UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the

Registrant |

|

☒ |

| Filed by a party other

than the Registrant |

|

☐ |

Check the appropriate box:

| ☐ |

|

Preliminary

Proxy Statement |

| ☐ |

|

Confidential, for Use of

the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

|

Definitive Proxy Statement |

| ☐ |

|

Definitive Additional Materials |

| ☐ |

|

Soliciting Material under

§240.14a-12 |

SPLASH

BEVERAGE GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

| Payment

of Filing Fee (Check all boxes that apply): |

| ☒ |

|

No fee required |

| ☐ |

|

Fee paid previously with

preliminary materials. |

| ☐ |

|

Fee computed on table in

exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 6, 2023

To the stockholders of Splash Beverage Group, Inc.,

You are cordially invited to attend the 2023 Annual

Meeting of Stockholders of Splash Beverage Group, Inc. (the “Company”) to be held in a virtual-only meeting format via live

webcast on the Internet on October 6, 2023 at 10:00 a.m. Eastern Time. At the annual meeting you will be asked to vote on the following

matters:

| |

1. |

to elect

directors to serve until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| |

2. |

to approve

the amendment of the Company’s 2020 Long-Term Incentive Plan; |

| |

3. |

to approve, pursuant

to Rule 713 of the NYSE American, the issuance of up to 21,000,000 shares of the Company’s common stock in connection with

future acquisition(s) or to certain accredited investors in a private placement (the “Issuance

Proposal”); |

| |

|

|

| |

4. |

to approve, on a non-binding advisory basis, the compensation paid to the Company’s named executive officers (the “Say-on-Pay Proposal”); and |

| |

|

|

| |

5. |

to recommend, on a non-binding advisory basis, the frequency of future advisory votes on the compensation paid to the Company’s named executive officers (the “Say-on-Frequency Proposal”). |

We also will transact such other business as may

properly come before the annual meeting or any adjournments thereof.

The Board of Directors recommends

that you vote at the annual meeting “FOR” the election of each nominee as director and “FOR” each of the

other proposals set forth in this Notice. These items of business are more fully described in the proxy statement

that is attached to this Notice. The Board of Directors has fixed the close of business on August 28, 2023, as

the “Record Date” for determining the stockholders that are entitled to notice of and to vote at the annual meeting and any

adjournments thereof. A list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for

any purpose related to the meeting to the Annual Meeting, by appointment, for a period of ten days before the meeting in person at our

corporate offices in Fort Lauderdale, Florida, and in electronic form at the meeting.

It is important that your shares are represented

and voted at the meeting. You can vote your shares by completing, signing, and returning your completed proxy card or vote by mail, internet

or by fax by following the instructions included in the proxy statement. You can revoke a proxy at any time prior to its exercise at

the meeting by following the instructions in the proxy statement.

We are holding the 2023 Annual Meeting of Stockholders

in a virtual-only meeting format via live webcast on the internet. You will not be able to attend at a physical location. Stockholders

will be able to join and attend online by logging in at www.virtualshareholdermeeting.com/SBEV2023. Your proxy is revocable in accordance

with the procedures set forth in the proxy statement.

| |

By Order of

the Board of Directors |

| |

/s/ Robert

Nistico |

| Fort Lauderdale, FL |

Chief Executive Officer

and Director |

| September 11, 2023 |

|

IMPORTANT NOTICE REGARDING THE

AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF SHAREHOLDERS

The Proxy Statement and the

2022 Annual Report on Form 10-K are available at

www.splashbeveragegroup.com or www.proxyvote.com

TABLE

OF CONTENTS

Stockholders Should Read

the Entire Proxy Statement Carefully Prior to Returning Their Proxies

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”)

of Splash Beverage Group, Inc. for use at our 2023 Annual meeting of stockholders to be held in a virtual-only (online) meeting format

via live webcast on the Internet on October 6, 2023 at 10:00 a.m. Eastern Time. Voting materials, including this proxy statement and

proxy card, are expected to be first delivered to all or our stockholders on or about September 7, 2023.

QUESTIONS AND ANSWERS

Following are some commonly asked questions raised

by our stockholders and answers to each of those questions.

What may I vote on at the annual meeting?

At the annual meeting, stockholders will consider

and vote upon the following matters:

| |

● |

to elect five directors to

serve until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| |

● |

to approve the amendment of the Company’s 2020 Long-Term Incentive Plan; |

| |

● |

to approve, pursuant to Rule 713 of the NYSE American, the issuance of up to 21,000,000 shares

of the Company’s common stock for potential future acquisition(s) or for certain accredited investors in a private placement.

At this time the Company has no plans of making any public offerings; |

| |

|

|

| |

● |

to approve, on a non-binding advisory basis, the compensation paid to our named executive officers; and |

| |

|

|

| |

● |

to recommend, on a non-binding advisory basis, the frequency of future advisory votes on the compensation paid to our named executive officers. |

How does the Board of Directors recommend that I vote on the proposals?

Our Board unanimously recommends that the stockholders

vote “FOR” the election of each nominee as director and “FOR” each of the other proposals being put before our

stockholders at the meeting.

How do I vote?

Whether you plan to participate in the online annual meeting or not, our Board

urges you to vote by proxy. If you vote by proxy, the individuals named on the proxy card, or your “proxies,” will vote your

shares in the manner you indicate. You may specify whether your shares: should be voted for or withheld for the nominees for director;

should be voted for; and should be voted for, against or abstained with respect to approving the amendment to our articles of incorporation

to increase the number of authorized shares of common stock. Voting by proxy will not affect your right to virtually attend the annual

meeting. If your shares are registered directly in your name through our transfer agent, VStock Transfer, LLC, or you have stock certificates

registered in your name, you may submit a proxy to vote:

| |

● |

By Internet or by telephone. Follow the instructions attached to the proxy card to submit a proxy to vote by Internet or telephone. |

| |

|

|

| |

● |

By mail. If you receive one or more proxy cards by mail, you can vote by mail by completing, signing, and returning the enclosed proxy card applicable to your class of stock in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board. |

| |

|

|

| |

● |

On the day of the meeting, you may go to www.virtualshareholdermeeting.com/SBEV2023, and log in by entering the 16-digit control number found on your proxy card, voting instruction form, or Notice, as applicable. If you do not have your control number, you will be able register as a guest; however, you will not be able to vote or submit questions during the meeting. |

Telephone and Internet

voting facilities for all stockholders of record will be available 24-hours a day and will close at 11:59 p.m., Eastern Time, on October

5, 2023.

If your shares are held in “street name”

(held in the name of a bank, broker or other nominee who is the holder of record), you must provide the bank, broker or other nominee

with instructions on how to vote your shares and can do so as follows:

| |

● |

By Internet or by telephone.

Follow the instructions you receive from the record holder to vote by Internet or telephone. |

| |

|

|

| |

● |

By mail. You should receive

instructions from the record holder explaining how to vote your shares. |

How may I attend and participate in the Meeting?

We will be hosting the meeting live via the internet. There will not be a

physical location for the meeting. Our virtual meeting allows stockholders to submit questions and comments before and during the meeting.

After the meeting, we will spend up to 15 minutes answering stockholder questions. Our virtual format also allows stockholders from around

the world to participate and ask questions and for us to give thoughtful responses. Any stockholder can listen to and participate in the

meeting live via the internet at www.virtualshareholdermeeting.com/SBEV2023. Stockholders may begin submitting written questions through

the internet portal at 9:45 a.m. (Eastern Time) on October 6, 2023, and the webcast of the annual meeting will begin at 10:00 a.m. (Eastern

Time) that day.

