DC 0001823466 false 0001823466 2025-01-15 2025-01-15 0001823466 note:Class160ACommonStockParValue0.0001PerShareMember 2025-01-15 2025-01-15 0001823466 us-gaap:WarrantMember 2025-01-15 2025-01-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 15, 2025

FISCALNOTE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-39672 |

|

88-3772307 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

1201 Pennsylvania Avenue NW, 6th Floor,

Washington, D.C. 20004

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (202)793-5300

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

NOTE |

|

NYSE |

| Warrants to purchase one share of Class A common stock |

|

NOTE.WS |

|

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

As previously announced, management of FiscalNote Holdings, Inc. (the “Company”) will present in person at the Needham & Co. 27th Annual Growth Conference on January 15, 2025, at the Lotte New York Palace Hotel in New York City. In connection therewith, the Company posted an updated investor presentation to the Investor Relations page of its corporate website. A copy of the presentation is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K.

The information disclosed under Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| FISCALNOTE HOLDINGS, INC. |

|

|

| By: |

|

/s/ Jon Slabaugh |

| Name: |

|

Jon Slabaugh |

| Title: |

|

Chief Financial Officer |

| Date: |

|

January 15, 2025 |

Exhibit 99.1 Company Overview Josh Resnik, CEO & President 27th

Annual Needham Growth Conference January 15, 2025 © 2025 FiscalNote fiscalnote.com

Disclaimer Forward Looking Statements Certain statements herein may be

considered forward-looking statements within the meaning of the federal securities laws. Forward-looking statements generally relate to future events or FiscalNote’s future financial or operating performance. Statements regarding

FiscalNote’s financial outlook for future periods, expectations regarding profitability, capital resources and anticipated growth in the industry in which FiscalNote operates are forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as “pro forma,” “may,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,”

“budget,” “forecast,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or

“continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other important factors that could cause actual results to differ

materially from those expressed or implied by such forward-looking statements. Factors that may impact such forward-looking statements include FiscalNote’s ability to achieve and sustain organic growth; changes in FiscalNote’s strategy,

future operations, financial position, estimated revenue and losses, forecasts, projected costs, prospects and plans; FiscalNote’s future capital requirements; FiscalNote’s ability to service its repayment obligations and maintain

compliance with covenants and restrictions under its existing debt agreements; demand for FiscalNote’s services and the drivers of that demand; FiscalNote’s ability to provide highly useful, reliable, secure and innovative products and

services to its customers; FiscalNote’s ability to attract and retain customers, and expand its offerings with existing customers; FiscalNote’s ability to develop, enhance, and integrate its existing platforms, products, and services;

risks associated with international operations; potential technical disruptions, cyberattacks, security, privacy or data breaches or other technical or security incidents; competition and competitive pressures; FiscalNote’s ability to retain

or recruit key personnel; the outcome of any known and unknown litigation and regulatory proceedings; FiscalNote’s ability to adequately protect its intellectual property rights; and the possibility that the strategic review undertaken by the

Board of Directors does not result in any transaction or other outcome or that any outcome is disruptive to operations and impacts financial performance. These and other factors discussed in FiscalNote’s SEC filings, including its most recent

reports on Forms 10-K and 10-Q, particularly the Risk Factors sections of those reports, could cause actual results to differ materially from those indicated by the forward-looking statements made herein. These forward-looking statements are based

upon estimates and assumptions that, while considered reasonable by FiscalNote and its management, are inherently uncertain. Nothing herein should be regarded as a representation by any person that the forward-looking statements set forth herein

will occur or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. FiscalNote undertakes no

obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Trademarks FiscalNote owns or has rights to various

trademarks, service marks and trade names it uses in connection with the operation of its businesses. This presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their

respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with FiscalNote or an endorsement or sponsorship by or of

FiscalNote. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, * or © symbols, but such references are not intended to indicate, in any way, that

FiscalNote will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. Use of Data This presentation contains information concerning

FiscalNote’s products, services and industry, including market size and growth rates of the markets in which FiscalNote participates, that are based on industry surveys and publications or other publicly available information, other

third-party survey data and research reports. This information involves many assumptions and limitations; therefore, there can be no guarantee as to the accuracy or reliability of such assumptions and you are cautioned not to give undue weight to

this information. Further, no representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or

modeling contained herein is not an indication as to future performance. This modeling data is subject to change. FiscalNote has not independently verified this third-party information. Similarly, other third-party survey data and research reports

commissioned by FiscalNote, while believed by FiscalNote to be reliable, are based on limited sample sizes and have not been independently verified by FiscalNote. In addition, projections, assumptions, estimates, goals, targets, plans and trends of

the future performance of the industry in which FiscalNote operates, and its future performance, are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause

results to differ materially from those expressed in the estimates made by independent parties and by FiscalNote. FiscalNote assumes no obligation to update such information. © 2025 FiscalNote 2

Table of Contents 1 Products, Markets, and Customers 2 The Company 3 Key

Takeaways 4 Appendix © 2025 FiscalNote 3

SECTION I: Products, Markets, and Customers © 2025 FiscalNote

fiscalnote.com 4

WHAT WE DO Deliver subscription based access to essential and

proprietary policy data, insights and workflow tools via an AI-driven SaaS platform 5 5

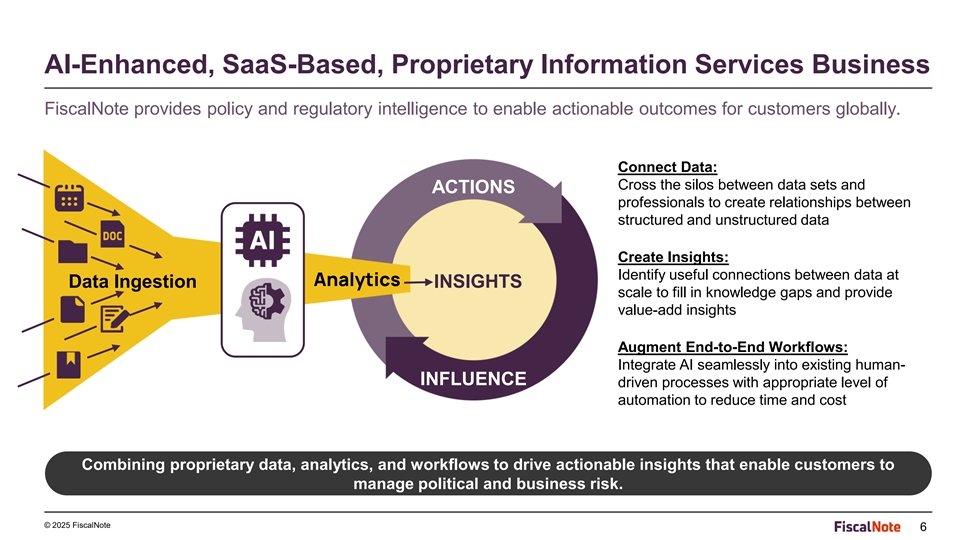

AI-Enhanced, SaaS-Based, Proprietary Information Services Business

FiscalNote provides policy and regulatory intelligence to enable actionable outcomes for customers globally. Connect Data: Cross the silos between data sets and ACTIONS professionals to create relationships between structured and unstructured data

Create Insights: Identify useful connections between data at Analytics Data Ingestion INSIGHTS scale to fill in knowledge gaps and provide value-add insights Augment End-to-End Workflows: Integrate AI seamlessly into existing human- INFLUENCE driven

processes with appropriate level of automation to reduce time and cost Combining proprietary data, analytics, and workflows to drive actionable insights that enable customers to manage political and business risk. © 2025 FiscalNote 6

Our Customers – Sample Logos Non-Profits & Public Sector /

Govt Orgs. Private Sector / Corporates NGOs CONSUMER & HEALTHCARE ENERGY FINANCE RETAIL TMT BUSINESS TRANSPORT EDUCATION SERVICES Note: Data as of December 31, 2024. © 2025 FiscalNote 7

