F I R S T Q U A R T E R 2 0 2 4 S H A R E H O L D E R L E T T E R M A Y 8 , 2 0 2 4 Exhibit 99.1

2 1Q 2 4 S H A R E H O L D E R L E T T E R A letter to shareholders We are off to a strong start in 2024, driving purposefully toward our planned Com- mercial Launch at the end of the year and the subsequent scaling of our business. Commitment to our mission remains steadfast within Aurora, fueling some of the highest levels of employee engagement we have seen as a public company. It’s this enthusiasm that drove our continued progress in the first quarter, including improv- ing the Aurora Driver’s autonomy performance, advancing our launch lane Safety Case, and continuing to execute with financial discipline. In March, we hosted an Analyst & Investor Day, where we demonstrated the maturity of our ecosystem, depth of our partnerships, and customer enthusiasm, which under- pin our expectations that our business model will drive rapid, capital efficient revenue growth, high gross margins, and most importantly support a self-sustaining company. We also gave attendees rides in Aurora Driver-powered driverless trucks at our test track in Pittsburgh and a first-look at how these trucks navigated advanced road scenarios, including handling interactions with aggressive drivers, avoiding danger- ous debris, responding to pedestrians who unexpectedly entered the path of the vehicle, and navigating tire blowouts.

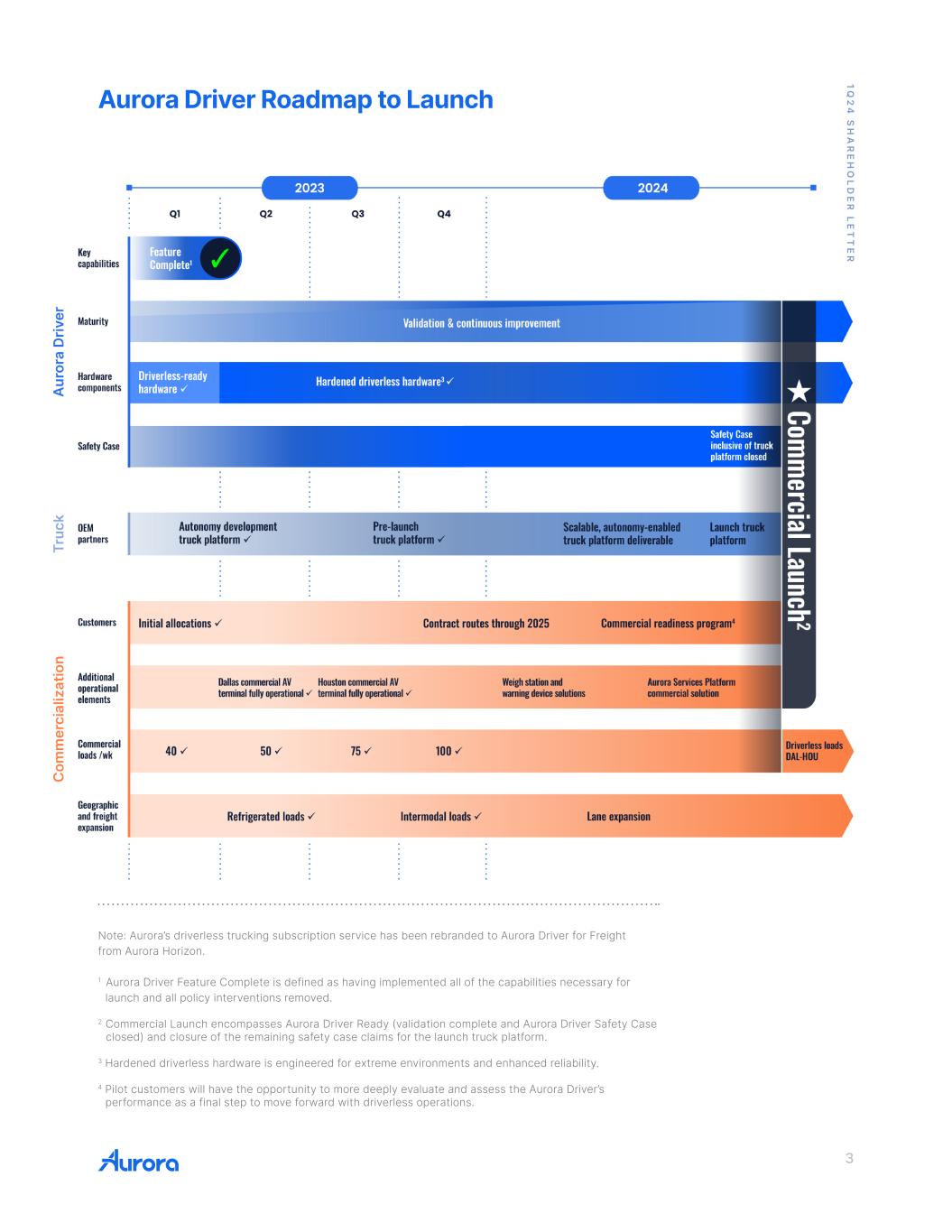

3 1Q 2 4 S H A R E H O L D E R L E T T E R Aurora Driver Roadmap to Launch 1Q 2 4 S H A R E H O L D E R L E T T E R Note: Aurora’s driverless trucking subscription service has been rebranded to Aurora Driver for Freight from Aurora Horizon. 1 Aurora Driver Feature Complete is defined as having implemented all of the capabilities necessary for launch and all policy interventions removed. 2 Commercial Launch encompasses Aurora Driver Ready (validation complete and Aurora Driver Safety Case closed) and closure of the remaining safety case claims for the launch truck platform. 3 Hardened driverless hardware is engineered for extreme environments and enhanced reliability. 4 Pilot customers will have the opportunity to more deeply evaluate and assess the Aurora Driver’s performance as a final step to move forward with driverless operations.

