FORM 6-K/A

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of February, 2024

Brazilian

Distribution Company

(Translation of Registrant’s Name Into English)

Av. Brigadeiro Luiz Antonio,

3142 São Paulo, SP 01402-901

Brazil

(Address of Principal Executive Offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

Form 20-F X Form

40-F

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (1)):

Yes ___ No X

(Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (7)):

Yes ___ No X

(Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ___ No X

Earnings release 4Q23

São Paulo, February

21, 2024. GPA [B3: PCAR3; NYSE: CBD] announces the results for the 4th quarter of 2023.

As a result of the process

of discontinuing the activities of the Extra hypermarkets and Almacenes Éxito S.A. (“Éxito”), as disclosed in

the material facts and notices to the market, the activities are accounted for as discontinued (IFRS 5 / CPC 31). Accordingly the income

statement were retroactively adjusted, as defined by CVM Deliberation 598/09 – Non-current assets held for sale and discontinued

operations.

In August 2023, the segregation

process of Almacenes Éxito S.A (“Éxito”) was concluded, with a distribution of approximately 83% of GPA’s

stake in Éxito to its shareholders. From there on, GPA pass to holds a 13.3% of remaining participation, which became to be accounted

as a financial application into current asset. In January 2024, it was concluded by GPA the sale of the total remaining participation

in Grupo Éxito.

The following comments refer

to the results of continued operations, including the effects of IFRS 16/CPC 06 (R2), unless otherwise indicated.

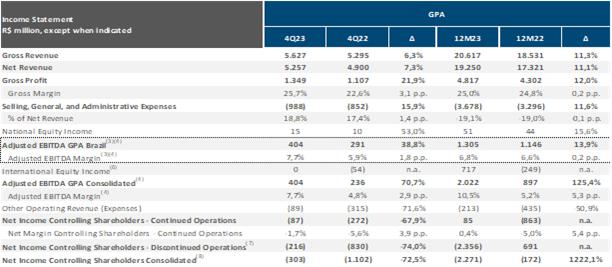

Consistency and continuous

improvement of results, with Adjusted EBITDA margin of 7.7% in the quarter – better result in eight quarters, and operational cash

generation of R$ 907 million in 2023

| · | R$ 907 million in Operating

Cash Generation(1) in 2023, improvement of R$ 1.4 billion vs. 2022, which presented R$ (532) million of deterioration; |

| · | Operations Gross revenue

growth of 6.3% vs. 4Q22; |

| o | Pão de Açúcar

grew 6.0% and Proximity format 19.3% |

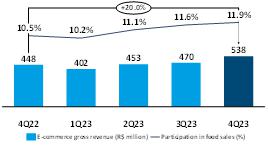

| o | Strong growth of over 20% in

E-commerce operation |

| · | Increase of 4.3% in Same-store

sales vs. 4Q22, supported by volume growth amidst a deflation scenario in important categories |

| o | Pão de Açúcar

grew 4.2% and Proximity format 5.6% |

| · | Fifth consecutive quarter

of Market share(2) gains, with a 0.3 p.p. progress vs. 4Q22; |

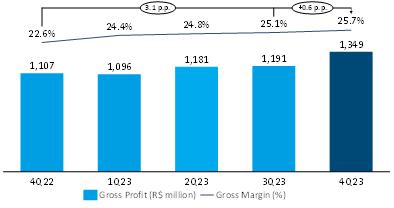

| · | Gross profit of 25.7%, a

growth of 3.1 p.p. vs. 4Q22 and 0.6 p.p. vs. 3Q23; |

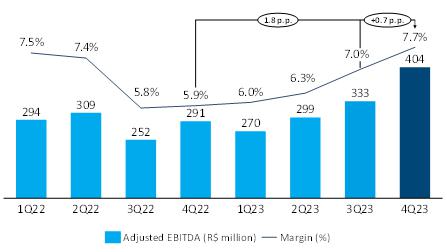

| · | Adjusted EBITDA(3)(4)

margin of 7.7%, improvement of 1.8 p.p. vs. 4Q22 and 0.7 p.p. vs. 3Q23; |

| · | Net debt reduction of R$

0.7 billion with 0.8x of deleverage(5) vs. 3Q23. Cash position of R$ 3.0 billion, corresponding to

3.1x short-term debt. |

(1) Managerial view of

the operating cash flow; (2) In comparison with total sales of brazil self-service market, calculated by Nielsen consultancy; (3) GPA

Brazil excludes impacts of the international perimeter (Cnova); (4) Operating income before interest, taxes, depreciation, and amortization

adjusted by Other Operating Income and Expenses; (5) Net debt by the LTM of GPA’s adjusted EBITDA; (6) Sale of the total participation

held in Cnova in 4Q23 and, as a consequence of that, null result for international equity income. In 3Q23, it was considered non-current

and non-cash effects of R$ 804 million with the reversion of accumulate results of Cnova; (7) it includes the results from the discontinued

operations of hypermarkets and Éxito; (8) it considers continued and discontinued operations.

