false

0001450704

0001450704

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024

VIVAKOR, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-41286 |

|

26-2178141 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5220 Spring Valley Road, Suite 500

Dallas, TX 75254

(Address of principal executive offices)

(949) 281-2606

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

VIVK |

|

The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

On October 30, 2024, the Company released an investor

presentation (the “Investor Presentation”) which includes updates regarding the Company’s financial position, business,

and operations that management of the Company intends to use from time to time in investor communications and conferences. A copy the

Investor Presentation is attached hereto as Exhibit 99.1.

The information in this Item 7.01 of this Current

Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed to be “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under such section,

nor shall it be deemed incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Exchange Act,

regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Cautionary Note Regarding Forward Looking Statements

Statements in this Current Report on Form 8-K and

in the Investor Presentation that are not statements of historical fact may be forward-looking statements that reflect management’s

current expectations, assumptions and estimates of future performance and economic conditions of the Company’s management team.

Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act and Section 21E of

the Exchange Act. Words such as “anticipates,” “believes,” “desires,” “plans,” “expects,”

“intends,” “will,” “potential,” “hope” and similar expressions are intended to identify forward-looking

statements. The assumptions and expectations expressed in these forward-looking statements are subject to various risks and uncertainties

and, therefore, may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from

those anticipated in such forward-looking statements as a result of various risks and uncertainties. These forward-looking statements

may include, but are not limited to, statements about the benefits of the Company’s operations, target basins, and volumes transported

and processed, statements about the Company’s desired financial model, as well as the Company’s plans, objectives, expectations

and intentions for the future. Detailed information regarding other factors that may cause actual results to differ materially from those

expressed or implied by statements in this Current Report on Form 8-K and the Investor Presentation, including the documents

incorporated by reference herein, may be found in the Company’s filings with the Securities Exchange Commission (the “SEC”),

including under sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” of the

Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Report on Form 8-K filed

with the SEC, as well as the Company’s other filings with the SEC, copies of which may be obtained from the SEC’s website,

www.sec.gov. All forward-looking statements included in this Current Report on Form 8-K and in the Investor Presentation, and

in the other documents the Company files with the SEC, are made only as of the date of this Current Report on Form 8-K and,

as applicable, the date of the other documents the Company files with the SEC. The Company disclaims any intention or obligation to update

or revise any forward-looking statements to reflect events or circumstances that subsequently occur, or of which the Company hereafter

becomes aware, except as required by law. Persons reading this Current Report on Form 8-K and the other documents the Company

files with the SEC are cautioned not to place undue reliance on such forward-looking statements.

| Exhibit No. |

|

Title |

| 99.1 |

|

Investor Presentation |

| 104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VIVAKOR, INC. |

| |

|

|

| Dated: October 30, 2024 |

By: |

/s/ James H. Ballengee |

| |

|

Name: |

James H. Ballengee |

| |

|

Title: |

Chairman, President & CEO |

Exhibit 99.1

1 October 2024 Investor Presentation

2 This Investor Presentation (“IP”) has been prepared by Vivakor, Inc . (“Vivakor” or the “Company”), in cooperation with ThinkEquity , LLC (“ ThinkEquity ”) and is being furnished solely for the purpose of an investor presentation conducted by Vivakor executives and advisors . The information contained in this IP was obtained from the Company and other sources believed by the Company to be reliable . No assurance is given as to the accuracy or completeness of such information . This IP does not purport to contain all the information that may be required or desired to evaluate the Company and any recipient hereof should conduct its own independent analysis of the Company and the data contained or referred to herein . No person has been authorized to give any information or make any representation concerning the Company not contained in this IP and, if given or made, such information or representation must be relied upon as having been authorized by the Company . Statements in this IP are made as of the date hereof . The delivery of this IP at any time thereafter shall not under any circumstances create an implication that the information herein is correct as of any time subsequent to the date hereof or that there has been no change in the business, condition (financial or otherwise), assets, operations, results of operations or prospects of the Company since the date hereof . The Company undertakes no obligation to update any of the information contained in this IP, including any projections, estimates or forward - looking statements . Any statement, estimate or projection as to events that may occur in the future (including, but not limited to, projections of revenue, expenses and net income) were not prepared with a view toward public disclosure or complying with any guidelines of the American Institute of Certified Public Accountants, any federal or state securities commission or any other guidelines regarding projected financial information . Such statements, estimates or projections will depend substantially upon, among other things, the Company achieving its overall business objectives and other factors (including general economic, financial and regulatory factors) over which the Company may have little or no control . There is no guarantee that any of these statements, estimates or projections will be attained . Actual results may vary significantly from the statements, estimates and projections in this IP, and such variations may be material and adverse . This Investor Presentation may contain forward - looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995 . Such statements are based upon our current expectations and speak only as of the date hereof . Our actual results may differ materially and adversely from those expressed in any forward - looking statements as a result of various factors and uncertainties, including economic slowdown affecting companies, our ability to successfully develop products, rapid change in our markets, changes in demand for our future products, legislative, regulatory and competitive developments and general economic conditions . These risks and uncertainties include, but are not limited to, risks and uncertainties discussed in Vivakor's filings with the Securities and Exchange Commission, which factors may be incorporated herein by reference . Forward - looking statements may be identified but not limited by the use of the words "anticipates", "expects", "intends", "plans", "should", "could", "would", "may", "will", "believes", "estimates", "potential", or "continue" and variations or similar expressions . We undertake no obligation to revise or update publicly any forward - looking statements for any reason . Confidential NOTICE TO RECIPIENTS - DISCLAIMER

3 Company Overview 1 Midstream Businesses & Assets 2 Financial Information 3 Key Investment Factors 4

VIVAKOR, INC. (NASDAQ:VIVK) Confidential 4 Vivakor (NASDAQ : VIVK) is an integrated provider of midstream services for producers located in major oil basins throughout the United States . The company's core capabilities include oil gathering, transportation, storage, water handling, and environmental services as well as marketing solutions that enable our nation’s energy infrastructure to operate sustainably . About Vivakor VIVK www.vivakor.com Vivakor's corporate mission is to develop, acquire, accumulate, and operate assets, properties, and technologies in the energy sector ▪ Provides environmental services and technology to remediate oilfield soils by recovery of oil contamination ▪ Operates two crude oil gathering, logistics, and storage terminals acquired in 2022 ; White Claw Colorado City Terminal (Texas) and Silver Fuels Delhi Terminal (Louisiana) . These terminals generated ~ $ 60 MM revenue in 2023 . ▪ Recent acquisition of the Endeavor Entities included integrated crude oil gathering, transportation, and storage assets and businesses located in major oil producing basins Business Highlights

Company Snapshot Confidential 5 ▪ Vivakor, Inc . is an integrated provider of energy transportation, storage, reuse, and remediation services ▪ March 3 , 2024 – signed definitive merger agreement with Empire Diversified Energy ▪ October 1 , 2024 – acquired Endeavor Entities, encompassing Endeavor Crude, Meridian Equipment Leasing, CPE Midcon, Equipment Transport, and Silver Fuels Processing Exchange/Ticker Nasdaq: VIVK Stock Price and Valuation $1.55 for $45 Million Market Cap (Vivakor) 52 - Week High/Low $3.45 – $0.44 Average Daily Volume 64,000 Shares/Day (over 30 days thru 9/30/2024) Revenue YTD Thru 8/31/2024 ~$79.5 Million (Vivakor & Endeavor Entities Combined) Total Assets at 8/31/2024 ~$7.08 Million (Vivakor & Endeavor Entities Combined) Company Name Company Name Exchange / Ticker Stock Price & Valuation 52 - week high - low Average Daily Volume Company Name Exchange/Ticker Stock Price and Valuation 52 - Week High/Low Average Daily Volume Revenue YTD thru 6/30/2024 EBITDA YTD thru 6/30/2024 Overview

