false

0001420520

0001420520

2024-07-30

2024-07-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of the

Securities Exchange Act of 1934

Date of report (Date

of earliest event reported): July 30,

2024

ATOMERA

INCORPORATED

(Exact Name of Registrant

as Specified in Its Charter)

| Delaware |

001-37850 |

30-0509586 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

750 University Avenue,

Suite 280

Los Gatos, California

95032

(Address of principal executive

offices)

(408) 442-5248

(Registrant’s telephone

number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock: Par value $0.001 |

|

ATOM |

|

Nasdaq

Capital Markets |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On July 30, 2024, Atomera Incorporated issued

a press release announcing its financial results for the three and six months ended June 30, 2024. The Company also intends to conduct

an earnings call over which it will distribute an investor presentation. The text of the press release is attached hereto as Exhibit 99.1

and the investor presentation is attached hereto as Exhibit 99.2, both are incorporated by reference herein.

The information in this Current Report, including

the exhibits attached hereto, is furnished pursuant to Item 2.02 and shall not be deemed “filed” for any purpose, including

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into

any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act regardless of any general

incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

The following exhibits are filed with this report:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

ATOMERA INCORPORATED |

|

| |

|

|

| |

|

|

| Dated: July 30, 2024 |

/s/ Francis B. Laurencio |

|

| |

Francis B. Laurencio,

Chief Financial Officer |

|

Exhibit 99.1

Atomera Provides

Second Quarter 2024 Results

LOS GATOS, Calif. July 30, 2024

Atomera Incorporated (NASDAQ: ATOM), a semiconductor materials and technology licensing company, today

provided a corporate update and announced financial results for the second quarter ended June 30, 2024.

Recent Company Highlights

| · | Announced the availability of an MST® RFSOI wafer substrates

solution for leading-edge cellular communication products |

| · | Added a new VP of Marketing and Business Development, Shawn Thomas |

| · | Submitted first proposal under the Chips and Sciences Act |

Management Commentary

“Atomera continues to make good progress in technology development

and commercial proposals across our targeted market segments, and with our lead customer on the path to production,” said Scott

Bibaud, President and CEO. “With the recent addition of our strong new leadership in business development, we expect to convert

these opportunities and others into license revenue for the company.”