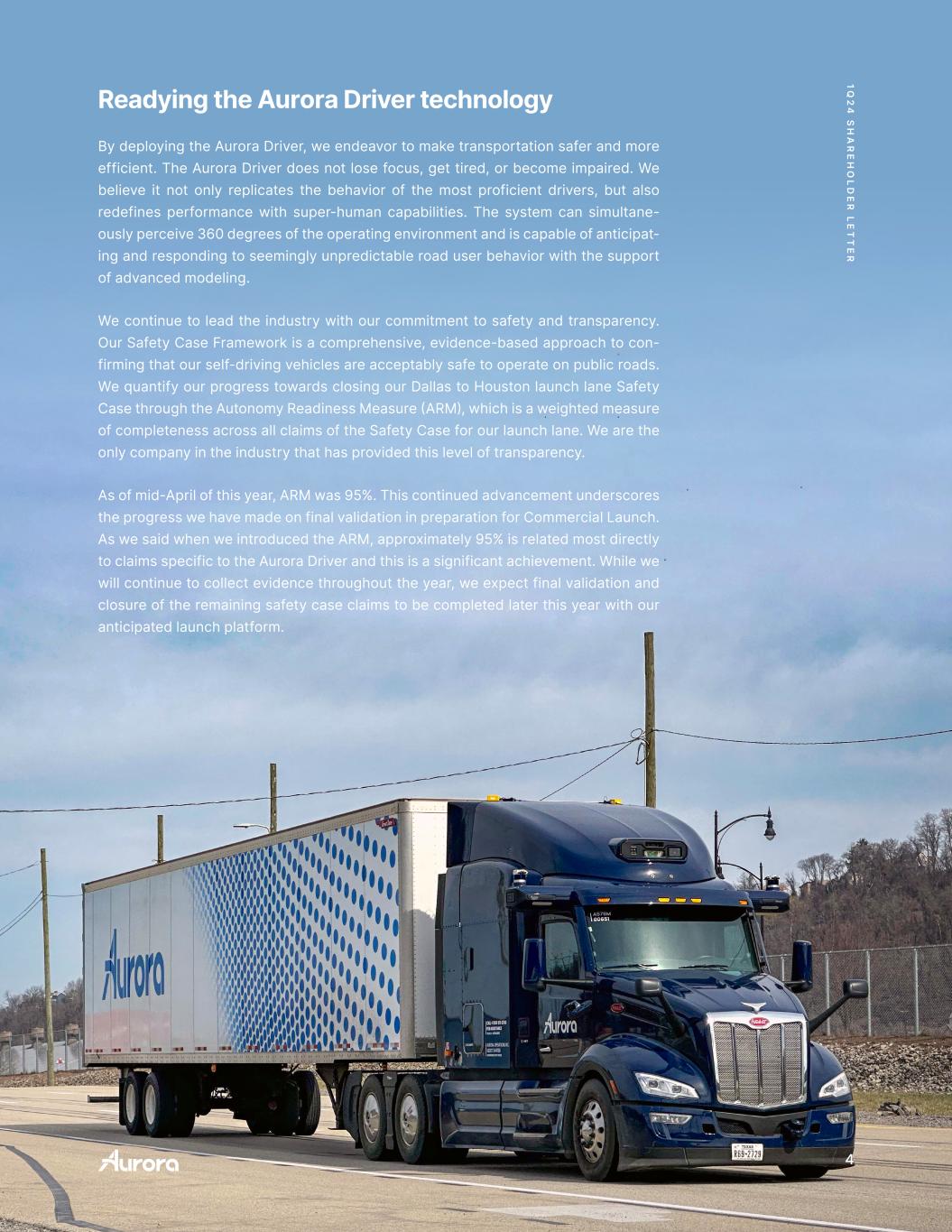

4 1Q 2 4 S H A R E H O L D E R L E T T E R Readying the Aurora Driver technology By deploying the Aurora Driver, we endeavor to make transportation safer and more efficient. The Aurora Driver does not lose focus, get tired, or become impaired. We believe it not only replicates the behavior of the most proficient drivers, but also redefines performance with super-human capabilities. The system can simultane- ously perceive 360 degrees of the operating environment and is capable of anticipat- ing and responding to seemingly unpredictable road user behavior with the support of advanced modeling. We continue to lead the industry with our commitment to safety and transparency. Our Safety Case Framework is a comprehensive, evidence-based approach to con- firming that our self-driving vehicles are acceptably safe to operate on public roads. We quantify our progress towards closing our Dallas to Houston launch lane Safety Case through the Autonomy Readiness Measure (ARM), which is a weighted measure of completeness across all claims of the Safety Case for our launch lane. We are the only company in the industry that has provided this level of transparency. As of mid-April of this year, ARM was 95%. This continued advancement underscores the progress we have made on final validation in preparation for Commercial Launch. As we said when we introduced the ARM, approximately 95% is related most directly to claims specific to the Aurora Driver and this is a significant achievement. While we will continue to collect evidence throughout the year, we expect final validation and closure of the remaining safety case claims to be completed later this year with our anticipated launch platform. 1Q 2 4 S H A R E H O L D E R L E T T E R

5 1Q 2 4 S H A R E H O L D E R L E T T E R The Autonomy Performance Indicator (API)1 serves as a key metric for assessing the Aurora Driver’s performance. The indicator penalizes the use of on-site support, which will be the most expensive support provided to enable the Aurora Driver. With the achievement of an aggregate API of 99% last quarter, we are now focused on driving up the percentage of commercial loads that did not require any form of on- site support (100% API). As a reminder, we do not anticipate that aggregate API will ever reach 100%, even at launch because certain situations (e.g., flat tires) will always require on-site support; however, we believe the percentage of 100% API loads will be a strong indicator of our progress toward Commercial Launch. During the first quarter, 75% of the commercial loads on the Dallas to Houston launch lane had a 100% API, reflecting a 13 point improvement sequentially, and meaningful progress toward our Commercial Launch estimate of approximately 90%. With the recent introduction of intermodal trailers into our pilot operations, we are now also including these loads in the API measure, demonstrating our increasing readiness for expansion beyond 53’ dry vans following our planned Commercial Launch. 1 Formally, API is the percentage of total commercially-representative miles driven on our launch lane over the quarter, that include: • Miles driven during the quarter that did not require support, with support meaning assistance via a local vehicle operator or other on-site support • Miles driven in autonomy with remote input from the Aurora Services Platform • Miles where the vehicle received support but where it’s determined, through internal analysis including simulation, that the support received was not required by the Aurora Driver 100% API LOADS 1Q23 2Q23 3Q23 4Q23 1Q24 % O F LO A D S 61% 48% 32% 62% 75%

6 1Q 2 4 S H A R E H O L D E R L E T T E R Contracting capacity and operational readiness The increasing confidence in our technology is accelerating our demand-building efforts. We have now secured multi-year contractual commitment on volume and pricing from multiple customers, with a mechanism to transition to driverless opera- tions, and we are in active negotiations with additional customers. As we prepare for Commercial Launch, we continue to autonomously haul freight for all of our pilot customers, including FedEx, Werner, Schneider, Hirschbach, Uber Freight, and others. We are now scheduling about 120 commercial loads per week, or triple the commercial volume we were executing a year ago. For the remainder of 2024, our focus is on finalizing contractual commitments through 2025 while increasing load capacity strategically to support operational readiness and customer expansion. Cumulative to-date 9/23/21 through 4/30/24, we have autonomously delivered (under the supervision of vehicle operators) 5,450 loads, driving approximately 1.5 million commercial miles, with nearly 100% on-time performance for our pilot cus- tomers. “We’ve been looking at Aurora as a technology for three years. And every single time we get in the truck, it’s gotten a little bit better. And that’s important.” –DARAGH MAHON, CIO - WERNER ENTERPRISES INC. “We have a contract. We’re ready to go when [Aurora is] ready.” –RICHARD STOCKING, CO-CEO - HIRSCHBACH MOTOR LINES