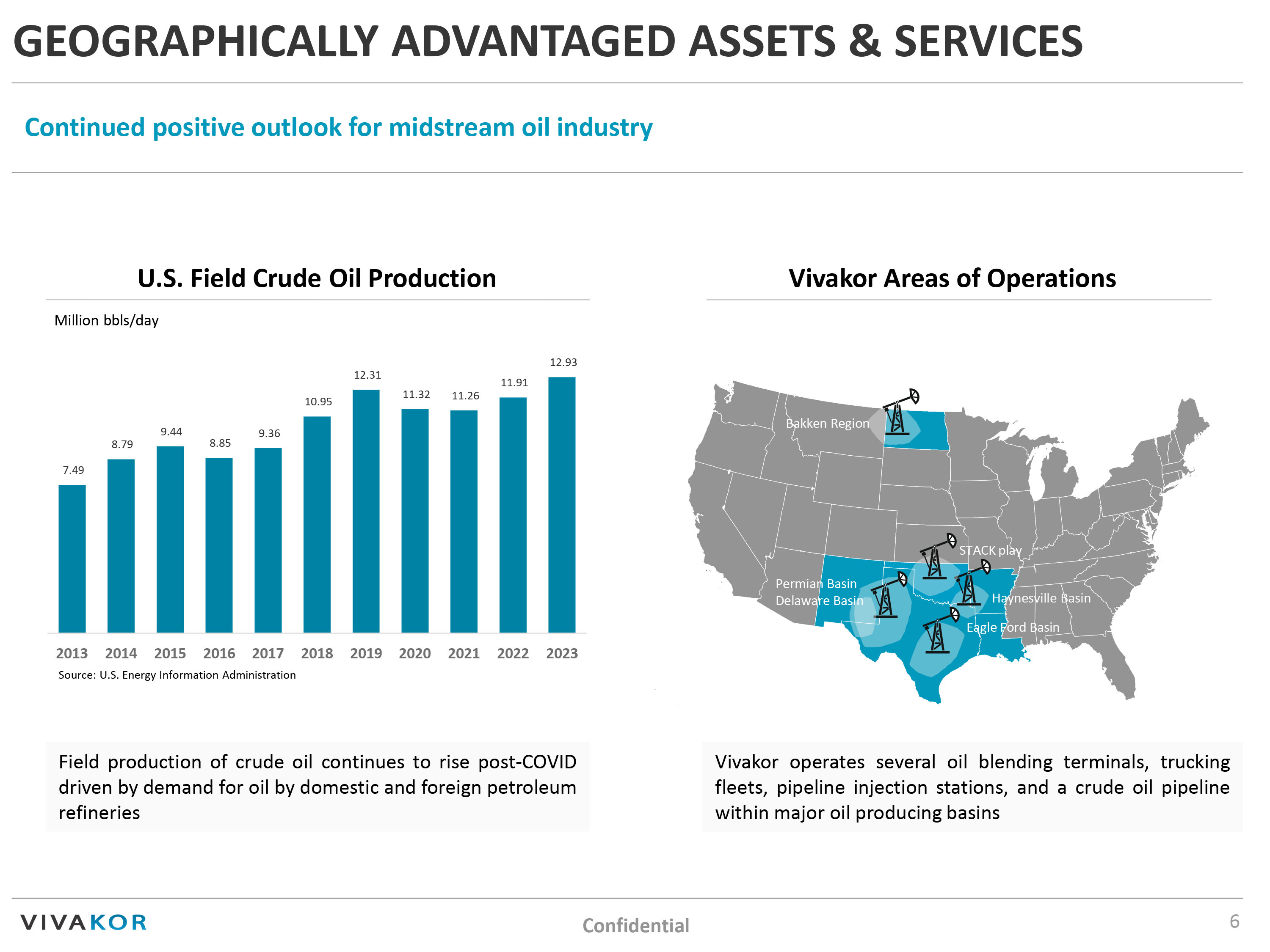

GEOGRAPHICALLY ADVANTAGED ASSETS & SERVICES Confidential Continued positive outlook for midstream oil industry 6 Ξ'ĞŽEĂŵĞƐ͕DŝĐƌŽƐŽŌ͕dŽŵdŽŵ WŽǁĞƌĞĚďLJŝŶŐ Vivakor Areas of Operations U.S. Field Crude Oil Production Permian Basin Delaware Basin Bakken Region Haynesville Basin 7.49 8.79 9.44 8.85 9.36 10.95 12.31 11.32 11.26 11.91 12.93 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Million bbls /day Vivakor operates several oil blending terminals, trucking fleets, pipeline injection stations, and a crude oil pipeline within major oil producing basins Field production of crude oil continues to rise post - COVID driven by demand for oil by domestic and foreign petroleum refineries Source: U.S. Energy Information Administration STACK play Eagle Ford Basin

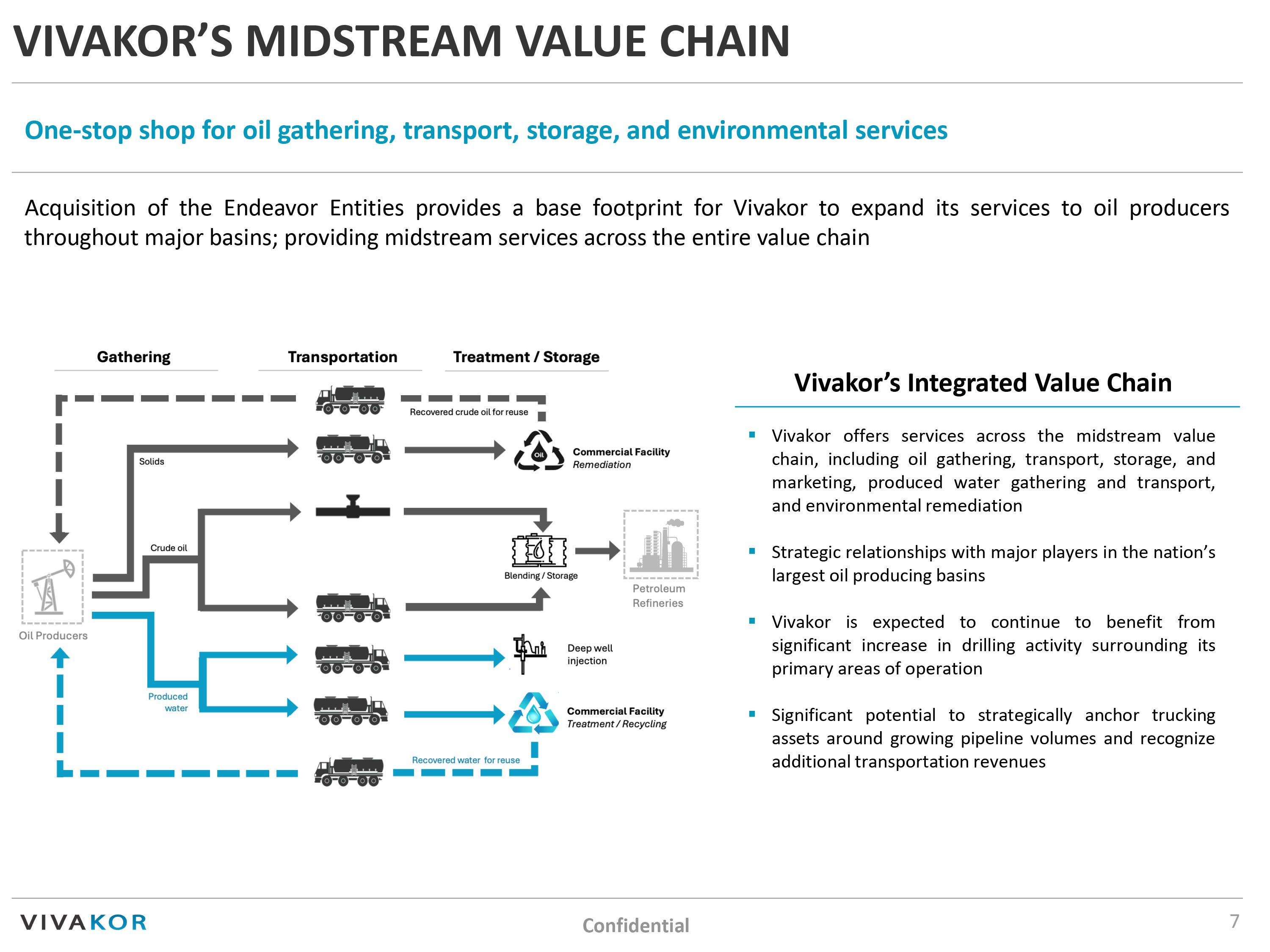

VIVAKOR’S MIDSTREAM VALUE CHAIN Confidential 7 One - stop shop for oil gathering, transport, storage, and environmental services Acquisition of the Endeavor Entities provides a base footprint for Vivakor to expand its services to oil producers throughout major basins ; providing midstream services across the entire value chain ▪ Vivakor offers services across the midstream value chain, including oil gathering, transport, storage, and marketing, produced water gathering and transport, and environmental remediation ▪ Strategic relationships with major players in the nation’s largest oil producing basins ▪ Vivakor is expected to continue to benefit from significant increase in drilling activity surrounding its primary areas of operation ▪ Significant potential to strategically anchor trucking assets around growing pipeline volumes and recognize additional transportation revenues Vivakor’s Integrated Value Chain

