UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File No. 001-39621

OPTHEA LIMITED

(Translation of registrant’s name into English)

Level 4

650 Chapel Street

South Yarra, Victoria, 3141

Australia

(Address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

OPTHEA LIMITED |

|

(Registrant) |

|

|

|

|

By: |

/s/ Frederic Guerard |

|

Name: |

Frederic Guerard |

|

Title: |

Chief Executive Officer |

Date: 01/11/2024

Sozinibercept (OPT-302) for Wet AMD�Transforming Patient Outcomes by Improving Vision Corporate Presentation | January 2024 OPTHEA.COM | @OptheaLimited | NASDAQ (OPT); ASX (OPT.AX) Exhibit 99.1

Disclaimer This presentation includes general background information about the activities of Opthea Limited (ABN 32 006 340 567) (“Opthea” or “Company”) and its affiliates and subsidiaries (together, the “Opthea Group”). The information contained in this presentation is in summary form and does not purport to be complete. This presentation contains forward-looking statements within the meaning of the U.S. federal securities laws that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this presentation, including statements regarding the therapeutic and commercial potential and size of estimated market opportunity of the Company's product in development, the viability of future opportunities, future market supply and demand, the expected timing of completion of patient enrollment under the clinical trials and timing of top-line data, our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements as predictions of future events. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. The forward-looking statements contained in this presentation reflect our current views with respect to future events, and we assume no obligation to update any forward-looking statements except as required by applicable law. Please refer to information, including risk factors, set forth in Opthea’s Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission on September 28, 2023 and other future filings with the U.S. Securities and Exchange Commission for key factors that could cause actual results to differ materially from those projected in the forward-looking statements contained herein. This presentation includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties as well as our own estimates of potential market opportunities. All of the market data used in this presentation involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Our estimates of the potential market opportunities for our product candidates include several key assumptions based on our industry knowledge, industry publications, third-party research and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While we believe that our internal assumptions are reasonable, no independent source has verified such assumptions including risks associated with future capital requirements, the development, testing, production, marketing and sale of drug treatments, regulatory risk and potential loss of regulatory approvals, ongoing clinical studies to demonstrate sozinibercept's safety, tolerability and therapeutic efficacy, additional analysis from Opthea's Phase 3 clinical trials once unmasked, timing of completion of Phase 3 clinical trial patient enrollment and clinical research organization and labor costs, intellectual property protections, compliance with the terms and conditions of the development funding agreement and other factors that are of a general nature which may affect the future operating and financial performance of the Company.. The information contained in this presentation does not constitute investment or financial product advice (nor taxation or legal advice) and is not intended to be used as the basis for making an investment decision. It does not take into account the investment objectives, financial situation, taxation position or needs of any particular investor, which should be considered when deciding if an investment is appropriate. You must consider your own investment objectives, financial situation and needs and conduct your own independent investigations and enquiries, including obtaining taxation, legal, financial or other professional advice in relation to the information contained in this presentation as appropriate to your jurisdiction. This presentation should not be relied upon by the Recipient in considering the merits of any particular transaction. This presentation may contain trademarks and trade names of third parties, which are the property of their respective owners. Third party trademarks and trade names used in this presentation belong to the relevant owners and use is not intended to represent sponsorship, approval or association by or with any of the Opthea Group.

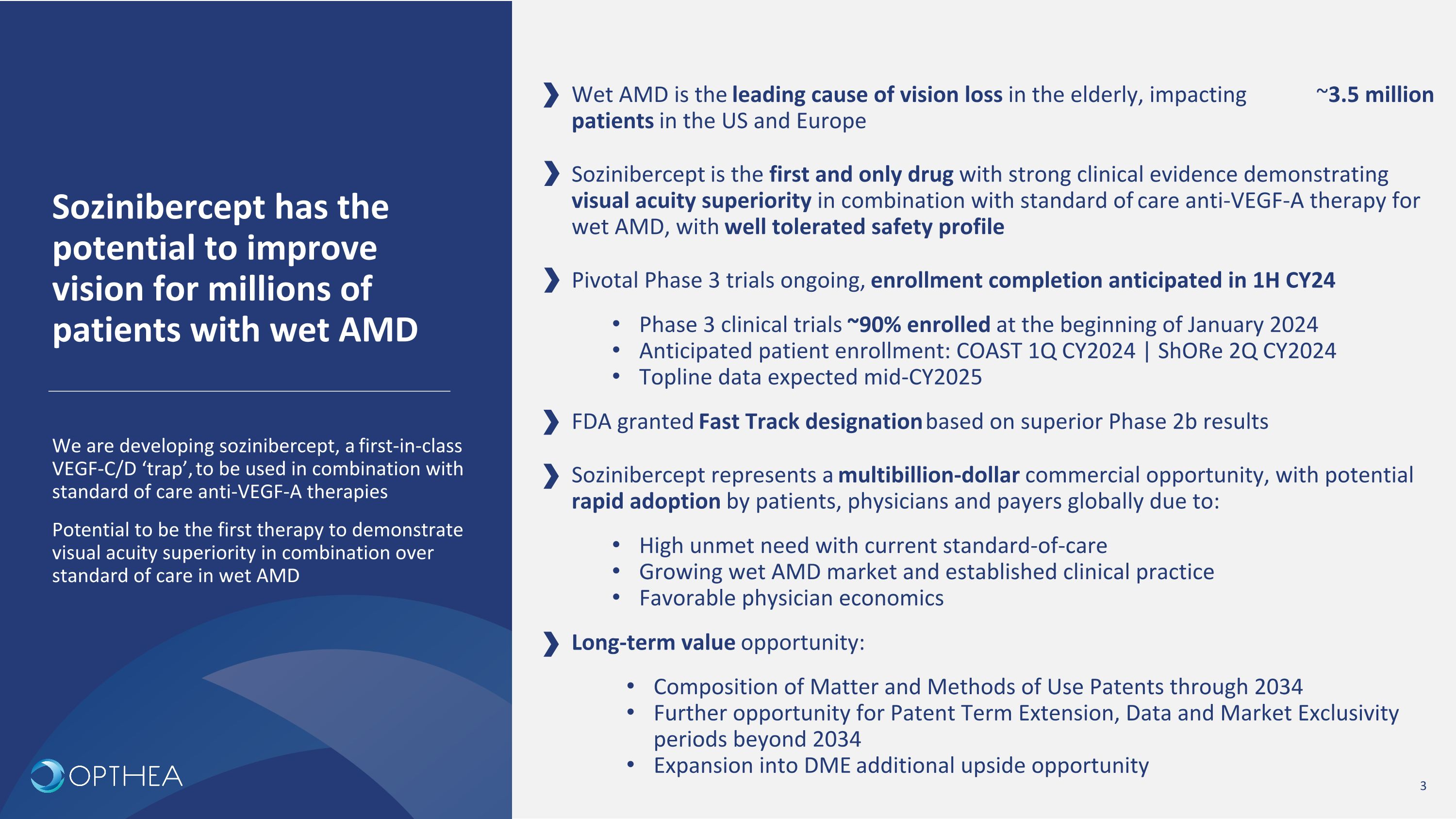

We are developing sozinibercept, a first-in-class VEGF-C/D ‘trap’, to be used in combination with standard of care anti-VEGF-A therapies Potential to be the first therapy to demonstrate visual acuity superiority in combination over standard of care in wet AMD Sozinibercept has the potential to improve vision for millions of patients with wet AMD Wet AMD is the leading cause of vision loss in the elderly, impacting ~3.5 million patients in the US and Europe Sozinibercept is the first and only drug with strong clinical evidence demonstrating visual acuity superiority in combination with standard of care anti-VEGF-A therapy for wet AMD, with well tolerated safety profile Pivotal Phase 3 trials ongoing, enrollment completion anticipated in 1H CY24 Phase 3 clinical trials ~90% enrolled at the beginning of January 2024 Anticipated patient enrollment: COAST 1Q CY2024 | ShORe 2Q CY2024 Topline data expected mid-CY2025 FDA granted Fast Track designation based on superior Phase 2b results Sozinibercept represents a multibillion-dollar commercial opportunity, with potential rapid adoption by patients, physicians and payers globally due to: High unmet need with current standard-of-care Growing wet AMD market and established clinical practice Favorable physician economics Long-term value opportunity: Composition of Matter and Methods of Use Patents through 2034 Further opportunity for Patent Term Extension, Data and Market Exclusivity periods beyond 2034 Expansion into DME additional upside opportunity

