As filed with the Securities and Exchange

Commission on September 1, 2023

Registration No. 333-272274

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Amendment No. 1 to

Form F-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

MERCURITY FINTECH HOLDING INC.

(Exact name of registrant as specified in its

charter)

| Cayman

Islands |

|

6199 |

|

Not

Applicable |

(State or other jurisdiction

of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

Shi Qiu

Chief Executive Officer

1330 Avenue of the Americas, Fl 33,

New York, NY 10019

Tel: +1(949)-678-9653

|

| (Address, including zip

code, and telephone number, |

| including area code,

of registrant’s principal executive offices) |

Cogency Global

Inc.

122 East 42nd Street,

18th Floor

New York, NY 10168

(212) 947-7200

(Name, address,

including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Huan

Lou, Esq. |

Sichenzia Ross Ference LLP

1185 Avenue of the America, 31st Fl

New York, NY 10036

Telephone: +1-212-930-9700 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If any of the securities

being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act,

check the following box. x

If this form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this form is

a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is

a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth

company ¨

If an emerging

growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected

not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ¨

| † |

The

term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

SEPTEMBER 1, 2023 |

32,087,130 ordinary shares

Mercurity Fintech Holding Inc.

This prospectus relates to

the resale by the selling shareholders identified in this prospectus of up to 32,087,130 ordinary shares, par value US$0.004 per share,

as further described below under “Prospectus Summary—Private Placements.”

The selling shareholders

are identified in the table commencing on page 13. No ordinary shares are being registered hereunder for sale by us. We will not

receive any proceeds from the sale of the ordinary shares by the selling shareholders. All net proceeds from the sale of the ordinary

shares covered by this prospectus will go to the selling shareholders (see “Use of Proceeds”). The selling shareholders

are offering their securities in order to create a public trading market for our equity securities in the United States. Unlike an initial

public offering, any sale by the selling shareholders of the ordinary shares is not being underwritten by any investment bank. The selling

shareholders may sell all or a portion of the ordinary shares from time to time in market transactions through any market on which our

ordinary shares are then traded, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the then

prevailing market price or at negotiated prices directly or through a broker or brokers, who may act as agent or as principal or by a

combination of such methods of sale (see “Plan of Distribution”).

Our ordinary shares currently

trade on the Nasdaq Capital Market, or NASDAQ, under the symbol “MFH.” The last reported closing price of our ordinary shares

on August 29, 2023 was $1.48.

We are not a “controlled

company” as defined under the Nasdaq Listing Rules, but we qualify as a “foreign private issuer”, as defined in Rule 405

under the U.S. Securities Act of 1933, as amended, or the Securities Act, and are eligible for reduced public company reporting requirements.

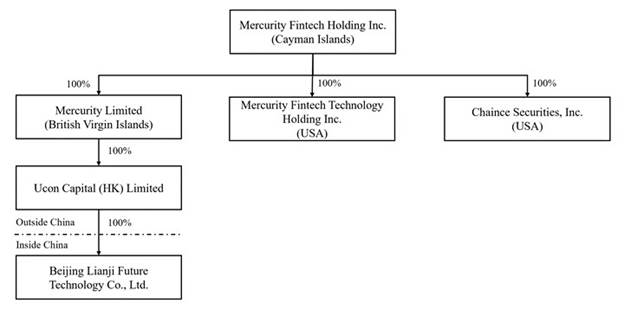

Mercurity Fintech Holding

Inc. or “MFH Cayman” is not a Chinese operating company but a Cayman Islands holding company with our operations conducted

through our U.S., Hong Kong and PRC subsidiaries. Under this holding company structure, investors are purchasing equity interests in

MFH Cayman, a Cayman Islands holding company, and obtaining indirect ownership interests in our U.S., Hong Kong and Chinese operating

companies. PRC regulatory authorities could decide to limit foreign ownership in our industry in the future, in which case there could

be a risk that we would be unable to do business in China as we are currently structured. In such event, despite our efforts to restructure

to comply with the then applicable PRC laws and regulations in order to continue our operations in China, we may experience material

changes in our business and results of operations, our attempts may prove to be futile due to factors beyond our control, and the value

of the ordinary shares you invest in may significantly decline or become worthless.

Prior to 2022, the majority

of our operations were based in mainland China. During 2022, we divested our software development business in mainland China, established

a new management team, and relocated our headquarters to the United States with the newly established Hong Kong office as the operational

hub for our business in the Asia Pacific region. As a result of the recent operational reorganization, the majority of our operations

are currently based in the U.S. while part of our technical and back-office team in mainland China.

To certain extent, we

are subject to legal and operational risks associated with having part of our operations in mainland China, including risks related to

the legal, political and economic policies of the Chinese government, the relations between China and the United States, and changes

in Chinese laws and regulations. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements

on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities

market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity

reviews, and expanding efforts in anti-monopoly enforcement. On December 28, 2021, thirteen governmental departments of the PRC,

including the Cyberspace Administration of China (the “CAC”), issued the Cybersecurity Review Measures, which became effective

on February 15, 2022. The Cybersecurity Review Measures provide that an online platform operator, which possesses personal information

of at least one million users, must apply for a cybersecurity review by the CAC if it intends to be listed in foreign countries. We do

not believe that we are subject to the cybersecurity review by the CAC. In addition, as of the date of this prospectus, we have not been

involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor have we received any inquiry, notice,

or sanction related to cybersecurity review under the Cybersecurity Review Measures. As of the date of this prospectus, no relevant laws

or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission (the “CSRC”)

or any other PRC governmental authorities for our overseas listing or securities offering plan, nor have we (including any of our subsidiaries)

received any inquiry, notice, warning or sanctions regarding our planned offering of securities from the CSRC or any other PRC governmental

authorities. Also, as of the date of this prospectus, we do not believe we are in a monopolistic position in the industry in which we

operate. However, since these statements and regulatory actions by the PRC government are newly published and official guidance and related

implementation rules have not been issued, it remains uncertain what the potential impact such modified or new laws and regulations

will have on our daily business operations. The Standing Committee of the National People’s Congress (the “SCNPC”)

or other PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that would require our

Chinese subsidiaries to obtain regulatory approval from Chinese authorities before future offerings of securities in the U.S. These risks

could result in a material change in our operations in China and potentially the value of our securities being registered herein for

sale. The CSRC regulatory risks could significantly limit or completely hinder our ability to offer or continue to offer securities to

investors and cause the value of such securities to significantly decline or be worthless.