Stockholders may also vote while connected to the

meeting on the Internet. You will need the control number included on your Notice or your proxy card (if you received a printed copy

of the proxy materials) in order to be able to vote your shares or submit questions. Instructions on how to connect and participate via

the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/SBEV2023.

We will have technicians ready to assist you with any technical difficulties

you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting

time, please call the technical support number that will be posted on the virtual shareholder meeting log-in page.

If you do not have your control number, you will

be able to listen to the meeting only — you will not be able to vote or submit questions.

What happens if additional matters are presented at the annual meeting?

Other than the matters identified in this proxy statement,

we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the person named as proxy holder,

Robert Nistico, our Chief Executive Officer, or Ron Wall, our Chief Financial Officer will have the discretion to vote your shares on

any additional matters properly presented for a vote at the annual meeting.

What happens if I do not give specific voting instructions?

If you hold shares in your name and you sign and

return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board on all matters

and as the proxy holder may determine in her or his discretion with respect to any other matters properly presented for a vote before

the annual meeting. If you hold your shares through a stockbroker, bank or other nominee and you do not provide instructions on how to

vote, your stockbroker or other nominee may exercise their discretionary voting power with respect to certain proposals that are considered

as “routine” matters

If the organization that holds your shares does

not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform

us that it does not have the authority to vote on these matters with respect to your shares. This is generally referred to as a “broker

non-vote.” When the vote is tabulated for any particular matter, broker non-votes will be counted for purposes of determining whether

a quorum is present, but will not otherwise be counted. In the absence of specific instructions from you, your broker does not have discretionary

authority to vote your shares with respect to the election of our Board of Directors, and amendment to our Articles of Incorporation

to increase the number of authorized shares of common stock. We encourage you to provide voting instructions to the organization that

holds your shares by carefully following the instructions provided in the notice.

What is the quorum requirement for the annual meeting?

On August 28, 2023, the Record Date for determining which stockholders are entitled to vote at the annual meeting or

any adjournments or postponements thereof, there were 42,810,518 shares of our common stock

outstanding which is our only class of voting securities. Each share of common stock entitles the holder to one vote on matters submitted

to a vote of our stockholders. Holders of thirty-four percent (34%) of our outstanding stock as of the Record Date must be present at

the annual meeting (in person or represented by proxy) in order to hold the meeting and conduct business. This is called a quorum. Your

shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters

introduced at the annual meeting, if you are present and vote online at the meeting or have properly submitted a proxy card or voted by

mail, internet or fax.

How can I change my vote after I return my proxy card?

You may revoke your proxy and change your vote at

any time before the final vote at the annual meeting. You may do this by signing a new proxy card with a later date or by attending the

annual meeting at www.virtualshareholdermeeting.com/SBEV2023 and voting at the meeting. However, your attendance at the annual meeting

will not automatically revoke your proxy unless you vote at the annual meeting or specifically request in writing that your prior proxy

be revoked.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations

that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either

within our Company or to third parties, except:

| |

● |

as

necessary to meet applicable legal requirements; |

| |

|

|

| |

● |

to

allow for the tabulation of votes and certification of the vote; and |

| |

|

|

| |

● |

to

facilitate a successful proxy solicitation. |

Any written comments that a stockholder might include

on the proxy card may be forwarded to our management.

Where can I find the voting results of the annual meeting?

The preliminary voting results will be announced

at the annual meeting. The final voting results will be tallied by our inspector of elections and reported in a Current Report on Form 8-K,

which we will file with the Securities and Exchange Commission, or SEC, within four business days of the date of the annual meeting.

How can I obtain a separate set of voting materials?

To reduce the expense of delivering duplicate voting

materials to our stockholders who may have more than one Splash Beverage Group, Inc. stock account, we are delivering only one Notice

to certain stockholders who share an address, unless otherwise requested. If you share an address with another stockholder and have received

only one Notice, you may write or call us to request to receive a separate Notice. Similarly, if you share an address with another stockholder

and have received multiple copies of the Notice, you may write or call us at the address and phone number below to request delivery of

a single copy of this Notice. For future annual meetings, you may request separate Notices, or request that we send only one Notice to

you if you are receiving multiple copies, by writing or calling us at:

Splash Beverage Group, Inc.

Attention: Robert Nistico, Chief Executive Officer

1314 East Las Olas Blvd, Suite 221

Fort Lauderdale, Florida 33301

Tel: (954) 745-5815

Who pays for the cost of this proxy solicitation?

We will pay the costs of the solicitation of proxies.

We may also reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding

the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting

proxies by mail, our board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally,

electronically or by telephone.

How can I obtain a copy of Splash Beverage Group, Inc.’s 2022

Annual Report on Form 10-K?

You may obtain a copy of our Annual Report on Form 10-K for the fiscal

year ended December 31, 2022, by sending a written request to the address listed above under “How can I obtain a separate set

of voting materials?” Our 2022 Annual Report on Form 10-K is available by accessing our Investors page at www. https://splashbeveragegroup.com

and our Form 10-K with exhibits is available on the website of the SEC at www.sec.gov.

What is the voting requirement to approve the proposals?

The proposal to approve an

amendment to our 2020 Long-Term Incentive Plan, the Issuance Proposal and the Say-on-Pay Proposal each needs to be approved by a majority

of the issued and outstanding shares entitled to vote on the proposal. The proposal to elect directors to serve until the next annual

meeting of stockholders and until their successors are duly elected and qualified needs to be approved by a plurality of the votes cast

at the meeting. Abstentions and broker non-votes will be treated as shares that are present or represented and entitled to vote for purposes

of determining the presence of a quorum at the annual meeting. In the Say-on-Frequency Proposal, the option (every one year, two years

or three years) receiving the most votes will be viewed as the recommendation of the stockholders. Abstentions will not be counted in

determining the number of votes cast in connection with any matter presented at the annual meeting. Broker non-votes will not be counted

as a vote cast on any matter presented at the annual meeting.

How many votes are required to approve other matters that may come

before the stockholders at the meeting?

An affirmative vote of a majority of the issued and

outstanding shares entitled to vote on the proposal of all other items being submitted to the stockholders for their consideration.

WHO CAN

HELP ANSWER YOUR QUESTIONS?

You may seek answers to your questions by calling

Robert Nistico, our Chief Executive Officer at (954) 745-5815.

CORPORATE

GOVERNANCE

Board of Directors

The Board of

Directors oversees our business affairs and monitors the performance of management. In accordance with our corporate governance

principles, the Board of Directors does not involve itself in day-to-day operations of the Company. The directors keep themselves

informed through discussions with the Chief Executive Officer, other key executives and by reading the reports and other materials

that we send them and by participating in Board of Directors and committee meetings. Our directors hold office until the next

succeeding annual meeting of shareholders or until their

successors have been elected and duly qualified unless the director resigns or by reason of death or other cause is unable to serve

in the capacity of director. Biographical information about our directors is provided later within this Proxy Statement in

“Election of Director — Proposal No. 1”.

