Form 8-K - Current report

January 03 2024 - 10:25AM

Edgar (US Regulatory)

0001534504FALSE000156601100015345042024-01-022024-01-020001534504pbf:PBFHoldingMember2024-01-022024-01-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): January 2, 2024

PBF ENERGY INC.

PBF HOLDING COMPANY LLC

(Exact Name of Registrant as Specified in its Charter) | | | | | | | | |

| Delaware | 001-35764 | 45-3763855 |

| Delaware | 333-186007 | 27-2198168 |

(State or other jurisdiction

of incorporation or organization) | (Commission

File Number) | (I.R.S. Employer

Identification Number) |

_____________________________________________

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

(Address of the Principal Executive Offices) (Zip Code)

(973) 455-7500

(Registrant’s Telephone Number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

⃞ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

⃞ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

⃞ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

⃞ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of The Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $.001 | PBF | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12-b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter): o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 - Regulation FD Disclosure.

On January 2, 2024, PBF Energy Inc. and its subsidiary, PBF Holding Company LLC (collectively, the “Company”), issued an investor presentation announcing their financial guidance for fiscal year 2024. A copy of the presentation is furnished with this Current Report as Exhibit 99.1 and is incorporated herein by reference.

The Company’s presentation materials, available on the Investor Relations section of the Company’s website at www.pbfenergy.com, are furnished with this Current Report as Exhibit 99.1 and are incorporated herein by reference.

The information in this report is being furnished, not filed, pursuant to Regulation FD. Accordingly, the information in Items 7.01 and 9.01 of this report will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company or any of its affiliates.

Forward-Looking Statements

Statements in this presentation relating to future plans, results, performance, expectations, achievements and the like are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, the Company’s expectations with respect to St. Bernard Renewables LLC ("SBR"), including SBR plans, objectives, expectations and intentions with respect to future earnings and operations. These forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which may be beyond the Company's control, that may cause actual results to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors and uncertainties that may cause actual results to differ include but are not limited to the risks disclosed in the Company's filings with the Securities and Exchange Commission, our ability to operate safely, reliably, sustainably and in an environmentally responsible manner; our ability to successfully diversify our operations; our ability to make acquisitions or investments, including in renewable diesel production, and to realize the benefits from such acquisitions or investments; our ability to successfully manage the operations of our 50-50 equity method investment in SBR; our expectations with respect to our capital spending and turnaround projects; risks associated with our obligation to buy Renewable Identification Numbers and related market risks related to the price volatility thereof; the possibility that we might reduce or not pay further dividends in the future; certain developments in the global oil markets and their impact on the global macroeconomic conditions; risks relating to the securities markets generally; the impact of changes in inflation, interest rates and capital costs; and the impact of market conditions, unanticipated developments, regulatory approvals, changes in laws and other events that negatively impact the Company. All forward-looking statements speak only as of the date hereof. The Company undertakes no obligation to revise or update any forward-looking statements except as may be required by applicable law.

Item 9.01 - Financial Statements and Exhibits.

(d) Exhibits | | | | | |

| Exhibit No. | Description |

| |

| Presentation materials dated January 2024 |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | |

