SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

FOMENTO ECONÓMICO

MEXICANO, S.A.B. DE C.V.

(Exact name of Registrant as specified in its charter)

Mexican Economic Development, Inc.

(Translation of Registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, Nuevo León 64410

México

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports

under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing

the information contained in this

Form, the registrant is also thereby furnishing the information to the

Commission pursuant to

Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨

No x

If "Yes" is marked, indicate below the

file number assigned to the registrant in

connection with Rule 12g3-2(b): 82-_____________

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the

registrant has duly caused this report to be signed

on its behalf of the

undersigned, thereunto duly authorized.

| |

FOMENTO ECONÓMICO MEXICANO, S.A. DE C.V. |

| |

|

| |

By: |

/s/ Eugenio Garza y Garza |

| |

Eugenio Garza y Garza |

| |

Director of Finance and Corporate Development |

Date: October, 27, 2023

Exhibit 99.1

3Q 2023

Results

October 27, 2023

Investor Contact

(52) 818-328-6167

investor@femsa.com.mx

femsa.gcs-web.com

Media Contact

(52) 555-249-6843

comunicacion@femsa.com.mx

femsa.com

October 27, 2023 | Page 1

HIGHLIGHTS

Monterrey, Mexico,

October 27, 2023 — Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA”) (NYSE: FMX; BMV: FEMSAUBD,

FEMSAUB) announced today its operational and financial results for the third quarter of 2023.

| • | FEMSA:

Total Consolidated Revenues grew 19.3% against 3Q22. |

| • | FEMSA

Retail1: Proximity Americas total Revenues increased 20.8% against 3Q22. |

| • | DIGITAL:

Spin by OXXO had 6.4 million active users2 while Spin Premia had 17.7

million active loyalty users2 and an average tender3 of 28.3%. |

| • | COCA-COLA

FEMSA: Total volume and revenues grew 11.6% and 10.1%, respectively, against 3Q22. |

Financial Summary

for the Third Quarter and First Nine Months 2023

Change

vs. comparable period

| | |

Total Revenues | | |

Gross Profit | | |

Income from Operations | | |

Same-Store Sales | |

| | |

3Q23 | | |

YTD23 | | |

3Q23 | | |

YTD23 | | |

3Q23 | | |

YTD23 | | |

3Q23 | | |

YTD23 | |

| FEMSA Consolidated | |

| 19.3 | % | |

| 19.4 | % | |

| 22.1 | % | |

| 21.3 | % | |

| 12.6 | % | |

| 8.8 | % | |

| | | |

| | |

| Proximity Americas | |

| 20.8 | % | |

| 20.8 | % | |

| 23.9 | % | |

| 21.1 | % | |

| 14.7 | % | |

| 17.2 | % | |

| 15.1 | % | |

| 16.1 | % |

| Health | |

| 0.2 | % | |

| 0.1 | % | |

| (0.6 | )% | |

| 3.6 | % | |

| (10.4 | )% | |

| (5.7 | )% | |

| (3.6 | )% | |

| (3.5 | )% |

| Fuel | |

| 14.2 | % | |

| 14.3 | % | |

| 10.2 | % | |

| 12.4 | % | |

| 3.3 | % | |

| 10.1 | % | |

| 8.1 | % | |

| 8.8 | % |

| Coca-Cola FEMSA | |

| 10.1 | % | |

| 9.2 | % | |

| 13.6 | % | |

| 10.9 | % | |

| 15.3 | % | |

| 13.0 | % | |

| | | |

| | |

José Antonio

Fernandez Carbajal, FEMSA’s Chief Executive Officer, commented:

“The

third quarter was very favorable for our business, with strong momentum across most of our operations. However, our positive results

were tempered by the unfortunate passing of FEMSA’s former CEO, Daniel Rodriguez Cofré, in the month of August. We honor

his legacy by continuing to execute on the strategy that he helped design and put in place.

Our

quarterly results show a continuation, and in some cases an acceleration, of the positive trends that we have seen during the past several

quarters, and again offer a glimpse of the significant organic growth potential we have before us. Notably, Proximity Americas increased

revenues by more than 20 percent, driven by strong traffic trends at OXXO and reflecting an accelerated store expansion. In Europe, Valora

continued to grow its top line, while Health revenues were again stable, reflecting a challenging comparison base in Chile as well as

significant currency headwinds. For its part, Coca-Cola FEMSA delivered very strong results across its income statement, while Digital@FEMSA

continued to add users at a rapid pace. Importantly, we are achieving solid growth today, while also investing significant capital in

the future of our core business verticals, across markets but particularly in Mexico.

On the

strategic front, during the third quarter we continued to make progress executing the FEMSA Forward gameplan, announcing the creation

of a new distribution platform in the United States by bringing together Envoy Solutions and BradyIFS. The regulatory process has advanced

according to schedule, and we expect this transaction to close soon.

As we

approach the final stretch, we are well positioned to close the year on a high note, and already begin to look forward to an interesting

and dynamic 2024.”

1 FEMSA Retail: Proximity

Americas & Europe, Fuel and FEMSA Health.

2 Active User for Spin by

OXXO: Any user with a balance or that has transacted within the last 56 days. Active User for Spin Premia: User that has transacted at

least once with OXXO Premia within the last 90 days.

3 Tender: OXXO Mexico MXN

sales with OXXO Premia or Spin Premia redemption or accrual divided by Total OXXO Mexico MXN Sales, during the period.

October 27, 2023 | Page 2

QUARTERLY RESULTS

Results are compared

to the same period of previous year

3Q23

Financial Summary

Amounts

expressed in millions of Mexican Pesos (Ps.)

| | |

3Q23 | | |

3Q22 | | |

Var. | | |

Org. | |

| Total Revenues | |

| 188,095 | | |

| 157,693 | | |

| 19.3 | % | |

| 11.9 | % |

| Income from Operations | |

| 15,929 | | |

| 14,146 | | |

| 12.6 | % | |

| 9.8 | % |

| Operating Margin (%) | |

| 8.5 | | |

| 9.0 | | |

| (50 | )bps | |

| | |

| Adjusted EBITDA4 | |

| 25,366 | | |

| 22,046 | | |

| 15.1 | % | |

| 7.7 | % |

| Adjusted EBITDA Margin (%) | |

| 13.5 | | |

| 14.0 | | |

| (50 | )bps | |

| | |

| Net Income | |

| 12,758 | | |

| 13,268 | | |

| (3.8 | )% | |

| | |

Net

Debt ex-KOF5

Amounts

expressed in millions of Mexican Pesos (Ps.)

| As of September 30, 2023 | |

Ps. | | |

US$3 | |

| Cash | |

| 140,738 | | |

| 8,209 | |

| Long-Term Debt | |

| 75,187 | | |

| 4,386 | |

| Lease Liabilities | |

| 93,338 | | |

| 5,444 | |

| Net debt | |

| 27,787 | | |

| 1,621 | |

| ND / Adj. EBITDA | |

| 0.49 | x | |

| - | |

Total revenues

increased 19.3% in 3Q23 compared to 3Q22, driven by growth across our business units. On an organic1 basis, total revenues

increased 11.9%.

Gross profit

increased 22.1%. Gross margin expanded 90 basis points, reflecting the consolidation of Proximity Europe, as well as margin expansions

at Proximity and Coca-Cola FEMSA. This was partially offset by a margin contraction at Health and Fuel.

Income from operations increased 12.6%.

On an organic basis, income from operations increased 9.8%. Consolidated operating margin decreased 50 basis points to 8.5% of total revenues,

reflecting margin expansion at Coca-Cola FEMSA, offset by margin contractions at Proximity Americas, Health, and Fuel, as well as the

consolidation of Proximity Europe.

Our effective income tax rate was 31.8%

in 3Q23 compared to 35.0% in 3Q22. Our income tax provision was Ps. 6,540 million in 3Q23.

Net consolidated income was Ps. 12,758

million, reflecting: i) higher income from operations; ii) a non-cash foreign exchange gain of Ps. 5,374, related to FEMSA’s U.S.

dollar-denominated cash position as impacted by the depreciation of the Mexican peso; and iii) a decrease in net interest expenses during

the quarter. This was offset by a decrease in net income from discontinued operations compared with 3Q22, which included the results of

FEMSA’s participation in Heineken.

Net majority income was Ps. 2.72 per FEMSA

Unit2 and US$1.56 per FEMSA ADS.

Capital expenditures amounted to Ps. 9,791

million, driven by ongoing investment activities across our business units.

1 Excludes the effects of

significant mergers and acquisitions in the last twelve months, including the acquisition of Valora.

2

FEMSA Units consist of FEMSA BD Units and FEMSA B Units. Each FEMSA BD Unit is comprised of one Series B Share, two Series D-B Shares

and two Series D-L Shares. Each FEMSA B Unit is comprised of five Series B Shares. The number of FEMSA Units outstanding as of September

30, 2023 was 3,578,226,270, equivalent to the total number of FEMSA Shares outstanding as of the same date, divided by 5.

3 The exchange rate published by the

Federal Reserve Bank of New York for September 30, 2023 was 17.4064 MXN per USD.

4 Adjusted EBITDA: Operating Income

+ Depreciation + Amortizations.

5 ex-KOF: FEMSA Consolidated reported

information – Coca-Cola FEMSA Consolidated reported information.

