false

0001851959

0001851959

2024-08-26

2024-08-26

0001851959

CNDA:UnitsEachConsistingOfOneShareOfClassCommonStockAndOnethirdOfOneWarrantMember

2024-08-26

2024-08-26

0001851959

CNDA:ClassCommonStockParValue0.0001PerShareMember

2024-08-26

2024-08-26

0001851959

CNDA:WarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50Member

2024-08-26

2024-08-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of

report (Date of earliest event reported): August 26, 2024

Concord Acquisition

Corp II

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction

of incorporation) |

001-40773

(Commission File Number) |

86-2171101

(I.R.S. Employer

Identification No.) |

|

477 Madison Avenue

New York, NY

(Address of principal executive offices) |

10022

(Zip Code) |

(212) 883-4330

(Registrant’s telephone number,

including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box

below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Units, each consisting of one share of Class A Common Stock and one-third of one Warrant |

|

CNDA.U |

|

NYSE American LLC |

| Class A Common Stock, par value $0.0001 per share |

|

CNDA |

|

NYSE American LLC |

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 |

|

CNDA.WS |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01. | Entry into a Material Definitive Agreement. |

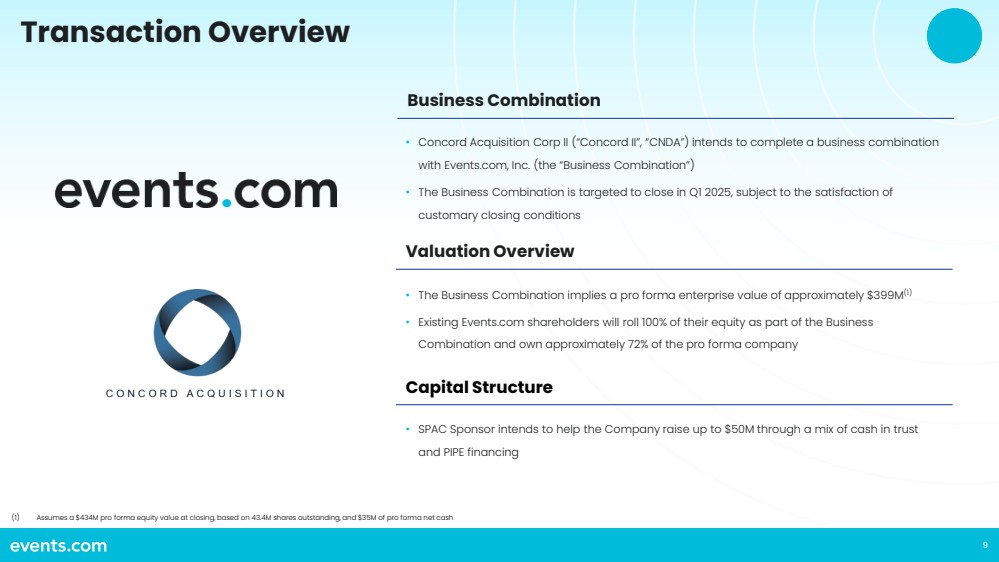

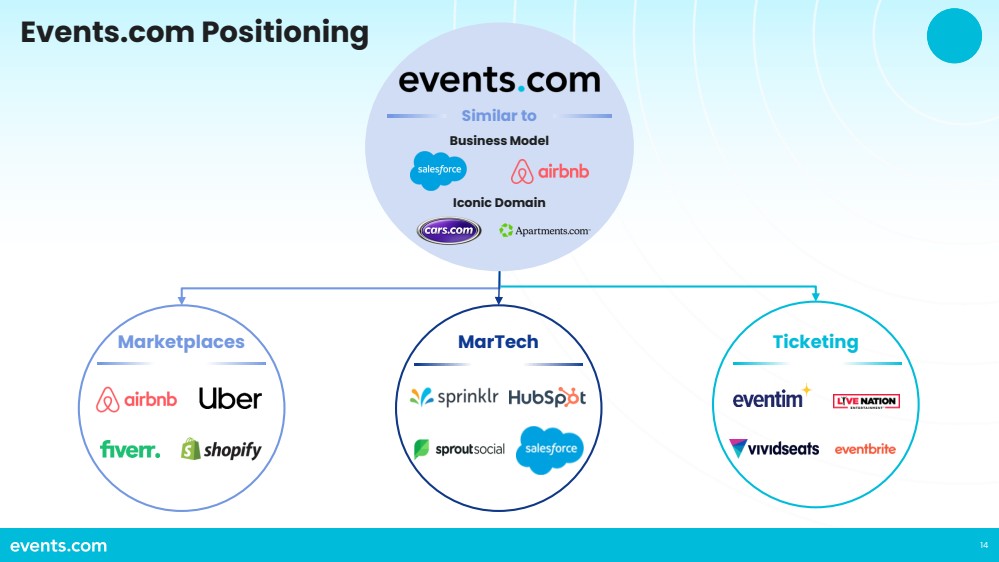

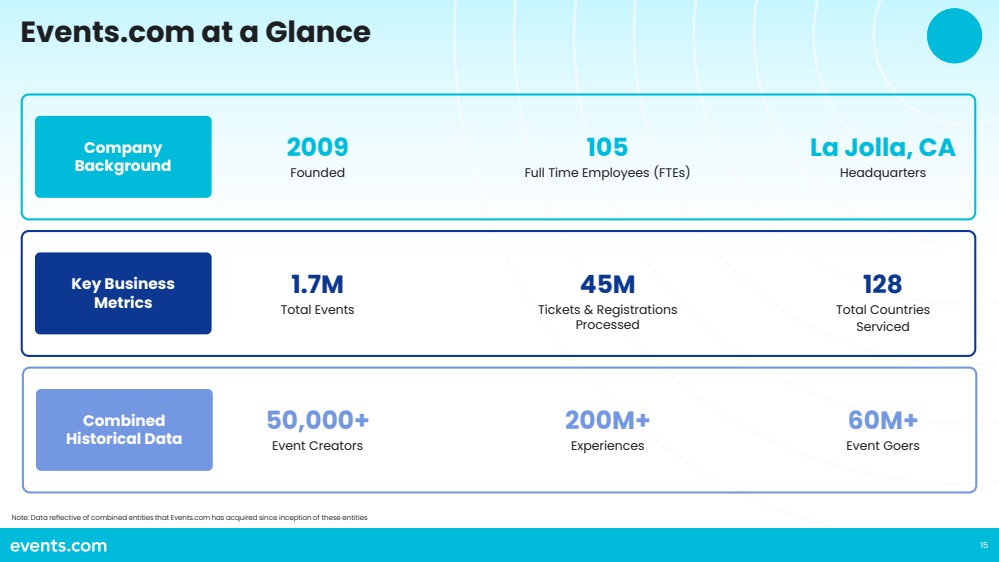

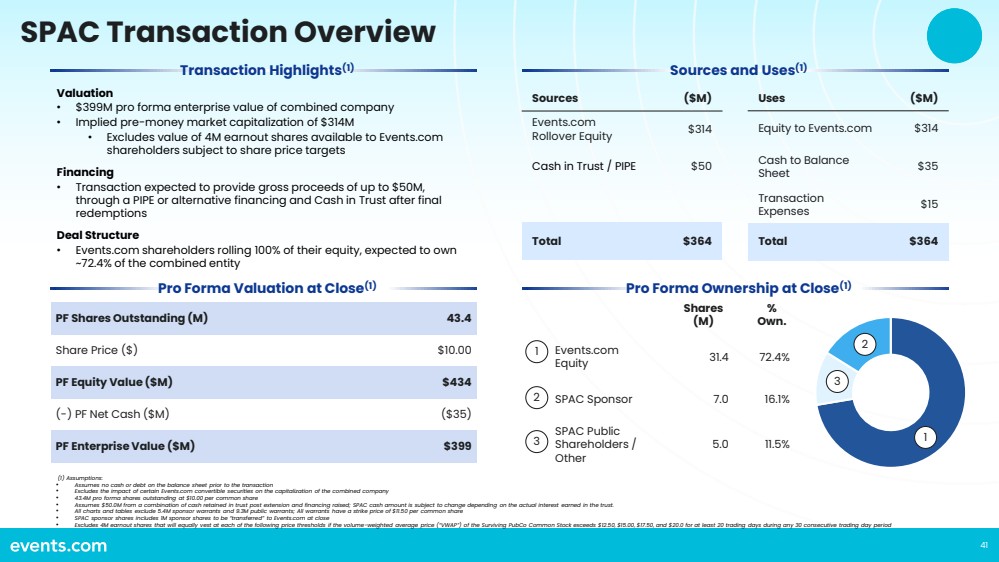

On

August 26, 2024, Concord Acquisition Corp II, a Delaware corporation (the “Company”) entered into an agreement and plan of

merger (the “Merger Agreement”) with Events.com, Inc., a California corporation (“Events.com”), and Concord Merger

Sub, Inc., a California corporation and a direct, wholly-owned subsidiary of the Company (“Merger Sub”).

Pursuant

to the Merger Agreement, the parties will consummate a business combination transaction pursuant to which Merger Sub will merge with and

into Events.com, with Events.com surviving the merger as a wholly-owned subsidiary of the Company (the “Merger” and, together

with the other transactions contemplated by the Merger Agreement, the “Transactions” and the closing of the Transactions,

the “Closing”). In connection with the Closing, it is expected that the Company will change its name to Events.com, Inc. and

is referred to herein as “New CND” as of the time following such change of name.

The

proposed Merger is expected to be consummated after receipt of the required approvals by the stockholders of the Company and shareholders

of Events.com and the satisfaction or waiver of certain other customary conditions, as summarized below.

Merger Agreement

Consideration

The

aggregate equity consideration (other than the Unvested Earn Out Shares described below) to be issued to Events.com’s stockholders

and issuable to certain other Events.com securityholders in the Transactions (the “Merger Consideration”) will be a number

of shares of New CND Class A common stock, par value $0.0001 per share (“New CND common stock”), equal to 1,000,000 plus

the quotient obtained by dividing (i) the sum of (a) $314,100,000, (b) the total amount raised by Events.com in any Interim Financing

(as defined below), and (c) the aggregate exercise price of all vested and “in-the-money” stock options and warrants of Events.com

outstanding immediately prior to the Closing, by (ii) $10.00.