In addition, our Ordinary

Shares may be prohibited from trading on a national exchange or over-the-counter market under the Holding Foreign Companies Accountable

Act (the “HFCA Act”) if the Public Company Accounting Oversight Board (United States) (the “PCAOB”) is unable

to inspect our auditors for three consecutive years. In addition, on June 22, 2021, the U.S. Senate passed the Accelerating Holding

Foreign Companies Accountable Act (the “AHFCAA”), which was signed into law on December 29, 2022, reducing the period

of time for foreign companies to comply with the PCAOB audits to two consecutive years instead of three, thus reducing the time period

for triggering the prohibition on trading. Pursuant to the HFCA Act, the PCAOB issued a Determination Report on December 16, 2021

which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (i) Mainland

China of the PRC, and (ii) Hong Kong; and such report identified the specific registered public accounting firms which are subject

to these determinations. On August 26, 2022, the PCAOB signed a Statement of Protocol with the CSRC and China’s Ministry of

Finance (the “PRC MOF”) in respect of cooperation on the oversight of PCAOB-registered public accounting firms based in Mainland

China and Hong Kong. Pursuant to the Statement of Protocol, the PCAOB conducted inspections on select registered public accounting firms

subject to the Determination Report in Hong Kong between September 2022 and November 2022. On December 15, 2022, the PCAOB

issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions

where it is unable to inspect or investigate completely registered public accounting firms. Each year, the PCAOB will determine whether

it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines

in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong

and we use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed

with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for

the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future

fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the

HFCAA. Our auditor, Onestop Assurance PAC, is headquartered in Singapore, and has been inspected by the PCAOB on a regular basis. Our

auditor is not headquartered in Mainland China or Hong Kong and was not identified in the Determination Report as a firm subject to the

PCAOB’s determinations.

Remittance of dividends by

a wholly foreign-owned company out of China is subject to examination by the banks designated by SAFE. Our PRC subsidiary has not paid

dividends and will not be able to pay dividends until they generate accumulated profits and meet the requirements for statutory reserve

funds. For PRC and United States federal income tax considerations in connection with an investment in our shares, see “Taxation.”

Under our current corporate

structure, to fund any liquidity requirements an entity in our corporate group may have, a subsidiary may rely on loans or payments from

MFH Cayman and MFH Cayman may receive distributions or cash transfers from our subsidiaries. Additionally, the transfer of funds and

assets between MFH Cayman and its subsidiaries is not subject to any Chinese currency exchange restrictions. As of the date of this prospectus,

during the past two completed fiscal years, none of our subsidiaries has made any dividends or distributions to MFH Cayman and neither

has MFH Cayman made any dividends or distributions to its shareholders or subsidiaries. We intend to keep any future earnings to finance

the expansion of our business, and we do not anticipate any cash dividends will be paid in the foreseeable future. If MFH Cayman determines

to pay dividends on any of its ordinary shares in the future, as a holding company, it may derive funds for such distribution from its

own cash position or contributions from its subsidiaries. During the past three completed fiscal years, some transfers of non-cash assets

occurred between MFH Cayman and its subsidiaries, in which MFH Cayman repaid the debts of its PRC subsidiary, MFH Cayman advanced expenses

for its Hong Kong subsidiary, MFH Cayman transferred fixed assets to MFH Tech and MFH Cayman collected money on behalf of certain other

subsidiaries. As of the date of this prospectus, neither MFH Cayman nor its subsidiaries had a cash management policy. See “The

Company–Cash Distribution” on page 9.

Investing

in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors”

starting on page 11 to read about the factors you should consider before buying the Ordinary Shares.

Neither the Securities

and Exchange Commission, or the SEC, nor any state or other foreign securities commission has approved nor disapproved these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

TABLE OF CONTENTS

You should rely only on

the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred

you. Neither we nor any of the selling shareholders have authorized anyone to provide you with different information. Neither we nor

any of the selling shareholders are making an offer of these securities in any jurisdiction where the offer is not permitted. You should

not assume that the information in this prospectus or any applicable prospectus supplement is accurate as of any date other than the

date of the applicable document. Since the date of this prospectus, our business, financial condition, results of operations and prospects

may have changed.

For investors outside of

the United States: Neither we nor any of the selling shareholders have done anything that would permit this offering or possession or

distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are

required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In this prospectus, “we,”

“us,” “our,” and the “Company” refer to Mercurity Fintech Holding Inc. and its wholly owned subsidiaries,

Mercurity Fintech Technology Holding Inc., Mercurity Limited, Ucon Capital (HK) Limited, Beijing Lianji Future Technology Co., Ltd.

and Chaince Securities.

Our reporting currency is

the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this prospectus to “dollars”

or “$” are to U.S. dollars.

This prospectus includes

statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications

and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they

obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the

information. Although we believe that these sources are reliable, we have not independently verified the information contained in such

publications.

Our

consolidated financial statements are prepared and presented in accordance with accounting principles generally accepted in the United

States of America, or U.S. GAAP.

The

number of ordinary shares currently issued and outstanding is 46,538,116 as of May 9, 2023. No new shares are being issued

by the Company pursuant to this offering.

ABOUT THIS PROSPECTUS

This prospectus describes

the general manner in which the selling shareholders identified in this prospectus may offer from time to time up to 32,087,130 ordinary

shares. If necessary, the specific manner in which the ordinary shares may be offered and sold will be described in a supplement to this

prospectus, which supplement may also add, update or change any of the information contained in this prospectus. To the extent there

is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information

in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document

having a later date—for example, any prospectus supplement—the statement in the document having the later date modifies or

supersedes the earlier statement.

GLOSSARY OF DEFINED TERMS

In this prospectus, unless otherwise indicated or the context otherwise

requires, references to:

| · | “we,”

“us,”, “company”, “our company,” or “our”

refers to Mercurity Fintech Holding Inc. and its consolidated subsidiaries, including Mercurity

Fintech Technology Holding Inc., Mercurity Limited, Ucon Capital (HK) Limited, Beijing Lianji

Future Technology Co., Ltd. and Chaince Securities; |

| · | “MFH

Cayman” refers to Mercurity Fintech Holding Inc., the holding company of our group. |

| · | “MFH

Tech” refers to Mercurity Fintech Technology Holding Inc., a wholly-owned subsidiary

of MFH Cayman; |

| | | |

| | · | “Chaince

Securities” refers to Chaince Securities, Inc. |

| · | “Ucon”

refers to Ucon Capital (HK) Limited, a subsidiary of the Company; |

| · | “ordinary

shares” refer to our ordinary shares, par value US$0.004 per share; |

| · | “ADS”

refers to our American depositary shares, each of which represented 360 ordinary shares before

the mandatory exchange of the ADS for ordinary shares and removal of the ADR facility, effective

February 28, 2023; |

| · | “ADR”

refers to American depositary receipt, which was cancelled on February 28, 2023 upon

termination of the ADR facility; |

| · | “VIEs”

refers to (i) Mercurity (Beijing) Technology Co., Ltd, or Mercurity Beijing, and (ii) Beijing

Lianji Technology Co., Ltd., or Lianji, which, together with Mercurity Beijing, were

consolidated by us solely for accounting purposes as variable interest entities, and which

have ceased to be our consolidated entities, following the termination of our VIE structure

on January 15, 2022; |

| · | “Our

WFOE” or “Lianji Future” refers to Beijing Lianji Future Technology Co., Ltd.,

our subsidiary in China that is a wholly foreign-owned enterprise; |

| · | “China”

or “PRC” are to the People’s Republic of China, including Hong Kong and

Macau; however the only time such jurisdictions are not included in the definition of PRC

and China is when we reference to the specific laws that have been adopted by the PRC. The

same legal and operational risks associated with operations in China also apply to operations

in Hong Kong. The term “Chinese” has a correlative meaning for the purpose of

this prospectus; |

| · | “Renminbi”

or “RMB” refers to the legal currency of China; and |

| · | “$,”

“US$,” “dollar” or “U.S. dollar” refers to the legal

currency of the United States. |

PROSPECTUS SUMMARY

This summary highlights

information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing

in our securities. Before you decide to invest in our securities, you should read the entire prospectus carefully, including the “Risk

Factors” section and the financial statements and related notes appearing at the end of this prospectus.