Adjusted EBITDA ex-KOF: FEMSA Consolidated Adjusted

EBITDA as described above – Coca-Cola FEMSA’s Consolidated Adjusted EBITDA + Dividends received by FEMSA from Coca-Cola FEMSA

and other investments.

All Net Debt calculations are shown on an Ex-KOF

basis. For a detailed reconciliation of this metric please see table on page 17 of this document.

October 27, 2023 | Page 3

PROXIMITY

AMERICAS

OXXO (Mexico & Latam3) |

|

3Q23 Financial Summary

Amounts expressed in millions of Mexican Pesos (Ps.) except same-store sales

| | |

| | |

| | |

| |

| | |

3Q23 | | |

3Q22 | | |

Var. | |

| Same-store sales (thousands of Ps.) | |

| 1,047.2 | | |

| 910.1 | | |

| 15.1 | % |

| Total Revenues | |

| 74,020 | | |

| 61,252 | | |

| 20.8 | % |

| Income from Operations | |

| 6,577 | | |

| 5,734 | | |

| 14.7 | % |

| Income from Operations Margin (%) | |

| 8.9 | | |

| 9.4 | | |

| (50 | )bps |

| Adjusted EBITDA | |

| 9,963 | | |

| 8,768 | | |

| 13.6 | % |

| Adjusted EBITDA Margin (%) | |

| 13.5 | | |

| 14.3 | | |

| (80 | )bps |

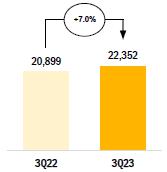

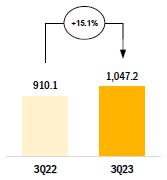

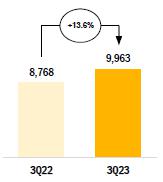

Net Additions

Vs. comparable quarter |

Store Base

As of 3Q23 |

Same-Store Sales

In thousands of Ps. |

Adjusted EBITDA

In millions of Ps. |

| |

|

|

|

|

|

|

|

Total revenues

increased 20.8% in 3Q23 compared to 3Q22, reflecting a 15.1% average same-store sales increase, driven by 6.6% growth in average

customer ticket and an increase of 8.0% in store traffic. These figures reflect a strong performance across most of OXXO’s categories

supported by the thirst and gathering occasions, such as beer, snacks, and other beverages. During the quarter, the OXXO

store base in Mexico & Latam expanded by 293 units to reach 1,453 total net store additions for the last twelve months. As of

September 30, 2023, Proximity Americas had a total of 22,352 OXXO stores.

Gross profit

reached 41.2% of total revenues, reflecting strong commercial activity and promotional programs from key suppliers, offset by a decrease

in the contribution of financial services relative to 3Q22.

Income from

operations amounted to 8.9% of total revenues. Operating expenses increased 26.7% to Ps. 23,943 million, above revenues, reflecting

an increase in labor expenses in connection with recent labor reforms in Mexico.

3 OXXO Latam: OXXO Colombia,

Chile and Peru.

October 27, 2023 | Page 4

PROXIMITY AMERICAS

Other formats |

|

Bara1

Total revenues

increased 36.7% in 3Q23 compared to 3Q22, driven by a 15.6% average same-store sales increase, reflecting the strong performance of the

groceries, home hygiene and convenience categories, particularly beverages. During the quarter, the Bara store base expanded by 13 units

to reach 309 total Bara stores as of September 30, 2023.

Grupo Nós2

Total revenues

for the period grew 151.6%3 year-over-year, reaching R$209.3 million4. This figure reflects the successful

evolution and expansion of the OXXO value proposition which resulted in same-store sales growth at OXXO of 12.4%3, as well

as the addition of 204 net new OXXO stores for the last twelve months. During the quarter, the store base of Grupo Nós expanded

by 30 units, the majority of which are OXXO stores. As of September 30, 2023, Grupo Nós had a total of 1,668 stores, which

include 380 company owned and operated OXXO stores.

1 Bara store count and results

are not consolidated within the Proximity Americas reported figures.

2 OXXO’s non-consolidated

joint-venture with Raízen in Brazil.

3 Local currency, BRL.

4 The exchange rate published

by the Federal Reserve Bank of New York for September 30, 2023 was 5.0021 BRL per USD.

October 27, 2023 | Page 5

3Q23 Financial Summary

Amounts expressed in millions of Mexican Pesos (Ps.)

| | |

| 3Q23 | |

| Total Revenues | |

| 11,194 | |

| Income from Operations | |

| 348 | |

| Income from Operations Margin (%) | |

| 3.1 | |

| Adjusted EBITDA | |

| 1,555 | |

| Adjusted EBITDA Margin (%) | |

| 13.9 | |

Total revenues

increased 8.7%2 in 3Q23 compared to 3Q22 to Ps. 11,194 million, reflecting traffic recovery as well as positive pricing

initiatives, and the growth of Valora’s foodservice and B2B business. As of the end of the period, Proximity Europe had 2,810 points

of sale.

Gross profit

reached 41.8% of total revenues, reflecting the continued recovery of the foodservice category, which has a structurally higher margin.

Income from

operations amounted to 3.1% of total revenues, reflecting the contribution of foodservice, as well as positive operating leverage.

1 The Proximity Europe segment

is comprised of Valora. The acquisition of Valora was concluded in October 2022.

2 Local currency, CHF.

October 27, 2023 | Page 6

| HEALTH |

|

3Q23 Financial Summary

Amounts expressed in millions of Mexican Pesos (Ps.) except same-store sales

| | |

| 3Q23 | | |

| 3Q22 | | |

| Var. | |

| Same-store sales (thousands of Ps.) | |

| 1,131.1 | | |

| 1,173.4 | | |

| (3.6 | )% |

| Total Revenues | |

| 18,569 | | |

| 18,526 | | |

| 0.2 | % |

| Income from Operations | |

| 844 | | |

| 942 | | |

| (10.4 | )% |

| Income from Operations Margin (%) | |

| 4.5 | | |

| 5.1 | | |

| (60 | )bps |

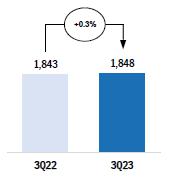

| Adjusted EBITDA | |

| 1,848 | | |

| 1,843 | | |

| 0.3 | % |

| Adjusted EBITDA Margin (%) | |

| 10.0 | | |

| 9.9 | | |

| 10 | bps |

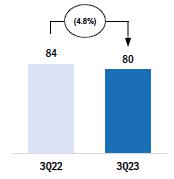

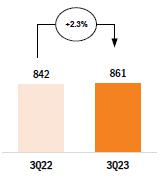

Net

Additions

Vs.

comparable quarter |

Locations

As

of 3Q23 |

Same-Store

Sales

In

thousands of Ps. |

Adjusted

EBITDA

In

millions of Ps. |

| |

|

|

|

|

|

|

|

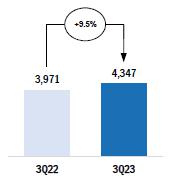

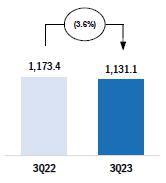

Total revenues

increased 0.2% in 3Q23 compared to 3Q22, mainly reflecting positive local currency sales trends in Chile and Colombia, offset by

a challenging competitive environment in Mexico, and by a negative currency translation effect. During the quarter, FEMSA Health’s

store base expanded by 80 units reaching a total of 4,347 locations across its territories as of September 30, 2023. This figure

reflects the addition of 365 net new locations for the last twelve months. Same-store sales decreased an average of 3.6%, reflecting

the trends described above. However, on a currency-neutral1 basis, total revenues grew 13.6% while same-store sales increased

by 4.7%.

1 Calculated

by translating comparable period figures at the foreign currency exchange rates used in the current period.

October 27, 2023 | Page 7

Gross profit

represented 29.2% of total revenues, reflecting improved efficiency and more effective collaboration and execution with key supplier

partners, as well as a negative mix effect reflecting an increase in the contribution of our institutional sales channel in Colombia.

Income from operations

amounted to 4.5% of total revenues. Operating expenses increased 1.4% to Ps. 4,587 million, reflecting an increase in labor expenses

in Mexico and Chile, partially offset by tight expense control across our operations.

| FUEL |

|

|

3Q23

Financial Summary

Amounts

expressed in millions of Mexican Pesos (Ps.) except same-station sales

| | |

| 3Q23 | | |

| 3Q22 | | |

| Var. | |

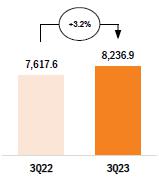

| Same-station

sales (thousands of Ps.) | |

| 8,236.9 | | |

| 7,617.6 | | |

| 8.1 | % |

| Total Revenues | |

| 15,782 | | |

| 13,823 | | |

| 14.2 | % |

| Income from

Operations | |

| 710 | | |

| 687 | | |

| 3.3 | % |

| Income

from Operations Margin (%) | |

| 4.5 | | |

| 5.0 | | |

| (50 | )bps |

| Adjusted EBITDA | |

| 1,026 | | |

| 960 | | |

| 6.9 | % |

| Adjusted

EBITDA Margin (%) | |

| 6.5 | | |

| 6.9 | | |

| (40 | )bps |

Net

Additions

Vs.

comparable quarter |

Service

Station Base

As

of 3Q23 |

Same-Station

Sales

In

thousands of Ps. |

Adjusted

EBITDA

In

millions of Ps. |

|

|

|

|

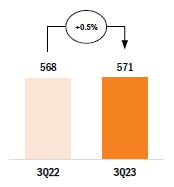

Total revenues increased 14.2% in 3Q23

compared to 3Q22, reflecting a 8.1% average same-station sales increase, driven by 4.0% growth in average volume and 4.0% increase in

the average price per liter, as well as volume growth in our institutional and wholesale customer network. The OXXO Gas retail network

had 571 points of sale as of September 30, 2023. This figure reflects the addition of three net stations for the last twelve months.

