Letter from the President and CEO John H. Kousinioris President and Chief Executive Officer Dear Fellow Shareholders, Across our sector, 2023 was marked by significant challenges, ranging from increasing geopolitical risks, high inflation and rising equipment and capital costs, to financial setbacks with key equipment suppliers and industry participants. In this environment, our industry is demanding higher returns for projects to better compensate for the considerable inherent risks of investments. While the transition to clean energy will have challenges, it represents a significant opportunity for a highly capable, experienced and flexible company like ours to deliver growth and innovate in navigating the path forward. The past year brought to the forefront the “trilemma of transition” confronting the global power sector. At TransAlta, we refer to this as the three-legged stool of transition. In order to be successful, decarbonization efforts need to balance affordability, reliability as well as the reduction of emissions. All three elements need to be prudently managed to successfully advance and pursue the transition that is required to meet the challenges of climate change. Continuing Exceptional Business Performance Despite the challenging landscape experienced in 2023, it was another exceptional year of performance for TransAlta. We generated record results for the third year in a row, with revenues of $3.4 billion and adjusted EBITDA of $1.6 billion, in line with our adjusted EBITDA record of last year. We also delivered record net earnings to shareholders of $644 million, a $640 million increase from 2022. On a free cash flow basis, we generated $890 million or an impressive $3.22 per share. We exceeded our guidance expectations for free cash flow, and we increased our quarterly common share dividend by nine per cent, which represents our fifth consecutive annual dividend increase. I am proud to say since 2021 that we have generated an exceptional $8.93 per share of free cash flow. In addition to distributing dividends, we also returned $87 million to shareholders in 2023 through share repurchases. We will continue to use share repurchases as part of our capital allocation strategy, which continues to be dynamic with the changing market landscape and the readiness and timing of our growth opportunities. It is my view that our strong free cash flow results and expectations for 2024 are not appropriately reflected in the current trading price of our common shares. We have an evergreen normal course issuer bid in place that we have actively used over the past several years, and we expect to continue making accretive share buy backs at this price level. Our increased common share dividend of $0.24 per common share, combined with our current intentions around share repurchases, would see up to approximately 40 per cent of our expected 2024 free cash flow returned to shareholders. Our Growth team advanced 678 MW of construction projects in 2023. We achieved commercial operation at the 130 MW Garden Plain wind facility in Alberta and the 48 MW Northern Goldfields combined solar and battery storage facilities in Australia. As for our remaining construction projects, we expect the 300 MW White Rock facilities, the 200 MW Horizon Hill facility and the Mount Keith Transmission Expansion to achieve commercial operation by the end of the first quarter. Together these facilities, along with the fully rehabilitated Kent Hills facilities, are expected to contribute over $175 million in EBITDA annually. Finally, I am pleased to say that 2023 was also a record year for our safety performance. We operated without any lost time injuries across our global operations and delivered a Total Recordable Injury Frequency rate of 0.30, an outstanding result that improved upon our previous best outcome of 0.39, which was achieved in 2022. Availability was also excellent across our facilities, at 88.8 per cent fleet-wide in 2023. 2 TransAlta Corporation 2023 Integrated Report

Delivered Structural Simplification and Strategic Acquisitions In 2023, we took two key strategic steps forward with the acquisitions of TransAlta Renewables and Heartland Generation. The acquisition of TransAlta Renewables represented a key milestone for us. It allowed us to simplify our corporate structure, unify our capital structure and add a net economic interest in 1.2 GW of generating capacity to our fleet. The transaction enables us to move forward with a simplified and unified strategy, positioning us well for future success. We also announced an agreement to acquire Heartland Generation and its entire business operations, representing approximately 1.8 GW of generation in Alberta and British Columbia. This acquisition, which remains subject to regulatory approval, will add highly flexible and complementary natural gas assets to our Alberta portfolio. As the energy transition continues to drive new investment in renewables, there will also be an increasing need for low-cost, highly flexible and fast-responding generation to support grid reliability. The Heartland acquisition supports the competitive positioning of our fleet to meet current and future demand for reliable electricity with a robust and diversified portfolio, while being aligned with our longer- term emissions reduction commitments. Our commitment to decarbonization remains unchanged. Global Leader in Carbon Reductions We are proud of our decarbonization efforts and are on track to meet our target of reducing our scope 1 and 2 greenhouse gas emissions by 75 per cent below 2015 levels by 2026. We have retired 4,664 MW of coal-fired generation capacity since 2018 while converting 1,659 MW of coal-fired capacity to natural-gas-fired generation. Comparatively, our converted natural gas units' CO2 intensity is approximately 57 per cent lower than coal generation. Since 2015, we have reduced scope 1 and 2 greenhouse gas emissions by 21.3 MT CO2e or 66 per cent, which is an incredible achievement for our fleet. Prudent Capital Allocation and Investment Discipline We remain focused on maintaining a balanced, prudent and disciplined approach to capital allocation with the aim of generating value for our shareholders. We continue to view investments in contracted clean energy assets, and strategic gas assets, as providing meaningful long-term shareholder value. We see many opportunities to deploy capital into higher-returning, longer-life assets, and we are focusing our efforts on capturing those opportunities over the next few years. The path to the energy transition presents tremendous opportunities for our company given our skill set, competitive advantages and market positioning – opportunities that we are uniquely positioned to capture in each of our core markets of Canada, the United States and Australia. At our Investor Day, we provided an update to our Clean Electricity Growth Plan goals that laid out a plan to add up to 1.75 GW of additional clean electricity over the next five years, by deploying approximately $3.5 billion of growth capital, for which we have a fully funded plan, to achieve an annual EBITDA contribution of approximately $350 million. Although we continue to advance a number of projects toward final investment decisions, we will remain disciplined in our investment decisions to ensure we obtain appropriate risk-adjusted returns for our shareholders. Securing, acquiring and developing great projects is challenging and it is critical that we meet or exceed our targeted rates of return when we deploy our growth capital for the benefit of our shareholders. Our Clean Electricity Growth Plan is an aspirational one. We will not grow simply for the sake of growth or to meet targets. Long-term shareholder value creation will ultimately drive our investment and capital allocation decisions. Our goal is to enhance shareholder returns, and we will look to enhance shareholder returns through our dividend and share repurchases, particularly given the current trading price of our common shares, which we consider to be undervalued. Clean Electricity Growth Plan to 2028 As we execute our plan, we expect that approximately 70 per cent of our adjusted EBITDA will be sourced from clean generation by the end of 2028 – an amount significantly higher than the approximately 40 per cent that we have today. And, as we make the shift, TransAlta will be greener, more contracted and more diversified. We see abundant opportunities for the company as the world increasingly electrifies to meet its growth and climate change goals. We are in a great position to succeed over the balance of the decade and beyond, with considerable optionality in our generating base and growth pipeline, coupled with our strong balance sheet and excellent financial outlook. We see robust demand for renewable energy as corporate and government sustainability commitments remain firm. Power purchase agreement prices are responding to reflect supply and input cost pressures. We continue to strengthen our development capabilities and competitive advantages. In 2023, we combined our growth and energy marketing teams under a single leader while maintaining focus on our customer advantages in customer delivery, project development marketing, financing and operational optimization. TransAlta Corporation 2023 Integrated Report 3

Preparing for 2024 and Beyond At TransAlta, we have been working hard to set ourselves up to meet the needs of a responsible transition. We retain a cost-effective legacy fleet to maintain affordability, and we are investing in a diversified, flexible and responsive generating fleet to meet future system reliability requirements. We are also making investments in zero- carbon generation and new technologies, while relying less on our merchant gas generation to further our decarbonization objectives. As we transition our fleet towards a greener and more contracted asset base, our business risk profile will reduce and provide a positive catalyst to a multiple rerate. In 2024, I will be focusing my efforts on our capital allocation strategy and ensuring that we return value to our shareholders through share repurchases and dividends, while also pursuing growth opportunities with appropriate returns without compromising our balance sheet strength and resilience. Our continuing strong free cash flow will permit us to fund returns to shareholders and transition TransAlta to a higher proportion of contracted clean generation. Our portfolio continues to perform and is expected to generate approximately $1.70 per share of free cash flow in 2024, contributing to our balanced approach. In 2024, we expect to return up to 40 per cent of free cash flow to our shareholders through share repurchases and dividends. We also remain focused on identifying the opportunities and challenges that will push our company forward in the second half of the decade and into the 2030s. Our achievements in 2023 would not have been possible without the collective contributions of all of our employees. It has been an honour to lead our talented team of committed, driven and skilled employees who embody our core values of safety, innovation, sustainability, respect, and integrity. I thank our employees for all that they do to ensure that we are powering and empowering our economies and communities sustainably. I would also like to express my thanks to our Board of Directors for the support, guidance and wisdom that they provide day after day to our company. We are grateful for the support and confidence of our shareholders. We greatly value your opinions and put your interests at the centre of our continued transformation and the development of our strategy. Finally, we sincerely appreciate the support of all of our stakeholders. I am confident in the future and believe our success will continue in 2024 and beyond. John H. Kousinioris President and Chief Executive Officer February 22, 2024 4 TransAlta Corporation 2023 Integrated Report

