK macro front, the S&P Global/CIPS construction PMI for September is scheduled for release at 0930 BST.

In equity markets, JD Wetherspoon edged higher as it posted a 33% drop in full-year pre-tax profit after separately disclosed items, but a 73.5% increase in pre-tax profit before separately disclosed items to £73.9m. The pub chain also said that full-year revenue rose 5.7% to £2.04bn as like-for-like sales grew 7.6%.

Watches of Switzerland gained after saying it had bought Hodinkee, a specialist website for luxury watch enthusiasts, for an undisclosed sum.

SSE was in the red as it emerged that completion of its Dogger Bank A offshore wind project has been pushed back to the second half of 2025.

Top 10 FTSE 100 Risers

| Sponsored by Plus500 |

|

| # | Name | Change Pct | Change | Cur Price | |

|---|---|---|---|---|---|

| 1 |  |

Schroders Plc | +2.59% | +9.00 | 356.20 |

| 2 |  |

Natwest Group Plc | +2.03% | +6.70 | 336.40 |

| 3 |  |

Woodside Energy Group Ltd | +1.76% | +24.00 | 1,384.00 |

| 4 |  |

Standard Chartered Plc | +1.58% | +12.60 | 810.00 |

| 5 |  |

Croda International Plc | +1.45% | +60.00 | 4,206.00 |

| 6 |  |

Prudential Plc | +1.34% | +9.40 | 712.60 |

| 7 |  |

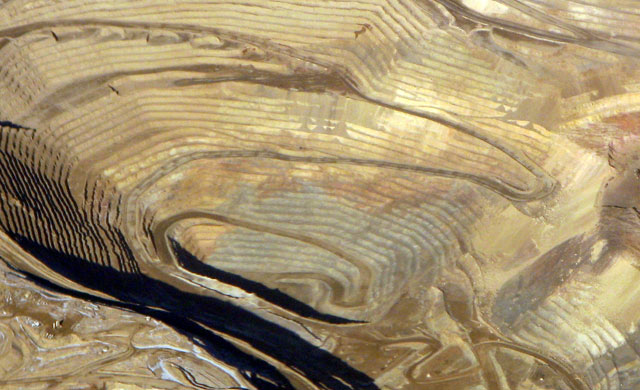

Antofagasta Plc | +1.23% | +24.00 | 1,970.00 |

| 8 |  |

Lloyds Banking Group Plc | +1.22% | +0.70 | 58.14 |

| 9 |  |

Taylor Wimpey Plc | +1.15% | +1.90 | 167.10 |

| 10 |  |

Bt Group Plc | +1.12% | +1.60 | 144.10 |

Top 10 FTSE 100 Fallers

| Sponsored by Plus500 |

|

| # | Name | Change Pct | Change | Cur Price | |

|---|---|---|---|---|---|

| 1 |  |

Wheaton Precious Metals Corp. | -4.72% | -230.00 | 4,640.00 |

| 2 |  |

Jd Sports Fashion Plc | -2.14% | -3.05 | 139.40 |

| 3 |  |

Relx Plc | -2.11% | -75.00 | 3,476.00 |

| 4 |  |

Smurfit Westrock Plc | -1.84% | -66.00 | 3,529.00 |

| 5 |  |

Rolls-royce Holdings Plc | -1.72% | -9.20 | 524.20 |

| 6 |  |

Bae Systems Plc | -1.39% | -18.00 | 1,281.50 |

| 7 |  |

Diageo Plc | -1.17% | -30.50 | 2,586.00 |

| 8 |  |

Experian Plc | -1.11% | -44.00 | 3,915.00 |

| 9 |  |

Halma Plc | -1.05% | -27.00 | 2,552.00 |

| 10 |  |

Sse Plc | -1.01% | -19.00 | 1,871.50 |

US close: Stocks lower as traders await September payrolls report

Major indices closed lower on Thursday amid heightened tensions in the Middle East and a looming September payrolls report.

At the close, the Dow Jones Industrial Average was down 0.44% at 42,011.59, while the S&P 500 lost 0.17% to 5,699.94 and the Nasdaq Composite saw out the session 0.04% weaker at 17,918.48.