Prior

to the Closing, Events.com will complete a recapitalization, pursuant to which all outstanding shares of preferred stock will be converted

into shares of common stock of Events.com. If the Events.com Charter Amendment (as defined below) is approved, at the Closing, each share

of common stock of Events.com that is issued and outstanding immediately prior to the effective time of the Merger (other than treasury

shares and Dissenting Shares, as defined in the Merger Agreement) will be cancelled and converted into the right to receive a number of

shares of New CND common stock equal to an exchange ratio (the “Exchange Ratio”) determined by dividing the number of shares

of New CND common stock constituting the Merger Consideration by the number of Aggregate Fully Diluted Company Common Shares (as defined

in the Merger Agreement). All outstanding Events.com stock options will be converted into options for New CND common stock, adjusted by

the Exchange Ratio, and any outstanding warrants and, to the extent permissible, convertible notes issued by Events.com will be assumed

by New CND.

If

the Events.com Charter Amendment is not approved, at the Closing, each share of common stock of Events.com that is issued and outstanding

immediately prior to the effective time of the Merger (other than Dissenting Shares) will be converted into shares of New CND common stock

in accordance with the terms of Events.com’s existing articles of incorporation. In such case, the Merger Consideration will be

distributed to all holders of Events.com’s capital stock and other securities convertible into Events.com stock, provided those

securities are vested, in-the-money, or automatically convertible at the time of the Merger.

Earnout

At

the Closing, New CND will issue 4,000,000 additional shares (the “Unvested Earn Out Shares”) of New CND common stock to the

stockholders of Events.com as of immediately prior to the Closing. The Unvested Earn Out Shares will be unvested at issuance, and will

vest if the volume weighted average price (the “VWAP”) of the shares of New CND Class A common stock equals or exceeds

certain minimum share prices for any 20 trading days during a period of 30 consecutive trading days at any time during the seven years

following the Closing (the “Earnout Period”), as follows:

| · | 1,000,000 shares if the VWAP of the shares of New CND common stock equals or exceeds $12.50 (“Triggering

Event I”); |

| · | 1,000,000 shares if the VWAP of the shares of New CND common stock equals or exceeds $15.00 (“Triggering

Event II”); |

| · | 1,000,000 shares if the VWAP of the shares of New CND common stock equals or exceeds $17.50 (“Triggering

Event III”); and |

| · | 1,000,000 shares if the VWAP of the shares of New CND common stock equals or exceeds $20.00 (“Triggering

Event IV”). |

If

a “change of control” of New CND occurs prior to the end of the Earnout Period, Triggering Event I and Triggering Event II

will be deemed to have occurred, and if the consideration payable in the change of control has a per share value in excess of the prices

applicable to Triggering Event III and/or Triggering Event IV, Triggering Event III and/or Triggering Event IV, as applicable, will also

be deemed to have occurred. Any Unvested Earn Out Shares that do not vest prior to the end of the Earnout Period will be automatically

forfeited.

Representations and

Warranties

The

Merger Agreement contains customary representations and warranties of the parties, which will terminate and be of no further force and

effect as of the Closing.

Covenants

The

Merger Agreement contains customary covenants of the parties, including, among others, covenants providing for (i) certain limitations

on the operation of the parties’ respective businesses prior to consummation of the Transactions, (ii) the parties’ efforts

to satisfy conditions to consummation of the Transactions, including by obtaining necessary approvals from governmental agencies as applicable,

(iii) prohibitions on the parties soliciting alternative transactions, (iv) the parties preparing and the Company filing a registration

statement on Form S-4 (the “Form S-4”) with the Securities and Exchange Commission (the “SEC”) and taking certain

actions to obtain the requisite approval of the Company’s stockholders to vote in favor of certain matters (the “Company Stockholder

Matters”), including the adoption and approval of the Merger Agreement and the Transactions, at a special meeting to be called therefor

(the “Company Stockholders’ Meeting”), (v) Events.com using reasonable best efforts to prepare and deliver certain financial

statements required to be included in the Form S-4 (the “Required Financials”), (vi) the parties’ efforts to obtain

commitments from additional investors as to the Financings (as defined below) and cooperate with respect to the Interim Financings and

(vii) the protection of, and access to, confidential information of the parties.

The

Merger Agreement also requires Events.com to use its reasonable best efforts to obtain the requisite approval of its shareholders to (i)

approve the Merger and (ii) an amendment and restated of Events.com’s articles of incorporation (the “Events.com Charter Amendment”)

providing for, among other things, the contemplated treatment of securities of Events.com set forth in the Merger Agreement and summarized

above.

Interim Financing

The

Merger Agreement provides for the parties to cooperate, between the date of the Merger Agreement and the Closing, to raise capital for

Events.com through the sale of equity securities, or securities convertible into equity securities (the “Interim Financing”).

Following date of the Merger Agreement and until the earlier of the Closing or the termination of the Merger Agreement (the “Interim

Period”), Events.com will be required to pay to the Company an amount equal to the lesser of (i) the amount of unpaid Company transaction

expenses actually incurred by the Company as of the applicable payment date and (ii) the Interim Parent Funding Amount (as defined below),

in each case, within three business days after receipt by Events.com of reasonably detailed evidence of the incurrence of such expenses.

“Interim Parent Funding Amount” is calculated as of any given date during the Interim Period, an amount equal to (i) 10% of

the first $7,000,000 of net proceeds received by Events.com from investors or other financing sources introduced by any person other than

the Company, Cohen & Company Capital Markets or their respective affiliates in connection with any Interim Financing, (ii) 25% of

the net proceeds received by Events.com from investors or other financing sources introduced by any person other than the Company, Cohen

& Company Capital Markets or their respective affiliates in connection with any Interim Financing in excess of the first $7,000,000

and (iii) 25% of the net proceeds received by Events.com from investors or other financing sources introduced by the Company, Cohen &

Company Capital Markets or their respective affiliates in connection with any Interim Financing. The Interim Parent Funding Amount as

of a given date shall be reduced by any amounts previously paid by or on behalf of Events.com to or as directed by the Company pursuant

to any prior payments of an Interim Parent Funding Amount, and in no event shall the aggregate amount of Interim Parent Funding Amounts

exceed $10,000,000 in the aggregate.

Second Amended and

Restated Certificate of Incorporation

Pursuant

to the terms of the Merger Agreement, at the Closing the amended and restated certificate of incorporation of New CND will be further

amended and restated (the “Second Restated Charter”) to, among other things, create a class of common stock of New CND, Class

B common stock. The shares of Class B common stock will be entitled to the rights and privileges set forth in the Second Restated Charter,

the form of which is attached as Exhibit D to the Merger Agreement, including ten votes per share on any matter that such share is entitled

to vote upon.

Conditions to Closing

The

consummation of the Transactions is subject to customary closing conditions, including, among others: (i) approval by the Company’s

and Events.com’s respective stockholders, (ii) no law, regulation, judgment, decree, executive order or award enjoining or prohibiting

the consummation of the Transactions, (iii) Available Closing Cash (as defined below) as of immediately after the Closing being at least

$30 million, (iv) the effectiveness of the Form S-4, (v) receipt of approval for listing on the New York Stock Exchange of the shares

of New CND common stock to be issued in connection with the Transactions, (vi) no material adverse effect with respect to the Company

or Events.com having occurred and continuing and (vii) the accuracy of the parties’ respective representations and warranties (subject

to specified materiality thresholds) and the material performance of the parties’ respective covenants and other obligations. “Available

Closing Cash” is defined in the Merger Agreement as (i) the aggregate cash proceeds in the Company’s trust account, after

giving effect to any redemptions by the Company’s public stockholders, plus any additional funds raised by the Company (other than

non-convertible debt securities and working capital loans), plus the aggregate amount of cash funded to Events.com pursuant to any Interim

Financing during the period commencing on the day prior to the signing of the Merger Agreement and ending at Closing, minus (ii) the amount

of all of the Company’s transaction expenses and Events.com’s transaction expenses (subject, for purposes of such calculation,

to a cap of $10,000,000).

Termination

The

Merger Agreement may be terminated at any time prior to the effective time of the Merger: (i) by mutual written consent of the Company

and Events.com; (ii) by either the Company or Events.com if the Closing has not occurred by March 3, 2025 (or such later date as the Company’s

deadline to consummate a business combination shall be extended to, if applicable) (the “Outside Date”), provided that the

right to terminate the Merger Agreement upon the occurrence of the Outside Date will not be available to a party if a breach or violation

by such party or its affiliates of any representation, warranty, covenant or obligation under the Merger Agreement was the primary cause

of, or resulted in, the failure of the Closing to occur on or before the Outside Date; (iii) by Events.com if there has been a Change

in Recommendation , or if, at the Company Stockholders’ Meeting, approval of the Company Stockholder Matters is not obtained; (iv)

by the Company if Events.com does not deliver approval of the Transactions by the requisite holders of its capital stock within ten business

days after the date that the Form S-4 is declared effective; (v) by Events.com if the Company’s Class A common stock has been delisted

from the NYSE American, and such delisting has become final and non-appealable; or (vi) in the event of certain uncured breaches by the

other party.

Transaction Expenses

The

Merger Agreement provides that each party to the Merger Agreement is generally responsible for its own expenses related to the Transactions.

However, Events.com has agreed to pay all filing fees pursuant to antitrust laws or other regulatory approvals required in connection

with the Merger and all costs, fees and expenses incurred in connection with the preparation, filing and mailing of the Form S-4 (including

the proxy statement to be included therein) and the review and approval of the Registration Statement by the SEC. If the Merger Agreement

is terminated as a result of Events.com failing to obtain the requisite shareholder approval, Events.com will be required to pay the Company

the total amount of the Company’s unpaid transaction expenses, not to exceed $3,000,000, reduced (but not below zero) by the aggregate

Interim Parent Funding Amount previously paid to or as directed by the Company.

Related Agreements

Lock-Up Agreement

Concurrently

with the execution and delivery of the Merger Agreement, and effective upon Closing, the Company entered into a Lock-Up Agreement (the

“Lock-Up Agreement”) with Mitch Thrower and Steven Partridge (the “Founders”), and following the execution of

the Merger Agreement Events.com will seek to have certain additional Events.com stockholders enter into the Lock-Up Agreement. Pursuant

to the terms of the Lock-Up Agreement, the Founders have agreed, and the other stockholders who become party to the Lock-Up Agreement

will agree, to not effect any sale or other transfer of New CND common stock, subject to certain customary exceptions set forth in the

Lock-Up Agreement, during the period commencing at the Closing and ending on the earlier of (i) one year following the Closing,

(ii) such date as New CND completes a liquidation, merger, share exchange, reorganization or other similar transaction that results

in all of New CND’s stockholders having the right to exchange their shares of New CND common stock for cash, securities or other

property or (iii) the date on which the last sale price of the New CND common stock equals or exceeds $12.00 per share (as adjusted

for share splits, share consolidations, share capitalizations, rights issuances, subdivisions, reorganizations, recapitalizations and

the like) for any 20 trading days within any 30 trading day period commencing at least 150 days after the Closing.; provided that for

the stockholders other than the Founders, 25% of each holder's shares will be released from lock-up every 3 months following the Closing.