Message from the Chairman of the Board John P. Dielwart Chair of the Board of Directors Dear Fellow Shareholders, As we report the financial results for the year ended December 31, 2023, I cannot overstate the pride I have in the accomplishments of all of TransAlta’s employees. The Company, under direction from the Board, simplified TransAlta’s structure with the acquisition of TransAlta Renewables, expanded its renewable portfolio with the commercial operation of our Garden Plain and Northern Goldfields facilities, and solidified its Alberta strategy through the announced acquisition of Heartland Generation. The Company continues to manage its evolution for the benefit of our shareholders. We have reported another year of superior results that went well beyond the original expectations we had at the beginning of 2023. Our management team delivered another year of exceptional free cash flow for our shareholders, achieved record-setting safety results, continued to reduce our emissions ahead of targets and deployed our capital in a disciplined and prudent way throughout the year. TransAlta has delivered performance at all levels: financial, operational, safety and sustainability. The Company’s evolving strategy continues to provide exceptional results and 2023’s record-setting performance reflect the success of that execution. We continue to transition the company through our Clean Electricity Growth Plan and are well-positioned as a credible and sought-after developer of choice for customers in all three core geographies in which we operate. We announced ambitious growth targets at our recent Investor Day that would see our company transition over time to one that has 70 per cent of its adjusted EBITDA clean and contracted. Our strategy is directed towards achieving material growth in our portfolio by 2028. However, growth is challenging and it is not easy to develop projects to deliver the targeted rates of return we have set for the deployment of our capital. As a result, we will remain disciplined in the deployment of our capital and we will not grow for the sake of growth even if it means we do not achieve our 2028 targets. Creating shareholder value trumps growth. We will maintain discipline as we consider our growth aspirations and rates of return for growth projects. Acquisitions must also meet our target thresholds for value creation. Long-term shareholder value creation will drive our investment decisions and we remain committed to our prudent capital allocation approach. To the extent we deploy reduced growth capital, we will pursue enhanced shareholder returns through dividends (base and/or special) and share repurchases. The Board would like to express our gratitude to the employees and capable leadership of TransAlta for their significant efforts in delivering another great year for the Company. The team has adapted to changing market conditions and will seek to add value to the Company in a disciplined and prudent way while being extremely mindful of capital allocation discipline and the creation of shareholder value. We also send special thanks to all of our shareholders for their ongoing commitment to the Company and for their continued engagement. As fellow shareholders, we look forward to TransAlta’s execution in 2024 and we value your engagement and viewpoints on our evolving strategy. The Board of Directors will strive to increase shareholder value through continuous engagement with the management team to assess new opportunities that will add value to the Company and improve performance. Finally, on behalf of the Board of Directors, I would like to extend my deep gratitude to the Honourable Rona Ambrose for her service to the Company. She has announced that she will not stand for re-election and will retire from the Board following the annual shareholders’ meeting on April 25, 2024. She has been a valuable contributor to our Board since 2017 and we thank her for her leadership and insights during her tenure, especially as the Chair of the Governance, Safety and Sustainability Committee of the Board. John P. Dielwart Chair of the Board of Directors February 22, 2024 TransAlta Corporation 2023 Integrated Report 5

TRANSALTA CORPORATION Management’s Discussion and Analysis This Management’s Discussion and Analysis (“MD&A”) contains forward-looking statements. These statements are based on certain estimates and assumptions and involve risks and uncertainties. Actual results may differ materially. Refer to the Forward-Looking Statements section of this MD&A for additional information. Table of Contents M2 Forward-Looking Statements M59 Key Non-IFRS Financial Ratios M4 Description of the Business M59 2024 Outlook M6 Highlights M62 Material Accounting Policies and Critical Accounting Estimates M11 Capital Expenditures M67 Accounting Changes M12 Significant and Subsequent Events M67 Environmental, Social and Governance M15 Segmented Financial Performance and Operating Results M69 Accelerating Our Business Transformation with a Target to Become Net-Zero by 2045 M23 Performance by Segment with Supplemental Geographical Information M70 Our 2023 Sustainability Performance M23 Optimization of the Alberta Portfolio M72 2024+Sustainability Targets M26 Fourth Quarter Highlights M75 Decarbonizing Our Energy Mix M28 Segmented Financial Performance and Operating Results for the Fourth Quarter M81 Key Climate Scenario Findings M29 Selected Quarterly Information M84 Managing Climate Change Risks and Opportunities M31 Strategy and Capability to Deliver Results M94 Enabling Innovation and Technology Adoption M31 Strategic Priorities and Clean Electricity Growth Plan to 2028 M97 Engaging with Our Stakeholders to Create Positive Relationships M36 Financial Position M103 Building a Diverse and Inclusive Workforce M37 Financial Capital M106 Progressive Environmental Stewardship M42 Cash Flows M112 Delivering Reliable and Affordable Energy M44 Other Consolidated Analysis M113 Sustainability Governance M46 Financial Instruments M114 Governance and Risk Management M48 Additional IFRS Measures and Non-IFRS Measures M125 Disclosure Controls and Procedures This MD&A should be read in conjunction with our 2023 audited annual consolidated financial statements (the "consolidated financial statements") and our 2023 Annual Information Form ("AIF"), each for the fiscal year ended Dec. 31, 2023. In this MD&A, unless the context otherwise requires, “we”, “our”, “us”, the “Company” and “TransAlta” refer to TransAlta Corporation and its subsidiaries. The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) for Canadian publicly accountable enterprises as issued by the International Accounting Standards Board (“IASB”) and in effect at Dec. 31, 2023. All tabular amounts in the following discussion are in millions of Canadian dollars unless otherwise noted, except amounts per share, which are in whole dollars to the nearest two decimals. This MD&A is dated Feb. 22, 2024. Additional information respecting TransAlta, including our AIF for the year ended Dec. 31, 2023, is available on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov and on our website at www.transalta.com. Information on or connected to our website is not incorporated by reference herein. TransAlta Corporation 2023 Integrated Report M1

Forward-Looking Statements This MD&A includes "forward-looking information" within the meaning of applicable Canadian securities laws and "forward-looking statements" within the meaning of applicable United States securities laws, including the Private Securities Litigation Reform Act of 1995 (collectively referred to herein as "forward-looking statements"). All forward-looking statements are based on our beliefs as well as assumptions based on information available at the time the assumption was made and on management's experience and perception of historical trends, current conditions and expected future developments, as well as other factors deemed appropriate in the circumstances. Forward-looking statements are not facts, but only predictions and generally can be identified by the use of statements that include phrases such as "may", "will", "can", "could", "would", "shall", "believe", "expect", "estimate", "anticipate", "intend", "plan", "forecast", "foresee", "potential", "enable", "continue" or other comparable terminology. These statements are not guarantees of our future performance, events or results and are subject to risks, uncertainties and other important factors that could cause our actual performance, events or results to be materially different from those set out in or implied by the forward-looking statements. In particular, this MD&A contains forward-looking statements including, but not limited to, statements relating to: the acquisition of Heartland (as defined below) and its entire business operations in Alberta and British Columbia, including closing conditions and regulatory approvals pursuant to the Heartland acquisition and the anticipated timing and completion of the acquisition; the annual average earnings before interest, taxes, depreciation and amortization ("EBITDA") to be generated from the Heartland acquisition and other benefits expected to arise from such transaction; the Company’s 2024 Outlook, including Adjusted EBITDA, free cash flow, annualized dividend per share, sustaining capital and energy marketing gross margin; the Company’s expanded growth targets to deliver 1.75 GW with a target investment of $3.5 billion by 2028 which is anticipated to deliver annual EBITDA of $350 million; the expansion of the Company's development pipeline to 10 GW by 2028; the Company’s investment strategy to deliver long-term value to shareholders; the common share dividend level through 2024; the Company's projects under construction, including capital costs, the timing of commercial operations and expected annual EBITDA; the impact of new asset additions in 2024 of Garden Plain, Northern Goldfields solar, Kent Hills, Mount Keith transmission, White Rock and Horizon Hill; the development of the early-stage and advanced-stage projects; achieving the anticipated benefits of the transfer of PTCs (defined below) generated from the White Rock and Horizon Hill wind projects; executing growth with Hancock under the Joint Development Agreement; the proportion of EBITDA to be generated from renewable sources to increase to 70 per cent by the end of 2028; the Company’s ability to achieve its long-term decarbonization goal to be net zero by 2045; the reduction of carbon emissions by 75 per cent from 2015 emissions levels by 2026; the expected impact and quantum of carbon compliance costs; regulatory developments and their expected impact on the Company; expectations regarding refinancing debt; and the Company continuing to maintain adequate liquidity. The forward-looking statements contained in this MD&A are based on many assumptions including, but not limited to, the following: no significant changes to applicable laws and regulations beyond those that have already been announced; no significant changes to fuel and purchased power costs; no material adverse impacts to long-term investment and credit markets; no significant changes to power price and hedging assumptions, including hedged volumes and prices; no significant changes to gas commodity prices and transport costs; no significant changes to decommissioning and restoration costs; no significant changes to interest rates; no significant changes to the demand and growth of renewables generation; no significant changes to the integrity and reliability of our assets; planned and unplanned outages and use of our assets; and no significant changes to the Company's debt and credit ratings. Forward-looking statements are subject to a number of significant risks and uncertainties that could cause actual plans, performance, results or outcomes to differ materially from current expectations. Factors that may adversely impact what is expressed or implied by forward-looking statements contained in this MD&A include risks relating to: fluctuations in power prices, including merchant pricing in Alberta, Ontario and Mid-Columbia; failure or delay in closing the Heartland acquisition; failure to realize the benefits of the Heartland acquisition, including the inability to advance the Battle River Carbon Hub Project to final investment decision or commercial operation, and any loss of value in the Heartland portfolio during the interim period prior to closing; reductions in production; restricted access to capital and increased borrowing costs, including any difficulty raising debt, equity or tax equity, as applicable, on reasonable terms or at all; labour relations matters, reduced labour availability and the ability to continue to staff our operations and facilities; reliance on key personnel; disruptions to our supply chains, including our ability to secure necessary equipment; force majeure claims; our ability to obtain regulatory and any other third- party approvals on the expected timelines or at all in respect of our growth projects; long-term commitments on M2 TransAlta Corporation 2023 Integrated Report