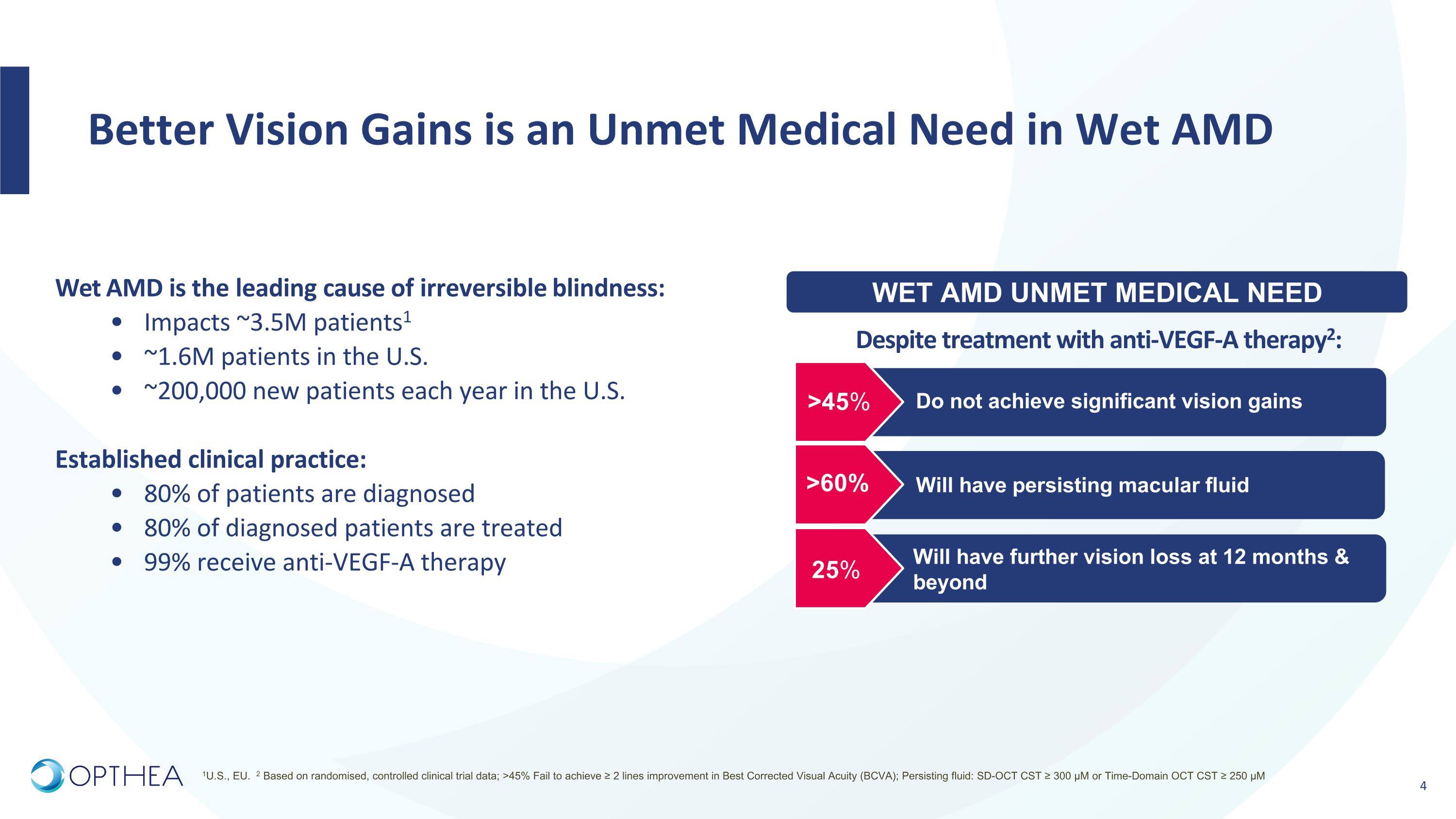

Better Vision Gains is an Unmet Medical Need in Wet AMD >45% >60% 25% Do not achieve significant vision gains Will have persisting macular fluid Will have further vision loss at 12 months & beyond Wet AMD is the leading cause of irreversible blindness: Impacts ~3.5M patients1 ~1.6M patients in the U.S. ~200,000 new patients each year in the U.S. Established clinical practice: 80% of patients are diagnosed 80% of diagnosed patients are treated 99% receive anti-VEGF-A therapy Despite treatment with anti-VEGF-A therapy2: 1U.S., EU. 2 Based on randomised, controlled clinical trial data; >45% Fail to achieve ≥ 2 lines improvement in Best Corrected Visual Acuity (BCVA); Persisting fluid: SD-OCT CST ≥ 300 µM or Time-Domain OCT CST ≥ 250 µM WET AMD UNMET MEDICAL NEED

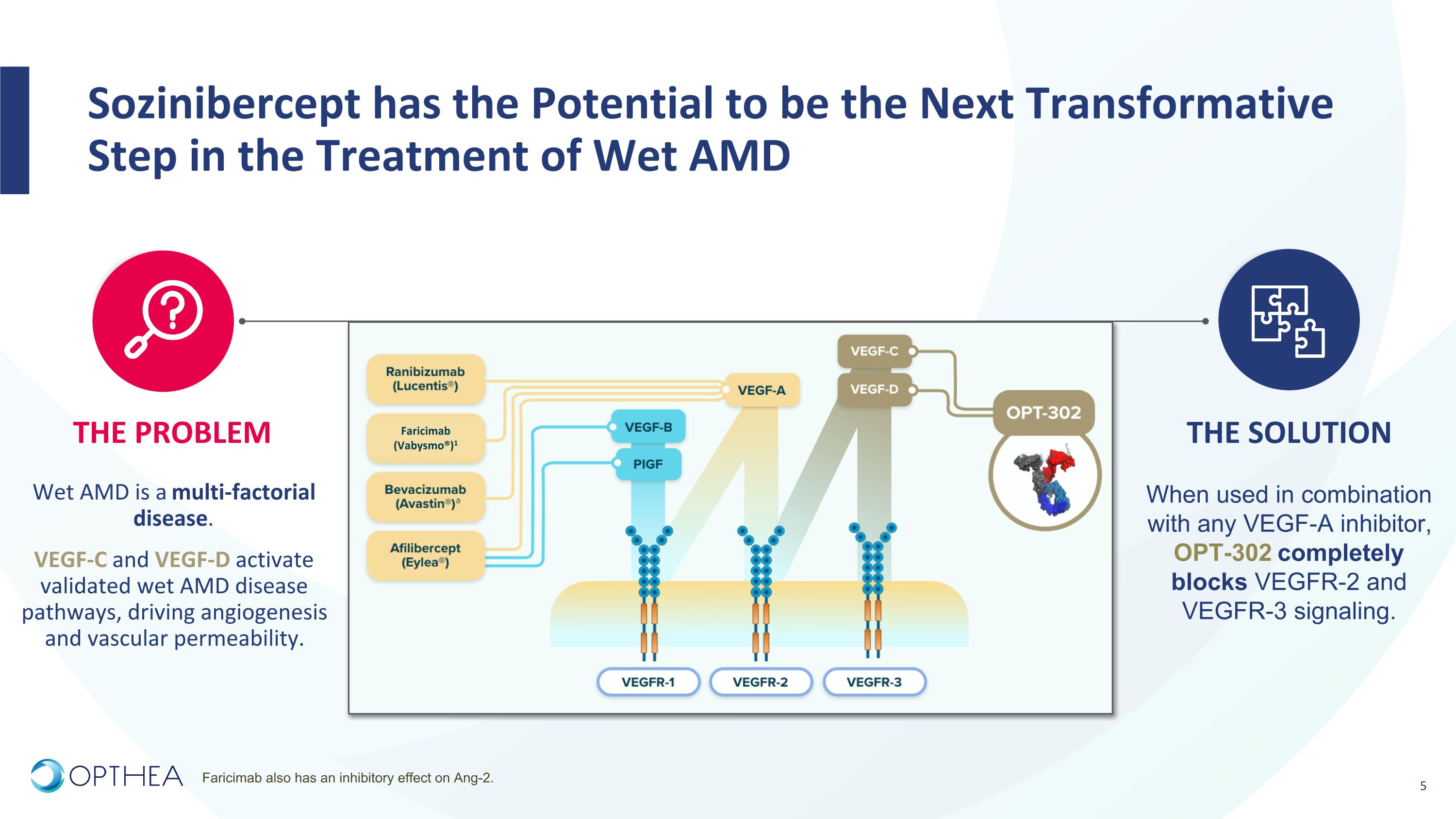

Sozinibercept has the Potential to be the Next Transformative Step in the Treatment of Wet AMD THE PROBLEM THE SOLUTION Wet AMD is a multi-factorial disease. VEGF-C and VEGF-D activate validated wet AMD disease pathways, driving angiogenesis and vascular permeability. When used in combination with any VEGF-A inhibitor, OPT-302 completely blocks VEGFR-2 and VEGFR-3 signaling. Faricimab (Vabysmo®)1 Faricimab also has an inhibitory effect on Ang-2.

Wet AMD Potential Addressable Market Wet AMD Total Global Revenue Large & Growing Market Opportunity in Wet AMD�Sozinibercept could be combined with any anti-VEGF-A ~US$8B+ Off-label use Implied Total Addressable Market for Sozinibercept Captures Lucentis, Eylea, Vabysmo, and Avastin or biosimilar-treated patients worldwide ~US$16B+ ~50% treated patients receive Avastin ® ~50% treated patients receive branded products Sozinibercept is positioned to tap into the entire VEGF-A inhibitor market