Overview

Prior to July 2019,

we provided integrated B2B services to food service suppliers and customers in China. In May 2019, we acquired Mercurity Limited

and its subsidiaries and variable interest entity (“VIE”) to start blockchain technical services including developing digital

asset transaction platforms and other solutions based on blockchain technologies.

On July 22, 2019, we

divested our B2B services to food service suppliers and customers by selling all the issued and outstanding shares of New Admiral Limited,

or New Admiral, our former wholly-owned subsidiary operating the B2B business, to Marvel Billion Development Limited, or Marvel Billion.

After this divestment, we are no longer engaged in B2B services and our current principal business is focused on providing blockchain

technical services. We design and develop digital asset transaction platforms based on blockchain technologies for customers to facilitate

crypto asset trading and asset digitalization and provide supplemental services for such platforms, such as customized software development

services, maintenance services and compliance support services.

In March 2020, we acquired

NBpay Investment Limited and its subsidiaries and variable interest entity(“VIE”), a developer of asset transaction platform

products based on blockchain technologies, to advance the blockchain technical services business.

In August 2021, we added

cryptocurrency mining as one of our main businesses going forward. We entered into cryptocurrency mining pools by executing a business

contract with a collective mining service provider on October 22, 2021 to provide computing power to the mining pool and derived

USD$664,307 related revenue in 2021 and USD$783,089 related revenue in the first half of 2022.

Due to the extremely adverse

regulatory measures taken by the Chinese government in 2021 in the field of digital currency production and transaction, our board of

Directors decided on December 10, 2021 to divest the VIEs, which were the Chinese operating companies of the related business controlled

through VIE agreements, and the divestiture of such VIEs was completed on January 15, 2022.

In late February 2022,

Wei Zhu, our former acting Chief Financial Officer, former Co-Chief Executive Officer, and a former member and Co-Chairperson of the

Board, and Minghao Li, a former member of the Board, were suspected of certain criminal offenses unrelated to our company’s operations

and had been detained by the Economic Crime Investigation Detachment of Sheyang County Public Security Bureau, Yancheng City, Jiangsu

Province, People’s Republic of China. At the same time, Sheyang Public Security Bureau wrongly seized the digital assets hardware

cold wallet which belonged to the Company, along with the cryptocurrencies stored therein.

Due to the dismantling

of the VIEs and the cessation of all business related to the digital asset transaction platforms, the temporary difficulties we faced

by the aforementioned incident where our cryptocurrencies were seized and impounded, the departure of our original Chinese technical

team in the first half of 2022, and because we failed to rebuild the technical service team in the second half of 2022, our blockchain

technical services business did not generate any revenue in 2022.

In July 2022, we added

digital consultation services as one of our main businesses going forward, providing digital payment solutions, asset management, and

a continued expansion into online and traditional brokerage services.

On July 15, 2022,

we incorporated Mercurity Fintech Technology Holding Inc. (“MFH Tech”) to develop distributed computing and storage services

and digital consultation services. On August 23, 2022, MFH Tech signed a Consulting Agreement with a Chinese media company, pursuant

to which MFH Tech will serve as a business consultant in order to facilitate the Client to establish the entity in the United States

and make financing strategy, and derived USD$80,000 related revenue in 2022.

On December 15,

2022, we entered into an asset purchase agreement with Huangtong International Co., Ltd., providing for the acquisition and purchase

of Web3 decentralized storage infrastructure, including cryptocurrency mining servers, cables, and other electronic devices, for an aggregate

consideration of USD$5,980,000, payable in our ordinary shares. The investment is made with an aim to own mining machines capable of

gathering, processing, and storing vast amounts of data, to advance the cryptocurrency mining business, and to further solidify us as

a pioneer in the creation of the Web3 framework. On December 20, 2022, the assets began to be used for Filecoin mining operations

and derived USD$348 related revenue in 2022.

On January 10, 2023,

we entered into an asset purchase agreement with Jinhe Capital Limited, providing for the purchase of 5,000 Antminer S19 PRO Bitcoin

mining machines, for an aggregate consideration of USD$9,000,000. The S19 Pro offers cutting-edge technology and are the highest quality

machines currently available on the market with increased speed, computing power and efficiency. The decision to purchase these machines

was made with the intention of providing our Company with a competitive edge in the cryptocurrency mining sector, and an increase in

revenue relative to cost, due to their efficiency and overall cost-effectiveness.

On January 28, 2023,

we decided to write off NBpay Investment Limited and its subsidiaries, which had no meaningful assets or business nor employees. After

the adjustment of the above corporate structure, MFH Tech has been acting as the primary U.S. operating entity of distributed computing

and storage services (including cryptocurrency mining) and digital consultation services business, and our Hong Kong and China subsidiaries

are expected to act as the operating entities of the digital consultation services (mainly digital payment solution services) in the

Asia-Pacific region, and we plan to establish a new technical services team in China to support our digital consultation services.

On April 12, 2023, the

Company completed the incorporation of another U.S. subsidiary, Chaince Securities, which plans to develop Financial advisory services,

online and traditional brokerage services independently in the future. On May 3, 2023, Chaince Securities entered into a Purchase

and Sale Agreement for the acquisition of all assets and liabilities of J.V. Delaney & Associates, an investment advisory firm

and FINRA licensed broker dealer.

Blockchain technical services

We provide digital asset

trading infrastructure solutions based on internet and blockchain technologies to our customers. These services include, among others,

(i) comprehensive solutions in connection with digital asset transactions, (ii) platform-based products, such as transaction

facilitation systems, trading systems, account management systems, operation management systems and mobile applications, and (iii) a

variety of supplemental services, such as customized software development services, maintenance services and compliance support services.

We launched Version 2.0 of our asset trading platform in 2019 which has included enhancements to the functionality of Version 1.0 as

well as new offerings of services and products for our customer on this platform. Our target customers for such trading platforms are

mainly cryptocurrency traders, blockchain-based virtual communities, and liquidity providers. In 2019, we generated substantially all

of our Revenue from selling our cryptocurrency asset trading platform and providing supplemental services to one customer who purchased

this platform. As a result of such sale, we are no longer operating such cryptocurrency asset trading platform. However, due to changes

in management and business team in 2021, we did not conclude any additional sales from this trading platform product in 2021. In 2022,

as a result of major changes to the regulatory environment and violent fluctuations in the cryptocurrency market, the Company dismantled

its VIE structure and suspended the provision of blockchain technology services to original customers, and has no current intention to

expand new customers for the time being. Nevertheless, the Company plans to focus on the development of digital payment functions on

the vision of the current asset digitalization platform, and hopes to provide digital payment products and solutions to the market after

obtaining the corresponding payment license.

