UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

PROXY

STATEMENT PURSUANT TO SECTION 14(A) OF

THE

SECURITIES EXCHANGE ACT OF 1934

| ☒ |

Filed

by the Registrant |

| ☐ |

Filed

by a Party other than the Registrant |

Check

the appropriate box:

| |

☐ |

Preliminary

Proxy Statement |

| |

☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☒ |

Definitive

Proxy Statement |

| |

☐ |

Definitive

Additional Materials |

| |

☐ |

Soliciting

Material under §240.14a-12 |

BIOMERICA,

INC.

(Name

of Registrant as Specified in Its Charter)

N/A

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

(1)

|

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

(2)

|

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4)

|

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

(5)

|

Total

fee paid: |

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1)

|

Amount

Previously Paid: |

| |

|

|

| |

(2)

|

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

(4) |

Date

Filed |

BIOMERICA,

INC.

17571

Von Karman Avenue

Irvine,

CA 92614

NOTICE

OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD ON DECEMBER 13, 2024

To

Our Stockholders:

NOTICE

IS HEREBY GIVEN that the annual meeting of the stockholders of BIOMERICA, INC., a Delaware corporation (herein called the “Company”

or “our”), will be held at the offices of the Company, 17571 Von Karman Avenue, Irvine, California 92614 on DECEMBER 13,

2024, at 10:00 a.m., Pacific Time (the “Annual Meeting”).

At

the meeting, you will be asked to consider and vote upon the following matters:

| |

1. |

To

elect five directors, each to serve until the

next annual meeting of stockholders and until his or her successor has been elected and qualified or until his or her earlier resignation,

death or removal. The proxy statement which accompanies this Notice includes the names of the nominees to be presented by

the Board of Directors for election; |

| |

|

|

| |

2. |

To

approve, on a non-binding advisory basis, the compensation paid to our named executive officers as disclosed in this proxy statement; |

| |

|

|

| |

3. |

To

ratify the selection of Haskell & White LLP as our independent registered public accounting firm for our fiscal

year ending May 31, 2025; |

| |

|

|

| |

4. |

To approve

our 2024 Stock Incentive Plan; |

| |

|

|

| |

5. |

To approve an amendment to our First Amended and Restated Certificate of Incorporation to authorize the Board, at their discretion, to effect a reverse stock split of our common stock; |

| |

|

|

| |

6. |

To approve an amendment to our First Amended and Restated Certificate of Incorporation to authorize the Board, at their discretion, to

effect an increase in the number of authorized shares of our common stock; |

| |

|

|

| |

7. |

To

approve an adjournment of the Annual Meeting; and |

| |

|

|

| |

8. |

To

transact such other business which may properly

come before the Annual Meeting and any adjournment thereof. |

You

will be able to attend the Annual Meeting in person at the Company’s headquarters located at 17571 Von Karman Avenue Irvine,

California 92614. No virtual connection to the Annual Meeting will be available for off-site viewing or attendance.

In

accordance with the provisions of our bylaws, the Board of Directors has fixed the close of business on October 16, 2024, as the record

date for the determination of the holders of our Common Stock, $0.08 par value, entitled to notice of and to vote at our Annual

Meeting. To ensure that your shares will be represented at the Annual Meeting, please complete, sign, date and promptly return the accompanying

proxy card in the enclosed envelope. You may revoke your proxy at any time before it is voted. It is important that your shares be represented

and voted at the Annual Meeting, whether or not you plan to attend the meeting.

| |

By

Order of the Board of Directors, |

| |

|

| |

/S/

Zackary S. Irani |

| |

ZACKARY

S. IRANI, |

| |

Chief

Executive Officer |

Irvine,

California

September

30, 2024

Approximate

Date of the Mailing of the Proxy Materials: October 24, 2024

BIOMERICA,

INC.

17571

Von Karman Avenue

Irvine,

California 92614

PROXY

STATEMENT

ANNUAL

MEETING OF STOCKHOLDERS

GENERAL

INFORMATION

This

Proxy Statement is furnished by the Board of Directors of Biomerica, Inc., a Delaware corporation (the “Company” or “our”),

in connection with the solicitation of proxies for use at the Company’s Annual Meeting of Stockholders to be held at our principal

executive office, 17571 Von Karman Avenue, Irvine, California 92614, on December 13, 2024, at 10:00 a.m., Pacific Time,

and at any and all adjournments thereof (the “Annual Meeting”). The Annual Meeting has been called for the purposes set forth

in the accompanying Notice of the Annual Meeting of Stockholders (the “Notice”). This Proxy Statement, and the Annual Report

on Form 10-K of the Company for the fiscal year ended May 31, 2024 (the “Annual Report”), will be mailed on or about October 24, 2024, to each stockholder

of record as of the close of business on October 16, 2024.

RECORD

DATE AND OUTSTANDING SHARES

The

close of business on October 16, 2024, has been set as the record date for the determination of stockholders entitled to notice of

and to vote at the Annual Meeting (the “Record Date”). As of September 30, 2024 there was outstanding and

entitled to vote an aggregate of 16,821,646 shares of the Company’s common stock, $0.08 par value per share (the

“Common Stock”), held of record by approximately 850 stockholders. However, the actual number of shareholders is unknown

as brokers and other institutions hold the majority of the Company’s stock on behalf of other beneficial owners. The actual

number of shares outstanding as of the Record Date may vary from the number of shares outstanding as of September 30,

2024.

VOTING

RIGHTS, QUORUM, & VOTES REQUIRED

The

presence, in-person or by proxy, of the holders of a majority of the issued and outstanding shares of Common Stock held on the Record

Date and entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. Each share of Common Stock is entitled

to one vote on each matter to be considered at the Annual Meeting.

A broker non-vote occurs when a broker holding shares in street name for a beneficial owner does not receive instructions

from the beneficial owner about how to vote its shares. Under applicable law and the listing rules of the Nasdaq Stock Market, Inc. (“Nasdaq”),

brokers have the discretion to vote on routine matters (Proposal Nos. 3, 5, 6, and 7) without instructions from the beneficial owner.

If a beneficial owner does not provide its broker instructions on how to vote its shares on non-routine matters (Proposal Nos. 1, 2, and

4), no votes will be cast on its behalf with respect to those proposals. Abstentions and broker non-votes are counted for purposes of

determining whether a quorum exists.

The voting requirements

to approve each of the proposals to be voted upon at the Annual Meeting, as well as the effects of abstentions and broker non-votes on

each of the proposals, are as follows:

| PROPOSAL |

|

VOTING

REQUIREMENT |

|

EFFECT

OF ABSTENTIONS |

|

EFFECT

OF BROKER NON-VOTES |

Proposal

No. 1:

To

elect five directors, each to serve until the next annual meeting of stockholders and until his or her successor has been elected and

qualified or until his or her earlier resignation, death or removal. |

|

Each

director nominee shall be elected by a plurality vote of the stockholders of the Company

present in person or by proxy at such meeting and entitled to vote on the election of directors

|

|

A

“WITHHOLD” vote will have no effect on the outcome of this proposal. |

|

Broker

non-votes will not count as votes cast on this proposal and will have no effect on the outcome of the vote on this proposal. |

| |

|

|

|

|

|

|

Proposal

No. 2:

To

approve, on a non-binding advisory basis, the compensation paid to our named executive officers. |

|

Requires

the affirmative vote of the majority of the stockholders of the Company present in person or by proxy at such meeting and entitled to

vote on the subject matter. |

|

An

“ABSTAIN” vote will be included in the total number of shares present and entitled to vote on this proposal, and will have

the same effect as a vote “AGAINST” this proposal. |

|

Broker

non-votes will not count as votes cast on this proposal and will have no effect on the outcome of the vote on this proposal. |

| |

|

|

|

|

|

|

Proposal

No. 3:

To

ratify the selection of Haskell & White LLP as our independent registered public accounting firm for our fiscal year ending May

