UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-41769

Foremost Lithium Resources & Technology Ltd.

(Translation of registrant's name into English)

750 West Pender Street, Suite 250

Vancouver, BC, V6C 2T7

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

On September 30, 2024, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

(c) Exhibit 99.1. Press release dated September 30, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Foremost Lithium Resources & Technology Ltd. |

| | | (Registrant) |

| | | |

| | | |

| Date: September 30, 2024 | | /s/ Jason Barnard |

| | | Jason Barnard |

| | | President and Chief Executive Officer |

| | | |

EXHIBIT 99.1

Foremost Announces Date for its Annual General and Special Meeting to Approve the Spin-Out of the Winston Group of Gold and Silver Properties

Highlights

- Shareholders of record on November 06, 2024 to vote at Shareholder meeting to be held on December 09, 2024

- Foremost Shareholders as of December 09, 2024, will receive 2 Rio Grande Resources Shares for every 1 Foremost Share, if shareholders vote to approve the Plan of Arrangement

- The board of directors of Foremost unanimously recommends that Foremost Shareholders vote FOR the resolution to approve the Arrangement

VANCOUVER, British Columbia, Sept. 30, 2024 (GLOBE NEWSWIRE) -- Foremost Clean Energy Ltd., (NASDAQ: FMST) (CSE: FAT) (“Foremost Clean Energy”, “Foremost” or the “Company”) an emerging North American uranium and lithium exploration company, is pleased to announce that, further to its announcement of July 30, 2024 with respect to the proposed spin-out of the Winston Group of Gold and Silver Properties (the “Properties”) pursuant to a statutory plan of arrangement under the Business Corporations Act (British Columbia) (the “Arrangement”), it has scheduled its Annual General and Special Meeting (the "Meeting") of shareholders for December 09, 2024 at 11:00 a.m. (Vancouver time). Foremost shareholders (“Foremost Shareholders”) will vote on the Arrangement, among other things, at the Meeting. Full details are provided below under “Further Details of AGSM”.

Pursuant to the Arrangement, the Properties will be transferred to a newly incorporated company, named Rio Grande Resources Ltd. (“Rio Grande”) and Foremost Shareholders will exchange each outstanding common share of Foremost for one (1) new Foremost common share and two (2) common shares of Rio Grande (“Rio Grande Shares”). The Arrangement, if completed, will result in Foremost retaining an approximate 19.95% interest in Rio Grande, prior to the Private Placement described below.

Foremost President and CEO states, “Having a new focused and dedicated team work on Winston will enable us to unlock value for our gold/silver assets. This will be a tremendous win for our shareholders, giving each an equity interest in a new public company at no additional cost to them.”

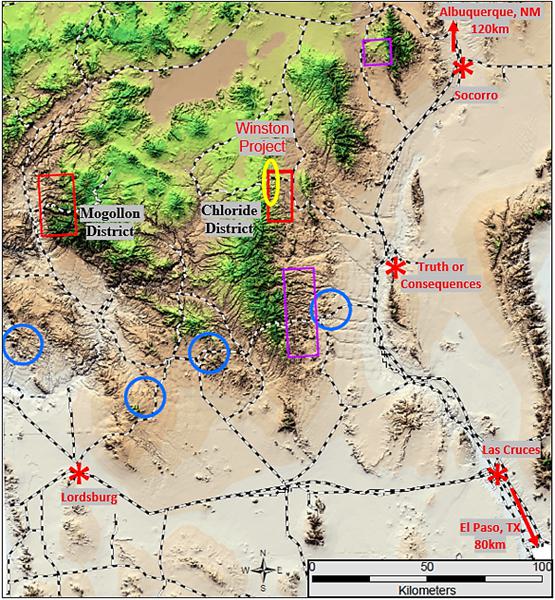

In connection with the Arrangement, the Company has filed an updated independent technical report for the Properties prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") titled "Technical Report for the Winston Gold-Silver Project: Sierra County, New Mexico, USA”. The Properties consist of one-hundred-forty-seven (147) unpatented lode mining claims and two (2) patented mining claims in Sierra County and Catron County, New Mexico. The Properties cover 1,229 hectares (3,037 acres) in the Black Range/Chloride Mining District of central New Mexico and are comprised of three historic past producing gold and silver mines: Ivanhoe, Emporia and Little Granite. Exceptional results from property-wide confirmatory sampling completed in 2021 included many high-grade samples including 41.5 g/t Gold and 4,610 g/t Silver on newly staked claims. Additional samples from these three mines returned peak values of 66.5 g/t gold and 2,940 g/t silver from Little Granite, 26.8 g/t gold and 1,670 g/t silver from Ivanhoe, and 46.1 g/t gold and 517 g/t silver from Emporia.

Figure 1. Winston Project (yellow ellipse) regional location map, showing the north end of Chloride District. Porphyry Copper Deposit (PCD) in blue circles; Base-Metal CRD Districts in purple rectangles; Epithermal Precious Metals in red rectangles

An application has been submitted to the CSE to list Rio Grande Shares upon completion of the Arrangement. It is a condition of the completion of the Arrangement that the CSE, and if required, the NASDAQ, will have conditionally approved the Arrangement, including the listing of the new Foremost common shares and the Rio Grande Shares.