7 1Q 2 4 S H A R E H O L D E R L E T T E R 1Q 2 4 S H A R E H O L D E R L E T T E R commercial loads 5,450 Cumulative to-date 9/23/21 through 4/30/24, we have delivered: on-time (Aurora controlled rate) 100% nearly miles ~1.5M across

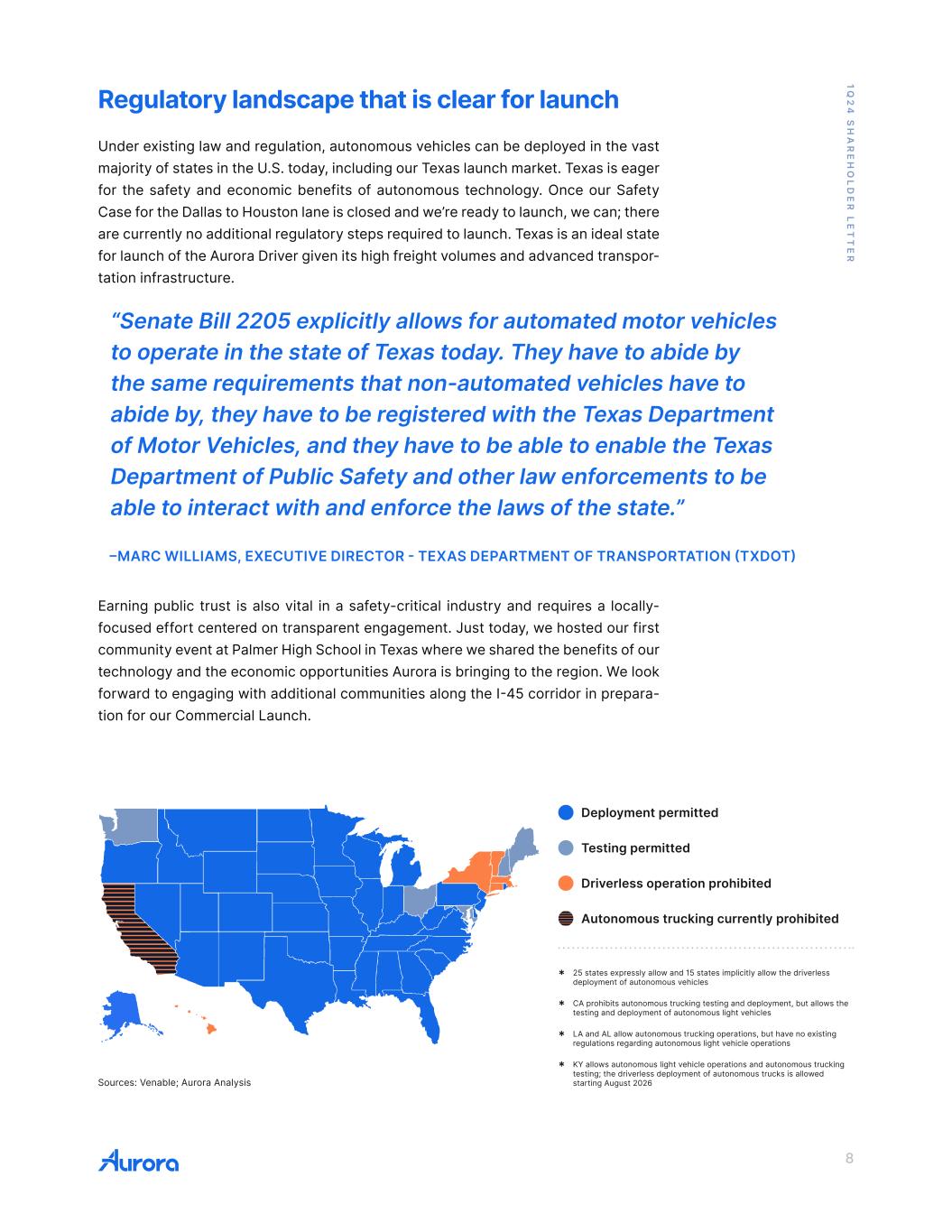

8 1Q 2 4 S H A R E H O L D E R L E T T E R Regulatory landscape that is clear for launch Under existing law and regulation, autonomous vehicles can be deployed in the vast majority of states in the U.S. today, including our Texas launch market. Texas is eager for the safety and economic benefits of autonomous technology. Once our Safety Case for the Dallas to Houston lane is closed and we’re ready to launch, we can; there are currently no additional regulatory steps required to launch. Texas is an ideal state for launch of the Aurora Driver given its high freight volumes and advanced transpor- tation infrastructure. Earning public trust is also vital in a safety-critical industry and requires a locally- focused effort centered on transparent engagement. Just today, we hosted our first community event at Palmer High School in Texas where we shared the benefits of our technology and the economic opportunities Aurora is bringing to the region. We look forward to engaging with additional communities along the I-45 corridor in prepara- tion for our Commercial Launch. Sources: Venable; Aurora Analysis Deployment permitted * 25 states expressly allow and 15 states implicitly allow the driverless deployment of autonomous vehicles Testing permitted * CA prohibits autonomous trucking testing and deployment, but allows the testing and deployment of autonomous light vehicles Driverless operation prohibited * LA and AL allow autonomous trucking operations, but have no existing regulations regarding autonomous light vehicle operations Autonomous trucking currently prohibited * KY allows autonomous light vehicle operations and autonomous trucking testing; the driverless deployment of autonomous trucks is allowed starting August 2026 “Senate Bill 2205 explicitly allows for automated motor vehicles to operate in the state of Texas today. They have to abide by the same requirements that non-automated vehicles have to abide by, they have to be registered with the Texas Department of Motor Vehicles, and they have to be able to enable the Texas Department of Public Safety and other law enforcements to be able to interact with and enforce the laws of the state.” –MARC WILLIAMS, EXECUTIVE DIRECTOR - TEXAS DEPARTMENT OF TRANSPORTATION (TXDOT)