gas transportation capacity that may not be fully utilized over time; adverse financial impacts arising from the Company's hedged position; risks associated with development and construction projects, including as it pertains to increased capital costs, permitting, labour and engineering risks, disputes with contractors and potential delays in the construction or commissioning of such projects; significant fluctuations in the Canadian dollar against the US dollar and Australian dollar; changes in short-term and long-term electricity supply and demand; counterparty credit risk and any higher rate of losses on our accounts receivables; inability to achieve our environmental, social and governance ("ESG") targets; the impact of the energy transition on our business; impairments and/or writedowns of assets; adverse impacts on our information technology systems and our internal control systems, including cybersecurity threats; commodity risk management and energy trading risks, including the effectiveness of the Company’s risk management tools associated with hedging and trading procedures to protect against significant losses; our ability to contract our generation for prices that will provide expected returns and to replace contracts as they expire; changes to the legislative, regulatory and political environments in the jurisdictions in which we operate; environmental requirements and changes in, or liabilities under, these requirements; disruptions in the transmission and distribution of electricity; the effects of weather, including man-made or natural disasters and other climate- change related risks; increases in costs; reductions to our generating units’ relative efficiency or capacity factors; disruptions in the source of fuels, including natural gas, coal, water, solar or wind resources required to operate our facilities; operational risks, unplanned outages and equipment failure and our ability to carry out or have completed any repairs in a cost-effective or timely manner or at all; failure to meet financial expectations; general domestic and international economic and political developments, including armed hostilities, the threat of terrorism, adverse diplomatic developments or other similar events; industry risk and competition in the business in which we operate; structural subordination of securities; public health crisis risks; inadequacy or unavailability of insurance coverage; our provision for income taxes and any risk of reassessment; and legal, regulatory and contractual disputes and proceedings involving the Company. The foregoing risk factors, among others, are described in further detail in the Governance and Risk Management section of this MD&A and the Risk Factors section in our AIF for the year ended Dec. 31, 2023. Readers are urged to consider these factors carefully when evaluating the forward-looking statements, which reflect the Company's expectations only as of the date hereof and are cautioned not to place undue reliance on them. The forward-looking statements included in this document are made only as of the date hereof and we do not undertake to publicly update these forward-looking statements to reflect new information, future events or otherwise, except as required by applicable laws. The purpose of the financial outlooks contained herein is to give the reader information about management's current expectations and plans and readers are cautioned that such information may not be appropriate for other purposes. In light of these risks, uncertainties and assumptions, the forward-looking statements might occur to a different extent or at a different time than we have described, or might not occur at all. We cannot assure that projected results or events will be achieved. TransAlta Corporation 2023 Integrated Report M3

Description of the Business TransAlta is a Canadian corporation and one of Canada's largest publicly traded power generators. Established in 1911, the Company now has over 112 years of operating experience in the development, production and sale of electricity. We own, operate and manage a geographically diversified portfolio of generation assets that include water, wind, solar, battery storage, natural gas and transition coal. We are one of the largest producers of wind power in Canada and the largest producer of hydro power in Alberta. We also have industry-leading energy marketing capabilities where we seek to maximize margins by securing and optimizing high-value products and markets for ourselves and our customers in dynamic market conditions. Our mix of merchant and contracted assets along with our energy marketing business provides resilient and growing cash flows that support our ability to pay dividends to our shareholders and reinvest in growth. The Company's goal is to be a leading clean electricity company that is committed to a sustainable future and a responsible energy transition. Our strategic priorities include accelerating growth into customer-centred renewables and storage, selectively expanding flexible generation and reliability assets to support the transition, defining the next generation of power solutions and maintaining financial strength and capital allocation discipline. We are primarily focused on opportunities within our core markets of Canada, the US and Western Australia. Our sustainability goals and our Clean Electricity Growth Plan remain the focus of our strategy, which includes our commitment to retire our last remaining operational coal facility at the end of 2025. We remain on track to achieve our 2026 greenhouse gas ("GHG") emissions reduction target of 75 per cent scope 1 and 2 GHG emissions reductions since 2015 and our carbon net-zero goal by 2045. Since 2005, we have reduced our scope 1 and 2 GHG emissions by 31 million tonnes ("MT") of CO2e or a 74 per cent reduction, proudly representing approximately 10 per cent of Canada's Paris Agreement 2030 decarbonization target(1). Portfolio of Assets Our asset portfolio is geographically diversified with operations across Canada, the United States and Australia. The portfolio also generates power using a diverse set generation technologies and reliably supplies a broad cross section of counterparties. Our Hydro, Wind and Solar, Gas and Energy Transition segments are responsible for operating and maintaining our electrical generation facilities. Our Energy Marketing segment is responsible for marketing and scheduling our merchant asset fleet in North America (excluding Alberta) along with the procurement of gas, transport and storage for our gas fleet, providing knowledge to support our growth team, and generating a stand-alone gross margin separate from our asset business through a leading North American energy marketing and trading platform. Our highly diversified portfolio consists of both high-quality contracted assets and merchant assets. Approximately, 56 percent of our total installed capacity, including 81 per cent of our Wind and Solar fleet and 53 per cent of our Gas fleet, is contracted with investment-grade or creditworthy counterparties. The weighted-average contract life for these contracted facilities is 10 years. Our merchant assets include our unique hydro merchant portfolio and our merchant legacy thermal portfolio and wind assets. Our merchant exposure is primarily in Alberta, where 53 per cent of our capacity is located and 75 per cent of our Alberta capacity is available to participate in the merchant market. The Alberta optimization team is responsible for marketing and scheduling our merchant asset fleet in Alberta. A significant portion of the thermal generation capacity in the portfolio has been hedged to provide cash flow certainty. The Company's hedging strategy includes maintaining a significant base of commercial and industrial customers and is supplemented with financial hedges. In 2023, 78 per cent of our energy production in Alberta was sold under long term contracts or fixed price hedges. Refer to the 2024 Outlook section and the Optimization of the Alberta Portfolio of this MD&A for further details. Our diversified fleet is a key success factor in our ability to deliver resilient cash flows while capturing higher risk-adjusted returns for our shareholders. (1) In 2005, TransAlta's estimated scope 1 and 2 GHG emissions were 41.9 MT of CO2e, which did not receive independent limited assurance. Canada's Paris Agreement 2030 decarbonization target assumed 293 MT of CO2e or a 40 per cent reduction from a 2005 baseline of 732 MT of CO2e. M4 TransAlta Corporation 2023 Integrated Report

The following table provides our consolidated ownership of our facilities across the regions in which we operate as of Dec. 31, 2023: Year ended Dec. 31, 2023 Gross Installed Capacity (MW) Number of facilities Gross Installed Capacity (MW)(1) Number of facilities Gross Installed Capacity (MW)(1) Number of facilities Gross Installed Capacity (MW) Number of facilities Gross Installed Capacity (MW)(1) Number of facilities Alberta 834 17 766 14 1,960 7 — — 3,560 38 Canada, excluding Alberta 88 7 751 9 645 3 — — 1,484 19 US — — 519 7 29 1 671 2 1,219 10 Australia — — 48 3 450 6 — — 498 9 Total 922 24 2,084 33 3,084 17 671 2 6,761 76 Hydro Wind & Solar Gas Energy Transition Total (1) Gross installed capacity for consolidated reporting represents 100 per cent output of a facility. Capacity figures for the Wind and Solar segment includes 100 per cent of the Kent Hills wind facilities, and capacity figures for the Gas segment include 100 per cent of the Ottawa and Windsor facilities, 100 per cent of the Poplar Creek facility, 50 per cent of the Sheerness facility and 60 per cent of the Fort Saskatchewan facility. Stable and Predictable Cash Flows The following table provides our contracted capacity by MW and as a percentage of total gross installed capacity of our facilities across the regions in which we operate as of Dec. 31, 2023: As at Dec. 31, 2023 Hydro Wind & Solar Gas Energy Transition Total Alberta — 374 511 — 885 Canada, excluding Alberta 88 751 645 — 1,484 US — 519 29 381 929 Australia — 48 450 — 498 Total contracted capacity (MW) 88 1,692 1,635 381 3,796 Contracted capacity as a % of total capacity (%) 10% 81% 53% 57% 56% The weighted average contract life (years) of our facilities across the regions in which we operate as of Dec. 31, 2023 is: As at Dec. 31, 2023 Hydro Wind & Solar Gas Energy Transition Total Alberta(1)(2) — 16 7 — 11 Canada, excluding Alberta(2) 10 10 8 — 9 US(2) — 10 2 2 7 Australia(2) — 15 15 — 15 Total weighted contract life (years)(2) 10 12 10 2 10 (1) The weighted-average remaining contract life in the Wind and Solar segment is related to the contract period for Garden Plain (130 MW), McBride Lake (38 MW), and Windrise (206 MW). The weighted-average remaining contract life in the Gas segment is related to the contract period for Poplar Creek (230 MW), Fort Saskatchewan (71 MW) and a capacity-contract that is not directly contracted with any one facility (210 MW). (2) For power generated under long-term power purchase agreements ("PPAs") and other long-term contracts, the weighted-average remaining contract life is based on long-term average gross installed capacity. The majority of TransAlta's long-term power purchase agreements are with investment-grade rated or creditworthy counterparties. TransAlta Corporation 2023 Integrated Report M5