Equity Holdings Sales

| · | On October

16, 2023, GPA's Board of Directors approved the signing of a pre-agreement for the sale of GPA's entire remaining 13.3% stake in Éxito

for US$ 156 million (R$ 789 million) to the Calleja Group, owner of the leading supermarket retail group in El Salvador, as part of a

Tender Offer (“TO”) launched by the Calleja Group in Colombia and the United States. Access the relevant fact in more detail

at the link. In

January 2024, the TO was concluded and the Company announced the receipt of R$789 million. In this way, the Company concluded the sale

of the entire remaining 13.3% stake held in Éxito. Access the material fact in more detail at the link. |

| · | In November

27th 2023 the Company concluded the sale of its indirect stake of 34% in CNova total share capital to its controlling shareholders

Casino Guichard Perrachon. The transaction amount was R$ 53.5 million. Access the material fact for more details through the link; |

Message

from the CEO

| 2023

was a year of consolidation and confirmation of the assertiveness of the GPA’s turnaround plan, started a year earlier, with a focus

on the “basics done right”. The results we achieved in 2023 also reflect the engagement of all our employees to achieve the

objective of returning our Company to a reference position in food retail in Brazil. With a lot of focus and discipline, we managed to

evolve in each of the six strategic pillars – Top Line, Customers, Digital, Expansion, Profitability and ESG & Culture –

to have an increasingly profitable operation, put our values into practice and comply with our purpose of “Feeding dreams and lives” |

|

|

We overcame important challenges,

such as completing the transition from the extinct hypermarket model. We carry out strong work focusing on profitability, reducing expenses

and shrinkage. We conducted a large category management project, to place the right product in the correct store, reaching an on shelf

availability of 95%, a benchmark for Brazilian retail. We defined new guidelines for our multichannel operations, transforming the physical

store into a product distribution hub. We resumed the organic expansion of stores and reorganized and defined unique goals for the entire

Company: thus, all together, we worked in a single direction, to achieve a single result.

The guideline of truly placing

the customer at the center of our decisions resulted in an increase in our NPS by 10 points, vs. 4Q22, and highlights in service improvements.

We invested on a variety of fronts, starting with training 100% of our store team so that everyone is connected to our culture and strategy.

We opened 61 new stores in

2023, most of which of Proximity format, under the Minuto Pão de Açúcar banner. In e-commerce, we made a major operational

change, migrating 100% of orders to ship from stores, integrating e-commerce with store operations. We had growth of more than 20% in

e-commerce revenue in 4Q23 vs. 4Q22 and positive contribution margin, supported by an important efficiency gain process, which allowed

us to reduce expenses with sales growth.

With all of this, we have seen

growing recognition from our customers, and a consequent gain in market share. In 4Q23, we recorded an increase of 0.3 p.p. compared to

4Q22, according to data from Nielsen in the self-service market – the fifth consecutive quarter of gains. It is important to highlight

that this increase in market share occurred simultaneously with the increase in our profitability, demonstrating the recognition of our

value proposition by the customer.

We can also celebrate 4Q23

for the improvement in our profitability indicators. In addition to the work to control expenses and shrinkage, the adoption of the Zero

Base Budget and the success of the process of selling non-core assets were fundamental to improving the Company's capital structure. Adjusted

EBITDA totaled R$ 404 million, with a margin of 7.7%, an increase of 1.8 p.p. vs. the previous year. The financial indicators demonstrate

that we have taken important steps towards an increasingly healthier business with consistent and sustainable results. Furthermore, with

the decision to sell our remaining shares in Éxito and the stake we held in the capital of Cnova, we once again became a 100% Brazilian

company, focused on the national food market, much more prepared to keep growing.

The achievements of 2023 expand

our conviction that we are moving forward to the right path. With consistency and clarity about our strategic objective, we continue to

build a strong culture that has been the foundation of all our work.

We see 2024 as the year of

accelerating earnings, consolidating our position in the premium market, strengthening our proximity and mainstream brands, while also

accounting for gains from improving the capital structure. We arrived this year stronger and with an improved value proposition, which

will allow us to continue delivering consistent results to our stakeholders.

Marcelo Pimentel

GPA CEO

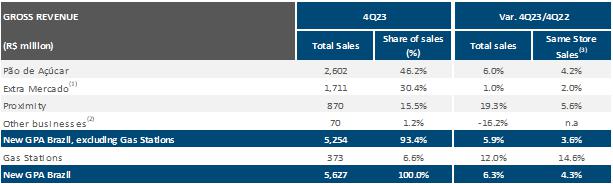

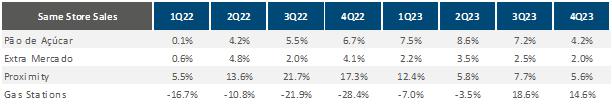

Sales Performance

Growth of total and same-store

sales above the food self-service market

(1) Remaining Compre bem stores were converted into

Extra Mercado between July and August 2023; (2) Revenues mainly from commercial centers rentals agreements, Stix Fidelidade, Cheftime

and James Delivery; (3) To reflect the calendar effect, it was added 0.7 p.p. in 4Q23

Total sales reached R$ 5.6

billion in 4Q23, resulting in a 6.3% growth, driven by the 19.3% growth of the Proximity format with 56 stores opened in 2023 (being 11

stores into 4Q23) which presented an accelerated maturation (in average seven months). Growth was once again higher than the growth of

the self-service market, with an increase of 0.3 p.p. in market share, despite the strong comparison base in relation to 4Q22, in which

we already had the positive effect of the conversions of part of the retail stores of hypermarkets into supermarkets.