Director Independence

The Board of Directors has considered the

independence of each director and nominee for election as a director in accordance with the elements of independence set forth in

the listing standards of the NYSE. Based upon information solicited from each nominee, the Board of Directors has affirmatively

determined that Peter McDonough, Candace Crawford and Bill Caple have no material relationship with the Company (either directly or

as a partner, stockholder or officer of an organization that has a relationship with the Company) and are “independent”

within the meaning of the NYSE’s director independence standards and Audit Committee independence standards, as currently in

effect. During 2022, Peter McDonough and Candace Crawford were the two independent directors and on May 3, 2023, Bill Caple was

appointed as an independent director to the Board of Directors.

Board leadership structure and role in risk oversight

The Board of Directors oversees our business and affairs and monitors the performance

of management. In accordance with corporate governance principles, the Board of Directors does not involve itself in day-to-day operations.

The directors keep themselves informed through discussions with the Chief Executive Officer and Chairman, Robert Nistico and other key

executives, visits to the Company’s facilities, by reading the reports and other materials that we send them and by participating

in Board and committee meetings. Each director’s term will continue until the election and qualification of his or her successor,

or his or her earlier death, resignation or removal.

Code of Conduct and Ethics

We have adopted a code of business conduct and ethics that applies to

our directors, officers (including our Chief Executive Officer, Chief Financial Officer and any person performing similar functions)

and employees. Our Code of Ethics is available at our website at www.splashbeveragegroup.com.

Anti-Hedging

and Anti-Pledging Policies

On August 24, 2023,

we adopted an insider trading policy to ensure proper alignment with our stockholders, to establish policies that prohibit our directors,

officers, other employees, and their family members from engaging in any transaction that might allow them to realize gains from declines

in our securities. Specifically, we prohibit our directors, officers, employees, and their family members from engaging in transactions

using derivative securities, short selling our securities, trading in any puts, calls or covered calls, writing purchase or call options

and short sales, or otherwise participating in hedging, “stop loss,” or other speculative transactions involving our securities.

Board of Directors Meetings and Attendance

During 2022,

the Board of Directors held five meetings. During 2022, each member of our Board of Directors attended at least 75%

of the aggregate of all meetings of our Board of Directors and of all meetings of

committees of our Board of Directors on which such member served that were held during

the period in which such director served.

Legal Proceedings

None of the Company’s current directors or

executive officers have been involved, in the past ten years and in a manner material to an evaluation of such director’s or officer’s

ability or integrity to serve as a director or executive officer, in any of those “Certain Legal Proceedings” more fully

detailed in Item 401(f) of Regulation S-K, which include but are not limited to, bankruptcies, criminal convictions and an adjudication

finding that an individual violated federal or state securities laws.

BOARD COMMITTEES

Our

Board of Directors has formed three standing committees: audit, compensation, and nominating

and corporate governance. Actions taken by our committees are reported to the full board.

Each of our committees has a charter and each charter is posted on our website, www.splashbeveragegroup.com.

As of September 11, 2023, each of our committees is composed of:

| Audit

Committee |

|

Nominating and Corporate

Governance Committee |

|

Compensation and Management

Resources Committee |

| Candace Crawford* |

|

Peter McDonough* |

|

Bill Caple* |

| Peter McDonough |

|

Candace Crawford |

|

Peter McDonough |

| Bill Caple |

|

Bill Caple |

|

Candace Crawford |

| |

* |

Indicates committee chair |

Audit Committee

We have separately designated an Audit Committee.

The Audit Committee is responsible for, among other things, the appointment, compensation, removal and oversight of the work of the Company’s

independent registered public accounting firm, overseeing the accounting and financial reporting process of the Company, and reviewing

related person transactions. During 2022, our Audit Committee was comprised of Candace Crawford and Peter McDonough. In June 2023, Bill

Caple was appointed as the third member of the Audit Committee. Under NYSE listing standards and applicable SEC rules, all the directors

on the audit committee must be independent and we are required to maintain an audit committee of three independent directors.

Our Board has determined that Peter McDonough, Candace Crawford and Bill Caple are independent under NYSE listing standards and applicable

SEC rules. Candace Crawford is the Chairperson of the audit committee. Each member of the audit committee is financially literate, and

our Board has determined that Candace Crawford qualifies as an “audit committee financial expert” as defined in applicable

SEC rules. The Audit Committee operates under a written charter adopted by the Board of Directors, which can be found on our website

at www.splashbeveragegroup.com. During 2022, the Audit Committee held four meetings in person or through conference calls.

Nominating and Corporate

Governance Committee

The Nominating and Corporate Governance Committee is responsible for overseeing

the appropriate and effective governance of the Company, including, among other things, (a) nominations to the Board of Directors and

making recommendations regarding the size and composition of the Board of Directors and (b) the development and recommendation of appropriate

corporate governance principles. During 2022, our Nominating and Corporate Governance Committee was comprised of Candace Crawford and

Peter McDonough. In June 2023, Bill Caple was appointed as the third member of the Nominating and Corporate Governance Committee. Each

member of the Nominating and Corporate Governance Committee is an independent director (as defined under Section 803 of the NYSE American

LLC Company Guide). The Chairperson of the committee is Peter McDonough. The Nominating and Corporate Governance Committee operates under

a written charter adopted by the Board of Directors, which can be found on our website at www.splashbeveragegroup.com

The Nominating and Corporate Governance Committee adheres to the Company’s

bylaws provisions and Securities and Exchange Commission rules relating to proposals by stockholders when considering director candidates

that might be recommended by stockholders, along with the requirements set forth in the committee’s Policy with regard to Consideration

of Candidates Recommended for Election to the Board of Directors, also available on our website. The Nominating and Corporate Governance

Committee of the Board of Directors is responsible for identifying and selecting qualified candidates for election to the Board of Directors

prior to each annual meeting of the Company’s stockholders. In identifying and evaluating nominees for director, the Committee considers

each candidate’s qualities, experience, background and skills, as well as other factors, such as the individual’s ethics,

integrity and values which the candidate may bring to the Board of Directors.

During 2022, the Compensation Management Resources Committee held two meetings in person

or through conference calls.

Compensation Committee

We have established a Compensation and Management

Resources Committee of our Board of Directors. The purpose of the Compensation and Management Resources Committee is to assist the Board

in discharging its responsibilities relating to executive compensation, succession planning for the Company’s executive team, and

to review and make recommendations to the Board regarding employee benefit policies and programs, incentive compensation plans and equity-based

plans.

The members of our Compensation and Management Resources Committee were Candace

Crawford and Peter McDonough during the year ended December 31, 2022. Bill Caple was appointed to serve as a member and chairperson of

the Compensation and Management Resources Committee in June 2023.

Under NYSE listing standards, we are required to

have at least two members of the compensation committee, all of whom must be independent directors. Our board of directors has determined

that each of Bill Caple, Candace Crawford and Peter McDonough are independent under NYSE listing standards. The Compensation and Management

Resources Committee is responsible for, among other things, (a) reviewing all compensation arrangements for the executive officers of

the Company and (b) administering the Company’s stock option plans. The Compensation and Management Resource Committee operates

under a written charter adopted by the Board of Directors, which can be found on our website at www.splashbeveragegroup.com.