| | | |

| Date: | January 3, 2024 | PBF Energy Inc. |

| | (Registrant) |

| | | | |

| | By: | /s/ Karen B. Davis | |

| | Name: | Karen B. Davis |

| | Title: | Senior Vice President, Chief Financial |

| | | Officer |

| | | | | | | | | | | | | | |

| | | |

| | | |

| Date: | January 3, 2024 | PBF Holding Company LLC |

| | (Registrant) |

| | | | |

| | By: | /s/ Karen B. Davis | |

| | Name: | Karen B. Davis |

| | Title: | Senior Vice President, Chief Financial |

| | | Officer |

PBF Energy 2024 Guidance Information January 2024

Safe Harbor Statements Statements in this presentation relating to future plans, results, performance, expectations, achievements and the like are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, the Company’s expectations with respect to SBR, including SBR plans, objectives, expectations and intentions with respect to future earnings and operations. These forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which may be beyond the Company's control, that may cause actual results to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors and uncertainties that may cause actual results to differ include but are not limited to the risks disclosed in the Company's filings with the SEC, our ability to operate safely, reliably, sustainably and in an environmentally responsible manner; our ability to successfully diversify our operations; our ability to make acquisitions or investments, including in renewable diesel production, and to realize the benefits from such acquisitions or investments; our ability to successfully manage the operations of our 50-50 equity method investment in SBR; our expectations with respect to our capital spending and turnaround projects; risks associated with our obligation to buy Renewable Identification Numbers and related market risks related to the price volatility thereof; the possibility that we might reduce or not pay further dividends in the future; certain developments in the global oil markets and their impact on the global macroeconomic conditions; risks relating to the securities markets generally; the impact of changes in inflation, interest rates and capital costs; and the impact of market conditions, unanticipated developments, regulatory approvals, changes in laws and other events that negatively impact the Company. All forward-looking statements speak only as of the date hereof. The Company undertakes no obligation to revise or update any forward-looking statements except as may be required by applicable law. See the Appendix for applicable reconciliations of the differences between the financial measures in accordance with U.S. generally accepted accounting principles (“GAAP”) and non-GAAP financial measures used in this presentation, including various estimates of EBITDA (earnings before interest, income taxes, depreciation and amortization), and their most directly comparable GAAP financial measures. 2

