NASDAQ false 0001780097 0001780097 2023-10-02 2023-10-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 2, 2023

Baudax Bio, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Pennsylvania |

|

001-39101 |

|

47-4639500 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 490 Lapp Road, Malvern, Pennsylvania |

|

19355 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (484) 395-2470

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Trading

Symbol |

|

Name of Exchange on Which Registered |

| Common Stock, par value $0.01 |

|

BXRX |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Resignation of Corporate Controller

On October 2, 2023, Jillian Dilmore, the Corporate Controller, Principal Financial Officer, Principal Accounting Officer and Corporate Secretary of Baudax Bio, Inc. (the “Company”) notified the Company of her decision to resign effective as of October 9, 2023 (the “Effective Date”). Ms. Dilmore resigned for personal reasons and not as a result of any disagreement with the Company or its independent registered public accountants on any matter relating to the Company’s financial or accounting operations, policies or practices. Ms. Dilmore has agreed to provide continued consulting support to the Company.

Appointment of Interim Chief Financial Officer

On October 5, 2023, the board of directors of the Company appointed Natalie McAndrew as Interim Chief Financial Officer, effective as of the Effective Date. Ms. McAndrew will also assume the duties of the Principal Financial Officer and Principal Accounting Officer of the Company as of the Effective Date. Beginning on the Effective Date, Ms. McAndrew will provide her services as a consultant through Danforth Advisors, LLC (“Danforth”), at an agreed upon hourly rate.

Ms. McAndrew, age 49, is a Director with Danforth, an advisory firm focused on providing financial strategy to life science organizations, and has been employed with Danforth since August 2021. Prior to Danforth, Ms. McAndrew was the VP, Corporate Controller of Tmunity Therapeutics, Inc., a biotechnology company, from January 2021 to July 2021. Ms. McAndrew previously served as Head of Accounting Operations at Spark Therapeutics, Inc., a biotechnology company, from March 2015 until January 2021. Prior to this, Ms. McAndrew served as Corporate Controller for over 8 years in other privately held and public companies at various life cycle stages, managing finance, accounting, and other corporate operational functions. Ms. McAndrew is a certified public accountant and holds a B.S. degree in Accounting from King’s College.

There are no arrangements or understandings between Ms. McAndrew and any other persons pursuant to which Ms. McAndrew was appointed as Interim Chief Financial Officer of the Company. In addition, there are no family relationships between Ms. McAndrew and any director or executive officer of the Company, and there are no transactions involving Ms. McAndrew requiring disclosure under Item 404(a) of Regulation S-K.

On October 6, 2023, the Company updated information reflected in a slide presentation, which is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The Company will use the updated presentation in various meetings with investors from time to time.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are being filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

| Date: October 6, 2023 |

|

Baudax Bio, Inc. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Gerri A. Henwood |

|

|

|

|

Name: |

|

Gerri A. Henwood |

|

|

|

|

Title: |

|

President and Chief Executive Officer |

October 2023 Exhibit 99.1

Forward Looking Statements This

presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Such forward-looking statements reflect Baudax Bio’s expectations about its

future performance and opportunities that involve substantial risks and uncertainties. When used herein, the words “anticipate,” “believe,” “estimate,” “may,” “upcoming,”

“plan,” “target,” “goal,” “intend,” and “expect,” and similar expressions, as they relate to Baudax Bio or its management, and TeraImmune or its management, are intended to identify such

forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on Baudax Bio’s current beliefs, expectations and assumptions regarding the future of its

business, future plans and strategies, clinical results and other future conditions. There are a number of important factors that could cause Baudax Bio’s actual results to differ materially from those indicated or implied by such

forward-looking statements including, without limitation: whether Baudax Bio will be able to successfully integrate the TeraImmune operations and realize the anticipated benefits of the acquisition of TeraImmune; whether Baudax Bio’s

shareholders approve the conversion of the Series X Preferred Stock and the required cash payment of the then-current fair value of the Series X Preferred Stock if such approval is not provided; whether Baudax Bio’s cash resources

will be sufficient to fund Baudax Bio’s continuing operations and the newly acquired TeraImmune operations, including the liabilities of TeraImmune incurred in connection with the completion of the Merger; whether Baudax Bio’s

collaborations will be successful; whether Baudax Bio will be able to advance its current product candidate pipeline through pre-clinical studies and clinical trials, that interim results may not be indicative of final results in clinical

trials, that earlier-stage trials may not be indicative of later-stage trials, the approvability of product candidates; whether Baudax Bio will be able to comply with the financial and other covenants under its credit facility; and whether Baudax