In Pão de Açúcar,

same-store sales grew by 4.2%, keeping the sequential improvement since 1Q22, being this improvement, once more, driven by volume

in sales. Likely the previous quarters, the main highlight was in perishables category, with growth in fruits & vegetables and Bakery

& Rotisserie. In Groceries, categories such as Beauty & Health and Cleaning showed a strong increase in sales, as a direct consequence

of the implementation of the category management project and review of assortment and prices, which resulted in an increase in the share

of wallet of customers with the banner. Finally, it is worth mentioning the continuous increase in the Premium & Valuable customer

base, a strategic pillar for increasing sales and profitability, with growth of 9.5% vs. the previous year.

In Extra Mercado, same-store

sales reached 2.0%, reflecting the same trend observed in other banners in 4Q23 in relation to 3Q23. As well as the last quarter,

the perishables category presented an above-average increase, with volume growth despite the strong deflation in butchery items. In 2023,

we made significant advances in the banner with a significant improvement in customer experience (+13 points in NPS), improved profitability

(conversion of the Compre Bem banner and efficiency gains in expenses) and the beginning of the journey to strengthen the brand. In 2024,

our focus will be on increasing customers' share of wallet with the banner, through the implementation of the category management project

and review of assortment and prices. We started implementing the project at Extra Mercado in 4Q23 and, throughout the first half of 2024,

we will have commercial execution, with suppliers, and operational execution, with adjustments in stores, aiming to capture gains in stock

out, inventory and, mainly, customer experience with a better price perception and increased competitiveness of the banner.

In the Proximity format, we

presented strong growth in total stores of 19.3% when compared to 4Q22, driven by the good performance of new stores. In the same

store comparison, we presented an increase of 5.6%, on top of a strong comparison base from 4Q22. The complete assortment review is

still ongoing in the Proximity format and should be completed in the first half of 2024. This review will allow a significant improvement

in the assertiveness of the product offered to the customer and we believe it will contribute positively to the format's sales. The proximity

format is in a privileged position, with advances in organic expansion, operational scale and differentiated value proposition, to further

accelerate its growth with the resumption of market conditions.

In Gas Stations, we

can see a strong advance in same store of 14.6% vs. 4Q22. This result is a consequence, mainly, of the volume growth (+9.1%), impacted,

in part, by the reopening of some hypermarkets sold to Assaí (in the Gas Stations that are located inside this stores complex)

| Consistent market share gains

in all formats

Five

consecutive quarters with increase of market share

Since April 2022, with the

kick off of GPA’s turnaround plan, we have maintained discipline and consistency in delivering the objectives of the six strategic

pillars, resulting in growing recognition from our clients, which may be observed by the relevant gains in market share.

In 4Q23, we grew our market

share by 0.3 p.p. compared to the previous year, this being the fifth consecutive quarter of increase, according to data from the consultancy

Nielsen considering the self-service market in Brazil. In 2023, we

|

|

|

accumulated a gain of

0.5 p.p. in market share compared to the self-service market, with the majority of this progress achieved under the Pão de

Açúcar banner, where we put the greatest focus on executing strategic plans during the year. It is worth highlighting

the continuity of the evolution of market share, which in addition to the sequential advances observed in the last five quarters,

occurs concomitantly with the increase in operational profitability, thus demonstrating the improvement in the customer experience

and adherence to our value proposition.

Pão de Açúcar

showed an evolution of 0.2 p.p. vs. the self-service market in 4Q23 compared to the previous year. The consistent increase in market

share is mainly due a result of advances in the perishables categories, with the capture of new customers and growth of the Premium &

Valuable customer base. Extra Mercado, in turn, remained stable compared to the same basis. The proximity format,

with the Minuto Pão de Açúcar and Mini Extra banners, is the biggest highlight in gaining market share, with a

gain of 2.9 p.p. in comparison with small supermarkets in greater SP, reinforcing the success of the proposal of value delivered to

customers in this format

Expansion: 61 stores opened in

2023, with 12 stores in 4Q23

R$ 673 million of incremental

sales in the quarter generated by opened stores since 2022

| The

focus of our stores expansion project is the proximity format with the Minuto Pão de Açúcar banner. Which already

has a scalable and mature format with greater capillarity potential, foreseeing the densification and verticalization of the city of São

Paulo and its metropolitan region. This stores, focused on the high income public, are located in high quality locations and present a

quickly maturation, in average seven months, and high performance, with 2022 and 2023 group of opening stores overcoming, in terms of

profitability, the stores opened previously and with an average profitability higher than the Company’s consolidated profitability. |

|

|

In 4Q23, we opened 12 stores

with: (i) 11 in proximity format, 9 Minuto Pão de Açúcar and 2 Mini Extra; and (ii) 1 Pão de Açúcar,

located in Itu city, state of São Paulo. By the end of 2023, we accumulate 61 new stores, being: (i) 56 in proximity format, 49

Minuto Pão de Açúcar and 7 Mini Extra; and (ii) 5 Pão de Açúcar.