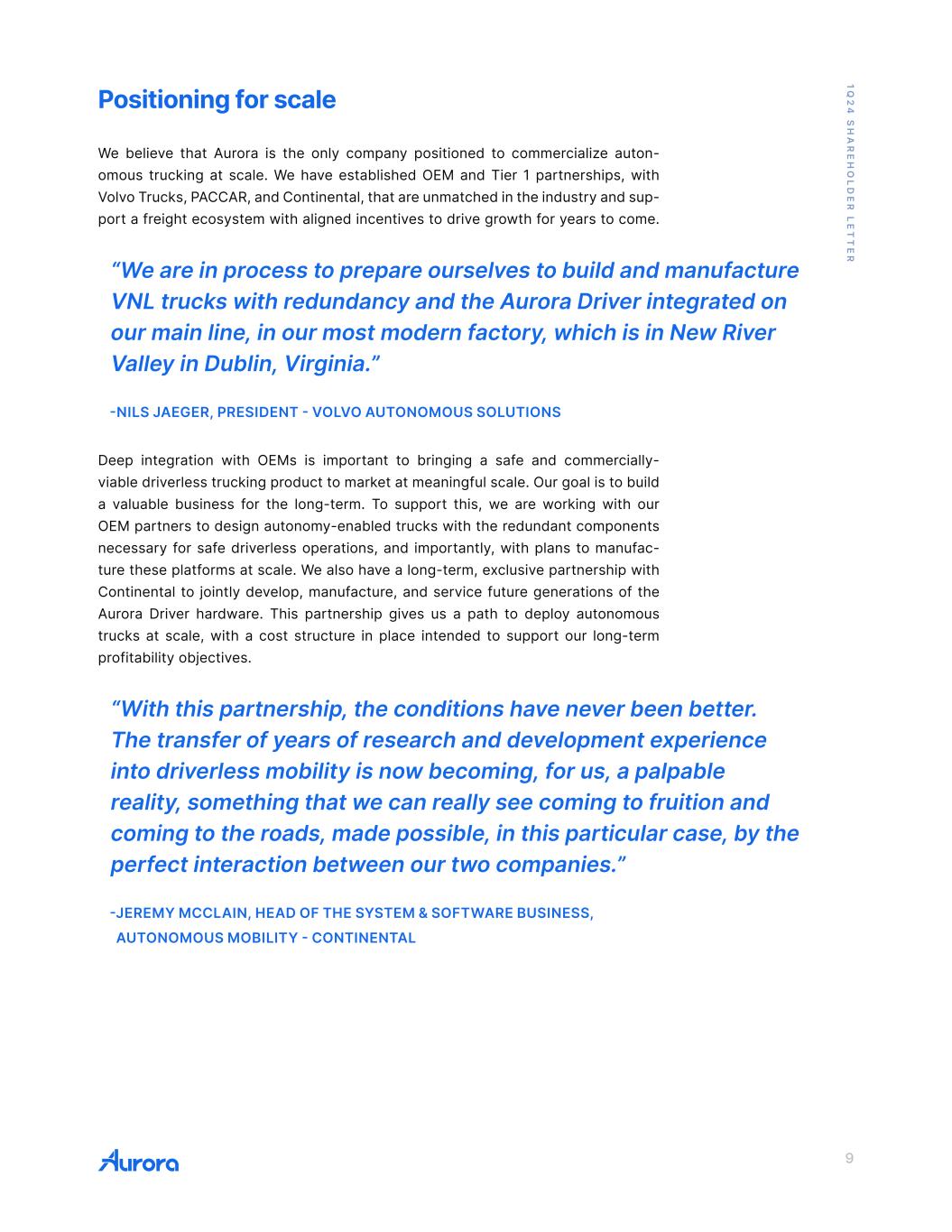

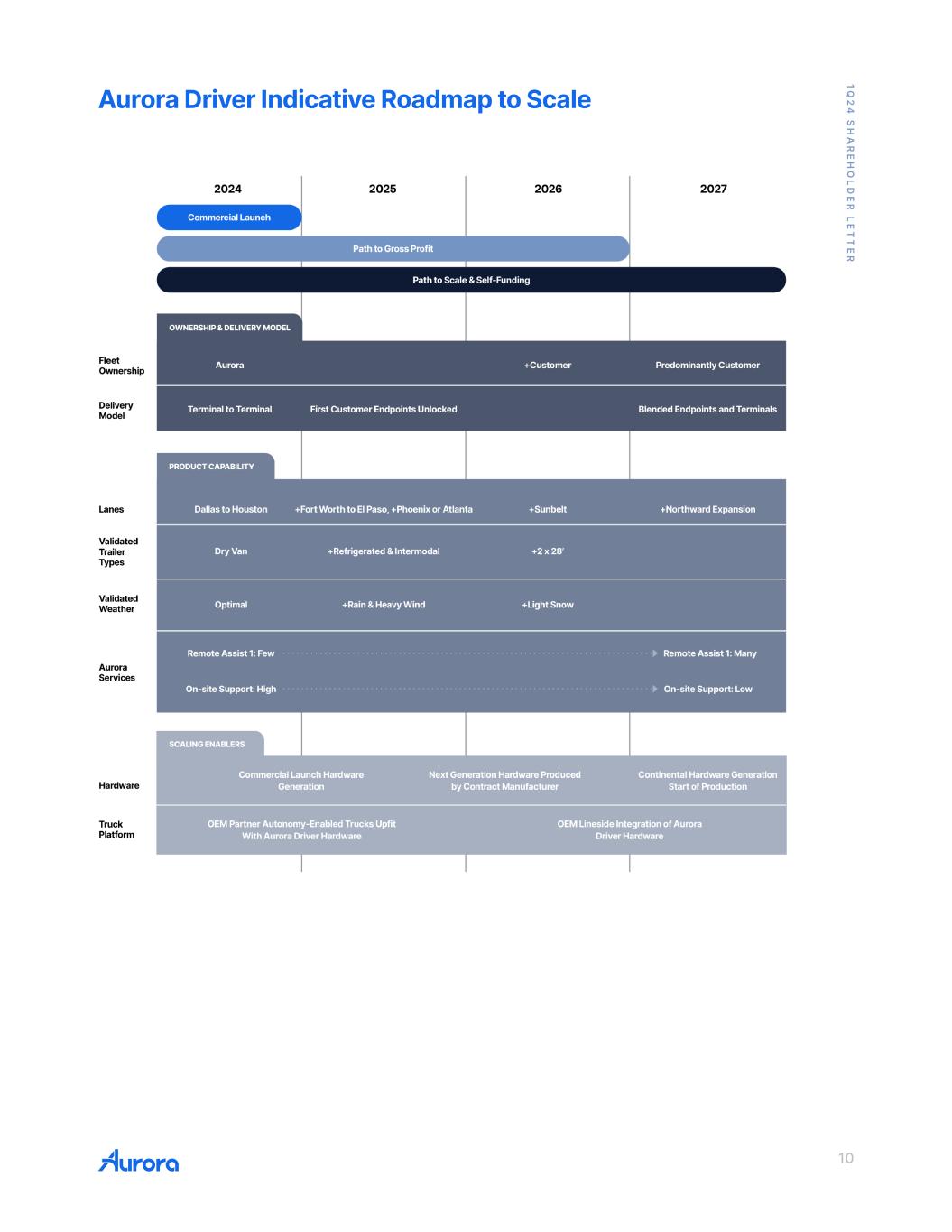

9 1Q 2 4 S H A R E H O L D E R L E T T E R Positioning for scale We believe that Aurora is the only company positioned to commercialize auton- omous trucking at scale. We have established OEM and Tier 1 partnerships, with Volvo Trucks, PACCAR, and Continental, that are unmatched in the industry and sup- port a freight ecosystem with aligned incentives to drive growth for years to come. Deep integration with OEMs is important to bringing a safe and commercially- viable driverless trucking product to market at meaningful scale. Our goal is to build a valuable business for the long-term. To support this, we are working with our OEM partners to design autonomy-enabled trucks with the redundant components necessary for safe driverless operations, and importantly, with plans to manufac- ture these platforms at scale. We also have a long-term, exclusive partnership with Continental to jointly develop, manufacture, and service future generations of the Aurora Driver hardware. This partnership gives us a path to deploy autonomous trucks at scale, with a cost structure in place intended to support our long-term profitability objectives. “We are in process to prepare ourselves to build and manufacture VNL trucks with redundancy and the Aurora Driver integrated on our main line, in our most modern factory, which is in New River Valley in Dublin, Virginia.” -NILS JAEGER, PRESIDENT - VOLVO AUTONOMOUS SOLUTIONS “With this partnership, the conditions have never been better. The transfer of years of research and development experience into driverless mobility is now becoming, for us, a palpable reality, something that we can really see coming to fruition and coming to the roads, made possible, in this particular case, by the perfect interaction between our two companies.” -JEREMY MCCLAIN, HEAD OF THE SYSTEM & SOFTWARE BUSINESS, AUTONOMOUS MOBILITY - CONTINENTAL

10 1Q 2 4 S H A R E H O L D E R L E T T E R Aurora Driver Indicative Roadmap to Scale

11 1Q 2 4 S H A R E H O L D E R L E T T E R We also recently engaged Fabrinet for the manufacturing and assembly of our next generation Aurora Driver hardware kit, which we plan to introduce in 2025 to sup- port our initial scaling ambitions before Continental’s start of production of our scal- able Hardware as a Service generation planned for 2027. The next generation kit brings some exciting performance gains and importantly, we expect it to drive a step function reduction in our hardware costs, which is a critical element of our path to scale and self-funding. Momentum into 2024 - leading the industry into a new era of safer, more efficient freight and logistics I couldn’t be prouder of the tremendous progress we are making while maintain- ing safety as our north star. Looking ahead, we will continue to work responsibly and purposefully to ready our technology for Commercial Launch and longer-term deployment at scale. Our path has never been more clear. We are convinced that Aurora will create immense value for society, our partners, our customers, and of course, our shareholders. Chris Urmson CEO & Co-founder