Bio will be able to maintain its listing on the Nasdaq Capital Market. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks anduncertainties. No representations or warranties (expressed or implied)

are made about the accuracy of any such forward-looking statements. Baudax Bio may not actually achieve the forecasts disclosed in such forward-looking statements, and you should not place undue reliance on such forward-looking statements. Such

forward-looking statements are subject to a number of material risks and uncertainties including but not limited to those set forth under the caption “Risk Factors” in Baudax Bio’s most recent Annual Report

on Form 10-K filed with the SEC, as well as discussions of potential risks, uncertainties, and other important factors in its subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was

made. Neither Baudax Bio, nor any of its affiliates, advisors or representatives, undertake any obligation to publicly update or revise any forward-looking statement, whether as result of new information, future events or otherwise, except as

required by law. These forward-looking statements should not be relied upon as representing Baudax Bio’s views as of any date subsequent to the date hereof.

Highlights Baudax Bio: Development and

Commercialization Teraimmune: Discovery Platform and Research IND cleared for TCR Treg, expected “once and done” treatment to eradicate “inhibitors/auto-antibodies” interfering with Factor VIII therapy for Hemophilia A. Q1

‘24 target for first ever human TCR Treg study for any product – will be an open Phase 1/2a study of TI-168 in Hemophilia A with inhibitors. Results for early patients could confirm early tolerability and efficacy. Powerful Combined Team

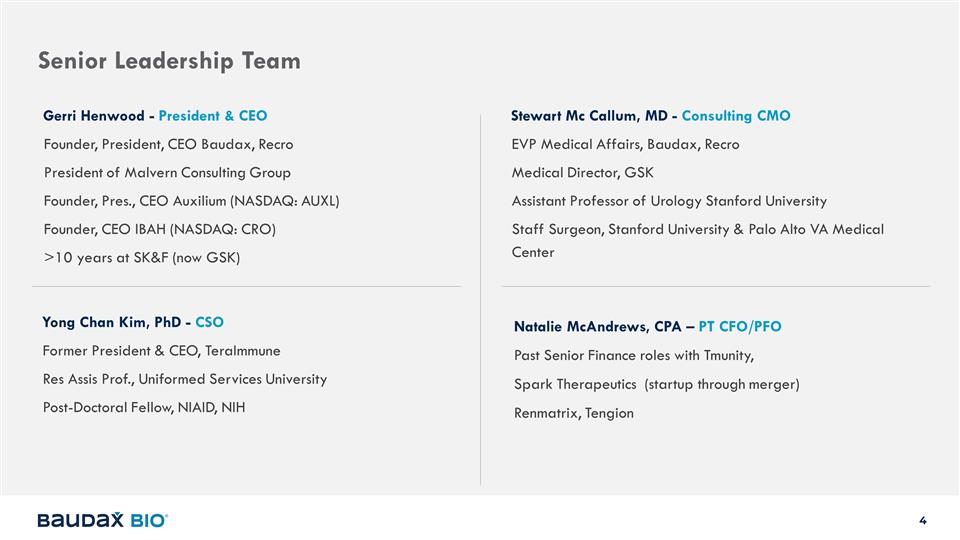

Senior Leadership Team Gerri Henwood -

President & CEO Founder, President, CEO Baudax, Recro President of Malvern Consulting Group Founder, Pres., CEO Auxilium (NASDAQ: AUXL) Founder, CEO IBAH (NASDAQ: CRO) >10 years at SK&F (now GSK) Stewart Mc Callum, MD - Consulting CMO EVP

Medical Affairs, Baudax, Recro Medical Director, GSK Assistant Professor of Urology Stanford University Staff Surgeon, Stanford University & Palo Alto VA Medical Center Yong Chan Kim, PhD - CSO Former President & CEO, TeraImmune Res Assis