The Dow closed 184.93 points lower on Thursday, easily reversing gains recorded yesterday in what was a rollercoaster session for major indices.

Escalating tensions in the Middle East continued to remain in focus on Thursday after Iran launched a missile attack on Israel after the latter launched a ground invasion into neighbouring Lebanon.

Both market participants and the Federal Reserve were also looking ahead to new jobs data, with the release of September’s all-important payrolls report set for Friday morning.

On the macro front for Thursday, US employers announced 72,821 job cuts in September, according to Challenger, Gray & Christmas, down from 75,891 in August but markedly higher than last August’s print of 47,457. The technology sector announced 11,430 cuts, while the healthcare and entertainment/leisure sectors announced 10,458 and 9,368, respectively.

Elsewhere, Americans lined up for unemployment benefits at an accelerated clip in the week ended 28 September, according to the Department of Labor. Initial jobless claims rose by 6,000 to 225,000, above market expectations for a reading of 220,000 for a new three-week high, supporting the belief that the Federal Reserve will implement interest rate cuts at every remaining meeting this year. Elsewhere, outstanding claims fell by 1,000 to 1.82m, while the four-week moving average for initial claims, which aims to strip out week-to-week volatility, declined by 750 to 224,250.

On another note, US factory orders eased by 0.2% month-on-month in August to $590.4bn, according to the Census Bureau, trimming last month’s 4.9% downwardly revised jump and missing forecasts for an unchanged monthly reading. New orders for non-durable goods fell by 0.5% to $300.8bn, while new orders for durable goods were marginally higher at $289.6bn.

Finally, the Institute of Supply Management‘s services PMI surged to 54.9 in September, up from 51.5 in August and easily beating market forecasts for a reading of 51.7 – pointing to the strongest growth in the services sector since February 2023.

“The stronger growth indicated by the index data was generally supported by panelists’ comments; however, concerns over political uncertainty are more prevalent than last month. Pricing of supplies remains an issue with supply chains continuing to stabilise; one respondent voiced concern over potential port labour issues. The interest-rate cut was welcomed; however, labour costs and availability continue to be a concern across most industries”, said the ISM’s Steve Miller.

In the corporate space, Levi Strauss shares traded lower after the jeans maker posted mixed Q3 results and said it was mulling over a sale of its loss-making Dockers unit.

Friday newspaper round-up: Electric car sales, SSE, small businesses

Rachel Reeves is paving the way for a multibillion-pound increase in public-sector investment at the budget after the government announced plans to commit almost £22bn over 25 years to fund carbon capture and storage projects. In what is expected to be one of the biggest green spending promises of the parliament, the chancellor, prime minister and the energy secretary, Ed Miliband, will unveil the details on a visit to the Liverpool city region on Friday declaring a “new era” for clean energy jobs. – Guardian

UK electric car sales hit a record high in September, even as bosses from big carmakers told the chancellor that government targets were putting too much pressure on the industry. The British industry sold 56,300 electric cars during the month, the highest on record, according to preliminary data published by the Society of Motor Manufacturers and Traders (SMMT), a lobby group. – Guardian

Sadiq Khan has called opponents of more taxpayer spending on London “unpatriotic” as he pressed the Government to support as much as £10bn of new investment into the capital’s railways. The Mayor said London was locked in a competition with cities such as Paris, New York, Hong Kong and Singapore, and must not be held back by squabbles over whether cash would be better directed elsewhere in the UK. – Telegraph

The first phase of a project to build one of the world’s largest wind farms in British waters has been pushed back to the second half of next year. Dogger Bank A, which together with its two sister wind farms will have a combined installed capacity of 3.6 gigawatts, was due for completion during the six months to the end of September. SSE, the FTSE 100 energy group, has blamed stormy weather for further delays to the development, which had initially been expected to be finished this year. However, “project returns are not expected to be materially impacted”, the company said. – The Times

Britain has lost half a million small businesses since its withdrawal from the European Union and the onset of the pandemic, official figures show. The total number of private sector businesses fell by 56,000 to 5.5 million in the year to the start of 2024, the Department for Business and Trade said in its annual official estimate. It takes the total decline to about 500,000 since the stock of businesses peaked at six million at the start of 2020. – The Times

Hot Features

Hot Features