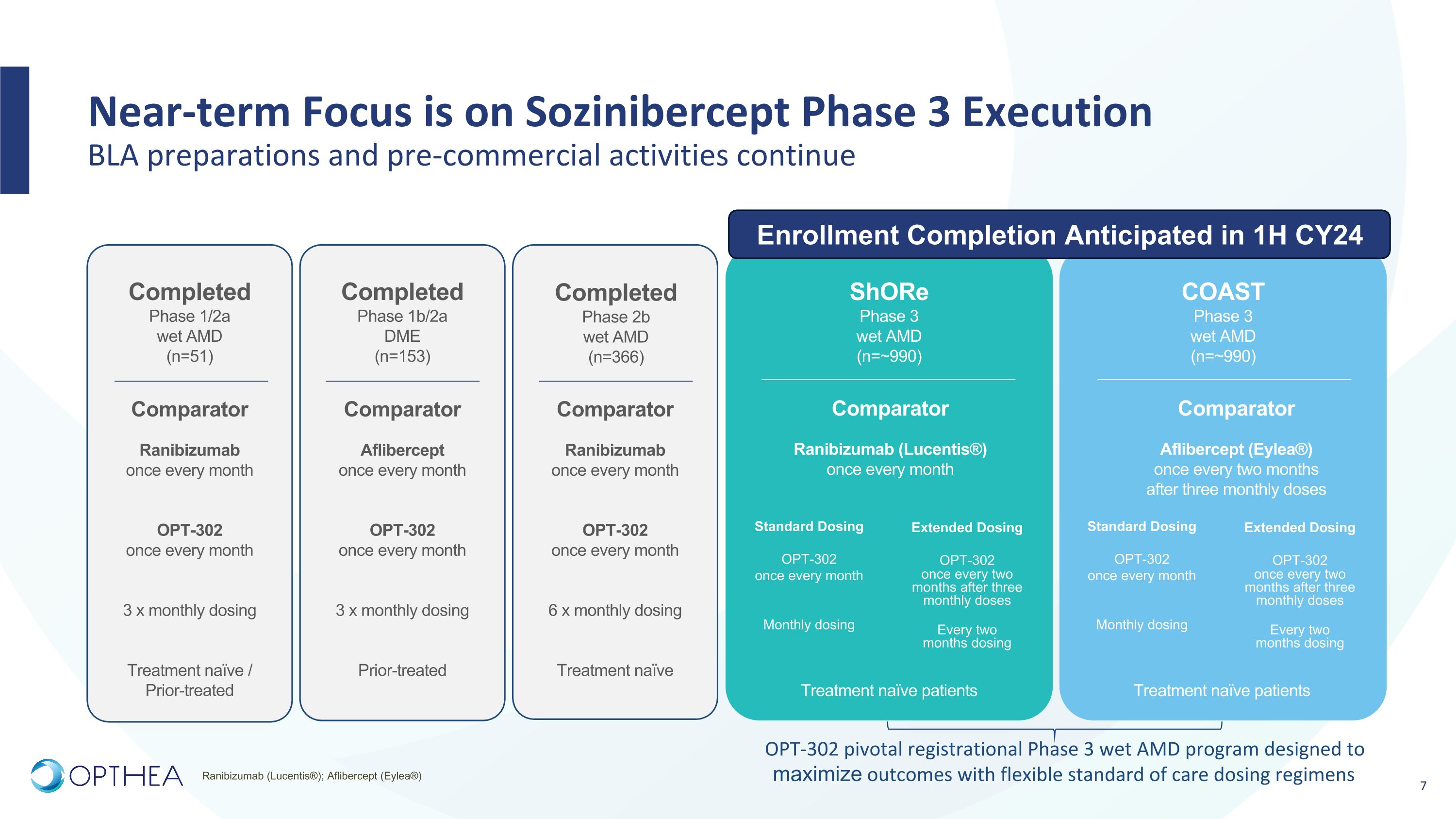

Near-term Focus is on Sozinibercept Phase 3 Execution�BLA preparations and pre-commercial activities continue ShORe Phase 3 wet AMD (n=~990) Comparator Ranibizumab (Lucentis®) once every month COAST Phase 3 wet AMD (n=~990) Comparator Aflibercept (Eylea®) once every two months after three monthly doses Standard Dosing OPT-302 once every month Monthly dosing Extended Dosing OPT-302 once every two months after three monthly doses Every two �months dosing Treatment naïve patients Standard Dosing OPT-302 once every month Monthly dosing Extended Dosing OPT-302 once every two months after three monthly doses Every two �months dosing Treatment naïve patients Completed Phase 1/2a wet AMD (n=51) Comparator Ranibizumab once every month OPT-302 once every month 3 x monthly dosing Treatment naïve / Prior-treated Comparator Aflibercept once every month OPT-302 once every month 3 x monthly dosing Prior-treated Completed Phase 1b/2a DME (n=153) Comparator Ranibizumab once every month OPT-302 once every month 6 x monthly dosing Treatment naïve Completed Phase 2b wet AMD (n=366) OPT-302 pivotal registrational Phase 3 wet AMD program designed to maximize outcomes with flexible standard of care dosing regimens Ranibizumab (Lucentis®); Aflibercept (Eylea®) Enrollment Completion Anticipated in 1H CY24

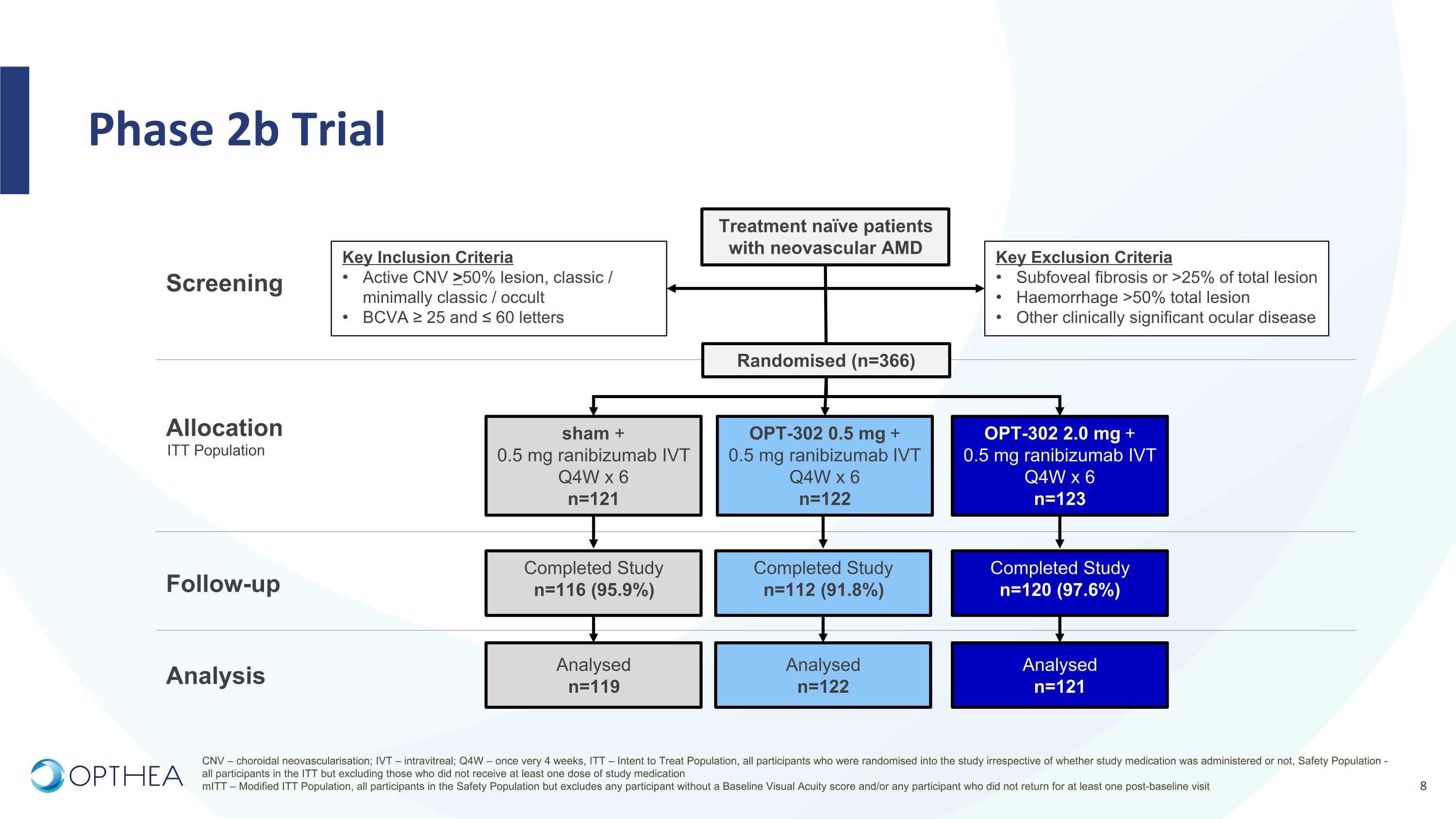

Phase 2b Trial Screening Treatment naïve patients with neovascular AMD Key Exclusion Criteria Subfoveal fibrosis or >25% of total lesion Haemorrhage >50% total lesion Other clinically significant ocular disease Key Inclusion Criteria Active CNV >50% lesion, classic / minimally classic / occult BCVA ≥ 25 and ≤ 60 letters Allocation Follow-up Analysis Randomised (n=366) OPT-302 0.5 mg + 0.5 mg ranibizumab IVT Q4W x 6 n=122 sham + 0.5 mg ranibizumab IVT Q4W x 6 n=121 OPT-302 2.0 mg + 0.5 mg ranibizumab IVT Q4W x 6 n=123 Completed Study n=112 (91.8%) Completed Study n=116 (95.9%) Completed Study n=120 (97.6%) Analysed n=122 Analysed n=119 Analysed n=121 ITT Population CNV – choroidal neovascularisation; IVT – intravitreal; Q4W – once very 4 weeks, ITT – Intent to Treat Population, all participants who were randomised into the study irrespective of whether study medication was administered or not, Safety Population - all participants in the ITT but excluding those who did not receive at least one dose of study medication mITT – Modified ITT Population, all participants in the Safety Population but excludes any participant without a Baseline Visual Acuity score and/or any participant who did not return for at least one post-baseline visit