We highlight that 2023 represented

a resumption of expansion on Pão de Açúcar banner after years without new openings. This is an important movement

to the banner, which returns to its value proposition in regions of high potential growth.

E-commerce with strong growth

acceleration and success on 100% ship from store model

20%

revenue increase, best growth rate in the last 6 quarters

| In 4Q23, we presented an increase

of 20% in e-commerce revenue, an acceleration when compared to the last quarters. The penetration reached 11.9% of total food sales, representing

an increase of 1.4 p.p. when compared to the last year. Both formats, 1P and 3P, presented a strong double digit growth. |

|

|

In 2023, we reached R$1.9 billion

in e-commerce sales, consolidating GPA as the leader in digital food retail in Brazil. Among the advances achieved in 2023, we highlight

the migration of 100% of sales to ship from store, which has enabled us to increase the penetration of perishables in the 1P channel,

which went from 27% (4Q22) to 33% (4Q23), being a fundamental pillar of differentiation of our value proposition.

The e-commerce pass through

a relevant process of efficiency gains in the last quarters, which allowed expenses reduction with no impact on sales growth, resulting

in an increase of our contribution margin. Among the initiatives, we highlight: (i) closure of the James marketplace operation (4Q22),

(ii) reduction of unprofitable marketplace sellers (1Q23); (iii) migration of 100% of sales from the Distribution Center to the stores

(2Q23). This last initiative allowed a complete integration between e-commerce and in-stores operations, with incremental sales to stores

and a significant reduction in the expenses structure.

Customers & NPS: Significant

improvement in customer satisfaction

Greater customer satisfaction

translates into greater flow and frequency

The consistency of focusing

on the customer at the center of decisions continues to produce important advances in NPS across all of our banners. In 4Q23, we reached

76 points in NPS, considering all brands, a strong increase of 10 points in the last 12 months, with highlights being the improvements

achieved in price perception and waiting time in the checkout line. It is also worth highlighting the excellent customer perception regarding

the quality of products and service in the store. This strong evolution of the NPS permeates all of our banners and we continue to see

opportunities to keep evolving throughout 2024.

At Pão de Açúcar,

after the relaunch of the Program Mais, we continued to see growth in Gold and Black customers, classifications with a higher

level of loyalty. This increase continues to drive growth in the number of Premium & Valuable customers, a group with the highest

purchase frequency and highest monthly expenditure, which increased by 9.5%, demonstrating the effectiveness of the new program in generating

value for the customer. We continue to advance in our communication with customers with the investment in the CDP – Customer Data

Platform tool, which will allow us to further personalize the customer experience on a larger scale, enhancing our Premium & Valuable

customer base and e-commerce sales.

Still on the topic of customer

loyalty, we have a privileged position in Private Brands and great potential for the development of this platform, which is connected

to the strong level of trust that our customers have in our brands. The value proposition in Private Brands aims to deliver high quality

products to the customer, comparable to the category leader, at an extremely competitive price. In 2023, we accelerated the development

of new products, culminating in more than 300 launches, increasing sales by 14.3% vs. 2022, reaching the mark of R$4.2 billion in sales,

and we achieved penetration of 21.6% in total sales of our banners. The high loyalty generated with customers can also be measured in

the relevant share that Private Brands have in customers' baskets, with 8 out of 10 customers consuming our brands, in addition to the

2.4 times higher average frequency of these customers in relation to those who still do not buy Private Brand.

We also highlight Stix, GPA's

loyalty coalition platform in partnership with Raia Drogasil that brings together Pão de Açúcar, Extra, Droga Raia

and Drogasil, Sodimac and C&A partners and which closed 2023 with 5.5 million active customers, 62% of these are engaged with two

or more partners. In 2023, 20 billion points were redeemed, of which 8 billion were in GPA. We highlight that 82% of the points redeemed

on GPA were used as a form of payment (“Stix no caixa”), demonstrating the platform’s strong loyalty potential.

In December 2023, Stix entered into

a new strategic partnership with Livelo, the largest rewards program in Brazil with more than 40 million subscribers, in this way Livelo

customers are able, through PagStix, to redeem their points in Stix partners. This new strategic partnership has great potential for GPA,

and in its first month of operation it was already responsible for doubling the Stix points redeemed for purchases at GPA.