In November 2020,

we launched an open, decentralized finance (DeFi) platform that designed to solve retail traders’ global problems of low liquidity

and capital utilization, poor governance, token growth incentive deficiencies, and slow transaction speeds. However, due to changes of

the business focus in 2021, the revenue from this DeFi platform was immaterial and we discontinued the development of such DeFi platform.

Later, we developed an

asset digitalization platform, which can provide blockchain-based digitalization solutions for traditional assets, such as fiat currencies,

bonds and precious metals. The revenue from this product was US$122,343 during the year of 2021, generated by one of the VIEs which have

been divested in 2022, and therefore these revenues are classified under loss/income from discontinued operations in our audited consolidated

financial statements for the year ended December 31, 2021. Due to the dismantling of the VIEs and the cessation of all business

related to the digital asset transaction platforms, as well as the temporary difficulties brought to us by the incident that a portion

of our cryptocurrencies were out of control, we did not conclude any digital asset trading and asset digitalization platform and solutions

related revenue in 2022. Currently we are no longer operating such asset digitalization platform. Due to the regulatory changes in the

digital asset industry, we do not plan to conduct any business related to the asset trading platform, asset digitalization platform and

decentralized finance (DeFi) platform. In terms of our blockchain technical services, we plan to combine our original project management

experience and technology related to blockchain technical services with our digital consultation services to further develop digital

banking and digital payment services business.

Cryptocurrency Mining

In August 2021, we

added cryptocurrency mining as one of our main businesses going forward. Cryptocurrency mining is part of our distributed computing and

storage services business. We carry out cryptocurrency mining primarily from our facilities located in New Jersey, United States.

We have entered into cryptocurrency

mining pools by executing contracts with the mining pool operators or executing contracts with the sharing mining service providers to

increase computing power or storage capacity to the mining pool. The contracts are terminable at any time by either party and our enforceable

right to compensation only begins when we provide computing power or storage capacity to the mining pool operator. In exchange for providing

computing power or storage capacity, we are entitled to a fractional share of the fixed digital asset awards the mining pool operator

receives, for successfully adding blocks to the blockchain. Our fractional share is relative to the proportion of computing power or

storage capacity we contribute to the mining pool operator toward the total computing power or storage capacity contributed by all mining

pool participants in solving the current algorithm.

Providing computing power

or storage capacity in digital asset transaction verification services is an output of our ordinary activities. The provision of such

computing power or storage capacity is the only performance obligation in our contracts with mining pool operators or contracts with

the sharing mining service providers. The transaction consideration we receive, if any, is noncash consideration, which we measure at

fair value on the date received, which is not materially different than the fair value at contract inception or the time we have earned

the award from the pools. These considerations are all variable. Since significant reversals of cumulative revenue are possible given

the nature of the assets, the consideration is constrained until the mining pool operator successfully places a block (by being the first

to solve an algorithm) and we receive confirmation of the consideration it will receive, at which time revenue is recognized. There is

no significant financing component related to these transactions. Fair value of the digital assets award received is determined using

the quoted price of the related digital assets at the time of receipt.

For the year ended December 31,

2022, we earned $783,090 in Bitcoin mining revenue from shared mining operations and $348 in Filecoin mining revenue from physical mining

operations.

In January 2023, our

U.S. subsidiary, MFH Tech signed a Coinbase Prime Broker Agreement with Coinbase, Inc., filed as Exhibit 99.1 to our registration statement

on Form F-1. The agreement includes the Coinbase Custody Custodial Services Agreement (the “Custody Agreement”) and the Coinbase

Master Trading Agreement (the “MTA”). The agreement sets forth the terms and conditions pursuant to which the Coinbase Entities

will open and maintain the prime broker account for us and provide services relating to custody, trade execution, lending or post-trade

credit (if applicable), and other services for certain digital assets. As of the date of this prospectus, we do not own and/or hold crypto

assets on behalf of third parties.

In May 2023, it was reported

that a trust sponsor had requested for withdrawal of its registration statement filed with the SEC in deference to the requests in the

SEC Staff’s letters, and that the SEC was of the view that Filecoins constituted “securities” under U.S. securities

laws. Additionally, in June 2023, the SEC filed a lawsuit against Binance, and named Filecoin as, among other cryptocurrencies, constituting

“securities” under U.S. securities laws. Such categorization, as well as further regulatory developments, new legislations

and regulations, and changes in regulatory policy, may have materially adverse impacts on our business, financial condition and results

of operations, as well as the price of our shares. Our Filecoin assets constituted less than 7% of our consolidated total assets as of

December 31, 2022. As such, we believe that such regulatory changes will have minimal impacts to us. We are reviewing the recent legal

and regulatory developments and we intend to alter our business focus and strategy whenever necessary to remain compliant with all applicable

laws and regulations. See also “Risk Factors—Certain crypto assets and cryptocurrencies have been identified as a “security”

in certain jurisdictions, and we may be subject to regulatory scrutiny, inquiries, investigations, fines, and other penalties, which

may adversely affect our business, operating results, and financial condition.”

In addition, due to recent

developments in the regulations of cryptocurrencies, particularly in the U.S., such as the creation of subcommittees of the House Financial

Services Committee, the approval of custodians for digital assets securities, and the Security and Exchange Commission’s crackdown

on illegal trading platforms, we have seen increases of the price volatility of various cryptocurrency assets. For instance, the price

of Bitcoins experienced sharp volatility in the first seven months of 2023, including a high price of more than $31,000 and a low price

of less than $17,000, and the price of Filecoins also experienced sharp volatility in the first seven months of 2023, including a high

price of more than $9 and a low price of less than $3. Our total cryptocurrency asset holdings constituted less than 25% of our consolidated

total assets as of December 31, 2022. As such, we believe that the immediate impact of such regulatory changes will be limited to us.

We are closely monitoring the changes and trends in prices of cryptocurrencies, and we may make changes to our business focus and strategies

in the future should the need arise. See also “Risk Factors—Our operating results may fluctuate and continue to fluctuate,

including due to the highly volatile nature of crypto.”

Similarly, due to the

increased price volatility of cryptocurrencies in general, individualized management failures, failures of internal control and oversight,

as well as other macroeconomic or other factors, a string of bankruptcies have occurred in the crypto asset industry, including those

of Genesis Global Capital, FTX, BlockFi, Celsuis Network, Voyager Digital and Three Arrows Capital. Such bankruptcies and adverse developments

in the crypto asset industry and have not impacted and is not expected to materially and adversely impact our business, financial condition,

customers, and counterparties, either directly or indirectly, as the Company is not a direct counterparty to such entities. We do not

have any material assets that may not be recovered due to the bankruptcies of those named companies or may otherwise be lost or misappropriated.

We are also not aware of any material direct or indirect exposures to other counterparties, customers, custodians, or other participants

in crypto asset markets that have filed for bankruptcy, that have been decreed insolvent or bankrupt, that have made any assignment for

the benefit of creditors, or have had a receiver appointed for them, that have experienced excessive redemptions or suspended redemptions

or withdrawals of crypto assets, that have the crypto assets of their customers unaccounted for; or that have experienced material corporate

compliance failures. However, it is possible that these recent bankruptcies may have exacerbated the further pricing decline of certain

cryptocurrencies, such as Bitcoin, in 2023 which may have imposed adverse impacts to our mining losses and/or value of the cryptocurrencies

we hold.