Financial Results

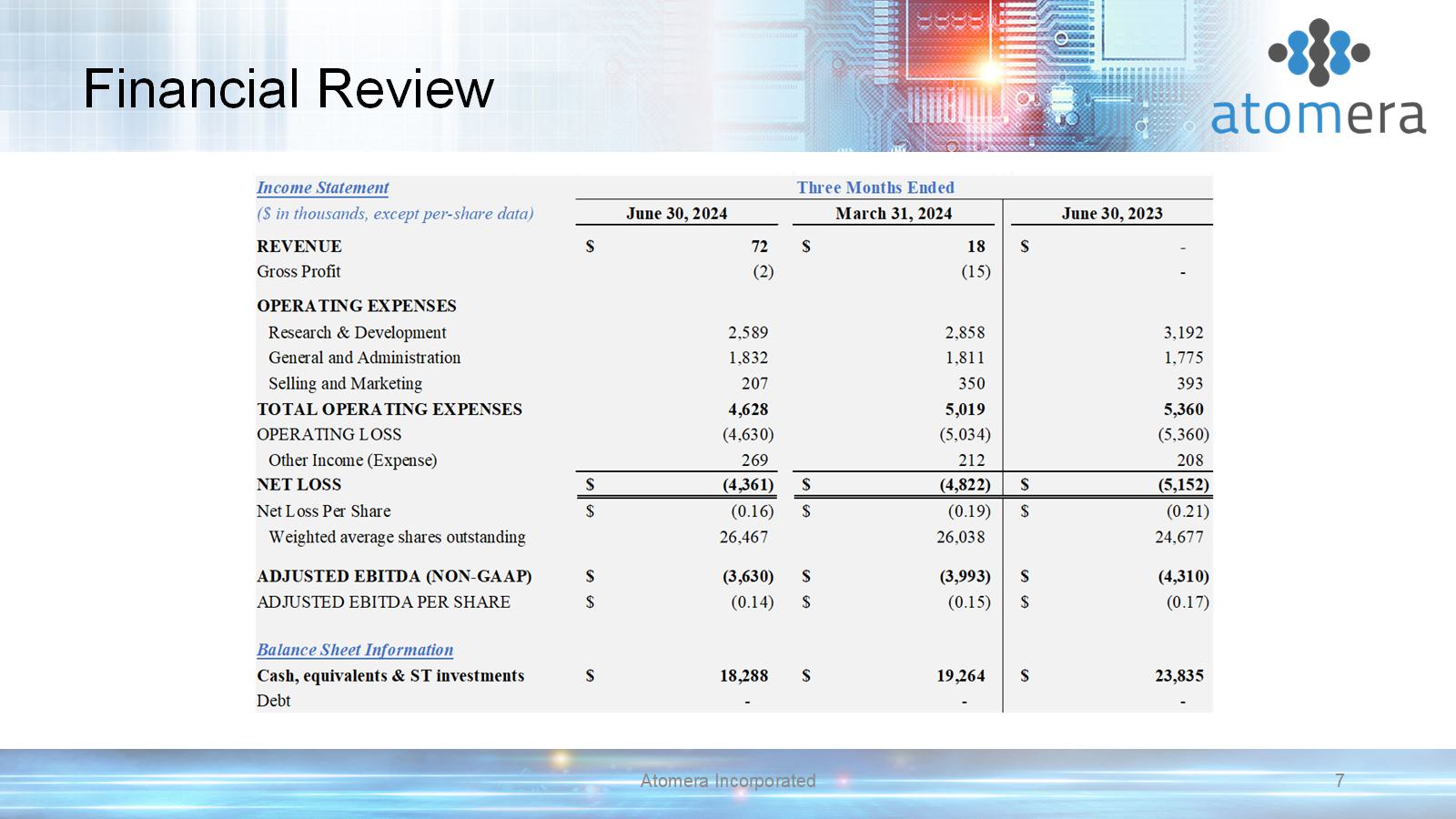

The Company incurred a net loss of ($4.4) million, or ($0.16) per basic

and diluted share in the second quarter of 2024, compared to a net loss of ($5.2) million, or ($0.21) per basic and diluted share, for

the second quarter of 2023. Adjusted EBITDA (a non-GAAP financial measure) in the second quarter of 2024 was a loss of ($3.6) million

compared to an adjusted EBITDA loss of ($4.3) million in the second quarter of 2023.

The Company had $18.3 million in cash, cash equivalents and short-term

investments as of June 30, 2024, compared to $19.5 million as of December 31, 2023.

The total number of shares outstanding was 27.6 million as of June

30, 2024.

Second Quarter 2024 Results Webinar

Atomera will host a live video webinar today to discuss its financial

results and recent progress.

Date: Tuesday, July 30, 2024

Time: 2:00 p.m. PT (5:00 p.m. ET)

Webcast: Accessible at https://ir.atomera.com

Note about Non-GAAP Financial Measures

In addition to the unaudited results presented in accordance with generally

accepted accounting principles, or GAAP, in this press release, Atomera presents adjusted EBITDA, which is a non-GAAP financial measure.

Adjusted EBITDA is determined by taking net loss and eliminating the impacts of interest, depreciation, amortization and stock-based compensation.

Our definition of adjusted EBITDA may not be comparable to the definitions of similarly-titled measures used by other companies. We believe

that this non-GAAP financial measure, viewed in addition to and not in lieu of our reported GAAP results, provides useful information

to investors by providing a more focused measure of operating results. This metric is used as part of the Company's internal reporting

to evaluate its operations and the performance of senior management. A table reconciling this measure to the comparable GAAP measure is

available in the accompanying financial tables below.