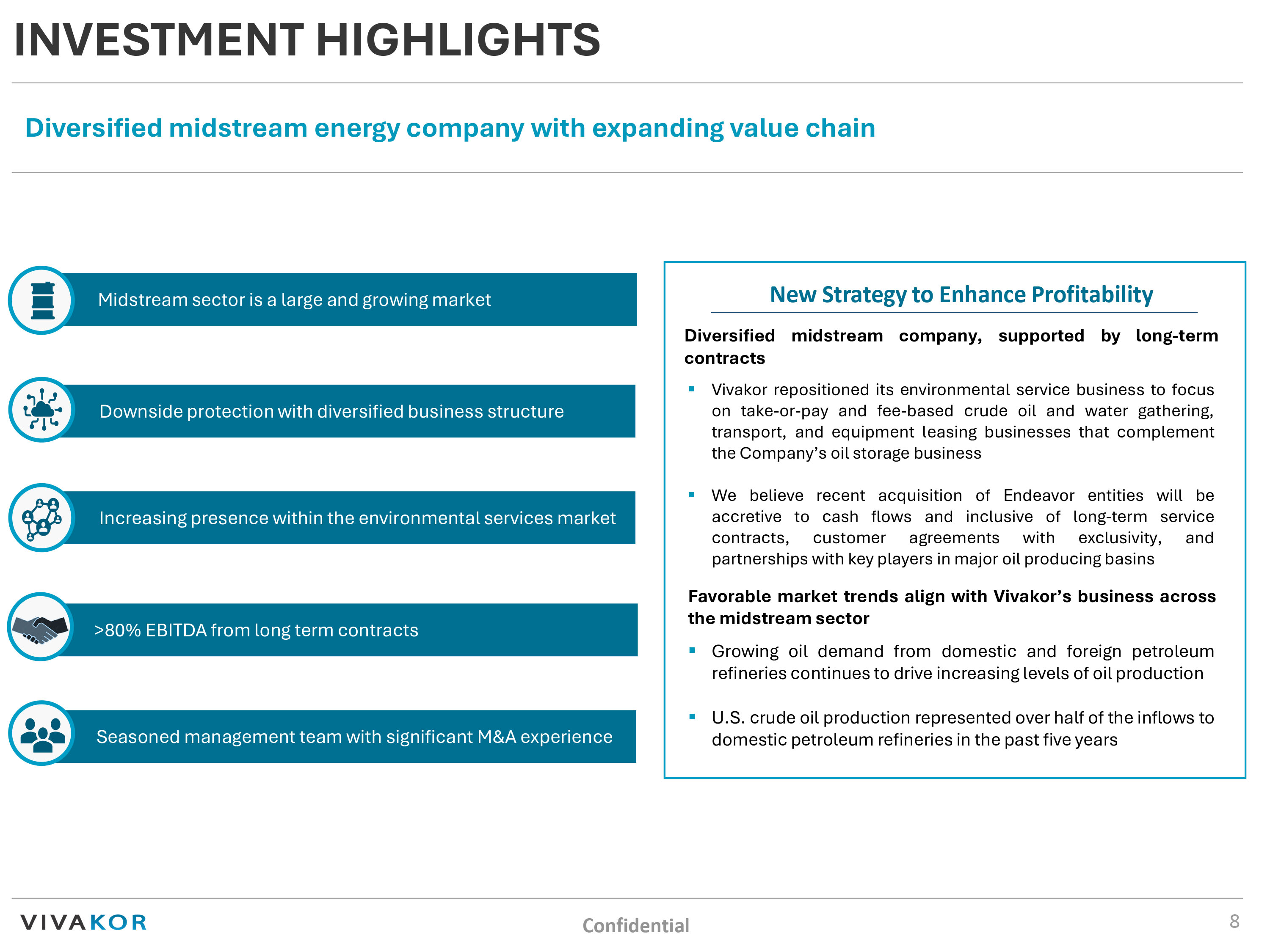

INVESTMENT HIGHLIGHTS Confidential Diversified midstream energy company with expanding value chain 8 Increasing presence within the environmental services market >80% EBITDA from long term contracts Seasoned management team with significant M&A experience Midstream sector is a large and growing market Downside protection with diversified business structure New Strategy to Enhance Profitability ▪ Vivakor repositioned its environmental service business to focus on take - or - pay and fee - based crude oil and water gathering, transport, and equipment leasing businesses that complement the Company’s oil storage business ▪ We believe recent acquisition of Endeavor entities will be accretive to cash flows and inclusive of long - term service contracts, customer agreements with exclusivity, and partnerships with key players in major oil producing basins Diversified midstream company, supported by long - term contracts Favorable market trends align with Vivakor’s business across the midstream sector ▪ Growing oil demand from domestic and foreign petroleum refineries continues to drive increasing levels of oil production ▪ U . S . crude oil production represented over half of the inflows to domestic petroleum refineries in the past five years

MANAGEMENT TEAM Confidential Vivakor’s management has a track record of M&A and capital markets execution 9 James Ballengee Chairman, President, & CEO Pat Knapp EVP, General Counsel & Secretary Tyler Nelson CFO, Director Mr . Ballengee has over 20 years of experience in senior management roles in the midstream oil and gas sector . He has held key positions such as Chief Commercial Officer, Chief Financial Officer, Chief Executive Officer, and Chairman of the Board in major private equity portfolio companies . Notably, he led Taylor Logistics, LLC through a successful sale to Gibson Energy, Inc . in 2008 and Bridger Group, LLC through a sale to Ferrellgas Partners, LP for $ 837 . 5 million . Currently, Mr . Ballengee manages a single - family office with investments in oil and gas, sports and entertainment, and real estate . He holds an accounting degree from Louisiana State University — Shreveport . Mr . Knapp is an accomplished corporate transactional lawyer whose practice has focused on M&A, financings, and complex commercial transactions principally relating to midstream liquids such as crude oil, refined products, and oilfield produced water . He has represented producers, marketers, refiners, midstream infrastructure providers, OFS companies, and oilfield waste recyclers in billions of dollars’ worth of transactions in the United States, Canada, and Mexico . He was previously a partner in the energy practice at Jackson Walker LLP from 2021 - 24 , and prior to that he was a partner at the international law firm McGuireWoods LLP . He holds a bachelor’s degree in economics and marketing from the University of Notre Dame and a juris doctor from Southern Methodist University . Mr . Nelson is a CPA who worked from 2006 to 2011 in Audit and Enterprise Risk Services at Deloitte LLP (USA) and later at KSJG, LLP (later acquired by Withum+Brown , PC) . He worked with clients with assets of more than $ 100 billion and annual revenues of more than $ 15 billion, which are considered some of the most respected financial institutions in the world . In 2011 , Mr . Nelson began working for LBL Professional Consulting, Inc . where he provided merger and acquisition, initial public offering, and interim chief financial officer services to clients . Mr . Nelson continues to sit on the Board of Directors and remains an officer of LBL Professional Consulting, Inc . Mr . Nelson earned a Master’s Degree in Accountancy from the University of Illinois - Urbana - Champaign, and a Bachelor’s Degree in Economics with a minor in Business Management from Brigham Young University . Russ Shelton EVP & COO Mr . Shelton is a seasoned operations executive with more than two decades of management experience with midstream trucking, terminaling , and marketing companies, including for several of the business units acquired in the Endeavor Entities acquisition . His management has focused on operational excellence, business development, and leveraging technology to obtain and retain customers . Prior to Vivakor, he was the Chief Operating Officer for Endeavor Crude, LLC . He served as Director of Operations for Senergy Petroleum from 2021 - 23 , and prior to that worked as the national Director of Transportation for Pilot Travel Centers LLC from 2018 - 21 . Prior to Pilot, he was Vice President of Transportation for Bridger Logistics, LLC, whose trucking business unit he helped lead through a successful sale to Pilot Travel Centers LLC in 2018 .

10 Company Overview Midstream Businesses & Assets Financial Information Key Investment Factors 1 2 3 4

MIDSTREAM BUSINESS SEGMENTS Confidential 11 Trucking Operations Facilities Marketing Vivakor Transportation, LLC (Holdco) ▪ Endeavor Crude, LLC . Truck transport and pipeline gathering of crude oil in the nation’s largest crude oil producing basins ▪ Equipment Transport, LLC . Truck transport of produced water and flowback water from oil drilling activities in the Permian Basin and the Eagle Ford ▪ Meridian Equipment Leasing, LLC . Leases tractors and trailers directly to owner - operators ▪ ET EmployeeCo , LLC . Owner - operators and staff that provide services for Endeavor Crude, LLC and Equipment Transport, LLC Vivakor Supply & Trading, LLC ▪ Vivakor Supply & Trading, LLC . Petroleum commodity marketing entity for buying / selling / exchanging physicals Growth - oriented business model with midstream infrastructure and assets poised for long - term success VM Facilities, LLC (Holdco) ▪ Silver Fuels Processing, LLC . Pipeline injection stations in Texas, New Mexico, and North Dakota ▪ Silver Fuels Delhi, LLC . Oil storage and logistics terminal in Richland Parish, Louisiana ▪ White Claw Colorado City, LLC . Oil storage and logistics terminal in Colorado City, Texas ▪ VivaVentures Remediation Corporation, LLC . Oil storage and logistics terminal in Colorado City, Texas ▪ CPE Gathering Midcon, LLC . Pipeline gathering, storage, and distribution of crude oil in the STACK Play via the Omega Pipeline and Terminal facilities