31, 2025. |

|

Requires

the affirmative vote of the majority of the stockholders of the Company present in person or by proxy at such meeting and entitled

to vote on the subject matter. |

|

An

“ABSTAIN” vote will be included in the total number of shares present and entitled to vote on this proposal, and will have

the same effect as a vote “AGAINST” this proposal. |

|

Because

a bank, broker, dealer or other nominee may generally vote without instructions on this proposal, we do not expect any broker non-votes

in connection with this proposal. |

| |

|

|

|

|

|

|

Proposal

No. 4:

To

approve our 2024 Stock Incentive Plan. |

|

Requires

the affirmative vote of the majority of the stockholders of the Company present in person or by proxy at such meeting and entitled to

vote on the subject matter. |

|

An

“ABSTAIN” vote will be included in the total number of shares present and entitled to vote on this proposal, and will have

the same effect as a vote “AGAINST” this proposal. |

|

Broker

non-votes will not count as votes cast on this proposal and will have no effect on the outcome of the vote on this proposal. |

| |

|

|

|

|

|

|

Proposal

No. 5:

To

approve an amendment to our First Amended and Restated Certificate of Incorporation to authorize the Board, at their discretion, to effect

a reverse stock split of our Common Stock. |

|

Requires

the affirmative vote of the majority of the votes cast. |

|

An

“ABSTAIN” vote will not be included in the total number of votes cast and will have no effect on the outcome of the vote

on this proposal. |

|

Because

a bank, broker, dealer or other nominee may generally vote without instructions on this proposal, we do not expect any broker non-votes

in connection with this proposal. |

| |

|

|

|

|

|

|

Proposal

No. 6:

To

approve an amendment to our First Amended and Restated Certificate of Incorporation to authorize the Board, at their discretion, to effect

an increase in the number of authorized shares of our Common Stock. |

|

Requires

the affirmative vote of the majority of the votes cast. |

|

An

“ABSTAIN” vote will not be included in the total number of votes cast and will have no effect on the outcome of the vote

on this proposal. |

|

Because

a bank, broker, dealer or other nominee may generally vote without instructions on this proposal, we do not expect any broker non-votes

in connection with this proposal. |

| |

|

|

|

|

|

|

Proposal

No. 7:

To

approve an adjournment of the Annual Meeting. |

|

Requires

the affirmative vote of the majority of the stockholders of the Company present in person or by proxy at such meeting and entitled to

vote on the subject matter. |

|

An

“ABSTAIN” vote will be included in the total number of shares present and entitled to vote on this proposal, and will have

the same effect as a vote “AGAINST” this proposal. |

|

Because

a bank, broker, dealer or other nominee may generally vote without instructions on this proposal, we do not expect any broker non-votes

in connection with this proposal. |

All

votes will be tabulated by the inspector of elections appointed for the meeting, who will separately tabulate, for each proposal, affirmative

and negative votes, abstentions, and broker non-votes.

APPRAISAL

RIGHTS

Under

Delaware General Corporation Law (the “DGCL”), stockholders are not entitled to any appraisal rights with respect to the approval of any of the proposals described

in this Proxy Statement.

PERSONS

MAKING THE SOLICITATION

The

Company, on behalf of its Board of Directors, is soliciting the proxy accompanying this Proxy Statement for use at the Annual

Meeting. The proxies are being solicited by mail. The Company will bear the cost of solicitation, including, preparing, assembling,

and mailing the proxy materials. Following the mailing of this Proxy Statement, directors, officers, and

employees of the Company may solicit proxies by mail, telephone, or personal interview. Such persons will receive no additional compensation

for such services. Brokerage houses and other nominees, fiduciaries, and custodians nominally holding shares of the Company’s Common

Stock of record will be requested to forward proxy soliciting material to the beneficial owners of such shares. The Company will, upon

request, reimburse such parties for their reasonable expenses in forwarding proxy materials to the beneficial owners.

TERMS

OF THE PROXY

The

enclosed proxy indicates the matters to be acted upon at the Annual Meeting and provides boxes to be marked to indicate the manner

in which the stockholder’s shares are to be voted with respect to such matters. By appropriately marking the boxes, a stockholder

may specify whether the proxy shall vote for or against or shall be without authority to vote the shares represented by the proxy.

The proxy also confers upon the proxy discretionary voting authority with respect to such other business as may properly come

before the Annual Meeting.

If

the proxy is executed properly and is received by the Company prior to the Annual Meeting, the shares represented by the proxy will be voted accordingly. A proxy

may be revoked at any time prior to its exercise (i) by resubmitting their vote online or (ii) by attending the Annual Meeting and

electing to vote at the Annual Meeting.

COMMON

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth, as of September 30, 2024, certain information as to shares of Common Stock owned by (i) each person

known to beneficially own more than 5% of the outstanding Common Stock, (ii) each director, including director nominees, and each of

our Named Executive Officers (as defined under “Executive Compensation of Named Executive Officers”), and (iii) all executive

officers and directors of the Company as a group. Unless otherwise indicated, each person listed has sole voting and investment power

over the shares beneficially owned by him or her. Unless otherwise indicated, the address of each beneficial owner is 17571 Von Karman

Avenue, Irvine, California 92614.

5%

or Greater Stockholders

| NAME OF BENEFICIAL OWNER (1) | |

SHARES

BENEFICIALLY OWNED | | |

PERCENTAGE

BENEFICIALLY OWNED (1) | |

| Zackary Irani | |

| 1,710,772 | | |

| 9.8 | % |

| Granahan Investment Management Inc | |

| 860,456 | | |

| 5.1 | % |

Directors

and Named Executive Officers

| NAME OF BENEFICIAL OWNER (1) | |

SHARES

BENEFICIALLY OWNED | | |

PERCENTAGE

BENEFICIALLY OWNED (1) | |

| Zackary Irani (2) | |

| 1,710,772 | | |

| 9.8 | % |

| Allen Barbieri (3) | |

| 393,337 | | |

| 2.3 | % |

| Jane Emerson, M.D., Ph.D. (4) | |

| 293,000 | | |

| 1.7 | % |

| Catherine Coste (5) | |

| 139,540 | | |

| | * |

| David Moatazedi (6) | |

| 38,250 | | |

| | * |

| Gary Lu (7) | |

| 25,000 | | |

| | * |

| Jack Kenny (8) | |

| - | | |

| | * |

| All executive officers and directors as a group (seven persons) | |

| 2,599,899 | | |

| 15.0 | % |

*Percentage of shares beneficially owned does not exceed 1.0% of our outstanding shares of Common Stock.

(1)

Beneficial ownership is determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934. Any shares of Common Stock that

each named person and group has the right to acquire within 60 days pursuant to options, warrants, conversion privileges or other rights,

are deemed outstanding for purposes of computing shares beneficially owned by and the percentage ownership of each such person and group.

However, such shares are not deemed outstanding for purposes of computing the shares beneficially owned by or percentage ownership of

any other person or group. Percentage ownership for each named beneficial owner, and the ownership of the directors and executive officers

as a group, is based on 16,821,646 shares outstanding as of September 30, 2024, plus the shares the named person and group has

a right to acquire within 60 days thereafter pursuant to options, warrants, conversion privileges or other rights and privileges.

(2)

Includes 690,212 shares underlying options exercisable by Mr. Zackary Irani at or within 60 days of September 30, 2024.

(3)

Includes 315,000 shares underlying options exercisable by Mr. Allen Barbieri at or within 60 days of September 30, 2024.

(4)

Includes 222,000 shares underlying options exercisable by Dr. Jane Emerson at or within 60 days of September 30, 2024.

(5)

Includes 95,750 shares underlying options exercisable by Ms. Catherine Coste at or within 60 days of September 30, 2024.

(6)

Includes 38,250 shares underlying options exercisable by Mr. David Moatazedi at or within 60 days of September 30, 2024.