The duties and responsibilities of the Compensation

and Management Resources Committee in accordance with its charter are to review and discuss with management and the Board the objectives,

philosophy, structure, cost and administration of the Company’s executive compensation and employee benefit policies and programs;

no less than annually, review and approve, with respect to the Chief Executive Officer and the other executive officers (a) all elements

of compensation, (b) incentive targets, (c) any employment agreements, severance agreements and change in control agreements or provisions,

in each case as, when and if appropriate, and (d) any special or supplemental benefits; make recommendations to the Board with respect

to the Company’s major long-term incentive plans applicable to directors, executives and/or non-executive employees of the Company

and approve (a) individual annual or periodic equity-based awards for the Chief Executive Officer and other executive officers and (b)

an annual pool of awards for other employees with guidelines for the administration and allocation of such awards; recommend to the Board

for its approval a succession plan for the Chief Executive Officer, addressing the policies and principles for selecting a successor

to the Chief Executive Officer, both in an emergency situation and in the ordinary course of business; review programs created and maintained

by management for the development and succession of other executive officers and any other individuals identified by management or the

Compensation and Management Resources Committee; review the establishment, amendment and termination of employee benefits plans, review

employee benefit plan operations and administration; and any other duties or responsibilities expressly delegated to the Compensation

and Management Resources Committee by the Board from time to time relating to the Committee’s purpose.

The Compensation and Management Resources Committee

may request any officer or employee of the Company or the Company’s outside counsel to attend a meeting of the Compensation and

Management Resources Committee or to meet with any members of, or consultants to, the Compensation and Management Resources Committee.

The Company’s Chief Executive Officer does not attend any portion of a meeting where the Chief Executive Officer’s performance

or compensation is discussed, unless specifically invited by the Compensation and Management Resources Committee.

The Compensation and Management Resources Committee

has the sole authority to retain and terminate any compensation consultant to be used to assist in the evaluation of director, Chief

Executive Officer or other executive officer compensation or employee benefit plans and has sole authority to approve the consultant’s

fees and other retention terms. The Compensation and Management Resources Committee also has the authority to obtain advice and assistance

from internal or external legal, accounting or other experts, advisors and consultants to assist in carrying out its duties and responsibilities

and has the authority to retain and approve the fees and other retention terms for any external experts, advisors or consultants.

During 2022, the Compensation Management Resources Committee held two meetings in person

or through conference calls.

Compensation

Committee Interlocks and Insider Participation

No

member of the compensation committee will be a current or former executive officer or employee of ours or any of our subsidiaries. None

of our executive officers serves as a member of the board of directors or compensation committee of any company that has one or more

of its executive officers serving as a member of our compensation committee.

DIRECTOR COMPENSATION

Directors Compensation

During the fiscal year ended December

31, 2022, our directors were paid compensation for serving as Directors of the Company.

| Name | |

Year | |

Compensation | |

Options/Warrants | |

Total |

| Candace Crawford | |

| 2022 | | |

| 75,000 | | |

| — | | |

| 75,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Peter McDonough | |

| 2022 | | |

| 69,996 | | |

| — | | |

| 69,996 | |

| | |

| | | |

| | | |

| | | |

| | |

| Justin Yorke | |

| 2022 | | |

| — | | |

| — | | |

| — | |

AUDIT COMMITTEE REPORT*

The Audit Committee of the Board of Directors (the “Audit Committee”)

was formed in June 2021. The Audit Committee for the fiscal year ended December 31, 2022 was composed of the following two directors:

Candace Crawford and Peter McDonough, each of whom is “independent” within the meaning of the applicable requirements set

forth in or promulgated under the Exchange Act and within the meaning of the New York Stock Exchange (“NYSE”) listing standards.

Management is responsible for the Company’s

financial statements, financial reporting process and systems of internal accounting and financial reporting control. The Company’s

independent auditor is responsible for performing an independent audit of the Company’s financial statements in accordance with

auditing standards generally accepted in the United States and for issuing a report thereon. The Audit Committee’s responsibility

is to oversee all aspects of the financial reporting process on behalf of the Board of Directors. The responsibilities of the Audit Committee

also include engaging and evaluating the performance of the accounting firm that serves as the Company’s independent auditor.

The Audit Committee discussed with the Company’s

independent auditor, with and without management present, such auditor’s judgments as to the quality, not just acceptability, of

the Company’s accounting principles, along with such additional matters required to be discussed under the Statement on Auditing

Standards No. 61, “Communication with Audit Committees.” The Audit Committee has discussed with the independent auditor,

the auditor’s independence from the Company and its management, including the written disclosures and the letter submitted to the

Audit Committee by the independent auditor as required by the Independent Standards Board Standard No. 1, “Independence Discussions

with Audit Committees.”

| * |

The information contained in this Audit Committee Report shall not be deemed to be “soliciting

material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of

Section 18 of the Securities Exchange Act of 1934, or the Exchange Act, except to the extent that the Company specifically requests

that the information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities

Act of 1933, as amended, or the Securities Act, or the Exchange Act. |

In reliance on such discussions with management and the independent auditor,

review of the representations of management and review of the report of the independent to the Audit Committee, the Audit Committee recommended

(and the Board approved) that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2022. The Audit Committee and the Board of Directors have also, respectively, recommended

and approved the selection of the Company’s current independent auditor.

Submitted by:

Audit Committee of the Board of Directors

/s/ Candace Crawford, Chairperson of the Audit Committee

/s/ Peter McDonough

DIRECTORS

AND EXECUTIVE OFFICERS

The following sets forth information about our

directors and executive officers as of September 11, 2023:

| Name |

|

Age |

|

Position |

| |

|

|

|

|

| Robert Nistico |

|

60 |

|

Chief Executive Officer and Director |

| |

|

|

|

|

| Ronald Wall |

|

56 |

|

Chief Financial Officer |

| |

|

|

|

|

| William Meissner |

|

57 |

|

President, Chief Marketing Officer |

| |

|

|

|

|

| Justin Yorke |

|

56 |

|

Director |

| |

|

|

|

|

| Peter McDonough |

|

64 |

|

Director |

| |

|

|

|

|

| Candace Crawford |

|

68 |

|

Director |

| |

|

|

|

|

| Bill Caple |

|

64 |

|

Director |

Directors are elected annually

and hold office until the next annual meeting of the stockholders of the Company and until their successors are elected. Officers are

elected annually by the Board of Directors (the “Board”) and serve at the discretion of the Board.

Robert

Nistico, In 2012, Mr. Nistico has served as the Chief Executive Officer and a member of the Board of Splash Beverage Group, Inc.,

prior to the Company’s acquisition by CMS. Mr. Nistico also served as the president of Viva Beverages, LLC from 2009 to 2011. Mr.

Nistico was the fifth employee at Red Bull North America, Inc. where he worked from 1996 to 2007 and served as Vice President of Field

Marketing and Sr. Vice President/General Manager. Mr. Nistico was instrumental in building the Red Bull brand in North and Central America

and the Caribbean from no revenues to $1.45 billion in annual revenues. Earlier, he held the brand position of Regional Portfolio V.P

and Division Manager for Diageo (formerly I.D.V. / Heublein), General Sales Manager for Republic National (formerly The Julius Schepps

Company) and North Texas State Manager for The E & J Gallo Winery (and a variety of other management positions for those companies).

Mr. Nistico serves as a director of Apollo Brands. Mr. Nistico has more than 27 years of experience in the beverage industry, including

direct and indirect sales management, strategic brand management & marketing, finance, operations, production and logistics. Mr.

Nistico holds a B.A. from the University of Colorado. The Company believes that Mr. Nistico’s extensive career in the beverage

industry brings value to the Board.

Ron

Wall, In April 2022 Mr. Wall joined the Company as the Chief Financial Officer. Mr Wall is a collaborative finance executive with

expertise leveraging analysis, insights and team approaches, driving organizational improvements, and implementing practices and controls.

