UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as

permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| TORTOISE

ENERGY INDEPENDENCE FUND, INC. |

| (Name of Registrant

as Specified in Its Charter) |

ATG CAPITAL MANAGEMENT LLC

ATG FUND II LLC

JID 2013 TRUST HOLDINGS LLLP

GABRIEL

D. GLIKSBERG

AARON T. MORRIS

|

| (Name of Persons(s) Filing Proxy Statement,

if Other Than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ |

No fee required.

|

☐ |

Fee computed on table below per Exchange Act

Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| |

|

|

☐ |

Fee

paid previously with preliminary materials. |

| |

|

☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

| |

|

|

| |

|

Persons who are to respond to the collection of information contained in this form are not

required to respond unless the form displays a currently valid OMB control number. |

ANNUAL MEETING OF STOCKHOLDERS

OF

TORTOISE

ENERGY INDEPENDENCE FUND, INC.

_________________________

PROXY STATEMENT

OF

ATG CAPITAL MANAGEMENT LLC

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD PROXY CARD TODAY

This Proxy Statement is being

provided by ATG Capital Management LLC (“ATG”), ATG Fund II LLC (“ATG Fund”) and JID 2013 Trust Holdings LLLP

(“JID” and, together with the foregoing, “ATG” or “we”).1 ATG Fund II LLC beneficially

owns 37,106 shares and JID beneficially owns 45,629 shares of common stock (the “Common Stock”) of Tortoise Energy Independence

Fund, Inc. (“Energy Independence Fund” or the “Fund”), a Maryland corporation registered as a non-diversified,

closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

We are writing to you in

advance of the upcoming annual meeting of stockholders on August 8, 2024 at 5100 W. 115th Place, Leawood, Kansas 66211 at [_:_ a.m./p.m.]

(the “Annual Meeting”). ATG has nominated two highly qualified candidates for election to the Fund’s Board of Directors

(the “Board”)— Gabriel Gliksberg (“Gliksberg”) and Aaron T. Morris (“Morris”) (together, the

“Nominees”). For further details regarding the Annual Meeting, please see the Fund’s forthcoming proxy materials.

Pursuant to this Proxy Statement,

ATG is soliciting proxies to elect the Nominees, who will introduce independence and fresh perspectives into the boardroom. We intend

to vote all shares FOR the election of the Nominees to the Board. We urge you to do the same.

This Proxy Statement and

GOLD proxy card are first being furnished to the Company's stockholders on or about [*], 2024.

The Company has set the close

of business on June 18, 2024 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting

(the “Record Date”). The mailing address of the principal executive offices of the Fund is 5100 W. 115th Place, Leawood,

Kansas 66211. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. As of

May 28, 2024, there were 1,666,014 shares of Common Stock outstanding.

We

urge you to promptly sign, date and return your GOLD proxy card

This solicitation is being

made by ATG and not on behalf of the Board or management of the Fund. We are not aware of any other matters to be brought before the

annual meeting other than as described herein. Should other matters be brought before the annual meeting, the persons named as proxies

in the enclosed GOLD proxy card will vote on such matters in their discretion.

1 ATG is the investment

manager of ATG Fund. Gabi Gliksberg is the principal of ATG and also manages the investments of JID. ATG Fund and JID are beneficial

owners of the Fund’s Common Stock.

If you have already voted

using the Fund’s white proxy card, you have every right to change your vote by completing and mailing the enclosed GOLD proxy card

in the enclosed pre-paid envelope or by voting via Internet or by telephone by following the instructions on the GOLD proxy card.

Importantly, only the latest validly executed proxy that you submit will be counted. In addition, any proxy may be revoked at any time

prior to its exercise at the Annual Meeting by following the instructions under “Can I change my vote or revoke my proxy?”

in the Questions and Answers section.

For instructions on how to

vote, including the quorum and voting requirements for the Fund and other information about the proxy materials, see Information Concerning

the Annual Meeting below.

