false

0000752642

0000752642

2024-08-06

2024-08-06

0000752642

UMH:CommonStock0.10ParValueMember

2024-08-06

2024-08-06

0000752642

UMH:Sec6.375SeriesDCumulativeRedeemablePreferredStock0.10ParValueMember

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 6, 2024

UMH

Properties, Inc.

(Exact

name of registrant as specified in its charter)

| Maryland |

|

001-12690 |

|

22-1890929 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| Juniper

Business Plaza, 3499 Route 9 North, Suite 3-C, Freehold, NJ |

|

07728 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (732) 577-9997

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a- 12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock, $0.10 par value |

|

UMH |

|

New

York Stock Exchange |

| 6.375%

Series D Cumulative Redeemable Preferred Stock, $0.10 par value |

|

UMH

PD |

|

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure.

On

August 6, 2024, UMH Properties, Inc. issued a press release announcing the results for the second quarter June 30, 2024 and disclosed

a supplemental information package in connection with its earnings conference call for the second quarter June 30, 2024. A copy of the

supplemental information package and press release is furnished with this report as Exhibit 99 and is incorporated herein by reference.

The

information in this report and the exhibit attached hereto is being furnished, not filed, for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, and pursuant to Item 2.02 and Item 7.01 of Form 8-K will not be incorporated by reference into any

filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Forward-Looking

Statements

Statements

contained in this report, including the document that is incorporated by reference, that are not historical facts are forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section

21E of the Securities Exchange Act of 1934, as amended and the Private Securities Litigation Reform Act of 1995 (the “Exchange

Act”). All statements, other than statements of historical facts that address activities, events or developments where the Company

uses any of the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,”

“intends,” or similar expressions, are forward-looking statements. These forward-looking statements are not guaranteed and

are based on the Company’s current intentions and on the Company’s current expectations and assumptions. These statements,

intentions, expectations and assumptions involve risks and uncertainties, some of which are beyond the Company’s control that could

cause actual results or events to differ materially from those that the Company anticipates or projects, such as:

| ● | changes

in the real estate market conditions and general economic conditions; |

| ● | the

inherent risks associated with owning real estate, including local real estate market conditions,

governing laws and regulations affecting manufactured housing communities and illiquidity

of real estate investments; |

| ● | increased

competition in the geographic areas in which we own and operate manufactured housing communities;

|

| ● | our

ability to continue to identify, negotiate and acquire manufactured housing communities and/or

vacant land which may be developed into manufactured housing communities on terms favorable

to us; |

| ● | our

ability to maintain or increase rental rates and occupancy levels; |

| ● | changes

in market rates of interest; |

| ● | inflation

and increases in costs, including personnel, insurance and the cost of purchasing manufactured

homes; |

| ● | our

ability to purchase manufactured homes for rental or sale; |

| ● | our

ability to repay debt financing obligations; |

| ● | our

ability to refinance amounts outstanding under our credit facilities at maturity on terms

favorable to us; |

| ● | our

ability to comply with certain debt covenants; |

| ● | our

ability to integrate acquired properties and operations into existing operations; |

| ● | the

availability of other debt and equity financing alternatives; |

| ● | continued

ability to access the debt or equity markets; |

| ● | the

loss of any member of our management team; |

| ● | our

ability to maintain internal controls and processes to ensure all transactions are accounted

for properly, all relevant disclosures and filings are timely made in a timely manner in

accordance with all rules and regulations, and any potential fraud or embezzlement is thwarted

or detected; |

| ● | the

ability of manufactured home buyers to obtain financing; |

| ● | the

level of repossessions by manufactured home lenders; |

| ● | market

conditions affecting our investment securities; |

| ● | changes

in federal or state tax rules or regulations that could have adverse tax consequences; |

| ● | our

ability to qualify as a real estate investment trust for federal income tax purposes; and |

| ● | risks

and uncertainties related to the COVID-19 pandemic or other highly infectious or contagious

diseases. |

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

UMH

Properties, Inc. |

| |

|

|

| Date:

August 6, 2024 |

By: |

/s/

Anna T. Chew |

| |

Name: |

Anna

T. Chew |

| |

Title: |

Executive

Vice President and Chief Financial Officer |

Exhibit 99

Certain

information in this Supplemental Information Package contains Non-GAAP financial measures. These Non-GAAP financial measures are REIT

industry financial measures that are not calculated in accordance with accounting principles generally accepted in the United States

of America. Please see page 15 for a definition of these Non-GAAP financial measures and page 7 for the reconciliation of certain captions

in the Supplemental Information Package to the statement of operations as reported in the Company’s filings with the SEC on Form

10-Q.

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 2 |

Financial

Highlights

(dollars

in thousands except per share amounts) (unaudited)

| | |

Three Months

Ended | | |

Six Months

Ended | |

| | |

June

30, 2024 | | |

June

30, 2023 | | |

June

30, 2024 | | |

June

30, 2023 | |

| Operating

Information | |

| | | |

| | | |

| | | |

| | |

| Number of Communities (1) | |

| | | |

| | | |

| 136 | | |

| 135 | |

| Total Sites | |

| | | |

| | | |

| 25,787 | | |

| 25,729 | |

| Rental and Related Income | |

$ | 51,494 | | |

$ | 47,063 | | |

$ | 101,823 | | |

$ | 92,368 | |

| Community Operating Expenses | |

$ | 21,595 | | |

$ | 20,034 | | |

$ | 42,692 | | |

$ | 40,122 | |

| Community NOI | |

$ | 29,899 | | |

$ | 27,029 | | |

$ | 59,131 | | |

$ | 52,246 | |

| Expense Ratio | |

| 41.9 | % | |

| 42.6 | % | |

| 41.9 | % | |

| 43.4 | % |

| Sales of Manufactured Homes | |

$ | 8,834 | | |

$ | 8,227 | | |

$ | 16,185 | | |

$ | 15,529 | |

| Number of Homes Sold | |

| 105 | | |

| 91 | | |

| 200 | | |

| 174 | |

| Number of Rentals Added, net | |

| 111 | | |

| 304 | | |

| 167 | | |

| 534 | |

| Net Income (Loss) | |

$ | 5,181 | | |

$ | (403 | ) | |

$ | 3,556 | | |

$ | (1,904 | ) |

| Net Income (Loss) Attributable to Common Shareholders | |

$ | 527 | | |

$ | (4,418 | ) | |

$ | (5,737 | ) | |

$ | (9,715 | ) |

| Adjusted EBITDA excluding Non-Recurring Other

Expense | |

$ | 28,329 | | |

$ | 25,270 | | |

$ | 55,014 | | |

$ | 48,731 | |

| FFO Attributable to Common Shareholders | |

$ | 16,182 | | |

$ | 12,043 | | |

$ | 30,228 | | |

$ | 22,683 | |

| Normalized FFO Attributable to Common Shareholders | |

$ | 16,807 | | |

$ | 13,049 | | |

$ | 31,824 | | |

$ | 24,769 | |

| | |

| | | |

| | | |

| | | |

| | |

| Shares Outstanding

and Per Share Data | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 71,418 | | |

| 61,236 | | |

| 70,291 | | |

| 60,186 | |

| Diluted | |

| 71,884 | | |

| 61,760 | | |

| 70,700 | | |

| 60,844 | |

| Net Income (Loss) Attributable

to Shareholders per Share- | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | 0.01 | | |

$ | (0.07 | ) | |

$ | (0.08 | ) | |

$ | (0.16 | ) |

| FFO per Share-(2) | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.23 | | |

$ | 0.20 | | |

$ | 0.43 | | |

$ | 0.38 | |

| Diluted | |

$ | 0.23 | | |

$ | 0.19 | | |

$ | 0.43 | | |

$ | 0.37 | |

| Normalized FFO per Share-(2) | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.24 | | |