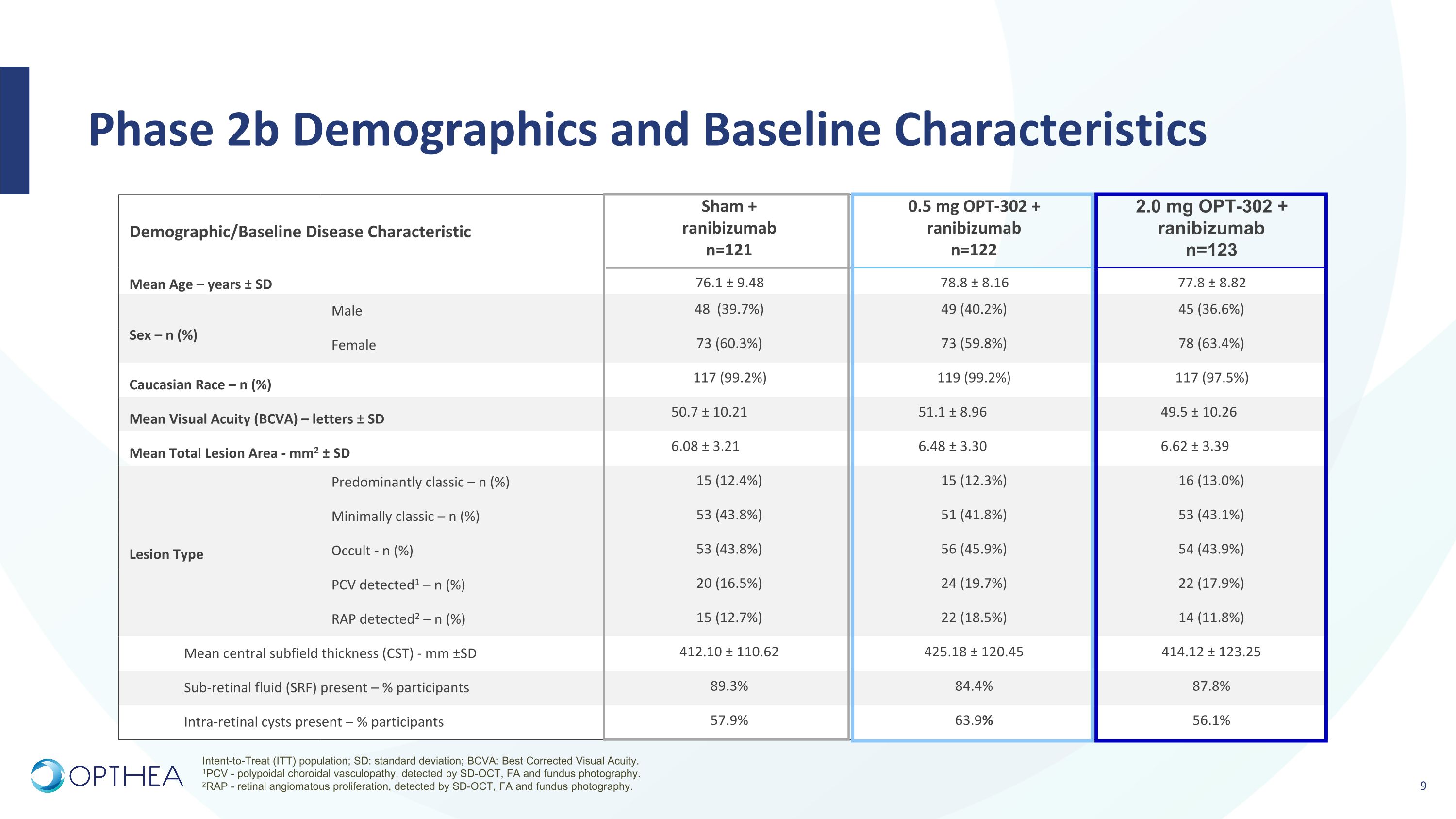

Phase 2b Demographics and Baseline Characteristics Demographic/Baseline Disease Characteristic Sham + ranibizumab n=121 0.5 mg OPT-302 + ranibizumab n=122 2.0 mg OPT-302 + ranibizumab n=123 Mean Age – years ± SD 76.1 ± 9.48 78.8 ± 8.16 77.8 ± 8.82 Sex – n (%) Male 48 (39.7%) 49 (40.2%) 45 (36.6%) Female 73 (60.3%) 73 (59.8%) 78 (63.4%) Caucasian Race – n (%) 117 (99.2%) 119 (99.2%) 117 (97.5%) Mean Visual Acuity (BCVA) – letters ± SD 50.7 ± 10.21 51.1 ± 8.96 49.5 ± 10.26 Mean Total Lesion Area - mm2 ± SD 6.08 ± 3.21 6.48 ± 3.30 6.62 ± 3.39 Lesion Type Predominantly classic – n (%) 15 (12.4%) 15 (12.3%) 16 (13.0%) Minimally classic – n (%) 53 (43.8%) 51 (41.8%) 53 (43.1%) Occult - n (%) 53 (43.8%) 56 (45.9%) 54 (43.9%) PCV detected1 – n (%) 20 (16.5%) 24 (19.7%) 22 (17.9%) RAP detected2 – n (%) 15 (12.7%) 22 (18.5%) 14 (11.8%) Mean central subfield thickness (CST) - mm ±SD 412.10 ± 110.62 425.18 ± 120.45 414.12 ± 123.25 Sub-retinal fluid (SRF) present – % participants 89.3% 84.4% 87.8% Intra-retinal cysts present – % participants 57.9% 63.9% 56.1% Intent-to-Treat (ITT) population; SD: standard deviation; BCVA: Best Corrected Visual Acuity. 1PCV - polypoidal choroidal vasculopathy, detected by SD-OCT, FA and fundus photography. 2RAP - retinal angiomatous proliferation, detected by SD-OCT, FA and fundus photography.

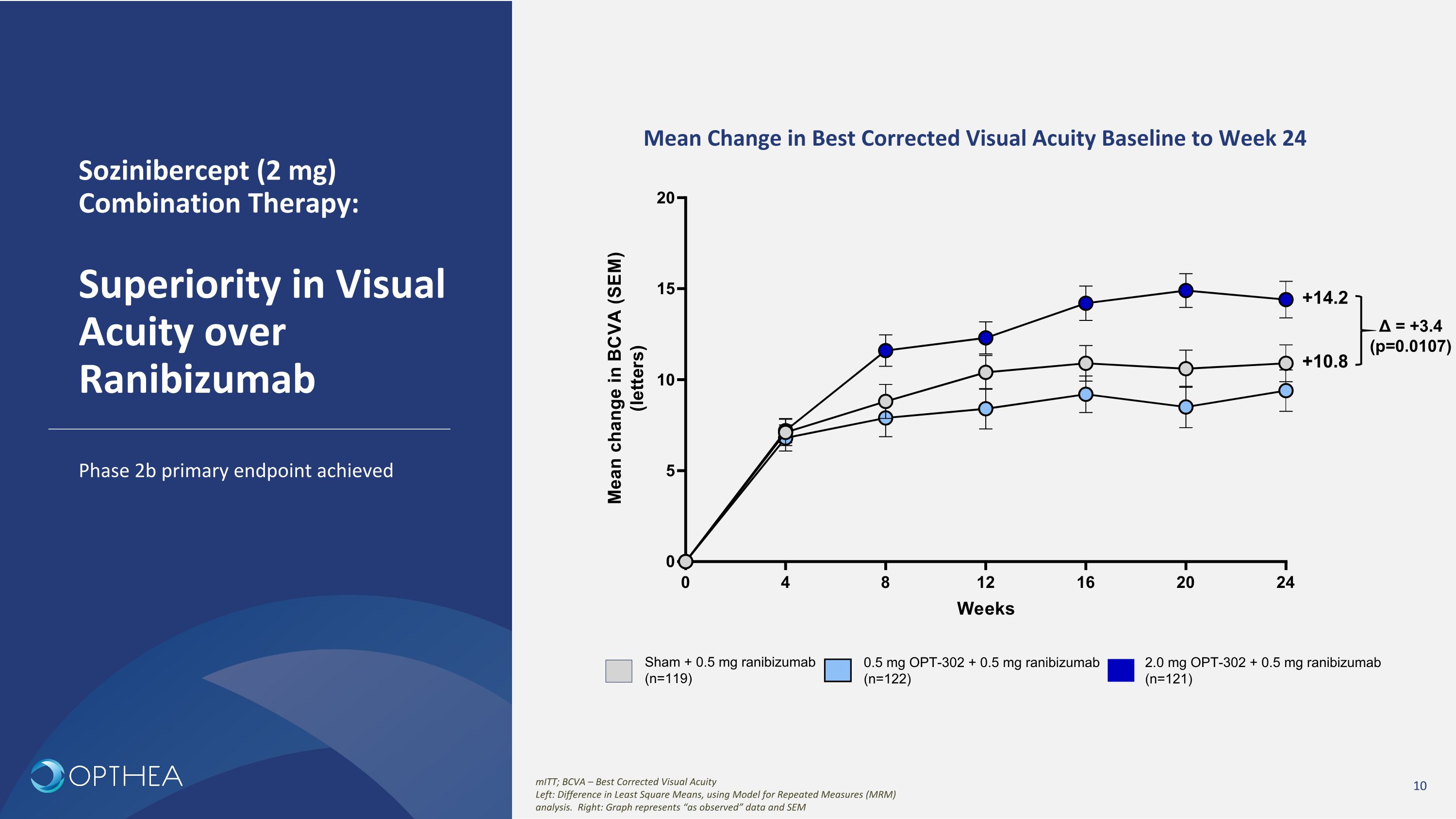

Sozinibercept (2 mg) Combination Therapy:��Superiority in Visual Acuity over Ranibizumab Phase 2b primary endpoint achieved Mean Change in Best Corrected Visual Acuity Baseline to Week 24 mITT; BCVA – Best Corrected Visual Acuity Left: Difference in Least Square Means, using Model for Repeated Measures (MRM) analysis. Right: Graph represents “as observed” data and SEM Sham + 0.5 mg ranibizumab (n=119) 2.0 mg OPT-302 + 0.5 mg ranibizumab (n=121) 0.5 mg OPT-302 + 0.5 mg ranibizumab (n=122) +10.8 +14.2 Δ = +3.4 (p=0.0107)