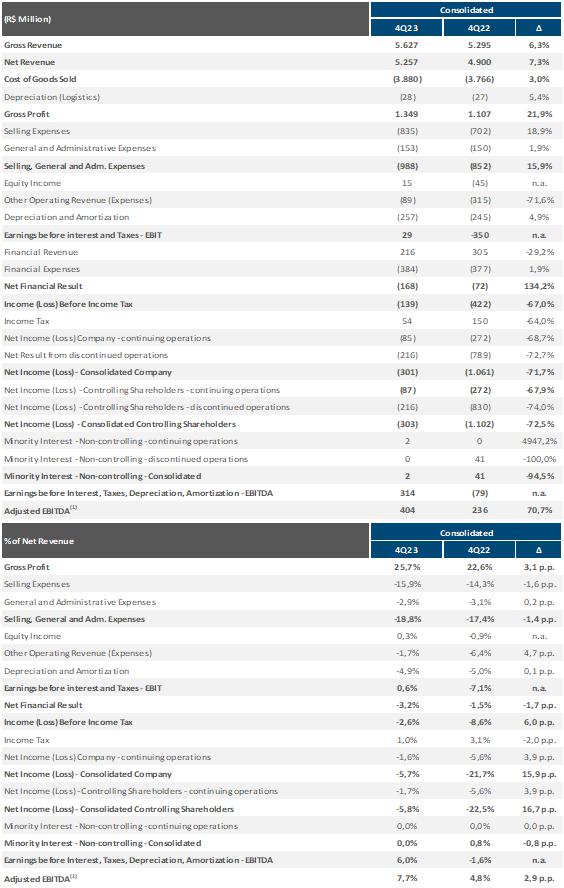

Financial Performance

Acceleration in gains of gross margin

Solid expansion of 0.6 p.p. when compared to 3Q23 and 3.1 p.p. vs. 4Q22

Gross Profit totaled

R$ 1.3 billion in 4Q23, with a margin of 25.7%, showing an improvement of 3.1 p.p. and 0.6 p.p. compared to 4Q22 and 3Q23, respectively.

The continuous evolution of Gross Profit is mainly the result of a significant improvement in commercial negotiations, reduction in shrinkage

and efficiency gains in operating costs. In relation to 3Q23, in addition to the improvement in commercial negotiations, we presented

a greater dilution of logistics costs, with gains of scale resulting from the increasing volume in operation.

Selling, General and Administrative

Expenses totaled R$ 988 million in the quarter, representing 18.8% of net revenue, which is the lowest level achieved in the year

reflecting a reduction of 0.2 p.p. compared to 3Q23. Compared to 4Q22, there was an increase of 1.4 p.p., as a percentage of net revenue,

mainly related to store expenses to improve the customer experience.

Equity Income totaled

R$ 15 million in 4Q23, an increase of R$ 5 million, substantially due to the change in the Pão de Açúcar card points

program, and a reduction in costs with bad debt provision and funding (FIC). It is worth noting that, as of 4Q23, with the sale of the

stake held by GPA in Cnova, the consolidated equity income no longer shows the impact of the losses generated by Cnova, starting to reflect

only the results generated by FIC.

As a result of the effects mentioned

above, GPA's Adjusted EBITDA was R$ 404 million, representing a growth of 39% vs. 4Q22, and adjusted EBITDA margin of 7.7%, showing

an improvement of 0.7 p.p. vs. 3Q23. Compared to 4Q22, the adjusted EBITDA margin increased by 1.8 p.p., in line with the Company's turnaround

process.

Best Adjusted EBITDA margin in the last 8 quarters

Solid expansion of 0.7 p.p. when compared to 3Q23 and

1.8 p.p. vs. 4Q22

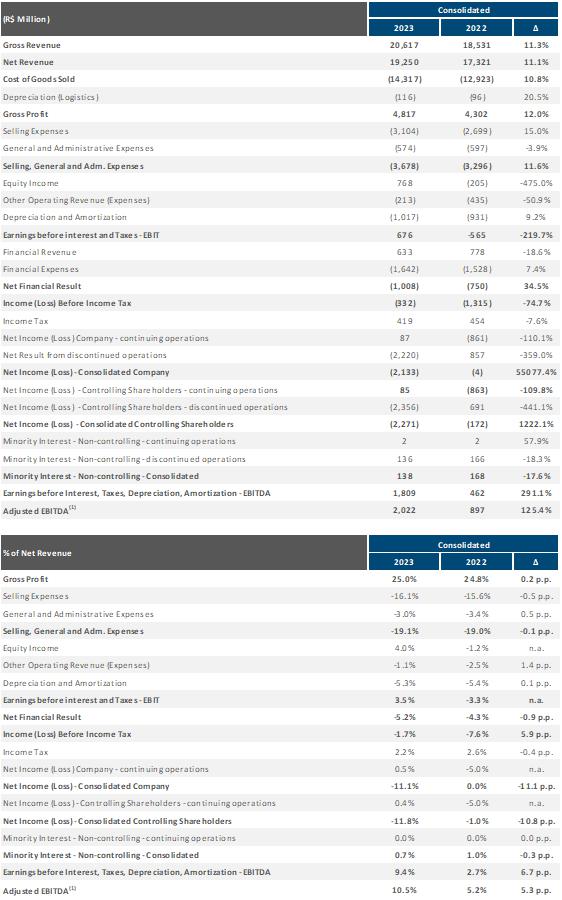

Regarding profitability,

the year 2023 was characterized by the reversal in the margin compression process observed in 2022. The initiatives implemented in the

