Form 8-K - Current report

October 09 2024 - 4:05PM

Edgar (US Regulatory)

false 0001537054 0001537054 2024-10-09 2024-10-09 0001537054 us-gaap:CommonStockMember 2024-10-09 2024-10-09 0001537054 us-gaap:PreferredStockMember 2024-10-09 2024-10-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 9, 2024

GOGO INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35975 |

|

27-1650905 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 105 Edgeview Dr., Suite 300 Broomfield, CO |

|

80021 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

303-301-3271

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

GOGO |

|

NASDAQ Global Select Market |

| Preferred Stock Purchase Rights |

|

GOGO |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On October 9, 2024, Gogo Inc., a Delaware corporation (the “Company”), made available an investor presentation on its website at http://ir.gogoair.com. A copy of the investor presentation is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in this Item 7.01, including the exhibit incorporated by reference herein, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), regardless of any incorporation by reference language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

Forward Looking Statements

Certain disclosures in this report include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding the Transactions, the Company’s business outlook, industry, business strategy, plans, goals and expectations concerning the Company’s market position, international expansion, future technologies, future operations, margins, profitability, future efficiencies, capital expenditures, liquidity and capital resources and other financial and operating information. When used in this discussion, the words “anticipate,” “assume,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “future” and the negative of these or similar terms and phrases are intended to identify forward-looking statements in this report. Forward-looking statements reflect the Company’s current expectations regarding future events, results or outcomes. These expectations may or may not be realized. Although the Company believes the expectations reflected in the forward-looking statements are reasonable, the Company can give you no assurance these expectations will prove to have been correct. Some of these expectations may be based upon assumptions, data or judgments that prove to be incorrect. Actual events, results and outcomes may differ materially from the Company’s expectations due to a variety of known and unknown risks, uncertainties and other factors. Although it is not possible to identify all of these risks and factors, they include, among others, our ability to effectively evaluate and pursue strategic opportunities. Additional information concerning these and other factors can be found under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2024, and in the Company’s Quarterly Reports on Form 10-Q as filed with the SEC on May 7, 2024 and August 7, 2024. Any one of these factors or a combination of these factors could materially affect the Company’s financial condition or future results of operations and could influence whether any forward-looking statements contained in this report ultimately prove to be accurate. The Company’s forward-looking statements are not guarantees of future performance, and you should not place undue reliance on them. All forward-looking statements speak only as of the date made and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Investor Presentation. |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

| By: |

|

/s/ Crystal L. Gordon |

|

|

Crystal L. Gordon Executive Vice President, General Counsel, Chief Administrative Officer, and Secretary |

Date: October 9, 2024

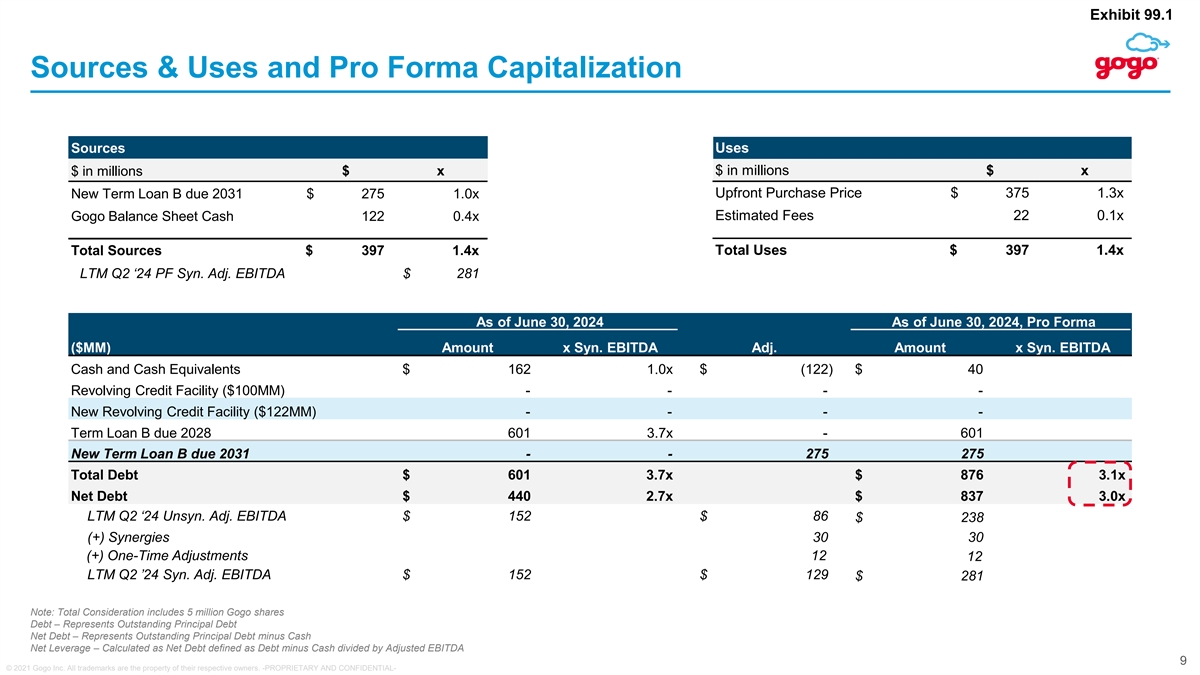

Exhibit 99.1 Sources & Uses and Pro Forma Capitalization Sources

Uses $ in millions $ x $ in millions $ x Upfront Purchase Price $ 375 1.3x New Term Loan B due 2031 $ 275 1.0x Estimated Fees 22 0.1x Gogo Balance Sheet Cash 122 0.4x Total Sources $ 397 1.4x Total Uses $ 397 1.4x LTM Q2 ‘24 PF Syn. Adj.