About Atomera Incorporated

Atomera Incorporated is a semiconductor materials and technology licensing

company focused on deploying its proprietary, silicon-proven technology into the semiconductor industry. Atomera has developed Mears Silicon

Technology™ (MST®), which increases performance and power efficiency in semiconductor transistors. MST can be implemented

using equipment already deployed in semiconductor manufacturing facilities and is complementary to other nano-scaling technologies already

in the semiconductor industry roadmap. More information can be found at www.atomera.com.

Safe Harbor

This press release contains forward-looking statements concerning Atomera

Incorporated, including statements regarding the prospects for the semiconductor industry generally and the ability of our MST technology

to significantly improve semiconductor performance. Those forward-looking statements involve known and unknown risks, uncertainties and

other factors that could cause actual results to differ materially. Among those factors are: (1) the fact that, to date, we have only

recognized minimal engineering services and licensing revenues and we have not yet commenced principal revenue producing operations, thus

subjecting us to all of the risks inherent in an early-stage enterprise; (2) the risk that STMicroelectronics does not proceed with

qualification of MST in its manufacturing process or does not take MST-enabled products to market, (3) risks related to our ability to

successfully complete the milestones in our joint development agreements or, even if successfully completed, to reach a commercial distribution

license with our JDA customers; (4) risks related to our ability to advance licensing arrangements with our integration licensees to royalty-based

manufacturing and distribution licenses or our ability to add other licensees; (5) risks related to our ability to raise sufficient capital,

as and when needed, to pursue the further development, licensing and commercialization of our MST technology; (6) our ability to

protect our proprietary technology, trade secrets and know-how and (7) those other risks disclosed in the section "Risk Factors"

included in our Annual Report on Form 10-K filed with the SEC on February 15, 2024. We caution readers not to place undue reliance on

any forward-looking statements. We do not undertake, and specifically disclaim any obligation, to update or revise such statements to

reflect new circumstances or unanticipated events as they occur.

-- Financial Tables Follow –

Atomera Incorporated

Condensed Balance Sheets

(in thousands, except per share data)

| | |

| |

| |

|

| | |

June 30, | |

March 31, | |

December 31, |

| | |

2024 | |

2024 | |

2023 |

| | |

| (Unaudited) | | |

| (Unaudited) | | |

| | |

| ASSETS | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 14,484 | | |

$ | 14,806 | | |

$ | 12,591 | |

| Short-term investments | |

| 3,804 | | |

| 4,458 | | |

| 6,940 | |

| Accounts receivable | |

| 6 | | |

| – | | |

| – | |

| Unbilled contracts receivable | |

| – | | |

| – | | |

| 550 | |

| Interest receivable | |

| 74 | | |

| 73 | | |

| 79 | |

| Prepaid expenses and other current assets | |

| 578 | | |

| 328 | | |

| 244 | |

| Total current assets | |

| 18,946 | | |

| 19,665 | | |

| 20,404 | |

| | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 75 | | |

| 83 | | |

| 100 | |

| Long-term prepaid maintenance and supplies | |

| 91 | | |

| 91 | | |

| 91 | |

| Security deposit | |

| 14 | | |

| 14 | | |

| 14 | |

| Operating lease right-of-use asset | |

| 401 | | |

| 459 | | |

| 517 | |

| Financing lease right-of-use-asset | |

| 2,341 | | |

| 2,622 | | |

| 2,903 | |

| Total assets | |

$ | 21,868 | | |

$ | 22,934 | | |

$ | 24,029 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Accounts payable | |

$ | 646 | | |

$ | 601 | | |

$ | 618 | |

| Accrued expenses | |

| 249 | | |

| 210 | | |

| 222 | |

| Accrued payroll related expenses | |

| 594 | | |

| 454 | | |

| 1,382 | |

| Current operating lease liability | |

| 256 | | |

| 263 | | |

| 264 | |

| Current financing lease liability | |

| 1,386 | | |

| 1,357 | | |

| 1,328 | |

| Deferred revenue | |

| 13 | | |

| 17 | | |

| – | |

| Total current liabilities | |

| 3,144 | | |

| 2,902 | | |

| 3,814 | |

| | |

| | | |

| | | |

| | |

| Long-term operating lease liability | |

| 137 | | |

| 194 | | |

| 295 | |

| Long-term financing lease liability | |

| 1,108 | | |

| 1,431 | | |

| 1,750 | |

| Total liabilities | |

| 4,389 | | |

| 4,527 | | |

| 5,859 | |

| | |

| | | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | | |

| | |

| Preferred stock $0.001 par value, authorized 2,500 shares; none issued and outstanding as of June 30, 2024, March 31, 2024 and December 31, 2023 | |