Investors in our securities

should be aware that engaging in cryptocurrency mining may result in certain environmental harms and transition risks related to climate

change that may affect our business, financial condition and results of operations, as mining operations consume a substantial amount

of power, which may contribute to increased carbon emissions. Recent policy and regulatory changes relating to limiting carbon emissions

could impose additional operational and compliance burdens on our cryptocurrency mining operations, such as more stringent reporting

requirements or higher compliance fees. There have also been recent market trends that may alter business opportunities for our industry,

stemming from recent regulatory and policy changes in the jurisdictions in which we operate, where regulators have come out to state

that certain cryptocurrencies constitute “securities” and that there would be increased regulation and oversight over businesses

engaged in cryptocurrencies, which is highly power-consuming and poses environmental risks. These may lead to increased credit risks,

which may lead to financiers and lenders being less willing to enter into business relationships with us, as well as increased litigation

risks related to climate change in the jurisdictions in which we carry out mining operations, Some businesses as well as some investors

may have also ceased accepting cryptocurrencies for certain types of purchases, and stopped investing in businesses involved in cryptocurrencies

businesses, due to environmental concerns associated with cryptocurrencies mining, which may have adverse impacts on our business, financial

condition, and results of operations. See “Risk Factors—Environmental concerns associated with cryptocurrencies mining

could have adverse impacts on our business, financial condition, and results of operations.”

Consultation services

In July 2022, we

added digital consultation services as one of our main businesses going forward, providing digital payment solutions for various types

of companies, asset management, and a continued expansion into online and traditional brokerage services.

Considering that the contents

of different projects of our consultation service business varies greatly, we adopt the percentage-of-completion method to measure and

recognize revenue for each consultation service project. The percentage-of-completion method recognizes income as work on a contract’s

(or group of closely related contracts) progress. The recognition of Revenue and profits is generally related to costs incurred in providing

the services required under the contract.

On August 23, 2022,

we signed a Consulting Agreement with a Chinese media company, pursuant to which we will serve as a business consultant in order to facilitate

the Client to establish the entity in the United States and make financing strategy. As of December 31, 2022, the project was approximately

50% on schedule and we recognized consultation service revenue of $80,000 for the year ended December 31, 2022 in line with the

completion schedule and have plans to expand upon this business in the near future.

In the first half of

2023, we further refined our business structure by further dividing consultation services into financial advisory services, digital banking

and digital payment services. MFH Tech is acting as our operating entity for digital banking and digital payment services in North America

while Ucon as our operating entity for digital payment services in Asia Pacific. We plan to make Chaince Securities our operating entity

for financial advisory services as well as the online and traditional brokerage services once it becomes a licensed FINRA member.

Types Of Cryptocurrencies We Have Held

As of December

31, 2022 and as of the date of this prospectus, we have held five types of cryptocurrencies, which are Bitcoin, USD Coin, FileCoin, Tether

USD, and FF Coin. We received these types of cryptocurrencies through mining operations, compensation to us for services and products

provided, and acquisition of certain digital assets. In May 2019, we acquired FFcoins with an estimated value of $1,200,000 at the prevailing

market price. FF(Fifty-five) coin is a decentralized blockchain digital asset issued by 55 Global Market. In 2020, due to the significant

decline in the FF coin market price, the Company recognized an impairment loss of $835,344 at market value at the end of 2020. Even more

unfortunately, in 2021, the FF coins further completely lost its market value, and the Company wrote down the remaining book value of

the FF coins to 0 and recognized an impairment loss of $372,995.

Due to the price

crash of Bitcoin in 2022, the Company, out of caution, decided to change the impairment test method of Bitcoin and other cryptocurrencies

from testing once or twice a year by calculating the fair value based on the average daily closing price of the past 12 months to testing

every day by calculating the fair value based on the intraday low price. We restated the impacted financial statements as of December

31, 2021, and for the year ended December 31, 2021, and related notes included herein to correct these changes. We recognized $1,292,568

impairment loss of intangible assets for the year ended December 31, 2021 and $3,144,053 impairment loss of intangible assets for the

year ended December 31, 2022 as the restated financial statements.

The revised impairment loss of

intangible assets for the year ended December 31, 2021 and 2022 is detailed as follows:

| | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2022 | | |

2021 | | |

2020 | |

| | |

| US$ | | |

| US$ | | |

| US$ | |

| Bitcoin | |

| 3,111,232 | | |

| 908,453 | | |

| - | |

| USD Coin | |

| - | | |

| 11,120 | | |

| - | |

| Filecoin | |

| 26,957 | | |

| - | | |

| | |

| Tether USDs (“USDT”) | |

| 5,864 | | |

| - | | |

| | |

| FF Coins | |

| - | | |

| 372,995 | | |

| 835,344 | |

| Total impairment loss of intangible assets | |

| 3,144,053 | | |

| 1,292,568 | | |

| 835,344 | |

In order to avoid the

recurrence of such asset losses, the current management of the company has optimized and improved the investment strategy, asset management

internal control and many other aspects to reduce the relevant business risks.

Analysis of Our Crypto Asset Mining Operations

In August 2021, based

on the Company's technical capabilities, experience and resources in the cryptocurrency industry, the potential of the cryptocurrency

market and the increasingly clear regulatory policy of the US government on cryptocurrency, our management entered into the field of

cryptocurrency mining.

On October 22, 2021,

we, through our wholly-owned subsidiary Ucon, entered into a Bitcoin joint mining business agreement (the “Computing Power Purchase

Agreement”) with Carpenter Creek LLC (“Bitdeer”), pursuant to which we purchased 180 days of computing power for 480

Antminer S17+ mining machines located in Tennessee from Bitdeer to start our Bitcoin mining business. Based on the Computing Power Purchase

Agreement, we paid for the electricity costs and computing power costs (including costs of renting mining machines, operating site and

networks) incurred for mining Bitcoins pursuant to our orders. Our average daily operating costs (electricity costs and computing power

costs) for this business was $11,080.35 and we recognized revenues on a daily basis based on the closing price of the rewarded Bitcoins

on that day. The comparative data of revenue and cost of this Bitcoin shared mining business compiled by month are as follows:

| Period |

The

number of Bitcoin rewards |

Revenue |

Cost |

Gross

profit |

Average

closing price of Bitcoin |

Breakeven

Bitcoin price |

| October,

2021 |

1.15637957 |

$71,061.41 |

$(60,018.55) |

$11,042.86 |

$61,659.24 |

$51,902.12

|

| November,

2021 |

5.82873982 |

$353,802.33 |

$(332,410.42) |

$21,391.91 |

$60,641.88 |

$57,029.55

|

| December,

2021 |

4.77001406 |

$239,443.11 |

$(310,249.72) |

$(70,806.61) |

$49,683.50 |

$65,041.68

|

| January,

2022 |

5.29383051 |

$220,287.73 |

$(343,490.76) |

$(123,203.03) |

$41,483.14 |

$64,885.11

|

| February,

2022 |

4.42114903 |

$179,749.11 |

$(310,249.72) |

$(130,500.61) |

$40,625.01 |

$70,174.00

|

| March,

2022 |

4.81988816 |

$201,511.74 |

$(343,490.76) |

$(141,979.02) |

$41,804.32 |

$71,265.30

|

| April,

2022 |

4.33004452 |

$181,540.87 |

$(294,552.57) |

$(122,897.40) |

$41,799.11 |

$68,025.30

|

| Total

Amount |

30.62004567 |

$1,447,396.30 |

$(1,994,462.50) |

$(556,951.90) |

|

|

We carried out the Bitcoin

mining from October 2021 to April 2022. Our computing power during this period was 35,000TH/s, our average daily output during this period

was 0.17011136 BTC, and the revenue per unit of computing power was 0.000004860 BTC/TH/day. For this Bitcoin mining business, we essentially

leased the Bitcoin mining machines instead of owning them, while the cost of renting the mining machines proved to be very high. The

average daily operating cost (including the cost of renting the mining machines) of our Bitcoin mining was $110,80.51, so we would not

make a profit until the average price of Bitcoin exceeds $65,137.

However, back in October

2021, the management did not anticipate the Bitcoin market crash that would begin in December 2021. In December 2021, the price of Bitcoin

suddenly plummeted from the price range of $60,000 per coin and during the first eight months of 2023 such price lingered around the

range of $16,000 to $30,000, causing the Company's Bitcoin mining business suffering a great loss. Due to the sharp fluctuations in the

price of Bitcoin over the past two years, from May 2022 to August 2023, we did not carry out any business related to Bitcoin mining.

On August 30, 2023, the

whole net computing power of Bitcoin was 366.47EH/s, and the net unit computing power income on that day was 0.00000232BTC/TH/day, which

was significantly lower than that in 2022. Accordingly, the cost of obtaining a unit Bitcoin reward from Bitcoin mining business will

increase significantly in the future.

Although the difficulty

of mining Bitcoin has significantly increased and the price of Bitcoin remains low, we will still seek to obtain certain profits through

cost control. In the future, cryptocurrency mining will be part of our distributed storage and computing services and will only be conducted

when we expect that it is likely to generate a profit.

S19 Pro Mining Project

On February 10, 2023,

the Company entered into a purchase agreement (the “S19 Pro Purchase Agreement”) with the seller to buy 5,000 Ant Miner S19

Pro Bitcoin miners for a total purchase price of $9 million, equivalent to the price of $1,800 per machine. Taking into account the increasing

difficulty of mining in the mining industry and the general loss of the top mining enterprises, the Company is considering the diversification

of its business in the financial technology field, and has decided to reduce the procurement scale of Bitcoin miners and reduce the company's

investment in the mining field. As such, the Company and seller entered into an amendment (the “Amendment”) to the S19 Pro

Purchase Agreement, pursuant to which the parties have agreed to reduce the purchase order to no more than 2,000 Bitcoin miners for a

total amount of no more than $3.6 million. As the Ant miner S19 Pro Bitcoin miner is currently one of the best-selling models in the

market and our order is back ordered, our batch of the S19 Pro has not been delivered as of the date of this letter. At present, the

Company has paid the seller $3 million US dollars. Depending on the actual delivery date of the mining machines and bitcoin market conditions,

the Company may change the order amount in the future. As things stand now, the Company may not receive these scheduled miners until

the end of 2023 and may begin Bitcoin mining operations in January 2024.

We have assumed that

the final number of Bitcoin mining machines purchased is 1500 for the following breakeven analysis. Based on the current level of Bitcoin

mining difficulty of the whole net, the breakeven analysis of this batch of Bitcoin mining machines to carry out Bitcoin mining business

is as follows:

| Types

of Bitcoin mining machines |

The

number of Bitcoin mining machines |

Expected

average computing power (TH/s) |

Average

daily operating costs |

Assumed

daily net unit computing power income (BTC/(TH/s)/day) |

Number of Bitcoin rewards (BTC/day)

[2] |

Breakeven Bitcoin price

[3=1/2] |

| Average

daily equipment depreciation cost |

Average

daily electricity, operating site and internet cost |

Average

daily labor cost |

Total

average daily operating costs [1] |

| Ant

Miner S19 Pro |

1500 |

150000 |

$1,500 |

$7,020 |

$200 |

$8,720 |

0.00000232 |

0.3480 |

$25,057 |

As of August

30, 2023, according to the data of Feixiaohao platforms, a platform that aggregates information of the global cryptocurrency markets,

the average daily lowest transaction price of Bitcoin for the last 30 days is $27,751.22, which is higher than the above breakeven price

of Bitcoin that we have measured.

On December 15, 2022,

we entered into an asset purchase agreement with Huangtong International Co., Ltd., providing for the acquisition and purchase of Web3

decentralized storage infrastructure, including cryptocurrency mining servers, cables, and other electronic devices, for an aggregate

consideration of USD$5,980,000, payable in our ordinary shares. The investment is made with an aim to own mining machines capable of

gathering, processing, and storing vast amounts of data, to advance the cryptocurrency mining business. Starting on December 20, 2022,

we have been using some of the storage capacity of these devices for Filecoin mining business, and other storage capacity will be used

to provide cloud storage services to distributed application product operators. We expect the storage capacity for Filecoin mining operations

to reach around 60.4PiB in June 2024. The operating costs of Filecoin mining business currently include depreciation costs of equipment,

site fees, electricity fees, network fees and software deployment costs. The comparative data of revenue and cost of this Filecoin mining

business as of June 30, 2023 compiled by month are as follows:

| Period |

The

number of Filecoin rewards |

Revenue |

Cost |

Gross

profit |

Average

lowest price of Filecoin |

Breakeven

Filecoin price |

| December,

2022 |

115.49 |

$348.40 |

$(69,816.21) |

$(69,467.81) |

$2.7529 |

$604.52

|

| January,

2023 |

3,844.55 |

$16,703.40 |

$(78,786.25) |

$(62,082.85) |

$4.0691 |

$20.49

|

| February,

2023 |

5,416.79 |

$31,691.07 |

$(111,791.17) |

$(80,100.10) |

$5.8636 |

$20.64

|

| March,

2023 |

6,147.68 |

$34,976.60 |

$(129,113.59) |

$(94,136.99) |

$5.6405 |

$21.00

|

| April,

2023 |

5,190.72 |

$28,880.42 |

$(99,253.75) |

$(70,373.33) |

$5.5566 |

$19.12

|

| May,

2023 |

6,480.06 |

$29,671.39 |

$(99,253.75) |

$(69,582.36) |

$4.6073 |

$15.32

|

| June,

2023 |

6,472.78 |

$24,942.82 |

$(99,253.75) |

$(74,310.93) |

$3.8786 |

$15.33

|

| Total

Amount |

33,668.07 |

$167,214.10 |

$(687,268.47) |

$(520,054.37) |

|

|

We carried

out the Filecoin mining business from December 2022. As of June 30, 2023, we have opened two nodes on the Filecoin blockchain with a

set storage capacity of 30.2Pib, one of which has not reached the maximum set storage capacity, so the current storage capacity of the

two nodes was 25.16PiB. We plan to open another two nodes in the second half of 2023 to enable our hardware devices to release more storage

capacity in exchange for revenue, and we expect our storage capacity for Filecoin mining operations to reach 60.4PiB in June 2024.