EBITDA $ 281 As of June 30, 2024 As of June 30, 2024, Pro Forma ($MM) Amount x Syn. EBITDA Adj. Amount x Syn. EBITDA Cash and Cash Equivalents $ 162 1.0x $ (122) $ 40 Revolving Credit Facility ($100MM) - - - - New Revolving Credit Facility ($122MM)

- - - - Term Loan B due 2028 601 3.7x - 601 New Term Loan B due 2031 - - 275 275 Total Debt $ 601 3.7x $ 876 3.1x Net Debt $ 440 2.7x $ 837 3.0x LTM Q2 ‘24 Unsyn. Adj. EBITDA $ 152 $ 86 $ 238 (+) Synergies 30 30 (+) One-Time Adjustments 12 12

LTM Q2 ’24 Syn. Adj. EBITDA $ 152 $ 129 $ 281 Note: Total Consideration includes 5 million Gogo shares Debt – Represents Outstanding Principal Debt Net Debt – Represents Outstanding Principal Debt minus Cash Net Leverage –

Calculated as Net Debt defined as Debt minus Cash divided by Adjusted EBITDA 9 © 2021 Gogo Inc. All trademarks are the property of their respective owners. -PROPRIETARY AND CONFIDENTIAL-

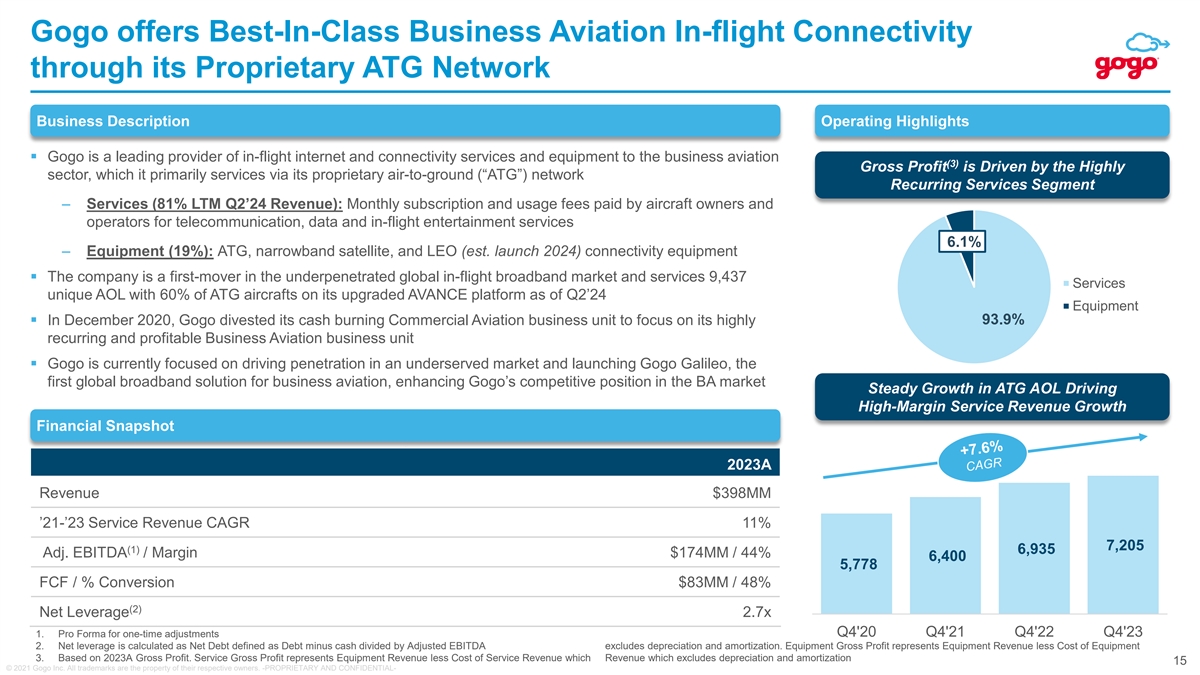

Gogo offers Best-In-Class Business Aviation In-flight Connectivity

through its Proprietary ATG Network Business Description Operating Highlights § Gogo is a leading provider of in-flight internet and connectivity services and equipment to the business aviation (3) Gross Profit is Driven by the Highly sector,

which it primarily services via its proprietary air-to-ground (“ATG”) network Recurring Services Segment – Services (81% LTM Q2’24 Revenue): Monthly subscription and usage fees paid by aircraft owners and operators for

telecommunication, data and in-flight entertainment services 6.1% – Equipment (19%): ATG, narrowband satellite, and LEO (est. launch 2024) connectivity equipment § The company is a first-mover in the underpenetrated global in-flight

broadband market and services 9,437 Services unique AOL with 60% of ATG aircrafts on its upgraded AVANCE platform as of Q2’24 Equipment § In December 2020, Gogo divested its cash burning Commercial Aviation business unit to focus on its

highly 93.9% recurring and profitable Business Aviation business unit § Gogo is currently focused on driving penetration in an underserved market and launching Gogo Galileo, the first global broadband solution for business aviation, enhancing

Gogo’s competitive position in the BA market Steady Growth in ATG AOL Driving High-Margin Service Revenue Growth Financial Snapshot 2023A Revenue $398MM ’21-’23 Service Revenue CAGR 11% 7,205 (1) 6,935 Adj. EBITDA / Margin $174MM /

44% 6,400 5,778 FCF / % Conversion $83MM / 48% (2) Net Leverage 2.7x 1. Pro Forma for one-time adjustments Q4'20 Q4'21 Q4'22 Q4'23 2. Net leverage is calculated as Net Debt defined as Debt minus cash divided by Adjusted EBITDA excludes depreciation

and amortization. Equipment Gross Profit represents Equipment Revenue less Cost of Equipment 3. Based on 2023A Gross Profit. Service Gross Profit represents Equipment Revenue less Cost of Service Revenue which Revenue which excludes depreciation and

amortization 15 © 2021 Gogo Inc. All trademarks are the property of their respective owners. -PROPRIETARY AND CONFIDENTIAL-