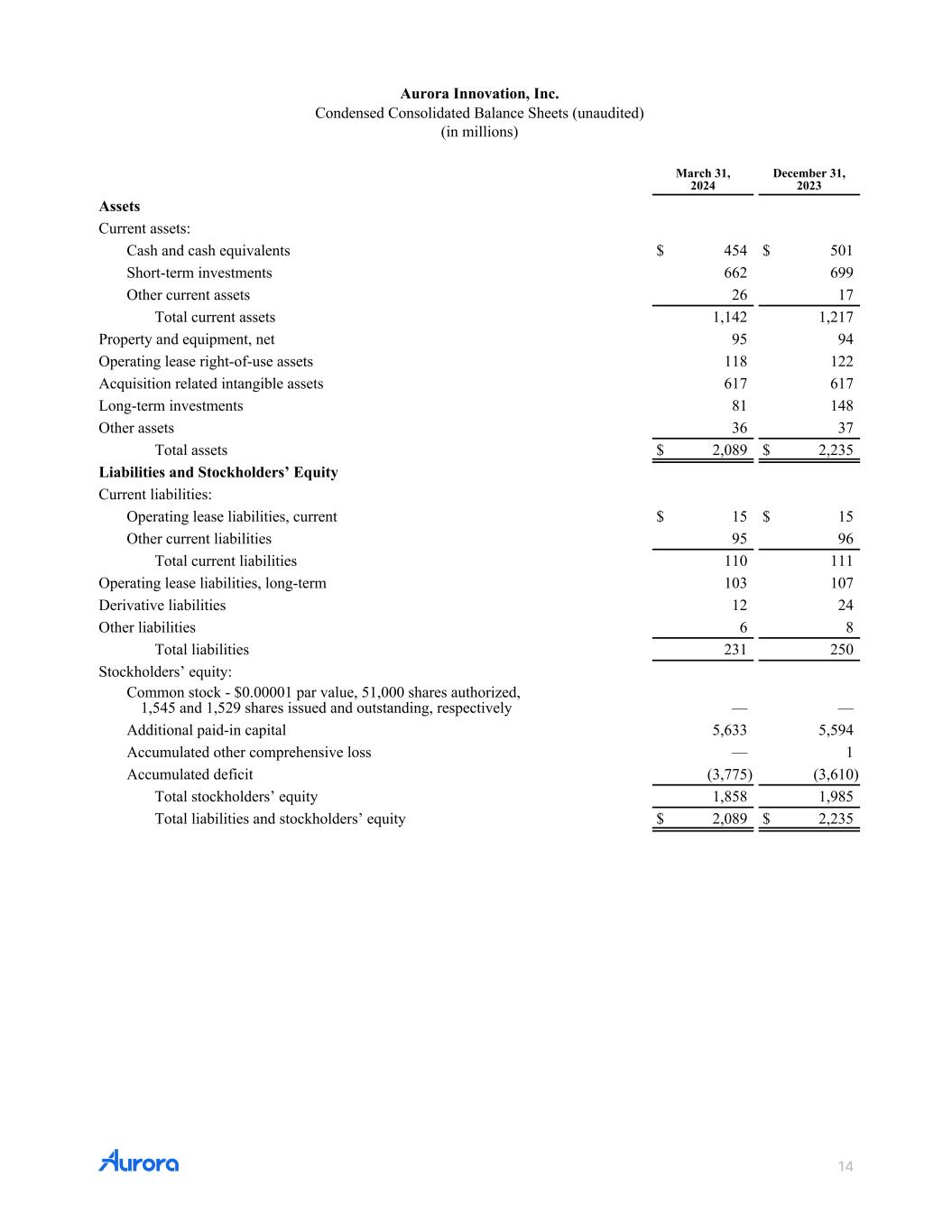

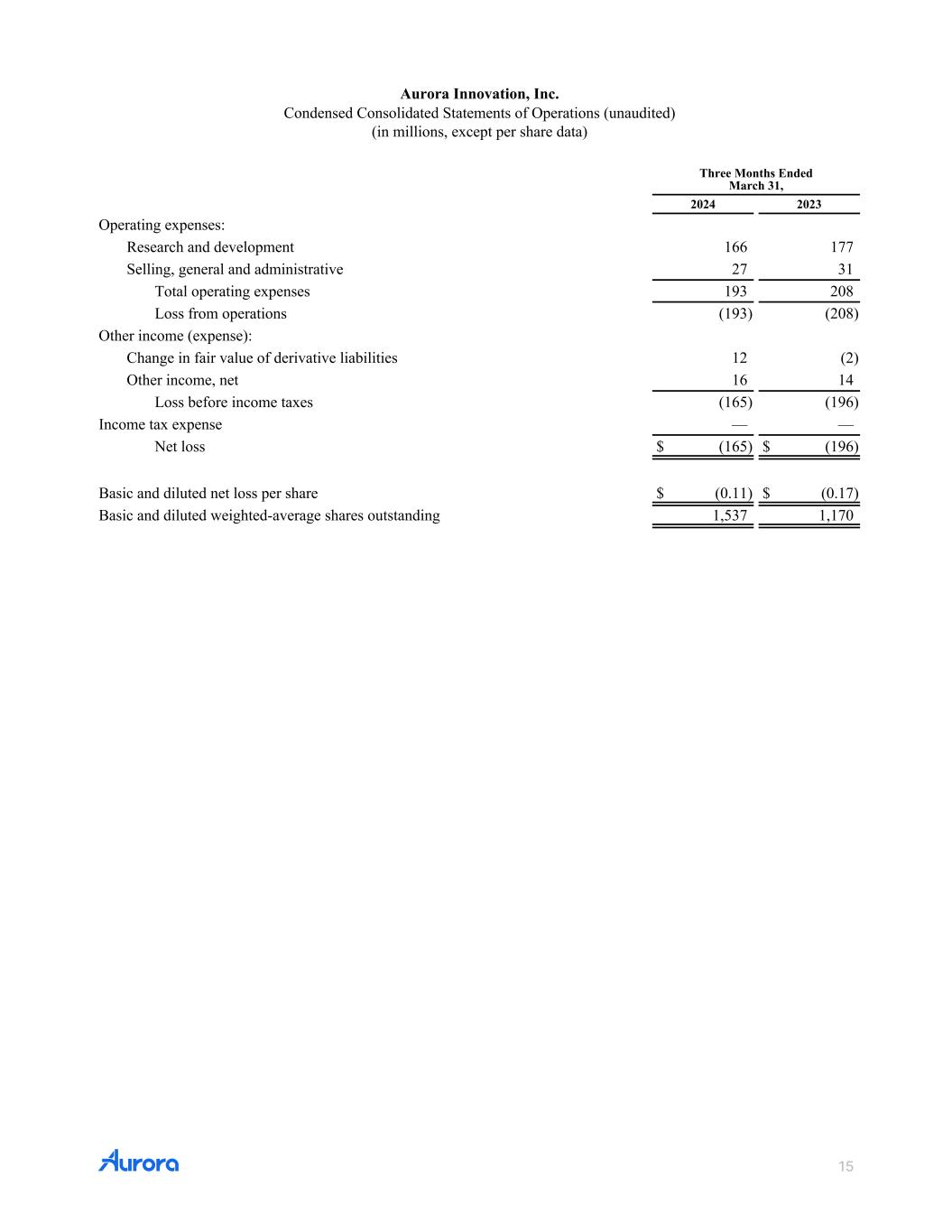

12 1Q 2 4 S H A R E H O L D E R L E T T E R From the desk of our CFO During the first quarter of 2024, we continued to demonstrate strong fiscal discipline while executing toward our planned Commercial Launch. First quarter 2024 oper- ating expenses, including stock-based compensation (SBC), totaled $193 million. Excluding SBC of $36 million, operating expenses totaled $157 million, reflecting $135 million in R&D, which is primarily comprised of personnel costs as we continue to invest in our industry-leading autonomy technology, and $22 million in SG&A. We used approximately $150 million in operating cash during the first quarter of 2024 and capital expenditures totaled $8 million. This cash spend was below our target, reflecting our continued commitment to fiscal prudence. In 2024, we contin- ue to expect quarterly cash use of $175 - $185 million, on average, which reflects an increase in capital expenditures relative to 2023 as we prepare for Commercial Launch. We expect second quarter cash spend to be above this range due to the payments associated with our 2023 annual incentive compensation program. We ended the first quarter with a very strong balance sheet, including $1.2 billion in cash & short-term and long-term investments. Given efficiencies we have found in the business that have translated to tangible and recurring cost savings, we now expect this liquidity to support our planned Commercial Launch and fund our oper- ations into the fourth quarter of 2025. David Maday CFO

13 1Q 2 4 S H A R E H O L D E R L E T T E R Cautionary Statement Regarding Forward-Looking Statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. The words “believe,” “may,” “will,” “estimate,” “con- tinue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “potential,” “indicative,” and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking statements, in- cluding but not limited to, those statements around our ability to achieve certain milestones around, and realize the potential benefits of, the development, manu- facturing, scaling, and commercialization of the Aurora Driver and related services, including relationships and anticipated benefits with partners and customers, and on the timeframe we expect or at all, the market opportunity and profitability of our products and services, the regulatory tailwinds and framework in which we oper- ate, and our expected cash use and cash runway. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially differ- ent from any future results, performance or achievements expressed or implied by the forward-looking statements. Our projected quarterly cash use is based upon assumptions, including research and development and general and administrative activities, as well as capital expenses and working capital. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 15, 2024 and other documents filed by Aurora from time to time with the SEC, which are ac- cessible on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances.