Gross profit

was 12.4% of total revenues.

Income from operations

amounted to 4.5% of total revenues. Operating expenses increased 14.5% to Ps. 1,241 million, reflecting increased labor expenses.

October 27, 2023 | Page 8

FEMSA

Retail Operations Summary

Currency-neutral terms where applicable

Total

Revenue Growth (% vs year ago)

| | |

3Q23 | |

| Proximity Americas | |

| | |

| OXXO1 | |

| 20.8 | % |

| Mexico | |

| 20.7 | % |

| OXXO

Latam2 | |

| 28.3 | % |

| | |

| | |

| Other Proximity Americas formats | |

| | |

| Bara | |

| 36.7 | % |

| OXXO

Brazil3 | |

| 151.6 | % |

| | |

| | |

| Proximity

Europe4 | |

| 8.7 | % |

| OXXO

Gas | |

| 14.2 | % |

| | |

| | |

| FEMSA

Health5 | |

| 13.6 | % |

| Chile | |

| 6.6 | % |

| Colombia | |

| 16.9 | % |

| Ecuador | |

| 0.8 | % |

| Mexico | |

| 7.0 | % |

| 1 |

OXXO

Consolidated figures shown in MXN including currency effects. |

| 2 |

Includes

OXXO Colombia, Chile and Peru. |

| 3 |

Operated

through Grupo Nós, our joint-venture with Raízen. |

| 4 |

Local

currency (CHF). |

| 5 |

FEMSA

Health Include franchised stores in Ecuador. |

Total

Unit Growth (% vs year ago)

| | |

3Q23 | |

| Proximity Americas | |

| | |

| OXXO | |

| 7.0 | % |

| Mexico | |

| 5.9 | % |

| OXXO

Latam1 | |

| 48.7 | % |

| | |

| | |

| Other Proximity Americas formats | |

| | |

| Bara | |

| 28.8 | % |

| OXXO

Brazil2 | |

| 115.9 | % |

| | |

| | |

| Proximity

Europe3 | |

| 2.0 | % |

| OXXO

Gas | |

| 0.5 | % |

| | |

| | |

| FEMSA

Health | |

| 9.5 | % |

| Chile | |

| 2.1 | % |

| Colombia | |

| 14.7 | % |

| Ecuador | |

| 5.9 | % |

| Mexico | |

| 12.8 | % |

| 1 |

Includes

OXXO Colombia, Chile and Perú. |

| 2 |

Operated

through Grupo Nós, our joint-venture with Raízen. |

| 3 |

Includes

company owned and franchised units. |

Same-Store

Sales

| | |

3Q23 | |

| Proximity Americas | |

| | |

| OXXO1 | |

| 15.1 | % |

| Mexico | |

| 15.2 | % |

| OXXO

Latam2 | |

| 15.1 | % |

| | |

| | |

| Other Proximity Americas formats | |

| | |

| Bara | |

| 15.6 | % |

| OXXO

Brazil3 | |

| 12.4 | % |

| | |

| | |

| Proximity

Europe4 | |

| N.A. | |

| OXXO

Gas5 | |

| 8.1 | % |

| | |

| | |

| FEMSA

Health5 | |

| 4.7 | % |

| Chile | |

| 2.3 | % |

| Colombia | |

| 12.6 | % |

| Ecuador | |

| 1.3 | % |

| Mexico | |

| (5.3 | )% |

| 1 |

OXXO

Consolidated figures shown in MXN including currency effects. |

| 2 |

Includes

OXXO Colombia, Chile and Peru. |

| 3 |

Operated

through Grupo Nós, our joint-venture with Raízen. |

| 4 |

Local

currency (CHF). |

| 5 |

Only

includes retail sales. FEMSA Health Include franchised stores in Ecuador. |

October 27, 2023 | Page 9

| DIGITAL@FEMSA1 |

|

Spin by OXXO

Spin

by OXXO acquired 1.2 million users during the quarter to reach 8.8 million total users in 3Q23, compared to 4.3 million users in 3Q22.

This represents an increase of 105.8% YoY and a 6.2% compound monthly growth rate. Active users2 represented

72.5% of the total acquired user base. Total transactions per month increased 15.6%3

during the quarter to reach an average of 41.8 million per month in 3Q23, reflecting an increase in user engagement.

Spin Premia

Spin

Premia acquired 3.8 million users during the quarter to reach 36.6 million total users in 3Q23, compared to 22.0 million users in 3Q22.

This represents an increase of 66.0% YoY and a 4.3% compound monthly growth rate. Active users4 represented

48.3% of the total acquired user base. The average tender5 during the quarter was

28.3%.

| COCA-COLA

FEMSA |

|

Coca-Cola FEMSA’s

financial results and discussion thereof are incorporated by reference from Coca-Cola FEMSA’s press release, which is attached

to this press release or may be accessed by visiting coca-colafemsa.com.

1 Digital@FEMSA’s

results are included within the Other business segment.

2

Active User for Spin by OXXO: Any user with a balance or that has transacted within the last 56 days.

3 Represents the quarter-over-quarter growth of average

monthly transactions.

4

Active User for Spin Premia: User that has transacted at least once with OXXO Premia or Spin Premia within the last 90 days.

5 Tender: OXXO Mexico MXN

sales with OXXO Premia or Spin Premia redemption or accrual divided by Total OXXO Mexico MXN Sales, during the period.

October 27, 2023 | Page 10

RESULTS

FOR THE FIRST NINE MONTHS OF 2023

Results

are compared to the same period of previous year

Financial Summary

for the First Nine Months

Amounts

expressed in millions of Mexican Pesos (Ps.)

| | |

2023 | | |

2022 | | |

Var. | | |

Org. | |

| Total Revenues | |

| 539,113 | | |

| 451,443 | | |

| 19.4 | % | |

| 10.9 | % |

| Income from Operations | |

| 44,009 | | |

| 40,447 | | |

| 8.8 | % | |

| 6.1 | % |

| Operating Margin (%) | |

| 8.2 | | |

| 9.0 | | |

| (80 | )bps | |

| | |

| Adjusted

EBITDA1 | |

| 72,434 | | |

| 63,481 | | |

| 14.1 | % | |

| 6.6 | % |

| Adjusted EBITDA Margin (%) | |

| 13.4 | | |

| 14.1 | | |

| (70 | )bps | |

| | |

| Net Income | |

| 71,994 | | |

| 26,793 | | |

| 168.7 | % | |

| | |

Total revenues

increased 19.4%. On an organic basis2, total revenues increased 10.9% reflecting growth across most of our operations.

Gross profit

increased 21.3%. Gross margin increased 60 basis points to 38.2% of total revenues, reflecting gross margin expansion at Proximity Americas

and Coca-Cola FEMSA, as well as the consolidation of Proximity Europe, offset by margin contraction at Health and Fuel.

Income from operations

increased 8.8%. On an organic basis2, income from operations increased 6.1%. Our consolidated operating margin decreased

80 basis points to 8.2% of total revenues, reflecting margin expansions at Coca-Cola FEMSA, offset by margin contractions at Proximity

Americas, Fuel, and Health, as well as by the consolidation of Proximity Europe.

Net consolidated

income increased to Ps. 71,994 million, reflecting; i) a Ps. 35,473 million net income from discontinued operations, mostly reflecting

the accounting re-measurement from historical cost to fair value of FEMSA’s investment in Heineken, as well as the divestiture

of this investment as part of the FEMSA Forward strategy announced on February 15, 2023, net of taxes; ii) a Ps. 12,963 million

non-cash financial product that mostly reflects the repurchase of US$ 1.7 billion3 of FEMSA’s outstanding debt at

favorable price levels during 1Q23, also in connection with FEMSA Forward; and iii) a Ps. 9,577 other non-operating income, mostly

reflecting the divestment of FEMSA’s minority stake in Jetro Restaurant Depot. This was offset by a non-cash foreign exchange loss

of Ps. 3,575, related to FEMSA’s U.S. dollar-denominated cash position as impacted by the appreciation of the Mexican peso, during

the first nine months of the year.

Net majority income

per FEMSA Unit4 was Ps.17.88 (US$10.27 per ADS).

Capital expenditures amounted to Ps. 23,279

million, reflecting the reactivation of ongoing investment activities at most of our business units.

1 Adjusted

EBITDA: Operating Income + Depreciation + Amortizations.

2

Excludes the effects of significant mergers and acquisitions in the last twelve months.

3

Face value

4 FEMSA Units consist of

FEMSA BD Units and FEMSA B Units. Each FEMSA BD Unit is comprised of one Series B Share, two Series D-B Shares and two Series D-L Shares.

Each FEMSA B Unit is comprised of five Series B Shares. The number of FEMSA Units outstanding as of September 30, 2023 was 3,578,226,270,

equivalent to the total number of FEMSA Shares outstanding as of the same date, divided by 5.