If you have any questions, require assistance

in voting your GOLD proxy card,

or need additional copies of ATG’s proxy

materials,

please contact:

19 Old Kings Highway S. – Suite 210

Darien, CT 06820

Stockholders call toll-free at (877) 972-0090

Banks and brokers call collect at (203) 972-9300

info@investor-com.com

IMPORTANT

Your vote is important no matter how many

shares of Common Stock you own. ATG urges you to sign, date, and return the enclosed GOLD proxy card today to vote FOR the Nominees.

| ● | If your shares of Common Stock are registered

in your own name, please sign and date the enclosed GOLD proxy card and return it

to ATG, c/o InvestorCom, in the enclosed postage-paid envelope today. |

| ● | If your shares of Common Stock are held

in a brokerage account or bank, you are considered the beneficial owner of the shares of

Common Stock, and these proxy materials, together with a GOLD voting form, are being

forwarded to you by your broker or bank. As a beneficial owner, if you wish to vote, you

must instruct your broker, trustee or other representative how to vote. Your broker cannot

vote your shares of Common Stock on your behalf without your instructions. |

| ● | Depending upon your broker or custodian,

you may be able to vote either by toll-free telephone or by the Internet. Please refer to

the enclosed voting form for instructions on how to vote electronically. You may also vote

by signing, dating and returning the enclosed voting form. |

If you have any questions, require assistance

in voting your GOLD proxy card,

or need additional copies of the ATG’s

proxy materials,

please contact:

19 Old Kings Highway S. – Suite 210

Darien, CT 06820

Stockholders call toll-free at (877) 972-0090

Banks and brokers call collect at (203)

972-9300

info@investor-com.com

|

REASONS

FOR THE SOLICITATION

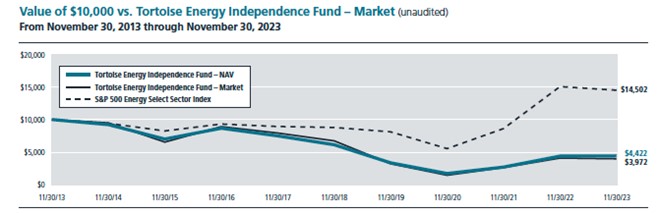

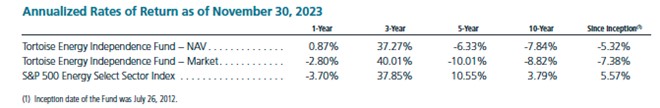

We believe that shareholders

of the Tortoise Energy Independence Fund would benefit from new and different perspectives on the Board. Tortoise’s own performance

numbers speak for themselves:

The Board appears undisturbed

by these results and has renewed Tortoise’s management contract year after year, despite the underperformance.

We urge stockholders to vote

FOR the Nominees, who will bring independence and conviction to the oversight and management of the Fund.

PROPOSAL

1: ELECTION OF DIRECTORS

We are soliciting proxies

to elect the Nominees—Gabriel Gliksberg and Aaron T. Morris—to serve as directors with a term expiring at the 2026 annual

meeting of shareholders. ATG intends to vote all of its shares in favor of the Nominees. The age and other information related to the

Nominees shown below are as of the date of this Proxy Statement.

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

Name,

Address, and

Age |

Position(s)

Held with

Fund |

Term of Office

and Length of

Time Served |

Principal

Occupation(s) During

Past 5 Years |

Number of

Portfolios in

Fund Complex

Overseen by

Trustee

or Nominee for

Trustee |

Other

Directorships

Held by

Trustee or

Nominee for

Trustee |

GABRIEL D. GLIKSBERG

Address

16690 Collins Avenue,

Suite #1103 Sunny Isles Beach, FL 33160

Age 36

|

None |

N/A |

Mr.

Gliksberg is the founder of ATG Capital Management LLC, which provides investment management services to private funds and accounts. |

N/A |

None |

Mr. Gliksberg holds a Bachelor’s

Degree in Business Administration with a major in Finance from Washington University in Saint Louis. His qualifications to serve as a

director derive from his significant financial, accounting, investment, audit, and marketing expertise gained through his management

and oversight of multiple private and public operating companies and investment companies.

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

Name,

Address, and

Age |

Position(s)

Held with

Fund |

Term

of Office

and Length of

Time Served |

Principal

Occupation(s) During

Past 5 Years |

Number of

Portfolios in

Fund Complex

Overseen by

Trustee

or Nominee for

Trustee |

Other

Directorships

Held by

Trustee or

Nominee for

Trustee |

AARON

T. MORRIS

Address

4915

Mountain Road, Unit 4

Stowe,

Vermont 05672

Age

37

|

None |

N/A |

Mr. Morris is the co-founder of Morris Kandinov

LLP, which represents retail and institutional investors in litigation. |

N/A |

None |

Mr. Morris holds a Bachelor’s

Degree in Economics from Indiana University and a Juris Doctorate from Boston College Law School. His qualifications to serve as a trustee

derive from his extensive legal experience in federal securities regulation and litigation and, specifically, in matters involving the

management and oversight of mutual funds, ETFs, closed-end funds, and other investment vehicles.