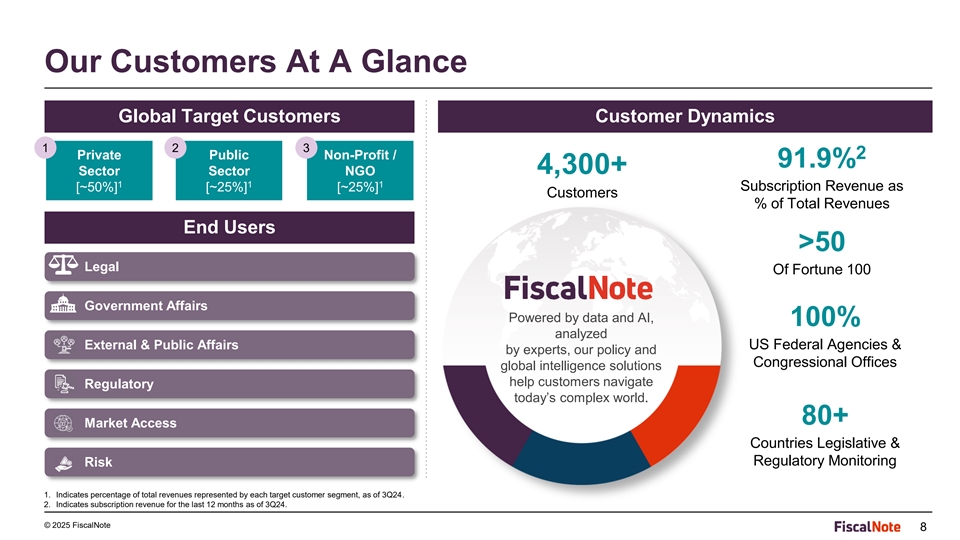

Our Customers At A Glance Global Target Customers Customer Dynamics 1 2

3 2 Private Public Non-Profit / 91.9% 4,300+ Sector Sector NGO 1 1 1 Subscription Revenue as [~50%] [~25%] [~25%] Customers % of Total Revenues End Users >50 Legal Of Fortune 100 Government Affairs Powered by data and AI, 100% analyzed External

& Public Affairs US Federal Agencies & by experts, our policy and Congressional Offices global intelligence solutions help customers navigate Regulatory today’s complex world. 80+ Market Access Countries Legislative & Regulatory

Monitoring Risk 1. Indicates percentage of total revenues represented by each target customer segment, as of 3Q24. 2. Indicates subscription revenue for the last 12 months as of 3Q24. © 2025 FiscalNote 8

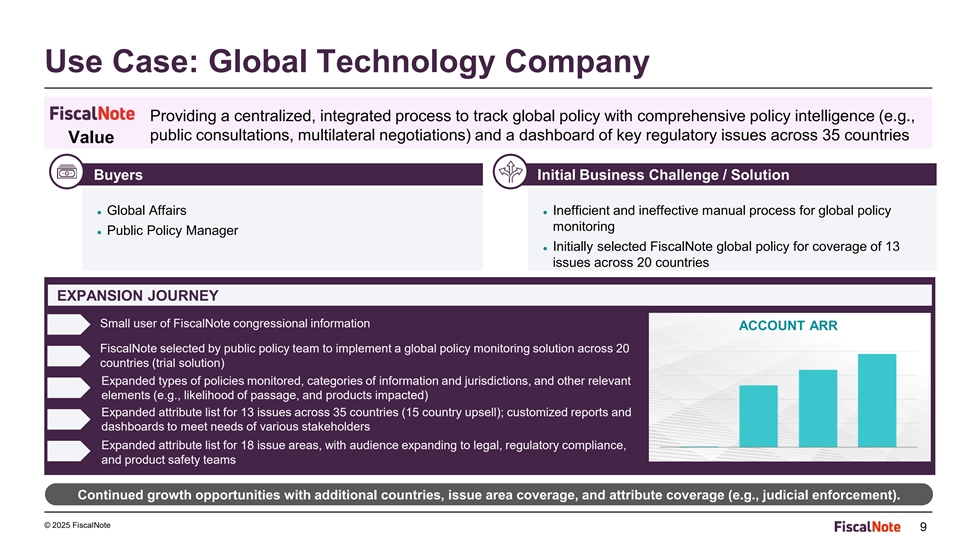

Use Case: Global Technology Company Providing a centralized, integrated

process to track global policy with comprehensive policy intelligence (e.g., public consultations, multilateral negotiations) and a dashboard of key regulatory issues across 35 countries Value Buyers Initial Business Challenge / Solution ●

Global Affairs ● Inefficient and ineffective manual process for global policy monitoring ● Public Policy Manager ● Initially selected FiscalNote global policy for coverage of 13 issues across 20 countries EXPANSION JOURNEY Small

user of FiscalNote congressional information ACCOUNT ARR FiscalNote selected by public policy team to implement a global policy monitoring solution across 20 countries (trial solution) Expanded types of policies monitored, categories of information

and jurisdictions, and other relevant elements (e.g., likelihood of passage, and products impacted) Expanded attribute list for 13 issues across 35 countries (15 country upsell); customized reports and dashboards to meet needs of various

stakeholders Expanded attribute list for 18 issue areas, with audience expanding to legal, regulatory compliance, and product safety teams Continued growth opportunities with additional countries, issue area coverage, and attribute coverage (e.g.,

judicial enforcement). © 2025 FiscalNote 9

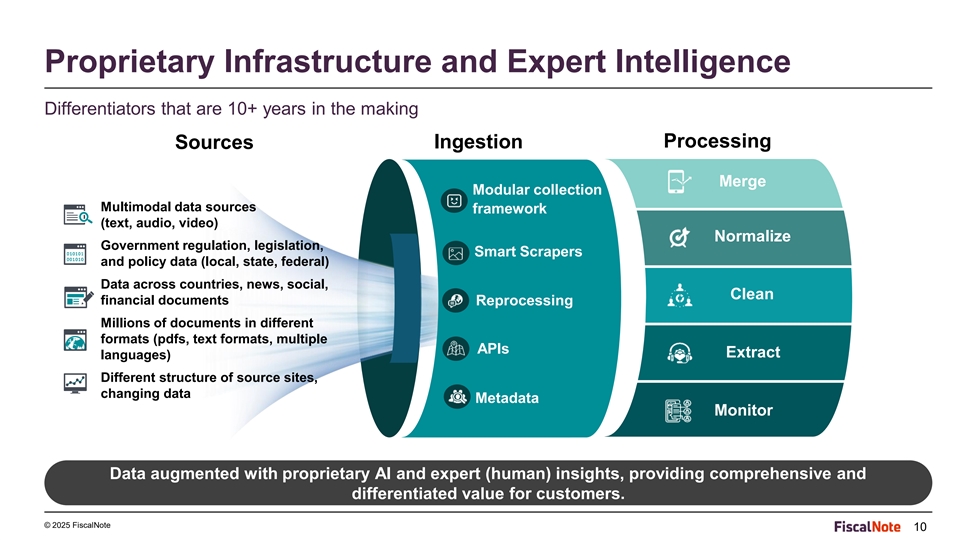

Proprietary Infrastructure and Expert Intelligence Differentiators that

are 10+ years in the making Ingestion Processing Sources Merge Modular collection ● Multimodal data sources framework (text, audio, video) Normalize ● Government regulation, legislation, Smart Scrapers and policy data (local, state,

federal) ● Data across countries, news, social, Clean financial documents Reprocessing ● Millions of documents in different formats (pdfs, text formats, multiple APIs Extract languages) ● Different structure of source sites,

changing data Metadata Monitor Data augmented with proprietary AI and expert (human) insights, providing comprehensive and differentiated value for customers. © 2025 FiscalNote 10