$ | 0.21 | | |

$ | 0.45 | | |

$ | 0.41 | |

| Diluted | |

$ | 0.23 | | |

$ | 0.21 | | |

$ | 0.45 | | |

$ | 0.41 | |

| Dividends per Common Share | |

$ | 0.215 | | |

$ | 0.205 | | |

$ | 0.42 | | |

$ | 0.41 | |

| | |

| | | |

| | | |

| | | |

| | |

| Balance

Sheet | |

| | | |

| | | |

| | | |

| | |

| Total Assets | |

| | | |

| | | |

$ | 1,441,295 | | |

$ | 1,393,869 | |

| Total Liabilities | |

| | | |

| | | |

$ | 697,315 | | |

$ | 756,002 | |

| | |

| | | |

| | | |

| | | |

| | |

| Market

Capitalization | |

| | | |

| | | |

| | | |

| | |

| Total Debt, Net of Unamortized Debt Issuance

Costs | |

| | | |

| | | |

$ | 668,876 | | |

$ | 726,862 | |

| Equity Market Capitalization | |

| | | |

| | | |

$ | 1,163,272 | | |

$ | 1,007,888 | |

| Series D Preferred Stock | |

| | | |

| | | |

$ | 295,757 | | |

$ | 265,032 | |

| Total Market Capitalization | |

| | | |

| | | |

$ | 2,127,905 | | |

$ | 1,999,782 | |

| |

(1) |

As of January 1, 2024, includes Duck River Estates,

a newly constructed community. |

| |

(2) |

Please see Definitions on page 15. |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 3 |

Consolidated

Balance Sheets

(in

thousands except per share amounts)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

| | |

| ASSETS | |

| | | |

| | |

| Investment Property and

Equipment | |

| | | |

| | |

| Land | |

$ | 87,301 | | |

$ | 86,497 | |

| Site and Land Improvements | |

| 907,400 | | |

| 896,568 | |

| Buildings and Improvements | |

| 39,749 | | |

| 39,506 | |

| Rental Homes and Accessories | |

| 539,746 | | |

| 516,470 | |

| Total Investment Property | |

| 1,574,196 | | |

| 1,539,041 | |

| Equipment and Vehicles | |

| 30,059 | | |

| 29,126 | |

| Total Investment Property and Equipment | |

| 1,604,255 | | |

| 1,568,167 | |

| Accumulated Depreciation | |

| (443,448 | ) | |

| (416,309 | ) |

| Net

Investment Property and Equipment | |

| 1,160,807 | | |

| 1,151,858 | |

| | |

| | | |

| | |

| Other Assets | |

| | | |

| | |

| Cash and Cash Equivalents | |

| 39,457 | | |

| 57,320 | |

| Marketable Securities at Fair Value | |

| 28,673 | | |

| 34,506 | |

| Inventory of Manufactured Homes | |

| 31,986 | | |

| 32,940 | |

| Notes and Other Receivables, net | |

| 85,940 | | |

| 81,071 | |

| Prepaid Expenses and Other Assets | |

| 15,485 | | |

| 11,729 | |

| Land Development Costs | |

| 52,736 | | |

| 33,302 | |

| Investment in Joint

Venture | |

| 26,211 | | |

| 24,851 | |

| Total

Other Assets | |

| 280,488 | | |

| 275,719 | |

| | |

| | | |

| | |

| TOTAL

ASSETS | |

$ | 1,441,295 | | |

$ | 1,427,577 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’

EQUITY | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Mortgages Payable, net

of unamortized debt issuance costs | |

$ | 491,030 | | |

$ | 496,483 | |

| Other Liabilities | |

| | | |

| | |

| Accounts Payable | |

| 5,386 | | |

| 6,106 | |

| Loans Payable, net of unamortized debt issuance

costs | |

| 77,367 | | |

| 93,479 | |

| Series A Bonds, net of unamortized debt issuance

costs | |

| 100,479 | | |

| 100,055 | |

| Accrued Liabilities and Deposits | |

| 13,145 | | |

| 15,117 | |

| Tenant Security Deposits | |

| 9,908 | | |

| 9,543 | |

| Total Other Liabilities | |

| 206,285 | | |

| 224,300 | |

| Total

Liabilities | |

| 697,315 | | |

| 720,783 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders’ Equity: | |

| | | |

| | |

| Series D- 6.375% Cumulative Redeemable Preferred Stock, $0.10 par value

per share; 13,700 shares authorized as of June 30, 2024 and December, 31 2023; 11,830 and 11,607 shares issued and outstanding as