The Nominees do not currently

hold, and have not at any time held, any position with the Fund. The Nominees do not oversee any portfolios in the Fund’s Fund

Complex (as defined in the Investment Company Act of 1940.

As of the date of this Proxy

Statement, the dollar range of the equity securities of the Fund beneficially owned by the Nominees and the aggregate range of equity

securities in all funds to be overseen by the Nominees, are as follows:

| Name

of Nominee |

Dollar

Range of Equity Securities

in the Fund |

Aggregate

Dollar Range of

Equity Securities in All

Companies to be Overseen by the

Nominee in a Family of

Investment Companies |

| Gabriel

D. Gliksberg |

Over

$100,0002 |

None |

| Aaron

T. Morris |

None |

None |

Neither of the persons above

is a parent, subsidiary, or affiliate of the Fund. We believe that, if elected, the Nominees will be considered independent trustees

of the Fund under (i) the pertinent listing standards of the New York Stock Exchange, and (ii) paragraph (a)(1) of Item 407 of Regulation

S-K. In addition, we believe that the Nominees are not and will not be “interested persons” of the Fund within the meaning

of section 2(a)(19) of the 40 Act.

We urge you to sign and return

our GOLD proxy card. If you have already voted using the Fund’s white proxy card, you have the right to change your vote by completing

and mailing the enclosed GOLD proxy card in the enclosed pre-paid envelope or by voting via Internet or by telephone by following the

instructions on the GOLD proxy card. Only the latest validly executed proxy that you submit will be counted. If you have any questions

or require any assistance with voting your shares, please contact our proxy solicitor, InvestorCom, toll free at (877) 972-0090 or collect

at (203) 972-9300.

2 All shares are beneficially

owned by ATG Fund and JID.

INFORMATION

CONCERNING THE ANNUAL MEETING

VOTING AND PROXY PROCEDURES

Only stockholders of record

on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting. Stockholders of record on the Record Date will

retain their voting rights in connection with the Annual Meeting even if they sell such shares of Common Stock after the Record Date.

As of May 28, 2024, there were 1,666,014 shares of Common Stock outstanding.

Shares of Common Stock represented

by properly executed GOLD proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions,

will be voted FOR the Nominees, and, in the discretion of the persons named as proxies, on all other matters as may properly come

before the Annual Meeting.

QUORUM

According to the Fund’s

bylaws, the presence, in person or by proxy, of holders of shares of Common Stock entitled to cast a majority of the votes entitled to

be cast (without regard to class) constitutes a quorum. For purposes of determining the presence or absence of a quorum, shares of Common

Stock present that are not voted, or abstentions, will be treated as present for purposes of determining the existence of a quorum. For

purposes of determining the presence or absence of a quorum, shares present at the annual meeting that are not voted, or abstentions,

and broker non-votes (which occur when a broker has not received directions from customers and does not have discretionary authority

to vote the customers’ shares) will be treated as shares that are present at the meeting but have not been voted.

VOTES REQUIRED FOR ELECTION

According to the Fund’s

bylaws, a plurality of all the votes cast at a meeting of stockholders duly called and at which a quorum is present shall be sufficient

to elect a director. The information set forth above is based on publicly available information. The incorporation of this information

in this Proxy Statement should not be construed as an admission by us that such process and procedures are legal, valid or binding.

DISCRETIONARY VOTING

Shares held in “street

name” and held of record by banks, brokers or nominees may not be voted by such banks, brokers or nominees unless the beneficial

owners of such shares provide them with instructions on how to vote. If you beneficially own shares that are held in “street name”

through a broker-dealer or that are held of record by a service agent and you do not give specific voting instructions for your shares,

they may not be voted at all or, as described above, they may be voted in a manner that you may not intend. You are strongly encouraged

to give your broker-dealer, or service agent or participating insurance company specific instructions as to how you want your shares

to be voted.