Sponsor Support

Agreement

Concurrently

with the execution and delivery of the Merger Agreement, the Company entered into a sponsor support agreement (the “Sponsor Support

Agreement”) with Events.com, Concord Sponsor Group II LLC (the “Sponsor”) and CA2 Co-Investment LLC (“CA2”).

Pursuant to the Sponsor Support Agreement, the Sponsor and CA2 have, among other things, agreed (i) to vote all of their shares of the

Company’s common stock in favor of the approval of the Transactions, including the Merger, (ii) not to redeem any of their shares

of the Company’s common stock, (iii) to waive their anti-dilution protections with respect to their shares of the Company’s

Class B common stock and (iv) to forfeit an aggregate of 1,000,000 shares of the Company’s Class B common stock at the Closing.

In addition, if the accrued and unpaid transaction expenses of the Company exceed $10,000,000 then, immediately prior to the Closing,

the Sponsor must either forfeit a number of shares of Parent Class B Stock, valued at $10 per share, to cover the excess amount, or pay

such excess amount by wire transfer of immediately available funds to an account designated by Events.com.

Stockholder Support

Agreement

In

connection with the execution of the Merger Agreement, the Company entered into a support agreement (the “Stockholder Support Agreement”)

with certain stockholders of Events.com pursuant to which such stockholders have, among other things, agreed to (i) vote all of their

shares of Events.com stock to adopt and approve the Merger Agreement and all other documents and transactions contemplated thereby and

(ii) subject their shares of Events.com common stock to certain transfer restrictions.

Tax Receivable

Agreement

In

connection with the Closing, Events.com, the Company and certain Events.com shareholders will enter into a Tax Receivable Agreement (the

“TRA”), pursuant to which, among other things, New CND will agree to pay certain Events.com stockholders 85% of the tax benefits

realized from the post-closing utilization of Events.com’s pre-closing tax attributes. Under the TRA, New CND will be required to

calculate realized tax benefits on an annual basis. Unless there is an early termination of the TRA, the TRA will remain in effect until

all of Events.com’s pre-closing tax attributes have been realized (which may never occur). New CND will have the right to terminate

the TRA at any time by giving notice and paying an “early termination payment.” For purposes of calculating the early termination

payment, it is assumed that New CND will generate enough income to use all remaining pre-closing tax attributes in the earliest possible

tax year. In addition, a change of control of New CND, or a divestiture of Events.com by Parent, generally would require an early termination

payment.

Registration Rights

Agreement

The

Merger Agreement provides that, in connection with the Closing, New CND, certain stockholders of the Company (including the Sponsor) and

certain stockholders of Events.com will enter into a registration rights agreement (the “Registration Rights Agreement”),

pursuant to which New CND will agree to register for resale certain shares of New CND common stock and other equity securities that are

held by the parties thereto from time to time.

Other

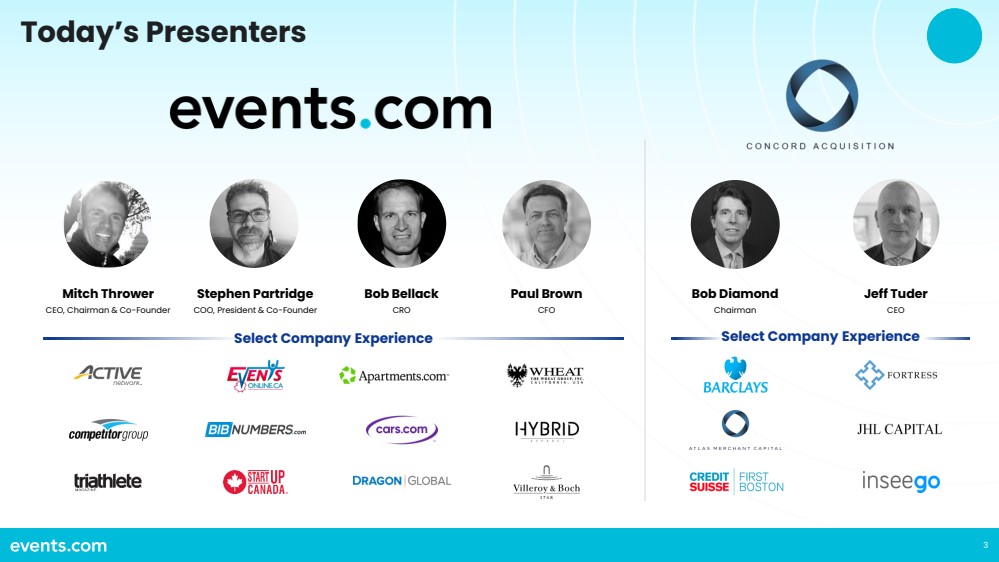

It

is expected that Mitch Thrower and Stephen Partridge will be employed as Chief Executive Officer and President and Chief Operating Officer,

respectively, of New CND and in connection therewith enter into new employment arrangements pursuant to which they will receive Class

B common stock in New CND and as a result control a majority of the voting power of New CND.

* * *

The

foregoing descriptions of the Merger Agreement, Lock-Up Agreement, Sponsor Support Agreement, Stockholder Support Agreement, TRA, Registration

Rights Agreement and the transactions contemplated thereunder are not complete and are qualified in their entirety by reference to the

respective agreements, copies of which (or the forms of which, in the case of the TRA and Registration Rights Agreement) are respectively

filed as Exhibits 2.1, 10.1, 10.2, 10.3, 10.4 and 10.5 to this Current Report on Form 8-K, and each of which is incorporated herein by

reference. The aforementioned agreements and the foregoing descriptions thereof have been included to provide investors and stockholders

with information regarding the terms of such agreements. They are not intended to provide any other factual information about the parties

to the respective agreements. The respective representations, warranties and covenants contained in such agreements were made only as

of specified dates for the purposes of each such agreement, were solely for the benefit of the parties to each such agreement and may

be subject to qualifications and limitations agreed upon by such parties. In particular, in reviewing the respective representations,

warranties and covenants contained in each such agreement and discussed in the respective foregoing description, it is important to bear

in mind that such representations, warranties and covenants were negotiated with the principal purpose of allocating risk between the

parties, rather than establishing matters as facts. Such representations, warranties and covenants may also be subject to a contractual

standard of materiality different from those generally applicable to stockholders and reports and documents filed with the SEC, and, with

respect to the Merger Agreement, are also qualified in important part by confidential disclosure schedules delivered by the parties to

each other in connection with the Merger Agreement. Investors and stockholders are not third-party beneficiaries under the Merger Agreement

or other foregoing agreements except as expressly contemplated therein. Accordingly, investors and stockholders should not rely on such

representations, warranties and covenants as characterizations of the actual state of facts or circumstances described therein. Information

concerning the subject matter of such representations, warranties and covenants may change after the date of the Merger Agreement and

each such other agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures.

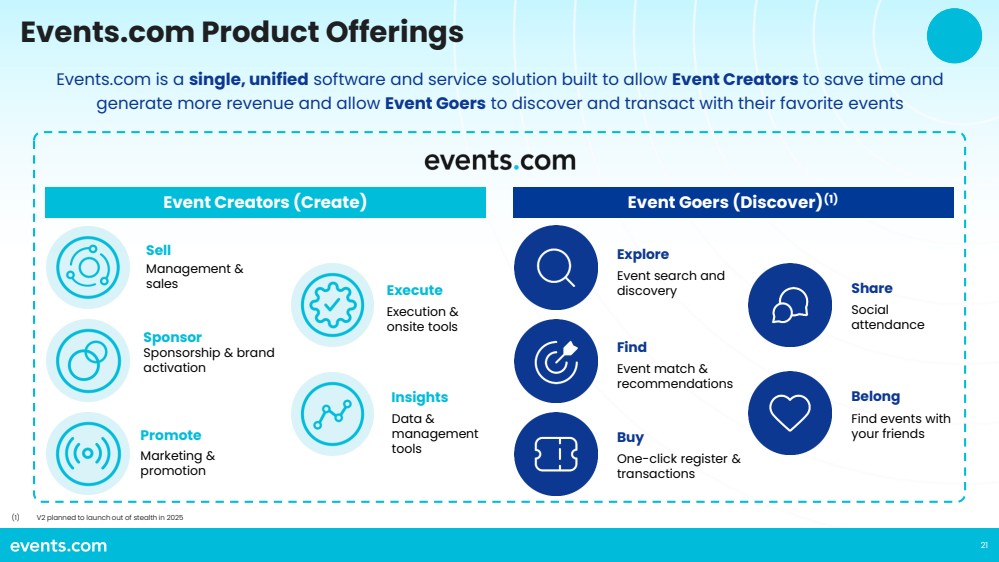

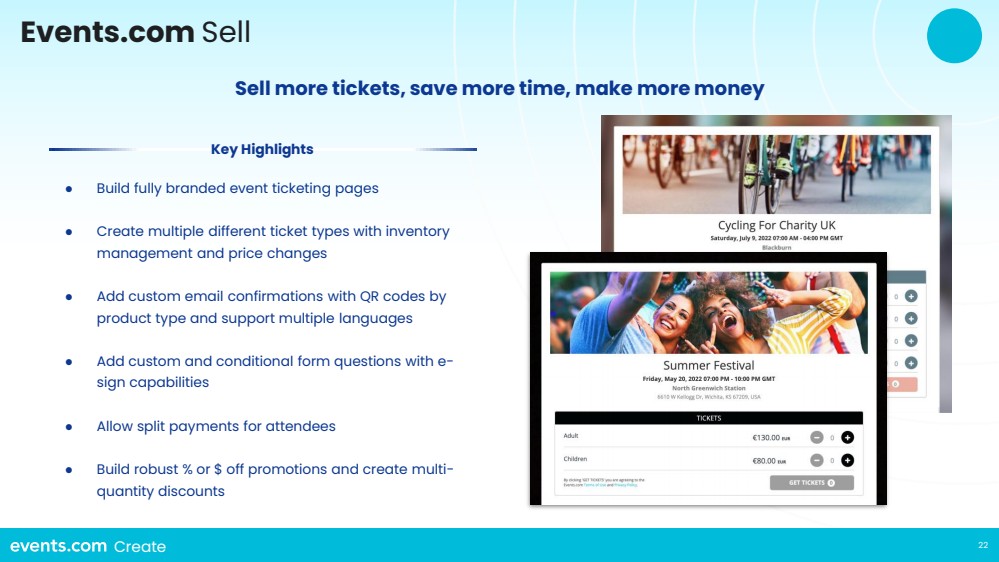

| Item 7.01. | Regulation FD Disclosure. |

On August 27, 2024, the Company and Events.com

issued a joint press release announcing the execution of the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1

and incorporated herein by reference.