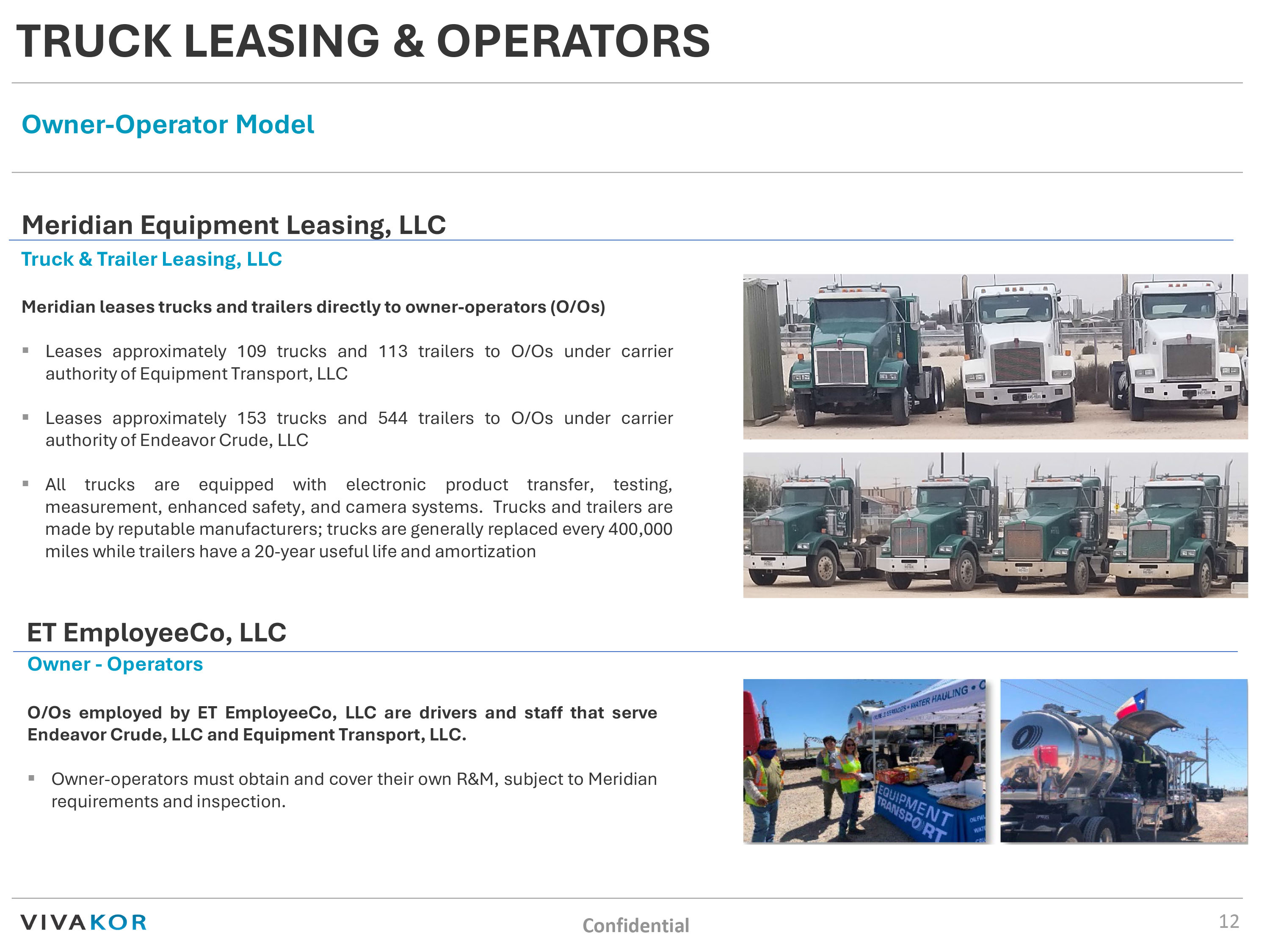

TRUCK LEASING & OPERATORS Confidential 12 Owner - Operator Model Meridian Equipment Leasing, LLC Truck & Trailer Leasing, LLC ET EmployeeCo , LLC Owner - Operators O/ Os employed by ET EmployeeCo , LLC are drivers and staff that serve Endeavor Crude, LLC and Equipment Transport, LLC . ▪ Owner - operators must obtain and cover their own R&M, subject to Meridian requirements and inspection . Meridian leases trucks and trailers directly to owner - operators (O/ Os ) ▪ Leases approximately 109 trucks and 113 trailers to O/ Os under carrier authority of Equipment Transport, LLC ▪ Leases approximately 153 trucks and 544 trailers to O/ Os under carrier authority of Endeavor Crude, LLC ▪ All trucks are equipped with electronic product transfer, testing, measurement, enhanced safety, and camera systems . Trucks and trailers are made by reputable manufacturers ; trucks are generally replaced every 400 , 000 miles while trailers have a 20 - year useful life and amortization

TRANSPORT SERVICES Confidential 13 Vivakor provides key gathering and transport services within the midstream sector Equipment Transport, LLC Endeavor Crude, LLC Crude oil transport Water transport Endeavor Crude is an interstate motor carrier qualified to haul hazardous materials, including crude oil and liquid petroleum . Presently operates more than a hundred leased tractors and trailers in key oil - producing regions of Texas, Louisiana, Oklahoma, New Mexico, Colorado, and North Dakota ▪ Diverse customer base includes large oil producers, refiners, and oil marketers ▪ Take - or - pay contracts contain MVCs for a total of 75 , 000 bbls /day crude oil . Crude is picked up by truck at production site (lease) and transported to storage and gathering facilities or direct to refineries Equipment Transport is an interstate motor carrier qualified to haul oilfield waste, including oilfield produced water, and operates primarily in Texas . ▪ Prior to Vivakor’s acquisition, the Endeavor Entities acquired Equipment Transport, LLC in a series of transactions with affiliates of Berkshire Hathaway - backed Pilot Travel Centers LLC . Pilot Water Solutions LLC operates one of the largest networks of Saltwater Disposal Wells (SWDs) for produced water in the Permian and Eagle Ford Basins ▪ Acquisition included an exclusive 2 - year Area of Mutual Interest Agreement whereby the Endeavor Entities and Pilot partner to mutually solicit and obtain volumes of produced water from key producers . AMI Agreement provides synthetic, already - integrated “anchor facilities” for Equipment Transport’s water trucking fleet

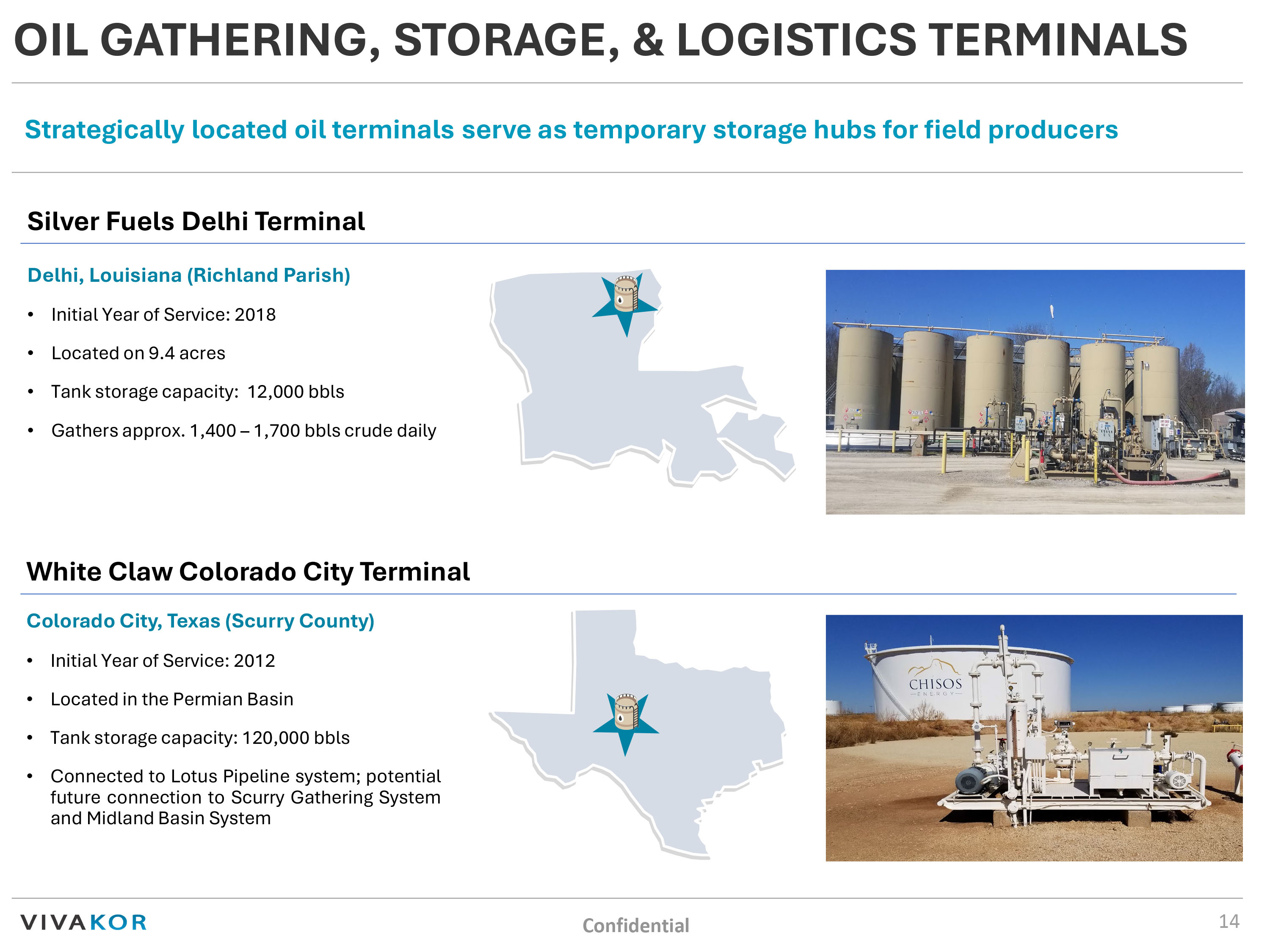

OIL GATHERING, STORAGE, & LOGISTICS TERMINALS Confidential 14 Strategically located oil terminals serve as temporary storage hubs for field producers Silver Fuels Delhi Terminal Delhi, Louisiana (Richland Parish) • Initial Year of Service : 2018 • Located on 9 . 4 acres • Tank storage capacity : 12 , 000 bbls • Gathers approx . 1 , 400 – 1 , 700 bbls crude daily Colorado City, Texas (Scurry County) • Initial Year of Service : 2012 • Located in the Permian Basin • Tank storage capacity : 120 , 000 bbls • Connected to Lotus Pipeline system ; potential future connection to Scurry Gathering System and Midland Basin System White Claw Colorado City Terminal