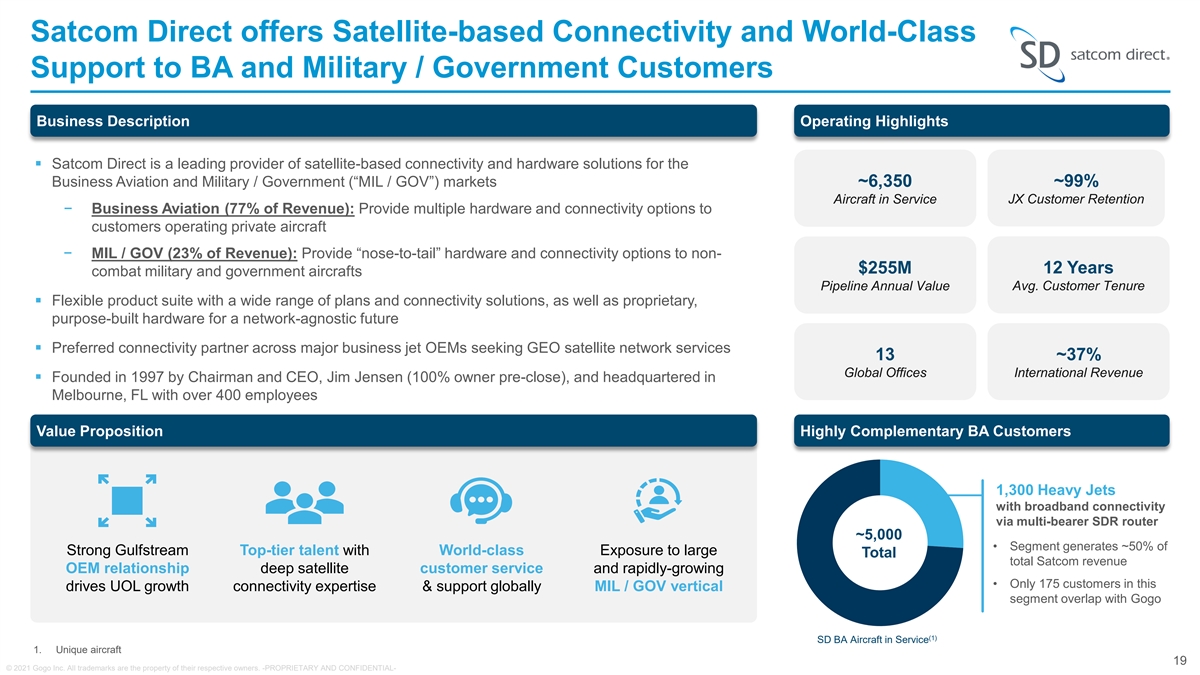

Satcom Direct offers Satellite-based Connectivity and World-Class

Support to BA and Military / Government Customers Business Description Operating Highlights § Satcom Direct is a leading provider of satellite-based connectivity and hardware solutions for the Business Aviation and Military / Government

(“MIL / GOV”) markets ~6,350 ~99% Aircraft in Service JX Customer Retention − Business Aviation (77% of Revenue): Provide multiple hardware and connectivity options to customers operating private aircraft − MIL / GOV (23% of

Revenue): Provide “nose-to-tail” hardware and connectivity options to non- $255M 12 Years combat military and government aircrafts Pipeline Annual Value Avg. Customer Tenure § Flexible product suite with a wide range of plans and

connectivity solutions, as well as proprietary, purpose-built hardware for a network-agnostic future § Preferred connectivity partner across major business jet OEMs seeking GEO satellite network services 13 ~37% Global Offices International

Revenue § Founded in 1997 by Chairman and CEO, Jim Jensen (100% owner pre-close), and headquartered in Melbourne, FL with over 400 employees Value Proposition Highly Complementary BA Customers 1,300 Heavy Jets with broadband connectivity via

multi-bearer SDR router ~5,000 • Segment generates ~50% of Strong Gulfstream Top-tier talent with World-class Exposure to large Total total Satcom revenue OEM relationship deep satellite customer service and rapidly-growing • Only 175

customers in this drives UOL growth connectivity expertise & support globally MIL / GOV vertical segment overlap with Gogo (1) SD BA Aircraft in Service 1. Unique aircraft 19 © 2021 Gogo Inc. All trademarks are the property of their