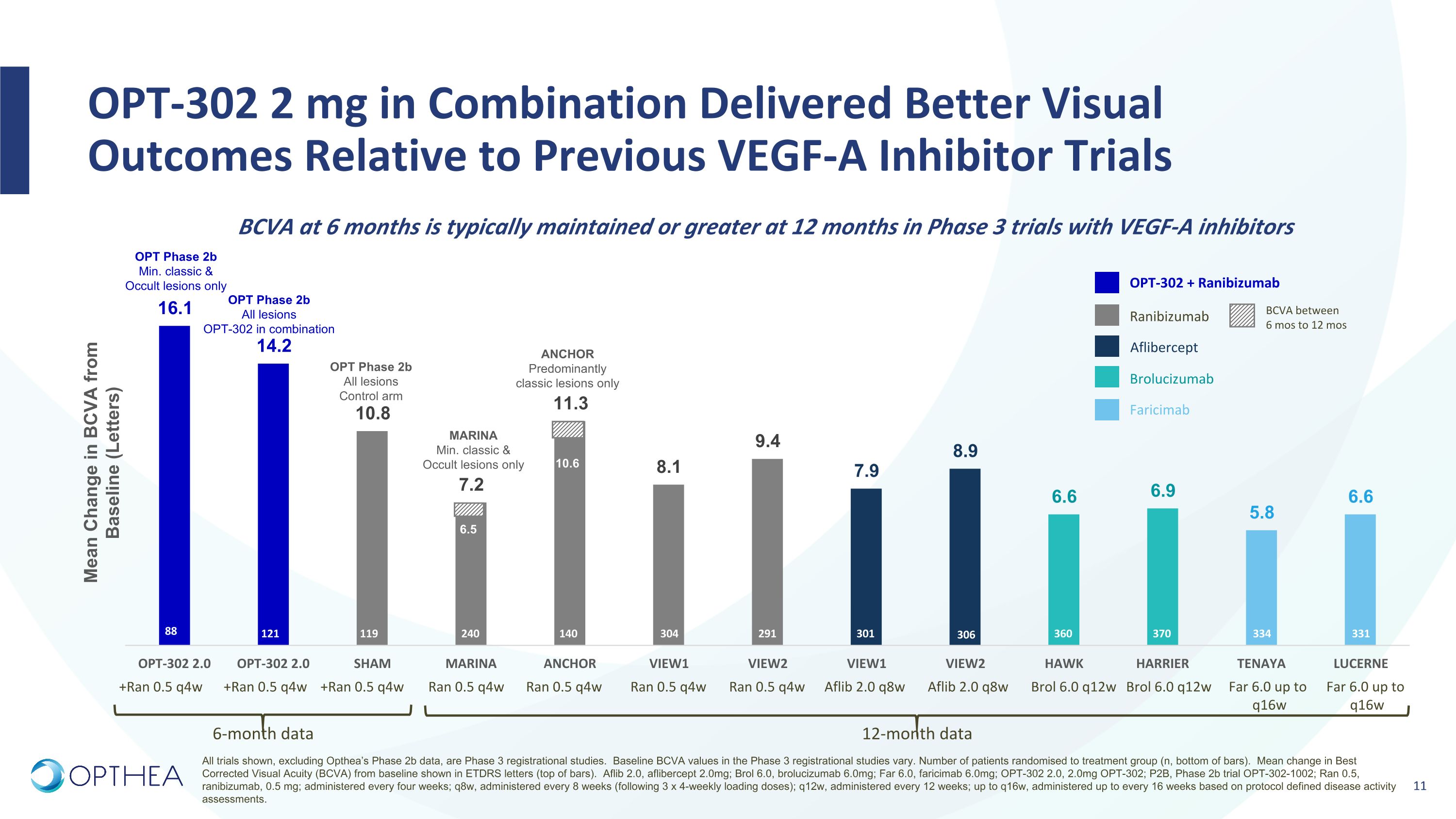

OPT-302 2 mg in Combination Delivered Better Visual Outcomes Relative to Previous VEGF-A Inhibitor Trials BCVA at 6 months is typically maintained or greater at 12 months in Phase 3 trials with VEGF-A inhibitors 121 119 240 140 304 291 301 306 360 370 6-month data 12-month data MARINA Min. classic & Occult lesions only ANCHOR Predominantly classic lesions only OPT Phase 2b Min. classic & Occult lesions only 88 +Ran 0.5 q4w +Ran 0.5 q4w +Ran 0.5 q4w Ran 0.5 q4w Ran 0.5 q4w Aflib 2.0 q8w Aflib 2.0 q8w Ran 0.5 q4w Ran 0.5 q4w Brol 6.0 q12w Brol 6.0 q12w OPT-302 + Ranibizumab Ranibizumab Aflibercept Brolucizumab BCVA between 6 mos to 12 mos Faricimab 10.6 6.5 OPT Phase 2b All lesions OPT-302 in combination OPT Phase 2b All lesions Control arm Mean Change in BCVA from Baseline (Letters) 334 331 Far 6.0 up to q16w Far 6.0 up to q16w All trials shown, excluding Opthea’s Phase 2b data, are Phase 3 registrational studies. Baseline BCVA values in the Phase 3 registrational studies vary. Number of patients randomised to treatment group (n, bottom of bars). Mean change in Best Corrected Visual Acuity (BCVA) from baseline shown in ETDRS letters (top of bars). Aflib 2.0, aflibercept 2.0mg; Brol 6.0, brolucizumab 6.0mg; Far 6.0, faricimab 6.0mg; OPT-302 2.0, 2.0mg OPT-302; P2B, Phase 2b trial OPT-302-1002; Ran 0.5, ranibizumab, 0.5 mg; administered every four weeks; q8w, administered every 8 weeks (following 3 x 4-weekly loading doses); q12w, administered every 12 weeks; up to q16w, administered up to every 16 weeks based on protocol defined disease activity assessments.

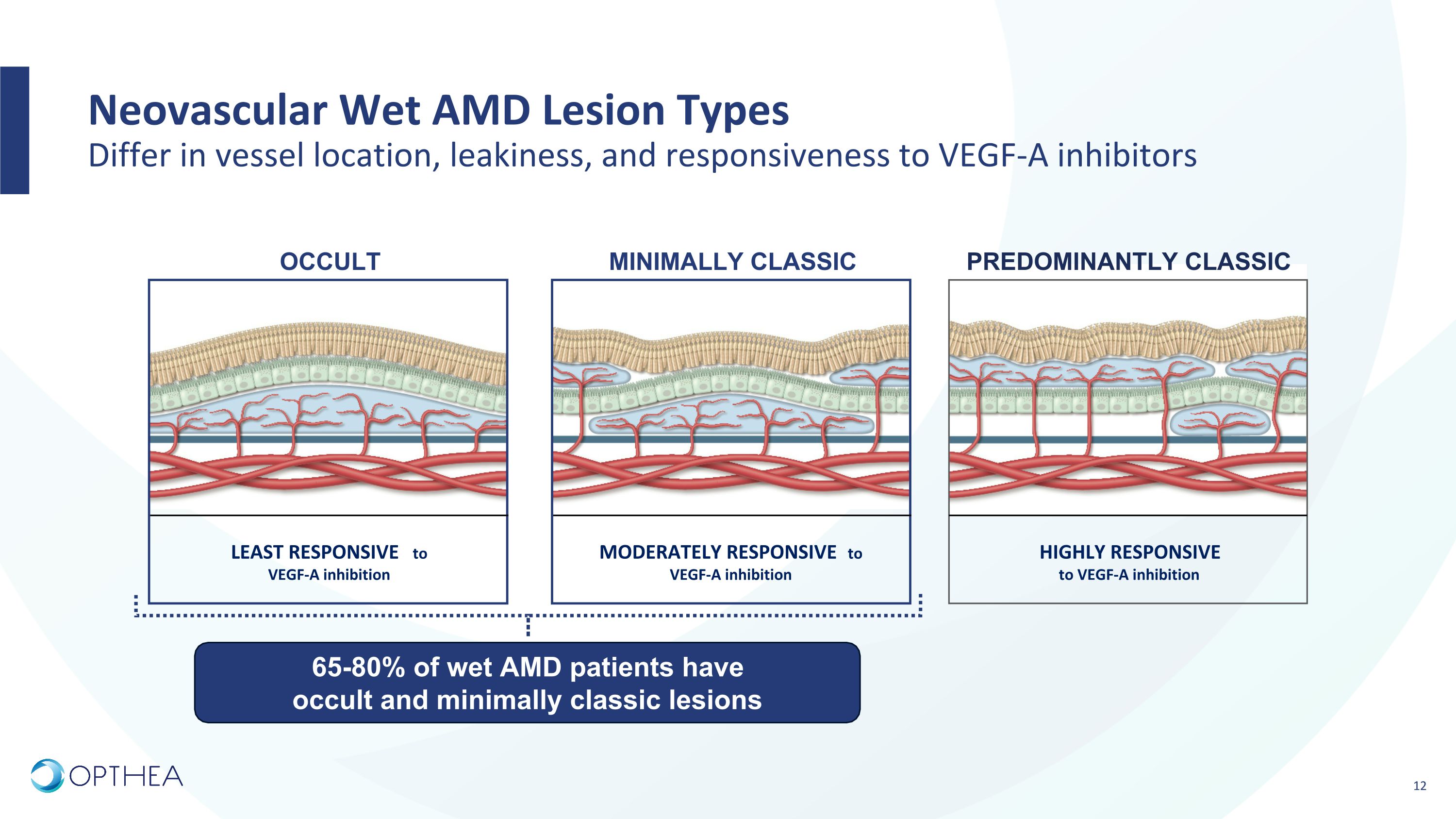

Neovascular Wet AMD Lesion Types�Differ in vessel location, leakiness, and responsiveness to VEGF-A inhibitors LEAST RESPONSIVE to VEGF-A inhibition MODERATELY RESPONSIVE to VEGF-A inhibition HIGHLY RESPONSIVE �to VEGF-A inhibition Predominantly Classic MINIMALLY CLASSIC OCCULT 65-80% of wet AMD patients have occult and minimally classic lesions