| – | | |

| – | | |

| – | |

| Common stock: $0.001 par value, authorized 47,500 shares; 27,622 shares issued and 27,610 outstanding as of June 30, 2024; 26,905 shares issued and 26,885 outstanding as of March 31, 2024; and 26,107 shares issued and outstanding as of December 31, 2023 | |

| 28 | | |

| 27 | | |

| 26 | |

| Additional paid-in capital | |

| 229,726 | | |

| 226,288 | | |

| 221,229 | |

| Other comprehensive income(loss) | |

| (7 | ) | |

| (1 | ) | |

| – | |

| Accumulated deficit | |

| (212,268 | ) | |

| (207,907 | ) | |

| (203,085 | ) |

| Total stockholders’ equity | |

| 17,479 | | |

| 18,407 | | |

| 18,170 | |

| Total liabilities and stockholders’ equity | |

$ | 21,868 | | |

$ | 22,934 | | |

$ | 24,029 | |

Atomera Incorporated

Condensed Statements of Operations

(Unaudited)

(in thousands, except per share data)

| | |

| |

| |

| |

|

| | |

Three Months Ended | |

Six Months Ended |

| | |

June 30, | |

March 31, | |

June 30, | |

June 30, |

| | |

2024 | |

2024 | |

2023 | |

2024 | |

2023 |

| Revenue | |

$ | 72 | | |

$ | 18 | | |

$ | – | | |

$ | 90 | | |

$ | – | |

| Cost of revenue | |

| (74 | ) | |

| (33 | ) | |

| – | | |

| (107 | ) | |

| – | |

| Gross margin | |

| (2 | ) | |

| (15 | ) | |

| – | | |

| (17 | ) | |

| – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,589 | | |

| 2,858 | | |

| 3,192 | | |

| 5,447 | | |

| 6,228 | |

| General and administrative | |

| 1,832 | | |

| 1,811 | | |

| 1,775 | | |

| 3,643 | | |

| 3,517 | |

| Selling and marketing | |

| 207 | | |

| 350 | | |

| 393 | | |

| 557 | | |

| 782 | |

| Total operating expenses | |

| 4,628 | | |

| 5,019 | | |

| 5,360 | | |

| 9,647 | | |

| 10,527 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (4,630 | ) | |

| (5,034 | ) | |

| (5,360 | ) | |

| (9,664 | ) | |

| (10,527 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 185 | | |

| 205 | | |

| 152 | | |

| 390 | | |

| 351 | |

| Accretion income | |

| 47 | | |

| 46 | | |

| 107 | | |

| 93 | | |

| 109 | |

| Interest expense | |

| (35 | ) | |

| (39 | ) | |

| (51 | ) | |

| (74 | ) | |

| (104 | ) |

| Other income, net | |

| 72 | | |

| – | | |

| – | | |

| 72 | | |

| – | |

| Total other income (expense), net | |

| 269 | | |

| 212 | | |

| 208 | | |

| 481 | | |

| 356 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (4,361 | ) | |

$ | (4,822 | ) | |

$ | (5,152 | ) | |

$ | (9,183 | ) | |

$ | (10,171 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share, basic and diluted | |