October 27, 2023 | Page 11

RECENT

DEVELOPMENTS

| · | On

Aug 29, 2023, FEMSA announced that it entered into definitive agreements with BradyIFS to

create a new platform within the facility care, foodservice disposables, and packaging distribution

industries in the United States. The combined platform will bring together Envoy Solutions

LLC and BradyIFS in a highly complementary combination, positioned to serve and provide value

to its customers and suppliers effectively and efficiently across the country. The transaction

is subject to customary conditions and regulatory approvals. |

Upon closing,

FEMSA will receive approximately US$1.7 billion in cash and retain an ownership stake of approximately 37% in the combined entity, which

is expected to have pro-forma revenues approaching US$5 billion.

For the

purposes of this transaction, the Envoy Solutions valuation implies an unlevered double-digit annualized rate of return on the accumulated

capital invested by FEMSA since entering this business in 2020.

Approximately

63% of the combined entity will be owned by existing BradyIFS equity holders led by Kelso & Company and its affiliate funds

and including BradyIFS management; by funds managed by Warburg Pincus LLC; and by the current minority shareholders of Envoy Solutions.

| · | On

Sep 22, 2023, FEMSA announced changes to its organizational structure that bring it into

full alignment with the FEMSA Forward strategy and its three core business verticals: Retail,

Coca-Cola FEMSA, and Digital. The Company also announced movements within its senior leadership

team, involving internal and newly attracted talent. These changes will enable the organization

to operate with maximum focus, positioning FEMSA to pursue and capture its considerable and

compelling opportunities for long-term profitable growth. |

The Retail

business vertical will be led by Jose Antonio Fernández Garza-Lagüera. Jose Antonio is currently CEO of Digital@FEMSA, where

he nurtured FEMSA’s digital ecosystem from its early days and has helped Spin become the prominent fintech and loyalty platform

in Mexico. Before Digital, Jose Antonio held leadership roles at every one of FEMSA’s major business units for over a decade, including

as Head of Strategic Planning at OXXO and FEMSA Comercio. Jose Antonio will be supported in his new role by a world-class operational

team: Carlos Arenas (Proximity OXXO Mexico), Constantino Spas (Proximity Americas and Fuel), Michael Mueller (Proximity Europe), Jacobo

Caller (Proximity Multiformat), and Daniel Belaúnde (FEMSA Health).

Juan Carlos

Guillermety is joining the Company as CEO of Digital@FEMSA. Juan Carlos comes to FEMSA from Nubank, where he held various senior leadership

positions since 2019, after a long tenure at Visa International. Juan Carlos will lead the rapidly growing talent pool that is shaping

the future of FEMSA’s digital ecosystem.

There is

no change at Coca-Cola FEMSA. Ian Craig will continue to lead this key business vertical as its CEO. Other operations outside of FEMSA’s

core verticals, including those that are in the active process of being divested, will report to the Corporate Office led by Francisco

Camacho. These changes to FEMSA’s organizational structure and senior leadership team were designed in conjunction with the FEMSA

Forward strategy as announced in February of this year, consistent with FEMSA’s leadership succession and talent development

process. The new appointments have been approved by FEMSA’s Board of Directors and will become effective on November 1st,

2023, with executives transitioning into their new roles and responsibilities in the coming months

October 27, 2023 | Page 12

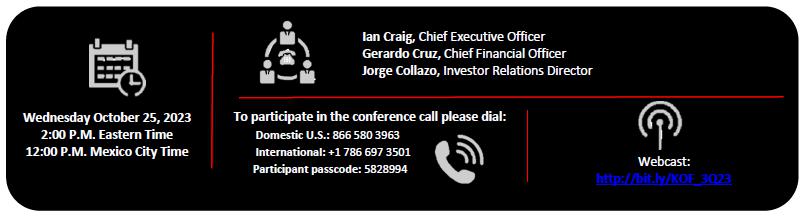

CONFERENCE CALL INFORMATION

Our Third Quarter 2023 Conference Call will be held on: Friday, October

27, 2023, 11:00 AM Eastern Time (9:00 AM Mexico City Time). The conference call will be webcast live through streaming audio.

| Telephone: |

Toll Free US: |

(866) 580 3963 |

| |

International: |

+1 (786) 697 3501 |

| Webcast: |

https://edge.media-server.com/mmc/p/6zh9pt2t/ |

| |

|

| Conference ID: |

FEMSA |

If you are unable to participate live, the conference call audio will be available on https://femsa.gcs-web.com/financial-reports/quarterly-results

ABOUT FEMSA

FEMSA is a company

that creates economic and social value through companies and institutions and strives to be the best employer and neighbor to the communities

in which it operates. It participates in the retail industry through a Proximity Division operating OXXO, a small-format store chain,

and other related retail formats, and Proximity Europe which includes Valora, our European retail unit which operates convenience and

foodvenience formats. In the retail industry it also participates though a FEMSA Health, which includes drugstores and related activities

and Digital@FEMSA, which includes Spin by OXXO and Spin Premia, among other digital financial services initiatives. In the beverage industry,

it participates through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume. Across its business

units, FEMSA has more than 350,000 employees in 18 countries. FEMSA is a member of the Dow Jones Sustainability MILA Pacific Alliance,

the FTSE4Good Emerging Index and the Mexican Stock Exchange Sustainability Index: S&P/BMV Total México ESG, among other indexes

that evaluate its sustainability performance.

The

translations of Mexican pesos into US dollars are included solely for the convenience of the reader, using the noon buying rate for Mexican

pesos as published by the Federal Reserve Bank of New York on September 30, 2023, which was 17.4064 Mexican pesos per US dollar.

FORWARD-LOOKING

STATEMENTS

This report may contain

certain forward-looking statements concerning our future performance that should be considered as good faith estimates made by us. These

forward-looking statements reflect management’s expectations and are based upon currently available data. Actual results are subject

to future events and uncertainties, which could materially impact our actual performance.

Nine

pages of tables and Coca-Cola FEMSA’s press release to follow

October 27, 2023 | Page 13

FEMSA

– Consolidated Income Statement

Amounts

expressed in millions of Mexican Pesos (Ps.)

| | |

For

the third quarter of: | | |

For

the nine months of: | |

| | |

2023 | | |

%

of rev. | | |

2022 | | |

%

of rev. | | |

%

Var. | | |

%

Org.(A) | | |

2023 | | |

%

of rev. | | |

2022 | | |

%

of rev. | | |

%

Var. | | |

%

Org.(A) | |

| Total revenues | |

| 188,095 | | |

| 100.0 | | |

| 157,693 | | |

| 100.0 | | |

| 19.3 | | |

| 11.9 | | |

| 539,113 | | |

| 100.0 | | |

| 451,443 | | |

| 100.0 | | |

| 19.4 | | |

| 10.9 | |

| Cost of sales | |

| 116,013 | | |

| 61.7 | | |

| 98,677 | | |

| 62.6 | | |

| 17.6 | | |

| | | |

| 333,277 | | |

| 61.8 | | |

| 281,714 | | |

| 62.4 | | |

| 18.3 | | |

| | |

| Gross profit | |

| 72,081 | | |

| 38.3 | | |

| 59,016 | | |

| 37.4 | | |

| 22.1 | | |

| | | |

| 205,836 | | |

| 38.2 | | |

| 169,729 | | |

| 37.6 | | |

| 21.3 | | |

| | |

| Administrative

expenses | |

| 8,339 | | |

| 4.4 | | |

| 7,365 | | |

| 4.7 | | |

| 13.2 | | |

| | | |

| 24,862 | | |

| 4.6 | | |

| 20,534 | | |

| 4.5 | | |

| 21.1 | | |

| | |

| Selling

expenses | |

| 48,060 | | |

| 25.5 | | |

| 37,414 | | |

| 23.6 | | |

| 28.5 | | |

| | | |

| 136,871 | | |

| 25.4 | | |

| 108,545 | | |

| 24.1 | | |

| 26.1 | | |

| | |

| Other

operating expenses (income), net (1) | |

| (246 | ) | |

| (0.1 | ) | |

| 91 | | |

| 0.1 | | |

| N.S.

| | |

| | | |

| 94 | | |

| - | | |

| 203 | | |

| - | | |

| (53.7 | ) | |

| | |

| Income

from operations (2) | |

| 15,929 | | |

| 8.5 | | |

| 14,146 | | |

| 9.0 | | |

| 12.6 | | |

| 9.8 | | |

| 44,009 | | |

| 8.2 | | |

| 40,447 | | |

| 9.0 | | |

| 8.8 | | |

| 6.1 | |

| Other non-operating

expenses (income) | |

| (262 | ) | |

| | | |

| 41 | | |

| | | |

| N.S.

| | |

| | | |

| (9,577 | ) | |

| | | |

| 146 | | |

| | | |

| N.S.

| | |

| | |

| Interest

expense | |

| 3,170 | | |

| | | |

| 3,615 | | |

| | | |

| (12.3 | ) | |

| | | |

| 8,964 | | |

| | | |

| 11,965 | | |

| | | |

| (25.1 | ) | |

| | |

| Interest

income | |

| 2,697 | | |

| | | |

| 1,161 | | |

| | | |

| 132.3 | | |

| | | |

| 12,963 | | |

| | | |

| 2,694 | | |

| | | |

| N.S.