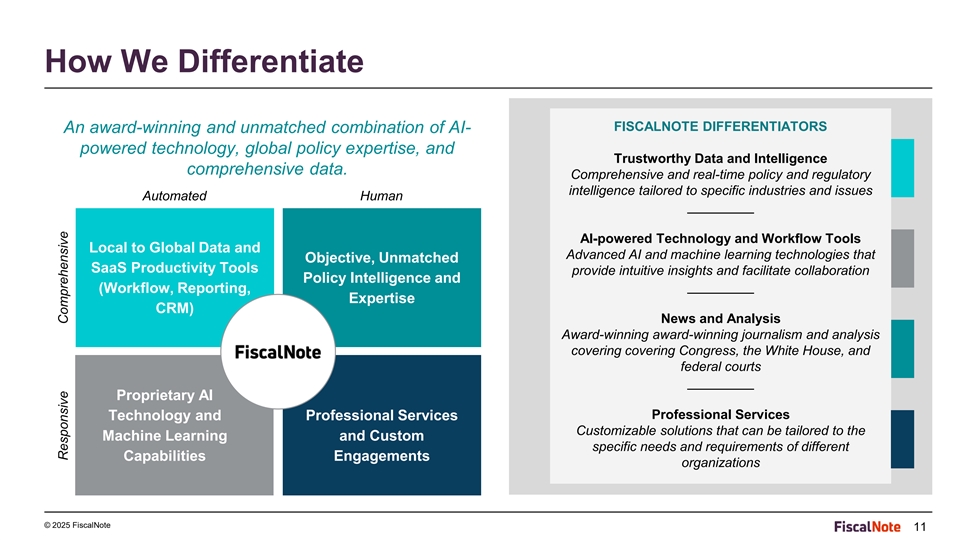

How We Differentiate FISCALNOTE DIFFERENTIATORS An award-winning and

unmatched combination of AI- powered technology, global policy expertise, and Trustworthy Data and Intelligence comprehensive data. Comprehensive and real-time policy and regulatory intelligence tailored to specific industries and issues Automated

Human _________ AI-powered Technology and Workflow Tools Local to Global Data and Advanced AI and machine learning technologies that Objective, Unmatched SaaS Productivity Tools provide intuitive insights and facilitate collaboration Policy

Intelligence and _________ (Workflow, Reporting, Expertise CRM) News and Analysis Award-winning award-winning journalism and analysis covering covering Congress, the White House, and federal courts _________ Proprietary AI Professional Services

Technology and Professional Services Customizable solutions that can be tailored to the Machine Learning and Custom specific needs and requirements of different Capabilities Engagements organizations © 2025 FiscalNote 11 Responsive

Comprehensive

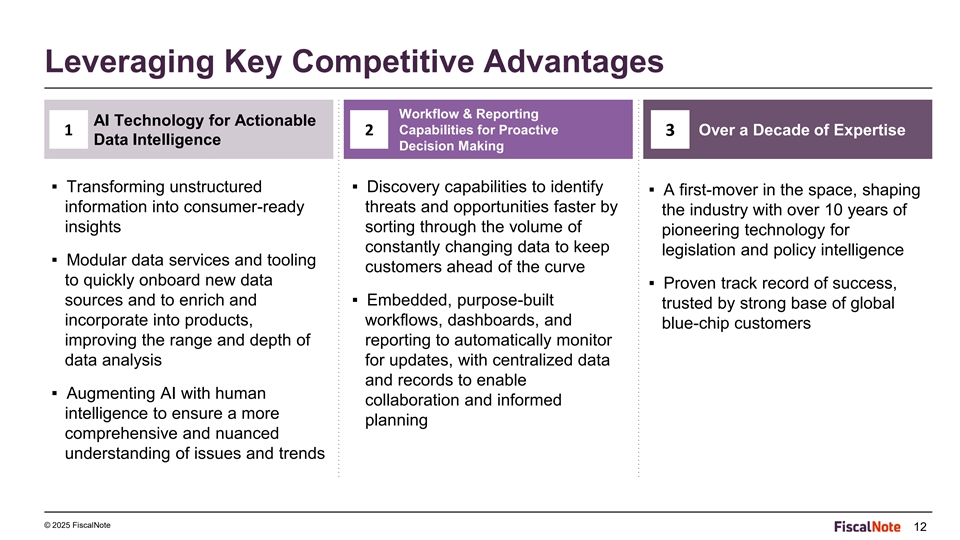

Leveraging Key Competitive Advantages Workflow & Reporting 4 AI

Technology for Actionable Capabilities for Proactive 1 2 3 Over a Decade of Expertise Data Intelligence Decision Making ▪ Transforming unstructured ▪ Discovery capabilities to identify ▪ A first-mover in the space, shaping

information into consumer-ready threats and opportunities faster by the industry with over 10 years of insights sorting through the volume of pioneering technology for constantly changing data to keep legislation and policy intelligence ▪

Modular data services and tooling customers ahead of the curve to quickly onboard new data ▪ Proven track record of success, sources and to enrich and ▪ Embedded, purpose-built trusted by strong base of global incorporate into products,

workflows, dashboards, and blue-chip customers improving the range and depth of reporting to automatically monitor data analysis for updates, with centralized data and records to enable ▪ Augmenting AI with human collaboration and informed

intelligence to ensure a more planning comprehensive and nuanced understanding of issues and trends © 2025 FiscalNote 12

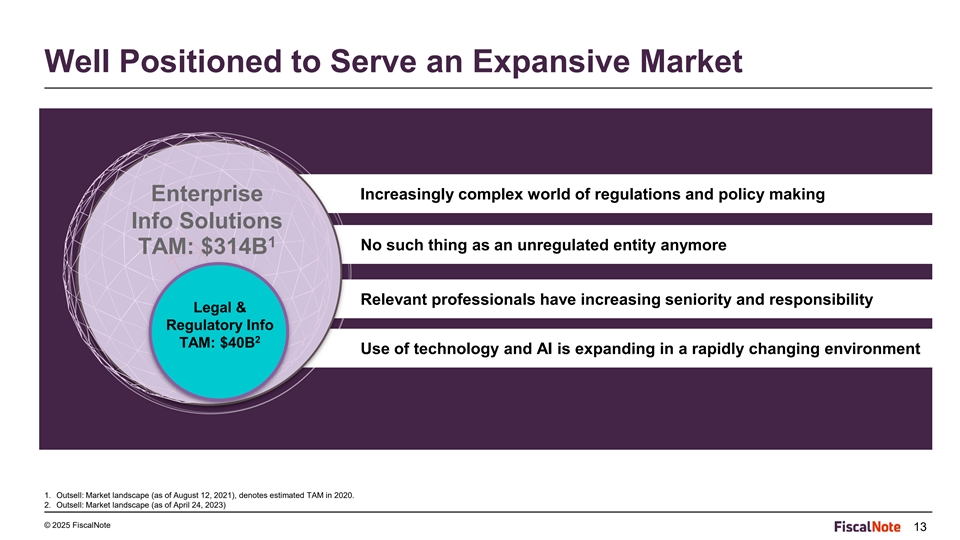

Well Positioned to Serve an Expansive Market Increasingly complex world

of regulations and policy making Enterprise Info Solutions 1 No such thing as an unregulated entity anymore TAM: $314B Relevant professionals have increasing seniority and responsibility Legal & Regulatory Info 2 TAM: $40B Use of technology and

AI is expanding in a rapidly changing environment 1. Outsell: Market landscape (as of August 12, 2021), denotes estimated TAM in 2020. 2. Outsell: Market landscape (as of April 24, 2023) © 2025 FiscalNote 13

