Solana’s decentralized applications (dapps) experienced a surge in revenue during November, with the ecosystem collectively generating a record-breaking sum. Notably, Pumpfun, a prominent player within the Solana ecosystem, surpassed the $100 million revenue milestone, showcasing the growing maturity and profitability of the Solana dapp landscape.

Solana Dapp Revenue Soars to New Heights

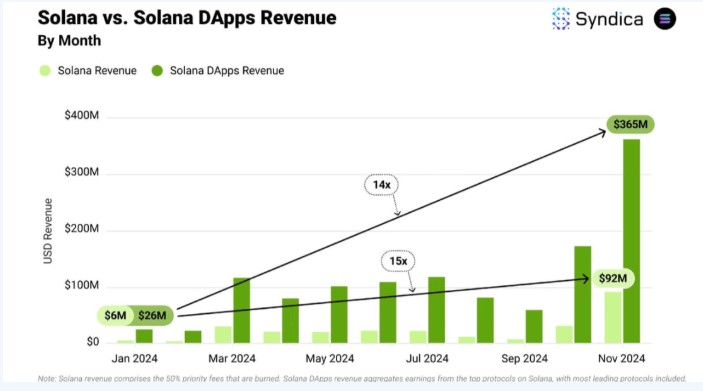

November witnessed a record-breaking surge in revenue generated by Solana’s decentralized applications (dapps), reaching a staggering $365 million. This figure, according to Syndica research, surpassed the network revenue of Solana itself, which stood at $92 million.

Over 30 protocols achieved revenue exceeding $1 million, with Pumpfun, a launchpad for memecoins, emerging as a frontrunner. Syndica research reported that Pumpfun generated $106 million in November, constituting approximately 25% of the total revenue generated by the Solana ecosystem.

Source: new.bitcoin.com

Raydium maintained its dominance in spot decentralized exchange (dex) revenue with a record-high of $32 million, representing a substantial 86% of the total spot dex revenue. Similarly, Jupiter, fueled by perpetual contracts, achieved a new revenue record of $17 million. Phantom emerged as the top earner among Jupiter’s swap API partners.

Year-to-date, memecoin dapps have led the revenue race, generating over $500 million. Pumpfun and Photon were identified as the key contributors in this sector. Telegram bots and spot dexs followed closely, generating $300 million and $141 million, respectively.

Kamino Finance emerged as the leader in the lending category, achieving an all-time high of $2.9 million. Syndica research indicated that these earnings were primarily derived from interest rate spreads, loan origination fees, and liquidation penalties.

Decentralized finance (defi) applications remained the primary driver of dapp revenue, contributing 83.7% to the total. Wallets, infrastructure, non-fungible tokens (NFTs), and gaming accounted for the remaining share with 9.6%, 3.4%, 2.2%, and 0.9%, respectively.

November witnessed significant growth within Solana’s dapp ecosystem, with monthly trade volume on dexs surpassing the $100 billion mark. These record-breaking figures suggest a strong trajectory for continued growth within the Solana ecosystem.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features