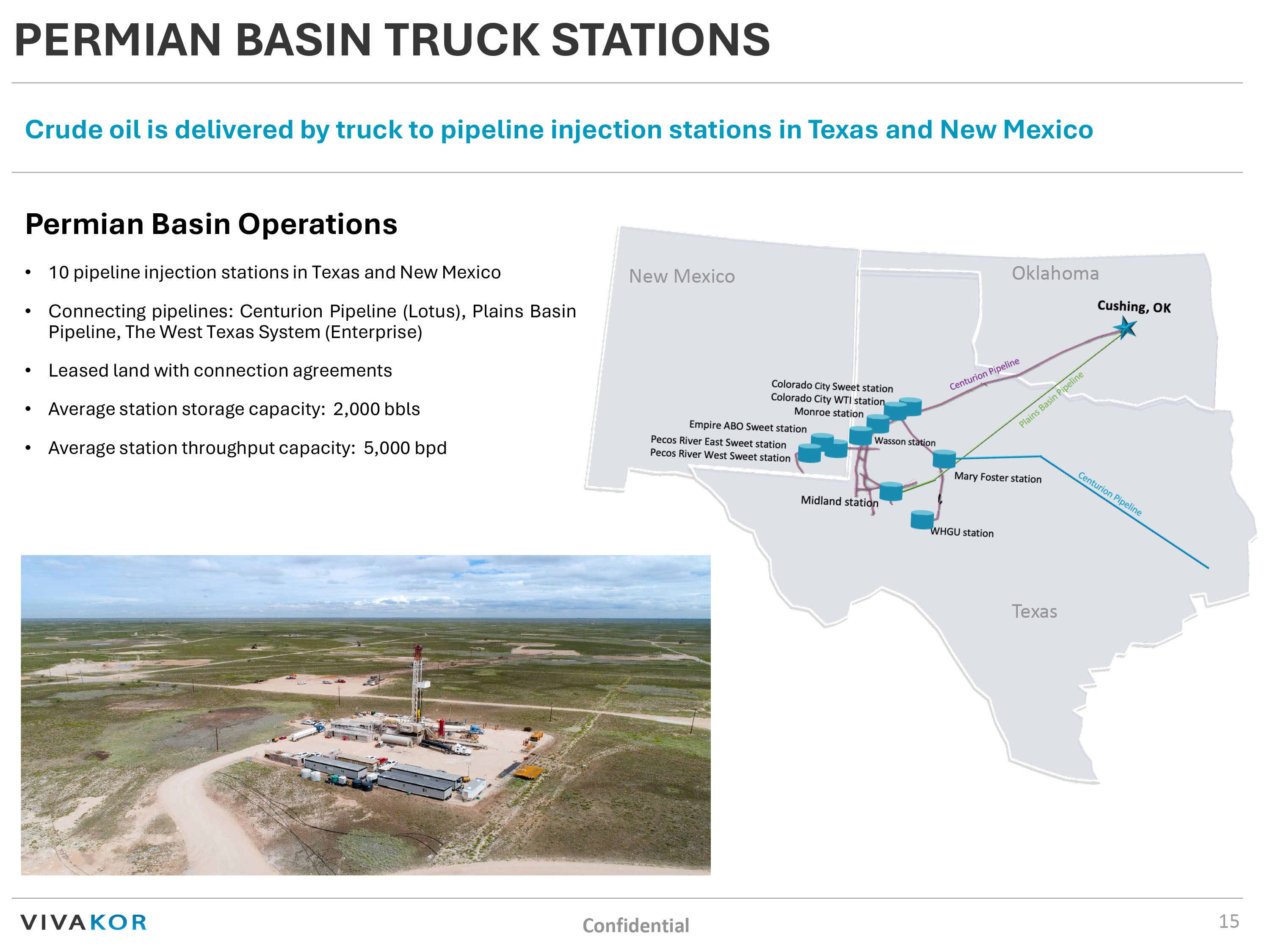

PERMIAN BASIN TRUCK STATIONS Confidential 15 • 10 pipeline injection stations in Texas and New Mexico • Connecting pipelines : Centurion Pipeline (Lotus), Plains Basin Pipeline, The West Texas System (Enterprise) • Leased land with connection agreements • Average station storage capacity : 2 , 000 bbls • Average station throughput capacity : 5 , 000 bpd Permian Basin Operations Crude oil is delivered by truck to pipeline injection stations in Texas and New Mexico New Mexico Texas Oklahoma

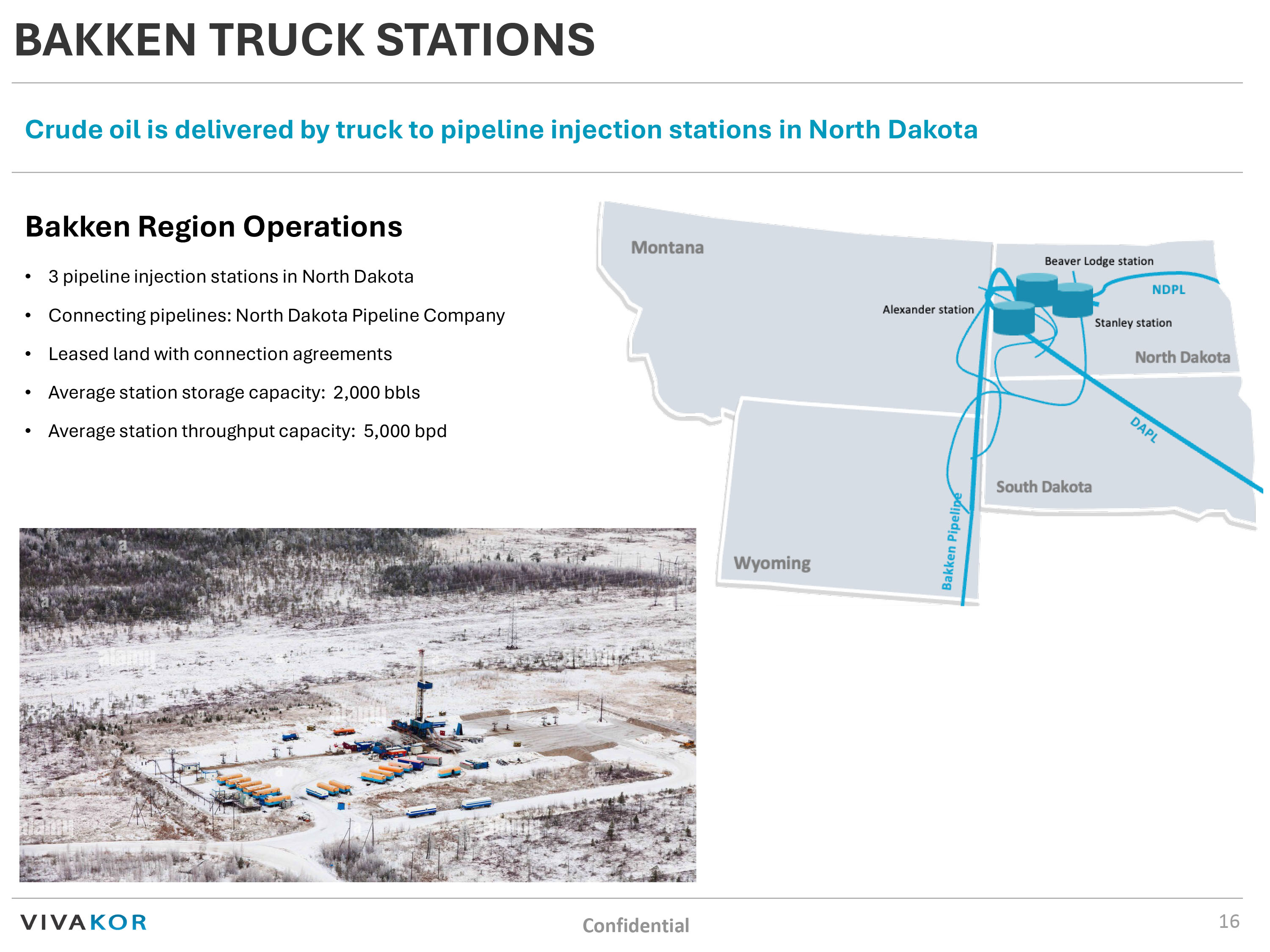

BAKKEN TRUCK STATIONS Confidential 16 Crude oil is delivered by truck to pipeline injection stations in North Dakota Bakken Region Operations • 3 pipeline injection stations in North Dakota • Connecting pipelines : North Dakota Pipeline Company • Leased land with connection agreements • Average station storage capacity : 2 , 000 bbls • Average station throughput capacity : 5 , 000 bpd