From 2016 to 2022, Mr. Wall served as the Chief Financial Officer for Americas of William Grant & Sons Inc., a premium spirits company.

Previously, Mr. Wall served in various capacities at William Grant & Sons Inc., including Chief Financial Officer for North America,

and Chief Financial Officer for the United States of America.

William

Meissner, In May 2020 Mr Meissner became the President and Chief Marketing Officer of the Company. Mr. Meissner is a proven leader

with more than twenty years of success in growing consumer brand companies with both large multinational and medium sized entrepreneurial

organizations. Meissner has held several other leadership and board director roles. Prior to Splash Meissner was a board director and

CEO in a beverage vertical organized by a mid-cap PE firm designed to acquire and build emerging brands, where he acquired two legacy

tea brands from Nestle, Sweet Leaf Tea and Tradewinds Tea. Meissner served as CEO and Board Director or Genesis Today, Inc. a plant based

superfood and supplement company, CEO and Board Director of a joint venture between Distant Lands Coffee Inc. and Caffitaly Systems s.p.a

called Tazza Pronto Inc., CEO and Board Director of Jones Soda Inc., President of Talking Rain Beverages, Inc., Chief Marketing Officer

of Coca-Cola’s Fuze Beverages, Brand Director of PepsiCo’s SoBe Beverages and Category Manager of Nutritional Beverages for

Tetra Pak Inc. Meissner has an MBA from the University of Pittsburgh’s Katz Graduate School of Business and a Bachelor’s

degree from Michigan State University. Meissner is married with three children and enjoys mountain bike riding, golf and volunteering.

Justin

Yorke became a member of the Board of the Company on March 31, 2020. Since March 31, 2020, Mr. Yorke has also served as the Company’s

Secretary. Mr. Yorke has over 25 years of experience in finance. Based in Hong Kong for over 10 years, he managed funds for a private

Swiss Bank, Darier Henstch from 1997 to 2000. Prior to that, from 1995 to 1997, Mr. Yorke managed funds for Peregrine Investments and

from 1990 to 1995 Unifund, Asia, Ltd, Hong Kong, a high net-worth family office headquartered Geneva, Switzerland. From 2000 to 2004,

he was a partner at Asiatic Investment Management, based in San Francisco. Since 2004, Mr. Yorke has been a partner in San Gabriel Advisors,

LLC and Arroyo Capital Management, LLC and is the manager of the San Gabriel Fund, JMW Fund and Richland Fund. The funds are highly diversified

in focus with investment holdings, public, private equity and debt investments and real estate investments. He has a B.A. degree from

UCLA. Mr. Yorke is the principal of WesBev LLC, which prior to the merger between CMS and our Company was the majority shareholder of

the Company. He also is an acting director and audit committee chair of Processa Pharmaceuticals, (ticker: PCSA). Mr. Yorke served

as non-executive Chairman of Jed Oil and a Director/CEO at JMG Exploration. The Company believes that Mr. Yorke’s experience in

finance brings value to the Board.

Peter

J. McDonough, has served as an independent director of the Company since October 5, 2020 and previously served as a member of the

Board of Splash Beverage Group, Inc. prior to the Company’s acquisition by CMS. Mr. McDonough brings more than 30 years of executive

leadership experience from an array of global industry leading consumer goods companies. Most recently, Mr. McDonough was Chief Executive

Officer of Trait Biosciences, Inc. (2019-2022) after serving as an independent management consultant (2016-2018). Earlier, Mr. McDonough

served as President, Chief Marketing and Innovation Officer for Diageo North America (2006-2015). Prior to joining Diageo, Mr. McDonough

was Vice President, European Marketing at The Procter & Gamble Company (2004-2006), where he led the Duracell Battery and Braun Appliance

marketing organizations. From 2002 to 2004, Mr. McDonough was a member of the graduate business school faculty and lecturer at the University

of Canterbury in Christchurch, New Zealand. Prior to this academic post he served as Vice President of Marketing for Gillette North America’s

Blade Razor & Grooming Products Business where he directed the market launch of industry leading brands like Mach3 Turbo and Venus

Razors. Earlier in his career, Mr. McDonough served as Director of North American Marketing at Black & Decker where he was involved

in launching the DeWalt Power Tool Company. Mr. McDonough received a B.A. from Cornell University and a Master of Business Administration

from the Wharton School of Business. He is also an independent director on the Board of Franklin BSP Realty Trust (NYSE : FBRT). The

Company believes that Mr. McDonough’s executive leadership experience with global industry leading consumer goods companies brings

value to the Board.

Candace

Crawford, has served as an independent director of the Company since May 24, 2021. Ms. Crawford is a highly accomplished senior executive

and entrepreneur with more than 30 years of success across the food and beverage, consumer products, manufacturing, retail, and commercial

real estate industries. Her broad areas of expertise include strategic planning, growth and growing businesses, financial acumen, P&L,

operations, and governance. Since 2017, Ms. Crawford has served as an adviser and board member to various companies. Ms. Crawford has

sat on the board of Vive Organic since February 2019 and the board of Skin Te since June 2018. She served as the CEO of Coco Libre from

2015 to 2017. Under her management, she was able to expand distribution, grow product innovation and build awareness of the flagship

coconut water brand Coco Libre. Prior to this, she was the Chief Operating Officer and Chief Financial Officer at Zico Beverages LLC

from 2009 to 2013. Before making her debut in the beverage world, Candace was the Chief Financial Officer for five different companies

including Metropolitan Theaters; Virgin Entertainment Group; Resort Theaters of America; OMP; and Ancora Capital. Ms. Crawford holds

a Bachelor of Science in Business from the University of Southern California and is a Certified Public Accountant. The Company believes

that Ms. Crawford’s experience in food and beverage, consumer products, manufacturing, retail, and commercial real estate industries

brings value to the Board.

Bill

Caple, has served as an independent director of the Company since May 3, 2023. Over the past five years, Mr. Caple has primarily

served as a consultant on corporate strategies, business development, corporate finance, and M&A. Mr. Caple is currently a board

member of Covax Data, Inc. (“Covax”), which he also assists establishing sales channels and business development for

Covax's cyber security blockchain product and assisting the Company raise growth capital. Previously, Mr. Caple was a member of the

board of directors and executive chairman of SevenTen Software. In this role, Mr. Caple consulted on corporate strategies, business

development, corporate finance, and the sale of SevenTen Software, Inc. The Company believes that Mr. Caple is an asset to the

Company because of his wealth of experience and success in corporate finance strategies, M&A, and business development to round

out the Board’s top-tier level of expertise in key subjects.