REVOCATION OF PROXIES

Stockholders of the Fund

may revoke their proxies at any time prior to exercise by: (1) sending a letter stating that you are revoking your proxy to the Secretary

of Energy Independence Fund at the Energy Independence Fund’s offices located at 5100 W. 115th Place, Leawood, Kansas 66211; (2)

properly executing and sending a later-dated GOLD proxy; or (3) attending the meeting, requesting return of any previously delivered

proxy, and voting in person. Attendance at the meeting will not, by itself, revoke a properly executed proxy.

SOLICITATION OF PROXIES

The solicitation of proxies

pursuant to this Proxy Statement is being made by ATG. Proxies may be solicited by mail, facsimile, telephone, Internet, in person and

by advertisements.

ATG has entered into an agreement

with InvestorCom for solicitation and advisory services in connection with this solicitation. The entire expense of soliciting proxies

is being borne by ATG, which intends to seek reimbursement from the Fund of all expenses it incurs in connection with this solicitation.

ATG does not intend to submit the question of such reimbursement to a vote of security holders of the Fund.

Some banks, brokers and other

nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means

that only one copy of this Proxy Statement may have been sent to multiple stockholders in your household. ATG will promptly deliver a

separate copy of the document to you if you contact our proxy solicitor, InvestorCom, at the following address or phone number: 19 Old

Kings Highway S. – Suite 210, Darien, CT 06820, or call toll free at (877) 972-0090. If you want to receive separate copies of

our proxy materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household,

you should contact your bank, broker or other nominee record holder, or you may contact our proxy solicitor at the above address and

phone number.

QUESTIONS

AND ANSWERS ABOUT THE

PROXY MATERIALS AND THE ANNUAL MEETING

| Q: | When and where is the Annual Meeting? |

| A: | Energy Independence Fund intends to hold the

Annual Meeting on August 8, 2024 at [_:__ a.m./p.m.] at 5100 W. 115th Place, Leawood, Kansas

66211. |

| Q: | Who is entitled to vote at the Annual

Meeting? |

| A: | All holders of shares of Common Stock as of

the Record Date (June 18, 2024) are entitled to receive notice of, and to vote at, the Annual

Meeting or any postponement or adjournment of the Annual Meeting scheduled in accordance

with Maryland law. |

| Q. | What am I being asked to vote

on at the Annual Meeting? |

| A. | Stockholders are being asked to vote on, potentially

among other things, the election of directors to the Board. |

| Q: | How should I vote on the Proposal? |

| A: | We recommend that you vote “FOR”

ATG’s Nominees described herein on the enclosed GOLD proxy card. |

| Q. | What vote is required to elect

the Nominees? |

| A. | According to the Fund’s bylaws, a plurality

of all the votes cast at a meeting of stockholders duly called and at which a quorum is present

shall be sufficient to elect a director. |

| Q. | How many shares must be present

to hold the Annual Meeting? |

| A. | According to the Fund’s bylaws, the presence

in person or by proxy of the holders of shares of Common Stock of the Fund entitled to cast

a majority of the votes entitled to be cast (without regard to class) shall constitute a

quorum at the Annual Meeting. |

| A. | You may vote at the Annual Meeting or you may

authorize a proxy to vote your shares using one of the methods below or by following the

instructions on your proxy card: |

| ● | By touch-tone telephone; simply

dial the toll-free number located on the enclosed proxy card. Please be sure to have your

proxy card available at the time of the call; |

| ● | By internet; please log on to the

voting website detailed on the enclosed proxy card. Again, please have your proxy card handy

at the time you plan on voting; or |

| ● | By returning the enclosed proxy

card in the postage-paid envelope. |

Please note, however,

that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain

from the record holder a proxy issued in your name. Even if you plan to attend the Annual Meeting, we urge you to authorize a proxy to

vote your shares in advance of the Annual Meeting. That will ensure that your vote is counted should your plans change.

| Q: | What do I need to do now? |

| A. | Even if you plan to attend the Annual Meeting,

after carefully reading and considering the information contained in this Proxy Statement,

please submit your GOLD proxy card promptly to ensure that your shares are represented

at the Annual Meeting. If you hold your shares of Common Stock in your own name as the shareholder

of record, please submit your proxy for your shares by completing, signing, dating and returning

the enclosed GOLD proxy card in the accompanying prepaid reply envelope. If you decide

to attend the Annual Meeting and vote your shares in person, your vote by ballot at the Annual