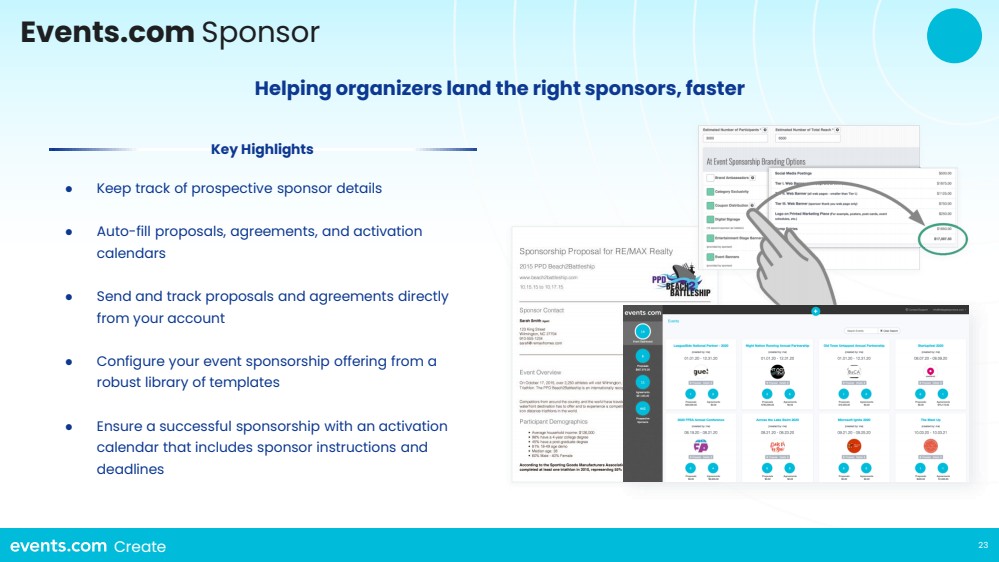

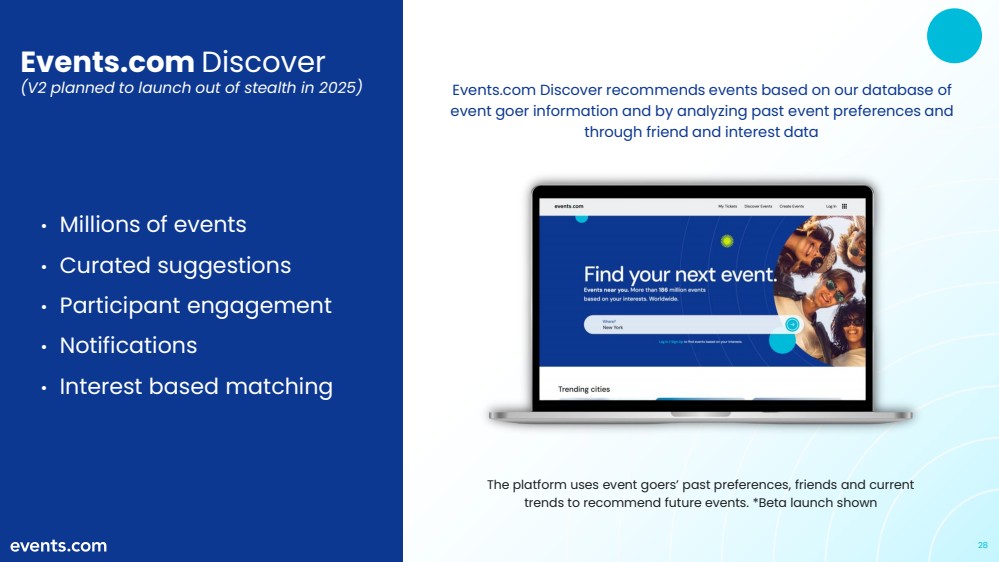

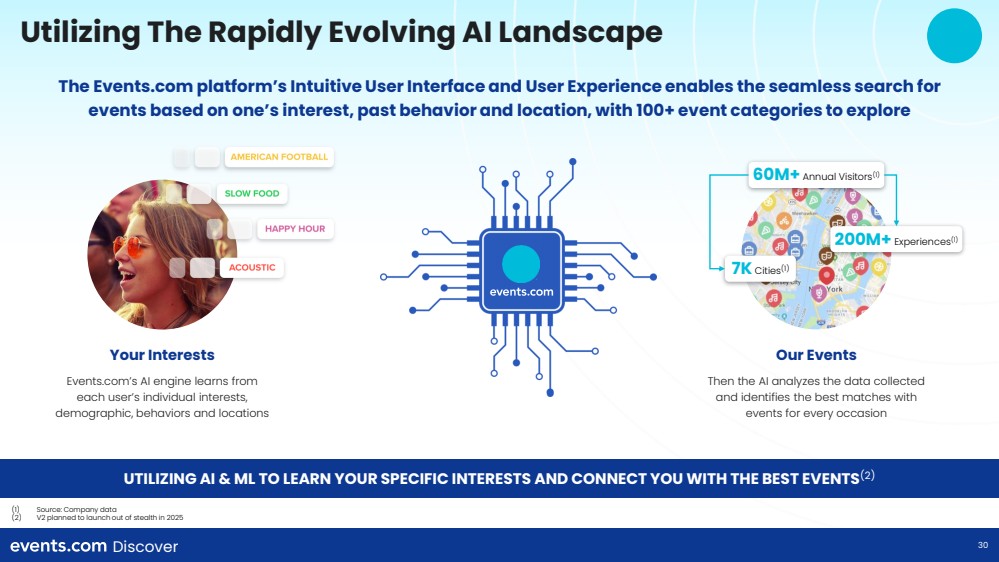

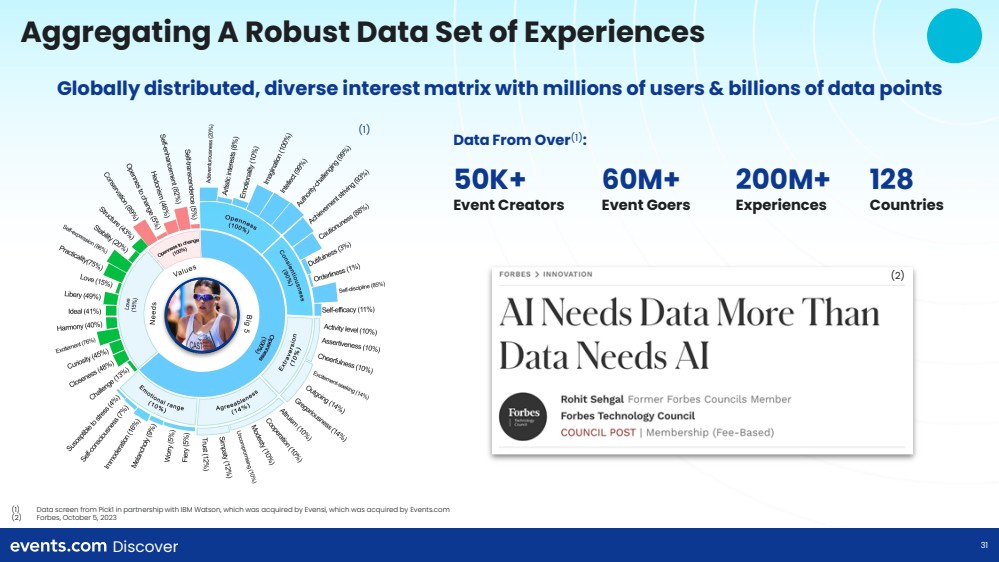

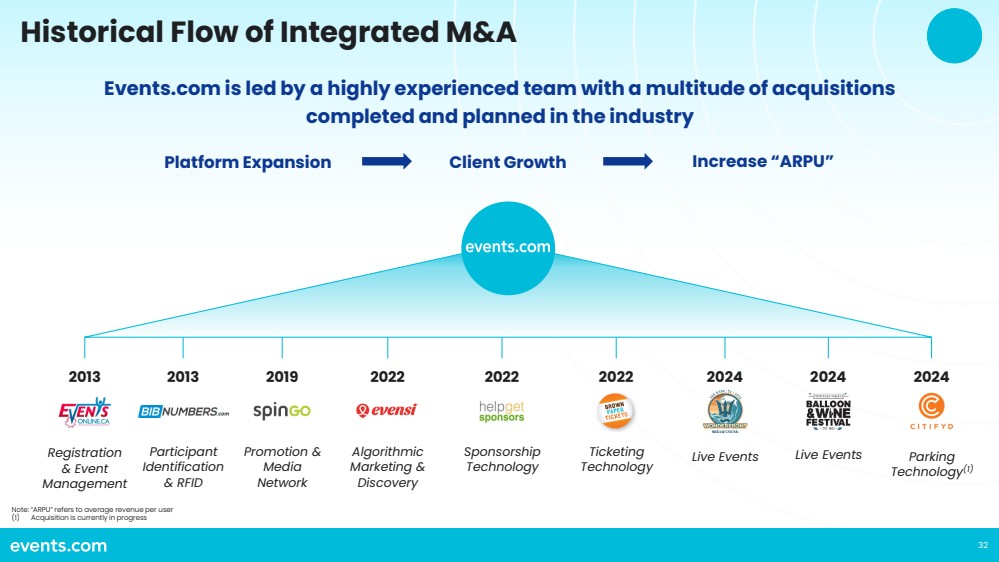

Attached

hereto as Exhibit 99.2 and incorporated herein by reference is the form of presentation to be used by the Company and Events.com

in presentations for certain of the Company’s stockholders and other persons.

The

foregoing (including the information presented in Exhibits 99.1 and 99.2) is being furnished pursuant to Item 7.01 and will not be deemed

to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities

Act of 1933, as amended (the “Securities Act”) or the Exchange Act. The submission of the information set forth in this Item

7.01 shall not be deemed an admission as to the materiality of any information in this Item 7.01, including the information presented

in Exhibits 99.1 and 99.2 that is provided solely in connection with Regulation FD.