respective owners. -PROPRIETARY AND CONFIDENTIAL-

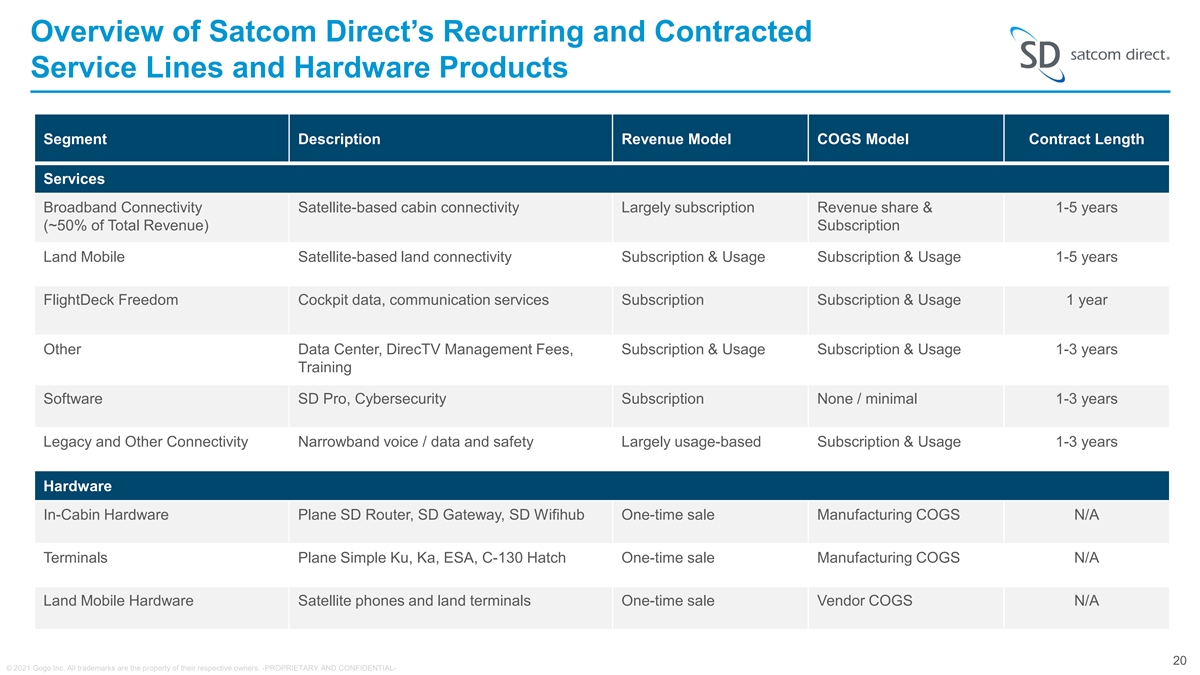

Overview of Satcom Direct’s Recurring and Contracted Service Lines

and Hardware Products Segment Description Revenue Model COGS Model Contract Length Services Broadband Connectivity Satellite-based cabin connectivity Largely subscription Revenue share & 1-5 years (~50% of Total Revenue) Subscription Land Mobile

Satellite-based land connectivity Subscription & Usage Subscription & Usage 1-5 years FlightDeck Freedom Cockpit data, communication services Subscription Subscription & Usage 1 year Other Data Center, DirecTV Management Fees,

Subscription & Usage Subscription & Usage 1-3 years Training Software SD Pro, Cybersecurity Subscription None / minimal 1-3 years Legacy and Other Connectivity Narrowband voice / data and safety Largely usage-based Subscription & Usage

1-3 years Hardware In-Cabin Hardware Plane SD Router, SD Gateway, SD Wifihub One-time sale Manufacturing COGS N/A Terminals Plane Simple Ku, Ka, ESA, C-130 Hatch One-time sale Manufacturing COGS N/A Land Mobile Hardware Satellite phones and land

terminals One-time sale Vendor COGS N/A 20 © 2021 Gogo Inc. All trademarks are the property of their respective owners. -PROPRIETARY AND CONFIDENTIAL-

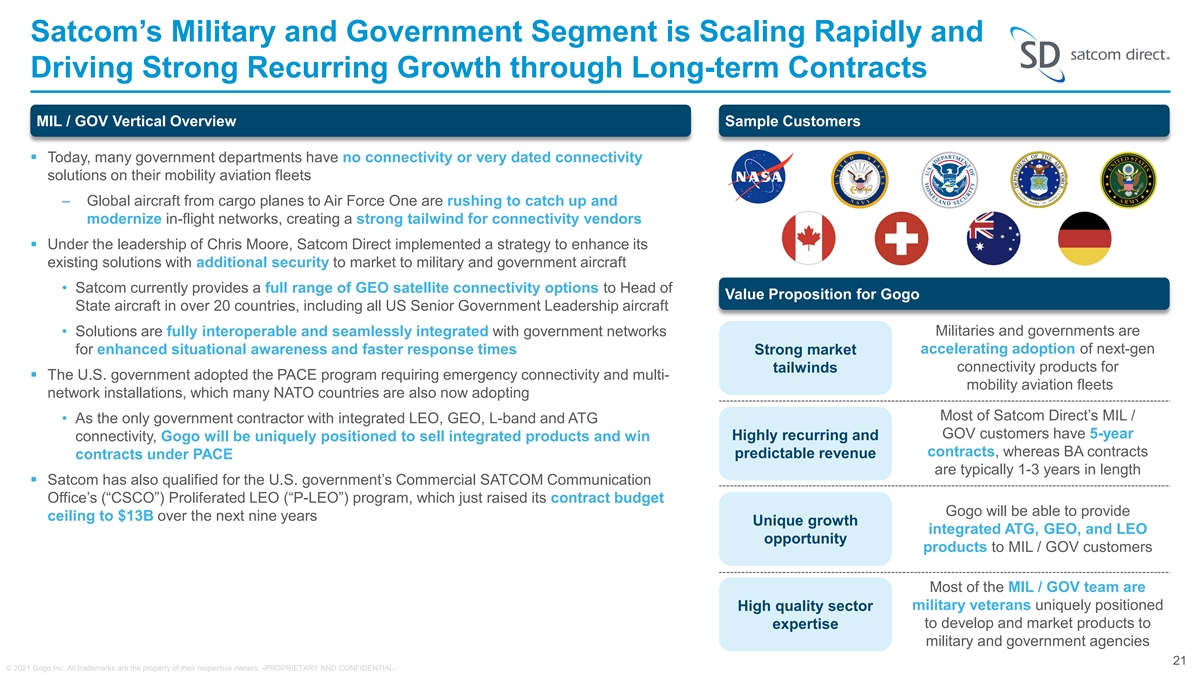

Satcom’s Military and Government Segment is Scaling Rapidly and

Driving Strong Recurring Growth through Long-term Contracts MIL / GOV Vertical Overview Sample Customers § Today, many government departments have no connectivity or very dated connectivity solutions on their mobility aviation fleets –

Global aircraft from cargo planes to Air Force One are rushing to catch up and modernize in-flight networks, creating a strong tailwind for connectivity vendors § Under the leadership of Chris Moore, Satcom Direct implemented a strategy to

enhance its existing solutions with additional security to market to military and government aircraft • Satcom currently provides a full range of GEO satellite connectivity options to Head of Value Proposition for Gogo State aircraft in over