(7)

Includes 25,000 shares underlying options exercisable by Mr. Gary Lu at or within 60 days of September 30, 2024.

(8)

Mr. Kenny joined the Board in August 2023 and resigned as an independent member of the Board on June 26, 2024. He has no stock options

that are exercisable at or within 60 days of September 30, 2024.

PROPOSAL

NO. 1

ELECTION

OF DIRECTORS

DIRECTORS

Pursuant

to the Company’s bylaws, the Board

of Directors of the Company (the “Board”) is granted the power to set the number of directors at no less than three

and no more than nine members. The size of the Board is currently set at five directors and the following five directors

have been nominated for re-election at the Annual Meeting: Mr. Zackary Irani, Mr. Allen Barbieri, Dr. Jane Emerson, Ms.

Catherine Coste, and Mr. David Moatazedi.

A

proxy cannot be voted for a greater number of directors than the five (5) nominees identified in this Proxy Statement. Each director

of the Company is elected annually and holds office for the ensuing year and until his or her successor has been elected and qualified

or until his or her earlier resignation, death or removal. In the event that any of our directors become unavailable prior

to the Annual Meeting, the proxy will be voted for a substitute nominee or nominees designated by the Board or the number of directors

may be reduced accordingly.

The

following table sets forth the name and current age of each director nominee, the year he or she was first elected, and his or her current

position(s) with the Company. The Company does not pay a fee to any third party to identify potential nominees. The Board has not

received recommended nominees from a stockholder and none of our directors or director nominees were selected pursuant to any arrangement

or understanding, other than with our directors acting within their capacity as a director. There are no family relationships among any

of our directors, director nominees, or executive officers.

| Name |

|

Age |

|

Director

Since |

|

Positions

Held |

| Zackary

Irani |

|

58 |

|

1997 |

|

Chief Executive Officer |

| Allen

Barbieri |

|

66 |

|

1999 |

|

Executive

Vice-Chairperson of the Board and Corporate Secretary |

| Jane

Emerson, M.D., Ph.D. |

|

69 |

|

2007 |

|

Director,

Chairperson of Nominating & Governance Committee and Member of Compensation and Audit

Committees |

| Catherine

Coste |

|

58 | |

2020 |

|

Director,

Chairperson of Audit Committee and Member of Nominating & Governance and Compensation

Committees

|

| David

Moatazedi |

|

46 |

|

2023 |

|

Director,

Chairperson of Compensation Committee and Member of Audit and Nominating and Governance

Committees

|

Background

of Nominees

Zackary

Irani

Mr.

Zackary Irani has served as a Director, Chief Executive Officer of the Company since April 1997. Prior to

that time, Mr. Zackary Irani served as the Company’s Vice-President of Business Development. He has been an employee of the Company

since 1986. During the fiscal years 2008 and 2009, Mr. Zackary Irani also served as Chairperson of the Board of Lancer Orthodontics,

Inc., a medical device company with manufacturing operations in the U.S. and Mexico, and served as Lancer’s Chief Executive Officer from April 1997 until April 2004. Mr. Zackary Irani holds a BS degree

and an MBA degree from the University of California, Irvine - The Paul Merage School of Business.

We

believe Mr. Zackary Irani is qualified to serve on our Board because of his service as the Chief Executive Officer of the Company,

his extensive knowledge of the Company’s business and operations, his financial expertise, his education, and his knowledge of

the business sector in which the company competes.

Allen

Barbieri

Mr.

Allen Barbieri served as an Executive Director and as Vice Chairperson and Corporate Secretary of the Company since August 2020. Since

January 2022, Mr. Barbieri has also concurrently served as the Chief Executive Officer of Küleon LLC, a small private biotech company engaged in development

of therapeutic drugs targeting neurologic disorders. From October 1999 through August 2020, Mr. Allen Barbieri also served as an outside

independent director of the Company From March 2015 to April 2022, Mr. Allen Barbieri served as a member of the board of directors of

CareTrust REIT, Inc. (NYSE:CTRE), a large publicly traded real estate investment trust, where he served as Chairman of the Corporate

Governance and Nominating Committee and as a member of the Audit and Compensation Committees. From January 2010 to March 2018, Mr. Allen

Barbieri served as the Chief Executive Officer of Biosynthetic Technologies, a privately held, renewable specialty chemicals company,

with BP and Monsanto as primary owners. Prior to that, from April 2004 to September 2009, Mr. Allen Barbieri served as the Chief Executive

Officer of Lancer Orthodontics, Inc., a medical device company with manufacturing operations in the U.S. and Mexico. From 1998 to 1999,

he served as President and Chief Financial Officer of BUY.COM, a major internet retailer, and from 1994 to 1999 Mr. Allen Barbieri was

President and Chief Executive Officer of Pacific National Bank. Mr. Allen Barbieri holds an MBA from Massachusetts Institute of Technology

(MIT).

We

believe Mr. Allen Barbieri is qualified to serve on our Board due to his extensive knowledge of the Company’s business and

operations, his financial expertise in investment banking and experience as a Chief Executive Officer and Chief Financial Officer of

public and private institutions, his education, and his prior experience as a board member of numerous public and private

companies.

Dr.

Jane Emerson

Dr.

Jane Emerson has served as a Director of the Company since April 2007. Since July 1, 2009, Dr. Emerson has served as Vice Chair for Clinical

Programs and Chief of Clinical Pathology at the University of Southern California Keck School of Medicine, Los Angeles, California. From

1994 to 2009, Dr. Emerson was on the faculty of the University of California, Irvine School of Medicines where she served as Chief of

Clinical Pathology, and from 2000 to 2009, she served as the Vice Chair for Clinical Programs, Department of Pathology, and Laboratory

Medicine. Dr. Emerson holds a MD from the University of Virginia, completed a residency in Laboratory Medicine at Johns Hopkins, and

earned a PhD in Physics from Brown.

We

believe Dr. Emerson is qualified to serve on our Board due to her extensive education, her industry leading experience in the clinical

laboratory sector, her knowledge of clinical lab products and the process of attaining regulatory clearance for new lab-based diagnostic

tests, and her 13 years of experience of service on the Board of the Company.

Catherine

Coste

Ms.

Catherine Coste has served as a Director of the Company since September 2020. Ms. Catherine Coste retired from Deloitte and Touche LLP

(“Deloitte”), an industry-leading audit, consulting, tax and advisory firm, in 2020, where she was a senior Partner and served

as one of Deloitte’s Life Sciences industry executive leaders. During her career at Deloitte, Ms. Catherine Coste was directly

involved with over 30 life science corporations, the majority of which were large-cap and medium-cap public corporations. Ms. Catherine

Coste has served as an Independent Director at Minerva Surgical, Inc., a commercial-stage medical technology company, since February

2021, where she is Chair of the Audit Committee and a Member of the Compensation Committee. Ms. Catherine Coste has also served as an

Independent Director at Renalytix, plc(NASDAQ: RNLX), an artificial intelligence-enable in vitro diagnostics company, since June 2023,

where she Chairs the Audit Committee and is also a Member of the Renumeration Committee. Ms. Catherine Coste spent 32 years in both corporate

and professional services positions leading global finance, internal audit and operations teams. She has extensive experience in Sarbanes-Oxley

compliance, corporate risk analysis and management, cyber risk assessment, fraud prevention, IT systems analysis and upgrades, internal

controls, and corporate governance. Ms. Catherine Coste is a Certified Public Accountant in California and holds a Bachelor of Science

in Business Administration with a focus on Accounting from California State University, Hayward.

We

believe Ms. Catherine Coste is qualified to serve on our Board due to her education, her extensive work experience as a partner at

Deloitte, more than 20 years of experience advising life sciences companies in multiple areas of their operations

including accounting and finance, and other experience serving on the board of a public life science company.

David

Moatazedi

Mr.