* * *

Important Information

About the Transaction and Where to Find It

In

connection with the proposed Transactions, the Company intends to file with the SEC a registration statement on Form S-4, which will include

a preliminary proxy statement/prospectus of the Company in connection with the Transactions and related matters. After the registration

statement on Form S-4 is declared effective, the Company will mail a definitive proxy statement/prospectus and other relevant documents

to its stockholders. This communication does not contain any information that should be considered by the Company’s stockholders

concerning the Transactions and is not intended to constitute the basis of any voting or investment decision in respect of the Transactions

or the securities of the Company. The Company’s stockholders and other interested persons are advised to read, when available, the

preliminary proxy statement/prospectus, and amendments thereto, and the definitive proxy statement/prospectus in connection with the Company’s

solicitation of proxies for its stockholders’ meeting to be held to approve the Transactions and related matters because the proxy

statement/prospectus will contain important information about the Company, Events.com and the Transactions.

The

definitive proxy statement/prospectus will be mailed to stockholders of the Company as of a record date to be established for voting on

the Transactions and related matters. Stockholders may obtain copies of the registration statement, proxy statement/prospectus and all

other relevant documents filed or that will be filed with the SEC by the Company, when available, without charge, at the SEC’s website

at www.sec.gov or by directing a request to: Concord Acquisition Corp II, Attn: Corporate Secretary, 477 Madison Avenue, 22nd

Floor, New York, NY 10022.

No Offer or Solicitation

This

communication is for informational purposes only and shall not constitute a proxy statement or solicitation of a proxy, consent or authorization

with respect to any securities or in respect of the Transactions, neither is it intended to nor does it constitute an offer to sell or

purchase, nor a solicitation of an offer to sell, buy or subscribe for any securities, nor is it a solicitation of any vote in any jurisdiction

pursuant to the Transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention

of applicable law. No offer of securities shall be deemed to be made except by means of a prospectus meeting the requirements of Section

10 of the Securities Act, or an exemption therefrom.

Participants in the

Solicitation

The

Company, Events.com and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies

from the Company’s stockholders in connection with the Transactions. Information about the directors and executive officers of the

Company is set forth in the Company’s Annual Report on Form 10-K filed with the SEC on March 1, 2024. Additional information regarding

the participants in the proxy solicitation and the interests of those persons may be obtained by reading the proxy statement/prospectus

regarding the Transactions when it becomes available. When available, you may obtain free copies of these documents as described above.

Cautionary Statement

Regarding Forward-Looking Statements

This

document (including the exhibits) contains certain forward-looking statements within the meaning of the federal securities laws with respect

to the proposed Transactions. All statements other than statements of historical facts contained in this document, including statements

regarding Events.com’s or the combined company’s future financial position, business strategy and plans and objectives of

management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology

such as “pro forma,” “may,” “should,” “could,” “might,” “plan,”

“possible,” “project,” “strive,” “budget,” “forecast,” “expect,”

“intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,”

“potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Forward-looking

statements include, without limitation, the Company’s, Events.com’s, or their respective management teams’ expectations

concerning the outlook for their or Events.com’s business, productivity, plans, and goals for future operational improvements and

capital investments, operational performance, future market conditions, or economic performance and developments in the capital and credit

markets and expected future financial performance, including expected net proceeds, expected additional funding, the percentage of redemptions

of the Company’s public stockholders, growth prospects and outlook of Events.com’s operations, individually or in the aggregate,

including the achievement of project milestones, commencement and completion of commercial operations of certain of Events.com’s

projects, as well as any information concerning possible or assumed future results of operations of Events.com. Forward-looking statements

also include statements regarding the expected benefits of the proposed Transactions between Events.com and the Company.

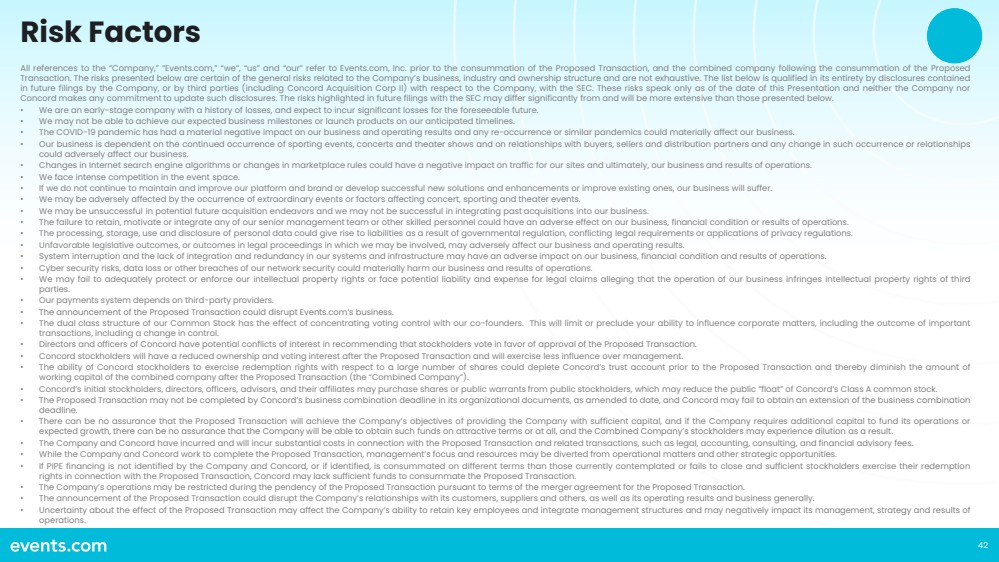

Forward-looking

statements involve a number of risks, uncertainties, and assumptions, and actual results or events may differ materially from those projected

or implied in those statements. Important factors that could cause such differences include, but are not limited to: (i) the risk that

the proposed Transactions may not be completed in a timely manner or at all, which may adversely affect the price of the Company’s

securities; (ii) the risk that the proposed Transactions may not be completed by the Company’s business combination deadline and

the potential failure to obtain an extension of the business combination deadline if sought by the Company; (iii) the failure to satisfy

the conditions to the consummation of the proposed Transactions, including the adoption of the Merger Agreement by the stockholders of

the Company and Events.com and the receipt of certain regulatory approvals; (iv) market risks; (v) the occurrence of any event, change

or other circumstance that could give rise to the termination of the Merger Agreement; (vi) the effect of the announcement or pendency

of the Proposed Business Combination on Events.com’s business relationships, performance, and business generally; (vii) risks that

the Proposed Business Combination disrupts current plans of Events.com and potential difficulties in its employee retention as a result

of the Proposed Business Combination; (viii) the outcome of any legal proceedings that may be instituted against Events.com or CNDA related

to the Merger Agreement or the Proposed Business Combination; (ix) failure to realize the anticipated benefits of the Proposed Business

Combination; (x) the inability to maintain the listing of CNDA’s securities or to meet listing requirements and maintain the listing

of New CND’s securities on the NYSE American; (xi) the risk that the price of New CND’s securities may be volatile due to

a variety of factors, including changes in the highly competitive industries in which Events.com plans to operate, variations in performance

across competitors, changes in laws, regulations, technologies, natural disasters or health epidemics/pandemics, national security tensions,

and macro-economic and social environments affecting its business, and changes in the combined capital structure; (xii) the inability

to implement business plans, forecasts, and other expectations after the completion of the Proposed Business Combination, identify and

realize additional opportunities, and manage its growth and expanding operations; (xiii) the risk that Events.com may not be able to successfully

develop its assets, including expanding the product offerings and implementing the acquisition plan (xiv) the risk that Events.com will

be unable to raise additional capital to execute its business plan, which many not be available on acceptable terms or at all; (xv) political

and social risks of operating in the U.S. and other countries; (xvi) the operational hazards and risks that Events.com faces; and (xvii)

the risk that additional financing in connection with the Proposed Business Combination may not be raised on favorable terms. The foregoing

list is not exhaustive, and there may be additional risks that neither the Company nor Events.com presently knows or that the Company

and Events.com currently believe are immaterial. You should carefully consider the foregoing factors, any other factors discussed in this

press release and the other risks and uncertainties described in the “Risk Factors” section of the Company’s Annual

Report on Form 10-K for the year ended December, 31, 2023, which was filed with the SEC on March 1, 2024, the risks to be described in

the registration statement on Form S-4 to be filed by the Company with the SEC in connection with the Proposed Business Combination, and

those discussed and identified in other filings made with the SEC by CNDA and PubCo from time to time.

Events.com

and the Company caution you against placing undue reliance on forward-looking statements, which reflect current beliefs and are based

on information currently available as of the date a forward-looking statement is made. Forward-looking statements set forth herein speak

only as of the date they are made. Neither Events.com nor the Company undertakes any obligation to revise forward-looking statements to

reflect future events, changes in circumstances, or changes in beliefs, except as otherwise required by law. In the event that any forward-looking

statement is updated, no inference should be made that Events.com or the Company will make additional updates with respect to that statement,

related matters, or any other forward-looking statements. Any corrections or revisions and other important assumptions and factors that

could cause actual results to differ materially from forward-looking statements, including discussions of significant risk factors, may

appear, up to the consummation of the proposed transaction, in the Company’s public filings with the SEC or, upon and following

the consummation of the proposed transaction, in the combined company’s public filings with the SEC, which are or will be (as appropriate)

accessible at www.sec.gov, and which you are advised to consult.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

|

Description |

| 2.1* |

|

Agreement and Plan of Merger, dated as of August 26, 2024, by and among Concord Acquisition Corp II, Events.com, Inc. and Concord Merger Sub Inc. |

| 10.1 |

|

Lock-Up Agreement. |

| 10.2 |

|

Sponsor Support Agreement, dated as of August 26, 2024, by and among Concord Acquisition Corp II, Events.com, Inc., Concord Sponsor Group II LLC and CA2 Co-Investment LLC. |

| 10.3 |

|

Stockholder Support Agreement, dated as of August 26, 2024, by and among Concord Acquisition Corp II and certain stockholders of Events.com, Inc. |

| 10.4 |

|

Form of Tax Receivables Agreement. |

| 10.5 |

|

Form of Registration Rights Agreement. |

| 99.1 |

|

Joint Press Release, dated August 27, 2024. |

| 99.2 |

|

Investor Presentation, dated August 2024. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| |

|

|

| * | Certain of the schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). The Registrant agrees

to furnish supplementally a copy of all omitted schedules to the Securities and Exchange Commission upon its request. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

CONCORD ACQUISITION CORP Ii |

| |

|

| |

|

| |

By: |

/s/ Jeff Tuder |

| |

|

Name: Jeff Tuder |

| |

|

Title: Chief Executive Officer |

Date: August 27, 2024

Exhibit 2.1

Execution version

PRIVILEGED & CONFIDENTIAL

AGREEMENT AND PLAN OF MERGER

BY AND AMONG

CONCORD ACQUISITION CORP II,

CONCORD MERGER SUB, INC.

AND

EVENTS.COM, INC.