As of June

30, 2023, the whole net computing power of Filecoin was 21.9288EiB, and the net unit storage capacity income on that day was 0.0084 FIL/TiB/day.

One of our nodes reached the set maximum storage capacity of 15.1PiB in early June 2023, and the actual output efficiency of this node

in June 2023 was 0.0095FIL/TiB/day, which is about 13 percent higher than the output efficiency of the whole network.

Considering that the market

price of Filecoin had also fluctuated significantly in the past two years, we, out of caution, recognize daily revenue based on the lowest

trading price on the day of receiving Filecoin rewards, and conduct impairment test monthly by calculating the fair value based on the

lowest historical value of Filecoin during the holding period. Since it takes some time for Filecoin to reach its maximum computing power

per node, our Filecoin mining business is not yet profitable. We currently have only two nodes, as of June 30, 2023, the final capacity

of the two nodes is 25.16PiB, these two nodes have not reached the maximum computing power, we also plan to open another two nodes in

the second half of 2023 to enable our hardware devices to release more storage capacity in exchange for revenue.

In addition, we are also

exploring opportunities to use some of the storage capacity of our hardware devices planned for non-Filecoin mining businesses to provide

computing power and cloud storage services to distributed platform operators. When and if the storage capacity of our Filecoin mining

business reaches the set 60.4PiB, the output of Filecoin mining will reach the expected stable level. We expect our Filecoin mining output

to reach the stable level in June 2024 but we cannot guaranty that we will achieve this goal on schedule or at all. We use the same batch

of Web3 decentralized storage infrastructure for our cloud storage services to decentralized platform operators and Filecoin mining business

and therefore do not need to add any new equipment.

On August 30, 2023, the

net unit storage capacity income of the whole net of Filecoin mining is 0.0071 FIL/TiB/day. Assuming that our Filecoin mining business

has reached the set maximum storage capacity of 60.4PiB and the average net unit storage capacity income is 0.0071 FIL/TiB/day, and that

our business of providing cloud storage services to decentralized platform operators can bring in $70,000 per month (average $2,333 per

day), then, our breakeven analysis of our business of Filecoin mining and providing cloud storage services to decentralized platform

operators is as follows:

| Expected

average storage capacity (PiB) |

Assumed

output efficiency (FIL/TiB/day) |

The

daily number of Filecoin rewards (1) |

Expected

daily operating cost of Filecoin mining and providing cloud storage services to decentralized platform operators (3) |

Expected

average daily revenue from providing cloud storage services to decentralized platform operators (3) |

Breakeven Filecoin price

[4=(2-3)/1] |

| Average

daily equipment depreciation cost |

Average

daily electricity, operating site and internet cost |

Average

daily labor cost |

Expected

daily operating cost (2) |

| 60.4PiB

(equal to 61,849.6TiB) |

0.0071 |

439.13 |

$2,493 |

$933 |

$267 |

$3,693 |

$2,333 |

$3.10

|

As of August 30, 2023,

according to the data of Feixiaohao platforms, a platform that aggregates information of the global cryptocurrency markets, the average

daily lowest transaction price of Filecoin for the last 30 days is $3.78, which is higher than the above breakeven price of Filecoin

that we have measured.

However, the above assumption about the revenue

of providing cloud storage services to decentralized platform operators is set based on our future business objectives. If we fail to

achieve the assumed objectives of the providing cloud storage services to decentralized platform operators in the future, our Filecoin

mining and cloud storage services to decentralized platform operators may incur a loss as a whole.

Private Placements

Our Company has entered into

certain transactions with investors involving the issuance of our ordinary shares as consideration (the “Private Placements”).

Private Placement to Hexin Global Limited

and others

Pursuant to a securities

purchase agreement dated November 11, 2022, our Company closed a private investment in public equity (“PIPE”) financing

with certain non-U.S. investors for gross proceeds of $3.15 million. Net proceeds from the PIPE financing are expected to be used to

advance the Company’s business development activities for working capital and other general corporate purposes. Among other purposes,

the Company intends to use part of the Proceeds to grow its cryptocurrency consultation services in the U.S., including obtaining the

“BitLicense” from New York State Department of Financial Services for digital currency related activities, although the Company

cannot provide any assurance on actually obtaining the “BitLicense” in the near future or at all. Pursuant to the securities

purchase agreement and the warrants, our Company issued an aggregate of 2,423,076,922 units at a purchase price of $0.0013 per unit (pre-reverse

split). Each unit shall consist of one ordinary share and three warrants, with each warrant entitling the investor to purchase one ordinary

share at the exercise price of USD$ 1/180th per ordinary share subject to certain adjustments and conditions set forth therein. The warrants

shall have a term of three years from the issuance date.

Following the completion

of the above financing and at the date hereof, Hexin Global Limited has a beneficial interest in 5,769,231 of our ordinary shares, which

are being registered for resale pursuant to this prospectus.

Private Placement to Ms. Hanqi Li and

others

On November 30, 2022,

our Company entered into a securities purchase agreement with two investors to offer and sell the Company’s units, each consisting

of one ordinary share and three warrants for total gross proceeds of $5 million.

Among other purposes, our

Company intends to use part of the proceeds to grow its cryptocurrency consultation services in the U.S., including obtaining the “BitLicense”

from New York State Department of Financial Services for digital currency related activities although the Company cannot provide any

assurance on actually obtaining the “BitLicense” in the near future or at all.

Pursuant to the agreement,

our Company issued an aggregate of 3,676,470,589 units at a purchase price of $0.00136 per unit (pre-reverse split) for a total of approximately

$5,000,000. Each unit shall consist of one ordinary share and three warrants, with each warrant entitling the investor to purchase one

ordinary share at the exercise price of $1/360th per ordinary share subject to certain adjustments and conditions set forth therein.

The warrants shall have a term of three years from the issuance date.

Further, on December 23,

2022, our Company entered into a securities purchase agreement with an accredited non-U.S. investor to offer and sell the Company’s

units, each consisting of one ordinary share and three warrants for total gross proceeds of $5 million. The Company expects to use the

net proceeds from the three rounds of PIPE financing to develop its Web3 and blockchain infrastructure, expand its consultation services,

and pursue the licensure for cryptocurrency from New York State Department of Financial Services.

Pursuant to this securities purchase

agreement, our Company issued an aggregate of 4,545,454,546 units at a purchase price of $0.00110 per unit (pre-reverse split) for total

gross proceeds of approximately $5,000,000. Each unit shall consist of one ordinary share and three warrants, with each warrant entitling

the investor to purchase one ordinary share at the exercise price of $1/360th per ordinary share subject to certain adjustments and conditions

set forth therein. The warrants shall have a term of three years from the issuance date.