EXECUTIVE

COMPENSATION

Summary

Compensation Table

The following table

sets forth information for our two most recently completed fiscal years ended December 31, 2021 and December 31, 2022, concerning all

of the compensation awarded to, earned by

the executive officers named below.

| Name | |

Year | |

Salary | |

Bonus | |

Other | |

Stock Awards | |

Options | |

Total |

| Robert Nistico | |

| 2022 | | |

| 325,000 | | |

| 100,000 | | |

| 14,400 | | |

| — | | |

| — | | |

| 439,000 | |

| Robert Nistico | |

| 2021 | | |

| 325,000 | | |

| 162,500 | | |

| 14,400 | | |

| — | | |

| 1,378,000 | | |

| 1,879,900 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| William Meissner | |

| 2022 | | |

| 325,000 | | |

| 90,000 | | |

| — | | |

| — | | |

| — | | |

| 415,000 | |

| William Meissner | |

| 2021 | | |

| 325,000 | | |

| 162,500 | | |

| — | | |

| — | | |

| 260,000 | | |

| 747,500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ronald Wall | |

| 2022 | | |

| 217,708 | | |

| 60,000 | | |

| 28,429 | | |

| — | | |

| 254,100 | | |

| 560,237 | |

| Dean Huge | |

| 2021 | | |

| 150,000 | | |

| 30,000 | | |

| — | | |

| 225,334 | | |

| — | | |

| 405,334 | |

Employment Agreements

Robert

Nistico, Chief Executive Officer

On

March 12, 2012, the Company entered into an employment agreement with Robert Nistico, pursuant to which Mr. Nistico serves

as Chief Executive Officer of the Company. Pursuant to Mr. Nistico’s employment agreement, the Company pays Mr. Nistico

an annual salary of $275,000. Mr. Nistico is also eligible to receive an annual bonus of 50% of his annual salary, and was

granted an option to purchase 350,000 shares of common stock. In the event Mr. Nistico terminates his employment with the

Company he shall provide the Company a minimum of 45 days of written notice.

On

December 9, 2019, the board of directors of the Company extended Mr. Nistico’s employment agreement beginning December 1, 2019,

and ending on November 30, 2024. Pursuant to the amendment, the Company increased Mr. Nistico’s base salary from $275,000

to $325,000.

William

Meissner, President and Chief Marketing Officer

On

May 4, 2020, the Company entered into an employment agreement with William Meissner, pursuant to which Mr. Meissner serves as President

and Chief Marketing Officer of Company. Pursuant to Mr. Meissner’s employment agreement, the Company pays Mr. Meissner an annual

base salary of $325,000 and includes annual increases based on cost of living adjustments and performance at the discretion of the Company’s

Chief Executive Officer. Mr. Meissner is also eligible for a discretionary bonus, as determined by the Company’s Chief Executive

Officer, of up to 50% of Mr. Meissner’s base salary. Mr. Meissner also received a grant of an option to purchase 666,667

shares of common stock under the Company’s equity incentive plan. The employment agreement with Mr. Meissner’s

does not have a fixed termination date and permits the Company to terminate Mr. Meissner upon twenty days prior written notice and

grants Mr. Meissner the right to resign upon twenty days prior written notice.

Ronald Wall, Chief Financial Officer

On April 18, 2022, the Company entered into

an employment agreement with Ronald Wall, pursuant to which Mr. Wall, serves as Chief Financial Officer of Company. Pursuant to

Mr. Wall’s employment agreement, the Company pays Mr. Wall an annual base salary of $325,000. Mr. Wall is also eligible

for a discretionary bonus, as determined by the Company’s Chief Executive Officer, of up to 50% of Mr. Wall’s base

salary. Mr. Wall also received a grant of options to purchase 333,000 shares of common stock under the Company’s equity

incentive plan. The employment agreement with Mr. Meissner’s does not have a fixed termination date.

Equity Compensation Plan Information

The following table gives information as of December

31, 2022, the end of the most recently completed fiscal year, about shares of common stock that have been issued under our Splash Beverage

Group, Inc. 2020 Incentive Plan. Under the 2020 Incentive Plan we have 1,151,000 options outstanding as of December 31, 2022.

| Plan

Category | |

No. of Shares to be Issued Upon Exercise

or Vesting of Outstanding Stock Options | |

Weighted Average Exercise Price of

Outstanding Stock Options | |

Number of Securities Remaining Available

for Future Issuance Under Equity Compensation Plans |

| Equity compensation plan approved by board

of directors | |

| 1,151,000 | | |

| 2.56 | | |

| 1,899,509 | |

| | |

| | | |

| | | |

| | |

| Total | |

| 1,151,000 | | |

| 2.56 | | |

| 1,899,509 | |

Outstanding Equity Awards at December 31, 2022

The following table summarizes the total outstanding equity awards as of December

31, 2022, for each Named Executive Officer:

| Name (1) | |

Grant

Date | |

Number of Securities Underlying Unexercised Options /

Warrants Exercisable | |

Option / Warrant Awards Number of Securities Underlying

Unexercised Options / Warrants Exercisable | |

Option

Exercise

Price | |

Option

Expiration

Date |

| Robert Nistico | |

2/28/2020 | |

| 159,008 | | |

| — | | |

| 2.19 | | |

2/27/2025 |

| Robert Nistico | |

10/16/2020 | |

| 1,000,000 | | |

| — | | |

| 2.25 | | |

10/15/2027 |

| Robert Nistico | |

9/16/2021 | |

| 530,000 | | |

| — | | |

| 2.60 | | |

9/15/2026 |

| William Meissner | |

10/16/2020 | |

| 416,667 | | |

| — | | |

| 2.25 | | |

10/15/2027 |

| William Meissner | |

9/16/2021 | |

| 66,666 | | |

| 33,334 | | |

| 2.60 | | |

9/15/2026 |

| Ron Wall | |

5/2/2022 | |

| 27,750 | | |

| 83,250 | | |

| 2.31 | | |

5/2/2032 |

| (1) | Unless

otherwise noted, the business address of each of the following individuals is 1314 East Las

Olas Blvd, Suite 221 Fort Lauderdale, Florida 33301 |

Pension Benefits

None of our employees participate in or have account

balances in qualified or non-qualified defined benefit plans sponsored by us. Our Compensation and Management Resources Committee may

elect to adopt qualified or non-qualified benefit plans in the future if it determines that doing so is in our Company’s best interests.

Potential Payments Under Severance/Change in Control

Arrangements

The table below sets forth potential payments payable

to our current executive officers in the event of a termination of employment under various circumstances. For purposes of calculating

the potential payments set forth in the table below, we have assumed that (i) the date of termination was December 31, 2022.

| Name | |

Termination of Employment Other Than for Cause or Resignation for Good Reason (Not in Connection with a Change of

Control)

($) | |

Termination Following a Change in Control without Cause or Executive Resigns with Good Reason

($) |

| Robert Nistico | |

| | | |

| | |

| Cash Payment | |

$ | 139,500 | | |

$ | — | |

| Acceleration of Options | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| Bill Meissner | |

| | | |

| | |

| Cash Payment | |

$ | 334,750 | | |

$ | — | |

| Acceleration of Options | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| Total Cash and Benefits | |

$ | 460,417 | | |

$ | — | |

For each of our executive officers, the term “change

of control” means:

| |

(i) |

the direct or indirect sale, transfer, conveyance or other disposition (other than by way of merger or

consolidation), in one or a series of related transactions, of all or substantially all of the properties or assets of the Company and

its subsidiaries, taken as a whole, to any “Person” (as that term is used in Section 13(d)(3) of the Exchange Act) that

is not an Affiliate; |

| |

(ii) |

the acquisition by any Person of “Beneficial Ownership” (within the meaning of Rule 13d-3

and Rule 13d-5 under the Exchange Act, except that in calculating the Beneficial Ownership of any particular Person, such Person

shall be deemed to have beneficial ownership of all securities that such Person has the right to acquire by conversion or exercise of

other securities, whether such right is currently exercisable or is exercisable only after the passage of time) of 50% or more (on a

fully diluted basis) of either (A) the then outstanding shares of Common Stock of the Company, taking into account as outstanding

for this purpose such Common Stock issuable upon the exercise of options or warrants, the conversion of convertible stock or debt, and

the exercise of any similar right to acquire such Common Stock (the “Outstanding Company Common Stock”) or (B) the combined

voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors (the “Outstanding

Company Voting Securities”); provided, however, that for purposes of the Plan, the following acquisitions shall not constitute

a Change of Control: (I) any acquisition by the Company or any Affiliate, (II) any acquisition by any employee benefit plan sponsored

or maintained by the Company or any Affiliate, (III) any acquisition which complies with clauses, (A), (B) and (C) of subsection