of June 30, 2024 and December 31, 2023, respectively | |

| 295,757 | | |

| 290,180 | |

| Common Stock- $0.10 par value per share: 153,714 shares authorized as

of June 30, 2024 and December 31, 2023; 72,750 and 67,978 shares issued and outstanding as of June 30, 2024 and December 31, 2023,

respectively | |

| 7,275 | | |

| 6,798 | |

| Excess Stock- $0.10 par value per share: 3,000 shares authorized; no

shares issued or outstanding as of June 30, 2024 and December 31, 2023 | |

| -0- | | |

| -0- | |

| Additional Paid-In Capital | |

| 464,330 | | |

| 433,106 | |

| Accumulated Deficit | |

| (25,364 | ) | |

| (25,364 | ) |

| Total UMH Properties, Inc.

Shareholders’ Equity | |

| 741,998 | | |

| 704,720 | |

| Non-Controlling Interest

in Consolidated Subsidiaries | |

| 1,982 | | |

| 2,074 | |

| Total

Shareholders’ Equity | |

| 743,980 | | |

| 706,794 | |

| | |

| | | |

| | |

| TOTAL

LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 1,441,295 | | |

$ | 1,427,577 | |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 4 |

Consolidated

Statements of Income (Loss)

(in

thousands except per share amounts) (unaudited)

| | |

Three Months

Ended | | |

Six Months

Ended | |

| | |

June

30, 2024 | | |

June

30, 2023 | | |

June

30, 2024 | | |

June

30, 2023 | |

| INCOME: | |

| | |

| | |

| | |

| |

| Rental and Related Income | |

$ | 51,494 | | |

$ | 47,063 | | |

$ | 101,823 | | |

$ | 92,368 | |

| Sales of Manufactured

Homes | |

| 8,834 | | |

| 8,227 | | |

| 16,185 | | |

| 15,529 | |

| TOTAL

INCOME | |

| 60,328 | | |

| 55,290 | | |

| 118,008 | | |

| 107,897 | |

| | |

| | | |

| | | |

| | | |

| | |

| EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| Community Operating Expenses | |

| 21,595 | | |

| 20,034 | | |

| 42,692 | | |

| 40,122 | |

| Cost of Sales of Manufactured Homes | |

| 5,461 | | |

| 5,740 | | |

| 11,017 | | |

| 10,725 | |

| Selling Expenses | |

| 1,744 | | |

| 1,665 | | |

| 3,390 | | |

| 3,477 | |

| General and Administrative Expenses | |

| 5,506 | | |

| 5,181 | | |

| 10,874 | | |

| 10,163 | |

| Depreciation Expense | |

| 15,001 | | |

| 13,751 | | |

| 29,742 | | |

| 27,124 | |

| TOTAL

EXPENSES | |

| 49,307 | | |

| 46,371 | | |

| 97,715 | | |

| 91,611 | |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE): | |

| | | |

| | | |

| | | |

| | |

| Interest Income | |

| 1,501 | | |

| 1,217 | | |

| 3,068 | | |

| 2,355 | |

| Dividend Income | |

| 362 | | |

| 531 | | |

| 722 | | |

| 1,237 | |

| Loss on Sales of Marketable Securities, net | |

| (3,778 | ) | |

| (1 | ) | |

| (3,778 | ) | |

| (43 | ) |

| Increase (Decrease) in Fair Value of

Marketable Securities | |

| 3,338 | | |

| (2,548 | ) | |

| (2,031 | ) | |

| (4,943 | ) |

| Other Income | |

| 205 | | |

| 288 | | |

| 364 | | |

| 616 | |

| Loss on Investment in Joint Venture | |

| (87 | ) | |

| (175 | ) | |

| (224 | ) | |

| (480 | ) |

| Interest Expense | |

| (7,371 | ) | |

| (8,639 | ) | |

| (14,845 | ) | |

| (16,969 | ) |

| TOTAL

OTHER INCOME (EXPENSE) | |

| (5,830 | ) | |

| (9,327 | ) | |

| (16,724 | ) | |

| (18,227 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income (Loss) before Gain (Loss) on Sales of