20 countries, including all US Senior Government Leadership aircraft • Solutions are fully interoperable and seamlessly integrated with government networks Militaries and governments are accelerating adoption of next-gen for enhanced

situational awareness and faster response times Strong market tailwinds connectivity products for § The U.S. government adopted the PACE program requiring emergency connectivity and multi- mobility aviation fleets network installations, which

many NATO countries are also now adopting Most of Satcom Direct’s MIL / • As the only government contractor with integrated LEO, GEO, L-band and ATG GOV customers have 5-year Highly recurring and connectivity, Gogo will be uniquely

positioned to sell integrated products and win contracts, whereas BA contracts predictable revenue contracts under PACE are typically 1-3 years in length § Satcom has also qualified for the U.S. government’s Commercial SATCOM

Communication Office’s (“CSCO”) Proliferated LEO (“P-LEO”) program, which just raised its contract budget Gogo will be able to provide ceiling to $13B over the next nine years Unique growth integrated ATG, GEO, and LEO

opportunity products to MIL / GOV customers Most of the MIL / GOV team are military veterans uniquely positioned High quality sector expertise to develop and market products to military and government agencies 21 © 2021 Gogo Inc. All trademarks

are the property of their respective owners. -PROPRIETARY AND CONFIDENTIAL-

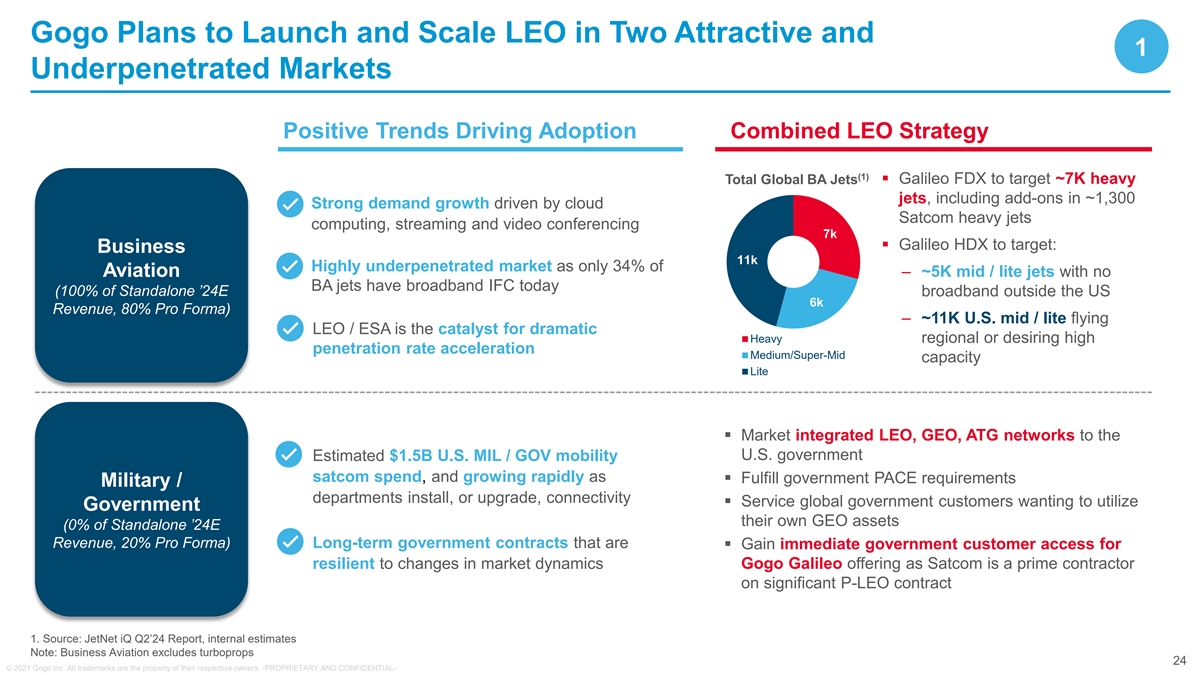

Gogo Plans to Launch and Scale LEO in Two Attractive and 1

Underpenetrated Markets Positive Trends Driving Adoption Combined LEO Strategy (1) Total Global BA Jets§ Galileo FDX to target ~7K heavy jets, including add-ons in ~1,300 Strong demand growth driven by cloud Satcom heavy jets computing,

streaming and video conferencing 7k § Galileo HDX to target: Business 11k Highly underpenetrated market as only 34% of Aviation – ~5K mid / lite jets with no BA jets have broadband IFC today (100% of Standalone ’24E broadband

outside the US 6k Revenue, 80% Pro Forma) – ~11K U.S. mid / lite flying LEO / ESA is the catalyst for dramatic Heavy regional or desiring high penetration rate acceleration Medium/Super-Mid capacity Lite § Market integrated LEO, GEO, ATG

networks to the U.S. government Estimated $1.5B U.S. MIL / GOV mobility satcom spend, and growing rapidly as § Fulfill government PACE requirements Military / departments install, or upgrade, connectivity § Service global government

customers wanting to utilize Government their own GEO assets (0% of Standalone ’24E Revenue, 20% Pro Forma) Long-term government contracts that are § Gain immediate government customer access for resilient to changes in market dynamics

Gogo Galileo offering as Satcom is a prime contractor on significant P-LEO contract 1. Source: JetNet iQ Q2’24 Report, internal estimates Note: Business Aviation excludes turboprops 24 © 2021 Gogo Inc. All trademarks are the property of

