OMG! Subscriptions are only £45 a year………………….

Market in Brief

The FTSE100 closed down 1.15% at 6,985, the FTSE 250 was off 1.33% while the Aim All Share and FTSE Small Cap were both virtually unchanged.

Results this Week

DDD Group (DDD) – 2.62p Finals

BooHoo (Boo)- 27.75p Finals

Before Thursday’s Election three main UK PMI’s, Construction, Services and Composites, will be reported. In the US the slowing economy may be evidenced by Employment Figures on Thursday.

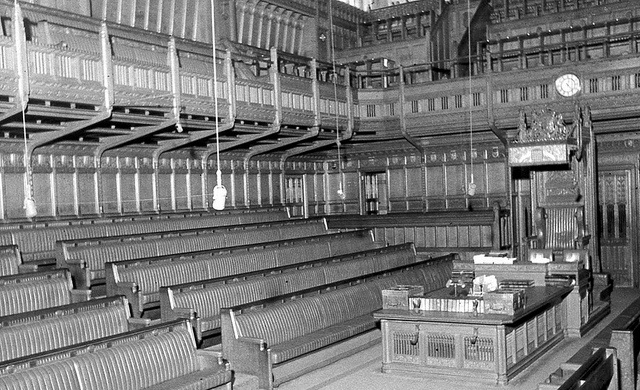

Final General Election Wisdom

- BBC Poll of Polls : Conservatives 34%, Labour 33%, UKIP 14%, Liberal Democrats 8%.

- A coalition is likely and the Party with the most seats will be given the first chance

- = The same again for another Five years seems most likely.

Reviews

PSPI 28.25p – Cash Back

PLA 106p- Growth wrapped

JQW 12p- Misunderstood?

ACC 3p – Slow growth =corporate action?

Public Service Properties Investments (LSE: PSPI)

28.25p (27.5p/29p)

Mkt cap: £10.7m

Next results: Interims September

Public Service Properties (LSE: PSPI) has completed the compulsory buy back of 67.454 million shares at 23.875p each. That buys back 64% of the shares in issue and uses up £16.1m of cash raised from recent property sales, leaving pro forma 2014 NAV of £20.3m or just over 53p a share. PSPI’s five remaining properties are in Germany so the company is exposed to the Euro. That could reduce the NAV and there is no guarantee that the remaining properties will be sold at their written down value.

On the plus side, Embrace, which bought the UK properties, has renewed certain care contracts that will trigger an initial payment of £2.5m – equivalent to 6.6p a share. That would take NAV to around 60p a share.

Allowing for the negatives, PSPI should still be able to distribute around 40p a share to shareholders.

Trading Strategy

Hold on for further cash distributions.

Original OMG! Price: 23.75p/24.5p

Plastics Capital (LSE:PLA)

106p (103p/109p)

Mkt Cap £37.5m

Next Results: Finals May

Second half trading was weaker than expected for Plastics Capital (LSE: PLA) but the long-term outlook remains positive.

Management says that trading was much stronger than in the first half helped by a recovery in the bearings business. The main problem was the improvement in hose mandrel revenues did not materialise until after the end of the financial year.

Plastic film packaging supplier Flexipol, acquired last November, performed better than expected and there are new products in the offing.

Allenby has reduced its 2014-15 profit estimate from £4.48m to £3.8m but the total dividend should still be 4p a share – covered nearly three times by earnings. The 2015-16 forecast has been cut from £6.1m to £4.9m with a forecast dividend of 5p a share. Net debt should still fall from £11.2m to less than £8m at the end of March 2016.

The current estimates appear achievable and provide some potential for upgrades.

Trading strategy

The shares remain good value despite the delays. They are trading on nine times 2015-16 estimates and yield 4.7%.

Original OMG! price: 114p/117p

JQW (LSE:JQW)

12p (11.5p-12.5p)

Mkt Cap £28.8m

Next Results: Interim September

The finals were good in most parts; with revenues up by 59% to £78.3m and a 14% increase in net profit to £14.7m. The gross margins however fell to 40% from 49% as client acquisition cost increased. No final dividend was paid and the share price fell from around 18p.

