Industrial and multi-unit residential asset

classes to lead the way

KELOWNA, BC, Feb. 25, 2021 /CNW/ - While endless challenges

faced commercial real estate markets in 2020, investors and end

users in Western Canada showed

incredible resilience in their ability to both adapt to changing

conditions and position themselves for the future, according to a

report released today by RE/MAX of Western Canada.

The RE/MAX Commercial Real Estate Report, highlighting trends

and developments in seven major centres in Western Canada, found that institutional

investors and private equity played a substantial role in almost

every market in 2020, fuelling demand for multi-unit residential,

industrial product, and office buildings while end users and

smaller investors were strong in the industrial and, to a lesser

extent, retail sectors. Industrial was the top performer from

Vancouver to Winnipeg, driven by increased demand for

warehouse and fulfillment space from multi-national companies such

as Amazon and FedEx, while demand for multi-unit residential

remained consistent, with higher CAP rates and lower values

attracting investors in markets like Edmonton and Calgary. Farmland rounded out the top three

sectors, with robust demand in Saskatchewan sparking strong sales and upward

pressure on values.

"Despite a strong start to 2020 in virtually all asset classes

across Western Canada, the

pandemic shook the very foundation of the commercial market, and

ultimately altered the playing field," says Elton Ash, Regional Executive Vice President,

RE/MAX of Western Canada.

"Industrial captured the spotlight in the aftermath as e-commerce

sales exploded across the country – prompting even greater demand

-- while the retail and office sectors struggled with lockdowns and

safety measures."

Closure of bricks and mortar during lockdown and the

acceleration of e-commerce placed retail tenants behind the

proverbial eight ball in 2020. Smaller retailers used the

opportunity to invest in their future by purchasing smaller

storefront locations, especially in high-traffic areas – with

equity gains buffering any downturn in sales. Others looked to

upgrade their online presence and augment with a reduced physical

footprint, and if need be, industrial space for warehousing and

distribution.

"The country's largest landlords were able to evaluate and pivot

with some success in 2020," explains Ash. "Changing up the tenant

mix has been one option exercised by landlords over the past year,

while redevelopment is another, with some malls owners planning

future multi-unit residential development on their properties.

Others, such as the Orchard Park Mall in Kelowna, are using vacated space to expand

their parking capacity. Conversion of retail vacancies to

industrial space is also likely in the future, with large companies

such as Brookfield already pushing

forward with retail conversion to distribution models within their

US portfolio. Given the movement underway in the US, it's only a

matter of time before we see this approach mirrored in Canada."

While restaurants were hard hit by the pandemic, drive through

locations emerged as 2020's perfect business model -- no touch, no

contact, just tap and go. Demand for this product has surged in

Saskatoon, Kelowna, and Calgary, and is expected to continue to

experience strong demand in the year ahead.

Lockdowns and uncertainty contributed to negative absorption and

higher vacancies in the commercial office sector throughout

Western Canada in 2020, although

year-over-year dollar volumes in some markets indicate the sale of

larger properties. Institutional investors in Calgary accounted for 48 per cent of sales

volumes while private equity represented 24 per cent in the office

sector last year. With CAP rates rising to their highest levels in

recent years at 10.1 per cent, according to CoStar's Office Capital

Markets Report, the growing presence of institutional investors and

private equity in Calgary suggests

the market is at or near bottom.

"Rebounding global demand for primary energy should help bolster

economic performance, as well as demand for commercial real estate,

in Alberta in the second half of

2021," explains Ash. "In the interim, we could see out-of-province

institutional investors walk-away with some of the city's most

coveted assets."

Major drivers identified for the upswing in demand in the year

ahead include historically low interest rates and strong economic

recovery. The Bank of Canada (BOC)

has indicated that it intends to keep overnight interest rates at

0.25 per cent and has predicted a strong second quarter rebound

with "consumption forecast to gain strength as parts of the economy

reopen and confidences improves, and exports and business

investment is buoyed by rising foreign demand." The BOC has

projected GDP growth at four per cent in Canada in 2021.

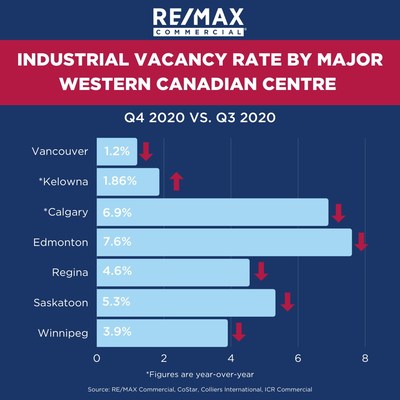

Limited inventory, shortage of available zoned land, and strong

demand overall have made industrial real estate the cash cow of

2020. Vacancies remain low for industrial product, with

Vancouver posting the tightest

rate at under 1.5 per cent, and rental rates climbing 10 per cent

year-over-year. Large multinational companies have been behind the

push as they gear up efforts to support a rapidly expanding

e-commerce industry. Smaller investors have also been active, as

the appetite for income properties in industrial areas that serve

strong supply chains and essential services increases in

strength. Diversification of smaller portfolios is underway

as investors choose to supplement their residential multi-unit

residential holdings with industrial product, and to a lesser

extent, office/retail.

Demand for farmland in Saskatchewan continued unabated in 2020 as

Alberta's Hutterite Colonies

sought to expand farming operations. The trend was highlighted by

the sale of a 20,000-acre farm in Norquay in August of 2020, considered one of

the largest in Western Canada.