SECTION II: The Company © 2025 FiscalNote fiscalnote.com

14

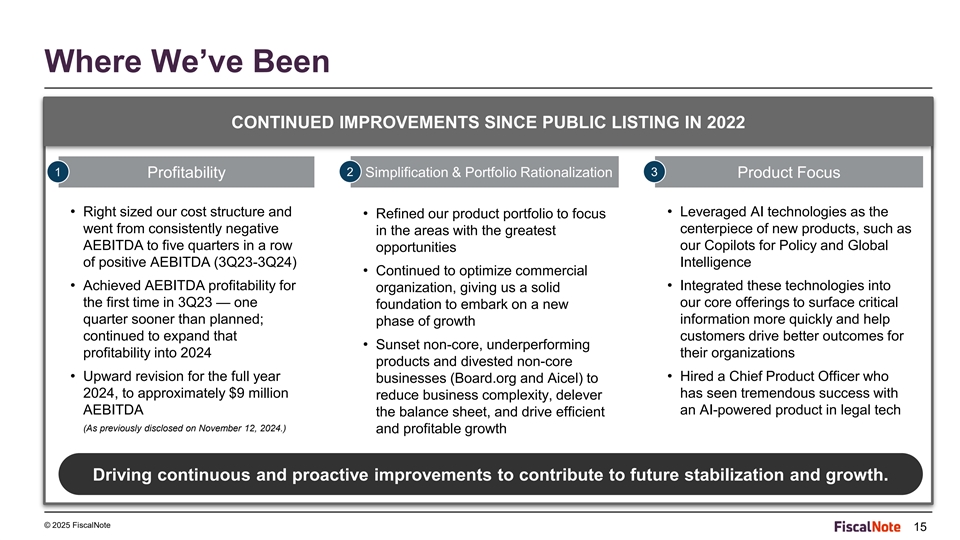

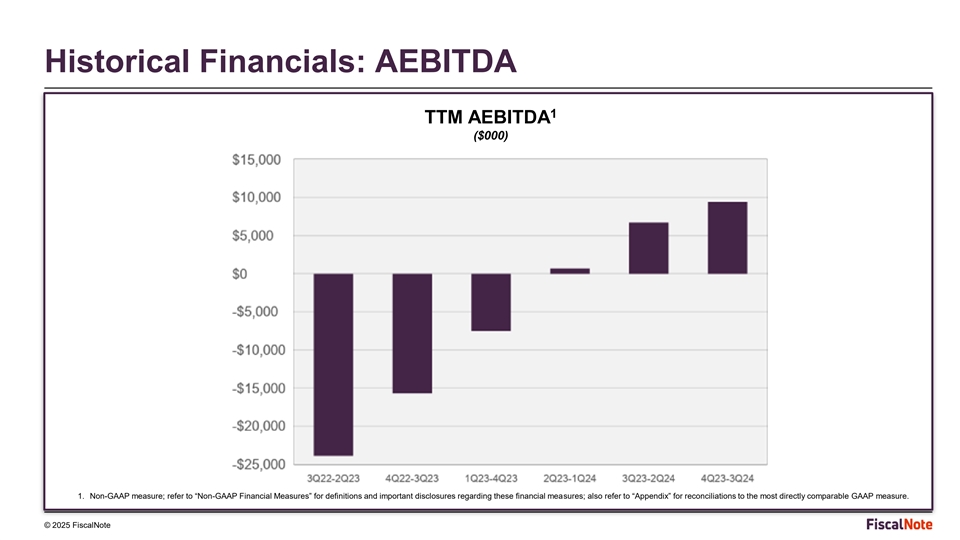

Where We’ve Been CONTINUED IMPROVEMENTS SINCE PUBLIC LISTING IN

2022 1 2 3 Simplification & Portfolio Rationalization Profitability Product Focus • Right sized our cost structure and • Leveraged AI technologies as the • Refined our product portfolio to focus went from consistently negative

centerpiece of new products, such as in the areas with the greatest AEBITDA to five quarters in a row our Copilots for Policy and Global opportunities of positive AEBITDA (3Q23-3Q24) Intelligence • Continued to optimize commercial •

Achieved AEBITDA profitability for • Integrated these technologies into organization, giving us a solid the first time in 3Q23 — one our core offerings to surface critical foundation to embark on a new quarter sooner than planned;

information more quickly and help phase of growth continued to expand that customers drive better outcomes for • Sunset non-core, underperforming profitability into 2024 their organizations products and divested non-core • Upward

revision for the full year • Hired a Chief Product Officer who businesses (Board.org and Aicel) to 2024, to approximately $9 million has seen tremendous success with reduce business complexity, delever AEBITDA an AI-powered product in legal

tech the balance sheet, and drive efficient (As previously disclosed on November 12, 2024.) and profitable growth Driving continuous and proactive improvements to contribute to future stabilization and growth. © 2025 FiscalNote 15

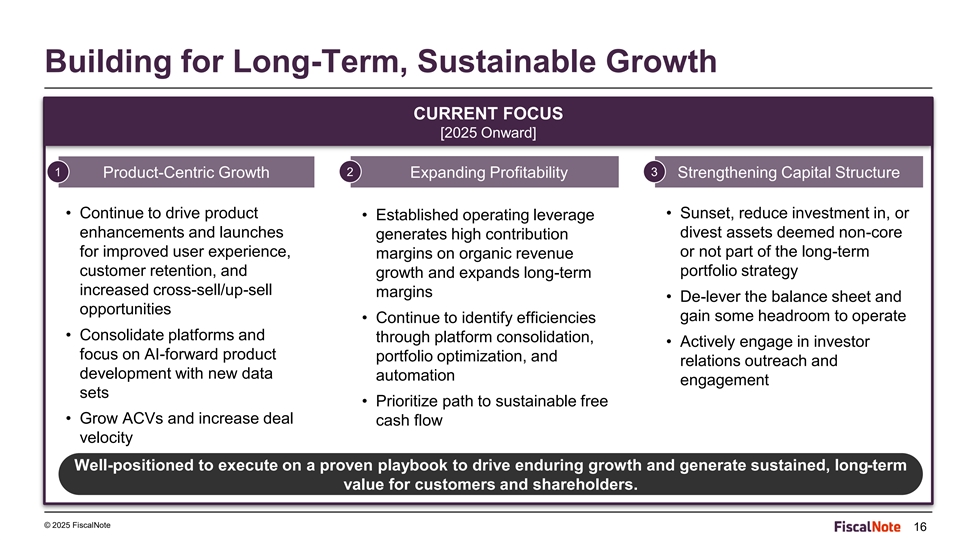

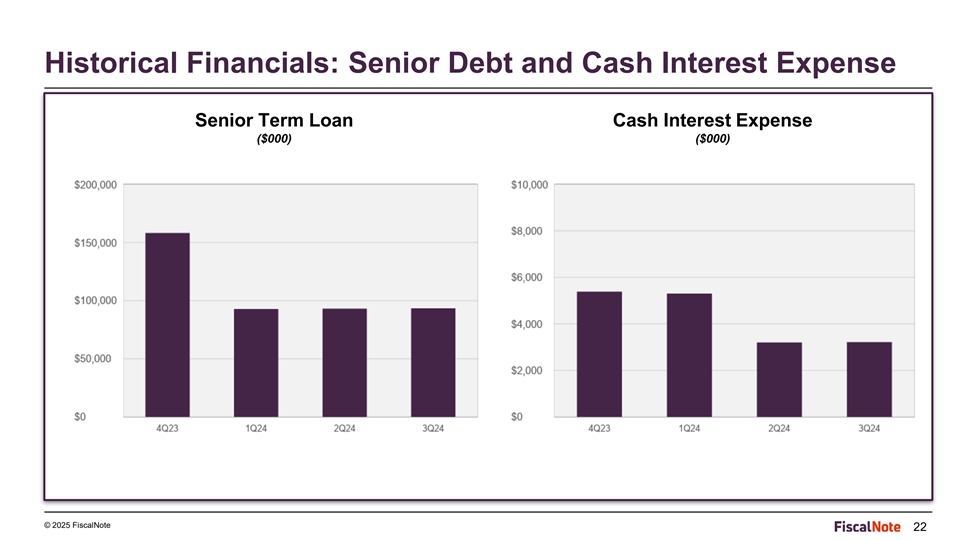

Building for Long-Term, Sustainable Growth CURRENT FOCUS [2025 Onward]

1 2 3 Product-Centric Growth Expanding Profitability Strengthening Capital Structure • Continue to drive product • Sunset, reduce investment in, or • Established operating leverage enhancements and launches divest assets deemed

non-core generates high contribution for improved user experience, or not part of the long-term margins on organic revenue customer retention, and portfolio strategy growth and expands long-term increased cross-sell/up-sell margins • De-lever

the balance sheet and opportunities gain some headroom to operate • Continue to identify efficiencies • Consolidate platforms and through platform consolidation, • Actively engage in investor focus on AI-forward product portfolio

optimization, and relations outreach and development with new data automation engagement sets • Prioritize path to sustainable free • Grow ACVs and increase deal cash flow velocity Well-positioned to execute on a proven playbook to drive

enduring growth and generate sustained, long-term value for customers and shareholders. © 2025 FiscalNote 16