context of the turnaround plan were critical in this sense and began to show results from the last quarter of 2022. Since then, the Company

has been reporting sequential expansion in the Adjusted EBITDA margin, thus demonstrating the effectiveness and consistency of the initiatives

implemented. For the upcoming quarters, we will continue to make progress: (i) in negotiating with our suppliers on commercial aspects;

(ii) in the completion of projects that will impact the rebalancing of categories in light of GPA's new value proposition; (iii) capturing

the reduction in expenses based on the project to implement the Zero-Based Budgeting methodology; and (iv) the best promotional balance

with the growing perception of the banners' new value proposition by customers.

OTHER CONSOLIDATED OPERATING INCOME AND EXPENSES

In the quarter, Other Income

and Expenses reached R$ (89) million. This result is mainly due to provisions related to: (i) stores restructuring and closures; and (ii)

termination of a contract to purchase electricity in the free energy market, aiming to reflect the current market price of this input.

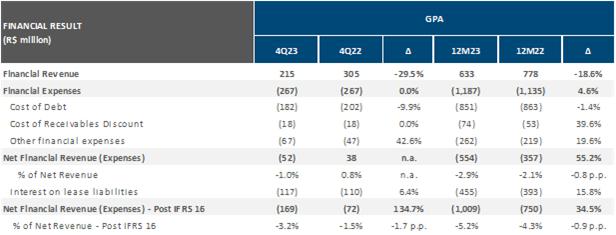

CONSOLIDATED NET FINANCIAL RESULT

In the

end of 4Q23 GPA's net financial result totaled R$ (52) million, representing -1.0% of net revenue. Considering the interest on the leasing

liability, the amount reached R$ (169) million, equivalent to -3.2% of net revenue.

The

main highlights of the financial result for the quarter were:

| · | Financial income reached R$

215 million, a negative variation of R$ 90 million vs. 4Q22. This variation is mainly due to exceptional effects of R$ 186 million, regarding

to tax credits, and R$ 36 million by the monetary correction

related to Extra Hiper operation in 4Q22, which was partially offset by R$ 139 million of mark-to-market gains with the remaining participation

that GPA held in Éxito in the end of 4Q23 |

| · | Financial expenses, including

prepayment of receivables, amounted R$ (267) million, in stable level vs. 4Q22 |

CONSOLIDATED NET INCOME OF CONTINUED AND DESCONTINUED

OPERATIONS

The Net Loss from Continued

Operations reached R$ (87) million in 4Q23, vs. a loss of R$ (272) million in the same period of last year. The Loss reduction is

due to an improvement in Adjusted EBITDA and other operational income and expenses

The Net Loss from Discontinued

Operations reached R$ (216) million, mainly due to the impact of the provisioning of: (i) Extra Hiper’s Labor contingencies;

and (ii) termination of a contract to purchase electricity in the free energy market, regarding to a surplus of contracted energy related

to discontinued activities

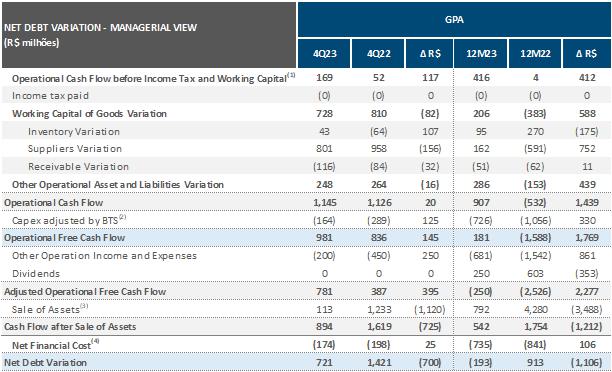

NET DEBT VARIATION

GPA presented a reduction in

net debt of R$ 721 million in 4Q23 vs. 3Q23, mainly due to an Operating Free Cash Flow (Operating Cash Flow deducted from CAPEX) of R$

981 million and the sale of non-core assets totaling R$ 113 million, partially offset by a cash consumption of R$ (200) million in other

operating income and expenses and R$ (174) million in net financial costs.

In 2023, the Company also presented

a positive Operating Free Cash Flow of R$ 181 million, an improvement of R$1,769 million compared to 2022. In 2023, there was also a cash

generation of R$ 792 million with sales of non-core assets and R$ 250 million with dividends received from Éxito. These amounts

were outweighed by R$ (681) million of other operating income and expenses and R$ (735) million of net financial costs, resulting in an

increase in net debt of R$ 193 million.