14 Aurora Innovation, Inc. Condensed Consolidated Balance Sheets (unaudited) (in millions) March 31, 2024 December 31, 2023 Assets Current assets: Cash and cash equivalents $ 454 $ 501 Short-term investments 662 699 Other current assets 26 17 Total current assets 1,142 1,217 Property and equipment, net 95 94 Operating lease right-of-use assets 118 122 Acquisition related intangible assets 617 617 Long-term investments 81 148 Other assets 36 37 Total assets $ 2,089 $ 2,235 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 15 $ 15 Other current liabilities 95 96 Total current liabilities 110 111 Operating lease liabilities, long-term 103 107 Derivative liabilities 12 24 Other liabilities 6 8 Total liabilities 231 250 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,545 and 1,529 shares issued and outstanding, respectively — — Additional paid-in capital 5,633 5,594 Accumulated other comprehensive loss — 1 Accumulated deficit (3,775) (3,610) Total stockholders’ equity 1,858 1,985 Total liabilities and stockholders’ equity $ 2,089 $ 2,235 Condense Consolidated Statements of Cash Flows (unaudited) Three Months Ended March 31, 2024 2023 Cash flows from operating activities Net loss $ (165) $ (196) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 5 5 Reduction in the carrying amount of right-of-use assets 7 7 Stock-based compensation 36 39 Goodwill impairment — — Change in fair value of derivative liabilities (12) 2 Accretion of discount on investments (8) (7) Other operating activities — — Changes in operating assets and liabilities: Other current and non-current assets (8) 2 Operating lease liabilities (6) (6) Other current and non-current liabilities 1 18 Net cash used in operating activities (150) (136) Cash flows from investing activities Purchases of property and equipment (8) (2) Purchases of investments (145) (247) Maturities of investments 254 303 Net cash provided by investing activities 101 54 Cash flows from financing activities Proceeds fr m issuance of common stock 3 1 Other financing activities (1) (1) Net cash provided by financing activities 2 — Net decrease in cash, cash equivalents, and restricted cash (47) (82) Cash, cash equivalents, and restricted cash at beginning of the period 518 277 Cash, cash equivalents, and restricted cash at end of the period $ 471 $ 195