| | |

| | |

| Interest

expense, net | |

| 472 | | |

| | | |

| 2,455 | | |

| | | |

| (80.8 | ) | |

| | | |

| (3,999 | ) | |

| | | |

| 9,270 | | |

| | | |

| N.S.

| | |

| | |

| Foreign

exchange loss (gain) | |

| (5,374 | ) | |

| | | |

| (1,212 | ) | |

| | | |

| N.S.

| | |

| | | |

| 3,575 | | |

| | | |

| 211 | | |

| | | |

| N.S.

| | |

| | |

| Other

financial expenses (income), net | |

| 504 | | |

| | | |

| 47 | | |

| | | |

| N.S.

| | |

| | | |

| 520 | | |

| | | |

| 346 | | |

| | | |

| 50.3 | | |

| | |

| Financing

expenses, net | |

| (4,397 | ) | |

| | | |

| 1,290 | | |

| | | |

| N.S.

| | |

| | | |

| 96 | | |

| | | |

| 9,827 | | |

| | | |

| (99.0 | ) | |

| | |

| Income before income tax and

participation in associates results | |

| 20,588 | | |

| | | |

| 12,815 | | |

| | | |

| 60.7 | | |

| | | |

| 53,490 | | |

| | | |

| 30,321 | | |

| | | |

| 76.4 | | |

| | |

| Income tax | |

| 6,540 | | |

| | | |

| 4,482 | | |

| | | |

| 45.9 | | |

| | | |

| 16,431 | | |

| | | |

| 11,124 | | |

| | | |

| 47.7 | | |

| | |

| Participation

in associates results (3) | |

| (110 | ) | |

| | | |

| 37 | | |

| | | |

| N.S.

| | |

| | | |

| (538 | ) | |

| | | |

| 87 | | |

| | | |

| N.S.

| | |

| | |

| Continued

Operations net income (Loss) | |

| 13,938 | | |

| | | |

| 8,370 | | |

| | | |

| 66.5 | | |

| | | |

| 36,521 | | |

| | | |

| 19,284 | | |

| | | |

| 89.4 | | |

| | |

| Discontinued

Operations net income (Loss) | |

| (1,180 | ) | |

| | | |

| 4,898 | | |

| | | |

| (108.9 | ) | |

| | | |

| 35,473 | | |

| | | |

| 7,509 | | |

| | | |

| 32.4 | | |

| | |

| Consolidated

net income (Loss) | |

| 12,758 | | |

| | | |

| 13,268 | | |

| | | |

| (3.8 | ) | |

| | | |

| 71,994 | | |

| | | |

| 26,793 | | |

| | | |

| 168.7 | | |

| | |

| Net majority income | |

| 9,742 | | |

| | | |

| 10,748 | | |

| | | |

| (9.4 | ) | |

| | | |

| 63,964 | | |

| | | |

| 19,980 | | |

| | | |

| N.S.

| | |

| | |

| Net minority

income | |

| 3,016 | | |

| | | |

| 2,520 | | |

| | | |

| 19.7 | | |

| | | |

| 8,030 | | |

| | | |

| 6,813 | | |

| | | |

| 17.9 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operative

Cash Flow & CAPEX | |

2023 | | |

%

of rev. | | |

2022 | | |

%

of rev. | | |

%

Var. | | |

%

Org.(A) | | |

2023 | | |

%

of rev. | | |

2022 | | |

%

of rev. | | |

%

Var. | | |

%

Org.(A) | |

| Income

from operations | |

| 15,929 | | |

| 8.5 | | |

| 14,146 | | |

| 9.0 | | |

| 12.6 | | |

| 9.8 | | |

| 44,009 | | |

| 8.2 | | |

| 40,447 | | |

| 9.0 | | |

| 8.8 | | |

| 6.1 | |

| Depreciation | |

| 8,234 | | |

| 4.4 | | |

| 6,669 | | |

| 4.2 | | |

| 23.5 | | |

| | | |

| 24,328 | | |

| 4.5 | | |

| 19,533 | | |

| 4.3 | | |

| 24.5 | | |

| | |

| Amortization

& other non-cash charges | |

| 1,190 | | |

| 0.6 | | |

| 1,230 | | |

| 0.8 | | |

| (3.2 | ) | |

| | | |

| 4,097 | | |

| 0.7 | | |

| 3,502 | | |

| 0.8 | | |

| 17.0 | | |

| | |

| Adjusted

EBITDA | |

| 25,366 | | |

| 13.5 | | |

| 22,046 | | |

| 14.0 | | |

| 15.1 | | |

| 7.7 | | |

| 72,434 | | |

| 13.4 | | |

| 63,481 | | |

| 14.1 | | |

| 14.1 | | |

| 6.6 | |

| CAPEX | |

| 9,791 | | |

| | | |

| 8,017 | | |

| | | |

| 22.1 | | |

| | | |

| 23,279 | | |

| | | |

| 19,900 | | |

| | | |

| 17.0 | | |

| | |

(A) Organic

basis (% Org.) excludes the effects of significant mergers and acquisitions in the last twelve months.

(1) Other

operating expenses (income), net = other operating expenses (income) +(-) equity method from operated associates.

(2) Income

from operations = gross profit – administrative and selling expenses – other operating expenses (income), net.

(3) Mainly

represents the results of our joint-venture with Raízen, Grupo Nós, net of taxes.

(4) At

the end of September, the CAPEX effectively paid is equivalent to Ps. 23,800 million.

October 27, 2023 | Page 14

FEMSA

– Consolidated Balance Sheet

Amounts expressed in millions of Mexican Pesos (Ps.)

| ASSETS | |

Sep-23 | | |

Dec-22 | | |

%

Inc. | |

| Cash

and cash equivalents | |

| 160,442 | | |

| 83,439 | | |

| 92.3 | |

| Investments | |

| 18,840 | | |

| 51 | | |

| N.S.

| |

| Accounts

receivable | |

| 45,304 | | |

| 45,527 | | |

| (0.5 | ) |

| Inventories | |

| 55,782 | | |

| 62,224 | | |

| (10.4 | ) |

| Other

current assets | |

| 43,350 | | |

| 35,208 | | |

| 23.1 | |

| Current

Assets Available for sale | |

| 54,723 | | |

| - | | |

| N.S.

| |

| Total

current assets | |

| 378,441 | | |

| 226,449 | | |

| 67.1 | |

| Investments in shares | |

| 10,876 | | |

| 103,669 | | |

| (89.5 | ) |

| Property,

plant and equipment, net | |

| 138,420 | | |

| 134,001 | | |

| 3.3 | |

| Right of use | |

| 85,076 | | |

| 83,966 | | |

| 1.3 | |

| Intangible

assets (1) | |

| 153,133 | | |

| 190,772 | | |

| (19.7 | ) |

| Other

assets | |

| 52,212 | | |

| 59,958 | | |

| (12.9 | ) |

| TOTAL

ASSETS | |

| 818,158 | | |

| 798,815 | | |

| 2.4 | |

| LIABILITIES & STOCKHOLDERS’ EQUITY | |

Sep-23 | | |

Dec-22 | | |

% Inc. | |

| Bank loans | |

| 2,936 | | |

| 1,862 | | |

| 57.7 | |

| Current maturities of long-term debt | |

| 6,062 | | |

| 14,471 | | |

| (58.1 | ) |

| Interest payable | |

| 1,770 | | |

| 2,075 | | |

| (14.7 | ) |

| Current maturities of long-term leases | |

| 11,743 | | |

| 12,095 | | |

| (2.9 | ) |

| Operating liabilities | |

| 164,085 | | |

| 144,411 | | |

| 13.6 | |

| Short term liabilities available for sale | |

| 9,828 | | |

| - | | |

| N.S. | |

| Total current liabilities | |

| 196,424 | | |

| 174,914 | | |

| 12.3 | |

| Long-term debt (2) | |

| 132,350 | | |

| 170,989 | | |

| (22.6 | ) |

| Long-term leases | |

| 83,210 | | |

| 81,222 | | |

| 2.4 | |

| Laboral obligations | |

| 7,583 | | |

| 7,048 | | |

| 7.6 | |

| Other liabilities | |

| 22,690 | | |

| 26,841 | | |

| (15.5 | ) |

| Total liabilities | |

| 442,257 | | |

| 461,014 | | |

| (4.1 | ) |

| Total stockholders’ equity | |

| 375,901 | | |

| 337,801 | | |

| 11.3 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| 818,158 | | |

| 798,815 | | |

| 2.4 | |

| | |

September 30,

2023 | |

| DEBT

MIX (2) | |

%

of Total | | |

Average

Rate | |

| Denominated

in: | |

| | | |

| | |

| Mexican

pesos | |

| 50.9 | % | |

| 7.8 | % |

| U.S.