(1) it considers gross profit and

SG&A, including leases and Extra Hiper discontinued activities (that impact mainly 2022); does not consider depreciation and equity

income; (2) net from the financing of built to suit (BTS) format to the new stores of Pão de Açúcar; (3) it Includes

revenues of asset sales and strategic projects, such as sale of Extra Hiper stores and the sale of participation in Éxito; (4)

It includes interest of gross debt, cash profitability, cost with banks guarantees and cost with discount of receivables.

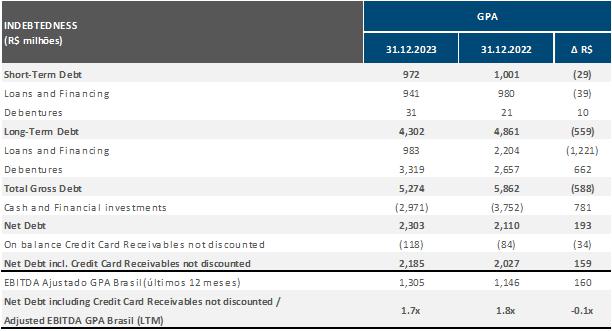

NET DEBT CONSOLIDATED CONTINUED OPERATIONS

It is worth noting that GPA's

consolidated net debt considers, in both periods, the operations of GPA Brasil, therefore excluding Éxito's operations, which are

considered as discontinued operations.

Net debt, including the balance

of unpaid receivables, reached R$ 2.2 billion, an increase of R$ 159 million vs. the same period as the previous year. Financial leverage,

measured by net debt divided by GPA Brasil's Adjusted EBITDA, decreased by 0.1x compared to 4Q22, reaching 1.7x.

At the end of 4Q23, GPA held

a cash position of R$3.0 billion, equivalent to 3.1x the Company's short-term debt.

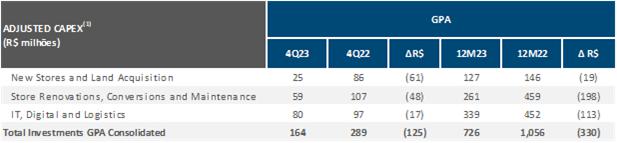

INVESTMENTS

In 4Q23, adjusted CAPEX

for built to suit operations (“Adjusted CAPEX”) reached R$ 164 million, a reduction of R$ 125 million vs. o 4Q22, mainly

in New Stores and Land Acquisition and Renovations, Conversions and Maintenance. In the year, Adjusted CAPEX reached R$ 726 million, a

reduction of R$ 330 million vs. o 2022, mainly in Renovations, Conversions and Maintenance, which in 2022 showed a greater concentration

of investments in renovations of Pão de Açúcar stores and conversions of hypermarkets into supermarkets.

(1) Net from the financing of built to-suit format

to the new stores of Pão de Açúcar.

ESG AT GPA

Agenda with and for society and the environment

Based on our sustainability strategy and GPA's pillars

of action, the main highlights of 3Q23 are as follows:

Women in leadership

positions: we concluded the year 2023 with 41% of women in leadership positions (management and above) vs. 38% in 2022, a reflection

of the development programs that have been carried out and which, since the beginning of the year, have enabled 78 women to be promoted,

joining a further 44 women hired for leadership positions. We closed the year with 63% of self-declared black and brown employees and,

of these, 48% occupying leadership positions (managers and above). At the end of the year, we launched the third edition of the Exclusive

Internship Program for Black and Brown People with the opening of 30 vacancies for different areas of the Company. In this edition, we

increased the number of positions by 15% compared to the previous program.

Combating climate change:

We ended 2023 with a reduction of more than 10% in scope 1 and 2 emissions compared to the previous year, as a result of “gas

replacement” and “engine room retrofit” projects. We are in line with our public commitment to reduce scope 1 and 2

emissions by 50% by 2025 (base year 2015), contributing more actively to a low-carbon economy.

Animal welfare in the

value chain: To achieve continuous improvement and contribute to animal welfare practices, in November we promoted a multisector engagement

event for our animal protein suppliers. The event featured presentations from experts, civil society, certification bodies and consumer

data science consultancies. In total, we had the participation of more than 60 commercial partners, where we discussed, together, ways

to advance the well-being agenda with more ethical and sustainable solutions.

Social Impact:

In 2023, six years will have passed since we started the Mãos na Massa project, which promotes basic training in baking

and confectionery through the GPA Institute for people in socially vulnerable situations. We closed the year with the training of 207

people, opening new income generation opportunities for these families. Furthermore, through Parceria Contra o Desperdício

Program, we promoted the donation of 1,800 tons of food to 255 partner social organizations, impacting 3.2 million meals.

Ethics and Transparency:

We reinforce our commitment to transparency by disclosing information about our environmental impact through the CDP (Carbon Disclosure

Project) with an “A-” grade in the Climate Change questionnaire. In the CDP Florestas ranking, we evolved from “B

to “A-” in the beef chain, being the only company in the sector presenting this grade, reinforcing our commitments to combat

deforestation. Furthermore, our annual sustainability report was recognized as one of the 10 best on the market according to the Reporting

Matters Brazil 2023 Report, carried out by the Conselho Empresarial Brasileiro para o Desenvolvimento Sustentável (CEBDS),

which analyzed 77 sustainability reports. This is further recognition of all the work that the Company has been carrying out in the transparency

of the disclosure of its information.