(v) of this definition, or (IV) in respect of an award held by a particular participant, any acquisition by the participant or any

group of persons including the participant (or any entity controlled by the participant or any group of persons including the participant);

or |

| |

(iii) |

the consummation of a reorganization, merger, consolidation, statutory share exchange or similar

form of corporate transaction involving the Company that requires the approval of the Company’s shareholders, whether for such

transaction or the issuance of securities in the transaction (a “Business Combination”), unless immediately following

such Business Combination: (A) more than 50% of the total voting power of (I) the entity resulting from such business combination

(the “Surviving Company”), or (II) if applicable, the ultimate parent entity that directly or indirectly has beneficial

ownership of sufficient voting securities eligible to elect a majority of the members of the Board of Directors (or the analogous

governing body) of the Surviving Company (the “Parent Company”), is represented by the outstanding company voting securities

that were outstanding immediately prior to such business combination (or, if applicable, is represented by shares into which the

outstanding company voting securities were converted pursuant to such business combination), and such voting power among the holders

thereof is in substantially the same proportion as the voting power of the outstanding company voting securities among the holders

thereof immediately prior to the business combination; (B) no Person (other than any employee benefit plan sponsored or maintained

by the Surviving Company or the Parent Company) is or becomes the beneficial owner, directly or indirectly, of 50% or more of the

total voting power of the outstanding voting securities eligible to elect members of the Board of Directors of the Parent Company

(or the analogous governing body) (or, if there is no Parent Company, the Surviving Company); and (C) at least a majority of

the members of the Board of Directors (or the analogous governing body) of the Parent Company (or, if there is no Parent Company,

the Surviving Company) following the consummation of the business combination were board members at the time of the Board of Directors’

approval of the execution of the initial agreement providing for such business combination |

The cash component (as opposed to option accelerations)

of any change of control payment would be structured as a one-time cash severance payment.

Pay

versus Performance Information

In accordance with rules adopted by the Securities and Exchange

Commission pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we provide the following disclosure

regarding executive compensation for our principal executive officer (“PEO”) and Non-PEO NEOs and Company performance

for the fiscal years listed below. The Compensation and Management Resources Committee did not consider the pay versus performance

disclosure below in making its pay decisions for any of the years shown. At the annual shareholder

meeting in 2023 the company is recommending that the compensation and management resource committee use Pay versus Performance

in establishing compensation

| Year |

Summary

Compensation Table Total for Robert Nistico¹ ($) |

Compensation

Actually Paid to Robert Nistico¹˒²˒³ ($) |

Average Summary Compensation Table Total for Non-PEO NEOs¹

($) |

Average Compensation Actually Paid to Non-PEO NEOs¹˒²˒³

($) |

Value

of Initial Fixed $100 Investment based on TSR4

($) |

Net

Income ($ Millions) |

| (a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

| 2022 |

439,000 |

636,481 |

487,619 |

460,778 |

17.71 |

(21.7) |

| 2021 |

1,879,900 |

2,081,081 |

576,417 |

608,132 |

21.51 |

(29.1) |

1. Robert Nistico was our PEO for each year presented. The individuals

comprising the Non-PEO NEOs for each year presented are listed below.

| 2021 |

2022 |

| William Meissner |

William Meissner |

| Dean Huge |

Ronald Wall |

2. The amounts shown for Compensation Actually Paid have been calculated

in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually earned, realized, or received by the Company’s

NEOs. These amounts reflect the Summary Compensation Table Total with certain adjustments as described in footnote 3 below.

3. Compensation Actually Paid reflects the exclusions and inclusions of

certain amounts for the PEO and the Non-PEO NEOs as set forth below. Equity values are calculated in accordance with FASB ASC Topic 718.

Amounts in the Exclusion of Stock Awards and Option Awards column are the totals from the Stock Awards and Option Awards columns set forth

in the Summary Compensation Table.

| Year |

Summary Compensation Table Total for Robert Nistico

($) |

Exclusion of Stock Awards and Option Awards for Robert Nistico

($) |

Inclusion of Equity Values for Robert Nistico

($) |

Compensation Actually Paid to Robert Nistico

($) |

| 2022 |

439,000 |

— |

297,482 |

636,481 |

| 2021 |

1,879,900 |

(1,378,000) |

1,579,181 |

2,081,081 |

| Year |

Average Summary Compensation Table Total for Non-PEO NEOs

($) |

Average Exclusion of Stock Awards and Option Awards for Non-PEO NEOs

($) |

Average Inclusion of Equity Values for Non-PEO NEOs

($) |

Average Compensation Actually Paid to Non-PEO NEOs

($) |

| 2022 |

487,619 |

(127,050) |

100,209 |

460,778 |

| 2021 |

576,417 |

(242,667) |

274,382 |

608,132 |

The amounts in the Inclusion of Equity Values in the tables above are derived

from the amounts set forth in the following tables:*

| Year |

Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Robert Nistico

($) |

Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Robert Nistico

($) |

Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for Robert Nistico

($) |

Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Robert Nistico

($) |

Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Robert Nistico

($) |

Value of Dividends or Other Earnings Paid on Equity Awards Not Otherwise Included for Robert Nistico

($) |

Total - Inclusion of

Equity Values for Robert Nistico

($) |

| 2022 |

— |

(31,803) |

— |

229,284 |

— |

— |

197,481 |

| 2021 |

403,248 |

294,031 |

422,476 |

459,426 |

— |

— |

1,579,181 |

| Year |

Average Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Non-PEO NEOs

($) |

Average Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Non-PEO NEOs

($) |

Average Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for Non-PEO NEOs

($) |

Average Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Non-PEO NEOs

($) |

Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO NEOs

($) |

Average Value of Dividends or Other Earnings Paid on Equity Awards Not Otherwise Included for Non-PEO NEOs

($) |

Total - Average Inclusion of

Equity Values for Non-PEO NEOs

($) |

| 2022 |

40,015 |

(3,001) |

32,050 |

31,145 |

— |

— |

100,209 |

| 2021 |

38,043 |

76,424 |

39,856 |

120,059 |

— |

— |

274,382 |

4. The calculation assumes $100 was invested for the period starting June 10, 2021, the day before our common stock began

trading on the New York Stock Exchange (NYSE) through the end of the listed fiscal year in the Company. Historical stock performance is

not necessarily indicative of future stock performance.

* The initial equity values for any awards granted prior to the reverse

merger that occurred on March 31, 2020 have been calculated from March 31, 2020.