As of June 30, 2023,

we have not received revenue related to our digital consultation services business. We plan to first apply for the financial license

required to engage in crypto-related business in the United States, following which we will develop our digital payment business and

digital bank business on the basis of cryptocurrency advisory business in the future.

The Company has done

the following work in 2023 to grow its crypto consulting-related business in the United States:

On May 1, 2023, the Company

engaged the Bates Group, a well-established compliance service company based in Portland, OR, to guide and assist the Company with obtaining

the cryptocurrency license and money transmitter license. Bates Group has a proven track record, having successfully helped companies

secure Bitlicenses in the past. Additionally, on May 23, 2023, Bates Group provided us with a proposed framework of the Company’s

compliance program, based on which we, together with Bates Group, are currently developing, refining and finalizing a standard and detailed

compliance program to assist and support worldwide crypto firms to settle operating compliance issues in the United States.

Furthermore, the Company

is developing the digital payment functions based on the current asset digitalization platform, and hopes to provide digital payment

solution consultation services to the market after obtaining the corresponding payment license.

In addition, Ucon successfully

earned the approval to enter the Cyberport Incubator in August 2023. The Cyberport Incubator is a collaborative government initiative

supporting over 1,900 technology companies, regarded as the Center of Web3 and crypto in Asia. Ucon’s mission is to provide the

digital consultation services in the Asia Pacific region.

Following completion of the

financings set out above and as at the date of this prospectus, as well as certain private sales undertaken by Ms. Hanqi Li to three

separate buyers, Xin Rong Gan, Hailei Zhang and Hong Mei Zhou, Ms. Li has a beneficial interest in 7,229,579 of our ordinary shares,

which are being registered for resale pursuant to this prospectus.

Private Placement to Huangtong International

Co., Ltd.

On December 15, 2022,

our Company entered into an asset purchase agreement (the “Asset Purchase Agreement”) with Huangtong International Co., Ltd.

(the “Huangtong International”), providing for the Company’s acquisition and purchase of Web3 decentralized storage

infrastructure, including cryptocurrency mining servers, cables, and other electronic devices, for an aggregate consideration of $5,980,000,

payable in the Company’s ordinary shares. The investment is made with an aim to own mining machines capable of gathering, processing,

and storing vast amounts of data, and to further solidify the Company as a pioneer in the creation of the Web3 framework.

Pursuant to the Agreement,

our Company would make the payment for the aforementioned equipment in the form of its ordinary shares, at a stipulated price of $0.0022

per share, in the aggregate amount of 2,718,181,818 shares (pre-reverse split). Following the completion of our share consolidation in

2023 and as at the date of this prospectus, Huangtong International now has a beneficial interest in 7,601,320 of our ordinary shares,

which are being registered for resale pursuant to this prospectus. The ownership of the crypto-mining equipment has been passed to MFH

after the Company successfully issued the Purchase Price Shares to Huangtong International. Huangtong International was responsible for

the installation of all mining equipment at sites designated by the Company and will also undertake routine maintenance of the devices

for one year.

Recent Regulatory Developments

We

are subject to a wide variety of complex laws and regulations in the United States, PRC and other jurisdictions in which we operate.

The laws and regulations govern many issues related to our business practices, including those regarding cryptocurrencies, cybersecurity,

offering and listing of securities, monopolistic behaviours, consumer protection, intellectual property, product liability and disclosures,

employee benefits, taxation and other matters.

These

laws and regulations are constantly evolving and may be interpreted, applied, created, superseded, or amended in a manner that could

harm our business. These changes may occur immediately or develop over time through judicial decisions or as new guidance or interpretations

are provided by regulatory and governing bodies, such as federal, state and local administrative agencies. As we expand our business

into new markets or introduce new features or offerings into existing markets, regulatory bodies or courts may claim that we are subject

to additional requirements, or that we are prohibited from conducting business in certain jurisdictions. This section summarizes the

certain regulations applicable to our business.

Recently,

the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations

in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over

China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly

enforcement. As of the date of this prospectus, we are not directly subject to these

regulatory actions or statements, as we have not implemented any monopolistic behavior and our business does not involve the large-scale

collection of user data, implicate cybersecurity, or involve any other type of restricted industry.

As

of the date of this prospectus, we believe that none of our subsidiaries is currently

required to obtain regulatory approvals or permissions from the CSRC, the CAC, or any other relevant PRC regulatory authorities for their

business operations, our offering (including the sales of securities to foreign investors) and our listing in the U.S. under any existing

PRC law, regulations or rules, nor have we received any inquiry, notice, warning, sanctions or regulatory objection to our business operations,

our offering and listing in the U.S. from the CSRC, the CAC, or other PRC regulatory authorities.

On

November 14, 2021, CAC released the Regulations on Network Data Security (draft for public comments) and accepted public comments

until December 13, 2021. The draft Regulations on Network Data Security provide that data processors refer to individuals or organizations

that autonomously determine the purpose and the manner of processing data. If a data processor that processes personal data of more than

one million users intends to list overseas, it shall apply for a cybersecurity review. In addition, data processors that process important

data or are listed overseas shall carry out an annual data security assessment on their own or by engaging a data security services institution,

and the data security assessment report for the prior year should be submitted to the local cyberspace affairs administration department

before January 31 of each year. On December 28, 2021, the Measures for Cybersecurity Review (2021 version) was promulgated

and took effect on February 15, 2022, which iterates that any “online platform operator” controlling personal information

of more than one million users which seeks to list in a foreign stock exchange should also be subject to cybersecurity review. We are not an “operator of critical information infrastructure” or “large-scale

data processor” as mentioned above. However, PRC regulations relating to personal information protection and data protection,

it has been clarified in the relevant provision that the processing of PRC individual’s personal information outside China will

also under the jurisdiction of the PRC Personal Information Protection Law and if data processing outside China harms the national security,

public interests or the rights and interests of citizens or organizations of the PRC, legal responsibilities will also be investigated.

In addition, neither the Company nor its subsidiaries is an operator of any “critical information infrastructure” as defined

under the PRC Cybersecurity Law and the Security Protection Measures on Critical Information Infrastructure.

However,

Measures for Cybersecurity Review (2021 version) was recently adopted and the Network Internet Data Protection Draft Regulations (draft

for comments) is in the process of being formulated and the Opinions remain unclear on how it will be interpreted, amended and implemented

by the relevant PRC governmental authorities. There remain uncertainties as to when the final measures will be issued and take effect,

how they will be enacted, interpreted or implemented, and whether they will affect us. If we inadvertently conclude that the Measures

for Cybersecurity Review (2021 version) do not apply to us, or applicable laws, regulations, or interpretations change and it is determined

in the future that the Measures for Cybersecurity Review (2021 version) become applicable to us, we may be subject to review when conducting

data processing activities, and may face challenges in addressing its requirements and make necessary changes to our internal policies

and practices. We may incur substantial costs in complying with the Measures for Cybersecurity Review (2021 version), which could result

in material adverse changes in our business operations and financial position. If we are not able to fully comply with the Measures for

Cybersecurity Review (2021 version), our ability to offer or continue to offer securities to investors may be significantly limited or

completely hindered, and our securities may significantly decline in value or become worthless.

On