Dollars | |

| 28.8 | % | |

| 3.2 | % |

| Euros | |

| 8.4 | % | |

| 2.7 | % |

| Swiss

Francs | |

| 1.0 | % | |

| 1.3 | % |

| Colombian

pesos | |

| 0.6 | % | |

| 0.0 | % |

| Argentine

pesos | |

| 0.0 | % | |

| 0.0 | % |

| Brazilian

reais | |

| 9.2 | % | |

| 0.0 | % |

| Chilean

pesos | |

| 1.0 | % | |

| 10.5 | % |

| Uruguayan

Pesos | |

| 0.0 | % | |

| 0.0 | % |

| Guatemalan

Quetzal | |

| 0.0 | % | |

| 0.0 | % |

| Total

debt | |

| 100.0 | % | |

| 5.2 | % |

| Fixed

rate (2) | |

| 82.6 | % | |

| | |

| Variable

rate (2) | |

| 17.4 | % | |

| | |

| DEBT

MATURITY PROFILE | |

2024 | | |

2025 | | |

2026 | | |

2027 | | |

2028 | | |

2029+ | |

| %

of Total Debt | |

| 0.4 | % | |

| 3.8 | % | |

| 1.5 | % | |

| 8.8 | % | |

| 13.9 | % | |

| 71.5 | % |

(1) Includes

mainly the intangible assets generated by acquisitions.

(2) Includes

the effect of derivative financial instruments on long-term debt.

October 27, 2023 | Page 15

Net Debt & Adjusted EBITDA ex-KOF

Amounts expressed in millions of US Dollars (US.)

| | |

Twelve

months ended September 30, 2023 | |

| | |

Reported

Adj. EBITDA | | |

Adjustments | | |

Adj.

EBITDA Ex-KOF4 | |

| Proximity

Americas & Europe1 | |

| 2,482 | | |

| - | | |

| 2,482 | |

| Fuel | |

| 202 | | |

| - | | |

| 202 | |

| Health

Division | |

| 431 | | |

| - | | |

| 431 | |

| Envoy

Solutions | |

| - | | |

| - | | |

| - | |

| Coca-Cola

FEMSA2 | |

| 2,544 | | |

| (2,544 | ) | |

| - | |

| Other3 | |

| (189 | ) | |

| - | | |

| (189 | ) |

| FEMSA

Consolidated | |

| 5,471 | | |

| (2,544 | ) | |

| 2,926 | |

| | |

| | | |

| | | |

| | |

| Dividends

Received4 | |

| - | | |

| 405 | | |

| 405 | |

| | |

| | | |

| | | |

| | |

| FEMSA

Consolidated ex-KOF | |

| 5,471 | | |

| (2,139 | ) | |

| 3,332 | |

| | |

As

of September 30, 2023 | |

| | |

Reported | | |

Adjustments | | |

Ex-KOF | |

| Cash &

Equivalents | |

| 8,209 | | |

| - | | |

| 8,209 | |

| Coca-Cola

FEMSA Cash & Equivalents | |

| 2,248 | | |

| (2,248 | ) | |

| - | |

| Cash &

Equivalents | |

| 10,457 | | |

| (2,248 | ) | |

| 8,209 | |

| | |

| | | |

| | | |

| | |

| Financial

Debt5 | |

| 4,386 | | |

| - | | |

| 4,386 | |

| Coca-Cola

FEMSA Financial Debt | |

| 3,859 | | |

| (3,859 | ) | |

| - | |

| Lease

Liabilities | |

| 5,444 | | |

| - | | |

| 5,444 | |

| Coca-Cola

FEMSA Lease Liabilities | |

| 94 | | |

| (94 | ) | |

| - | |

| Debt | |

| 13,783 | | |

| (3,953 | ) | |

| 9,830 | |

| | |

| | | |

| | | |

| | |

| FEMSA

Net Debt | |

| 3,326 | | |

| (1,705 | ) | |

| 1,621 | |

Translated

to USD for readers’ convenience using the exchange rate published by the Federal Reserve Bank of New York for September 30,

2023 which was 17.4064 MXN per USD.

1

Includes Proximity Europe only for the consolidated period.

2

Coca-Cola FEMSA adjustment represents 100% of its LTM Adjusted EBITDA.

3

Includes FEMSA Other Businesses (including Solistica and Digital@FEMSA), FEMSA corporate expenses and the effects of consolidation adjustments

4

Reflects cash dividends received from Coca-Cola FEMSA for approximately US$295 mm, US$45 mm from JRD, and US$57 mm from Heineken during

the last twelve months. 5 Includes EUR€ 500.0 mm in notes convertible to Heineken Holding N.V. shares.

October 27, 2023 | Page 16

Proximity

Americas – Results of Operations

Amounts

expressed in millions of Mexican Pesos (Ps.)

| | |

For

the third quarter of: | |

For

the nine months of: | |

| | |

2023 | |

%

of rev. | |

2022 | |

%

of rev. | |

%

Var. | |

2023 | |

%

of rev. | |

2022 | |

%

of rev. | |

%

Var. | |

| Total

revenues | |

74,020 | |

| 100.0 | |

| 61,252 | |

| 100.0 | |

| 20.8 | |

| 206,990 | |

| 100.0 | |

| 171,306 | |

| 100.0 | |

| 20.8 | |

| Cost

of sales | |

43,500 | |

| 58.8 | |

| 36,620 | |

| 59.8 | |

| 18.8 | |

| 122,381 | |

| 59.1 | |

| 101,419 | |

| 59.2 | |

| 20.7 | |

| Gross

profit | |

30,520 | |

| 41.2 | |

| 24,632 | |

| 40.2 | |

| 23.9 | |

| 84,609 | |

| 40.9 | |

| 69,887 | |

| 40.8 | |

| 21.1 | |

| Administrative

expenses | |

1,737 | |

| 2.3 | |

| 1,496 | |

| 2.4 | |

| 16.1 | |

| 4,507 | |

| 2.2 | |

| 4,372 | |

| 2.6 | |

| 3.1 | |

| Selling

expenses | |

22,110 | |

| 29.9 | |

| 17,363 | |

| 28.3 | |

| 27.3 | |

| 61,687 | |

| 29.8 | |

| 49,785 | |

| 29.0 | |

| 23.9 | |

| Other

operating expenses (income), net | |

96 | |

| 0.1 | |

| 39 | |

| 0.1 | |

| 146.2 | |

| 164 | |

| 0.1 | |

| 158 | |

| 0.1 | |

| 3.8 | |

| Income

from operations | |

6,577 | |

| 8.9 | |

| 5,734 | |

| 9.4 | |

| 14.7 | |

| 18,251 | |

| 8.8 | |

| 15,572 | |

| 9.1 | |

| 17.2 | |

| Depreciation | |

3,140 | |

| 4.2 | |

| 2,831 | |

| 4.6 | |

| 10.9 | |

| 9,157 | |

| 4.4 | |

| 8,231 | |

| 4.8 | |

| 11.3 | |

| Amortization&

other non-cash charges | |

246 | |

| 0.4 | |

| 203 | |

| 0.3 | |

| 21.2 | |

| 688 | |

| 0.4 | |

| 767 | |

| 0.4 | |

| (10.3 | ) |

| Adjusted

EBITDA | |

9,963 | |

| 13.5 | |

| 8,768 | |

| 14.3 | |

| 13.6 | |

| 28,096 | |

| 13.6 | |

| 24,570 | |

| 14.3 | |

| 14.4 | |

| CAPEX | |

4,198 | |

| | |

| 2,985 | |

| | |

| 40.6 | |

| 9,804 | |

| | |

| 6,776 | |

| | |

| 44.7 | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Information

of OXXO Stores | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Total

stores | |

| |

| | |

| | |

| | |

| | |

| 22,352 | |

| | |

| 20,899 | |

| | |

| 7.0 | |

| Stores

Mexico | |

| |

| | |

| | |

| | |

| | |

| 21,583 | |

| | |

| 20,382 | |

| | |

| 5.9 | |

| Stores

South America | |

| |

| | |

| | |

| | |

| | |

| 769 | |

| | |

| 517 | |

| | |

| 48.7 | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Net

new convenience stores: | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| vs.

Last quarter | |

293 | |

| | |

| 231 | |

| | |

| 26.8 | |

| | |

| | |

| | |

| | |

| | |

| Year-to-date | |

894 | |

| | |

| 468 | |

| | |

| 91.0 | |

| | |

| | |

| | |

| | |

| | |

| Last-twelve-months | |

1,453 | |

| | |

| 902 | |

| | |

| 61.1 | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Same-store

data: (1) | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Sales

(thousands of pesos) | |

1,047.2 | |

| | |

| 910.1 | |

| | |

| 15.1 | |

| 994.9 | |

| | |

| 857 | |

| | |

| 16.1 | |

| Traffic

(thousands of transactions) | |

19.5 | |

| | |

| 18.1 | |

| | |

| 8.0 | |

| 18.7 | |

| | |

| 17.5 | |

| | |

| 7.1 | |

| Ticket

(pesos) | |

53.6 | |

| | |

| 50.3 | |

| | |

| 6.6 | |

| 53.2 | |

| | |

| 49.1 | |

| | |

| 8.4 | |

(1) Monthly

average information per store, considering same stores with more than twelve months of operations, income from services are included.