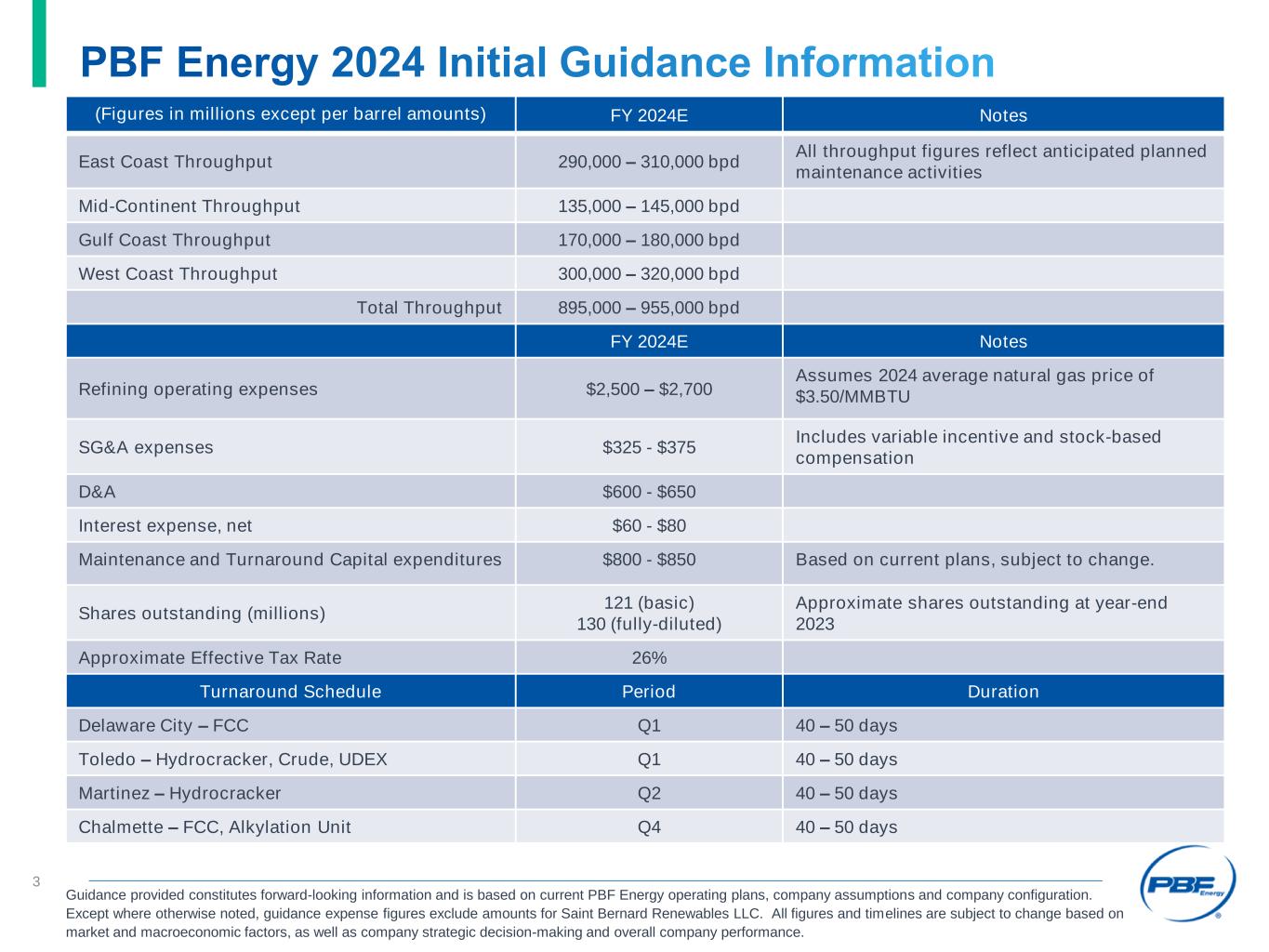

PBF Energy 2020 Guidance Guidance provided constitutes forward-looking information and is based on current PBF Energy operating plans, company assumptions and company configuration. Except where otherwise noted, guidance expense figures exclude amounts for Saint Bernard Renewables LLC. All figures and timelines are subject to change based on market and macroeconomic factors, as well as company strategic decision-making and overall company performance. (Figures in millions except per barrel amounts) FY 2024E Notes East Coast Throughput 290,000 – 310,000 bpd All throughput figures reflect anticipated planned maintenance activities Mid-Continent Throughput 135,000 – 145,000 bpd Gulf Coast Throughput 170,000 – 180,000 bpd West Coast Throughput 300,000 – 320,000 bpd Total Throughput 895,000 – 955,000 bpd FY 2024E Notes Refining operating expenses $2,500 – $2,700 Assumes 2024 average natural gas price of $3.50/MMBTU SG&A expenses $325 - $375 Includes variable incentive and stock-based compensation D&A $600 - $650 Interest expense, net $60 - $80 Maintenance and Turnaround Capital expenditures $800 - $850 Based on current plans, subject to change. Shares outstanding (millions) 121 (basic) 130 (fully-diluted) Approximate shares outstanding at year-end 2023 Approximate Effective Tax Rate 26% Turnaround Schedule Period Duration Delaware City – FCC Q1 40 – 50 days Toledo – Hydrocracker, Crude, UDEX Q1 40 – 50 days Martinez – Hydrocracker Q2 40 – 50 days Chalmette – FCC, Alkylation Unit Q4 40 – 50 days P F Energy 2024 Initial Guidance Information 3

Appendix

PBF Energy Regional Benchmark Indicators ▪ Indicative calculation of regional refining benchmarks(1) in dollars per barrel: • East Coast • Dated Brent (NYH) 2-1-1 • Calculated as: (1*RBOB) + (1*ULSD) – (2*Dated Brent) • Mid-Continent • WTI (Chicago) 4-3-1 • Calculated as: (3*CBOB) + (0.5*ULSD) + (0.5*GC Jet) – (4*WTI) • Gulf Coast • LLS (Gulf Coast) 2-1-1 • Calculated as: (1*87 Conv) + (1*ULSD) – (2*LLS) • West Coast • Southern California • ANS (West Coast) 4-3-1 • Calculated as: (3*CARBOB) + (1* LA Diesel) – (4*ANS) • Northern California • ANS (West Coast) 3-2-1 • Calculated as: (2*CARBOB) + (1*CARB Diesel) – (3*ANS) 5 (1) Actual realized refinery gross margin on a per barrel basis can differ from indicative regional benchmarks for reasons described in our filings with the SEC.

v3.23.4

Cover

|

Jan. 02, 2024 |

| Document Information [Line Items] |

|

| Entity Incorporation, State or Country Code |

DE

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Entity Registrant Name |

PBF ENERGY INC.

|

| Document Period End Date |

Jan. 02, 2024

|

| Entity Central Index Key |

0001534504

|

| Entity File Number |

001-35764

|

| Entity Tax Identification Number |

45-3763855

|

| Entity Address, Address Line One |

One Sylvan Way, Second Floor

|

| Entity Address, City or Town |

Parsippany

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07054

|

| City Area Code |

973

|

| Local Phone Number |

455-7500

|

| Title of 12(b) Security |

Common Stock, par value $.001

|

| Trading Symbol |

PBF

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| PBF Holding [Member] |

|

| Document Information [Line Items] |

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Registrant Name |

PBF HOLDING COMPANY LLC

|

| Entity Central Index Key |

0001566011

|

| Entity File Number |

333-186007

|

| Entity Tax Identification Number |

27-2198168

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=pbf_PBFHoldingMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

PBF Energy (NYSE:PBF)

Historical Stock Chart

From Oct 2024 to Nov 2024

PBF Energy (NYSE:PBF)

Historical Stock Chart

From Nov 2023 to Nov 2024