Highlights For the year ended Dec. 31, 2023, the Company demonstrated strong performance mainly due to the continued strong market conditions in Alberta in the first half of the year, higher production in the Gas and Energy Transition segments, and higher hedged volumes and lower realized gas prices in the Gas segment, partially offset by lower wind and water resources. The Energy Marketing segment's performance was lower compared to 2022 due to the lower realized settled trades during the year on market positions compared to the prior year. Year ended Dec. 31 2023 2022 2021 Operational information Adjusted availability (%) 88.8 90.0 86.6 Production (GWh) 22,029 21,258 22,105 Select financial information Revenues 3,355 2,976 2,721 Earnings (loss) before income taxes 880 353 (380) Adjusted EBITDA(1) 1,632 1,634 1,286 Net earnings (loss) attributable to common shareholders 644 4 (576) Cash flows Cash flow from operating activities 1,464 877 1,001 Funds from operations(1) 1,351 1,346 994 Free cash flow(1) 890 961 585 Per share Weighted average number of common shares outstanding 276 271 271 Net earnings (loss) per share attributable to common shareholders, basic and diluted 2.33 0.01 (2.13) Dividends declared per common share 0.22 0.21 0.19 Funds from operations per share(1)(2) 4.89 4.97 3.67 Free cash flow per share(1)(2) 3.22 3.55 2.16 Liquidity and capital resources Available liquidity 1,738 2,118 2,177 Adjusted net debt to adjusted EBITDA(1) (times) 2.5 2.2 2.6 Total consolidated net debt(1)(3) 3,453 2,854 2,636 As at Dec. 31 2023 2022 2021 Total assets 8,659 10,741 9,226 Total long-term liabilities 5,253 5,864 4,702 Total liabilities 6,995 8,752 6,633 (1) These items are not defined and have no standardized meaning under IFRS. Presenting these items from period to period provides management and investors with the ability to evaluate earnings (loss) trends more readily in comparison with prior periods’ results. Refer to the Segmented Financial Performance and Operating Results section of this MD&A for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS. Also, refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A. (2) Funds from operations ("FFO") per share and free cash flow ("FCF") per share are calculated using the weighted average number of common shares outstanding during the period. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A for the purpose of these non-IFRS ratios. (3) Refer to the table in the Financial Capital section of this MD&A for more details on the composition of total consolidated net debt. M6 TransAlta Corporation 2023 Integrated Report

Operating Performance Adjusted Availability The following table provides adjusted availability (%) by segment: Year ended Dec. 31 2023 2022 2021 Hydro 90.8 96.7 92.4 Wind and Solar 86.9 83.8 91.9 Gas 91.6 94.6 85.7 Energy Transition(1) 79.8 79.0 78.8 Adjusted availability (%) 88.8 90.0 86.6 (1) Availability, not adjusted for dispatch optimization, was 79.8 per cent for the year ended Dec. 31, 2023 (2022 - 77.2 per cent; 2021 - 75.3 per cent). Availability is an important measure for the Company as it represents the percentage of time a facility is available to produce electricity and is therefore an important indicator of the overall performance of the fleet. Availability is impacted by planned and unplanned outages, including the extended outage at the Kent Hills wind facility within the Wind and Solar fleet. Availability adjusted to exclude the Kent Hills extended outage for the years ended Dec. 31, 2022 and 2023, was 91.0 per cent and 92.8 per cent, respectively. The Company schedules dedicated time (planned outages) to maintain, repair or make improvements to the facilities at a time that will minimize the impact to the operations. In high price environments, actual outage schedules may change to accelerate the return to service of the unit. Adjusted availability for the year ended Dec. 31, 2023, was 88.8 per cent, compared to 90.0 per cent in 2022, and was consistent with management's expectations. Lower adjusted availability was primarily due to: • Planned outages in the Hydro segment, mainly at our Alberta Hydro Assets, to perform scheduled maintenance and • Planned outages at Sundance Unit 6, Sheerness Unit 1, Keephills Units 2 and 3 and Sarnia for scheduled maintenance in the Gas segment, partially offset by • Lower planned outages at Centralia Unit 2 in the Energy Transition segment and • The partial return to service of the Kent Hills wind facilities. Production and Long-Term Average Generation 2023 2022 2021 Year ended Dec. 31 Actual production (GWh) LTA generation (GWh) Production as a % of LTA Actual production (GWh) LTA generation (GWh) Production as a % of LTA Actual production (GWh) LTA generation (GWh) Production as a % of LTA Hydro 1,769 2,015 88% 1,988 2,015 99% 1,936 2,030 95% Wind and Solar 4,243 5,387 79% 4,248 4,950 86% 3,898 4,345 90% Gas 11,873 11,448 10,565 Energy Transition 4,144 3,574 5,706 Total 22,029 21,258 22,105 In addition to adjusted availability, the Company utilizes long-term average production ("LTA generation") as another indicator of performance for the renewable assets whereby actual production levels are compared against the expected long-term average. In the short term, for each of the Hydro and Wind and Solar segments, the conditions will vary from one period to the next. Over longer durations, facilities are expected to produce in line with their long-term averages, which is considered a reliable indicator of performance. LTA generation is calculated on an annualized basis from the average annual energy yield predicted from our simulation model based on historical resource data performed over a period of typically greater than 25 years. LTA generation for Energy Transition is not considered as we are currently transitioning these units with the expectation that they will retire by the end of 2025 and the LTA generation for Gas is not applicable as these units are dispatchable and their production is largely dependent on market conditions and merchant demand. TransAlta Corporation 2023 Integrated Report M7

Total production for 2023, increased by 771 GWh or 4 per cent compared to 2022. Production from the Centralia facility within the Energy Transition segment benefited from fewer planned and unplanned outage hours compared to the prior year and was able to be dispatched during periods of higher merchant pricing for the region. The Company's Gas segment had a strong performance, resulting in production that was both higher than the prior year as well as higher than expectations for the year. The Gas segment was available during periods of supply tightness, allowing for the Company to operate during periods of peak pricing. The Gas segment was unfavourably impacted by relatively mild weather in the fourth quarter of 2023, as the Company did not experience the same weather conditions compared to the same period in 2022, which had tighter supply due to the extreme cold weather in Alberta. Production for our renewables assets for the year ended Dec. 31, 2023, was lower by 224 GWh, or 4 per cent, compared to 2022 and was 81 per cent of LTA generation. Lower than average renewable resources in the year impacted production in both the Hydro and the Wind and Solar segments. Hydro production was further impacted by lower availability due to increased planned maintenance outages compared to 2022, while the Wind and Solar segment production was positively impacted by the addition of the Garden Plain wind facility, the partial return to service of the Kent Hills wind facility and the addition of the Northern Goldfields solar facilities during the year. Market Pricing Year ended Dec. 31, 2023 2023 2022 2021 Alberta spot power price ($/MWh) 134 162 102 Mid-Columbia spot power price (US$/MWh) 76 82 49 Ontario spot power price ($/MWh) 28 47 30 Natural gas price (AECO) per GJ ($) 2.54 5.08 3.39 For the year ended Dec. 31, 2023, spot electricity prices in Alberta and the Pacific Northwest were lower compared to 2022. Lower prices in both regions resulted from lower natural gas prices and overall weaker weather-driven demand in the second half of 2023, with notably lower prices due to above normal weather patterns in the fourth quarter of 2023. For Alberta specifically, warm weather in the fourth quarter resulted in a strong wind resource pattern which, combined with new installed capacity, added supply in the market compared to the prior year. AECO natural gas prices for the year ended Dec. 31, 2023, were lower compared to 2022 mainly due to improved production and storage levels in Alberta and North America. Financial Performance review on Consolidated Information Year ended Dec. 31 2023 2022 2021 Revenues 3,355 2,976 2,721 Fuel and purchased power 1,060 1,263 1,054 Carbon compliance 112 78 178 Operations, maintenance and administration 539 521 511 Depreciation and amortization 621 599 529 Asset impairment charges (reversals) (48) 9 648 Interest income 59 24 11 Earnings (loss) before income taxes 880 353 (380) Income tax expense 84 192 45 Net earnings (loss) attributable to common shareholders 644 4 (576) Net earnings attributable to non-controlling interests 101 111 112 M8 TransAlta Corporation 2023 Integrated Report