Prof., Uniformed Services University Post-Doctoral Fellow, NIAID, NIH Natalie McAndrews, CPA – PT CFO/PFO Past Senior Finance roles with Tmunity, Spark Therapeutics (startup through merger) Renmatrix, Tengion

What is the opportunity? Expected Q1

‘24 open and begin enrollment of Phase 1/2a TI 168 trial in Hemophilia A patients with inhibitors. Clinical trial for an orphan drug complication. Treatment expected to be “once and done” administration of patient’s own

targeted Tregs (modified to block production of Factor VIII inhibitors in Hemophilia A). We believe a TCR Treg autologous product for elimination of the Factor VIII inhibitor in Hemophilia A patients can be developed and commercialized in a timely

and cost-efficient manner. Commercial opportunity could produce peak year sales of $50-100 Million, assuming TPP met.

Hemophilia A with Inhibitors Estimated

180,000 Hemophilia A patients in the developed world Hemophilia A patients do not make Factor VIII, needed for normal blood clotting About 30% of the Hemophilia A patients develop antibodies to Factor VIII, called inhibitors that make it hard to use

Factor VIII medicine for successful treatment Source: The report on the WFH Annual Global Survey 2021; Facts about inhibitors, National Hemophilia Foundation, www.hemophila.org; Grandview research: Hemophilia Market Size, 2020 Fortune Bus.

Insights.com/Hemophila; FDA.gov, Roctavian prescribinbg information, 2023, sec. 8.7.

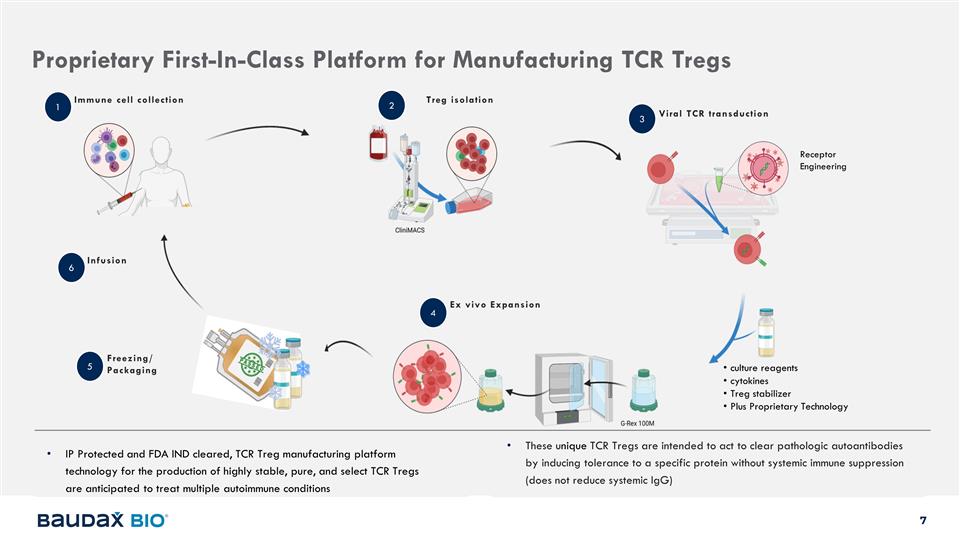

Proprietary First-In-Class Platform

for Manufacturing TCR Tregs These unique TCR Tregs are intended to act to clear pathologic autoantibodies by inducing tolerance to a specific protein without systemic immune suppression (does not reduce systemic IgG) 1 Immune cell collection 2 Treg

isolation 3 Viral TCR transduction 4 Ex vivo Expansion Receptor Engineering culture reagents cytokines Treg stabilizer Plus Proprietary Technology 5 Freezing/ Packaging Infusion 6 IP Protected and FDA IND cleared, TCR Treg manufacturing platform

technology for the production of highly stable, pure, and select TCR Tregs are anticipated to treat multiple autoimmune conditions