David Moatazedi has served as a Director of the Company since September 2020. Mr. David Moatazedi has served as the President and

Chief Executive Officer, and as a member of the of board of directors of Evolus, Inc. (“Evolus”) (NASDAQ: EOLS), since

May 2018. Evolus is a publicly traded life sciences company headquartered in Orange County, California, with a market capitalization

of approximate $500 million. From March 2017 to June 2020, David also served as an independent board member of Obalon Therapeutics,

a publicly traded life sciences company that was later merged into ReShape Lifesciences Inc. From 2016 to 2018, Mr. David Moatazedi

served as Senior Vice President at Allergan Inc. (“Allergan”), and head of the U.S. Medical Aesthetics division. Mr.

David Moatazedi also worked in various other leadership positions within Allergan since 2005, including Vice President, Sales and

Marketing of the U.S. Facial Aesthetics, and the U.S. Plastic Surgery Divisions. Before Allergan, from 2000 to 2005 Mr. David

Moatazedi was a district manager for Novartis Pharmaceuticals, a multinational pharmaceuticals company. Mr. David Moatazedi holds,

an MBA from Pepperdine University and a BA degree from California State University, Long Beach.

We

believe Mr. David Moatazedi is qualified to serve on our Board due to his education, his financial expertise, his experience as a

Chief Executive Officer of a publicly traded life sciences company, his professional experiences, and his prior experience serving

as a member of the board of directors of a public life science company.

BOARD

DIVERSITY

The

diversity of the Company’s Board is listed below and is reviewed annually by the Board.

| Board

Diversity Matrix (as of September 30, 2024) |

| Total Number of Directors |

|

5 |

|

|

|

|

|

|

| |

|

Female |

|

Male |

|

Non-

Binary |

|

Did

Not Disclose Gender |

| Part I: Gender Identity |

|

|

|

|

|

|

|

|

| Directors |

|

2 |

|

3 |

|

- |

|

- |

| Part II: Demographic Background |

|

|

|

|

|

|

|

|

| African American or Black |

|

- |

|

- |

|

- |

|

- |

| Alaskan Native or Native American |

|

- |

|

- |

|

- |

|

- |

| Asian |

|

- |

|

- |

|

- |

|

- |

| Hispanic or Latinx |

|

- |

|

- |

|

- |

|

- |

| Native Hawaiian or Pacific Islander |

|

- |

|

- |

|

- |

|

- |

| White |

|

2 |

|

3 |

|

- |

|

- |

| Two or More Races or Ethnicities |

|

- |

|

- |

|

- |

|

- |

| LGBTQ+ |

|

- |

|

- |

|

- |

|

- |

| Did Not Disclose Demographic Background |

|

- |

|

- |

|

- |

|

- |

Vote

Required and Board Recommendation

Each

director nominee shall be elected by a plurality vote of the stockholders of the Company present in person or by proxy at the Annual

Meeting and entitled to vote.

Our

Board Recommends that the Stockholders Vote “FOR” the Election of Each of the Five Director Nominees.

EXECUTIVE

OFFICERS

The

following table sets forth the names, ages and positions of our executive officers:

| Name |

|

Age |

|

Position(s) |

| Zackary

Irani |

|

58 |

|

Chief

Executive Officer |

| Allen

Barbieri |

|

66 |

|

Executive

Vice Chairperson |

| Gary

Lu |

|

44 |

|

Chief

Financial Officer |

The

following provides certain biographical information with respective to each of our executive officers who is not a director.

| Zackary

Irani |

Mr.

Zackary Irani’s background is discussed above under the heading “Background of Nominees.” |

| |

|

| Allen

Barbieri |

Mr.

Allen Barbieri’s background is discussed above under the heading “Background of Nominees.” |

| |

|

| Gary

Lu |

Mr.

Gary Lu has served as the Chief Financial Officer of the Company since March 2023. Mr. Gary Lu brings over 20 years of diverse

extensive experience with SEC publicly traded and privately held companies in corporate strategy, financial management, operations,

fundraising, and merger and acquisition activities. Prior to joining the Company, from September 2019 to February 2023, Mr. Gary Lu

served as the Controller and Vice President of Finance at Happy Money, a leading platform for unsecured lending. From January 2019

to September 2019, Mr. Gary Lu served as Controller and Vice President of Finance at Verb Technology Company, Inc. (NASDAQ: VERB), a

software company. From January 2015 to January 2019, Mr. Gary Lu served as Vice President Southwest Corporate Controller at

FirstService Residential Management, Inc., a property management company, and the largest subsidiary of FirstService Corporation

(NASDAQ: FSV). From October 2014 to January 2015, he served as the Corporate Controller and Head of Finance at Hoag Orthopedic

Institute, LLC, a nationally ranked organization for orthopedic care. From December 2008 to October 2014, he served within various

finance cross-disciplined roles at Broadcom Inc. (NASDAQ: AVGO), a semi-conductor manufacturing company. Mr. Gary Lu began his

career at Ernst & Young, LLP, a professional services company, where he served as an Assurance Manager from September 2003 to

November 2008, and provided assurance services to both publicly traded and private company clients of the firm. Mr. Gary Lu is a

certified public accountant and received a BA in Economics and Accounting from the University of California, Los Angeles

(UCLA). |

BOARD

OF DIRECTORS MEETINGS AND COMMITTEES

The

Board maintains an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. For the fiscal year

ended May 31, 2024, the Board held eight in-person or telephonic Board meetings, three of which were strategy and update meetings

with management, and acted by unanimous written consent three times. The Audit Committee held seven meetings;

the Compensation Committee held four meetings; and the Nominating and Corporate Governance Committee held four meetings. During the fiscal

year ended May 31, 2024, all directors attended 75% or more of the aggregate meetings of the Board and the Committees on which

they served.

NOMINATING

AND CORPORATE GOVERNANCE COMMITTEE

The

Company has a Nominating and Corporate Governance Committee Charter which may be viewed on the Company’s website at www.biomerica.com.

The

Company has a standing Nominating and Corporate Governance Committee (the “Governance Committee”). The Governance Committee

regularly assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise

arise. In the event that vacancies are anticipated or otherwise arise, the Governance Committee utilizes a variety of methods for identifying

and evaluating director candidates. The Governance Committee will consider candidates recommended by current directors, professional

search firms, stockholders or other persons.

To

select a director candidate, the Governance Committee undergoes a series of discussions and review of the candidates. Once the Governance

Committee has identified a prospective nominee, the Governance Committee will evaluate the prospective nominee in the context of the

then current composition of the Board and will consider a variety of other factors, including the prospective nominee’s public

company experience, corporate governance experience, business, technology, strategy, and industry experience, finance and financial reporting

experience, and other attributes that would be expected to contribute to an effective Board. The Board seeks to identify nominees who

possess a diverse range of experience, skills, areas of expertise, industry knowledge, business judgment, and professional ethics and

values. Although the Governance Committee does not have a formal policy with respect to diversity, it has a well-established process to identify

director nominees, and considers diversity when evaluating candidates for director nominees. The Board does not evaluate stockholder

nominees differently than any other nominee.

Our

Board will consider stockholder nominations for directors if we receive timely written notice, in proper form, of the nomination. To

be timely, the notice must be received within the time frame discussed below in this Proxy Statement under the heading “Date of

Submission of Stockholder Proposals.” To be in proper form, the notice must, among other matters, include each nominee’s

written consent to serve as a director for the Company if elected at the next annual meeting, a description of all arrangements

or understandings between the nominating stockholder and the nominee, and certain other information about the nominating

stockholder and the nominee.

The

Governance Committee met four times during the fiscal year ended May 31, 2024. For the fiscal year ended May 31, 2024, the Committee

consisted of Mr. Jack Kenny, Dr. Jane Emerson, Mr. David Moatazedi and Ms. Catherine Coste, with Mr. Jack Kenny serving as Chairperson

of the Governance Committee. Following our fiscal year end, on June 24, 2024, Mr. Jack Kenny resigned as an independent member

of the Board, thereby vacating his position as Chair of the Governance Committee. In response, the Board appointed Dr. Jane Emerson as

Chairperson of the Governance Committee, with Mr. David Moatazedi and Ms. Catherine Coste continuing to serve as members. After

the Annual Meeting, it is anticipated that Dr. Jane Emerson will continue to serve as Chair of the Governance Committee

and Mr. David Moatazedi and Ms. Catherine Coste will remain members.