Current Year Variance Analysis (2023 versus 2022) Revenues totalling $3,355 million, increased by $379 million, or 13 per cent, compared to 2022, primarily due to: • Higher realized and unrealized gains from hedging and derivative positions across the segments, partially offset by • Lower revenue from merchant sales due to lower spot power prices and production in Alberta. Fuel and purchased power costs totalling $1,060 million, decreased by $203 million, or 16 per cent, compared to 2022, primarily due to: • Lower natural gas commodity pricing, partially offset by • Higher fuel usage in both the Gas and Energy Transition segments. Carbon compliance costs totalling $112 million, increased by $34 million, or 44 per cent, compared to 2022, primarily due to: • An increase in the carbon price per tonne from $50 per tonne in 2022 to $65 per tonne in 2023, • Higher production in the Gas segment and • No utilization of emission credits to settle GHG obligations as was done in the prior year. Operations, maintenance and administration ("OM&A") expenses totalling $539 million, increased by $18 million, or 3 per cent, compared to 2022, primarily due to: • Higher spending on strategic and growth initiatives, • Higher costs associated with the relocation of the Company's head office and • Increased costs due to inflationary pressures. Depreciation and amortization totalling $621 million, increased by $22 million, or 4 per cent, compared to 2022, primarily due to: • Revisions to useful lives on certain facilities and • Commercial operation of new facilities. Asset impairment reversals totalling $48 million, increased by $57 million, or 633 per cent, compared to an asset impairment charge in 2022, primarily due to: • Decommissioning and restoration provisions for retired assets being favourably impacted by a change in timing of expected cash outflows, partially offset by lower discount rates, resulting in a net impairment reversal of $34 million and • A Hydro segment impairment reversal of $10 million due to a contract extension and favourable changes in power price assumptions. Interest income totalling $59 million increased by $35 million, or 146 per cent, compared to 2022, primarily due to higher cash balances and favourable interest rates. Earnings before income taxes totalling $880 million, increased by $527 million, or 149 per cent, compared to 2022, due to the above noted items. Income tax expense totalling $84 million, decreased by $108 million, or 56 per cent, compared to 2022, due to a recovery relating to the reversal of previously derecognized Canadian deferred tax assets and lower US non-deductible expenses relating to the US operations, partially offset by higher earnings from Canadian operations. Net earnings attributable to non-controlling interests totalling $101 million, decreased by $10 million, or 9 per cent, compared to 2022, primarily due to lower net earnings for TA Cogen. TransAlta Corporation 2023 Integrated Report M9

Adjusted EBITDA For the year ended Dec. 31, 2023, the Company's adjusted EBITDA was $1,632 million as compared to $1,634 million in 2022, a decrease of $2 million. The major factors impacting adjusted EBITDA are summarized in the following table: Year ended Dec. 31 Adjusted EBITDA for the year ended Dec. 31, 2022 1,634 Hydro: lower primarily due to lower ancillary services volumes, lower spot power and ancillary services prices and lower than average water resources, partially offset by realized gains from hedging and sales of environmental attributes. (68) Wind and Solar: lower primarily due to lower environmental attribute revenues, lower spot power pricing in Alberta, lower wind resource across the operating fleets, lower liquidated damages recognized at the Windrise wind facility and higher OM&A, partially offset by the commercial operation of the Garden Plain wind facility, the Northern Goldfields solar facilities and the partial return of service of the Kent Hills wind facilities. (54) Gas: higher primarily due to higher power price hedges partially offsetting the impacts of lower Alberta spot prices, lower natural gas commodity costs and higher production, partially offset by lower thermal revenues, higher carbon prices and higher carbon costs and fuel usage related to production. The Gas fleet significantly exceeded management's expectations. 172 Energy Transition: higher primarily due to higher production from higher availability and higher merchant sales volumes, partially offset by lower market prices compared to the prior year. 36 Energy Marketing: lower primarily due to lower realized settled trades during the year on market positions in comparison to prior year and higher OM&A. Energy Marketing results were in line with management's expectations and performance was consistent with our revised full year financial guidance provided in the second quarter of 2023. (74) Corporate: lower primarily due to increased spending to support strategic and growth initiatives and higher costs associated with the relocation of the Company's head office. (14) Adjusted EBITDA(1) for the year ended Dec. 31, 2023 1,632 (1) Adjusted EBITDA is not defined and has no standardized meaning under IFRS. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A. M10 TransAlta Corporation 2023 Integrated Report

Free Cash Flow During the second quarter of 2023, the Company revised and increased our 2023 guidance for FCF based on the strong financial performance attained in the first half of the year and our expectations for the balance of the year. For the year ended Dec. 31, 2023, the Company's FCF decreased by $71 million, or 7 per cent, compared to 2022, and was in line with our revised expected full year financial guidance. The major factors impacting FCF are summarized in the following table: Year ended Dec. 31 FCF for the year ended Dec. 31, 2022 961 Lower adjusted EBITDA: lower FCF due to the items noted in Adjusted EBITDA above. (2) Higher interest income: Higher cash balances and favourable interest rates positively impacting FCF. 35 Lower current income tax expense: Previously restricted non-capital loss carryforwards were utilized to offset taxable income resulting in higher FCF. 15 Higher sustaining capital expenditures: Higher planned major maintenance costs for the Hydro and Gas segments, partially offset by lower planned major maintenance in Wind and Solar and Energy Transition segments, resulting in lower FCF. (31) Higher distributions paid to subsidiaries' non-controlling interests: Related to timing of distributions paid to TA Cogen, partially offset by lower distributions paid to TransAlta Renewables resulting in lower FCF. (36) Lower provisions: Lower provisions being accrued compared to the prior year, with no notable settlements being recorded in either year resulting in lower FCF due to the timing of provisions accrued. (26) Other non-cash items(1) (12) Other(2) (14) FCF(3) for the year ended Dec. 31, 2023 890 (1) Other non-cash items consists of Alberta market pool incentives, carbon obligation, contract liabilities, and the SunHills royalty onerous contract. Refer to the Reconciliation of Cash Flow from Operations to FFO and FCF section tables in this MD&A for more details. (2) Other consists of higher realized foreign exchange loss, higher decommissioning and restoration costs settled, higher dividends paid on preferred shares and higher principal payments on lease liabilities. Refer to the Reconciliation of Cash Flow from Operations to FFO and FCF section tables in this MD&A for more details. (3) FCF is not defined and has no standardized meaning under IFRS. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A. Capital Expenditures We are in a long-cycle, capital-intensive business that requires significant capital expenditures. Our goal is to undertake sustaining capital expenditures that ensure our facilities operate reliably and safely. Year ended Dec. 31 2023 2022 2021 Hydro 41 35 26 Wind and Solar 15 18 13 Gas 76 41 128 Energy Transition 15 19 19 Corporate 27 29 13 Total sustaining capital expenditures 174 142 199 Total sustaining capital expenditures in 2023 were $32 million higher compared to 2022, primarily due to: • Higher planned major maintenance at our Alberta Hydro Assets, • Higher planned major maintenance at our Sarnia, Sundance Unit 6 and Keephills Units 2 and 3 facilities in the Gas segments, partially offset by • Lower planned major maintenance in the Wind and Solar segment primarily due to a reduction in major component replacements and • Lower planned outage work performed in the Energy Transition segment. TransAlta Corporation 2023 Integrated Report M11

Total sustaining capital expenditures in 2022 were $57 million lower compared to 2021, primarily due to: • Coal-to-gas conversions being completed in 2021, partially offset by • Higher planned major maintenance in 2022 in the Hydro segment and a higher level of major component replacements in 2022 in the Wind and Solar segment and • Higher spend on leasehold improvements associated with the planned relocation of the Company's head office. Year ended Dec. 31 2023 2022 2021 Hydro 6 2 3 Wind and Solar 659 759 124 Gas 13 3 38 Energy Transition — — 70 Corporate(1) 61 10 47 Total growth and development expenditures 739 774 282 (1) Expenditures related to projects in the development phase are included in the Corporate segment. In 2023 and 2022, the growth and development expenditures incurred primarily related to: • The Garden Plain wind facility, which achieved commercial operation in August 2023; • The Northern Goldfields solar facilities, which achieved commercial operation in November 2023; • The White Rock wind projects, which are expected to reach commercial operation in the first quarter of 2024; • The Horizon Hill wind project, which is expected to reach commercial operation in the first quarter of 2024; and • The Mount Keith 132kV expansion, which is on track to be completed in the first quarter of 2024. Refer to the Strategic Priorities and Clean Electricity Growth Plan to 2028 section of this MD&A for more details. Significant and Subsequent Events Change to Board of Directors The Honourable Rona Ambrose has decided that she will not stand for re-election and will retire from the Board of Directors ("the Board") following the annual shareholder meeting on April 25, 2024. The Board extends its gratitude for her service to the Company. She has been a valuable contributor to the Board since 2017 and we thank her for her leadership and insights during her tenure, especially as Chair of the Governance, Safety and Sustainability Committee of the Board. Production Tax Credit ("PTC") Sale Agreements On Feb. 22, 2024, the Company entered into 10-year transfer agreements with an AA- rated customer for the sale of approximately 80 per cent of the expected PTCs to be generated from the White Rock wind projects and the Horizon Hill wind project. The expected annual average EBITDA from these contracts is approximately $57 million (US$43 million). Normal Course Issuer Bid ("NCIB") and Automatic Share Purchase Plan ("ASPP") On May 26, 2023, the Toronto Stock Exchange ("TSX") accepted the notice filed by the Company to implement an NCIB for a portion of its common shares. Pursuant to the NCIB, TransAlta may repurchase up to a maximum of 14,000,000 common shares, representing approximately 7.29 per cent of its public float of common shares as at May 17, 2023. Purchases under the NCIB may be made through open market transactions on the TSX and any alternative Canadian trading platforms on which the common shares are traded, based on the prevailing market price. Any common shares purchased under the NCIB will be cancelled. The period during which TransAlta is authorized to make purchases under the NCIB commenced on May 31, 2023, and ends on May 30, 2024, or such earlier date on which the maximum number of common shares are purchased under the NCIB or the NCIB is terminated at the Company’s election. M12 TransAlta Corporation 2023 Integrated Report