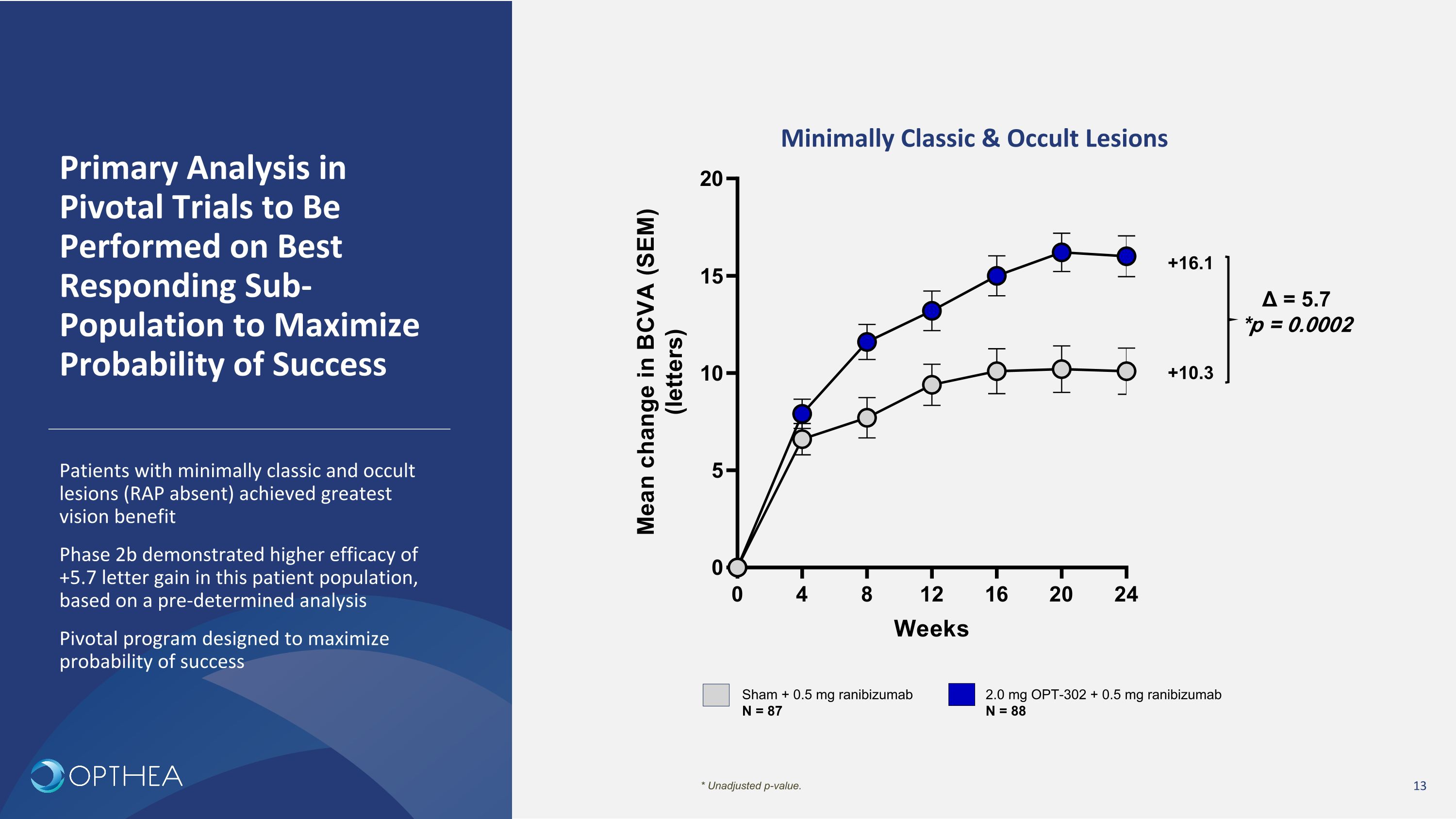

Primary Analysis in Pivotal Trials to Be Performed on Best Responding Sub-Population to Maximize Probability of Success Minimally Classic & Occult Lesions Sham + 0.5 mg ranibizumab N = 87 2.0 mg OPT-302 + 0.5 mg ranibizumab N = 88 +10.3 +16.1 Δ = 5.7 *p = 0.0002 * Unadjusted p-value. Patients with minimally classic and occult lesions (RAP absent) achieved greatest vision benefit Phase 2b demonstrated higher efficacy of +5.7 letter gain in this patient population, based on a pre-determined analysis Pivotal program designed to maximize probability of success

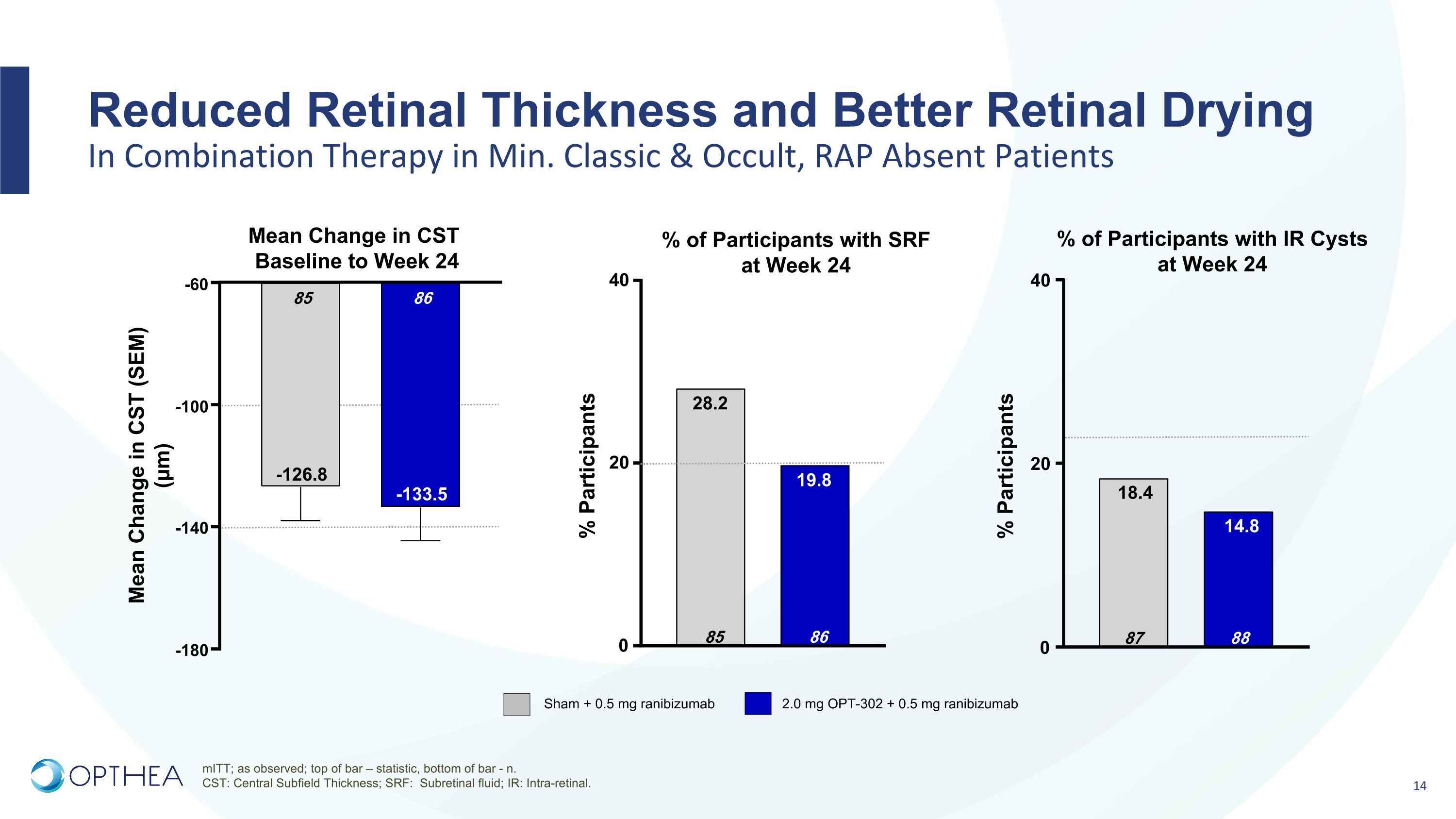

Reduced Retinal Thickness and Better Retinal Drying�In Combination Therapy in Min. Classic & Occult, RAP Absent Patients Mean Change in CST Baseline to Week 24 Sham + 0.5 mg ranibizumab 2.0 mg OPT-302 + 0.5 mg ranibizumab % of Participants with IR Cysts at Week 24 % of Participants with SRF at Week 24 mITT; as observed; top of bar – statistic, bottom of bar - n. CST: Central Subfield Thickness; SRF: Subretinal fluid; IR: Intra-retinal. % Participants -180 -140 -100 -60 86 -133.5 85 -126.8 Mean Change in CST (SEM)�(µm) 0 20 40 88 14.8 87 18.4 0 20 40 86 19.8 85 28.2 % Participants