$ | (0.16 | ) | |

$ | (0.19 | ) | |

$ | (0.21 | ) | |

$ | (0.35 | ) | |

$ | (0.42 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding, basic and diluted | |

| 26,467 | | |

| 26,038 | | |

| 24,677 | | |

| 26,253 | | |

| 24,171 | |

Atomera Incorporated

Reconciliation to Non-GAAP EBITDA

(Unaudited)

| | |

| |

| |

| |

|

| | |

Three Months Ended | |

Six Months Ended |

| | |

June 30, | |

March 31, | |

June 30, | |

June 30, |

| | |

2024 | |

2024 | |

2023 | |

2024 | |

2023 |

| Net loss (GAAP) | |

$ | (4,361 | ) | |

$ | (4,822 | ) | |

$ | (5,152 | ) | |

$ | (9,183 | ) | |

$ | (10,171 | ) |

| Depreciation and amortization | |

| 13 | | |

| 17 | | |

| 20 | | |

| 30 | | |

| 40 | |

| Stock-based compensation | |

| 987 | | |

| 1,024 | | |

| 1,030 | | |

| 2,011 | | |

| 1,957 | |

| Interest income | |

| (185 | ) | |

| (205 | ) | |

| (152 | ) | |

| (390 | ) | |

| (351 | ) |

| Accretion income | |

| (47 | ) | |

| (46 | ) | |

| (107 | ) | |

| (93 | ) | |

| (109 | ) |

| Interest expense | |

| 35 | | |

| 39 | | |

| 51 | | |

| 74 | | |

| 104 | |

| Other income, net | |

| (72 | ) | |

| – | | |

| – | | |

| (72 | ) | |

| – | |

| Net loss non-GAAP EBITDA | |

$ | (3,630 | ) | |

$ | (3,993 | ) | |

$ | (4,310 | ) | |

$ | (7,623 | ) | |

$ | (8,530 | ) |

Investor Contact:

Bishop IR

Mike Bishop

(415) 894-9633

investor@atomera.com

Exhibit 99.2

Q2 2024 Conference Call July 30, 2024 Atomera Incorporated 1

Safe Harbor This presentation contains forward - looking statements concerning Atomera Incorporated (““Atomera,” the “Company,” “we,” “us,” and “our”). The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “woul d,” “project,” “plan,” “expect” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forwar d - looking statements. These forward - looking statements are subject to a number of risks, uncertainties and assumptions, including those disclosed in the section "Risk Factors" included in our Annual Report on Form 10 - K filed with the SEC on February 15, 2024 (the “Annual Report ”). In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in our forward - looking statements. You should not rely upon forward - looking statements as predictions of future events. Although we believe that the expectations reflected in our forward - looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward - looking statements will be achieved or occur. This presentation contains only basic information concerning Atomera. The Company’s filings with the Securities Exchange Commission, including the Annual Report, include more information about factors that could affect the Company’s operating and financial results. We assume no obligation to update information contained in this presentation. Although this presentation m ay remain available on the Company's website or elsewhere, its continued availability does not indicate that we are reaffirming or confirming any of the information contained herein. Atomera Incorporated 2

3 Strong, Growing and Defensible Patent Portfolio High Leverage IP Licensing Business Model Top Tier Management Team Transistor enhancement technology for the $550B semiconductor market Mears Silicon Technology (MST®) Quantum Engineered Materials

MST technology focus areas Atomera 4 MST for Advanced Nodes MST for RF - SOI MST for Power SP, SPX MST for DRAM