Dated as of August 26, 2024

TABLE

OF CONTENTS

Page

| Article I

THE MERGER |

3 |

| Section 1.1 |

The Merger |

3 |

| Section 1.2 |

Effective Time |

3 |

| Section 1.3 |

Effect of the Merger |

3 |

| Section 1.4 |

Governing Documents of the Surviving Subsidiary |

3 |

| Section 1.5 |

Directors and Officers of the Surviving Subsidiary |

4 |

| Article II

MERGER CONSIDERATION;

CONVERSION OF SECURITIES |

4 |

| Section 2.1 |

Closing Date Statement |

4 |

| Section 2.2 |

Aggregate Consideration |

5 |

| Section 2.3 |

Payment of Other Amounts at Closing |

5 |

| Section 2.4 |

Separation of Parent Securities |

6 |

| Section 2.5 |

Conversion of Company Stock and Company Securities |

6 |

| Section 2.6 |

Parent Redeemed Shares |

8 |

| Section 2.7 |

Exchange Procedures for Company Stockholders |

8 |

| Section 2.8 |

Earn Out Consideration |

11 |

| Section 2.9 |

Withholding Rights |

12 |

| Section 2.10 |

Tax Consequences |

12 |

| Article III

REPRESENTATIONS AND WARRANTIES

OF THE GROUP COMPANIES |

13 |

| Section 3.1 |

Organization |

13 |

| Section 3.2 |

Authorization |

13 |

| Section 3.3 |

Capitalization |

14 |

| Section 3.4 |

Company Subsidiaries |

15 |

| Section 3.5 |

Consents and Approvals; No Violations |

15 |

| Section 3.6 |

Financial Statements |

16 |

| Section 3.7 |

No Undisclosed Liabilities |

16 |

| Section 3.8 |

Absence of Certain Changes |

17 |

| Section 3.9 |

Real Property |

17 |

| Section 3.10 |

Intellectual Property; IT Security |

17 |

| Section 3.11 |

Litigation |

20 |

| Section 3.12 |

Company Material Contracts |

20 |

| Section 3.13 |

Tax Returns; Taxes |

22 |

| Section 3.14 |

Environmental Matters |

24 |

| Section 3.15 |

Licenses and Permits |

24 |

| Section 3.16 |

Company Benefit Plans |

24 |

| Section 3.17 |

Labor |

26 |

| Section 3.18 |

International Trade & Anti-Corruption Matters |

28 |

| Section 3.19 |

Certain Fees |

28 |

| Section 3.20 |

Insurance Policies |

29 |

| Section 3.21 |

Affiliate Transactions |

29 |

| Section 3.22 |

Information Supplied |

29 |

| Section 3.23 |

Customers and Suppliers |

29 |

| Section 3.24 |

Compliance with Laws |

29 |

| Section 3.25 |

No Other Representations or Warranties; Schedules |

30 |

| Article IV

REPRESENTATIONS AND WARRANTIES

OF THE PARENT PARTIES |

30 |

| Section 4.1 |

Organization |

30 |

| Section 4.2 |

Authorization |

31 |

| Section 4.3 |

Capitalization |

31 |

| Section 4.4 |

Consents and Approvals; No Violations |

32 |

| Section 4.5 |

Financial Statements |

33 |

| Section 4.6 |

No Undisclosed Liabilities |

33 |

| Section 4.7 |

Litigation |

33 |

| Section 4.8 |

Parent Material Contracts |

33 |

| Section 4.9 |

Tax Returns; Taxes |

34 |

| Section 4.10 |

Compliance with Laws |

35 |

| Section 4.11 |

Certain Fees |

35 |

| Section 4.12 |

Business Activities |

35 |

| Section 4.13 |

SEC Filings; NYSE; Investment Company Act |

36 |

| Section 4.14 |

Information Supplied |

38 |

| Section 4.15 |

Board Approval; Stockholder Vote |

38 |

| Section 4.16 |

Trust Account |

38 |

| Section 4.17 |

Affiliate Transactions |

39 |

| Section 4.18 |

No Other Representations or Warranties; Schedules |

39 |

| Article V

COVENANTS |

39 |

| Section 5.1 |

Interim Operations of the Company |

42 |

| Section 5.2 |

Interim Operations of the Parent Parties |

42 |

| Section 5.3 |

Interim Financing |

44 |

| Section 5.4 |

Trust Account |

45 |

| Section 5.5 |

Commercially Reasonable Efforts; Consents |

45 |

| Section 5.6 |

Public Announcements |

46 |

| Section 5.7 |

Access to Information; Confidentiality |

47 |

| Section 5.8 |

Tax Matters |

48 |

| Section 5.9 |

Directors’ and Officers’ Indemnification |

50 |

| Section 5.10 |

Proxy Statement; Registration Statement |

52 |

| Section 5.11 |

Parent Stockholder Meeting |

55 |

| Section 5.12 |

Section 16 of the Exchange Act |

55 |

| Section 5.13 |

Nonsolicitation |

56 |

| Section 5.14 |

Termination of Agreements |

56 |

| Section 5.15 |

Requisite Company Approval |

56 |

| Section 5.16 |

Elections and Other Matters |

56 |

| Section 5.17 |

Approval of 280G Payments |

57 |

| Section 5.18 |

Release |

57 |

| Section 5.19 |

Amendment and Restatement of the Parent Charter and

Bylaws |

58 |

| Section 5.20 |

Post-Closing Parent Board of Directors and Executive

Officers |

58 |

| Section 5.21 |

Equity Incentive Plan |

58 |

| Section 5.22 |

Employment Agreements |

59 |

| Section 5.23 |

Required Financials |

59 |

| Section 5.24 |

Notification of Certain Matters |

60 |

| Section 5.25 |

Additional Securityholder Agreements |

60 |

| Article VI

CONDITIONS TO OBLIGATIONS

OF THE PARTIES |

60 |

| Section 6.1 |

Conditions to Each Party’s

Obligations |

60 |

| Section 6.2 |

Conditions to Obligations of the Company |

61 |

| Section 6.3 |

Conditions to Obligations of the Parent Parties |

62 |

| Section 6.4 |

Frustration of Closing Conditions |

63 |

| Article VII

CLOSING |

63 |

| Section 7.1 |

Closing |

63 |

| Section 7.2 |

Deliveries by the Company |

63 |

| Section 7.3 |

Deliveries by Parent |

63 |

| Article VIII

TERMINATION |

64 |

| Section 8.1 |

Termination |

64 |

| Section 8.2 |

Procedure and Effect of Termination |

65 |

| Article IX

MISCELLANEOUS |

65 |

| Section 9.1 |

Fees and Expenses |

65 |

| Section 9.2 |

Notices |

66 |

| Section 9.3 |

Severability |

67 |

| Section 9.4 |

Binding Effect; Assignment |

68 |

| Section 9.5 |

No Third Party Beneficiaries |

68 |

| Section 9.6 |

Section Headings |

68 |

| Section 9.7 |

Jurisdiction; Waiver of Jury Trial |

68 |

| Section 9.8 |

Entire Agreement |

69 |

| Section 9.9 |

Governing Law |

69 |

| Section 9.10 |

Specific Performance |

69 |

| Section 9.11 |

Counterparts |

69 |

| Section 9.12 |

Amendment; Waiver |

69 |

| Section 9.13 |

Schedules |

70 |

| Section 9.14 |

No Recourse |

70 |

| Section 9.15 |

Construction |

71 |

| Section 9.16 |

Non-Survival |

72 |

| Section 9.17 |

Trust Account Waiver |

72 |

| Section 9.18 |

Conflicts and Privilege |

73 |

| Section 9.19 |

Independent Investigation; No Reliance |

74 |

LIST OF EXHIBITS

| Exhibit A |

Definitions |

| Exhibit B |

Form of Registration Rights Agreement |

| Exhibit C |

Form of Tax Receivable Agreement |

| Exhibit D |

Form of Parent’s Second Amended and Restated Certificate of

Incorporation |

| Exhibit E |

Form of Parent’s Amended and Restated Bylaws |

| Exhibit F |

Form of Surviving Subsidiary’s Amended and Restated Articles of Incorporation |

| |

|

| Schedule A |

Key Company Stockholders |

AGREEMENT AND PLAN OF MERGER

This AGREEMENT AND PLAN OF

MERGER, dated August 26, 2024 (this “Agreement”), is made and entered into by and among CONCORD ACQUISITION CORP

II, a Delaware corporation (“Parent”), CONCORD MERGER SUB, INC., a California corporation and a wholly-owned

Subsidiary of Parent (“Merger Sub” and, together with Parent, the “Parent Parties”), and EVENTS.COM, INC.,

a California corporation (the “Company”). Parent, Merger Sub and the Company are sometimes individually referred to

in this Agreement as a “Party” and collectively as the “Parties”. Capitalized terms used in this

Agreement shall have the meanings ascribed to them in Exhibit A attached hereto.

WHEREAS, Parent is a blank

check company and was incorporated for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase,

reorganization or similar business combination with one or more businesses;

WHEREAS, Merger Sub is a

wholly owned, direct Subsidiary of Parent and was incorporated for the purpose of effectuating the Merger;

WHEREAS, upon the terms and

subject to the conditions of this Agreement, the Parties intend to enter into a business combination transaction pursuant to which, in

accordance with the California Corporations Code (the “CCC”), Merger Sub shall merge with and into the Company, with

the Company surviving such merger (the “Merger”), as a result of which the Company will become a wholly owned Subsidiary

of Parent and Parent will continue as a publicly traded company;

WHEREAS, the board of directors

of Parent (“Parent Board”) has (a) determined that it is in the best interests of Parent and its stockholders

for Parent to enter into this Agreement and the Ancillary Agreements, (b) approved the execution and delivery of this Agreement

and the Ancillary Agreements, Parent’s performance of its obligations hereunder and thereunder and the consummation of the transactions

contemplated hereby and thereby, including the Merger, and (c) recommended the adoption and approval of this Agreement and the Ancillary

Agreements and the transactions contemplated hereby and thereby by the stockholders of Parent;

WHEREAS, the sole director

of Merger Sub has (a) determined that it is in the best interests of Merger Sub and its sole stockholder to enter into this Agreement

and the Ancillary Agreements, (b) approved the execution and delivery of this Agreement and the Ancillary Agreements to which Merger

Sub is or will be a party, Merger Sub’s performance of its obligations hereunder and thereunder and the consummation of the transactions

contemplated hereby and thereby, including the Merger, and (c) recommended the adoption and approval of this Agreement and the Ancillary

Agreements to which Merger Sub is or will be a party and the transactions contemplated hereby and thereby by Parent, as the sole stockholder

of Merger Sub;