their respective owners. -PROPRIETARY AND CONFIDENTIAL-

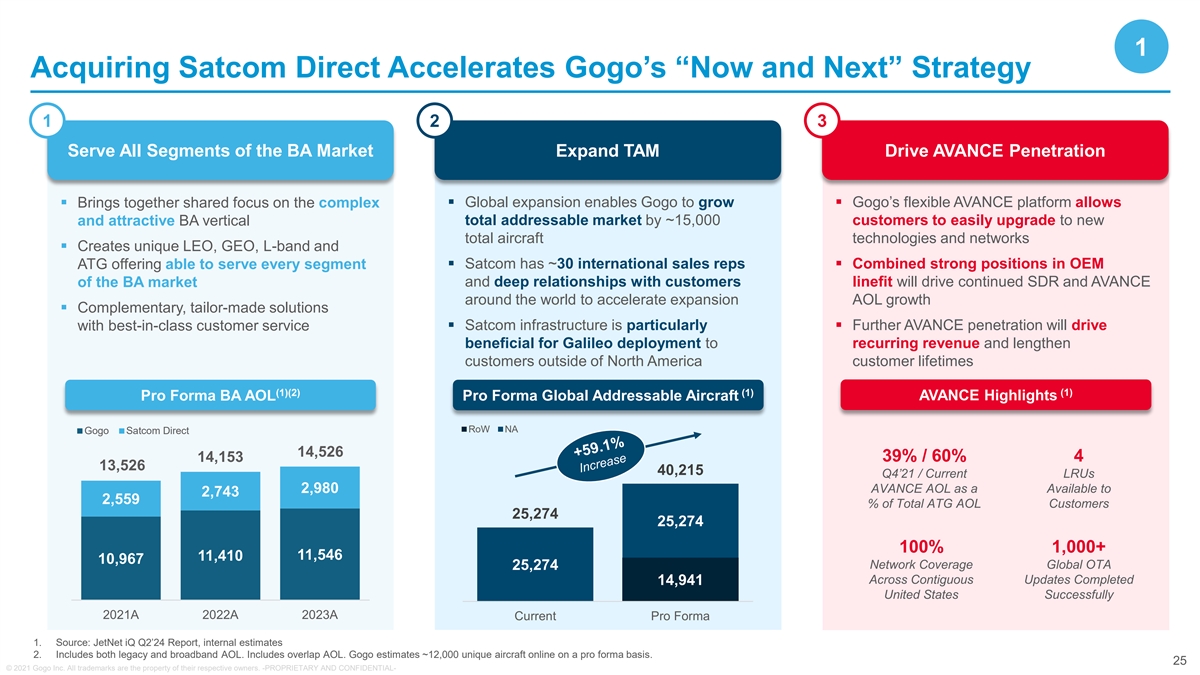

1 Acquiring Satcom Direct Accelerates Gogo’s “Now and

Next” Strategy 1 2 3 Serve All Segments of the BA Market Expand TAM Drive AVANCE Penetration § Brings together shared focus on the complex § Global expansion enables Gogo to grow § Gogo’s flexible AVANCE platform allows

total addressable market by ~15,000 customers to easily upgrade to new and attractive BA vertical total aircraft technologies and networks § Creates unique LEO, GEO, L-band and ATG offering able to serve every segment § Satcom has ~30

international sales reps § Combined strong positions in OEM and deep relationships with customers linefit will drive continued SDR and AVANCE of the BA market around the world to accelerate expansion AOL growth § Complementary, tailor-made

solutions § Satcom infrastructure is particularly § Further AVANCE penetration will drive with best-in-class customer service beneficial for Galileo deployment to recurring revenue and lengthen customers outside of North America customer

lifetimes cv (1)(2) (1) (1) AVANCE Highlights Pro Forma BA AOL Pro Forma Global Addressable Aircraft RoW NA Gogo Satcom Direct 14,526 39% / 60% 4 14,153 13,526 40,215 Q4’21 / Current LRUs AVANCE AOL as a Available to 2,980 2,743 2,559 % of

Total ATG AOL Customers 25,274 25,274 100% 1,000+ 11,546 11,410 10,967 Network Coverage Global OTA 25,274 Across Contiguous Updates Completed 14,941 United States Successfully 2021A 2022A 2023A Current Pro Forma 1. Source: JetNet iQ Q2’24

Report, internal estimates 2. Includes both legacy and broadband AOL. Includes overlap AOL. Gogo estimates ~12,000 unique aircraft online on a pro forma basis. 25 © 2021 Gogo Inc. All trademarks are the property of their respective owners.