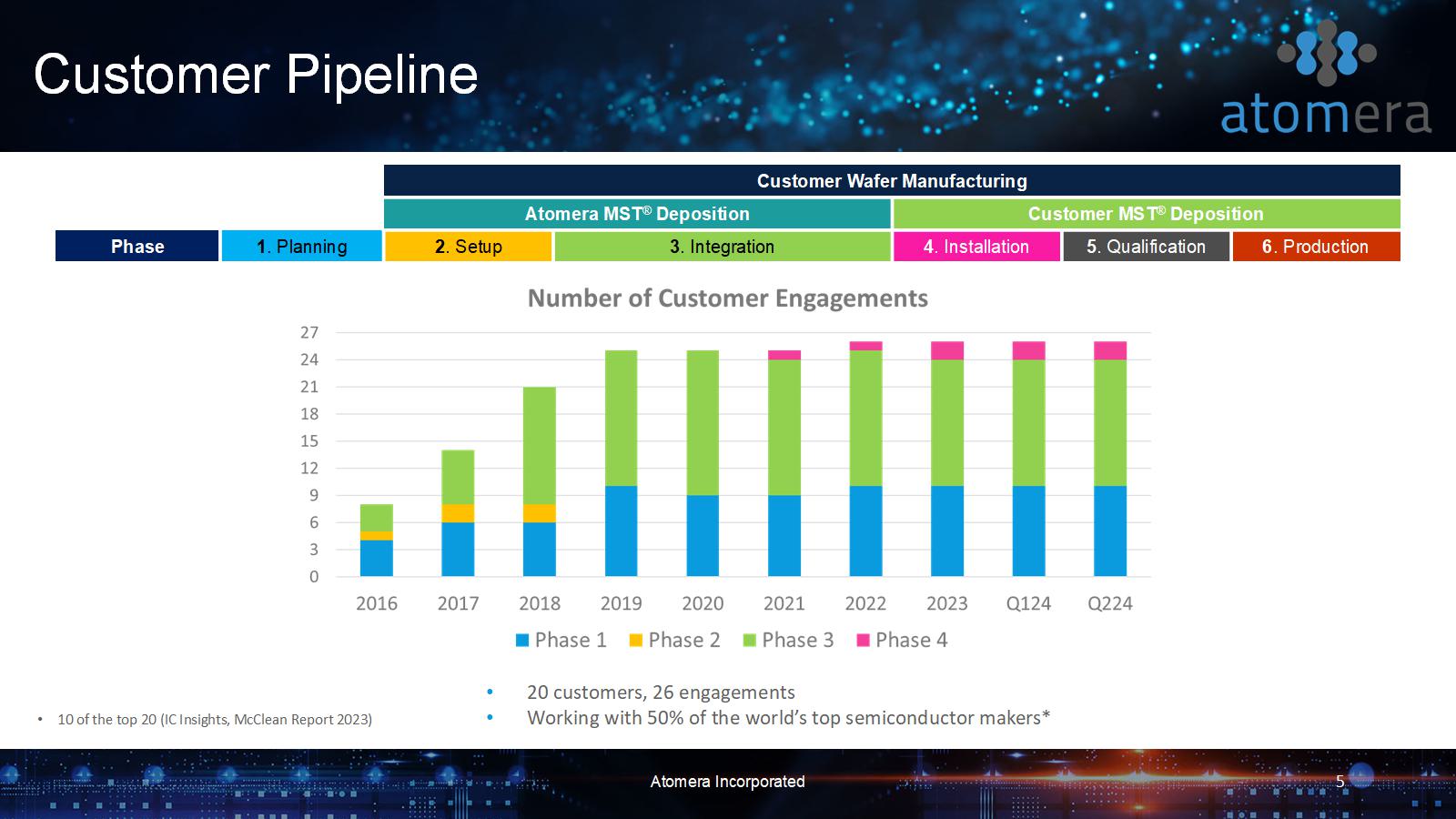

Customer Pipeline 5 • 20 customers, 26 engagements • Working with 50% of the world’s top semiconductor makers* • 10 of the top 20 (IC Insights, McClean Report 2023) Atomera Incorporated Customer Wafer Manufacturing v Customer MST ® Deposition Atomera MST ® Deposition 6 . Production 5 . Qualification 4 . Installation 3 . Integration 2 . Setup 1 . Planning Phase