Investment Property and Equipment | |

| 5,191 | | |

| (408 | ) | |

| 3,569 | | |

| (1,941 | ) |

| Gain (Loss) on Sales of

Investment Property and Equipment | |

| (10 | ) | |

| 5 | | |

| (13 | ) | |

| 37 | |

| NET INCOME (LOSS) | |

| 5,181 | | |

| (403 | ) | |

| 3,556 | | |

| (1,904 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Preferred Dividends | |

| (4,712 | ) | |

| (4,051 | ) | |

| (9,385 | ) | |

| (7,887 | ) |

| Loss Attributable to

Non-Controlling Interest | |

| 58 | | |

| 36 | | |

| 92 | | |

| 76 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET

INCOME (LOSS) ATTRIBUTABLE TO COMMON SHAREHOLDERS | |

$ | 527 | | |

$ | (4,418 | ) | |

$ | (5,737 | ) | |

$ | (9,715 | ) |

| | |

| | | |

| | | |

| | | |

| | |

NET

INCOME (LOSS) ATTRIBUTABLE TO COMMON SHAREHOLDERS PER SHARE – | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | 0.01 | | |

$ | (0.07 | ) | |

$ | (0.08 | ) | |

$ | (0.16 | ) |

| | |

| | | |

| | | |

| | | |

| | |

WEIGHTED

AVERAGE COMMON SHARES OUTSTANDING: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 71,418 | | |

| 61,236 | | |

| 70,291 | | |

| 60,186 | |

| Diluted | |

| 71,884 | | |

| 61,760 | | |

| 70,700 | | |

| 60,844 | |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 5 |

Consolidated

Statements of Cash Flows

(in

thousands) (unaudited)