-PROPRIETARY AND CONFIDENTIAL-

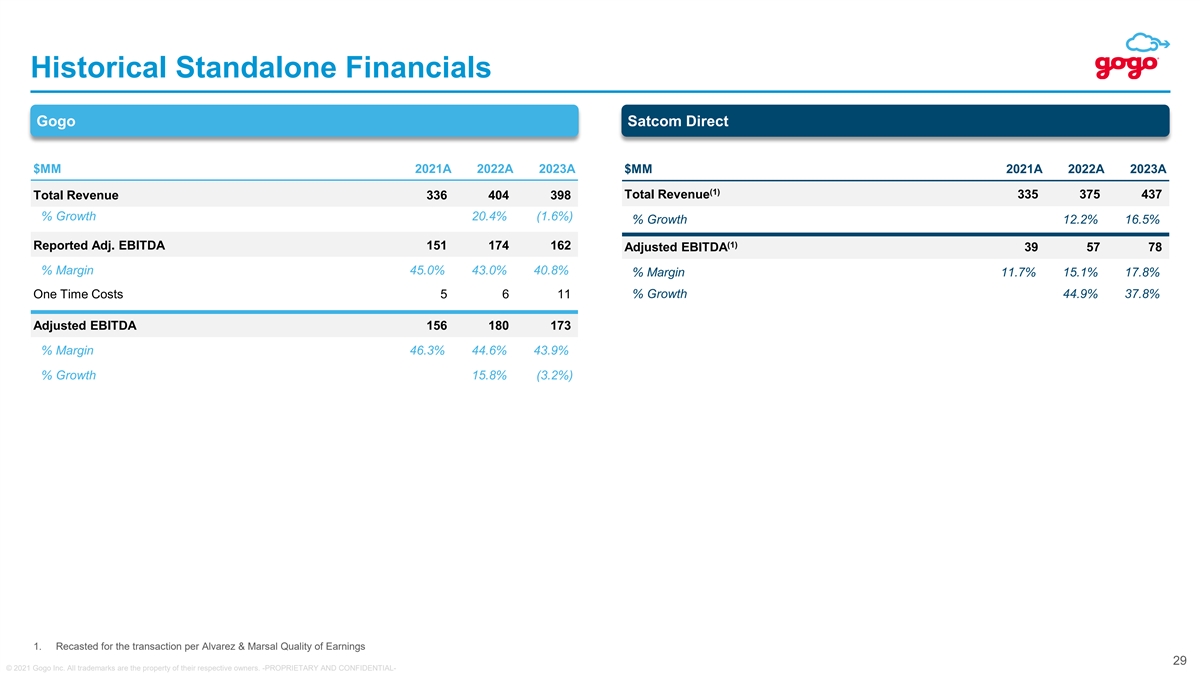

Historical Standalone Financials Gogo Satcom Direct $MM 2021A 2022A

2023A $MM 2021A 2022A 2023A (1) Total Revenue 335 375 437 Total Revenue 336 404 398 % Growth 20.4% (1.6%) % Growth 12.2% 16.5% (1) Reported Adj. EBITDA 151 174 162 Adjusted EBITDA 39 57 78 % Margin 45.0% 43.0% 40.8% % Margin 11.7% 15.1% 17.8% One

Time Costs 5 6 11 % Growth 44.9% 37.8% Adjusted EBITDA 156 180 173 % Margin 46.3% 44.6% 43.9% % Growth 15.8% (3.2%) 1. Recasted for the transaction per Alvarez & Marsal Quality of Earnings 29 © 2021 Gogo Inc. All trademarks are the property

of their respective owners. -PROPRIETARY AND CONFIDENTIAL-

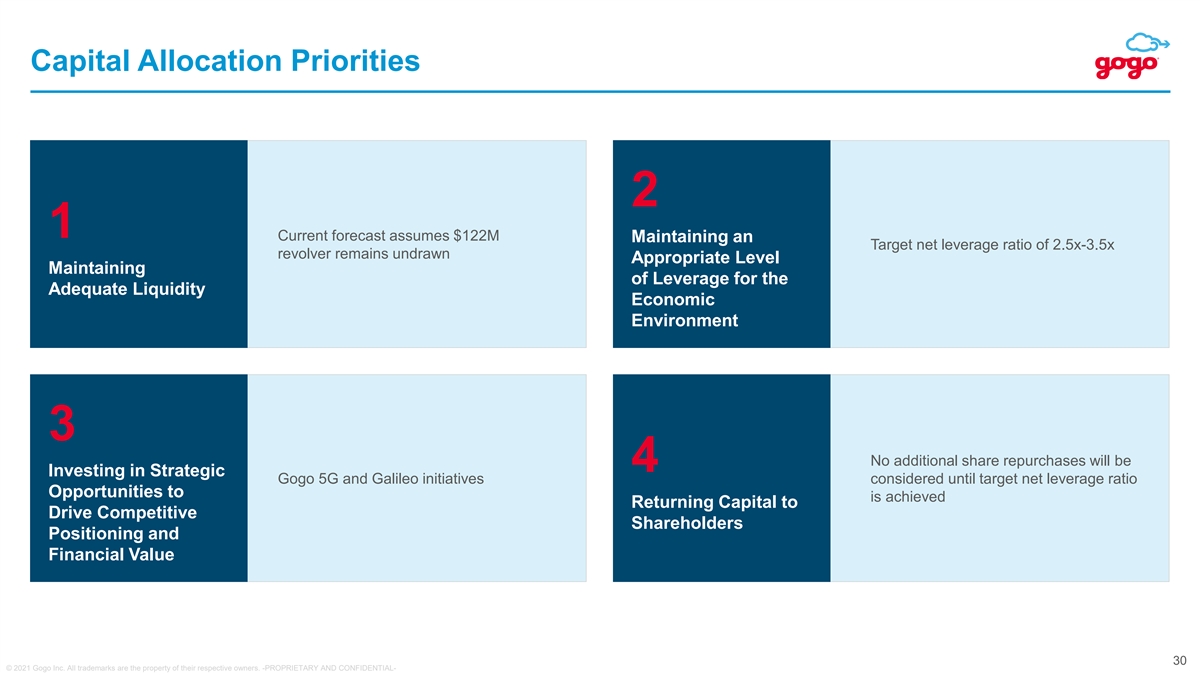

Capital Allocation Priorities 2 1 Current forecast assumes $122M

Maintaining an Target net leverage ratio of 2.5x-3.5x revolver remains undrawn Appropriate Level Maintaining of Leverage for the Adequate Liquidity Economic Environment 3 No additional share repurchases will be 4 Investing in Strategic Gogo 5G and

Galileo initiatives considered until target net leverage ratio Opportunities to is achieved Returning Capital to Drive Competitive Shareholders Positioning and Financial Value 30 © 2021 Gogo Inc. All trademarks are the property of their