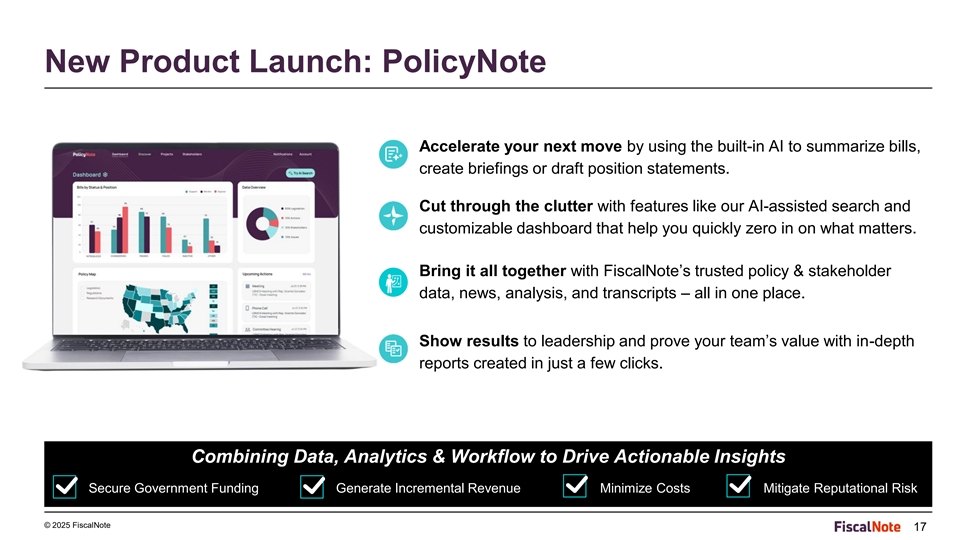

New Product Launch: PolicyNote Accelerate your next move by using the

built-in AI to summarize bills, create briefings or draft position statements. Cut through the clutter with features like our AI-assisted search and customizable dashboard that help you quickly zero in on what matters. Bring it all together with

FiscalNote’s trusted policy & stakeholder data, news, analysis, and transcripts – all in one place. Show results to leadership and prove your team’s value with in-depth reports created in just a few clicks. Combining Data,

Analytics & Workflow to Drive Actionable Insights Secure Government Funding Generate Incremental Revenue Minimize Costs Mitigate Reputational Risk © 2025 FiscalNote 17

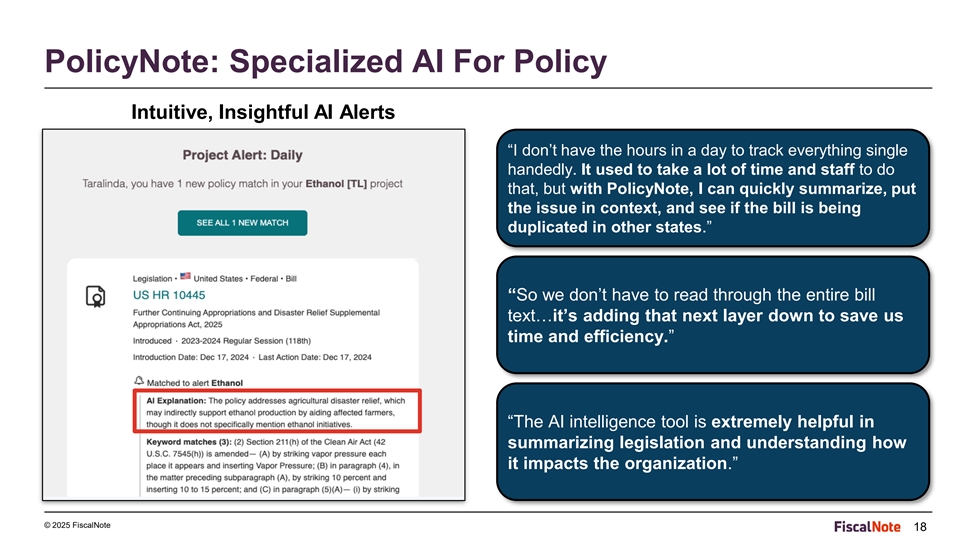

PolicyNote: Specialized AI For Policy Intuitive, Insightful AI Alerts

“I don’t have the hours in a day to track everything single handedly. It used to take a lot of time and staff to do that, but with PolicyNote, I can quickly summarize, put the issue in context, and see if the bill is being duplicated in

other states.” “So we don’t have to read through the entire bill text…it’s adding that next layer down to save us time and efficiency.” “The AI intelligence tool is extremely helpful in summarizing

legislation and understanding how it impacts the organization.” © 2025 FiscalNote 18

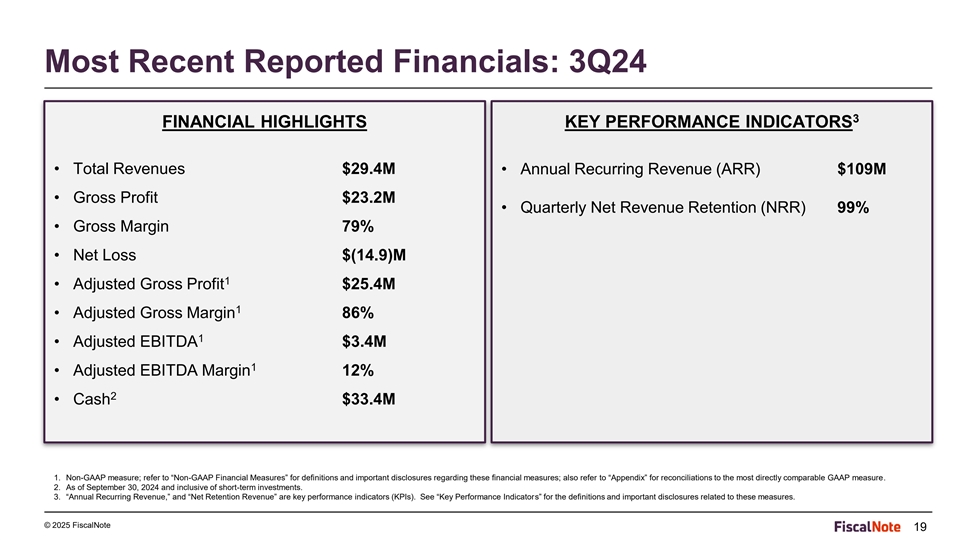

Most Recent Reported Financials: 3Q24 3 FINANCIAL HIGHLIGHTS KEY

PERFORMANCE INDICATORS • Total Revenues $29.4M • Annual Recurring Revenue (ARR) $109M • Gross Profit $23.2M • Quarterly Net Revenue Retention (NRR) 99% • Gross Margin 79% • Net Loss $(14.9)M 1 • Adjusted

Gross Profit $25.4M 1 • Adjusted Gross Margin 86% 1 • Adjusted EBITDA $3.4M 1 • Adjusted EBITDA Margin 12% 2 • Cash $33.4M 1. Non-GAAP measure; refer to “Non-GAAP Financial Measures” for definitions and important

disclosures regarding these financial measures; also refer to “Appendix” for reconciliations to the most directly comparable GAAP measure. 2. As of September 30, 2024 and inclusive of short-term investments. 3. “Annual Recurring

Revenue,” and “Net Retention Revenue” are key performance indicators (KPIs). See “Key Performance Indicators” for the definitions and important disclosures related to these measures. © 2025 FiscalNote 19

Historical Financials: AEBITDA 1 TTM AEBITDA ($000) 1. Non-GAAP

measure; refer to “Non-GAAP Financial Measures” for definitions and important disclosures regarding these financial measures; also refer to “Appendix” for reconciliations to the most directly comparable GAAP measure. ©