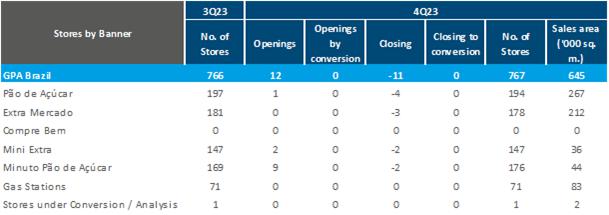

BREAKDOWN OF STORE CHANGES

BY BANNERS

In 4Q23, we opened 12 new stores:

| · | 11 in Proximity Format (9 Minuto

Pão de Açúcar and 2 Mini Extra) |

| · | 1 Pão de Açúcar

Banner, in city of Itu, state of São Paulo |

Furthermore, it was closed

7 supermarket stores and 4 of proximity format.

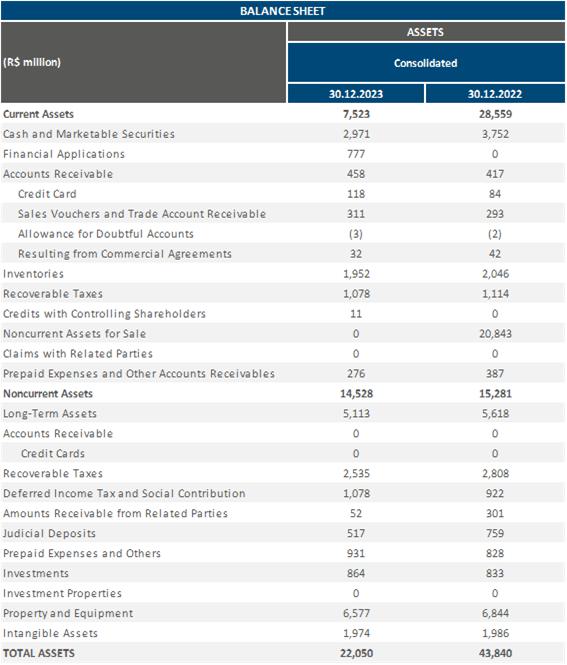

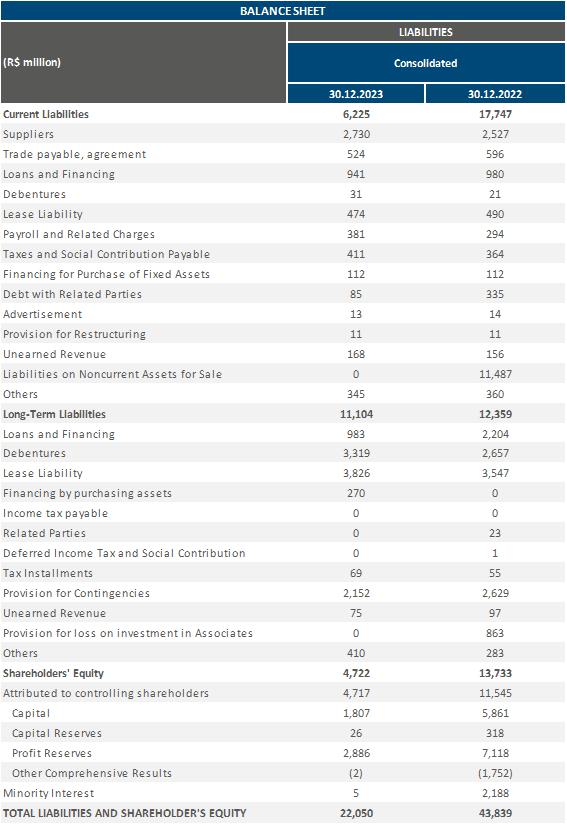

CONSOLIDATED FINANCIAL STATEMENTS

Balance Sheet

CONSOLIDATED FINANCIAL STATEMENTS

Balance Sheet

INCOME STATEMENT – 4th QUARTER OF

2023

(1) Adjusted EBITDA excludes Other Operating Income and

Expenses

INCOME STATEMENT – 2023

(1) Adjusted EBITDA excludes Other Operating Income and

Expenses

SIGNATURES

Pursuant

to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

|

| |

|

COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO

|

| Date: February

22, 2024 |

By: /s/ Marcelo Pimentel

|

| |

|

Name: |

Marcelo Pimentel |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

|

By: /s/

Rafael Sirotsky Russowsky |

| |

|

Name: |

Rafael Sirotsky Russowsky |

| |

|

Title: |

Investor Relations Officer |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

Companhia Brasileira de ... (NYSE:CBD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Companhia Brasileira de ... (NYSE:CBD)

Historical Stock Chart

From Nov 2023 to Nov 2024