October 27, 2023 | Page 17

Proximity

Europe – Results of Operations

Amounts

expressed in millions of Mexican Pesos (Ps.)

| |

|

For

the third quarter of: |

|

|

For

the nine months of: |

|

| |

|

2023 |

|

|

%

of rev. |

|

|

2023 |

|

|

%

of rev. |

|

| Total

revenues |

|

|

11,194 |

|

|

|

100.0 |

|

|

|

32,137 |

|

|

|

100.0 |

|

| Cost

of sales |

|

|

6,516 |

|

|

|

58.2 |

|

|

|

18,635 |

|

|

|

58.0 |

|

| Gross

profit |

|

|

4,678 |

|

|

|

41.8 |

|

|

|

13,502 |

|

|

|

42.0 |

|

| Administrative

expenses |

|

|

815 |

|

|

|

7.3 |

|

|

|

2,335 |

|

|

|

7.3 |

|

| Selling

expenses |

|

|

3,518 |

|

|

|

31.4 |

|

|

|

10,416 |

|

|

|

32.4 |

|

| Other

operating expenses (income), net |

|

|

(3 |

) |

|

|

- |

|

|

|

(53 |

) |

|

|

(0.2 |

) |

| Income

from operations |

|

|

348 |

|

|

|

3.1 |

|

|

|

804 |

|

|

|

2.5 |

|

| Depreciation |

|

|

1,079 |

|

|

|

9.6 |

|

|

|

3,261 |

|

|

|

10.1 |

|

| Amortization &

other non-cash charges |

|

|

128 |

|

|

|

1.2 |

|

|

|

337 |

|

|

|

1.1 |

|

| Adjusted

EBITDA |

|

|

1,555 |

|

|

|

13.9 |

|

|

|

4,402 |

|

|

|

13.7 |

|

| CAPEX |

|

|

468 |

|

|

|

|

|

|

|

742 |

|

|

|

|

|

October 27, 2023 | Page 18

Health

Division – Results of Operations

Amounts expressed in millions of Mexican Pesos (Ps.)

| | |

For

the third quarter of: | |

For

the nine months of: | |

| | |

2023 | |

%

of rev. | |

2022 | |

%

of rev. | |

%

Var. | |

2023 | |

%

of rev. | |

2022 | |

%

of rev. | |

%

Var. | |

| Total

revenues | |

18,569 | |

| 100.0 | |

| 18,526 | |

| 100.0 | |

| 0.2 | |

| 56,105 | |

| 100.0 | |

| 56,026 | |

| 100.0 | |

| 0.1 | |

| Cost

of sales | |

13,138 | |

| 70.8 | |

| 13,061 | |

| 70.5 | |

| 0.6 | |

| 39,228 | |

| 69.9 | |

| 39,732 | |

| 70.9 | |

| (1.3 | ) |

| Gross

profit | |

5,431 | |

| 29.2 | |

| 5,465 | |

| 29.5 | |

| (0.6 | ) |

| 16,877 | |

| 30.1 | |

| 16,294 | |

| 29.1 | |

| 3.6 | |

| Administrative

expenses | |

768 | |

| 4.1 | |

| 953 | |

| 5.1 | |

| (19.4 | ) |

| 2,238 | |

| 4.0 | |

| 2,135 | |

| 3.8 | |

| 4.8 | |

| Selling

expenses | |

3,836 | |

| 20.7 | |

| 3,580 | |

| 19.4 | |

| 7.2 | |

| 11,867 | |

| 21.2 | |

| 11,236 | |

| 20.1 | |

| 5.6 | |

| Other

operating expenses (income), net | |

(17 | ) |

| (0.1 | ) |

| (10 | ) |

| (0.1 | ) |

| 70.0 | |

| 16 | |

| - | |

| (1 | ) |

| - | |

| N.S.

| |

| Income

from operations | |

844 | |

| 4.5 | |

| 942 | |

| 5.1 | |

| (10.4 | ) |

| 2,756 | |

| 4.9 | |

| 2,924 | |

| 5.2 | |

| (5.7 | ) |

| Depreciation | |

762 | |

| 4.1 | |

| 727 | |

| 3.9 | |

| 4.8 | |

| 2,311 | |

| 4.1 | |

| 2,203 | |

| 3.9 | |

| 4.9 | |

| Amortization&

other non-cash charges | |

242 | |

| 1.4 | |

| 174 | |

| 0.9 | |

| 39.1 | |

| 744 | |

| 1.4 | |

| 550 | |

| 1.0 | |

| 35.3 | |

| Adjusted

EBITDA | |

1,848 | |

| 10.0 | |

| 1,843 | |

| 9.9 | |

| 0.3 | |

| 5,811 | |

| 10.4 | |

| 5,677 | |

| 10.1 | |

| 2.4 | |

| CAPEX | |

378 | |

| | |

| 245 | |

| | |

| 54.3 | |

| 996 | |

| | |

| 245 | |

| | |

| N.S.

| |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Information of

Stores | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Total

stores | |

| |

| | |

| | |

| | |

| | |

| 4,347 | |

| | |

| 3,971 | |

| | |

| 9.5 | |

| Stores

Mexico | |

| |

| | |

| | |

| | |

| | |

| 1,710 | |

| | |

| 1,516 | |

| | |

| 12.8 | |

| Stores

South America | |

| |

| | |

| | |

| | |

| | |

| 2,637 | |

| | |

| 2,455 | |

| | |

| 7.5 | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Net

new stores: | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| vs.

Last quarter | |

80 | |

| | |

| 84 | |

| | |

| (4.8 | ) |

| | |

| | |

| | |

| | |

| | |

| Year-to-date | |

241 | |

| | |

| 319 | |

| | |

| (24.5 | ) |

| | |

| | |

| | |

| | |

| | |

| Last-twelve-months | |

365 | |

| | |

| 431 | |

| | |

| (15.3 | ) |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Same-store

data: (1) | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Sales

(thousands of pesos) | |

1,131.1 | |

| | |

| 1,173.4 | |

| | |

| (3.6 | ) |

| 1,174.5 | |

| | |

| 1,216.9 | |

| | |

| (3.5 | ) |

(1) Monthly

average information per store, considering same stores with more than twelve months of all the retail operations of the Health Division.

October 27, 2023 | Page 19

Fuel – Results of Operations

Amounts expressed in millions of Mexican Pesos (Ps.)

| | |

For the

third quarter of: | | |

For the

nine months of: | |

| | |

2023 | | |

% of

rev. | | |

2022 | | |

% of

rev. | | |

% Var. | | |

2023 | | |

% of

rev. | | |

2022 | | |

% of

rev. | | |

% Var. | |

| Total revenues | |

| 15,782 | | |

| 100.0 | | |

| 13,823 | | |

| 100.0 | | |

| 14.2 | | |

| 43,378 | | |

| 100.0 | | |

| 37,938 | | |

| 100.0 | | |

| 14.3 | |

| Cost of sales | |

| 13,831 | | |

| 87.6 | | |

| 12,052 | | |

| 87.2 | | |

| 14.8 | | |

| 38,056 | | |

| 87.7 | | |

| 33,203 | | |

| 87.5 | | |

| 14.6 | |

| Gross profit | |

| 1,951 | | |

| 12.4 | | |

| 1,771 | | |

| 12.8 | | |

| 10.2 | | |

| 5,322 | | |

| 12.3 | | |

| 4,735 | | |

| 12.5 | | |

| 12.4 | |

| Administrative expenses | |

| 70 | | |

| 0.4 | | |

| 58 | | |

| 0.4 | | |

| 20.7 | | |

| 199 | | |

| 0.5 | | |

| 148 | | |

| 0.4 | | |

| 34.5 | |

| Selling expenses | |

| 1,152 | | |

| 7.4 | | |

| 1,029 | | |

| 7.4 | | |

| 12.0 | | |

| 3,303 | | |

| 7.6 | | |

| 2,963 | | |

| 7.8 | | |

| 11.5 | |

| Other operating expenses (income), net | |

| 19 | | |

| 0.1 | | |

| (3 | ) | |

| - | | |

| N.S.

| | |

| 19 | | |

| - | | |

| (12 | ) | |

| - | | |

| N.S.

| |

| Income from operations | |

| 710 | | |

| 4.5 | | |

| 687 | | |

| 5.0 | | |

| 3.3 | | |

| 1,801 | | |

| 4.2 | | |

| 1,636 | | |

| 4.3 | | |

| 10.1 | |

| Depreciation | |

| 285 | | |

| 1.8 | | |

| 266 | | |

| 1.9 | | |

| 7.1 | | |

| 844 | | |

| 1.9 | | |

| 784 | | |

| 2.1 | | |

| 7.7 | |

| Amortization & other non-cash

charges | |

| 31 | | |

| 0.2 | | |

| 7 | | |

| - | | |

| N.S.

| | |

| 60 | | |

| 0.1 | | |

| 31 | | |

| 0.1 | | |

| 93.5 | |

| Adjusted EBITDA | |

| 1,026 | | |

| 6.5 | | |

| 960 | | |

| 6.9 | | |

| 6.9 | | |

| 2,705 | | |

| 6.2 | | |

| 2,451 | | |

| 6.5 | | |

| 10.4 | |

| CAPEX | |

| 48 | | |

| | | |

| 22 | | |

| | | |

| 115.7 | | |

| 116 | | |

| | | |

| 58 | | |

| | | |

| 98.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Information of OXXO GAS Service Stations | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total stores | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 571 | | |

| | | |

| 568 | | |

| | | |

| 0.5 | |

| Net new convenience stores: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| vs. Last quarter | |

| 1 | | |

| | | |

| (1 | ) | |

| | | |

| - | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Year-to-date | |

| 3 | | |

| | | |

| 1 | | |

| | | |

| - | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Last-twelve-months | |

| 3 | | |

| | | |

| 2 | | |

| | | |

| 50.0 | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Volume (millions of liters) total stations | |

| 616 | | |

| | | |

| 613 | | |

| | | |

| 0.6 | | |

| 1,840 | | |

| | | |

| 1,755 | | |

| | | |

| 4.8 | |

Same-store

data: (1) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sales (thousands of pesos) | |

| 8,236.9 | | |

| | | |

| 7,617.6 | | |

| | | |

| 8.1 | | |

| 7,430.3 | | |

| | | |

| 6,826.7 | | |

| | | |

| 8.8 | |

| Traffic (thousands of liters) | |

| 391.7 | | |

| | | |

| 376.8 | | |

| | | |

| 4.0 | | |

| 358.7 | | |

| | | |

| 342.2 | | |

| | | |

| 4.8 | |

| Average price per liter | |

| 21.0 | | |

| | | |

| 20.2 | | |

| | | |

| 4.0 | | |

| 20.8 | | |

| | | |

| 20.0 | | |

| | | |

| 3.8 | |

(A) Unaudited consolidated financial information.