On Dec. 19, 2023, the Company entered into an ASPP to facilitate repurchases of TransAlta’s common shares under its NCIB. Under the ASPP, the Company’s broker may purchase common shares from the effective date of the ASPP until the end of the ASPP. All purchases of common shares made under the ASPP will be included in determining the number of common shares purchased under the NCIB. The ASPP will terminate on the earliest of the date on which: (a) the maximum purchase limits under the ASPP are reached; (b) Feb. 24, 2024; or (c) the Company terminates the ASPP in accordance with its terms. During the year ended Dec. 31, 2023, the Company purchased and cancelled a total of 7,537,500 common shares, at an average price of $11.49 per common share, for a total cost of $87 million. The NCIB provides the Company with a capital allocation alternative with a view to ensuring long-term shareholder value. TransAlta’s Board of Directors and management believe that, from time to time, the market price of the common shares might not be reflective of the underlying value and purchases of common shares for cancellation under the NCIB may provide an opportunity to enhance shareholder value. Northern Goldfields Solar Achieves Commercial Operation On Nov. 22, 2023, the Company announced that the 48 MW Northern Goldfields solar and battery storage facilities achieved commercial operation. The facilities consist of the 27 MW Mount Keith solar facility, the 11 MW Leinster solar facility, the 10 MW Leinster battery energy storage system and interconnecting transmission infrastructure, all of which are now integrated into TransAlta’s existing 169 MW Southern Cross Energy North remote network in Western Australia. The facilities are fully contracted to BHP Nickel West for a term of 15 years and are expected to reduce BHP's scope 2 emissions at Mount Keith and Leinster by 12 per cent annually. TransAlta Announces Growth Targets to 2028 and Declares 9% Dividend Increase On Nov. 21, 2023, the Company held its 2023 Investor Day event and announced it had updated its strategic growth targets to 2028, which strengthens the Company’s commitment to being a leader in clean electricity by delivering customer-centred power solutions. The growth targets include: • Adding up to 1.75 GW of new capacity to the Company's fleet by investing approximately $3.5 billion to develop, construct or acquire new assets through to the end of 2028, • A focus on customer-centred renewables and storage through the development of its 4.8 GW development pipeline and • Expanding the Company’s development pipeline to 10 GW by 2028. The Board approved an annualized $0.02 per share increase, or 9 per cent increase to our common share dividend and declared a dividend of $0.06 per common share to be paid on April 1, 2024. The quarterly dividend of $0.06 per common share represents an annualized dividend of $0.24 per common share. TransAlta Enters Joint Development Agreement with Hancock On Nov. 21, 2023, the Company entered into a joint development agreement with Hancock Prospecting Pty Ltd. (“Hancock”), Australia’s fourth largest iron ore producer. This arrangement will build on TransAlta’s expertise in supplying power to remote mining operations in Western Australia. TransAlta will work collaboratively with Hancock to define and supply behind-the-fence generation solutions for Hancock in the Port Hedland area. TransAlta to Acquire Heartland Generation from Energy Capital Partners On Nov. 2, 2023, the Company announced that it had entered into a definitive share purchase agreement with an affiliate of Energy Capital Partners, the parent of Heartland Generation Ltd. and Alberta Power (2000) Ltd. (collectively, "Heartland"), pursuant to which TransAlta will acquire Heartland and its entire business operations in Alberta and British Columbia. The acquisition will add 10 facilities to TransAlta’s fleet, totalling 1,844 MW of new capacity. The transaction is expected to close in the first half of 2024, subject to customary closing conditions, including receipt of regulatory approvals. The purchase price for the acquisition is $390 million, subject to working capital and other adjustments, as well as the assumption of $268 million of low-cost debt. The Company will finance the transaction using cash on hand and drawing on its credit facilities. The assets are expected to add approximately $115 million of average annual EBITDA including synergies. Approximately 55 per cent of revenues are under contract with highly creditworthy counterparties, with a weighted- average remaining contract life of 16 years. Corporate pre- tax synergies are expected to exceed $20 million annually. The acquisition will competitively position the Company to respond to the highly dynamic and shifting electricity landscape in Alberta given the expected significant increase in renewables and other large baseload generation coming online in the next several years in the TransAlta Corporation 2023 Integrated Report M13

province. The Clean Electricity Growth Plan continues to be at the heart of our strategy and is primarily focused on meeting the future needs of our customers with clean electricity solutions. TransAlta Corporation Completes Acquisition of TransAlta Renewables Inc. On Oct. 5, 2023, the Company completed the acquisition of TransAlta Renewables pursuant to the terms of the previously announced arrangement agreement between the parties (the "Arrangement"). TransAlta acquired all of the outstanding common shares of TransAlta Renewables ("RNW Shares") not already owned, directly or indirectly, by TransAlta and certain of its affiliates, resulting in TransAlta Renewables becoming a wholly owned subsidiary of the Company. Prior to the Arrangement, TransAlta and its affiliates collectively held 160,398,217 RNW Shares, representing 60.1 per cent of the issued and outstanding RNW Shares, with the remaining 106,510,884 RNW Shares held by TransAlta Renewables shareholders ("RNW Shareholders") other than TransAlta and its affiliates. The Arrangement was approved by RNW Shareholders at a special meeting of shareholders held on Sept. 26, 2023, and by the Court of King’s Bench of Alberta on Oct. 4, 2023. The consideration paid totalled $1.3 billion which consisted of $800 million of cash and approximately 46 million common shares of the Company. The closing of the acquisition of TransAlta Renewables represents a key milestone for the Company and the simplified and unified corporate structure positions it well for future success. TransAlta Tops Newsweek's Inaugural List of World's Most Trustworthy Companies On Sept. 14, 2023, the Company announced that it ranked first on Newsweek's inaugural “World's Most Trustworthy Companies 2023” list for the Energy and Utilities category. The list identifies the top 1,000 companies in 21 countries and across 23 industries. Newsweek’s 2023 World’s Most Trustworthy Companies were chosen based on a holistic approach to evaluating three pillars of public trust – customers, investors and employees. The list was compiled based on an extensive survey of over 70,000 participants, gathering 269,000 evaluations of companies that people trust as a customer, as an investor or as an employee. Garden Plain Wind Facility Achieved Commercial Operation In August 2023, the Garden Plain wind facility was commissioned adding 130 MW to our gross installed capacity. The facility is fully contracted with Pembina Pipeline Corporation and PepsiCo Canada, with a weighted average contract life of approximately 17 years. Tent Mountain Pumped Hydro Development Project On April 24, 2023, the Company acquired a 50 per cent interest in the Tent Mountain Renewable Energy Complex (“Tent Mountain”), an early-stage 320 MW pumped storage hydro development project located in southwest Alberta, from Evolve Power Ltd. ("Evolve"), formerly known as Montem Resources Limited. The acquisition includes land rights, fixed assets and intellectual property associated with Tent Mountain. The Company and Evolve own the Tent Mountain project within a special purpose partnership that is jointly managed, with the Company acting as project developer. The partnership is actively seeking an offtake agreement for the energy and environmental attributes that will be generated by the facility. Annual Shareholder Meeting On April 28, 2023, the Company held its annual meeting of shareholders. All director nominees were elected to the Board, including Candace MacGibbon, a new member to the Board. The Company also received strong support on all other items of business, including say-on-pay and an amendment to the Company's Share Unit Plan. M14 TransAlta Corporation 2023 Integrated Report

Segmented Financial Performance and Operating Results Segmented information is prepared on the same basis that the Company manages its business, evaluates financial results and makes key operating decisions. The following table reflects the summary financial information on a consolidated basis for the year ended Dec. 31: Adjusted EBITDA(1) Year ended Dec. 31 2023 2022 2021 Hydro 459 527 322 Wind and Solar 257 311 262 Gas 801 629 488 Energy Transition 122 86 133 Energy Marketing 109 183 166 Corporate (116) (102) (85) Total adjusted EBITDA(1) 1,632 1,634 1,286 Earnings (loss) before income taxes 880 353 (380) (1) This item is not defined and has no standardized meaning under IFRS. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A. TransAlta Corporation 2023 Integrated Report M15