respective owners. -PROPRIETARY AND CONFIDENTIAL-

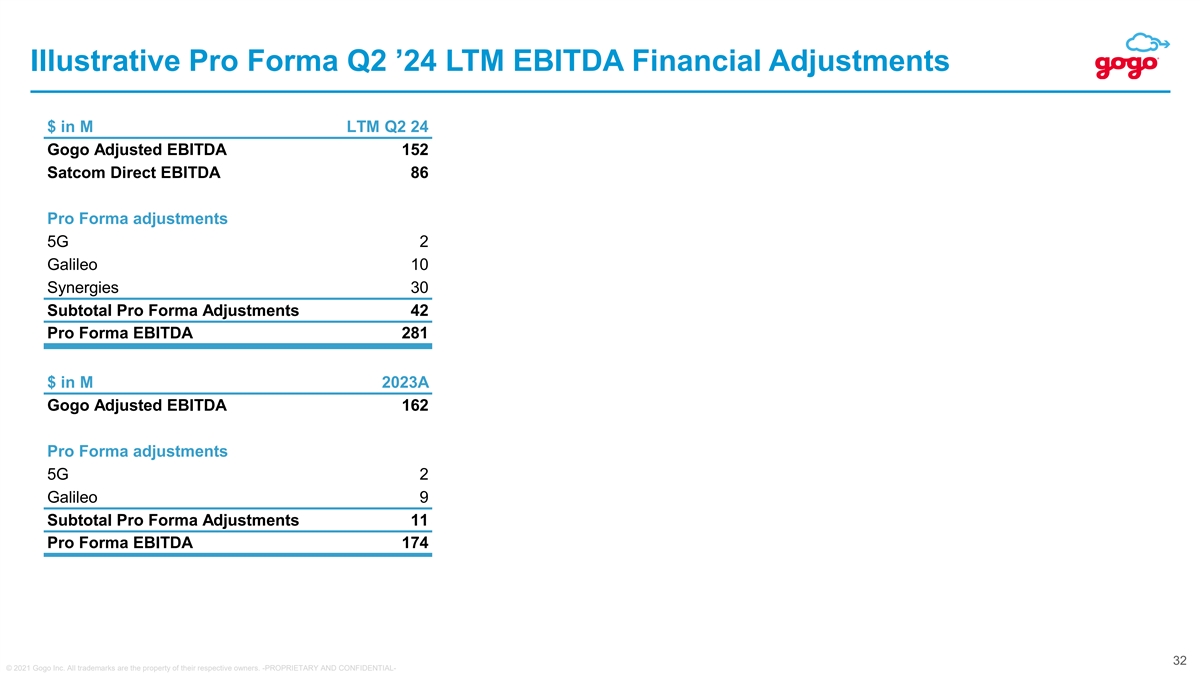

Illustrative Pro Forma Q2 ’24 LTM EBITDA Financial Adjustments $

in M LTM Q2 24 Gogo Adjusted EBITDA 152 Satcom Direct EBITDA 86 Pro Forma adjustments 5G 2 Galileo 10 Synergies 30 Subtotal Pro Forma Adjustments 42 Pro Forma EBITDA 281 $ in M 2023A Gogo Adjusted EBITDA 162 Pro Forma adjustments 5G 2 Galileo 9

Subtotal Pro Forma Adjustments 11 Pro Forma EBITDA 174 32 © 2021 Gogo Inc. All trademarks are the property of their respective owners. -PROPRIETARY AND CONFIDENTIAL-

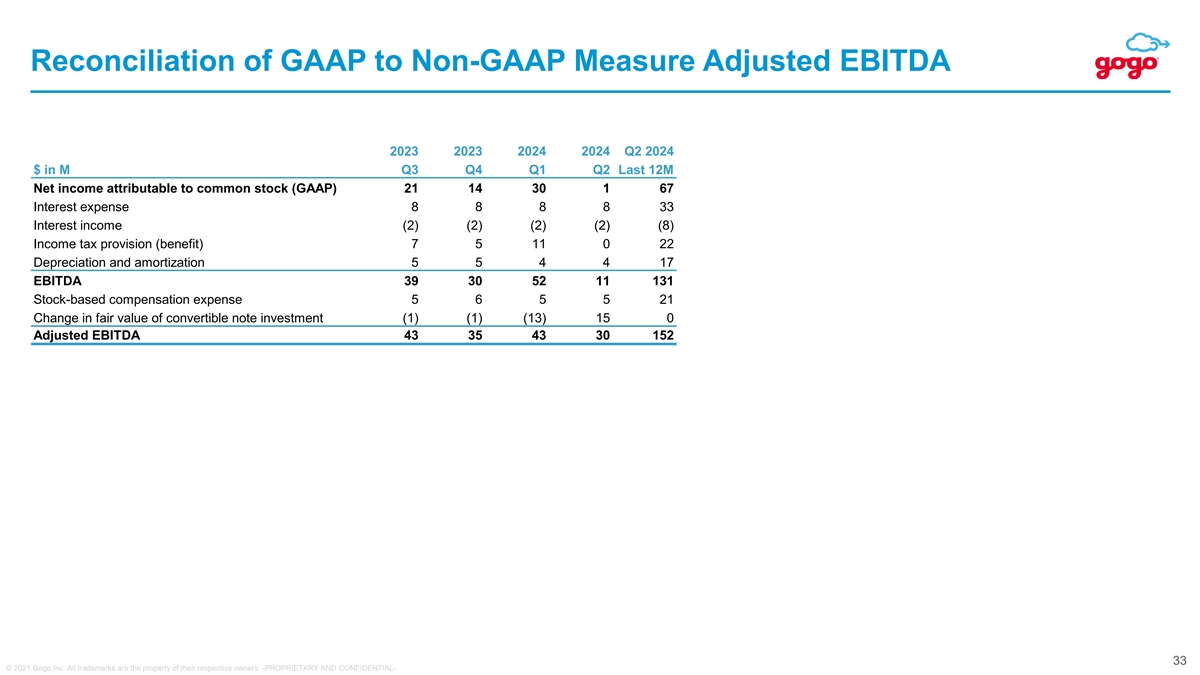

Reconciliation of GAAP to Non-GAAP Measure Adjusted EBITDA 2023 2023

2024 2024 Q2 2024 $ in M Q3 Q4 Q1 Q2 Last 12M Net income attributable to common stock (GAAP) 21 14 30 1 67 Interest expense 8 8 8 8 33 Interest income (2) (2) (2) (2) (8) Income tax provision (benefit) 7 5 11 0 22 Depreciation and amortization 5 5 4

4 17 EBITDA 39 30 52 11 131 Stock-based compensation expense 5 6 5 5 21 Change in fair value of convertible note investment (1) (1) (13) 15 0 Adjusted EBITDA 43 35 43 30 152 33 © 2021 Gogo Inc. All trademarks are the property of their

respective owners. -PROPRIETARY AND CONFIDENTIAL-

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Gogo (NASDAQ:GOGO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gogo (NASDAQ:GOGO)

Historical Stock Chart

From Nov 2023 to Nov 2024