WHEREAS, Parent, as the sole

stockholder of Merger Sub, has approved this Agreement, the Ancillary Agreements to which Merger Sub is or will be a party, the Merger

and the transactions contemplated hereby and thereby;

WHEREAS, the board of directors

of the Company (the “Company Board”) has (a) determined that it is in the best interests of the Company and its

stockholders for the Company to enter into this Agreement and the Ancillary Agreements, (b) approved the execution and delivery

of this Agreement and the Ancillary Agreements, the Company’s performance of its obligations hereunder and thereunder and the consummation

of the transactions contemplated hereby and thereby, including the Merger, and (c) recommended adoption and approval of this Agreement

and the Ancillary Agreements and the transactions contemplated hereby and thereby by the stockholders of the Company;

WHEREAS, concurrently with

the execution and delivery of this Agreement, Parent, the Company and the Key Company Stockholders have entered into a stockholder support

agreement (the “Stockholder Support Agreement”), pursuant to which, among other things, the Key Company Stockholders

have agreed to (a) vote all of their shares of Company Stock in favor of the adoption and approval of this Agreement and the transactions

contemplated hereby, including the Merger, and (b) subject their shares of Company Stock to certain restrictions, in each case,

on the terms and subject to the conditions set forth therein;

WHEREAS, as a condition to

the consummation of the transactions contemplated hereby and in accordance with the terms hereof, Parent shall provide an opportunity

to its stockholders to have their shares of Parent Class A Common Stock redeemed for the consideration, and on the terms and subject

to the conditions and limitations, set forth in this Agreement and Parent’s Organizational Documents in conjunction with obtaining

approval from the stockholders of Parent for the transactions contemplated hereby (collectively with the other transactions, authorizations

and approvals set forth in the Proxy Statement, the “Offer”);

WHEREAS, concurrently with

the execution and delivery of this Agreement, the Company, Parent, the Parent Sponsor and CA2 are entering into the Sponsor Support Agreement

(the “Sponsor Support Agreement”), pursuant to which, among other things, each of Parent Sponsor and CA2 have agreed

to (a) vote all of its shares of Parent Stock in favor of this Agreement and the transactions contemplated hereby, including the

Merger, (b) not redeem its shares of Parent Stock, (c) waive its anti-dilution protection with respect to its shares of Parent

Class B Common Stock, (d) agree to certain transfer restrictions with respect to the shares of Parent Stock held by such Persons

following the Closing, which terms will be substantially consistent to the terms of the transfer restrictions to which the Founders agree

pursuant to the Lock-Up Agreement and (e) forfeit certain shares of Parent Class B Common Stock; in each case, on the terms

and subject to the conditions set forth therein;

WHEREAS, concurrently with

the execution and delivery of this Agreement, and effective upon Closing, Parent and the Founders shall enter into a Lock-Up Agreement

(the “Lock-Up Agreement”);

WHEREAS, in connection with

the Closing, Parent, certain stockholders of Parent and certain Company Stockholders shall enter into a Registration Rights Agreement

(the “Registration Rights Agreement”), substantially in the form attached hereto as Exhibit B;

WHEREAS, each Parent Unit

shall separate and convert automatically into one share of Parent Class A Common Stock and one-third of a Parent Warrants upon a

Business Combination;

WHEREAS, except as set forth

in the Sponsor Support Agreement, all shares of Parent Class B Common Stock shall automatically convert into shares of Parent Class A

Common Stock upon a Business Combination; and

WHEREAS, the Parties desire

to make certain representations, warranties, covenants and other agreements in connection with the foregoing and also prescribe certain

conditions to the Merger as specified herein.

NOW, THEREFORE, in consideration

of the foregoing and the respective representations, warranties, covenants, agreements and conditions set forth in this Agreement, and

intending to be legally bound hereby, each Party hereby agrees:

Article I

THE MERGER

Section 1.1 The

Merger. Upon the terms and subject to the conditions set forth in this Agreement and in accordance with the CCC, at the Effective

Time, Merger Sub shall merge with and into the Company, with the Company surviving the Merger. Following the Merger, the separate corporate

existence of Merger Sub will cease, and the Company will continue as the surviving corporation of the Merger (the “Surviving

Subsidiary”) and as a wholly-owned Subsidiary of Parent.

Section 1.2 Effective

Time. Upon the terms and subject to the provisions of this Agreement, as soon as practicable on the Closing Date, the Parties shall

cause the Merger to be consummated by filing a certificate of merger in form and substance reasonably acceptable to the Company and Parent

(the “Certificate of Merger”) with the Secretary of State of the State of California in accordance with the applicable

provisions of the CCC. As soon as practicable on or after the Closing Date, the Parties shall make any and all other filings or recordings

required under the CCC to give effect to the Merger. The Company shall cause its Subsidiaries to take corporate action as reasonably

necessary to approve and effectuate the Merger in accordance with the CCC. The Merger will be effective at such time as the Parties duly

file the Certificate of Merger with the Secretary of State of the State of California or at such other date or time as Parent and the

Company agree in writing and specify in the Certificate of Merger (the time the Merger becomes effective being the “Effective

Time”).

Section 1.3 Effect

of the Merger. At the Effective Time, the Merger will have the effect set forth in this Agreement and the relevant provisions of

the CCC. Without limiting the generality of the foregoing, and subject hereto, at the Effective Time, all property, rights, privileges,

immunities, powers and franchises of Merger Sub will vest in the Surviving Subsidiary and all claims, obligations, restrictions, disabilities,

liabilities, debts and duties of Merger Sub will become the claims, obligations, restrictions, disabilities, liabilities, debts and duties

of the Surviving Subsidiary.

Section 1.4 Governing

Documents of the Surviving Subsidiary.

(a) Articles

of Incorporation. At the Effective Time and by virtue of the Merger, the amended and restated articles of incorporation of the Company

shall be amended and restated in its entirety to read as set forth in Exhibit F attached hereto and, as so amended and restated,

shall be the articles of incorporation of the Surviving Subsidiary until amended in accordance with applicable Law and the articles of

incorporation of the Surviving Subsidiary, subject to Section 5.9.

(b) Bylaws.

At the Effective Time and by virtue of the Merger, the bylaws of the Merger Sub as in effect at the Effective Time shall become the bylaws

of the Surviving Subsidiary, except that all references to the Merger Sub shall be automatically amended and shall become references

to the Surviving Subsidiary, until amended in accordance with applicable Law, the second amended and restated articles of incorporation

of the Surviving Subsidiary and such bylaws, subject to Section 5.9.

Section 1.5 Directors

and Officers of the Surviving Subsidiary. At the Effective Time, the directors and officers set forth in Section 1.5

of the Parent Disclosure Schedule will become the directors and officers of the Surviving Subsidiary and will remain the directors and

officers of the Surviving Subsidiary after the Merger, in each case until their respective successors are duly elected or appointed and

qualified, or their earlier death, resignation or removal.

Article II

MERGER CONSIDERATION; CONVERSION OF SECURITIES

Section 2.1 Closing

Date Statement.

(a) Not

less than three (3) Business Days prior to the Closing Date, the Company shall deliver to Parent a statement (the “Company

Closing Statement”) setting forth the (i) name and email address of each Company Stockholder and Company Securityholder

of record on the books and records of the Company; (ii) number of shares of each class or series of Company Stock and/or Company

Securities owned by each such Company Stockholder or Company Securityholder, as applicable (and in the case of a Company Security, the

number of shares of Company Stock underlying the applicable Company Security, and the exercise price thereof, if applicable); (iii) with

respect to the Company Securities, the vesting schedule and expiration or termination dates thereof; and (iv) the Pro Rata Portion

allocable to each Company Stockholder and Company Securityholder (the information set forth in the foregoing clauses (i), (ii), (iii) and

(iv) shall constitute the “Allocation Schedule”); (v) the quantum of Interim Financing raised on or prior

to the Closing Date; and (vi) the amount of the Company Transaction Expenses (including copies of invoices for third party Company

Transaction Expenses, together with applicable Tax Forms for any Company Transaction Expenses). From and after delivery of the Company

Closing Statement until the Closing, the Company shall (x) reasonably cooperate with and provide Parent and its Representatives

information reasonably requested by Parent or any of its Representatives and within the Company’s or its Representatives’

possession or control in connection with Parent’s review of the Company Closing Statement and (y) consider in good faith any

comments to the Company Closing Statement provided by Parent, and Company shall revise such Company Closing Statement to incorporate

any changes the Company determines is necessary or appropriate given such comments. The allocations and calculations set forth in the

Company Closing Statement (as may be amended in accordance with the preceding sentence) shall, to the fullest extent permitted by applicable

Law, be binding on all Parties hereto and be used by Parent for purposes of issuing all consideration in accordance with this Agreement,

absent manifest error.

(b) Not

less than three (3) Business Days prior to the Closing Date, the Parent shall deliver to the Company a statement (the “Parent

Closing Statement”) setting forth (i) the number of shares of each class or series of Parent Class A Common Stock

constituting the Merger Consideration determined based on the Company Closing Statement; (ii) the aggregate amount of cash in the

Trust Account (prior to giving effect to the Parent Common Stockholder Redemption); (iii) the aggregate amount of all payments required

to be made in connection with the Parent Common Stockholder Redemption; (iv) the Available Closing Cash; (v) the amount of

the Parent Transaction Expenses (including copies of invoices for third party Parent Transaction Expenses, together with applicable Tax

forms for any Parent Transaction Expenses); (vi) the number of shares of Parent Stock to be outstanding as of immediately prior

to the Closing after giving effect to the Parent Common Stockholder Redemption; and (vii) the number of shares of Parent Class A

Common Stock that may be issued upon the exercise of all Parent Warrants issued and outstanding as of immediately prior to the Closing

and the exercise prices therefor; in each case, including reasonable supporting detail therefor. From and after delivery of the Parent

Closing Statement until the Closing, Parent shall (A) cooperate with and provide the Company and its Representatives all information

reasonably requested by the Company or any of its Representatives and within Parent’s or its Representatives’ possession

or control in connection with the Company’s review of the Parent Closing Statement and (B) consider in good faith any comments

to the Parent Closing Statement provided by the Company, and Parent shall revise such Parent Closing Statement to incorporate any changes

Parent determines are necessary or appropriate given such comments.

Section 2.2 Aggregate

Consideration. The total consideration to be paid in respect of the Merger shall equal (a) an aggregate number of shares of

Parent Class A Common Stock equal to the Merger Consideration, plus (b) the Earn Out Consideration on the terms set

forth in Section 2.8, plus (c) the rights under the Tax Receivable Agreement (collectively, the “Aggregate

Consideration”). The portion of the Merger Consideration and the Earn Out Consideration payable to Company Stockholders shall

be paid at the Closing in accordance with the Allocation Schedule and the terms herein (subject to Section 2.8). Additionally,

Parent shall pay, or cause to be paid when due, to the Company Stockholders and Company Securityholders, the remainder of the Aggregate

Consideration in accordance with the terms herein.