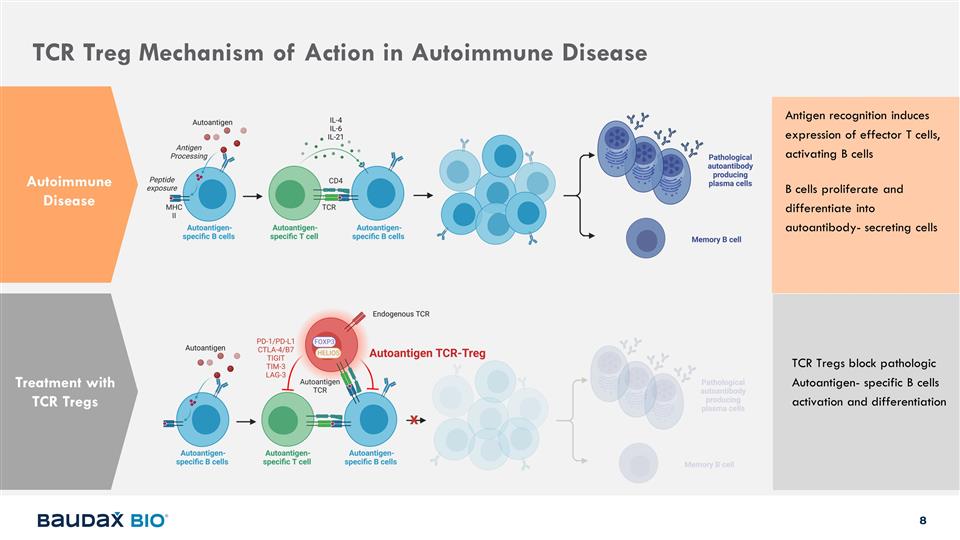

TCR Treg Mechanism of Action in

Autoimmune Disease Autoimmune Disease Treatment with TCR Tregs TCR Tregs block pathologic Autoantigen- specific B cells activation and differentiation Antigen recognition induces expression of effector T cells, activating B cells B cells proliferate

and differentiate into autoantibody- secreting cells

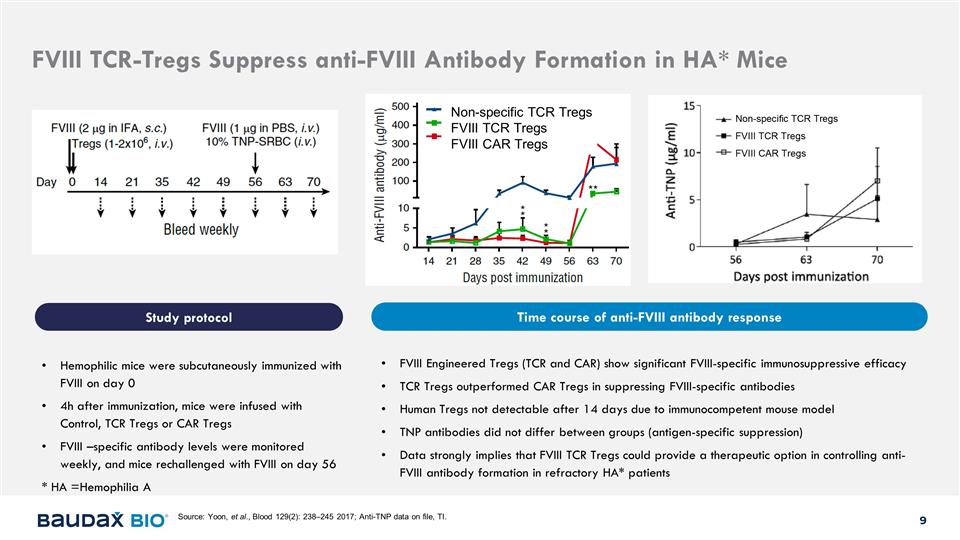

Non-specific TCR Tregs FVIII TCR Tregs

FVIII CAR Tregs Hemophilic mice were subcutaneously immunized with FVIII on day 0 4h after immunization, mice were infused with Control, TCR Tregs or CAR Tregs FVIII –specific antibody levels were monitored weekly, and mice rechallenged with