OKLAHOMA CRUDE OIL PIPELINE AND TERMINAL Confidential 17 Crude oil gathering station, storage terminal, and pipeline in Oklahoma CPE Gathering Midcon, LLC CPE is an owner and operator of an approximately 40 - mile crude oil pipeline, together with ancillary gathering, truck station, and storage facilities serving the STACK play in Blaine County, Oklahoma ▪ Acquired in a distressed sale from CP Energy in December 2022 ▪ Terminal facility is connected to Plains STACK Pipeline ▪ MVC take - or - pay contract for 200 , 000 bbls /month with marketer White Claw Crude, LLC ▪ Exclusive Gathering & Dedication Agreements with Ovintiv Mid - Continent, Inc . and Citizen Energy III, LLC ▪ Exclusive Gathering & Dedication Agreement covering ~ 36 , 000 acres being developed by Validus Energy, LLC ▪ Validus Energy intends to develop significant acreage in the immediate future ; approximately 1 - 2 wells per month within the AMI (Area of Mutual Interest Agreement) thereafter . Two wells subject to the AMI are scheduled to reach initial production in November 2024 . Each new well provides incremental EBITDA to the Omega Pipeline at decreasing marginal capex to construct connection lines . CPE Gathering Midcon Terminal and Pipeline Blaine County, OK

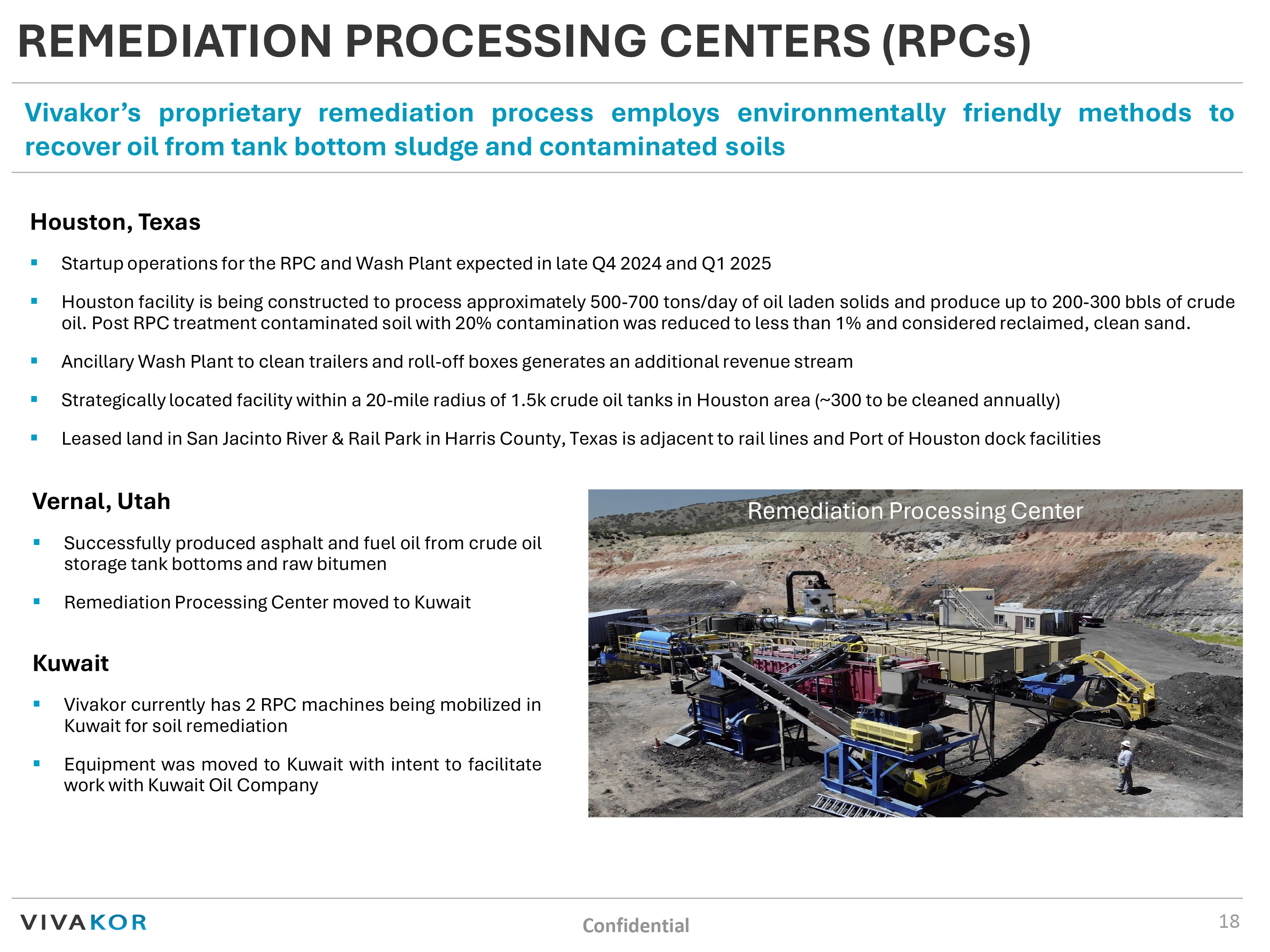

REMEDIATION PROCESSING CENTERS (RPCs) Confidential 18 Vivakor’s proprietary remediation process employs environmentally friendly methods to recover oil from tank bottom sludge and contaminated soils Houston, Texas ▪ Startup operations for the RPC and Wash Plant expected in late Q 4 2024 and Q 1 2025 ▪ Houston facility is being constructed to process approximately 500 - 700 tons/day of oil laden solids and produce up to 200 - 300 bbls of crude oil . Post RPC treatment contaminated soil with 20 % contamination was reduced to less than 1 % and considered reclaimed, clean sand . ▪ Ancillary Wash Plant to clean trailers and roll - off boxes generates an additional revenue stream ▪ Strategically located facility within a 20 - mile radius of 1 . 5 k crude oil tanks in Houston area (~ 300 to be cleaned annually) ▪ Leased land in San Jacinto River & Rail Park in Harris County, Texas is adjacent to rail lines and Port of Houston dock facilities Vernal, Utah ▪ Successfully produced asphalt and fuel oil from crude oil storage tank bottoms and raw bitumen ▪ Remediation Processing Center moved to Kuwait Kuwait ▪ Vivakor currently has 2 RPC machines being mobilized in Kuwait for soil remediation ▪ Equipment was moved to Kuwait with intent to facilitate work with Kuwait Oil Company Remediation Processing Center

MARKETING Confidential 19 Enhancing operations, petroleum marketing with acquisitions and increasing scale Vivakor Supply & Trading, LLC ▪ Petroleum commodity marketing entity for buying / selling / exchanging physicals ▪ Marketing business is integrated and centered around Vivakor’s Transportation and Facility assets ▪ Marketing strategy geared to mitigate seasonal market swings and inventory risks while maximizing Transportation and Facility performance Acquisition Strategy ▪ Enhance operating scale and efficiencies through acquisitions ▪ Assets are contiguous with owned assets, increasing density and enhancing scale Ξ'ĞŽEĂŵĞƐ͕DŝĐƌŽƐŽŌ͕dŽŵdŽŵ WŽǁĞƌĞĚďLJŝŶŐ Vivakor Asset Overview