2025 FiscalNote 20

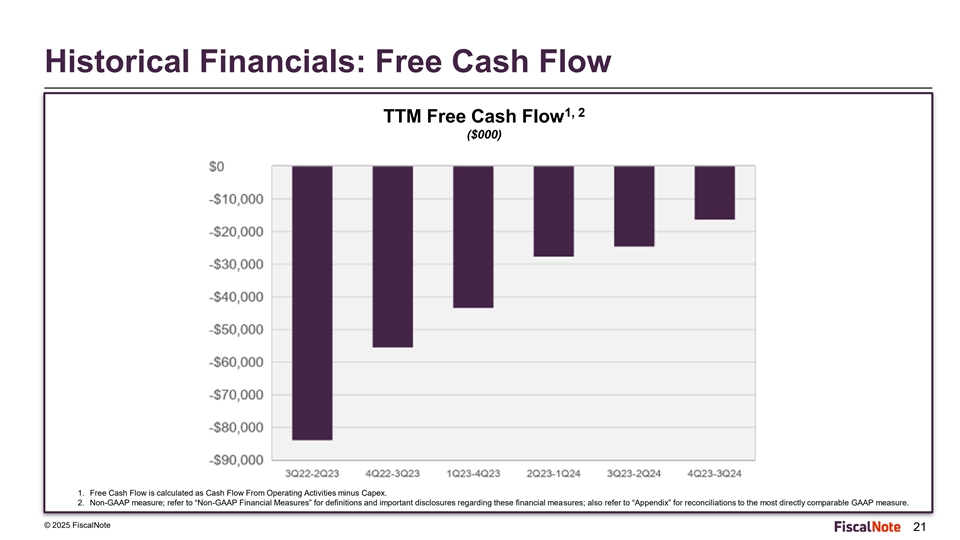

Historical Financials: Free Cash Flow 1, 2 TTM Free Cash Flow ($000) 1.

Free Cash Flow is calculated as Cash Flow From Operating Activities minus Capex. 2. Non-GAAP measure; refer to “Non-GAAP Financial Measures” for definitions and important disclosures regarding these financial measures; also refer to

“Appendix” for reconciliations to the most directly comparable GAAP measure. © 2025 FiscalNote 21

Historical Financials: Senior Debt and Cash Interest Expense Senior

Term Loan Cash Interest Expense ($000) ($000) © 2025 FiscalNote 22

SECTION III: Key Takeaways © 2025 FiscalNote fiscalnote.com

23

Key Takeaways Continue to Implement Strategic Shift to Product-Led

Growth and Drive 1 Improvements to Key Performance Metrics Continue to Exercise Operational Discipline and Drive Margin Expansion 2 Through Operating Leverage Continue to Optimize Costs and Rationalize Portfolio and Drive Sustainable 3 Profitability

(AEBITDA) and Durable FCF Continue to De-lever Balance Sheet and Drive Strengthening of the Capital 4 Structure to Fund Future Growth © 2025 FiscalNote 24

Q&A Session © 2025 FiscalNote fiscalnote.com 25

SECTION IV: Appendix © 2025 FiscalNote fiscalnote.com

26

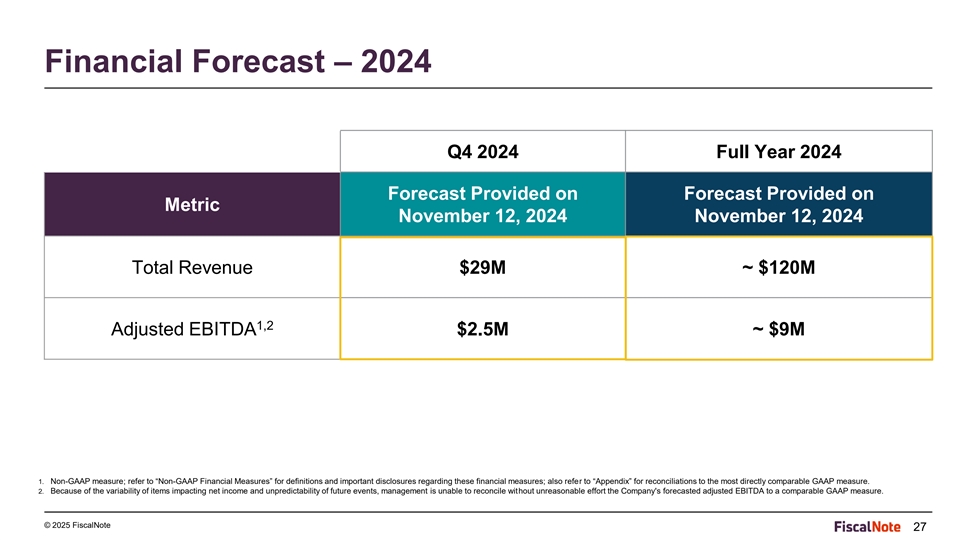

Financial Forecast – 2024 Q4 2024 Full Year 2024 Forecast

Provided on Forecast Provided on Metric November 12, 2024 November 12, 2024 Total Revenue $29M ~ $120M 1,2 Adjusted EBITDA $2.5M ~ $9M 1. Non-GAAP measure; refer to “Non-GAAP Financial Measures” for definitions and important disclosures

regarding these financial measures; also refer to “Appendix” for reconciliations to the most directly comparable GAAP measure. 2. Because of the variability of items impacting net income and unpredictability of future events, management

is unable to reconcile without unreasonable effort the Company's forecasted adjusted EBITDA to a comparable GAAP measure. © 2025 FiscalNote 27

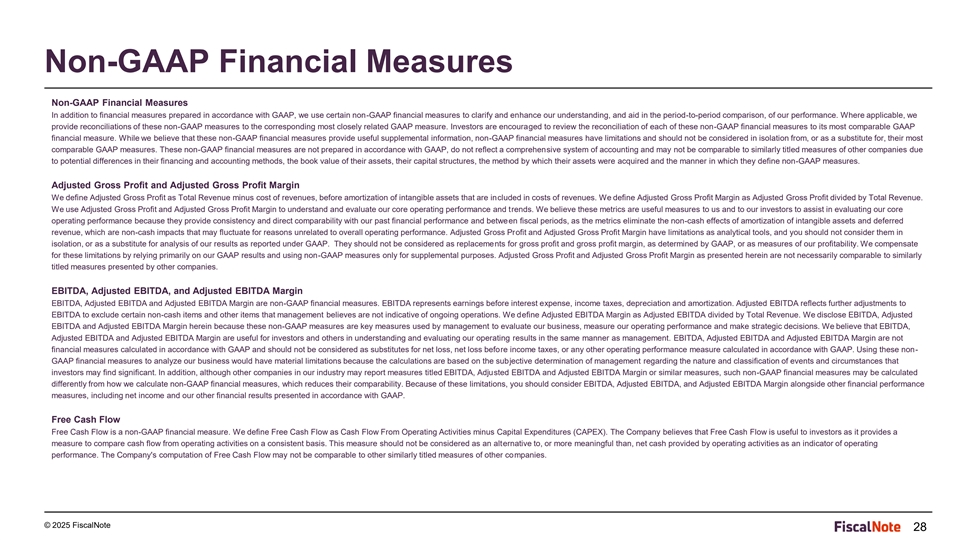

Non-GAAP Financial Measures Non-GAAP Financial Measures In addition to

financial measures prepared in accordance with GAAP, we use certain non-GAAP financial measures to clarify and enhance our understanding, and aid in the period-to-period comparison, of our performance. Where applicable, we provide reconciliations of

these non-GAAP measures to the corresponding most closely related GAAP measure. Investors are encouraged to review the reconciliation of each of these non-GAAP financial measures to its most comparable GAAP financial measure. While we believe that

these non-GAAP financial measures provide useful supplemental information, non-GAAP financial measures have limitations and should not be considered in isolation from, or as a substitute for, their most comparable GAAP measures. These non-GAAP

financial measures are not prepared in accordance with GAAP, do not reflect a comprehensive system of accounting and may not be comparable to similarly titled measures of other companies due to potential differences in their financing and accounting

methods, the book value of their assets, their capital structures, the method by which their assets were acquired and the manner in which they define non-GAAP measures. Adjusted Gross Profit and Adjusted Gross Profit Margin We define Adjusted Gross