FVIII on day 56 * HA =Hemophilia A FVIII Engineered Tregs (TCR and CAR) show significant FVIII-specific immunosuppressive efficacy TCR Tregs outperformed CAR Tregs in suppressing FVIII-specific antibodies Human Tregs not detectable after 14 days due

to immunocompetent mouse model TNP antibodies did not differ between groups (antigen-specific suppression) Data strongly implies that FVIII TCR Tregs could provide a therapeutic option in controlling anti-FVIII antibody formation in refractory HA*

patients Source: Yoon, et al., Blood 129(2): 238–245 2017; Anti-TNP data on file, TI. FVIII TCR-Tregs Suppress anti-FVIII Antibody Formation in HA* Mice Study protocol Time course of anti-FVIII antibody response

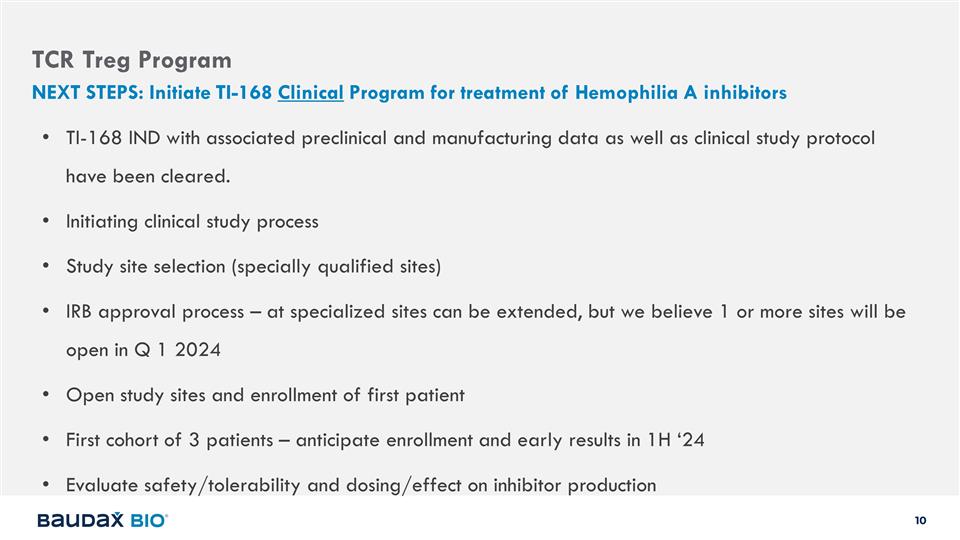

TCR Treg Program TI-168 IND with

associated preclinical and manufacturing data as well as clinical study protocol have been cleared. Initiating clinical study process Study site selection (specially qualified sites) IRB approval process – at specialized sites can be extended,

but we believe 1 or more sites will be open in Q 1 2024 Open study sites and enrollment of first patient First cohort of 3 patients – anticipate enrollment and early results in 1H ‘24 Evaluate safety/tolerability and dosing/effect on

inhibitor production NEXT STEPS: Initiate TI-168 Clinical Program for treatment of Hemophilia A inhibitors