In the past 10 years, JQW has evolved from being a website designer in small region of southern China to one of the mainstream B2B platform operators in China. Its core offering has been expanded and improved from that of pure website design to other value-added services such as business search engine facility, marketing clients’ websites and their businesses, providing a marketplace for users to trade their products online in China and internationally.

The number of sales agencies increased by 14 to 44 at the end of 2014 (2013: 30 agencies) and the Board maintains its target to have at least 60 sales agencies by the end of 2015. Sales generated from agents have continued to grow fast, up 69% from £38.8m in 2013 to £65.7m in 2014, which contributed 84% of total sales.

The Group maintained its strategy to expand through the agency model which the Board believes offers the most efficient channel for the Group’s continued growth. The numbers of fee paying members, increased by 22% to 241,000 year-on-year. JQW has been working with CreditEase Group, a financial institution which provides wealth management, credit management, microfinance investment, and microcredit loan origination and services in China, to provide a platform and a direct link to a financial institution that provides SMEs with microloan services. The current year P/E is around 2x.

Financials

JQW remains a highly cash generative business. During 2014, the Group’s cash balances increased by £5.1 m to £ 39.5m, after the Company paid out total dividends of £11.4 m during the year. The Group’s robust cash position provides JQW with the ability to invest in new opportunities to deliver further growth.

Trading Strategy

If the Private Equity shareholders stop persistently selling shares than then confidence could start being rebuilt. We suspect the anti- Chinese sentiment could in time lift to reveal a growth stock.

Last OMG! Price 12p

Access Intelligence (LSE:ACC)

2.875p (2.75-3)

Mkt Cap: £6.75m

Next Results Interims

Finals showed a sharp reduction in losses from £2m to £1m on turnover of £8m.

ACC are focused on building a Software-as-a-Service business model. This enables long-term visibility of revenues as well as recurring revenues which increased to 77% from 72% of total revenues. The 2% increase in total revenue was held back by lower than expected one-off consultancy revenue due to focus on delivering internal development projects. The speed of change and adoption of next regulations means that customers demand an unprecedented level of configurability and flexibility in their software investments. Access Intelligence’s innovative centralised platform should help them to deliver a seemingly tailor-made solution as increasingly higher margin. Late in April 2015 the IT support services segment, Willow Starcom Ltd was sold for £1.4m. ACC have There is a loyal institutional shareholder list who would be able to fund development plans.

Financials

Cash at the yearend stood at £1.1m (£1.5m) broadly in line with expectations and reflecting the ongoing impact of R&D capitalisation.

Trading Strategy

It is slowly moving forward into profits, although further corporate action seems likely to be needed to speed the progress up.

Last OMG! Price 3p

Plastics Capital (LSE:PLA)

106p (103p/109p)

Mkt Cap £37.5m

Next Results: Finals May

Second half trading was weaker than expected for Plastics Capital (LSE: PLA) but the long-term outlook remains positive.

Management says that trading was much stronger than in the first half helped by a recovery in the bearings business. The main problem was the improvement in hose mandrel revenues did not materialise until after the end of the financial year.

Plastic film packaging supplier Flexipol, acquired last November, performed better than expected and there are new products in the offing.

Allenby has reduced its 2014-15 profit estimate from £4.48m to £3.8m but the total dividend should still be 4p a share – covered nearly three times by earnings. The 2015-16 forecast has been cut from £6.1m to £4.9m with a forecast dividend of 5p a share. Net debt should still fall from £11.2m to less than £8m at the end of March 2016.

The current estimates appear achievable and provide some potential for upgrades.

Trading strategy

The shares remain good value despite the delays. They are trading on nine times 2015-16 estimates and yield 4.7%.

Original OMG! price: 114p/117p

Hot Features

Hot Features