COMPENSATION

COMMITTEE

The

Company has a Compensation Committee Charter which may be viewed on the Company’s website at www.biomerica.com.

The

Compensation Committee is responsible for assisting the Board in discharging its responsibilities regarding the compensation of our employees

and directors. The specific duties of the Compensation Committee include, among other matters: reviewing and approving executive compensation;

evaluating our executive officers’ performance; setting the compensation levels of our executive officers; setting our incentive

compensation plans, including our equity-based incentive plans; making recommendations to the Board for annual compensation of directors;

and making recommendations to our Board regarding our overall compensation structure, policies and programs.

The

Compensation Committee may delegate authority to the chief executive officer or the chief financial officer to grant equity

incentive plan awards to our non-executive employees consistent with the parameters approved in advance by the compensation committee.

Historically, our Chief Executive

Officer and Executive Vice-chairperson have provided input and recommendations to the Compensation Committee on the compensation

of executive officers and members of the Board. In addition, representatives from our executive management team finance function have

provided information or recommendations to the Compensation Committee regarding design of any cash and equity incentive programs. Also,

while the Compensation Committee does not officially retain an executive compensation consultant, it does obtain industry and peer-group

compensation information from certain national compensation consulting firms and other industry resources. The Compensation Committee

reviews all of this input and information in determining and setting director and executive officer compensation plans. All decisions

affecting executive officer compensation are made by the Compensation Committee, in its sole discretion.

The

Compensation Committee met four times during the fiscal year ended May 31, 2024. One Compensation Committee meetings was held without

management, and three Compensation Committee meetings were held with management attending at least a portion of the meeting. At

fiscal year-end May 31, 2024, the Compensation Committee was comprised of Mr. David Moatazedi, Dr. Jane Emerson and Ms. Catherine Coste,

with Mr. David Moatazedi serving as Chairperson of the Compensation Committee. It is anticipated that Mr. David Moatazedi will continue

to serve as Chairperson of the Compensation Committee after the Annual Meeting, and Dr. Jane Emerson and Ms. Catherine Coste will

remain members.

AUDIT

COMMITTEE

The

Company has an Audit Committee Charter which may be viewed on the Company’s website at www.biomerica.com.

The

Audit Committee is responsible for overseeing our accounting and financial reporting processes and the audits of our financial statements.

In addition, the Audit Committee assists the Board in its oversight of our compliance with legal and regulatory requirements. The specific

duties of the Audit Committee include, among others: monitoring the integrity of our financial process and systems of internal controls

regarding finance, accounting and legal compliance; selecting our independent auditor; monitoring the independence and performance of

our independent auditor; and providing an avenue of communication among the independent auditor, our management and our Board. The Audit

Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to

all of our employees and to the independent auditor. The Audit Committee also has the ability to retain, at the Company’s expense

and without further approval of the Board, special legal, accounting, or other consultants or experts that it deems necessary in the

performance of its duties.

The

Audit Committee met seven times during the fiscal year ended May 31, 2024. For the fiscal year ended May 31, 2024, the Audit Committee

consisted of Ms. Catherine Coste, Mr. Jack Kenny, and Mr. David Moatazedi, with Ms. Catherine Coste serving as Chairperson of the Audit

Committee. Following our fiscal year end, on June 24, 2024, Mr. Jack Kenny resigned as an independent member of the Board, thereby

vacating his position as a member of the Audit Committee. In response, the Board appointed Dr. Jane Emerson as a member of the Audit

Committee. It is anticipated that Ms. Catherine Coste will serve as the Chairperson of the Audit Committee after the Annual

Meeting, and Dr. Jane Emerson and Mr. David Moatazedi will remain members. The Board has determined that Ms. Catherine Coste qualifies

as an “audit committee financial expert” and that each member of the Audit Committee is financially literate. All members

of the Audit Committee meet the independence standards set forth in applicable Securities and Exchange Commission (“SEC”) and Nasdaq rules.

DIRECTOR

INDEPENDENCE

The

Board reviews the independence of each director when he or she is elected to the Board and monitors their independence

on a continual basis. The Board considers the transactions and relationships between each member and the Company in determining independence.

The Board determines independence based on the definition of “Director Independence” as defined by SEC

rules and as determined in accordance with Rule 5605 of the Marketplace Rules of Nasdaq. Based upon that review, the Board has

affirmatively determined that Ms. Catherine Coste, Mr. David Moatazedi, and Dr. Jane Emerson are independent, (collectively, the “Independent Directors”).

BOARD

LEADERSHIP STRUCTURE

The Board selects a Chairperson

in a manner it determines to be in the best interests of the Company. It is in the Board’s discretion to determine whether the

same individual should serve as both the Chief Executive Officer and Chairperson of the Board or whether those roles should be

separated. During the fiscal year ended May 31, 2024, Mr. Zackary Irani served as both Chairperson of the Board and Chief Executive Officer

until January 23, 2024, at which time the Board decided the roles should be separated. On January 23, 2024, Mr. Jack Kenny was appointed

Chairperson of the Board and Mr. Zackary Irani continued to serve as Chief Executive Officer. On June 24, 2024, Mr. Jack Kenny resigned

as an independent Board member and vacated his position as Chairperson of the Board. His resignation was not due to any disagreement

with the Company on matters related to its operations, policies, or practices. At this time, the Board has not yet appointed a new person

to serve as the Chairperson of the Board.

The

Board believes it is appropriate for Mr. Zackary Irani to serve as Chief Executive Office due to his extensive knowledge of, and experience

in, the global medical diagnostic industry. This knowledge and experience is critical in identifying strategic priorities and providing

unified leadership in the execution of strategy. The Company believes that Mr. Zackary Irani’s experience and knowledge as the

Chief Executive Officer of the Company is an asset to the Company with independent board leadership provided by the Independent Directors.

In April 2020, the Board appointed

Mr. Allen Barbieri as Executive Vice Chairperson and Corporate Secretary. In this role, Mr. Allen Barbieri took on key responsibilities,

including involvement in the operations, strategic transactions and accounting and finance areas of the Company. With this

increased involvement in the Company, in August 2020, Mr. Allen Barbieri stepped down from all Board committees and transitioned

from an independent outside director to an executive director, retaining the title of Executive Vice Chairperson and Secretary.

This transition allows Mr. Allen Barbieri to be more actively involved in the Company’s daily operations, regulatory and legal

matters, and strategic relationships.

BOARD

ROLE IN RISK OVERSIGHT

The

Board is responsible for oversight of material risks facing the Company, including financial, cybersecurity, and compliance risks, while

our management team is responsible for the day-to-day management of risk. In addition, the Board has delegated oversight of certain categories

of risk to the Audit Committee and the Compensation Committee, which are comprised entirely of independent directors. The Audit Committee

and the Compensation Committee respectively report to the Board as appropriate on matters that involve specific areas of risk that each

committee oversees.

Financial,

Compliance and Controls Risks

The

Audit Committee has scheduled periodic and annual reviews and discussions with management regarding significant risk exposures and incident

metrics, including those relating to global financial, accounting, and treasury matters, internal audit and controls, and legal and regulatory

compliance. These discussions cover the steps management has taken to monitor, control, and report such exposures, as well as the Company’s

policies with respect to risk assessment and risk management.