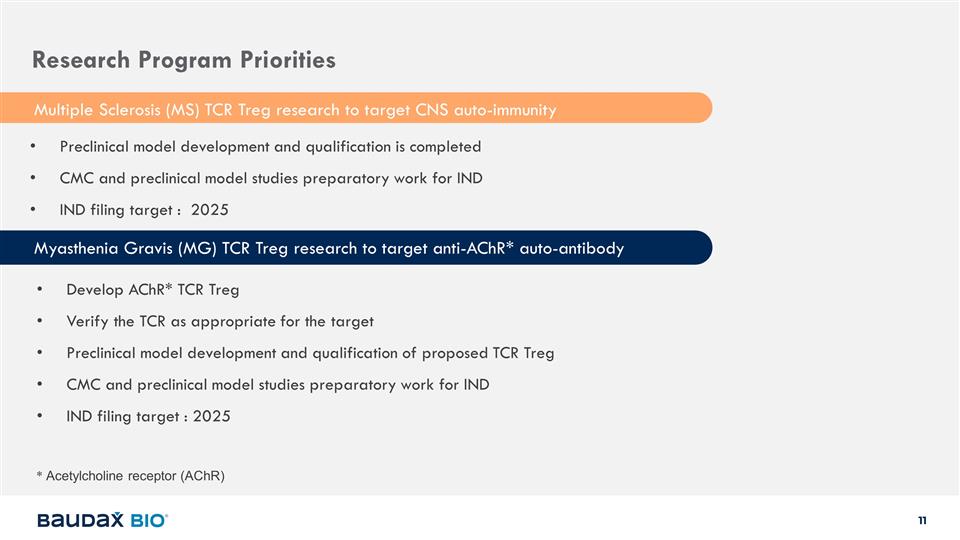

Research Program Priorities Develop

AChR* TCR Treg Verify the TCR as appropriate for the target Preclinical model development and qualification of proposed TCR Treg CMC and preclinical model studies preparatory work for IND IND filing target : 2025 * Acetylcholine receptor (AChR)

Myasthenia Gravis (MG) TCR Treg research to target anti-AChR* auto-antibody Multiple Sclerosis (MS) TCR Treg research to target CNS auto-immunity Preclinical model development and qualification is completed CMC and preclinical model studies

preparatory work for IND IND filing target : 2025

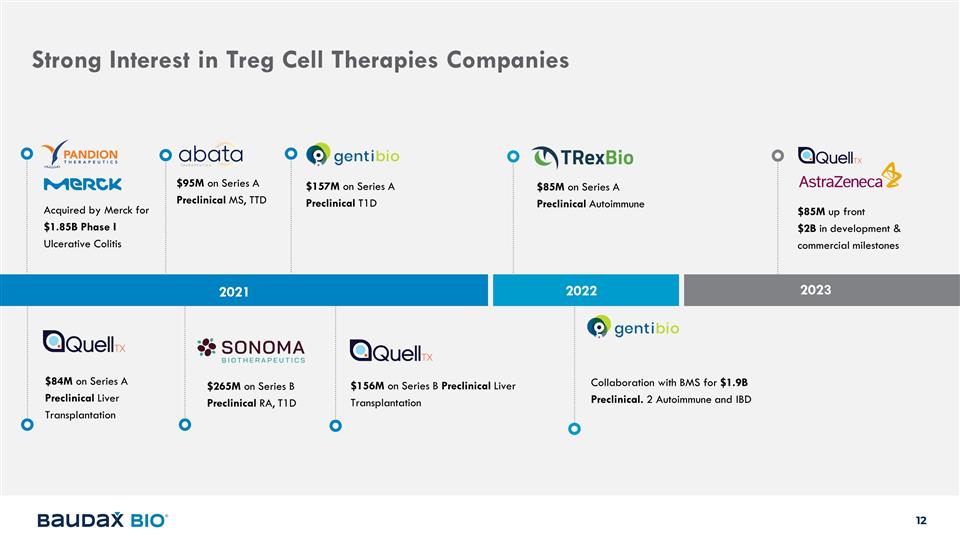

Strong Interest in Treg Cell

Therapies Companies 2021 2022 Acquired by Merck for $1.85B Phase I Ulcerative Colitis $84M on Series A Preclinical Liver Transplantation $95M on Series A Preclinical MS, TTD $85M on Series A Preclinical Autoimmune $157M on Series A Preclinical T1D

$265M on Series B Preclinical RA, T1D Collaboration with BMS for $1.9B Preclinical. 2 Autoimmune and IBD $156M on Series B Preclinical Liver Transplantation 2023 $85M up front $2B in development & commercial milestones