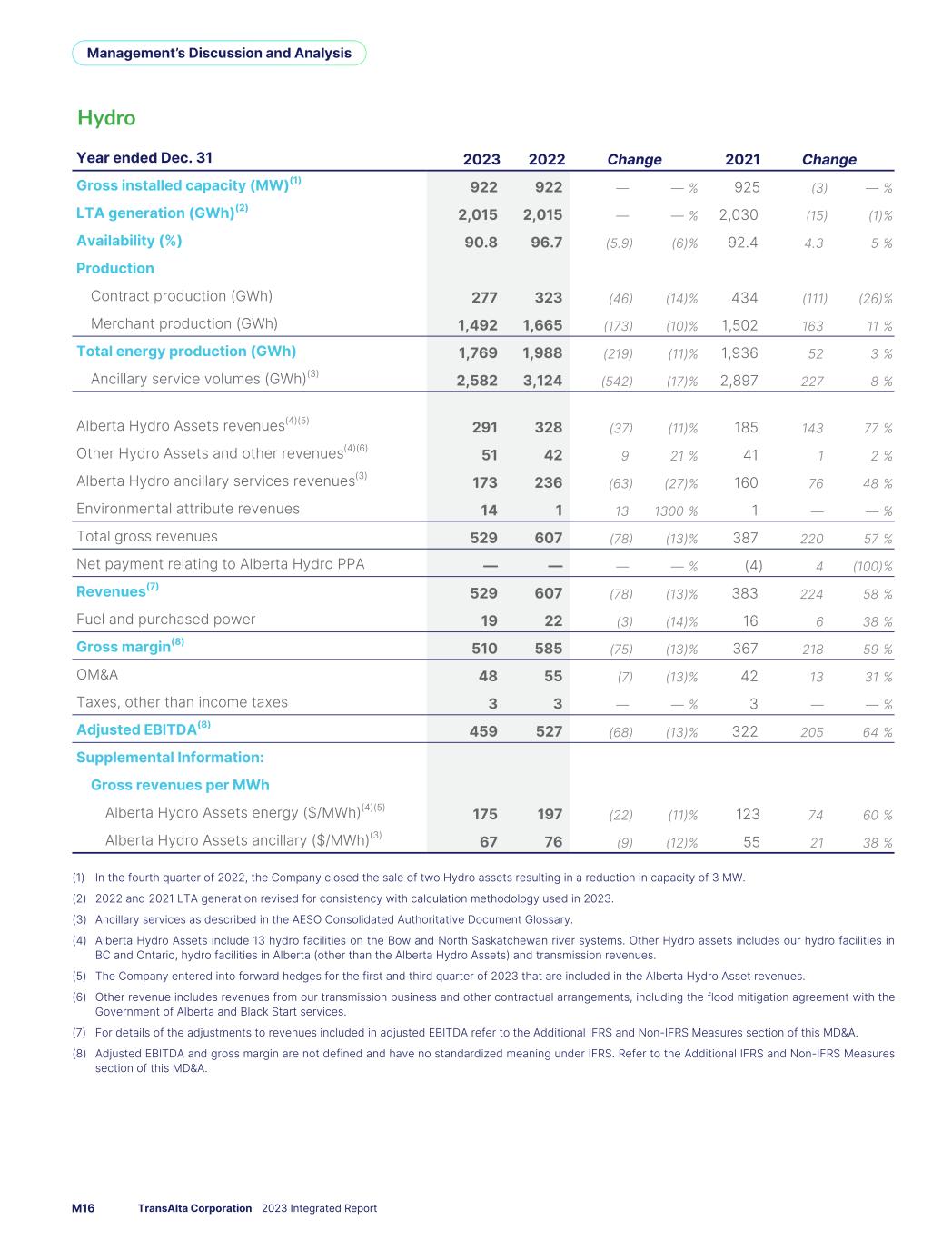

Hydro Year ended Dec. 31 2023 2022 Change 2021 Change Gross installed capacity (MW)(1) 922 922 — — % 925 (3) — % LTA generation (GWh)(2) 2,015 2,015 — — % 2,030 (15) (1) % Availability (%) 90.8 96.7 (5.9) (6) % 92.4 4.3 5 % Production Contract production (GWh) 277 323 (46) (14) % 434 (111) (26) % Merchant production (GWh) 1,492 1,665 (173) (10) % 1,502 163 11 % Total energy production (GWh) 1,769 1,988 (219) (11) % 1,936 52 3 % Ancillary service volumes (GWh)(3) 2,582 3,124 (542) (17) % 2,897 227 8 % Alberta Hydro Assets revenues(4)(5) 291 328 (37) (11) % 185 143 77 % Other Hydro Assets and other revenues(4)(6) 51 42 9 21 % 41 1 2 % Alberta Hydro ancillary services revenues(3) 173 236 (63) (27) % 160 76 48 % Environmental attribute revenues 14 1 13 1300 % 1 — — % Total gross revenues 529 607 (78) (13) % 387 220 57 % Net payment relating to Alberta Hydro PPA — — — — % (4) 4 (100) % Revenues(7) 529 607 (78) (13) % 383 224 58 % Fuel and purchased power 19 22 (3) (14) % 16 6 38 % Gross margin(8) 510 585 (75) (13) % 367 218 59 % OM&A 48 55 (7) (13) % 42 13 31 % Taxes, other than income taxes 3 3 — — % 3 — — % Adjusted EBITDA(8) 459 527 (68) (13) % 322 205 64 % Supplemental Information: Gross revenues per MWh Alberta Hydro Assets energy ($/MWh)(4)(5) 175 197 (22) (11) % 123 74 60 % Alberta Hydro Assets ancillary ($/MWh)(3) 67 76 (9) (12) % 55 21 38 % (1) In the fourth quarter of 2022, the Company closed the sale of two Hydro assets resulting in a reduction in capacity of 3 MW. (2) 2022 and 2021 LTA generation revised for consistency with calculation methodology used in 2023. (3) Ancillary services as described in the AESO Consolidated Authoritative Document Glossary. (4) Alberta Hydro Assets include 13 hydro facilities on the Bow and North Saskatchewan river systems. Other Hydro assets includes our hydro facilities in BC and Ontario, hydro facilities in Alberta (other than the Alberta Hydro Assets) and transmission revenues. (5) The Company entered into forward hedges for the first and third quarter of 2023 that are included in the Alberta Hydro Asset revenues. (6) Other revenue includes revenues from our transmission business and other contractual arrangements, including the flood mitigation agreement with the Government of Alberta and Black Start services. (7) For details of the adjustments to revenues included in adjusted EBITDA refer to the Additional IFRS and Non-IFRS Measures section of this MD&A. (8) Adjusted EBITDA and gross margin are not defined and have no standardized meaning under IFRS. Refer to the Additional IFRS and Non-IFRS Measures section of this MD&A. M16 TransAlta Corporation 2023 Integrated Report

2023 Revenues for the year ended Dec. 31, 2023, decreased compared to 2022, primarily due to: • Lower ancillary services volumes due to the AESO procuring lower volumes given its decision to reduce the cumulative volume of imports into Alberta, • Lower spot power prices and ancillary services prices in the Alberta market and • Lower production due to lower availability from planned outages at our Alberta Hydro Assets and lower than average water resources, partially offset by • Realized gains from our hedging strategy for the Alberta Hydro Assets and • Sales of environmental attributes driven by an increase in emission credit sales. Adjusted EBITDA for the year ended Dec. 31, 2023, decreased compared to 2022, primarily due to: • Lower revenues as explained by the factors above. For further discussion on the Alberta market conditions and pricing, refer to the Alberta Electricity Portfolio section of this MD&A. 2022 Revenues for the year ended Dec. 31, 2022, increased compared to 2021, primarily due to: • Higher merchant and ancillary service prices and volumes in the Alberta market, • Higher production and higher availability due to lower planned and unplanned outages at our Alberta Hydro Assets and • Higher ancillary service volumes due to higher availability and demand. Adjusted EBITDA for the year ended Dec. 31, 2022, increased compared to 2021, primarily due to: • Higher revenues as explained by the factors above, partially offset by • Higher OM&A costs for the year related to increased insurance premiums for updated replacement value coverage and the Company's performance-related incentive accruals. TransAlta Corporation 2023 Integrated Report M17

Wind and Solar Year ended Dec. 31 2023 2022 Change 2021 Change Gross installed capacity (MW)(1) 2,084 1,906 178 9 % 1,906 — — % LTA generation (GWh) 5,387 4,950 437 9 % 4,345 605 14 % Availability (%) 86.9 83.8 3.1 4 % 91.9 (8.1) (9) % Production Contract production (GWh) 3,095 3,182 (87) (3) % 2,850 332 12 % Merchant production (GWh) 1,148 1,066 82 8 % 1,048 18 2 % Total production (GWh) 4,243 4,248 (5) — % 3,898 350 9 % Wind and Solar revenues 347 357 (10) (3) % 320 37 12 % Environmental attribute revenues 26 50 (24) (48) % 28 22 79 % Revenues(2) 373 407 (34) (8) % 348 59 17 % Fuel and purchased power 30 31 (1) (3) % 17 14 82 % Carbon compliance — 1 (1) (100) % — 1 100 % Gross margin(3) 343 375 (32) (9) % 331 44 13 % OM&A 80 68 12 18 % 59 9 15 % Taxes, other than income taxes 12 12 — — % 10 2 20 % Net other operating income(2) (6) (16) 10 (63) % — (16) (100) % Adjusted EBITDA(3) 257 311 (54) (17) % 262 49 19 % Supplemental information: Kent Hills wind rehabilitation expenditures(4) 87 77 10 13 % — 77 100 % Insurance proceeds - Kent Hills (1) (7) 6 (86) % — (7) (100) % (1) Gross installed capacity and availability for 2023 includes the 130 MW Garden Plain wind facility that achieved commercial operation in August 2023 and the 48 MW Northern Goldfields solar facilities that achieved commercial operation in November 2023. (2) For details of the adjustments to revenues and net other operating income included in adjusted EBITDA, refer to the Additional IFRS Measures and Non- IFRS Measures section of this MD&A. (3) Adjusted EBITDA and gross margin are not defined and have no standardized meaning under IFRS. Refer to the Additional IFRS and Non-IFRS Measures section of this MD&A. (4) The Kent Hills wind facilities rehabilitation capital expenditures are segregated from the sustaining capital expenditures due to the extraordinary nature of the expenditures. M18 TransAlta Corporation 2023 Integrated Report