In connection with the Arrangement, Rio Grande is expected to complete a private placement of subscription receipts for approximate aggregate gross proceeds of $1,750,000 (the “Private Placement”), with each subscription receipt automatically converting upon the satisfaction or waiver of conditions precedent to the Arrangement and the listing of the Rio Grande Shares on the CSE into Rio Grande Shares. The gross proceeds of the Private Placement will be held in escrow pending the satisfaction of the release conditions.

Further Details of AGSM

A copy of the arrangement agreement between Rio Grande and Foremost (the “Arrangement Agreement”) pursuant to which the Arrangement will be affected will be filed under Foremost’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Full details of the Arrangement and the other items to be approved by the Foremost Shareholders at the Meeting will be included in a management information circular of Foremost to be provided to Foremost Shareholders by notice-and-access procedures on or about November 5, 2024. Pursuant to those procedures, Foremost Shareholders will receive a notice indicating that the Meeting materials, including the management information circular, have been posted and the process to access or obtain a paper copy of those materials. The management information circular will be posted, together with the notice of the Meeting and other meeting materials, on Foremost’s website at www.foremostcleanenergy.com, on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov under Foremost’s profile.

Foremost Shareholders as of December 09, 2024, will receive 2 Rio Grande Resources Shares for every 1 Foremost Share, if Arrangement is approved with a minimum of 66 2/3% of the votes cast in person or by proxy, at the Meeting. The board of directors of Foremost unanimously recommends that Foremost Shareholders vote FOR the resolution to approve the Arrangement. Foremost Shareholders are urged to carefully review all Meeting materials as they contain important information concerning the Arrangement and the rights and entitlements of the Foremost Shareholders in relation thereto. In addition, at the Meeting, Company shareholders will be asked to consider those matters further described in the notice of the Meeting.

The Arrangement is also subject to the approval of the CSE and the Supreme Court of British Columbia, and applicable regulatory approvals and the satisfaction of certain other closing conditions customary for transactions of this nature. It is anticipated that the closing of the Arrangement will take place prior to December 31, 2024, assuming that the required Foremost Shareholder, court and regulatory approvals have been received by such time, and subject to the other terms and conditions set out in the Arrangement Agreement. There can be no assurance that the Arrangement will be completed as proposed, or at all.

About Foremost

Foremost (NASDAQ: FMST) (CSE: FAT) (FSE: F0R0) (WKN: A3DCC8), assuming the effectiveness of the Transaction, will be an emerging North American uranium and lithium exploration company with interests in 10 prospective properties spanning over 330,000 acres in the prolific, uranium-rich Athabasca Basin. As global demand for decarbonization accelerates, the need for nuclear power is crucial. Foremost expects to be positioned to capitalize on the growing demand for uranium through discovery in a top jurisdiction with the objective of supporting the world’s energy transition goals. Alongside its exploration partner Denison, Foremost will be committed to a strategic and disciplined exploration strategy to identify resources by testing drill–ready targets with identified mineralization along strike of recent major discoveries.

Foremost also maintains a secondary portfolio of significant lithium projects at different stages of development spanning over 50,000 acres across Manitoba and Quebec. For further information please visit the company’s website at www.foremostcleanenergy.com.

Contact and Information

Company

Jason Barnard, President and CEO

+1 (604) 330-8067

info@foremostcleanenergy.com

Investor Relations

Lucas A. Zimmerman

Managing Director

MZ Group - MZ North America

(949) 259-4987

FMST@mzgroup.us

www.mzgroup.us

Follow us or contact us on social media:

Twitter: @fmstcleanenergy

Linkedin: https://www.linkedin.com/company/foremostcleanenergy/

Facebook: https://www.facebook.com/ForemostCleanEnergy/

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release and oral statements made from time to time by representatives of the Company are or may constitute “forward-looking statements” as such term is used in applicable United States and Canadian laws and including, without limitation, within the meaning of the Private Securities Litigation Reform Act of 1995, for which the Company claims the protection of the safe harbor for forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management and include statements with respect to the Meeting, including the timing thereof, the Meeting Materials and the delivery thereof, the Arrangement and the completion and timing thereof, the receipt of Shareholder, Court and other approvals, the conduct, timing and pricing of the Private Placement, the benefits of the Arrangement and the listing of the new Foremost common shares and Rio Grande Resources shares. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,” “estimates” or “intends,” or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, accidents, labor disputes and other risks of the automotive industry including, without limitation, those associated with the environment, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities or claims limitations on insurance coverage. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities. and information. Please refer to the Company’s most recent filings under its profile at on Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov for further information respecting the risks affecting the Company and its business.

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/80aa66ef-a182-471f-b72b-04e23ff9d076

Foremost Clean Energy (NASDAQ:FMSTW)

Historical Stock Chart

From Oct 2024 to Nov 2024

Foremost Clean Energy (NASDAQ:FMSTW)

Historical Stock Chart

From Nov 2023 to Nov 2024