Overall average price for farmland in Canada increased 3.7 per cent in the first six

months of 2020, with Saskatchewan

reporting the greatest increase in values, according to the Farm

Credit Canada's (FCC) 2020 Mid-Year Farmland Value Report.

"Saskatchewan's attractive

price point is expected to continue to attract investors and end

users, especially those from province's that have higher farmland

values, in the coming months," says Ash. "This segment is also

expected to heat-up as foreign investment returns to the overall

market in 2021."

Institutional and private investors flocked to multi-unit

residential in 2020, spurred on by the promise of greater security

and lower interest rates. Calgary

and the Greater Edmonton Area saw

consistent demand in 2020, although much of the activity occurred

in the first quarter, while Vancouver kicked off 2021 with a $292 million sale of 15 rental apartments to two

Ontario-based Real Estate

Investment Trusts (REIT).

"While the COVID-19 vaccine roll out should have been

well-underway at this point, supply issues continue to hamper

progress, with just 10 per cent of Canada's population expected to be vaccinated

the end of the first quarter," says Ash. "Economic growth, as such,

will remain on standby in short-term. However, once that objective

is achieved, the general consensus is that economy's across

Canada will roar back to life,

fuelling an upswing in commercial real estate activity as greater

stability returns to major centres."

About the 2021 RE/MAX Commercial Real Estate Report

The 2021 RE/MAX Commercial Real Estate Report includes insights

from RE/MAX brokerages. Brokers and agents are surveyed on trends

and developments in their local markets. The report also includes

select data from the Real Estate Board of Greater Vancouver (REBGV), CoStar, Farm Credit

Canada, Colliers International, Building Permits Summary for

Winnipeg, Canada Mortgage and

Housing Corporation (CMHC) and RBC Economics.

About RE/MAX Commercial

RE/MAX Commercial, part of the world's most productive real

estate network, provides experienced professionals and leadership

in the commercial and investment arena with over 4,000 commercial

practitioners in 73 countries and territories. In Western Canada, RE/MAX Commercial is

represented by 300 commercial practitioners in more

than 40 independently owned and operated commercial

franchises and divisions.

About RE/MAX of Western

Canada and the RE/MAX Network

RE/MAX was founded in 1973 by Dave and

Gail Liniger, with an innovative, entrepreneurial culture

affording its agents and franchisees the flexibility to operate

their businesses with great independence.

RE/MAX of Western Canada is a

subsidiary of RE/MAX, LLC, and oversees RE/MAX franchising in

British Columbia, Alberta, Saskatchewan, Manitoba, Northwest

Territories and Yukon.

RE/MAX of Western Canada is

Western Canada's leading real

estate organization with more than 6000 Sales Associates and over

270 independently-owned and operated offices.

RE/MAX, LLC, one of the world's leading franchisors of real

estate brokerage services, is a subsidiary of RE/MAX Holdings, INC.

(NYSE: RMAX). With a passion for the communities in which its

agents live and work, RE/MAX is proud to have raised millions of

dollars for Children's Miracle Network Hospitals® and other

charities. For more information about RE/MAX, to search home

listings or find an agent in your community, please visit

www.remax.ca.

Forward looking statements

This press release includes "forward-looking statements" within

the meaning of the "safe harbor" provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements are often identified by the use of words such as

"believe," "intend," "expect," "estimate," "plan," "outlook,"

"project," "anticipate," "may," "will," "would" and other similar

words and expressions that predict or indicate future events or

trends that are not statements of historical matters.

Forward-looking statements include statements related to: real

estate activity and market conditions; economic conditions

(including interest rates); and foreign investment. Forward-looking

statements should not be read as a guarantee of future performance

or results and will not necessarily accurately indicate the times

at which such performance or results may be achieved.

Forward-looking statements are based on information available at

the time those statements are made and/or management's good faith

belief as of that time with respect to future events and are

subject to risks and uncertainties that could cause actual

performance or results to differ materially from those expressed in

or suggested by the forward-looking statements. These risks and

uncertainties include the global COVID-19 pandemic, which continues

to pose significant and widespread risks to the Company's business.

The duration and magnitude of the impact from the COVID-19 pandemic

depends on future developments that cannot be predicted at this

time. Other important risks and uncertainties include, without

limitation, (1) changes in the real estate market or interest rates

and availability of financing, (2) changes in business and economic

activity in general, (3) the Company's ability to attract and

retain quality franchisees, (4) the Company's franchisees' ability

to recruit and retain real estate agents and mortgage loan

originators, (5) changes in laws and regulations, (6) the Company's

ability to enhance, market, and protect the RE/MAX and Motto

Mortgage brands, (7) the Company's ability to implement its

technology initiatives, and (8) fluctuations in foreign currency

exchange rates, and those risks and uncertainties described in the

sections entitled "Risk Factors" and "Management's Discussion and

Analysis of Financial Condition and Results of Operations" in the

most recent Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q filed with the Securities and Exchange Commission ("SEC")

and similar disclosures in subsequent periodic and current reports

filed with the SEC, which are available on the investor relations

page of the Company's website at www.remax.com and on the SEC

website at www.sec.gov. Readers are cautioned not to place undue

reliance on forward-looking statements, which speak only as of the

date on which they are made. Except as required by law, the Company

does not intend, and undertakes no obligation, to update this

information to reflect future events or circumstances.

SOURCE RE/MAX Western Canada