20 Company Overview Midstream Businesses & Assets Financial Information Key Investment Factors 1 2 3 4

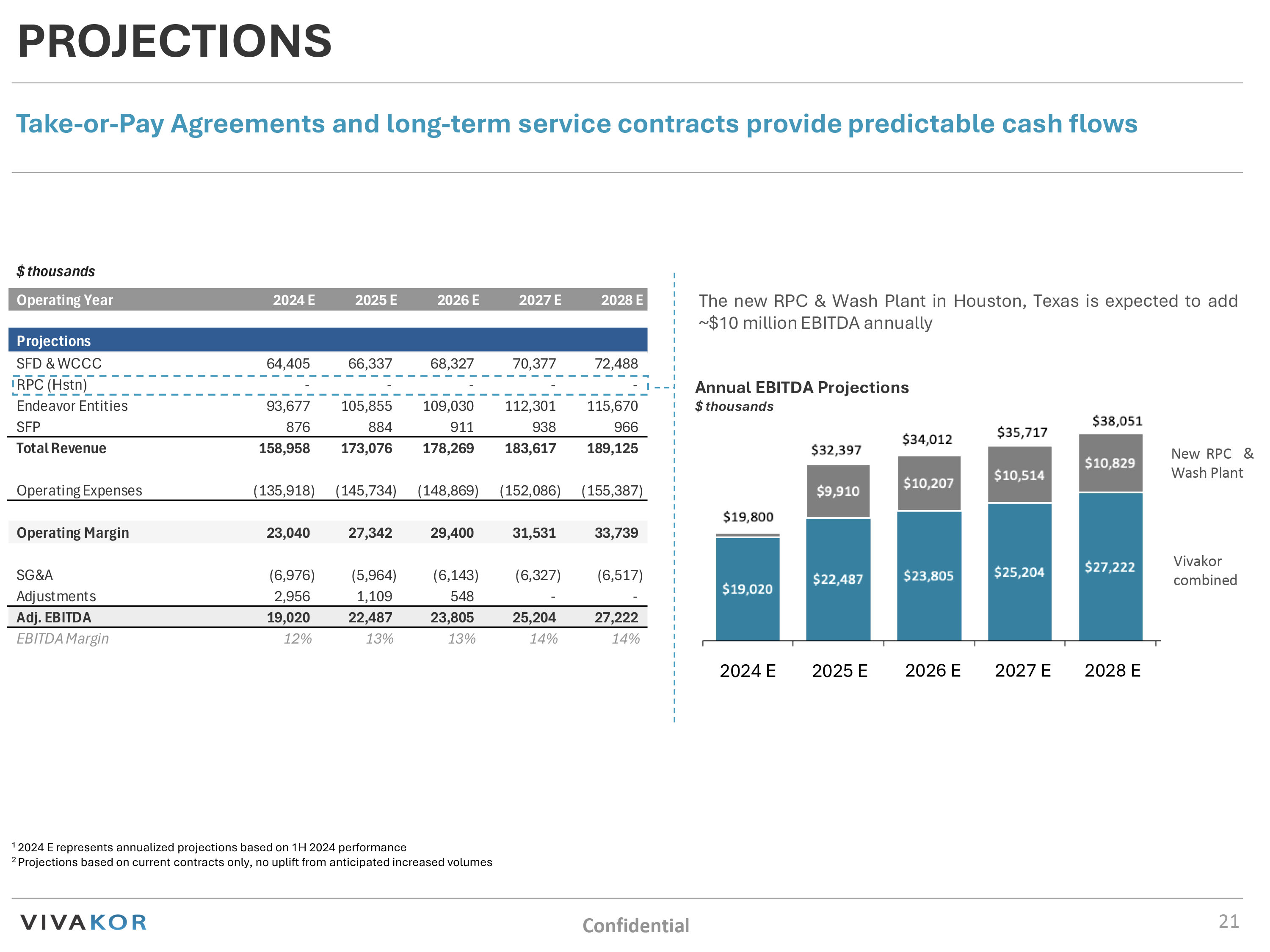

PROJECTIONS Confidential 21 The new RPC & Wash Plant in Houston, Texas is expected to add ~ $ 10 million EBITDA annually Take - or - Pay Agreements and long - term service contracts provide predictable cash flows New RPC & Wash Plant Vivakor combined 1 2024 E represents annualized projections based on 1H 2024 performance 2 Projections based on current contracts only, no uplift from anticipated increased volumes Annual EBITDA Projections $ thousands 2024 E 2025 E 2026 E 2027 E 2028 E $ thousands Operating Year 2024 E 2025 E 2026 E 2027 E 2028 E Projections SFD & WCCC 64,405 66,337 68,327 70,377 72,488 RPC (Hstn) - - - - - Endeavor Entities 93,677 105,855 109,030 112,301 115,670 SFP 876 884 911 938 966 Total Revenue 158,958 173,076 178,269 183,617 189,125 Operating Expenses (135,918) (145,734) (148,869) (152,086) (155,387) Operating Margin 23,040 27,342 29,400 31,531 33,739 SG&A (6,976) (5,964) (6,143) (6,327) (6,517) Adjustments 2,956 1,109 548 - - Adj. EBITDA 19,020 22,487 23,805 25,204 27,222 EBITDA Margin 12% 13% 13% 14% 14%

22 Company Overview Midstream Businesses & Assets Financial Information Key Investment Factors 1 2 3 4

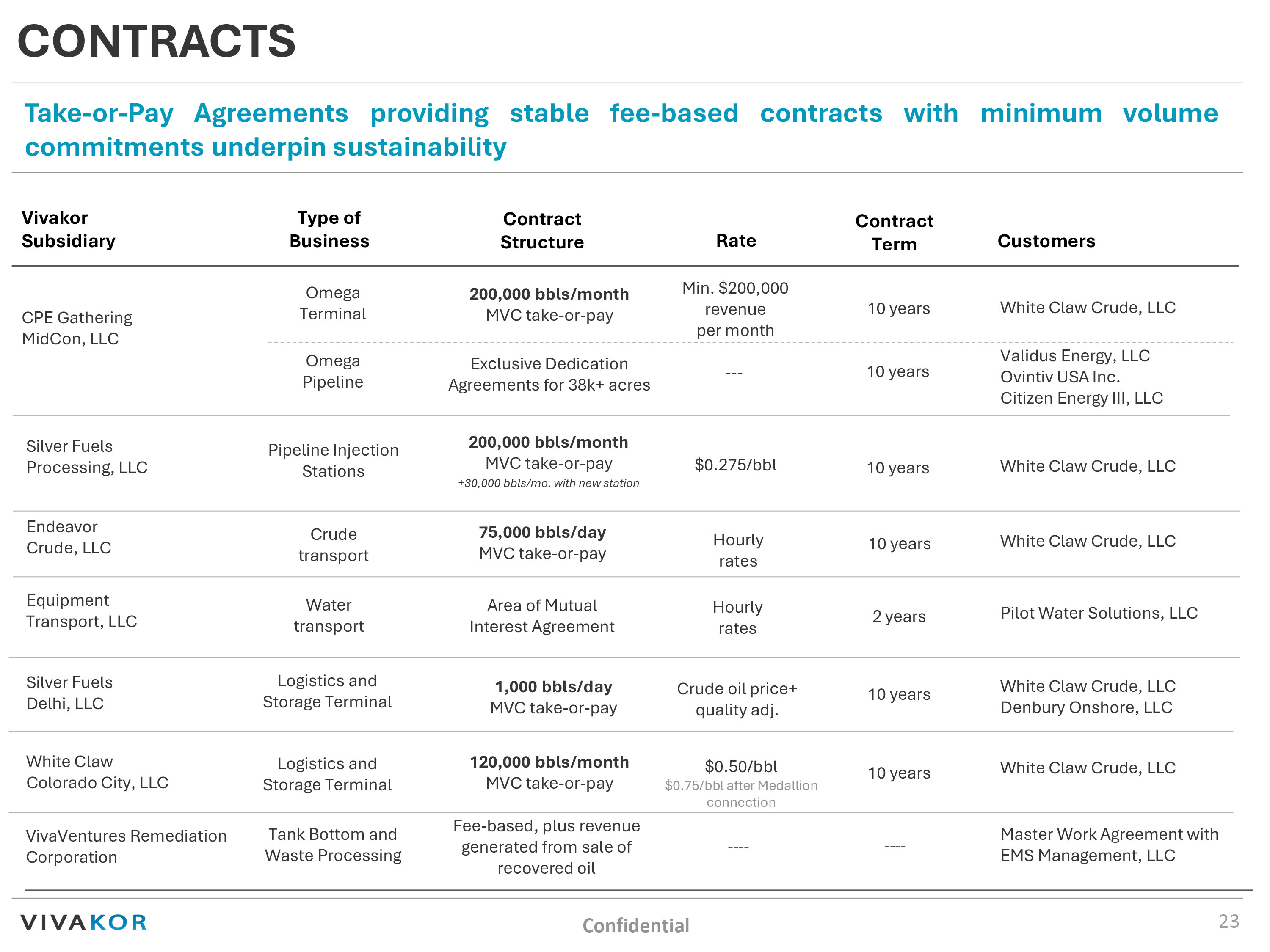

CONTRACTS Confidential 23 Take - or - Pay Agreements providing stable fee - based contracts with minimum volume commitments underpin sustainability Type of Business Customers Omega Terminal White Claw Crude, LLC Crude transport White Claw Crude, LLC Water transport Logistics and Storage Terminal White Claw Crude, LLC Denbury Onshore, LLC Tank Bottom and Waste Processing Contract Structure Pipeline Injection Stations White Claw Crude, LLC 200,000 bbls /month MVC take - or - pay Exclusive Dedication Agreements for 38k+ acres Pilot Water Solutions, LLC 200,000 bbls /month MVC take - or - pay +30,000 bbls /mo. with new station Vivakor Subsidiary CPE Gathering MidCon , LLC Endeavor Crude, LLC Equipment Transport, LLC Silver Fuels Delhi, LLC VivaVentures Remediation Corporation Silver Fuels Processing, LLC White Claw Crude, LLC White Claw Colorado City, LLC 75,000 bbls /day MVC take - or - pay Contract Term 10 years Area of Mutual Interest Agreement 2 years Validus Energy, LLC Ovintiv USA Inc. Citizen Energy III, LLC 10 years 10 years 10 years Fee - based, plus revenue generated from sale of recovered oil Master Work Agreement with EMS Management, LLC 1,000 bbls /day MVC take - or - pay 10 years 10 years ---- 120,000 bbls /month MVC take - or - pay Omega Pipeline Logistics and Storage Terminal Rate --- Hourly rates Min. $200,000 revenue per month $0.275/ bbl Hourly rates Crude oil price+ quality adj. $0.50/ bbl $0.75/ bbl after Medallion connection ----