Employee

Compensation Risks

The

Compensation Committee oversees management of risks relating to the Company’s compensation plans and programs. The Company’s

management and the Compensation Committee have assessed the risks associated with the Company’s compensation policies and practices

for all employees, including non-executive officers. These include risks relating to setting ambitious targets for our employees’

compensation or the vesting of their equity awards, our emphasis on at-risk equity-based compensation, discrepancies in the values of

equity-based compensation depending on employee tenure relative to increases in stock price over time and the potential impact of such

factors on the retention or decision-making of our employees, particularly our senior management. Based on the results of this assessment,

the Company does not believe that its compensation policies and practices for all employees, including non-executive officers, create

risks that are reasonably likely to have a material adverse effect on the Company.

REPORT

OF THE AUDIT COMMITTEE

The

information in this Report of the Audit Committee is not deemed “soliciting material” or to be “filed” with the

SEC.

The

Audit Committee oversees the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility

for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities,

the Audit Committee reviewed and discussed the audited consolidated financial statements in the Annual Report with management

including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments,

and the clarity of disclosures in the consolidated financial statements.

The

Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited

consolidated financial statements with accounting principles generally accepted in the United States of America, their judgments as to

the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed

by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) including Auditing Standard

No. 1301, “Communication with Audit Committees,” and the SEC. The Audit Committee has discussed with the independent

auditors their independence from management and the Company, and the Audit Committee has received the written disclosures and the letter

from the independent accountant required by applicable requirements of the PCAOB, including Rule 3526 “Communication

with Audit Committees Concerning Independence,” and has discussed with the independent auditors its independence

from the Company and its management.

The

Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their audit. The Audit Committee

meets with the independent auditors, with and without management present, to discuss the results of their examinations, their understanding

of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In

reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board (and the Board has approved)

that the audited consolidated financial statements be included in the Annual Report for the fiscal year ended May 31, 2024. The

Audit Committee and the Board have also recommended the selection of the Company’s independent auditors, Haskell & White LLP.

| |

AUDIT

COMMITTEE |

| |

|

| |

Ms.

Catherine Coste (Chair) |

| |

Mr.

David Moatazedi |

| |

Dr.

Jane Emerson |

EXECUTIVE

COMPENSATION OF NAMED EXECUTIVE OFFICERS

In

December 2023, our Compensation Committee conducted its annual review of our compensation philosophy and made recommendations to the

Board, which set the total compensation plan for our Named Executive Officers. This review included certain market data, other factors,

and operational performance of the Company. The focus of the Compensation Committee, the Board, and management is aligning management

total compensation with shareholder return. As such, the Company pays below market salaries and cash bonuses (when paid) and focuses

on equity awards for Named Executive Officers.

Cash

Compensation

We

use salary to compensate our Named Executive Officers for services rendered during the year and to recognize each of their experience,

skills, knowledge, and responsibilities required of each Named Executive Officers. Our Compensation Committee considers adjustments

to salary to reflect market conditions and Company results.

Equity

Compensation

We

view equity awards as the critical element of total compensation of our Named Executive Officers. Although we do not specifically tie

any portion of a Named Executive Officer’s equity compensation to Company performance, the Company utilizes incentive stock options

as equity awards, the value of which bears a direct correlation to total shareholder return. Stock options issued to Named Executive

Officers, often vest over a four-year period and are always issued with an exercise price equal to the then current market price of the

Company’s Common Stock. As such, the value in these issued stock options is tied to long-term increases in stockholder value. Further,

since issued stock options generally vest over four (4) years, these stock options awards serve as a means of retaining our Named Executive

Officers, as well as other employees of the Company.

The

following table sets forth the total compensation earned by the Company’s Chief Executive Officer, Vice Chairperson and Chief Financial

Officer, Treasurer and Secretary (the “Named Executive Officers”) for the fiscal years ended May 31, 2024 and 2023.

EXECUTIVE

COMPENSATION

SUMMARY

COMPENSATION TABLE

| Name and Principal Position | |

Year | |

Salary

($) | | |

Option

Awards

($) (4) | | |

Total

($) | |

| Zackary Irani (1), Chairman and Chief Executive Officer | |

2024 | |

$ | 150,000 | | |

| 210,103 | | |

$ | 360,103 | |

| | |

2023 | |

$ | 141,250 | | |

| - | | |

$ | 141,250 | |

| | |

| |

| | | |

| | | |

| | |

| Allen Barbieri (2), Director, Executive Vice Chairman and Secretary | |

2024 | |

$ | 124,583 | | |

| 119,400 | | |

$ | 243,983 | |

| | |

2023 | |

$ | 126,250 | | |

| - | | |

$ | 126,250 | |

| | |

| |

| | | |

| | | |

| | |

| Gary Lu (3), Chief Financial Officer | |

2024 | |

$ | 260,000 | | |

| 125,636 | | |

$ | 385,636 | |

| | |

2023 | |

$ | 65,000 | | |

| 140,098 | | |

$ | 205,098 | |

| (1) |

Mr.

Zackary Irani did not receive a salary increase during the fiscal year ended May 31, 2024.

In the fiscal year ended May 31, 2023, Mr. Zackary Irani’s salary was increased from

$135,000 to $150,000, effective January 1, 2023. In the fiscal years ended May 31, 2024 and

2023, there were no management incentive cash bonuses and Mr. Zackary Irani received no issuance

of stock. Mr. Zackary Irani received a total of 260,000 shares in stock options in the fiscal

year ended May 31, 2024. One option, for 105,000 shares, was granted at the exercise price

of $1.67 per share (market value on the date of grant) and was valued at $84,467. The second

option, for 155,000 shares, was granted at the exercise price of $0.99 per share (market

value on the date of grant) and was valued at $125,636. The value of these options was determined

using the Black-Scholes option-pricing model (which uses assumptions for expected volatility,

expected dividends, expected forfeiture rate, expected term and the risk-free interest rate). |

| |

|

| (2) |

As

part of cost reduction measures during the fiscal year ended May 31, 2024, Mr. Allen Barbieri

voluntarily reduced his salary from $135,000 to $110,000 effective January 1, 2024. In the

previous fiscal year ended May 31, 2023, Mr. Allen Barbieri’s salary was increased

from $120,000 to $135,000, effective January 1, 2023. In the fiscal years ended May 31, 2024

and 2023, there were no management incentive cash bonuses and Mr. Allen Barbieri received

no issuance of stock. Mr. Allen Barbieri received a total of 150,000 shares in stock options

grant in the fiscal year ended May 31, 2024. One option, for 50,000 shares, was granted at

the exercise price of $1.67 per share (market value on the date of grant) and was valued

at $39,451. The second option, for 100,000 shares, was granted at the exercise price of $0.99

per share (market value on the date of grant) and was valued at $79,949. The value of these

options was determined using the Black-Scholes option-pricing model (which uses assumptions

for expected volatility, expected dividends, expected forfeiture rate, expected term and

the risk-free interest rate). |

| |

|

| (3) |

During

the fiscal year ended May 31, 2024, Mr. Gary Lu did not receive a salary increase. In the

previous fiscal year ended May 31, 2023, his salary became effective upon his appointment

as chief financial officer on March 1, 2023. In the fiscal years ended May 31, 2024 and 2023,

there were no management incentive cash bonuses and Mr. Gary Lu received no issuance of stock.

Mr. Gary Lu received a total of 155,000 shares in stock option grants in the fiscal year

ended May 31, 2024. The option was granted at the exercise price of $0.99 per share (market

value on the date of grant) and was valued at $125,636 using the Black-Scholes option-pricing

model (which uses assumptions for expected volatility, expected dividends, expected forfeiture

rate, expected term and the risk-free interest rate). |

| |

|

| (4) |

For

additional information as to the assumptions made in valuation, see Note 2 to the Company’s audited financial statements filed

with the SEC in our Annual Report. |

Employment

Agreement

The

Company has a written employment agreement with Mr. Gary Lu for his role as the Chief Financial Officer of the Company (the “Lu

Employment Agreement”). Mr. Gary Lu’s employment is at-will and may be terminated by him or the Company at any time, with

or without cause or notice. Pursuant to the Lu Employment Agreement, Mr. Gary Lu is entitled to separation pay under the following circumstances:

| |

i. |

Termination

by the Company for Cause: If the Company terminates Mr. Gary Lu for Cause (as defined in the Lu Employment Agreement), Mr. Gary

Lu is entitled to all accrued but unpaid base salary and any accrued but unused paid time-off to the date of the termination. |

| |

ii. |

Termination

by the Company without Cause: If the Company terminates Mr. Gary Lu without Cause (as defined in the Lu Employment Agreement),

Mr. Gary Lu shall be paid all accrued but unpaid base salary and any accrued but unused paid time-off to the date of the termination.