Meeting will revoke any proxy previously submitted. If you are a beneficial owner of shares,

please refer to the instructions provided by your bank, brokerage firm or other nominee to

see which of the above choices are available to you. |

SCHEDULE I

TRANSACTIONS IN SECURITIES OF

the FUND DURING THE PAST TWO YEARS

JID

2013 Trust Holdings LLLP

| Transaction |

Date |

Amount |

| Purchase |

6/1/23 |

18 |

| Purchase |

6/1/23 |

782 |

| Purchase |

3/19/21 |

253 |

| Purchase |

3/18/21 |

400 |

| Purchase |

3/9/21 |

700 |

| Purchase |

3/8/21 |

300 |

| Purchase |

3/8/21 |

300 |

| Purchase |

3/8/21 |

300 |

| Purchase |

12/22/20 |

200 |

| Purchase |

12/21/20 |

400 |

| Purchase |

12/21/20 |

100 |

| Purchase |

12/21/20 |

100 |

| Purchase |

12/21/20 |

200 |

| Purchase |

12/21/20 |

298 |

| Purchase |

12/21/20 |

300 |

| Purchase |

12/21/20 |

2,400 |

| Purchase |

12/21/20 |

100 |

| Purchase |

12/21/20 |

100 |

| Purchase |

12/21/20 |

150 |

| Purchase |

12/21/20 |

1,000 |

| Purchase |

12/14/20 |

200 |

| Purchase |

12/14/20 |

400 |

| Purchase |

12/9/20 |

300 |

| Purchase |

12/1/20 |

100 |

| Purchase |

12/1/20 |

200 |

| Purchase |

12/1/20 |

2,080 |

| Purchase |

12/1/20 |

120 |

| Purchase |

11/30/20 |

370 |

| Purchase |

11/30/20 |

1,000 |

| Purchase |

11/30/20 |

300 |

| Transaction |

Date |

Amount |

| Purchase |

11/30/20 |

100 |

| Purchase |

11/30/20 |

900 |

| Purchase |

11/30/20 |

300 |

| Purchase |

11/30/20 |

128 |

| Purchase |

11/30/20 |

100 |

| Purchase |

11/30/20 |

72 |

| Purchase |

11/30/20 |

100 |

| Purchase |

11/30/20 |

29 |

| Purchase |

11/30/20 |

71 |

| Purchase |

11/30/20 |

200 |

| Purchase |

11/30/20 |

200 |

| Purchase |

11/30/20 |

600 |

| Purchase |

11/30/20 |

800 |

| Purchase |

11/30/20 |

600 |

| Purchase |

11/30/20 |

300 |

| Purchase |

11/30/20 |

600 |

| Purchase |

11/30/20 |

100 |

| Purchase |

11/30/20 |

200 |

| Purchase |

11/30/20 |

400 |

| Purchase |

11/30/20 |

900 |

| Purchase |

11/30/20 |

200 |

| Purchase |

11/30/20 |

400 |

| Purchase |

11/27/20 |

300 |

| Purchase |

11/19/20 |

400 |

| Purchase |

11/19/20 |

400 |

| Purchase |

11/19/20 |

200 |

| Purchase |

11/18/20 |

3,000 |

| Purchase |

11/13/20 |

179 |

| Purchase |

11/13/20 |

200 |

| Purchase |

11/13/20 |

100 |

| Purchase |

11/13/20 |

100 |

| Purchase |

11/13/20 |

100 |

| Purchase |

11/13/20 |

100 |

| Purchase |

11/13/20 |

200 |

| Purchase |

11/13/20 |

200 |

| Purchase |

11/13/20 |

200 |

| Purchase |

11/13/20 |

100 |

| Purchase |

11/13/20 |

950 |

| Purchase |

11/13/20 |

50 |

| Purchase |

11/13/20 |

1,070 |

| Purchase |

11/13/20 |

350 |

| Purchase |

11/13/20 |

450 |

| Transaction |

Date |

Amount |

| Purchase |

11/13/20 |

300 |

| Purchase |

11/13/20 |

1,000 |

| Purchase |

11/13/20 |

200 |

| Purchase |

11/13/20 |

200 |

| Purchase |

11/13/20 |

200 |

| Purchase |

11/13/20 |

250 |

| Purchase |

11/13/20 |

200 |

| Purchase |

11/13/20 |

600 |

| Purchase |

11/13/20 |

600 |

| Purchase |

11/13/20 |

200 |

| Purchase |

11/12/20 |

61 |

| Purchase |

11/12/20 |

100 |

| Purchase |

11/12/20 |

100 |

| Purchase |

11/12/20 |