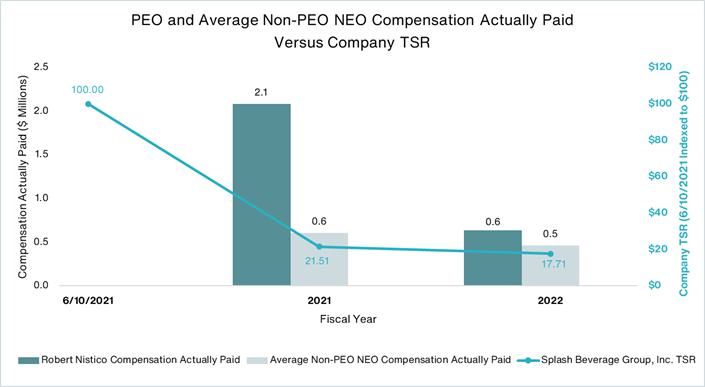

Description of Relationship Between PEO and Non-PEO NEO Compensation

Actually Paid and Company Total Shareholder Return (“TSR”)

The following chart sets forth the relationship between Compensation Actually

Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, and the Company’s cumulative TSR since June 10,

2021.

Description of Relationship Between

PEO and Non-PEO NEO Compensation Actually Paid and Net Income

The following chart sets forth the relationship between Compensation Actually

Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, and our Net Income during the two most recently completed

fiscal years.

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information with respect to the beneficial

ownership of our common stock as of September 11, 2023, for:

| ● |

each of our current directors and executive officers; |

| |

|

| ● |

all of our current directors and executive officers as a group; and |

| |

|

| ● |

each person, or group of affiliated persons, who beneficially owned more than 5% of our common stock. |

Except as indicated by

the footnotes below, we believe, based on information furnished to us, that the persons and entities named in the table below have sole

voting and sole investment power with respect to all shares of common stock that they beneficially, subject to applicable community property

laws. Unless otherwise specified, the address for each of the persons named in the table is 1314 E Las Olas Blvd. Suite 221, Fort Lauderdale,

Florida 33301.

Our calculation of the percentage

of beneficial ownership prior to this offering is based on 42,810,518 shares of common stock outstanding as of September 11, 2023. We have

determined beneficial ownership in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial

ownership for any other purpose. Under Rule 13d-3 of the Exchange Act of 1934, as amended (the “Exchange Act”), a beneficial

owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship or

otherwise has or shares: (i) voting power, which includes the power to vote or to direct the voting of shares; and (ii) investment power,

which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more

than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed

to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within

60 days of the date as of which the information is provided. In computing the percentage ownership of any person or persons, the amount

of shares outstanding is deemed to include the amount of shares beneficially owned by such person or persons (and only such person or

persons) by reason of these acquisition rights.

| Name | |

Shares of Common

Stock | |

Percentage of

Common Stock |

| Executive Officers and Directors | |

| | | |

| | |

| Robert Nistico | |

| 1,386,000 | | |

| 3.2 | % |

| | |

| | | |

| | |

| Justin Yorke(1) | |

| 5,486,109 | | |

| 12.8 | % |

| | |

| | | |

| | |

| Peter McDonough | |

| 22,716 | | |

| 0.1 | % |

| | |

| | | |

| | |

| Candace Crawford | |

| — | | |

| — | |

| | |

| | | |

| | |

| William Meissner | |

| — | | |

| — | |

| | |

| | | |

| | |

| Ronald Wall | |

| — | | |

| — | |

| | |

| | | |

| | |

| Officers and Directors as a Group (6 individuals) | |

| 6,894,825 | | |

| 16.1 | % |

| 5% or greater owners: | |

| | | |

| | |

| | |

| | | |

| | |

| Total | |

| 6,894,824 | | |

| 16.1 | % |

| |

(1) |

Of which 3,297,243 shares are held by Richland Fund LLC, 1,398,012 shares are held by JMW Fund

LLC and 790,854 shares are held by San Gabriel LLC. All funds are managed by Mr. Yorke. |

CERTAIN RELATIONSHIPS

AND RELATED TRANSACTIONS

The following is a description

of the transactions and series of similar transactions, since December 31, 2022, that we were a participant or will be a participant

in, which:

| ● |

the amount involved exceeds the lesser of $120,000 or one percent of the average of the smaller reporting

company’s total assets at year-end for the last two completed fiscal years; and |

| ● |

any of our directors, executive officers, holders of more than 5% of our capital stock (which we

refer to as “5% stockholders”) or any member of their immediate family had or will have a direct or indirect material

interest, other than compensation arrangements with directors and executive officers. |

PRINCIPAL

ACCOUNTING FEES AND SERVICES

December 31, 2022

| Audit | |

$ | 193,000 | |

| Audit related | |

| — | |

| Tax | |

| 19,725 | |

| Total | |

$ | 212,725 | |

December 31, 2021

| Audit | |

$ | 182,430 | |

| Audit related | |

| — | |

| Tax | |

| 3,200 | |

| Total | |

$ | 185,630 | |

PROPOSAL 1

ELECTION OF DIRECTORS

Pursuant to our bylaws, the authorized number of members of the Board of Directors allows up to six

directors.

Currently, we have five directors. Our Board of Directors recommends that Robert Nistico, Justin Yorke, Peter McDonough, Candace

Crawford, and Bill Caple be elected as members of the Board of Directors at the annual meeting. There are no family relationships

between any of the executive officers and directors.

Pursuant to our bylaws, our Directors hold office

until the next succeeding annual meeting of shareholders and until their successors shall have been elected and shall qualify. Any Director

or Directors of the corporation may be removed at any time, with or without cause, in the manner provided in Nevada Revised Statutes.

A Director may resign at any time by giving written notice to the Board of Directors, President or Secretary of the corporation. The

resignation shall take effect upon the date of receipt of such notice, or at any later period of time specified therein. The acceptance

of such resignation shall not be necessary to make it effective, unless the resignation requires it to be effective as such.

Vote Required

Directors are elected by a majority of the issued

and outstanding shares entitled to vote on the proposal. Broker non-votes will not affect the outcome of the election of directors because

brokers do not have discretion to cast votes on this proposal without instruction from the beneficial owner of the shares.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

ELECTION OF

THE DIRECTOR NOMINEES.

PROPOSAL

2

approval

of AN AMENDMENT TO THE SPLASH BEVERAGE GROUP, INC. 2020 LONG-TERM

INCENTIVE

PLAN

General

On August 24, our board adopted an amendment (the “Amendment”) to the Splash Beverage Group, Inc.

2020 Long-Term Incentive Plan (the “Plan”), which makes the following material changes to the Plan: (1) increase the

aggregate number of shares of common stock available under the Plan by 1,500,000 shares to a total of 1,807,415 shares and (2)

increases the automatic annual increase in the number of shares under the Plan from 5% to 7.5% of the total number of shares of

common stock outstanding as of December 31st of the preceding fiscal year.

Within this Proposal No. 2, we refer to the Plan, as amended by the Amendment,

as the “Amended Plan.”

Reasons for the Amended Plan

The Company views its use of stock-based awards as an essential part of

the Company’s compensation program and as an important element in achieving the program’s goals of attracting and retaining

key employees and directors, providing them with additional incentive to increase the long-term value of the Company, and linking their

financial interests with those of the Company’s stockholders. The Company also believes that stock-based awards motivate employees

and non-employee directors to create stockholder value because the value they realize from these awards is based in large part on the

Company’s common stock price performance.

The Company also uses stock-based awards to compensate certain consultants

to the business and the Company believes this is an important element in aligning these consultants and service providers to the goals

of the Company. It motivates the consultants and service providers to give a maximum effort to share in the returns for their services.

The increase in the number of the shares available and annual

increase in shares under the Plan is to ensure that we have the continued ability to make awards under the Plan. We expect

that the requested increase in the number of shares would likely be sufficient to provide Plan awards for at

least an additional year, at which time the Company would seek stockholder approval for the award of any additional shares