In the event Mr. Gary Lu is terminated by the Company without Cause, including following a Change in Control (as defined by the Lu

Employment Agreement), he will be eligible for severance pay that is equal to 12 months of Mr. Gary Lu’s base bay, provided that

he does not revoke a general release of claims against the Company and its affiliates, officers, directors, agents, and employees (the

“Severance Payment”). |

| |

|

|

| |

iii. |

Termination

by the Employee with Cause: If Mr. Gary Lu terminates his employment with the Company with Cause, including a termination with

Cause following a Change in Control, he will be eligible for a Severance Payment. In the event of a termination of employment by Mr.

Gary Lu with Cause following a Change in Control, all unvested stock options previously issued to him shall become immediately vested

and exercisable. |

OUTSTANDING

EQUITY AWARDS AT FISCAL YEAR-END

| | |

| |

Option Awards | | |

|

| Name | |

Option Grant Date(1) | |

Number of Securities Underlying Unexercised Options (#) Exercisable | | |

Number

of Securities Underlying Unexercised Options (#) Unexercisable | | |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options | | |

Option Exercise

Price ($) | | |

Option Expiration Date |

| Zackary Irani(2) | |

2/26/2015 | |

| 105,000 | | |

| 0 | | |

| 0 | | |

$ | 0.82 | | |

2/26/2025 |

| | |

3/24/2016 | |

| 100,000 | | |

| 0 | | |

| 0 | | |

$ | 1.20 | | |

3/24/2026 |

| | |

1/22/2018 | |

| 75,000 | | |

| 0 | | |

| 0 | | |

$ | 3.90 | | |

1/22/2028 |

| | |

12/20/2018 | |

| 150,000 | | |

| 0 | | |

| 0 | | |

$ | 2.25 | | |

12/20/2028 |

| | |

12/19/2019 | |

| 125,000 | | |

| 0 | | |

| 0 | | |

$ | 2.81 | | |

12/19/2029 |

| | |

12/10/2020 | |

| 58,962 | | |

| 19,654 | | |

| 0 | | |

$ | 6.36 | | |

12/10/2030 |

| | |

12/9/2021 | |

| 50,000 | | |

| 50,000 | | |

| 0 | | |

$ | 4.46 | | |

12/9/2031 |

| | |

12/7/2023 | |

| 26,250 | | |

| 78,750 | | |

| 0 | | |

$ | 1.67 | | |

4/20/2033 |

| | |

12/13/2023 | |

| 0 | | |

| 155,000 | | |

| 0 | | |

$ | 0.99 | | |

12/13/2033 |

| | |

2/26/2015 | |

| 30,000 | | |

| 0 | | |

| 0 | | |

$ | 0.82 | | |

2/26/2025 |

| | |

3/24/2016 | |

| 35,000 | | |

| 0 | | |

| 0 | | |

$ | 1.20 | | |

3/24/2026 |

| | |

12/10/2020 | |

| 30,000 | | |

| 0 | | |

| 0 | | |

$ | 6.36 | | |

12/10/2030 |

| | |

1/22/2018 | |

| 25,000 | | |

| 0 | | |

| 0 | | |

$ | 3.90 | | |

1/22/2028 |

| Allen Barbieri(3) | |

12/20/2018 | |

| 50,000 | | |

| 0 | | |

| 0 | | |

$ | 2.25 | | |

12/20/2028 |

| | |

12/19/2019 | |

| 50,000 | | |

| 0 | | |

| 0 | | |

$ | 2.81 | | |

12/19/2029 |

| | |

12/9/2021 | |

| 45,000 | | |

| 0 | | |

| 0 | | |

$ | 4.46 | | |

12/9/2031 |

| | |

12/7/2023 | |

| 50,000 | | |

| 0 | | |

| 0 | | |

$ | 1.67 | | |

4/20/2033 |

| | |

12/13/2023 | |

| 0 | | |

| 100,000 | | |

| 0 | | |

$ | 0.99 | | |

12/13/2033 |

| Gary Lu(4) | |

4/6/2023 | |

| 25,000 | | |

| 75,000 | | |

| 0 | | |

$ | 1.74 | | |

4/6/2033 |

| | |

12/13/2023 | |

| 0 | | |

| 155,000 | | |

| 0 | | |

| 0.99 | | |

12/13/2033 |

| (1) |

The

vesting dates coincide with the option grant date annually for options held at the fiscal

year-end. |

| |

|

| (2) |

For Mr. Zackary Irani, 25% of the option awards granted

on 12/7/2023 vested immediately, while the remaining 75% will vest in equal installments over a 36-month period. The option awards

granted to him on 1/22/2018 also vest in equal installments over a 36-month period. All other option awards granted to Mr. Zackary

Irani vest in equal installments over a 48-month period. |

| |

|

| (3) |

All share option awards granted to Mr. Allen Barbieri

vest in equal installments over a 12-month period. |

| |

|

| (4) |

All share option awards granted to Mr. Gary Lu vest in equal installments

over a 48-month period. |

ITEM

402(v) PAY VERSUS PERFORMANCE

The

disclosure included in this section is prescribed by SEC rules and does not necessarily align with how the Company or the

Compensation Committee view the link between the Company’s performance and named executive officer pay. This disclosure is

intended to comply with the requirements of Item 402(v) of Regulation S-K applicable to “smaller reporting companies.”

The tabular disclosure of pay versus performance, as required by Section 953(a) of the Dodd-Frank Wall Street Reform and

Consumer Protection Act and Item 402(v) of Regulation S-K, pertains to the relationship between executive compensation

actually paid and certain financial performance metrics of the Company. The following table sets forth information

concerning compensation actually paid (the “CAP”) to our principal executive officer (the

“PEO”) and our non-PEO named executive officers (the “NEOs”) versus our total shareholder return (the

“TSR”) and net income (loss) performance results for the fiscal years ended May 31, 2024, 2023, and 2022. The

amounts set forth below under the headings “Compensation Actually Paid to PEO” and “Average Compensation Actually

Paid to Non-PEO NEOs” have been calculated in a manner consistent with Item 402(v) of Regulation S-K. Use of the measurement

CAP is required by the SEC’s rules and as a result of the calculation methodology required by the SEC, such amounts differ

from compensation reported in the Summary Compensation Table (the “SCT”) and the compensation decisions described

in the section entitled “Executive Compensation Information”.

| Fiscal Year | |

Summary Compensation Table Total for PEO ($) (1) | | |

Compensation Actually Paid to PEO ($) (3) | | |

Average Summary Compensation Table Total for Non-PEO NEOs ($) (2) | | |

Average Compensation Actually Paid to Non-PEO NEOs ($) (3) | | |

Value of Initial Fixed $100 Investment Based On: Total Shareholder Return ($) (4) | | |

Net Income (Loss) ($) (5) | |

| (a) | |

| (b) | | |

| (c) | | |

| (d) | | |

| (e) | | |

| (f) | | |

| (g) | |

| 2024 | |

| 360,103 | | |

| 199,836 | | |

$ | 314,810 | | |

| 238,392 | | |

| 15.89 | | |

| (5,978,000 | ) |

| 2023 | |

| 141,250 | | |

| (108,437 | ) | |

$ | 174,027 | | |

| 110,778 | | |

| 37.53 | | |

| (7,140,000 | ) |

| 2022 | |

| 491,333 | | |

| 416,627 | | |

$ | 351,744 | | |

| 318,143 | | |

| 95.89 | | |

| (4,531,000 | ) |

| (1) |

The

dollar amounts reported in column (b) are the amounts of total compensation reported for our chief executive officer, Mr.