(1) Monthly average information per station, considering

same stations with more than twelve months of operations.

October 27, 2023 | Page 20

Coca-Cola FEMSA – Results of Operations

Amounts expressed in millions of Mexican Pesos (Ps.)

| | |

For the

third quarter of: | | |

For the

nine months of: | |

| | |

2023 | | |

% of

rev. | | |

2022 | | |

% of

rev. | | |

% Var. | | |

2023 | | |

% of

rev. | | |

2022 | | |

% of

rev. | | |

% Var. | |

| Total revenues | |

| 62,853 | | |

| 100.0 | | |

| 57,093 | | |

| 100.0 | | |

| 10.1 | | |

| 181,376 | | |

| 100.0 | | |

| 166,042 | | |

| 100.0 | | |

| 9.2 | |

| Cost of sales | |

| 34,005 | | |

| 54.1 | | |

| 31,702 | | |

| 55.5 | | |

| 7.3 | | |

| 99,926 | | |

| 55.1 | | |

| 92,573 | | |

| 55.8 | | |

| 7.9 | |

| Gross profit | |

| 28,848 | | |

| 45.9 | | |

| 25,392 | | |

| 44.5 | | |

| 13.6 | | |

| 81,451 | | |

| 44.9 | | |

| 73,469 | | |

| 44.2 | | |

| 10.9 | |

| Administrative expenses | |

| 3,239 | | |

| 5.2 | | |

| 2,895 | | |

| 5.1 | | |

| 11.9 | | |

| 9,824 | | |

| 5.4 | | |

| 8,238 | | |

| 5.0 | | |

| 19.3 | |

| Selling expenses | |

| 16,731 | | |

| 26.5 | | |

| 15,038 | | |

| 26.4 | | |

| 11.3 | | |

| 46,676 | | |

| 25.8 | | |

| 43,052 | | |

| 25.8 | | |

| 8.4 | |

| Other operating expenses (income), net | |

| 418 | | |

| 0.7 | | |

| 124 | | |

| 0.2 | | |

| N.S.

| | |

| 235 | | |

| 0.1 | | |

| 298 | | |

| 0.2 | | |

| (21.1 | ) |

| Income from operations | |

| 8,460 | | |

| 13.5 | | |

| 7,335 | | |

| 12.8 | | |

| 15.3 | | |

| 24,716 | | |

| 13.6 | | |

| 21,881 | | |

| 13.2 | | |

| 13.0 | |

| Depreciation | |

| 2,468 | | |

| 3.9 | | |

| 2,515 | | |

| 4.4 | | |

| (1.9 | ) | |

| 7,179 | | |

| 4.0 | | |

| 7,287 | | |

| 4.4 | | |

| (1.5 | ) |

| Amortization & other non-cash

charges | |

| 912 | | |

| 1.4 | | |

| 776 | | |

| 1.4 | | |

| 17.5 | | |

| 1,851 | | |

| 1.0 | | |

| 1,983 | | |

| 1.2 | | |

| (6.7 | ) |

| Adjusted EBITDA | |

| 11,840 | | |

| 18.8 | | |

| 10,626 | | |

| 18.6 | | |

| 11.4 | | |

| 33,746 | | |

| 18.6 | | |

| 31,151 | | |

| 18.8 | | |

| 8.3 | |

| CAPEX | |

| 4,964 | | |

| | | |

| 4,034 | | |

| | | |

| 23.1 | | |

| 11,713 | | |

| | | |

| - | | |

| | | |

| N.S. | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sales Volumes | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (Millions of unit cases) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mexico and Central America | |

| 633.2 | | |

| 61.3 | | |

| 555.8 | | |

| 60.0 | | |

| 13.9 | | |

| 1,813.9 | | |

| 60.6 | | |

| 1,640.5 | | |

| 59.4 | | |

| 10.6 | |

| South America | |

| 144.0 | | |

| 13.9 | | |

| 131.1 | | |

| 14.2 | | |

| 9.8 | | |

| 420.5 | | |

| 14.1 | | |

| 398.9 | | |

| 14.5 | | |

| 5.4 | |

| Brazil | |

| 255.9 | | |

| 24.8 | | |

| 238.9 | | |

| 25.8 | | |

| 7.1 | | |

| 757.2 | | |

| 25.3 | | |

| 720.5 | | |

| 26.1 | | |

| 5.1 | |

| Total | |

| 1,033.1 | | |

| 100.0 | | |

| 925.8 | | |

| 100.0 | | |

| 11.6 | | |

| 2,991.6 | | |

| 100.0 | | |

| 2,759.9 | | |

| 100.0 | | |

| 8.4 | |

(1) Organic basis (% Org.) excludes the effects of

significant mergers and acquisitions in the last twelve months.

October 27, 2023 | Page 21

FEMSA Macroeconomic Information

| | |

Inflation | | |

End-of-period

Exchange Rates | |

| | |

3Q

2023 | | |

LTM

(1) Sep-23 | | |

Sep-23 | | |

Sep-22 | |

| | |

| | |

| | |

Per USD | | |

Per MXN | | |

Per USD | | |

Per MXN | |

| Mexico | |

| 1.01 | % | |

| 4.44 | % | |

| 17.62 | | |

| 1.0000 | | |

| 20.31 | | |

| 1.0000 | |

| Colombia | |

| 1.20 | % | |

| 11.49 | % | |

| 4,053.76 | | |

| 0.0043 | | |

| 4,532.07 | | |

| 0.0045 | |

| Brazil | |

| 0.51 | % | |

| 4.43 | % | |

| 5.01 | | |

| 3.5186 | | |

| 5.41 | | |

| 3.7557 | |

| Argentina | |

| 20.26 | % | |

| 128.90 | % | |

| 349.95 | | |

| 0.0503 | | |

| 147.32 | | |

| 0.1378 | |

| Chile | |

| 0.35 | % | |

| 4.59 | % | |

| 895.60 | | |

| 0.0197 | | |

| 960.24 | | |

| 0.0211 | |

| Euro Zone | |

| 0.74 | % | |

| 5.18 | % | |

| 0.95 | | |

| 18.5710 | | |

| 1.04 | | |

| 19.6142 | |

(1) LTM = Last twelve months.

October 27, 2023 | Page 22

Mexico

City, October 25, 2023, Coca-Cola FEMSA, S.A.B. de C.V. (BMV: KOFUBL, NYSE: KOF) (“Coca-Cola

FEMSA”, “KOF” or the “Company”), the largest Coca-Cola franchise bottler in the world by sales volume,

announces results for the third quarter of 2023.

THIRD QUARTER

HIGHLIGHTS

| • | Operating

income growth 15.3% |

| • | Majority

net income growth 23.0% |

| • | Earnings

per share1 were Ps. 0.32. (Earnings per unit were Ps. 2.56 and per ADS were Ps.

25.61.) |

| • | Achieved

more than 946 thousand monthly active buyers on Juntos+, our omnichannel B2B platform |

FIRST NINE MONTHS

HIGHLIGHTS

| • | Operating

income growth 13.0% |

| • | Majority

net income growth 19.1% |

| • | Earnings

per share1 were Ps. 0.85. (Earnings per unit were Ps. 6.77 and per ADS were Ps.

67.66.) |

| • | Achieved

more than US$1.7 billion in digital revenues through Juntos+ |

FINANCIAL

SUMMARY FOR THE THIRD QUARTER RESULTS

Change

vs. same period of last year

| | |

| |

Total Revenues | | |

Gross Profit | | |

Operating

Income | | |

Majority

Net Income | |

| | |

| |

3Q23 | | |

YTD 2023 | | |

3Q23 | | |

YTD 2023 | | |

3Q23 | | |

YTD 2023 | | |

3Q23 | | |

YTD 2023 | |

| |

Consolidated | |

| 10.1 | % | |

| 9.2 | % | |

| 13.6 | % | |

| 10.9 | % | |

| 15.3 | % | |

| 13.0 | % | |

| 23.0 | % | |

| 19.1 | % |

| As Reported | |

Mexico &

Central America | |

| 15.5 | % | |

| 14.9 | % | |

| 17.9 | % | |

| 14.9 | % | |

| 19.2 | % | |

| 11.5 | % | |

| | | |

| | |

| | |

South

America | |

| 2.2 | % | |

| 1.2 | % | |

| 6.5 | % | |

| 4.0 | % | |

| 6.7 | % | |

| 16.6 | % | |

| | | |

| | |