The share price of Magnolia Petroleum (LSE:MAGP) rose by 4.65% on the London Exchange today on the heels of a highly favorable report for the quarter ended 30 September. Although Magnolia is a long way from being a constituent of the FTSE 100 with a market cap of only £10.25 million, it does appear to be well positioned to evolve into a significantly larger player in the U.S. oil production market.

The first and most obvious reason I suggest watching MAGP is the stunning news of its 93% increase in half-year revenues from $910,000 to $1.75 million. It’s EBITDA for the same period increased nearly three-fold from $237,552 in 2013 to $699,397 as at the end of September.

The second reason is that it is successfully operating in the Bakken Shale region of North Dakota, one of the fastest growing commercial and industrial areas in North America. In a country where a growing percentage of workers cannot find employment, Indeed.com lists about 1,000 jobs in Williston, North Dakota, the closest city, nearly every day. Four years ago Williston’s population was 14,700. It now exceeds 21,000. Think about that. Even with a 50% increase in population over a four year period, over 1,000 jobs continue to be advertised daily.

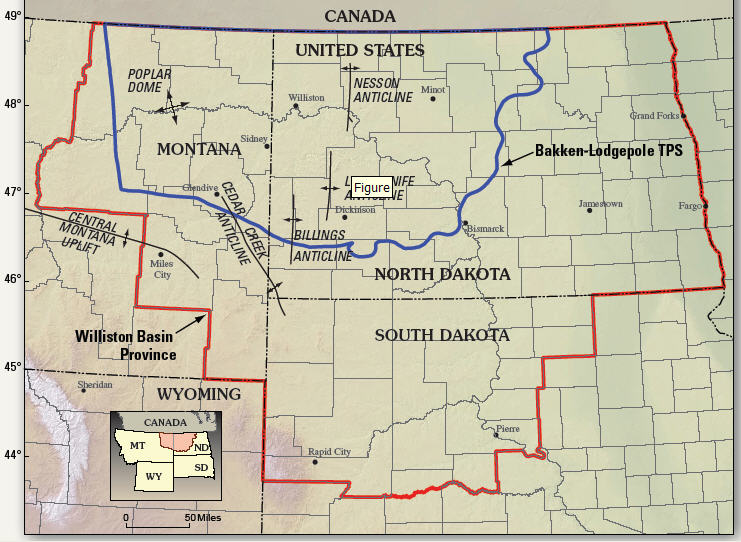

The Bakken region is now considered one of the most important sources of oil in the U.S., due to the vast amounts of estimated recoverable oil in reserve, but even more so because of the introduction of fracking and horizontal drilling. The region extends beyond North Dakota into neighboring Montana and across the border into Saskatchewan and Manitoba.

The United States Geological Survey (USGS) has estimated that the Bakken field contains 7.4 billion barrels of as yet undiscovered oil and 6.7 trillion cubic feet of natural gas. As of November 2013, the Bakken region had already accounted for more than 10% of total U.S. oil production. As of April 2014, Bakken production had increased 10-fold over the previous seven years, making North Dakota the second largest oil-producing state in the U.S. whilst having the lowest unemployment rate of any of the 50 states. There are currently (as of 13 October), 193 shale rigs in operation in the Bakken region.

Magnolia’s interests are not all vested in North Dakota. The company also maintains interest in operations in Montana, Mississippi and Oklahoma. The company has also announced that it has recently secured a credit facility in the amount of $6 million, which it will use to “accelerate drilling activity and prove-up reserves on leases.” MAGP has 161 producing wells and an additional 67 in various stages of construction.

COO, Rita Whittington, declared that, “With our US$6 million credit facility in place and our rapidly growing revenues, which at the half year stage almost doubled year on year to US$1,755,459, we will continue to participate in new drilling activity alongside established operators such as Devon Energy. We have put in place a platform from which we can accelerate the roll-out of our strategy, and in the process, deliver on our objective to generate value for shareholders.“

Is Magnolia Petroleum one of the big boys? No, not yet. Is it worth watching? Most certainly, yes.

Hot Features

Hot Features