Profit as Total Revenue minus cost of revenues, before amortization of intangible assets that are included in costs of revenues. We define Adjusted Gross Profit Margin as Adjusted Gross Profit divided by Total Revenue. We use Adjusted Gross Profit

and Adjusted Gross Profit Margin to understand and evaluate our core operating performance and trends. We believe these metrics are useful measures to us and to our investors to assist in evaluating our core operating performance because they

provide consistency and direct comparability with our past financial performance and between fiscal periods, as the metrics eliminate the non-cash effects of amortization of intangible assets and deferred revenue, which are non-cash impacts that may

fluctuate for reasons unrelated to overall operating performance. Adjusted Gross Profit and Adjusted Gross Profit Margin have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of our

results as reported under GAAP. They should not be considered as replacements for gross profit and gross profit margin, as determined by GAAP, or as measures of our profitability. We compensate for these limitations by relying primarily on our GAAP

results and using non-GAAP measures only for supplemental purposes. Adjusted Gross Profit and Adjusted Gross Profit Margin as presented herein are not necessarily comparable to similarly titled measures presented by other companies. EBITDA, Adjusted

EBITDA, and Adjusted EBITDA Margin EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. EBITDA represents earnings before interest expense, income taxes, depreciation and amortization. Adjusted EBITDA reflects further

adjustments to EBITDA to exclude certain non-cash items and other items that management believes are not indicative of ongoing operations. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by Total Revenue. We disclose EBITDA, Adjusted

EBITDA and Adjusted EBITDA Margin herein because these non-GAAP measures are key measures used by management to evaluate our business, measure our operating performance and make strategic decisions. We believe that EBITDA, Adjusted EBITDA and

Adjusted EBITDA Margin are useful for investors and others in understanding and evaluating our operating results in the same manner as management. EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are not financial measures calculated in accordance

with GAAP and should not be considered as substitutes for net loss, net loss before income taxes, or any other operating performance measure calculated in accordance with GAAP. Using these non- GAAP financial measures to analyze our business would

have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant. In addition, although other companies

in our industry may report measures titled EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin or similar measures, such non-GAAP financial measures may be calculated differently from how we calculate non-GAAP financial measures, which reduces their

comparability. Because of these limitations, you should consider EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin alongside other financial performance measures, including net income and our other financial results presented in accordance with

GAAP. Free Cash Flow Free Cash Flow is a non-GAAP financial measure. We define Free Cash Flow as Cash Flow From Operating Activities minus Capital Expenditures (CAPEX). The Company believes that Free Cash Flow is useful to investors as it provides a

measure to compare cash flow from operating activities on a consistent basis. This measure should not be considered as an alternative to, or more meaningful than, net cash provided by operating activities as an indicator of operating performance.

The Company's computation of Free Cash Flow may not be comparable to other similarly titled measures of other companies. © 2025 FiscalNote 28

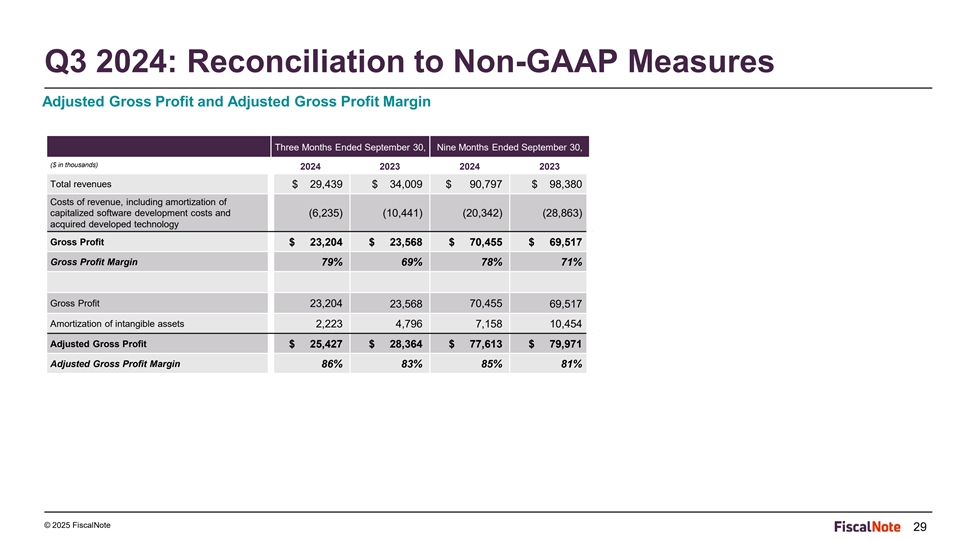

Q3 2024: Reconciliation to Non-GAAP Measures Adjusted Gross Profit and

Adjusted Gross Profit Margin Three Months Ended September 30, Nine Months Ended September 30, ($ in thousands) 2024 2023 2024 2023 Total revenues $ 29,439 $ 34,009 $ 90,797 $ 98,380 Costs of revenue, including amortization of capitalized software

development costs and (6,235) (10,441) (20,342) (28,863) acquired developed technology Gross Profit $ 23,204 $ 23,568 $ 70,455 $ 69,517 Gross Profit Margin 79% 69% 78% 71% Gross Profit 23,204 70,455 23,568 69,517 Amortization of intangible assets

2,223 4,796 7,158 10,454 Adjusted Gross Profit $ 25,427 $ 28,364 $ 77,613 $ 79,971 Adjusted Gross Profit Margin 86% 83% 85% 81% © 2025 FiscalNote 29

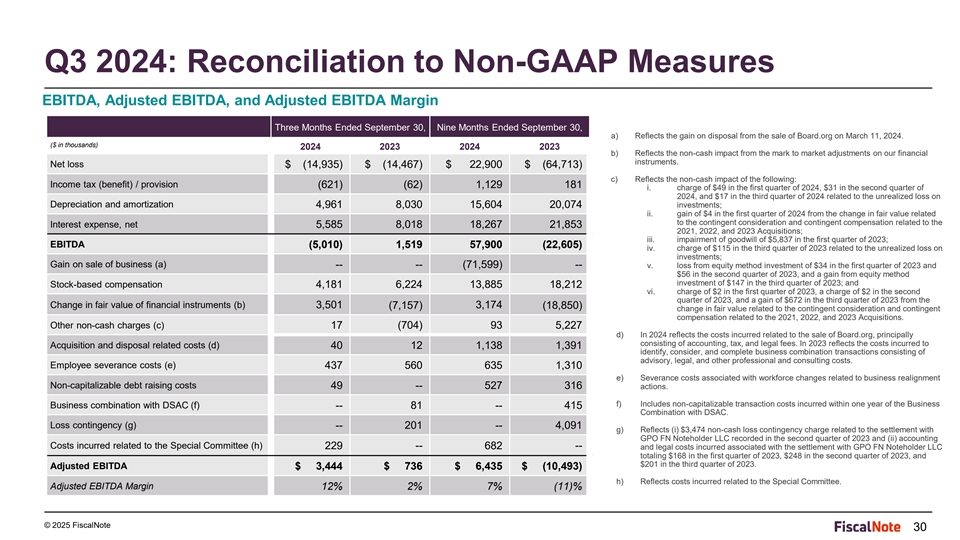

Q3 2024: Reconciliation to Non-GAAP Measures EBITDA, Adjusted EBITDA,

and Adjusted EBITDA Margin Three Months Ended September 30, Nine Months Ended September 30, a) Reflects the gain on disposal from the sale of Board.org on March 11, 2024. ($ in thousands) 2024 2023 2024 2023 b) Reflects the non-cash impact from the

mark to market adjustments on our financial instruments. Net loss $ (14,935) $ (14,467) $ 22,900 $ (64,713) c) Reflects the non-cash impact of the following: Income tax (benefit) / provision (621) (62) 1,129 181 i. charge of $49 in the first quarter

of 2024, $31 in the second quarter of 2024, and $17 in the third quarter of 2024 related to the unrealized loss on Depreciation and amortization 4,961 8,030 15,604 20,074 investments; ii. gain of $4 in the first quarter of 2024 from the change in

fair value related to the contingent consideration and contingent compensation related to the Interest expense, net 5,585 8,018 18,267 21,853 2021, 2022, and 2023 Acquisitions; iii. impairment of goodwill of $5,837 in the first quarter of 2023;