15 Aurora Innovation, Inc. Condensed Consolidated Statements of Operations (unaudited) (in millions, except per share data) Three Months Ended March 31, 2024 2023 Operating expenses: Research and development 166 177 Selling, general and administrative 27 31 Total operating expenses 193 208 Loss from operations (193) (208) Other income (expense): Change in fair value of derivative liabilities 12 (2) Other income, net 16 14 Loss before income taxes (165) (196) Income tax expense — — Net loss $ (165) $ (196) Basic and diluted net loss per share $ (0.11) $ (0.17) Basic and diluted weighted-average shares outstanding 1,537 1,170 e se s li ate tate e ts f Cash Fl ws ( a ite ) (in millions) Cash flows from operating activities N t loss $ ( 5) $ ( 96) Adjustments to reconcile et loss to net cash used in operating activities: Depreciation and amortization 5 5 Reduction in the carrying amount of right-of-use assets 7 7 Stock-bas d compensation 36 39 Goodwill impairment — — Change in fair value of derivative liabilities ( 2) 2 Accretion of discount on investments (8 (7 Other operating activities Changes in operating assets and liabilities: Other current and non-current assets (8) 2 Operating lease liabilities (6) (6) Other current and non-current liabilities 1 18 Net cash used in operating activities (150) (136) Cash flows from investing activities Purchases of property and equipment (8) (2) Purchases of investments (145) (247) Maturities of investments 254 303 Net cash provided by investing activities 101 54 Cash flows from financing activities Proceeds from issuance of common stock 3 1 Other financing activities (1) (1) Net cash provided by financing activities 2 — Net decrease in cash, cash equivalents, and restricted cash (47) (82) Cash, cash equivalents, and restricted cash at beginning of the period 518 277 Cash, cash equivalents, and restricted cash at end of the period $ 471 $ 195

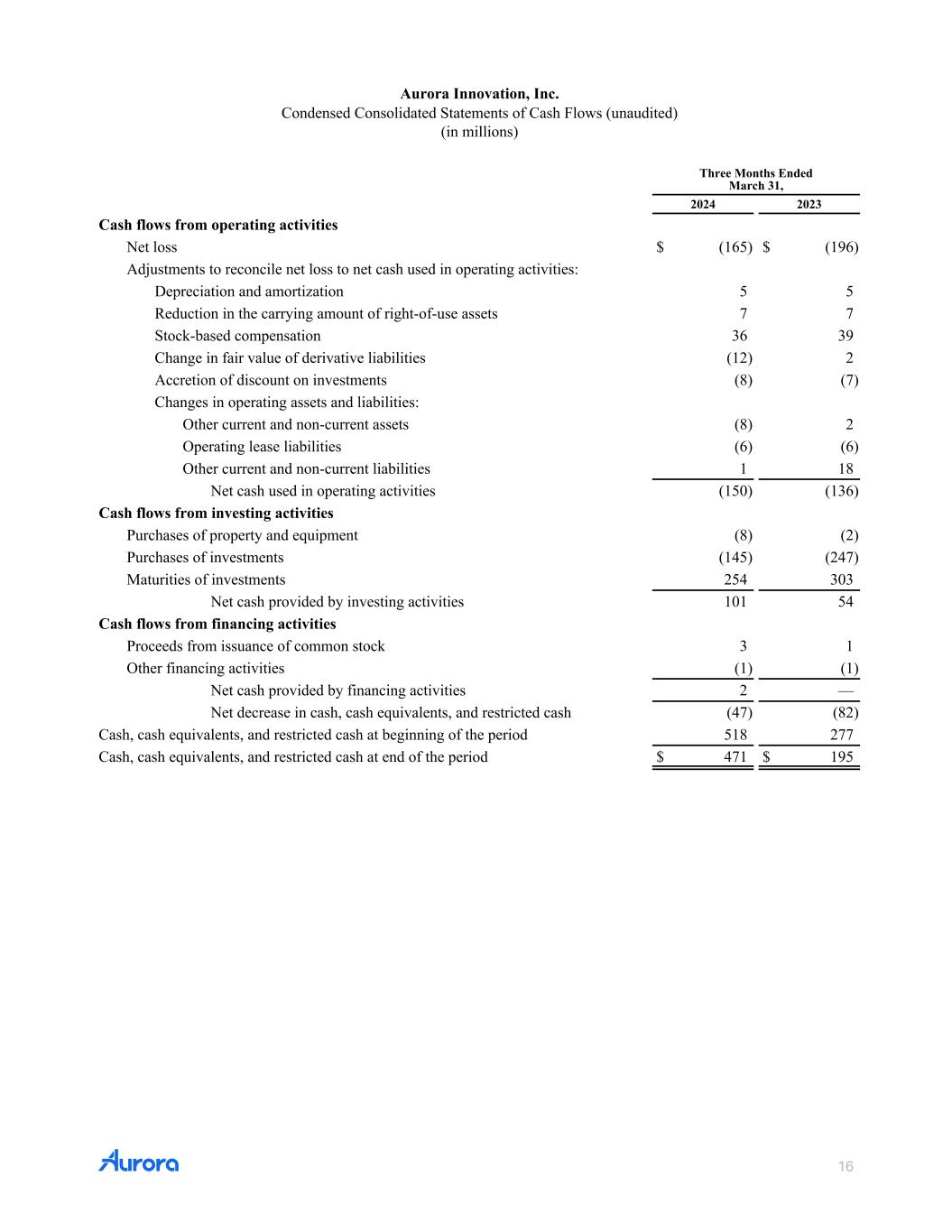

16 Aurora Innovation, Inc. Condensed Consolidated Statements of Cash Flows (unaudited) (in millions) Three Months Ended March 31, 2024 2023 Cash flows from operating activities Net loss $ (165) $ (196) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 5 5 Reduction in the carrying amount of right-of-use assets 7 7 Stock-based compensation 36 39 Change in fair value of derivative liabilities (12) 2 Accretion of discount on investments (8) (7) Changes in operating assets and liabilities: Other current and non-current assets (8) 2 Operating lease liabilities (6) (6) Other current and non-current liabilities 1 18 Net cash used in operating activities (150) (136) Cash flows from investing activities Purchases of property and equipment (8) (2) Purchases of investments (145) (247) Maturities of investments 254 303 Net cash provided by investing activities 101 54 Cash flows from financing activities Proceeds from issuance of common stock 3 1 Other financing activities (1) (1) Net cash provided by financing activities 2 — Net decrease in cash, cash equivalents, and restricted cash (47) (82) Cash, cash equivalents, and restricted cash at beginning of the period 518 277 Cash, cash equivalents, and restricted cash at end of the period $ 471 $ 195 Goodwill impairment — — Change i fair value of deri ative liabilities (12 2 Accretion of discount on investments (8) (7) Other operating activities — — Changes in operating ssets and liabilities: assets (8) 2 Operating lease liabilities (6 ( Other curre t and non-current liabilities 1 18 Net cash used in operating activities (150 (136 Cash flows from i vesting activities Purchas property and equipment (8) (2) Purchases of investments ( 45) (247) Maturities of investments 254 303 Net c sh provided by investing activities 101 54 Cash flows from fin ncing activities Proceeds from issu nce of common stock 3 1 Other financing activitie (1 (1 Ne cash provided by financin activities 2 — Ne decrease in cash, cash equivalents, and restricted cash (47) (82) Cash, cash equivalents, and restricted cash at beginning of the period 518 277 Cash, cash equivalents, and restricted cash at end of the period $ 471 $ 195