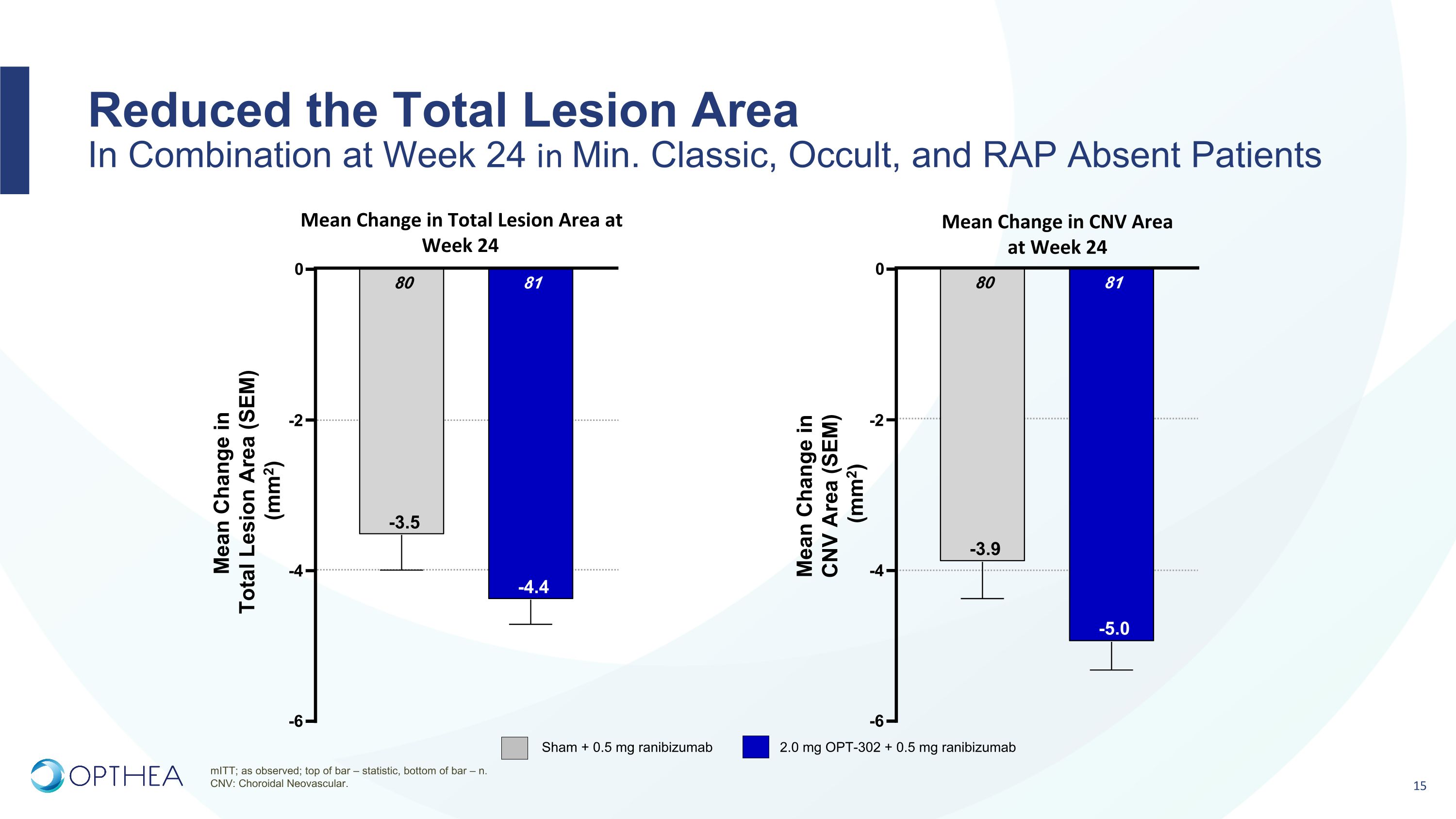

Reduced the Total Lesion Area�In Combination at Week 24 in Min. Classic, Occult, and RAP Absent Patients mITT; as observed; top of bar – statistic, bottom of bar – n. CNV: Choroidal Neovascular. Mean Change in Total Lesion Area at Week 24 Mean Change in CNV Area �at Week 24 -6 -4 -2 0 81 -4.4 80 -3.5 Mean Change in �Total Lesion Area (SEM) �(mm2) -6 -4 -2 0 81 -5.0 80 -3.9 Mean Change in �CNV Area (SEM) �(mm2) Sham + 0.5 mg ranibizumab 2.0 mg OPT-302 + 0.5 mg ranibizumab