400 |

| Purchase |

11/12/20 |

400 |

| Purchase |

11/12/20 |

100 |

| Purchase |

11/12/20 |

400 |

| Purchase |

11/12/20 |

600 |

| Purchase |

11/12/20 |

100 |

| Purchase |

11/12/20 |

100 |

| Purchase |

11/12/20 |

200 |

| Purchase |

11/12/20 |

400 |

| Purchase |

11/12/20 |

100 |

| Purchase |

11/12/20 |

200 |

| Purchase |

11/12/20 |

200 |

| Purchase |

11/12/20 |

400 |

| Purchase |

11/12/20 |

100 |

| Purchase |

11/12/20 |

100 |

| Purchase |

11/12/20 |

100 |

| Purchase |

11/12/20 |

400 |

| Purchase |

11/12/20 |

1,398 |

| Purchase |

11/12/20 |

4,000 |

| Purchase |

11/12/20 |

500 |

| Purchase |

11/12/20 |

300 |

| Purchase |

11/12/20 |

500 |

| Purchase |

11/12/20 |

600 |

| Purchase |

11/12/20 |

600 |

ATG FUND II LLC

| Transaction |

Date |

Amount |

| Purchase |

11/28/23 |

700 |

| Purchase |

10/16/23 |

1,100 |

| Purchase |

10/16/23 |

300 |

| Purchase |

10/16/23 |

200 |

| Purchase |

10/16/23 |

283 |

| Purchase |

10/16/23 |

400 |

| Purchase |

10/16/23 |

500 |

| Purchase |

10/16/23 |

100 |

| Purchase |

10/16/23 |

200 |

| Purchase |

10/12/23 |

800 |

| Purchase |

10/11/23 |

1,000 |

| Purchase |

10/10/23 |

523 |

| Purchase |

10/10/23 |

1,000 |

| Purchase |

10/10/23 |

100 |

| Purchase |

10/10/23 |

100 |

| Purchase |

10/10/23 |

900 |

| Purchase |

10/6/23 |

844 |

| Purchase |

10/6/23 |

156 |

| Purchase |

10/6/23 |

1,000 |

| Purchase |

10/5/23 |

1,100 |

| Purchase |

10/5/23 |

1,000 |

| Purchase |

10/4/23 |

1,000 |

| Purchase |

10/4/23 |

599 |

| Purchase |

10/4/23 |

1,000 |

| Purchase |

10/4/23 |

100 |

| Purchase |

10/3/23 |

1,000 |

| Purchase |

10/3/23 |

6,000 |

| Purchase |

10/3/23 |

657 |

| Purchase |

10/3/23 |

915 |

| Purchase |

10/3/23 |

43 |

| Purchase |

10/3/23 |

1,000 |

| Purchase |

10/3/23 |

1,000 |

| Purchase |

10/2/23 |

300 |

| Purchase |

10/2/23 |

600 |

| Purchase |

10/2/23 |

200 |

| Purchase |

10/2/23 |

768 |

| Purchase |

10/2/23 |

200 |

| Transaction |

Date |

Amount |

| Purchase |

10/2/23 |

800 |

| Purchase |

10/2/23 |

800 |

| Purchase |

10/2/23 |

300 |

| Purchase |

9/27/23 |

11 |

| Purchase |

9/27/23 |

1 |

| Purchase |

7/27/23 |

1,500 |

| Purchase |

7/27/23 |

1,500 |

| Purchase |

7/20/23 |

1,000 |

| Purchase |

7/19/23 |

50 |

| Purchase |

7/19/23 |

950 |

| Purchase |

7/14/23 |

102 |

| Purchase |

7/13/23 |

500 |

| Purchase |

7/11/23 |

800 |

| Purchase |

7/5/23 |

1,000 |

| Purchase |

6/29/23 |

100 |

| Purchase |

6/27/23 |

4 |

IMPORTANT

Your vote is important. No

matter how many shares you own, please give ATG your proxy FOR the Nominees by taking three steps:

| ● | SIGNING the enclosed GOLD proxy card, |

| ● | DATING the enclosed GOLD proxy card,

and |

| ● | MAILING the enclosed GOLD proxy

card in the envelope provided (no postage is required if mailed in the United States). |

If any of your shares

are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote such shares and only upon receipt

of your specific instructions. Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or

by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing,

dating and returning the enclosed GOLD voting form.