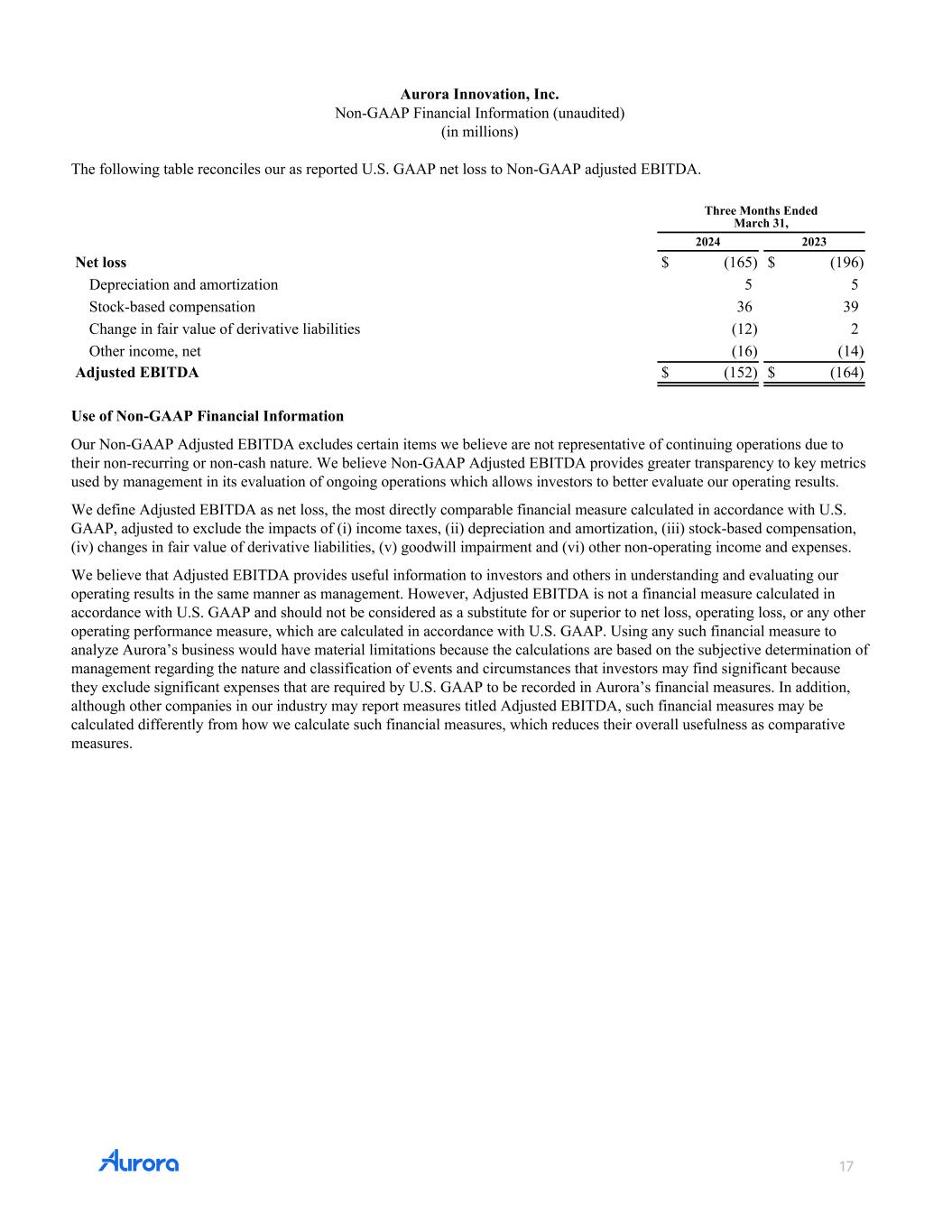

17 Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended December 31, Twelve Months Ended December 31, 2023 2022 2023 2022 Net loss $ (192) $ (293) $ (796) $ (1,723) Depreciation and amortization 5 5 21 22 Stock-based compensation 37 44 160 156 Goodwill impairment — 114 — 1,114 Change in fair value of derivative liabilities 13 (11) 20 (114) Other income, net (19) (8) (59) (15) Adjusted EBITDA $ (156) $ (149) $ (654) $ (560) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of derivative liabilities, (v) goodwill impairment and (vi) other non-operating income and expenses. Aurora believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating Aurora’s operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in Aurora’s industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures. Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in mi lions) The fo lowing table reconciles our as reported U.S. GAAP net lo s to Non-GAAP adjusted EBITDA. Thre t s March 31, 2024 20 3 Net lo s $ (165) $ (196) Depreciation and amortization 5 5 Stock-based compensation 36 39 Change in fair value of derivative liabilities (12) 2 Other income, net (16) (14) Adjusted EBITDA $ (152) $ (164) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of derivative liabilities, (v) goodwill impairment and (vi) other non-operating income and expenses. We believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in our industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how we calculate such financial measures, which reduces their overall usefulness as comparative measures. Condensed Consolidated Statements of Cash Flows (unaudited) Three Months Ended March 31, 2024 2023 Cash flows from operating activities Net loss $ (165) $ (196) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 5 5 Reduction in the carrying amount of right-of-use assets 7 7 Stock-based compensation 36 39 Goodwill impairment — — Change in fair value of derivative liabilities (12) 2 Accretion of discount on investments (8) (7) Other operating activities — — Changes in operating assets and liabilities: Other current and non-current assets (8) 2 Operating lease liabilities (6) (6) Other current and non-current liabilities 1 18 Net cash used in operating activities (150) (136) Cash flows from investing activities Purchases of property and equipment (8) (2) Purchases of investments (145) (247) Maturities of investments 254 303 Net cash provided by investing activities 101 54 Cash flows f om financing activities Proceeds from issuance of common s ock 3 1 Other financing activities (1) (1) Net cash provided by financing activities 2 — Net decrease in cash, cash equivalents, and restricted cash (47) (82) Cash, cash equivalents, and restricted cash at beginning of the period 518 277 Cash, cash equivalents, and restricted cash at end of the period $ 471 $ 195