Section 2.3 Payment

of Other Amounts at Closing. At the Closing, Parent shall:

(a) cause

Parent to make any payments, by wire of immediately available funds from the Trust Account, required to be made by Parent in connection

with the Parent Common Stockholder Redemptions;

(b) on

behalf of the Company, pay or cause to be paid to such account or accounts as the Company specifies to Parent in the Company Closing

Statement, the unpaid Company Transaction Expenses;

(c) on

behalf of the Company, pay or cause to be paid to such account or accounts specified in the Payoff Letters the applicable Payoff Amounts

to the applicable Existing Lenders pursuant to the Payoff Letters;

(d) on

behalf of the Parent, pay or cause to be paid to such account or accounts as the Parent specifies to the Company pursuant to the Parent

Closing Certificate, the unpaid Parent Transaction Expenses; and

(e) cause

Parent to contribute any remaining balance from the Trust Account (after giving effect to the payments set forth in the foregoing clauses

(a) through (d)) to the Surviving Subsidiary for working capital and general corporate purposes.

Section 2.4 Separation

of Parent Securities. At the Effective Time, by virtue of the Merger and without any action on the part of any Party or the holders

of any of the following securities, each Parent Unit issued and outstanding immediately prior to the Effective Time shall be automatically

separated and the holder thereof shall be deemed to hold one (1) share of Parent Class A Common Stock and one-third (1/3) of

a Parent Warrant. Notwithstanding anything to the contrary contained herein, no evidence of book-entry shares representing fractional

Parent Warrants shall be issued in exchange for Parent Warrants. Each holder of Parent Warrants who would otherwise be entitled to a

fraction of a Parent Warrant (after aggregating all fractional shares of Parent Warrants that would otherwise be received by such Person)

shall instead have the number of Parent Warrants issued to such Person rounded down in the aggregate to the nearest whole Parent Warrant.

Section 2.5 Conversion

of Company Stock and Company Securities.

(a) Recapitalization.

Immediately prior to the Effective Time, subject to the substantially concurrent occurrence of the Effective Time, the Company shall

consummate the Recapitalization. Upon the consummation of the Recapitalization, the shares of Company Preferred Stock shall no longer

be outstanding and shall cease to exist, and each holder of Company Preferred Stock shall thereafter cease to have any rights with respect

to such Company Preferred Stock.

(b) Company

Stock and Company Securities. If the Company Charter Amendment is approved, at the Effective Time, by virtue of the Merger and without

any action on the part of any Party or the Company Stockholders or Company Securityholders, as applicable:

(i) each

share of Company Common Stock (including shares of Company Common Stock resulting from the Recapitalization, but excluding (i) any

shares of Company Common Stock held in the treasury of the Company, which treasury shares shall be canceled as part of the Merger and

shall not constitute “Company Stock” hereunder, and (ii) any Company Dissenting Shares (collectively, the “Excluded

Shares”)) that is issued and outstanding immediately prior to the Effective Time shall be canceled and converted into the right

to receive a number of shares of Parent Class A Common Stock equal to the Exchange Ratio and a portion of the remainder of

the Aggregate Consideration as set forth on the Allocation Schedule. Accordingly, each holder of shares of Company Common Stock as of

immediately prior to the Effective Time (other than Excluded Shares) shall be entitled to receive the applicable portion of the Merger

Consideration in the form of Parent Class A Common Stock equal to (A) the Exchange Ratio, multiplied by (B) the

number of shares of Company Common Stock held by such holder as of immediately prior to the Effective Time (as set forth in the Allocation

Schedule), with fractional shares being treated in accordance with Section 2.7(d);

(ii) each

Company Option (whether vested or unvested) that is outstanding and unexercised immediately prior to the Effective Time will be converted

into the right to receive an option relating to shares of Parent Class A Common Stock upon substantially the same terms and conditions

as are in effect with respect to such Company Option immediately prior to the Effective Time, including with respect to vesting and termination-related

provisions (each such option, an “Exchanged Option”), except that (x) such Exchanged Option shall relate to (A) a

number of shares of Parent Class A Common Stock (rounded down to the nearest whole share) equal to the number of shares of Company

Common Stock subject to such Company Option immediately prior to the Effective Time (taking into account the consummation of the Recapitalization)

multiplied by the Exchange Ratio and (B) a portion of the Earn Out Consideration as set forth on the Allocation Schedule, and (y) the

exercise price per share for each such Exchanged Option shall be equal to the exercise price per share of such Company Option in effect

immediately prior to the Effective Time (taking into account the consummation of the Recapitalization) divided by the Exchange Ratio

(the exercise price per share, as so determined, being rounded up to the nearest full cent); provided, however, that the conversion of

the Company Options will be made in a manner consistent with Treasury Regulations Section 1.424-1, such that such conversion will

not constitute a “modification” of such Company Options for purposes of Section 409A or, for Company Options that are

intended to be incentive stock options within the meaning of Section 422 of the Code or Section 424 of the Code. As promptly

as practicable following the Effective Time and, in any event, in accordance with applicable Law, Parent shall file an appropriate registration

statement or registration statements with respect to the shares of Parent Class A Common Stock underlying such Exchanged Options

and shall use commercially reasonable efforts to maintain the effectiveness of such registration statement or registration statements

(and maintain the current status of the prospectus or prospectuses contained therein) for so long as such awards remain outstanding;

(iii) each

Company Warrant and, to the extent permitted by the terms thereof, each Company Convertible Note that is outstanding and unexercised

immediately prior to the Effective Time (and which is not automatically and fully exercised in accordance with its terms prior to the

Effective Time) shall automatically, without any further action on the part of the holder thereof, be assumed by Parent in accordance

with the terms of such Company Warrant or Company Convertible Note, as applicable (including as to vesting, exercisability or convertibility,

to the extent applicable). Following the Effective Time, each assumed Company Warrant shall be exercisable for shares of Parent Class A

Common Stock and a portion of the Earn Out Consideration as set forth on the Allocation Schedule;

(iv) following

the Closing, each Company Stockholder and (upon exercise of the applicable underlying security) Company Securityholder shall be entitled

to its Pro Rata Portion of the Earn Out Consideration and the rights under the Tax Receivable Agreement, subject to the terms herein

and in the Tax Receivable Agreement; and

(v) if

the Company Charter Amendment is not approved, at the Effective Time, by virtue of the Merger and without any action on the part of any

Party or the Company Stockholders or Company Securityholders, the Company Stock and Company Securities shall be converted in accordance

with the terms of the Company Charter and the foregoing Section 2.5(b)(i).

For the avoidance of doubt, it is the intent

of the Parties that, generally, the Merger Consideration will be allocated among and distributed to all holders of capital stock of the

Company that is outstanding immediately prior to Effective Time and all other securities of the Company that are outstanding immediately

prior to Effective Time and that are exercisable for or convertible into capital stock of the Company to the extent (i) any such

other securities that are exercisable for capital stock of the Company are both vested and in-the-money and (ii) any such securities

that are automatically convertible into capital stock of the Company in connection with the Merger are automatically converted immediately

prior to the Effective Time.

(c) Equity

Interests of Merger Sub. At the Effective Time, by virtue of the Merger and without any action on the part of any Party or the holders

of any shares of capital stock of the Company or Merger Sub, each share of common stock of Merger Sub issued and outstanding immediately

prior to the Effective Time shall be converted into and exchanged for one (1) validly issued, fully paid and nonassessable share

of common stock of the Surviving Subsidiary.

Section 2.6 Parent

Redeemed Shares.

(a) Dividends.

No dividends or other distributions declared with respect to Parent Class A Common Stock, the record date for which is at or after

the Effective Time, shall be paid with respect to any Parent Redeemed Shares.

(b) Parent

Redeemed Shares. Any share of Parent Class A Common Stock held by any Parent Stockholder that exercises redemption rights pursuant

to the Offer (a “Parent Redeemed Share”) shall be canceled and converted into the right to receive the consideration

set forth in the Offer. The Parent Parties shall give the Company prompt notice of the exercise of any redemption rights pursuant to

the Offer.

Section 2.7 Exchange

Procedures for Company Stockholders.

(a) Payment

of the Merger Consideration. At or prior to the Effective Time, Parent shall deposit, or shall cause to be deposited, with the Exchange

Agent, in trust for the benefit of the Company Stockholders, evidence of book-entry shares representing the portion of the Merger Consideration

and the Earn Out Consideration deliverable to the Company Stockholders pursuant to this Article II. Any such shares of Parent

Class A Common Stock deposited with the Exchange Agent, shall hereinafter be referred to as the “Exchange Agent Fund”.

The Exchange Agent Fund shall be subject to the terms of this Agreement and the Exchange Agent Agreement. Subject to this Section 2.7,

at the Closing, Parent shall cause to be issued or paid from the Exchange Agent Fund to each Company Stockholder that holds Company Stock

(other than shares of Company Stock to be canceled pursuant to Section 2.6 and any Company Dissenting Shares) immediately

prior to the Effective Time, evidence of book-entry shares representing such Company Stockholder’s allocable portion of the Merger

Consideration and the Earn Out Consideration in accordance with the terms herein.

(b) Reasonably

promptly after the Effective Time, Parent shall send or shall cause the Exchange Agent to send, to each Company Stockholder of record

as of immediately prior to the Effective Time, whose Company Common Stock was converted pursuant to Section 2.5(b)(i) into

the right to receive a portion of the Aggregate Consideration, a letter of transmittal and instructions (which shall specify that the

delivery shall be effected, and the risk of loss and title shall pass, only upon proper transfer of each share of Company Common Stock

to the Exchange Agent, and which letter of transmittal will be in customary form and have such other provisions as Parent may reasonably

specify) for use in such exchange (each, a “Letter of Transmittal”).

(c) Each

holder of shares of Company Common Stock that have been converted into the right to receive a portion of the Aggregate Consideration,

pursuant to Section 2.5(b)(i), shall be entitled to receive its allocable portion of the Merger Consideration and the

Earn Out Consideration, upon receipt of an “agent’s message” by the Exchange Agent (or such other evidence, if any,

of transfer as the Exchange Agent may reasonably request), and/or a duly completed and validly executed Letter of Transmittal and such

other documents as may reasonably be requested by the Exchange Agent. No interest shall be paid or accrued upon the transfer of any share

of Company Common Stock.

(d) Promptly