Zackary Irani, (our PEO) for each corresponding year in the “Total” column of the SCT.

Refer to “Executive Compensation – Summary Compensation Table” |

| |

|

| (2) |

The

dollar amounts reported in column (d) represent the average of the amounts reported for the Non-PEO NEOs (excluding our PEO) in the

“Total” column of the SCT. The Non-PEO NEOs included in the table above were as follows: |

| |

● |

For 2024: Mr. Allen Barbieri and Mr. Gary Lu |

| |

● |

For

2023: Mr. Allen Barbieri, Mr. Gary Lu, and Mr. Steve Sloan |

| |

● |

For

2022: Mr. Allen Barbieri and Mr. Steven Sloan |

| (3) |

The

dollar amounts reported in columns (c) and (e) represent the CAP to Mr. Zackary Irani, and the average CAP to our non-PEO NEOs, respectively,

as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation

earned by or paid to our NEOs during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, to

calculate CAP, compensation related to equity awards were remeasured based on the following: For stock options, a Black-Scholes

(“BSM”) option-pricing model was used as of the applicable year-end date, or, in the case of vested options, the vesting

date. The BSM model requires us to make assumptions and judgments regarding the variables used in the calculation, including the

expected remaining term, expected volatility, and the expected risk-free rate. The valuation assumptions used to calculate the CAP

shown in the table were materially consistent with those used to calculate our share-based compensation expense, as disclosed in

our 2023 Annual Report on Form 10-K. |

The

2024 CAP to our PEO and the average CAP to our non-PEO NEOs reflects the following adjustments required by the applicable SEC rules from

the total compensation reported in the SCT:

| | |

PEO | | |

Average of

Non-PEO NEOs | |

| Total Reported in 2024 SCT | |

| 360,103 | | |

| 314,810 | |

| Less: value of equity awards reported in SCT | |

| (210,103 | ) | |

| (122,518 | ) |

| Add: year-end value of equity awards granted in 2024 that are unvested and outstanding | |

| 102,614 | | |

| 57,148 | |

| Add: change in fair value (from prior year-end) of prior year equity awards that are unvested and

outstanding | |

| (47,169 | ) | |

| (25,380 | ) |

| Add: fair market value of equity awards granted in 2024 and that vested in 2024 | |

| 20,914 | | |

| 19,918 | |

| Add: change in fair value (from prior year-end) of prior year equity awards that vested in 2024 | |

| (26,523 | ) | |

| (5,585 | ) |

| Less: fair market value of equity awards deemed to fail to meet the applicable vesting conditions

during 2024 | |

| - | | |

| - | |

| Compensation Actually Paid for 2024 | |

| 199,836 | | |

| 238,392 | |

The

2023 CAP to our PEO and the average CAP to our non-PEO NEOs reflects the following adjustments required by the applicable SEC rules from

the total compensation reported in the SCT:

| | |

PEO | | |

Average of

Non-PEO NEOs | |

| Total Reported in 2023 SCT | |

| 141,250 | | |

| 174,027 | |

| Less: value of equity awards reported in SCT | |

| - | | |

| (46,699 | ) |

| Add: year-end value of equity awards granted in 2023 that are unvested and outstanding | |

| - | | |

| 35,934 | |

| Add: change in fair value (from prior year-end) of prior year equity awards that are unvested and outstanding | |

| (264,287 | ) | |

| - | |

| Add: fair market value of equity awards granted in 2023 and that vested in 2023 | |

| - | | |

| - | |

| Add: change in fair value (from prior year-end) of prior year equity awards that vested in 2023 | |

| 14,600 | | |

| 4,840 | |

| Less: fair market value of equity awards deemed to fail to meet the applicable vesting conditions during 2023 | |

| - | | |

| (57,323 | ) |

| Compensation Actually Paid for 2023 | |

| (108,437 | ) | |

| 110,778 | |

The

2022 CAP to our PEO and the average CAP to our non-PEO NEOs reflects the following adjustments required by the applicable SEC rules from

the total compensation reported in the SCT:

| | |

PEO | | |

Average of

Non-PEO NEOs | |

| Total Reported in 2022 SCT | |

| 491,333 | | |

| 351,744 | |

| Less: value of equity awards reported in SCT | |

| (356,333 | ) | |

| (150,263 | ) |

| Add: year-end value of equity awards granted in 2022 that are unvested and outstanding | |

| 272,496 | | |

| 113,811 | |

| Add: change in fair value (from prior year-end) of prior year equity awards that are unvested and outstanding | |

| (32,588 | ) | |

| (7,158 | ) |

| Add: fair market value of equity awards granted in 2022 and that vested in 2022 | |

| - | | |

| - | |

| Add: change in fair value (from prior year-end) of prior year equity awards that vested in 2022 | |

| 41,720 | | |

| 10,009 | |

| Compensation Actually Paid for 2022 | |

| 416,627 | | |

| 318,143 | |

| (4) |

TSR

is determined based on the value of an initial fixed investment of $100 on December 31, 2021. Cumulative TSR is calculated by dividing

the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between

the Company’s share price at the end of the measurement period and the Company’s share price at the beginning of the

measurement period. |

| |

|

| (5) |

The

dollar amounts reported in column (g) represent the amount of net loss reflected in the Company’s audited financial statements

for the applicable year. |

Required

Disclosure of the Relationship between Compensation Actually Paid and Financial Performance Measures

In

accordance with Item 402(v) of Regulation S-K, we are providing the following description of the relationship between (1) information

presented in the Pay Versus Performance table above and (2) the executive CAP to our PEO and, on average, to our

other Non-PEO NEOs over the Company’s three most recently completed fiscal years.

Compensation

Actually Paid and Net Income (Loss)

Due

to the nature of our Company’s consolidated financials and primary focus on research and development of diagnostic-guided therapy

products to treat gastrointestinal diseases, our Company has not historically utilized net income (loss) as a performance measure

for our executive compensation program. However, as the inFoods product has now launched, the Board will evaluate the relationship between

our total revenues and net income (loss) and CAP to our PEO and Non-PEO NEOs going forward.

Compensation

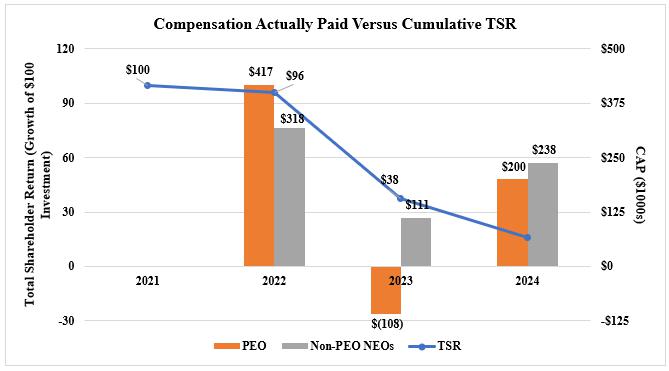

Actually Paid and TSR

The

following graph sets forth the relationship between CAP to our PEO, the average CAP for our Non-PEOs, and the Company’s TSR over

the period covering 2024, 2023, and 2022.

All

information provided above under the “Item 402(v) Pay Versus Performance” heading will not be deemed to be incorporated by

reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended,

whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the

extent the Company specifically incorporates such information by reference.

INDEPENDENT

DIRECTOR COMPENSATION

Our

Independent Directors receive a cash component in addition to an equity component as part of their annual Board retainer fee.

The cash component of Board retainer fees is paid quarterly, while stock options typically vest on the one-year anniversary date of issuance.