NMB Portfolio

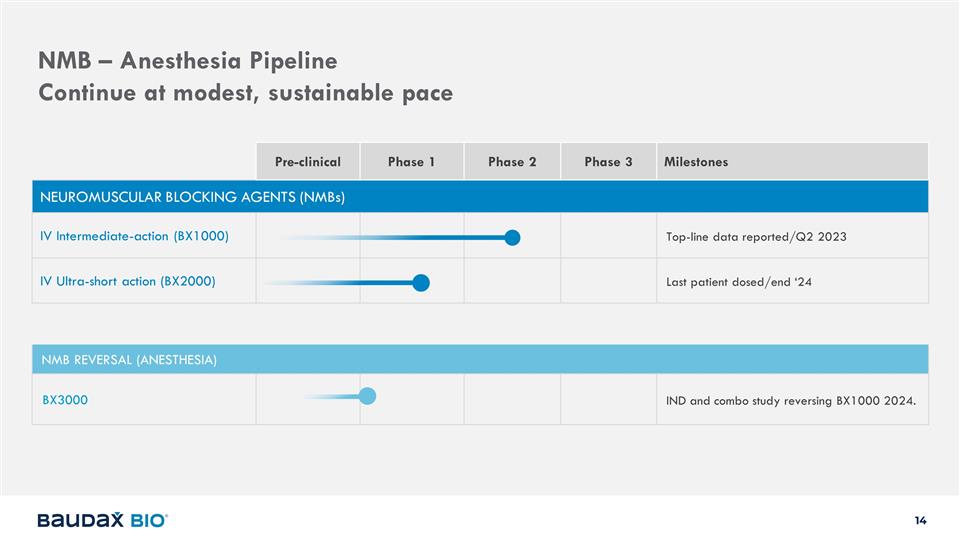

NMB – Anesthesia Pipeline

Continue at modest, sustainable pace Pre-clinical Phase 1 Phase 2 Phase 3 Milestones NEUROMUSCULAR BLOCKING AGENTS (NMBs) IV Intermediate-action (BX1000) Top-line data reported/Q2 2023 IV Ultra-short action (BX2000) Last patient dosed/end ‘24

NMB REVERSAL (ANESTHESIA) BX3000 IND and combo study reversing BX1000 2024.

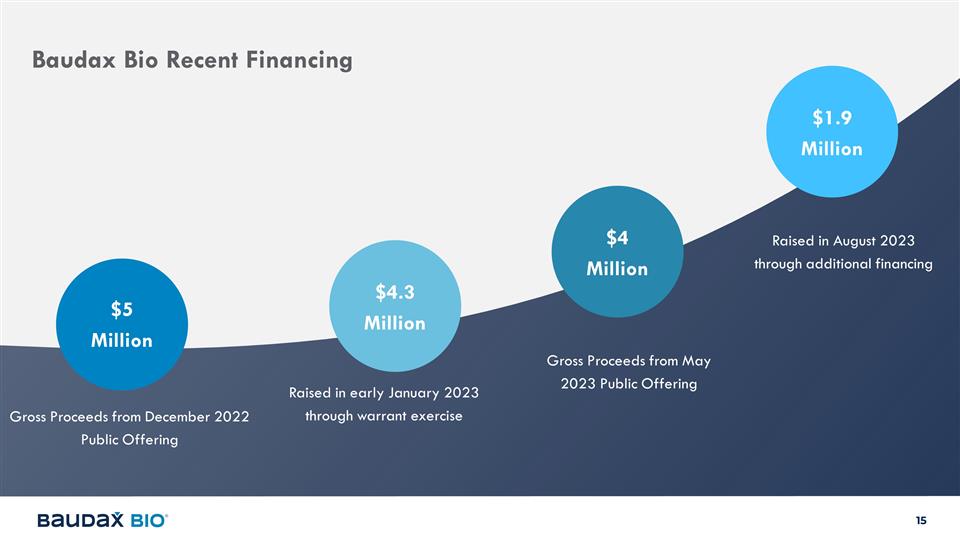

Baudax Bio Recent Financing Gross

Proceeds from December 2022 Public Offering Raised in early January 2023 through warrant exercise $5 Million $4.3 Million Gross Proceeds from May 2023 Public Offering $4 Million Raised in August 2023 through additional financing $1.9 Million

Highlights Baudax Bio: Development

and Commercialization Teraimmune: Discovery Platform and Research IND cleared for TCR Treg, expected “once and done” treatment to eradicate “inhibitors/auto-antibodies” interfering with Factor VIII therapy for Hemophilia A.

Q1 ‘24 target for first ever human TCR Treg study for any product – will be an open Phase 1/2a study of TI-168 in Hemophilia A with inhibitors. Results for early patients could confirm early tolerability and efficacy. Powerful Combined

Team

Contact Information Mike Moyer

LifeSci Advisors mmoyer@lifesciadvisors.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Baudax Bio (NASDAQ:BXRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Baudax Bio (NASDAQ:BXRX)

Historical Stock Chart

From Nov 2023 to Nov 2024