EBITDA (5,010) 1,519 57,900 (22,605) iv. charge of $115 in the third quarter of 2023 related to the unrealized loss on investments; Gain on sale of business (a) -- -- (71,599) -- v. loss from equity method investment of $34 in the first quarter of

2023 and $56 in the second quarter of 2023, and a gain from equity method investment of $147 in the third quarter of 2023; and Stock-based compensation 4,181 6,224 13,885 18,212 vi. charge of $2 in the first quarter of 2023, a charge of $2 in the

second quarter of 2023, and a gain of $672 in the third quarter of 2023 from the Change in fair value of financial instruments (b) 3,501 (7,157) 3,174 (18,850) change in fair value related to the contingent consideration and contingent compensation

related to the 2021, 2022, and 2023 Acquisitions. Other non-cash charges (c) 17 (704) 93 5,227 d) In 2024 reflects the costs incurred related to the sale of Board.org, principally consisting of accounting, tax, and legal fees. In 2023 reflects the

costs incurred to Acquisition and disposal related costs (d) 40 12 1,138 1,391 identify, consider, and complete business combination transactions consisting of advisory, legal, and other professional and consulting costs. Employee severance costs

(e) 437 560 635 1,310 e) Severance costs associated with workforce changes related to business realignment Non-capitalizable debt raising costs 49 -- 527 316 actions. f) Includes non-capitalizable transaction costs incurred within one year of the

Business Business combination with DSAC (f) -- 81 -- 415 Combination with DSAC. Loss contingency (g) -- 201 -- 4,091 g) Reflects (i) $3,474 non-cash loss contingency charge related to the settlement with GPO FN Noteholder LLC recorded in the second

quarter of 2023 and (ii) accounting Costs incurred related to the Special Committee (h) 229 -- 682 -- and legal costs incurred associated with the settlement with GPO FN Noteholder LLC totaling $168 in the first quarter of 2023, $248 in the second

quarter of 2023, and $201 in the third quarter of 2023. Adjusted EBITDA $ 3,444 $ 736 $ 6,435 $ (10,493) h) Reflects costs incurred related to the Special Committee. Adjusted EBITDA Margin 12% 2% 7% (11)% © 2025 FiscalNote 30

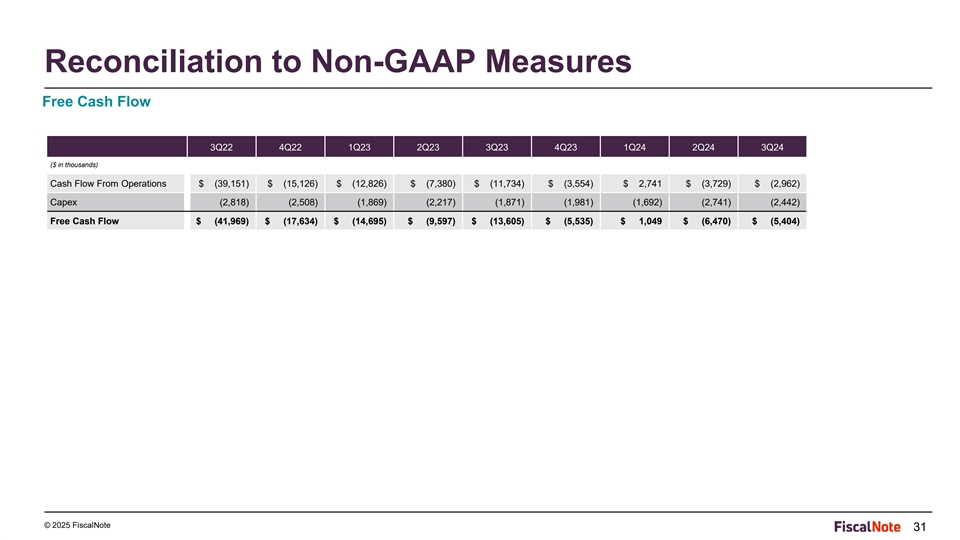

Reconciliation to Non-GAAP Measures Free Cash Flow 3Q22 4Q22 1Q23 2Q23

3Q23 4Q23 1Q24 2Q24 3Q24 ($ in thousands) Cash Flow From Operations $ (39,151) $ (15,126) $ (12,826) $ (7,380) $ (11,734) $ (3,554) $ 2,741 $ (3,729) $ (2,962) Capex (2,818) (2,508) (1,869) (2,217) (1,871) (1,981) (1,692) (2,741) (2,442) Free Cash

Flow $ (41,969) $ (17,634) $ (14,695) $ (9,597) $ (13,605) $ (5,535) $ 1,049 $ (6,470) $ (5,404) © 2025 FiscalNote 31

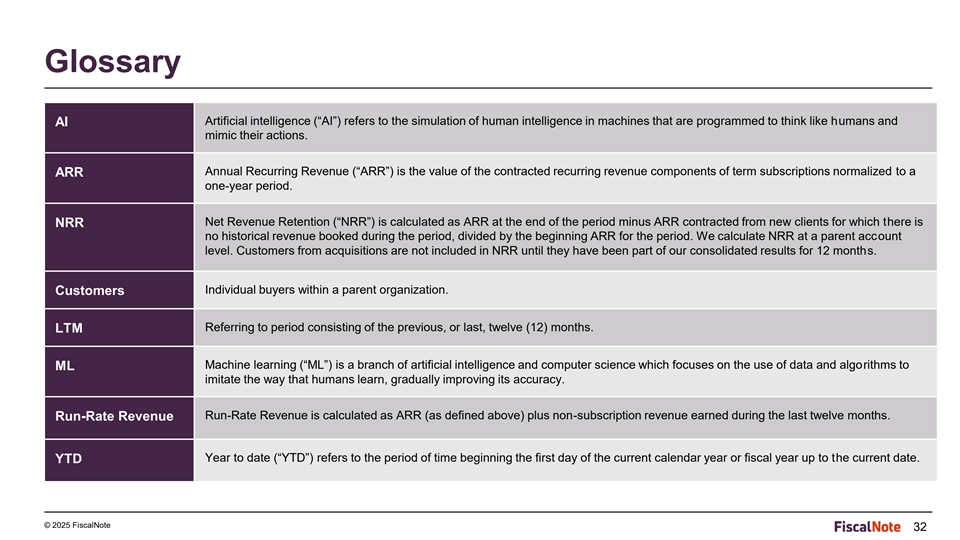

Glossary Artificial intelligence (“AI”) refers to the

simulation of human intelligence in machines that are programmed to think like humans and AI mimic their actions. Annual Recurring Revenue (“ARR”) is the value of the contracted recurring revenue components of term subscriptions

normalized to a ARR one-year period. Net Revenue Retention (“NRR”) is calculated as ARR at the end of the period minus ARR contracted from new clients for which there is NRR no historical revenue booked during the period, divided by the

beginning ARR for the period. We calculate NRR at a parent account level. Customers from acquisitions are not included in NRR until they have been part of our consolidated results for 12 months. Individual buyers within a parent organization.

Customers Referring to period consisting of the previous, or last, twelve (12) months. LTM Machine learning (“ML”) is a branch of artificial intelligence and computer science which focuses on the use of data and algorithms to ML imitate

the way that humans learn, gradually improving its accuracy. Run-Rate Revenue is calculated as ARR (as defined above) plus non-subscription revenue earned during the last twelve months. Run-Rate Revenue Year to date (“YTD”) refers to the

period of time beginning the first day of the current calendar year or fiscal year up to the current date. YTD © 2025 FiscalNote 32

Contact ir@fiscalnote.com © 2025 FiscalNote fiscalnote.com

33

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=note_Class160ACommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

FiscaNote (NYSE:NOTE)

Historical Stock Chart

From Dec 2024 to Jan 2025

FiscaNote (NYSE:NOTE)

Historical Stock Chart

From Jan 2024 to Jan 2025