2023 Revenues for the year ended Dec. 31, 2023, decreased compared to 2022 primarily due to: • Lower environmental attribute revenues driven by a reduction of offsets and emission credit sales, • Lower spot power pricing in Alberta and • Weaker than long-term average wind resource across the operating fleets, partially offset by • Commercial operation of the Garden Plain wind facility and the Northern Goldfield Solar facilities in the third and fourth quarter, respectively and • The partial return to service of the Kent Hills wind facilities. Adjusted EBITDA for the year ended Dec. 31, 2023, decreased compared to the same period in 2022, primarily due to: • Lower revenues as explained by the factors above, • Higher OM&A related to salary escalations, higher insurance costs and long-term service agreement escalations and • Lower liquidated damages recognized at the Windrise wind facility. 2022 Revenues for the year ended Dec. 31, 2022, increased compared to 2021, primarily due to: • Higher production from the addition of the Windrise wind facility and the acquisition of the North Carolina Solar facilities in the fourth quarter of 2021 and higher wind resources in Eastern Canada, • Higher realized merchant and spot power pricing in Alberta and • Higher environmental attribute revenue, partially offset by • Lower availability as a result of the extended outage at the Kent Hills 1 and 2 wind facilities. Adjusted EBITDA for the year ended Dec. 31, 2022, increased compared to 2021, primarily due to: • Higher revenue as explained by the factors above and • The recognition of liquidated damages recoverable from turbine availability being below the contractual target at the Windrise wind facility, partially offset by • Higher fuel and purchased power from increases in transmission rates, • Higher OM&A related to the addition of the Windrise wind and North Carolina Solar facilities during the year and • A one-time favourable adjustment as a result of the AESO transmission line loss ruling that was included in 2021. TransAlta Corporation 2023 Integrated Report M19

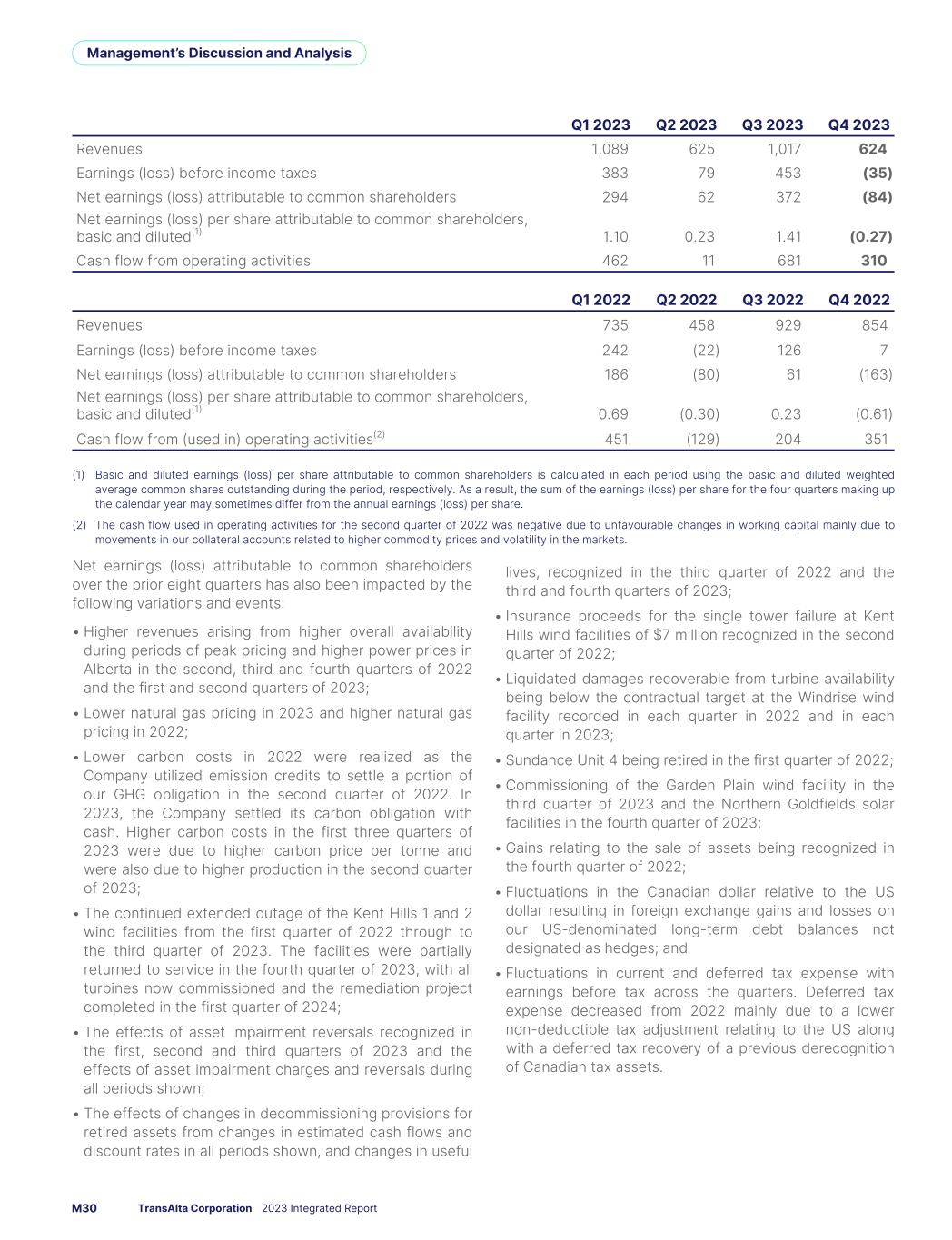

Gas Year ended Dec. 31 2023 2022 Change 2021 Change Gross installed capacity (MW) 3,084 3,084 — — % 3,084 — — % Availability (%) 91.6 94.6 (3.0) (3) % 85.7 8.9 10 % Production Contract sales volume (GWh) 4,172 3,609 563 16 % 3,622 (13) — % Merchant sales volume (GWh) 7,889 7,927 (38) — % 7,084 843 12 % Purchased power (GWh)(1) (188) (88) (100) 114 % (141) 53 (38) % Total production (GWh) 11,873 11,448 425 4 % 10,565 883 8 % Revenues(2) 1,525 1,521 4 — % 1,126 395 35 % Fuel and purchased power(2) 449 637 (188) (30) % 374 263 70 % Carbon compliance 112 83 29 35 % 118 (35) (30) % Gross margin(3) 964 801 163 20 % 634 167 26 % OM&A 192 195 (3) (2) % 173 22 13 % Taxes, other than income taxes 11 15 (4) (27) % 13 2 15 % Net other operating income (40) (38) (2) 5 % (40) 2 (5) % Adjusted EBITDA(3) 801 629 172 27 % 488 141 29 % (1) Power required to fulfill contractual obligations during planned and unplanned outages is included in purchased power. (2) For details of the adjustments to revenues and fuel and purchased power included in adjusted EBITDA, refer to the Additional IFRS Measures and Non- IFRS Measures section of this MD&A. (3) Adjusted EBITDA and gross margin are not defined and have no standardized meaning under IFRS. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A. 2023 Revenues for the year ended Dec. 31, 2023, increased compared to 2022, primarily due to: • Higher production due to the fleet being available during periods of supply tightness and peak pricing and • Higher power price hedges, partially offsetting the impact of lower Alberta spot prices, partially offset by • Lower thermal revenues due to lower steam revenue pricing at the Sarnia facility compared to 2022. Adjusted EBITDA for the year ended Dec. 31, 2023, increased compared to 2022, primarily due to: • Lower natural gas commodity costs for the Alberta gas assets and • Higher revenues explained above, partially offset by • Higher carbon costs and fuel usage related to production with the utilization of emission credits to settle a portion of the GHG obligation in 2022 and • Carbon price increases from $50 per tonne to $65 per tonne, impacting our Canadian gas assets. The Gas fleet significantly exceeded management's expectations for the segment. 2022 Revenues for the year ended Dec. 31, 2022, increased compared to 2021, primarily due to: • Higher production due to higher availability and dispatch optimization of the Alberta assets, • Higher realized energy prices through dispatch optimization of our Alberta assets, net of hedging and • Higher Ontario merchant pricing and steam generation. Adjusted EBITDA for the year ended Dec. 31, 2022, increased compared to 2021, primarily due to: • Higher revenues explained above and • Lower carbon compliance costs due to reductions in GHG emissions as a result of operating exclusively on natural gas in Alberta rather than coal, and the utilization of compliance credits to settle a portion of the GHG obligation, partially offset by • Increased natural gas consumption on recently converted units and higher natural gas prices, • Carbon price increases from $35 per tonne to $50 per tonne and • Higher OM&A due to the Company's performance- related incentive accruals and increased general operating expenses. M20 TransAlta Corporation 2023 Integrated Report