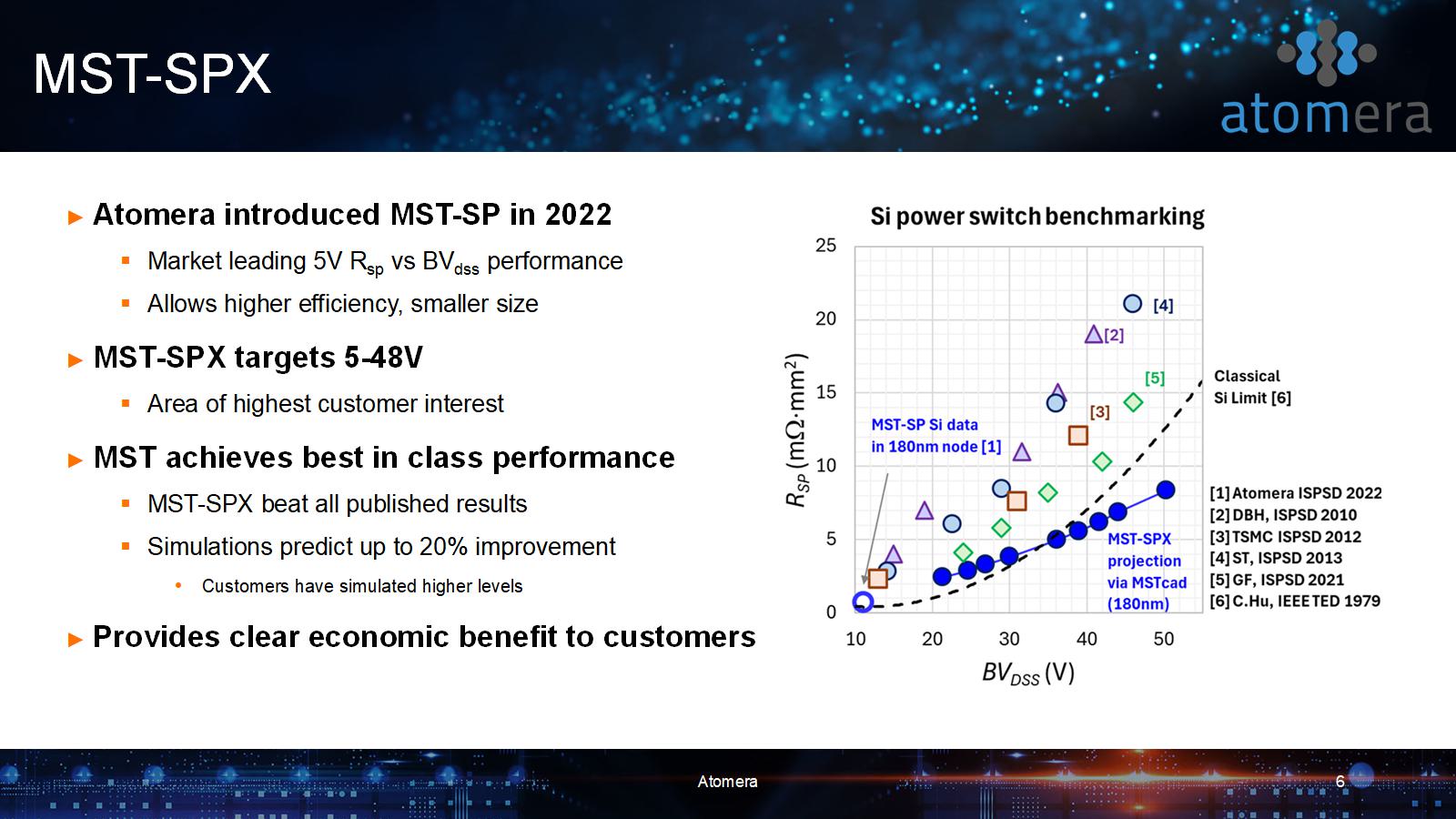

MST - SPX ► Atomera introduced MST - SP in 2022 ▪ Market leading 5V R sp vs BV dss performance ▪ Allows higher efficiency, smaller size ► MST - SPX targets 5 - 48V ▪ Area of highest customer interest ► MST achieves best in class performance ▪ MST - SPX beat all published results ▪ Simulations predict up to 20% improvement • Customers have simulated higher levels ► Provides clear economic benefit to customers Atomera 6

Financial Review Atomera Incorporated 7

We collaborate with customers to improve their products, through integration of MST, so that both companies benefit financially Mission Statement Atomera Incorporated 8

Thank You Atomera Incorporated 9

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Atomera (NASDAQ:ATOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Atomera (NASDAQ:ATOM)

Historical Stock Chart

From Jul 2023 to Jul 2024