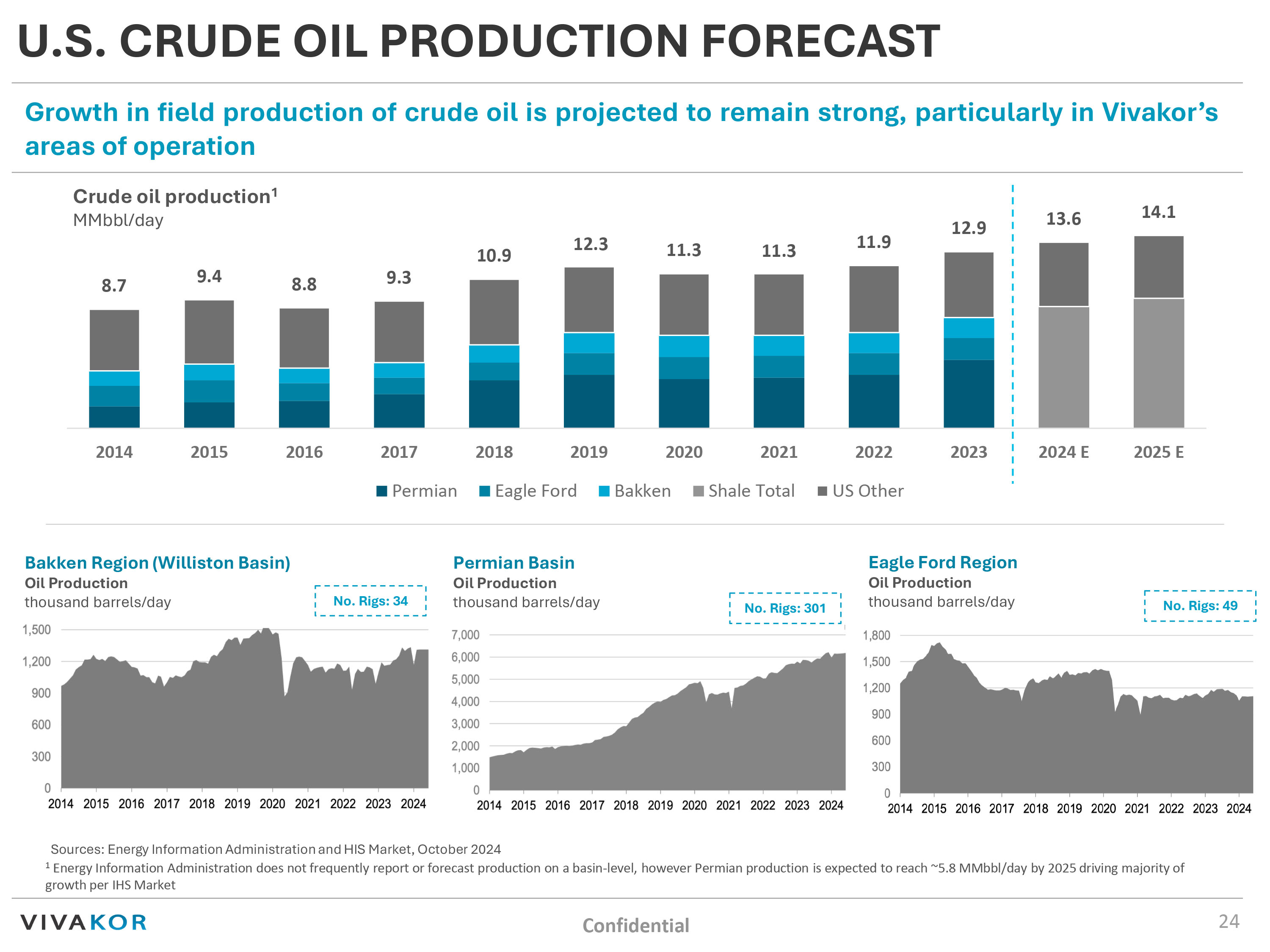

U.S. CRUDE OIL PRODUCTION FORECAST Confidential 24 Growth in field production of crude oil is projected to remain strong, particularly in Vivakor’s areas of operation 1 Energy Information Administration does not frequently report or forecast production on a basin - level, however Permian productio n is expected to reach ~5.8 MMbbl /day by 2025 driving majority of growth per IHS Market Crude oil production 1 MMbbl /day Sources: Energy Information Administration and HIS Market, October 2024 Bakken Region (Williston Basin) Oil Production thousand barrels/day Permian Basin Oil Production thousand barrels/day No. Rigs: 301 No. Rigs: 34 Eagle Ford Region Oil Production thousand barrels/day No. Rigs: 49 8.7 9.4 8.8 9.3 10.9 12.3 11.3 11.3 11.9 12.9 13.6 14.1 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 E 2025 E Permian Eagle Ford Bakken Shale Total US Other

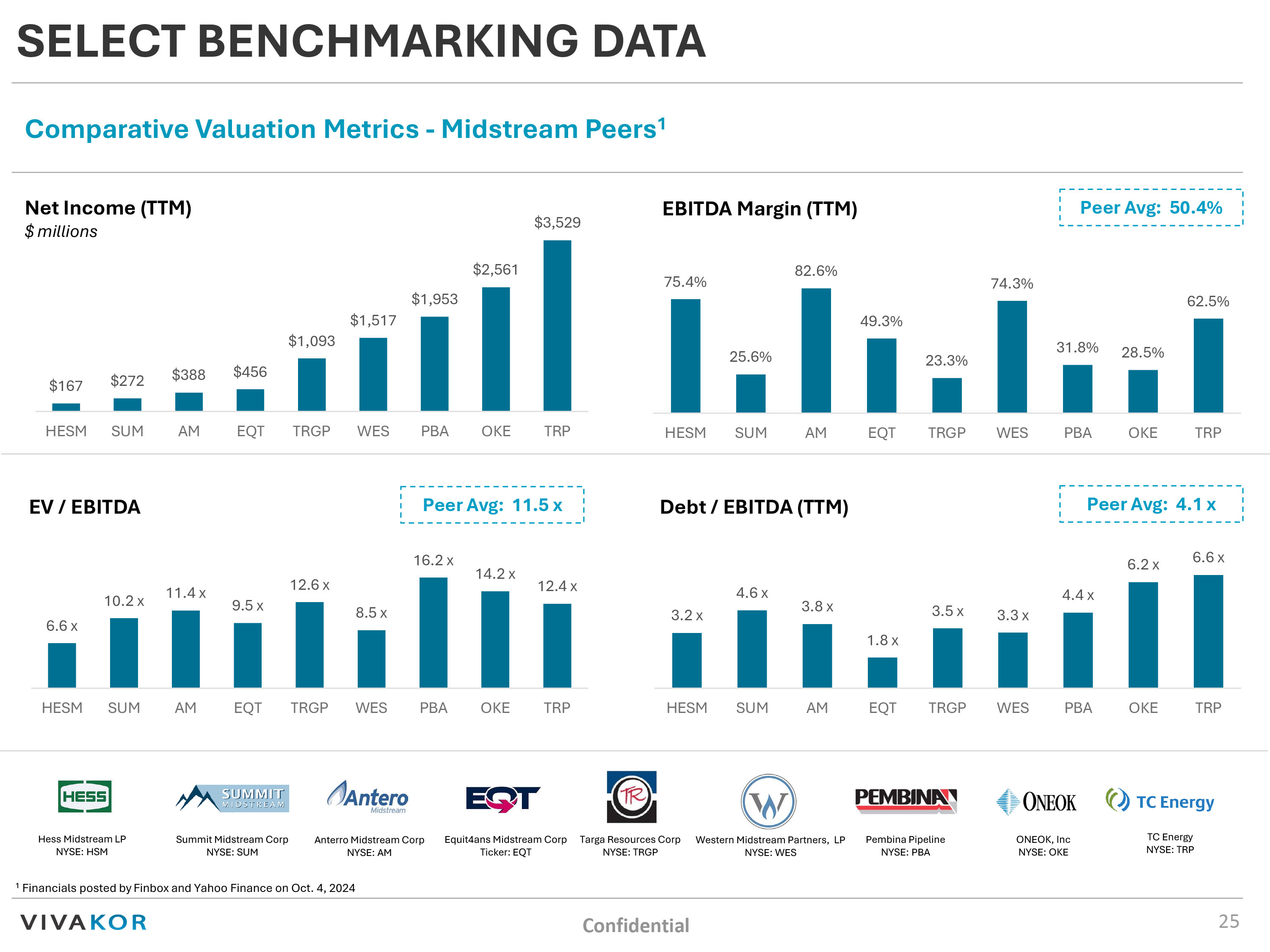

SELECT BENCHMARKING DATA Confidential 25 Comparative Valuation Metrics - Midstream Peers 1 1 Financials posted by Finbox and Yahoo Finance on Oct. 4, 2024 Hess Midstream LP NYSE: HSM Summit Midstream Corp NYSE: SUM Anterro Midstream Corp NYSE: AM Equit4ans Midstream Corp Ticker: EQT Targa Resources Corp NYSE: TRGP Western Midstream Partners, LP NYSE: WES Pembina Pipeline NYSE: PBA ONEOK, Inc NYSE: OKE TC Energy NYSE: TRP EBITDA Margin (TTM) Peer Avg: 50.4% 75.4% 25.6% 82.6% 49.3% 23.3% 74.3% 31.8% 28.5% 62.5% HESM SUM AM EQT TRGP WES PBA OKE TRP 6.6 x 10.2 x 11.4 x 9.5 x 12.6 x 8.5 x 16.2 x 14.2 x 12.4 x HESM SUM AM EQT TRGP WES PBA OKE TRP $167 $272 $388 $456 $1,093 $1,517 $1,953 $2,561 $3,529 HESM SUM AM EQT TRGP WES PBA OKE TRP Peer Avg: 11.5 x Net Income (TTM) $ millions EV / EBITDA Debt / EBITDA (TTM) 3.2 x 4.6 x 3.8 x 1.8 x 3.5 x 3.3 x 4.4 x 6.2 x 6.6 x HESM SUM AM EQT TRGP WES PBA OKE TRP Peer Avg: 4.1 x

26 Thank You James Ballengee , CEO jballengee@vivakor.com VIVK www . vivakor . com 5220 Spring Valley Road, Ste 500 Dallas, Texas 75254

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Vivakor (NASDAQ:VIVK)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vivakor (NASDAQ:VIVK)

Historical Stock Chart

From Jan 2024 to Jan 2025