If you have any questions

or require any additional information concerning this Proxy Statement, please contact InvestorCom at the address set forth below.

If you have any questions, require assistance

in voting your GOLD proxy card,

or need additional copies of ATG’s

proxy materials,

please contact:

19 Old Kings Highway S. – Suite 210

Darien, CT 06820

Stockholders call toll-free at (877) 972-0090

Banks and brokers call collect at (203)

972-9300

info@investor-com.com

|

GOLD PROXY CARD

Tortoise

Energy Independence Fund, Inc.

ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF ATG CAPITAL

MANAGEMENT LLC

AND JID 2013 TRUST HOLDINGS LLLP

THE BOARD OF DIRECTORS OF Tortoise

Energy

Independence Fund, Inc. IS NOT SOLICITING THIS PROXY

P R O X Y

The undersigned appoints

John Grau, Gabriel Gliksberg and Aaron T. Morris, and each of them, attorneys and agents with full power of substitution to vote all

shares of common stock of Tortoise Energy Independence Fund, Inc. (the “Company”) that the undersigned would be entitled

to vote if personally present at the Annual Meeting of the stockholders of the Company scheduled to be held on August 8, 2024 (the “Annual

Meeting”).

The undersigned hereby revokes

any other proxy or proxies heretofore given to vote or act with respect to the common stock of the Company held by the undersigned, and

hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take by

virtue hereof. If properly executed, this Proxy will be voted as directed on the reverse and in the discretion of the herein named attorneys

and proxies or their substitutes with respect to any other matters as may properly come before the Annual Meeting.

IF NO DIRECTION IS INDICATED

WITH RESPECT TO THE PROPOSAL ON THE REVERSE, THIS PROXY WILL BE VOTED “FOR” ATG’S NOMINEES.

This Proxy will be valid

until the completion of the Annual Meeting. This Proxy will only be valid in connection with ATG’s solicitation of proxies for

the Annual Meeting in favor of its Nominees.

IMPORTANT: PLEASE SIGN, DATE AND MAIL THIS

PROXY CARD PROMPTLY!

CONTINUED AND TO BE SIGNED

ON REVERSE SIDE

GOLD PROXY CARD

☒ Please mark vote as in this example

ATG STRONGLY RECOMMENDS

THAT STOCKHOLDERS VOTE “FOR” BOTH OF ITS NOMINEES.

| 1. | Election at the Annual Meeting of the individuals

nominated by ATG. |

| Nominees: |

FOR

ALL |

WITHHOLD ALL |

FOR

ALL EXCEPT |

Gabriel D. Gliksberg

Aaron T. Morris |

☐ |

☐ |

☐ |

| |

|

|

|

(INSTRUCTIONS: To withhold authority to vote for any individual Nominee,

mark the “For All Except” box above and write the name of the nominee(s) from which you wish to abstain in the space provided

below.)

| |

|

|

| Signature (Capacity) |

|

Date |

| |

|

|

| |

|

|

| Signature

(Joint Owner) (Capacity/Title) |

|

Date |

| |

NOTE: Please sign exactly as your name(s)

appear(s) on stock certificates or on the label affixed hereto. When signing as attorney, executor, administrator or other fiduciary,

please give full title as such. Joint owners must each sign personally. ALL HOLDERS MUST SIGN. If a corporation or partnership,

please sign in full corporate or partnership name by an authorized officer and give full title as such.

|

PLEASE SIGN, DATE AND PROMPTLY RETURN THIS PROXY

IN THE ENCLOSED RETURN ENVELOPE THAT IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES.

Tortoise Energy Independ... (NYSE:NDP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tortoise Energy Independ... (NYSE:NDP)

Historical Stock Chart

From Feb 2024 to Feb 2025