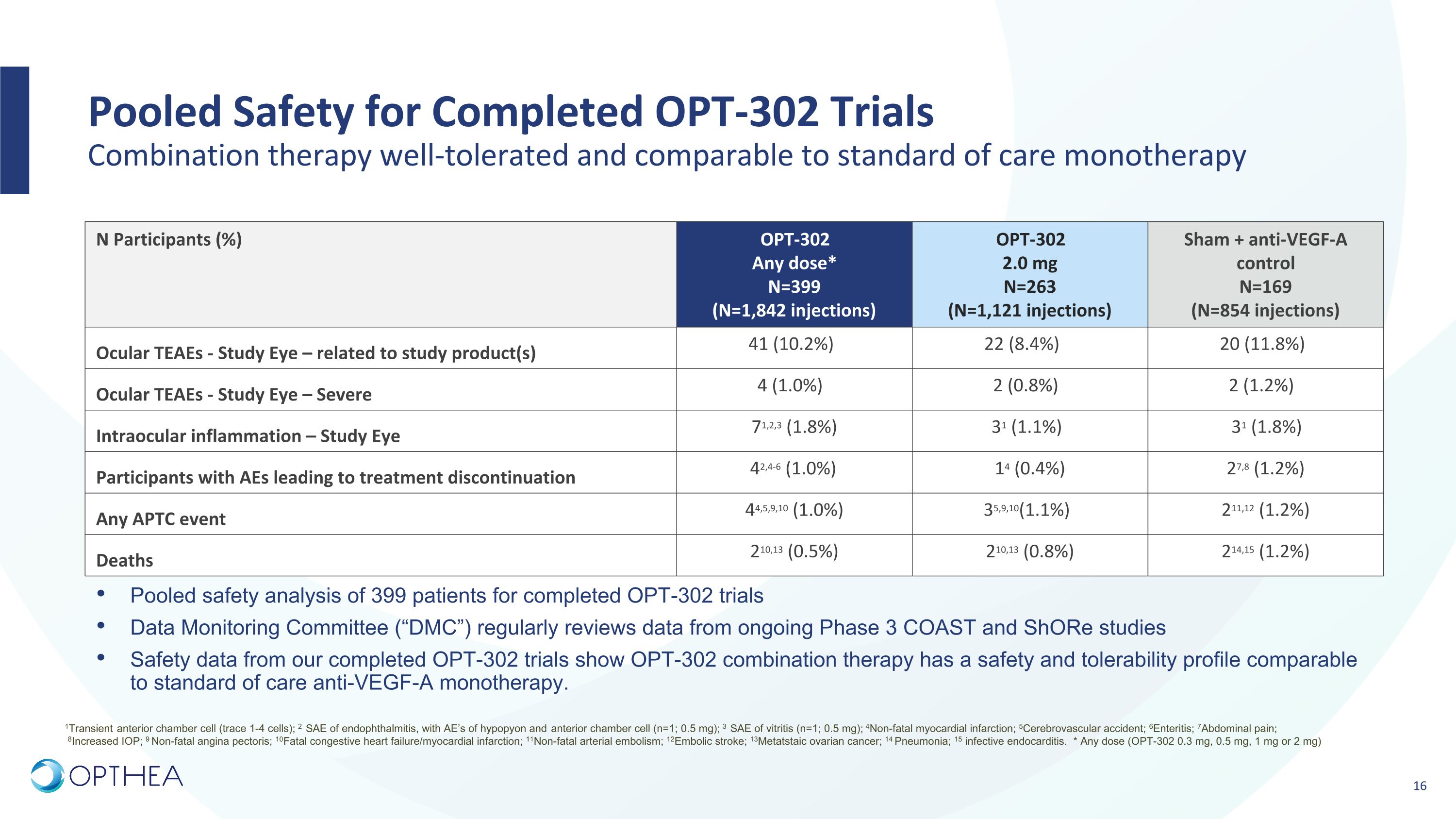

Pooled Safety for Completed OPT-302 Trials�Combination therapy well-tolerated and comparable to standard of care monotherapy N Participants (%) OPT-302 Any dose* N=399 (N=1,842 injections) OPT-302 2.0 mg N=263 (N=1,121 injections) Sham + anti-VEGF-A control N=169 (N=854 injections) Ocular TEAEs - Study Eye – related to study product(s) 41 (10.2%) 22 (8.4%) 20 (11.8%) Ocular TEAEs - Study Eye – Severe 4 (1.0%) 2 (0.8%) 2 (1.2%) Intraocular inflammation – Study Eye 71,2,3 (1.8%) 31 (1.1%) 31 (1.8%) Participants with AEs leading to treatment discontinuation 42,4-6 (1.0%) 14 (0.4%) 27,8 (1.2%) Any APTC event 44,5,9,10 (1.0%) 35,9,10(1.1%) 211,12 (1.2%) Deaths 210,13 (0.5%) 210,13 (0.8%) 214,15 (1.2%) Pooled safety analysis of 399 patients for completed OPT-302 trials Data Monitoring Committee (“DMC”) regularly reviews data from ongoing Phase 3 COAST and ShORe studies Safety data from our completed OPT-302 trials show OPT-302 combination therapy has a safety and tolerability profile comparable to standard of care anti-VEGF-A monotherapy. 1Transient anterior chamber cell (trace 1-4 cells); 2 SAE of endophthalmitis, with AE’s of hypopyon and anterior chamber cell (n=1; 0.5 mg); 3 SAE of vitritis (n=1; 0.5 mg); 4Non-fatal myocardial infarction; 5Cerebrovascular accident; 6Enteritis; 7Abdominal pain; 8Increased IOP; 9 Non-fatal angina pectoris; 10Fatal congestive heart failure/myocardial infarction; 11Non-fatal arterial embolism; 12Embolic stroke; 13Metatstaic ovarian cancer; 14 Pneumonia; 15 infective endocarditis. * Any dose (OPT-302 0.3 mg, 0.5 mg, 1 mg or 2 mg)

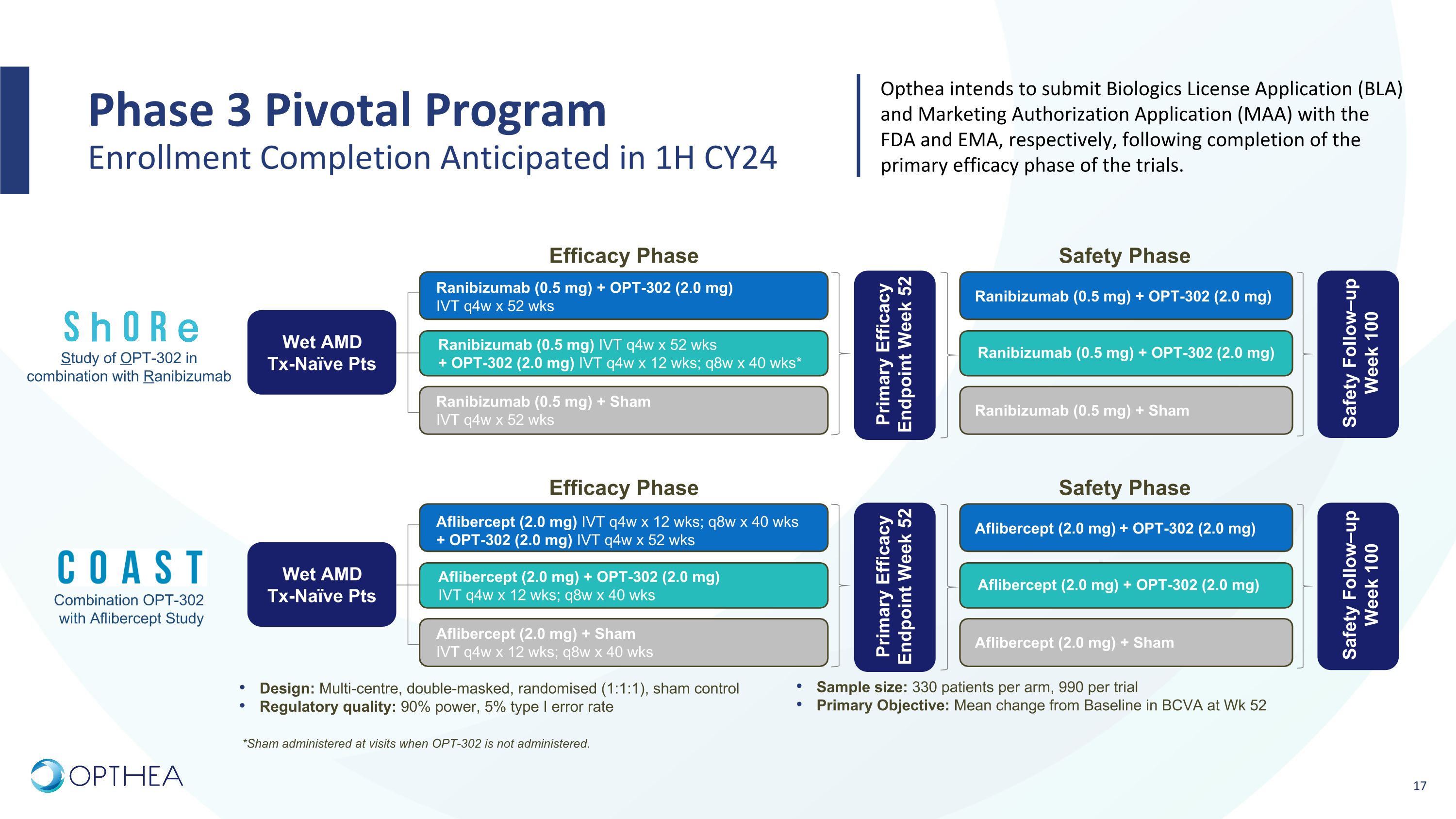

Phase 3 Pivotal Program �Enrollment Completion Anticipated in 1H CY24 Sample size: 330 patients per arm, 990 per trial Primary Objective: Mean change from Baseline in BCVA at Wk 52 Design: Multi-centre, double-masked, randomised (1:1:1), sham control Regulatory quality: 90% power, 5% type I error rate Study of OPT-302 in combination with Ranibizumab Primary Efficacy Endpoint Week 52 Wet AMD Tx-Naïve Pts Ranibizumab (0.5 mg) + OPT-302 (2.0 mg) IVT q4w x 52 wks Ranibizumab (0.5 mg) + Sham IVT q4w x 52 wks Efficacy Phase Ranibizumab (0.5 mg) IVT q4w x 52 wks + OPT-302 (2.0 mg) IVT q4w x 12 wks; q8w x 40 wks* Safety Phase Ranibizumab (0.5 mg) + OPT-302 (2.0 mg) Ranibizumab (0.5 mg) + Sham Ranibizumab (0.5 mg) + OPT-302 (2.0 mg) Safety Follow–up Week 100 Combination OPT-302 with Aflibercept Study Primary Efficacy Endpoint Week 52 Wet AMD Tx-Naïve Pts Aflibercept (2.0 mg) IVT q4w x 12 wks; q8w x 40 wks + OPT-302 (2.0 mg) IVT q4w x 52 wks Aflibercept (2.0 mg) + Sham IVT q4w x 12 wks; q8w x 40 wks Efficacy Phase Aflibercept (2.0 mg) + OPT-302 (2.0 mg) IVT q4w x 12 wks; q8w x 40 wks Safety Phase Aflibercept (2.0 mg) + OPT-302 (2.0 mg) Aflibercept (2.0 mg) + Sham Aflibercept (2.0 mg) + OPT-302 (2.0 mg) Safety Follow–up Week 100 Opthea intends to submit Biologics License Application (BLA) and Marketing Authorization Application (MAA) with the FDA and EMA, respectively, following completion of the primary efficacy phase of the trials. *Sham administered at visits when OPT-302 is not administered.

Sozinibercept is a Potential Multibillion Dollar Drug Strong Phase 2b Data Superior vision gains of OPT-302 combination therapy over standard of care Consistent improvement across anatomical endpoints Safety profile similar to standard of care in our trials to date Pivotal Phase 3 Trials Ongoing; Enrollment Completion Anticipated in 1H CY24 Phase 3 clinical trials ~90% enrolled at the beginning of January 2024; topline data expected in mid-CY2025 Design informed by Phase 2b data to maximize probability of success Aligned with FDA to allow use with any VEGF-A inhibitors FDA Fast Track designation granted Multibillion Dollar Commercial Opportunity Existing > US$8 billion p.a. global market for wet AMD alone DME provides additional opportunity Co-formulation with approved therapies possible Most advanced product in clinical development to address #1 unmet need for wet AMD patients: improvement in vision outcomes Differentiated MOA to Improve Efficacy Sozinibercept is a proprietary biologic VEGF-C/D “trap” with no known late-stage competition The first therapy directly targeting VEGF-C & VEGF-D inhibiting angiogenic signaling through VEGFR-2 and VEGFR-3

Financial Snapshot & Corporate Activities Cash and cash equivalents at Fiscal Year End 6/30/2023 of US$89.2M Completed an Australian rights equity offering and placement in September 2023, raising A$90 million (~US$58M) Received remaining US$35M funding under Development Funding Agreement (DFA), as well as a further US$50M option under Amended DFA in December 2023 Total funding under DFA: US$170M Provides non-equity funding for the development of OPT-302 If sozinibercept is approved in major market, repayment split between fixed payments and variable payments at 7% of revenues, capped at 4x investment No amounts owed if the clinical trials do not meet the primary endpoint or if regulatory approval is not received Expanded U.S. based team with newly appointed CEO and CFO

Opthea (NASDAQ:OPT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Opthea (NASDAQ:OPT)

Historical Stock Chart

From Dec 2023 to Dec 2024