| | |

Six Months

Ended | |

| | |

June

30, 2024 | | |

June

30, 2023 | |

| CASH FLOWS FROM OPERATING

ACTIVITIES: | |

| | | |

| | |

| Net Income (Loss) | |

$ | 3,556 | | |

$ | (1,904 | ) |

| Non-Cash Items Included in Net Income (Loss): | |

| | | |

| | |

| Depreciation | |

| 29,742 | | |

| 27,124 | |

| Amortization of Financing

Costs | |

| 1,163 | | |

| 1,056 | |

| Stock Compensation Expense | |

| 2,543 | | |

| 2,999 | |

| Provision for Uncollectible

Notes and Other Receivables | |

| 795 | | |

| 797 | |

| Loss on Sales of Marketable

Securities, net | |

| 3,778 | | |

| 43 | |

| Decrease in Fair Value

of Marketable Securities | |

| 2,031 | | |

| 4,943 | |

| (Gain) Loss on Sales of

Investment Property and Equipment | |

| 13 | | |

| (37 | ) |

| Loss on Investment in Joint

Venture | |

| 469 | | |

| 577 | |

| Changes in Operating Assets and Liabilities: | |

| | | |

| | |

| Inventory of Manufactured

Homes | |

| 954 | | |

| 27,414 | |

| Notes and Other Receivables,

net of notes acquired with acquisitions | |

| (5,664 | ) | |

| (9,017 | ) |

| Prepaid Expenses and Other

Assets | |

| 552 | | |

| 1,591 | |

| Accounts Payable | |

| (720 | ) | |

| 317 | |

| Accrued Liabilities and

Deposits | |

| (1,972 | ) | |

| (3,534 | ) |

| Tenant

Security Deposits | |

| 365 | | |

| 633 | |

| Net

Cash Provided by Operating Activities | |

| 37,605 | | |

| 53,002 | |

| CASH FLOWS FROM INVESTING

ACTIVITIES: | |

| | | |

| | |

| Purchase of Manufactured

Home Communities | |

| -0- | | |

| (3,679 | ) |

| Purchase of Investment

Property and Equipment | |

| (41,052 | ) | |

| (74,604 | ) |

| Proceeds from Sales of

Investment Property and Equipment | |

| 2,348 | | |

| 1,332 | |

| Additions to Land Development

Costs | |

| (18,249 | ) | |

| (12,587 | ) |

| Purchase of Marketable

Securities | |

| (12 | ) | |

| (11 | ) |

| Proceeds from Sales of

Marketable Securities | |

| 36 | | |

| 502 | |

| Investment

in Joint Venture | |

| (1,829 | ) | |

| (5,349 | ) |

| Net

Cash Used in Investing Activities | |

| (58,758 | ) | |

| (94,396 | ) |

| CASH FLOWS FROM FINANCING

ACTIVITIES: | |

| | | |

| | |

| Net (Payments) Proceeds

from Short-Term Borrowings | |

| (15,837 | ) | |

| 29,527 | |

| Principal Payments of Mortgages

and Loans | |

| (5,915 | ) | |

| (64,583 | ) |

| Financing Costs on Debt | |

| (552 | ) | |

| (814 | ) |

| Proceeds from At-The-Market

Preferred Equity Program, net of offering costs | |

| 5,058 | | |

| 34,600 | |

| Proceeds from At-The-Market

Common Equity Program, net of offering costs | |

| 56,478 | | |

| 78,447 | |

| Proceeds from Issuance

of Common Stock in the DRIP, net of dividend reinvestments | |

| 3,503 | | |

| 3,197 | |

| Proceeds from Exercise

of Stock Options | |

| 2,079 | | |

| 550 | |

| Preferred Dividends Paid | |

| (9,385 | ) | |

| (7,887 | ) |

| Common

Dividends Paid, net of dividend reinvestments | |

| (27,831 | ) | |

| (23,331 | ) |

| Net

Cash Provided by Financing Activities | |

| 7,598 | | |

| 49,706 | |

| | |

| | | |

| | |

| NET (DECREASE) INCREASE

IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | |

| (13,555 | ) | |

| 8,312 | |

| CASH,

CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF PERIOD | |

| 64,437 | | |

| 40,876 | |

| CASH,

CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | |

$ | 50,882 | | |

$ | 49,188 | |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 6 |

Reconciliation

of Net Income (Loss) to Adjusted EBITDA and Net Income (Loss) Attributable to Common Shareholders to FFO and Normalized FFO

(in

thousands) (unaudited)

| | |

Three Months

Ended | | |

Six Months

Ended | |

| | |

June

30, 2024 | | |

June

30, 2023 | | |

June

30, 2024 | | |

June

30, 2023 | |

| Reconciliation of Net Income (Loss)

to Adjusted EBITDA | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Net Income

(Loss) | |

$ | 5,181 | | |

$ | (403 | ) | |

$ | 3,556 | | |

$ | (1,904 | ) |

| Interest Expense | |

| 7,371 | | |

| 8,639 | | |

| 14,845 | | |

| 16,969 | |

| Franchise Taxes | |

| 114 | | |

| 100 | | |

| 228 | | |

| 201 | |

| Depreciation Expense | |

| 15,001 | | |

| 13,751 | | |

| 29,742 | | |

| 27,124 | |

| Depreciation Expense from

Unconsolidated Joint Venture | |

| 204 | | |

| 166 | | |

| 401 | | |

| 325 | |

| (Increase) Decrease in

Fair Value of Marketable Securities | |

| (3,338 | ) | |

| 2,548 | | |

| 2,031 | | |

| 4,943 | |

| Loss

on Sales of Marketable Securities, net | |

| 3,778 | | |

| 1 | | |

| 3,778 | | |

| 43 | |

| Adjusted

EBITDA | |

| 28,311 | | |

| 24,802 | | |

| 54,581 | | |

| 47,701 | |

| Non-

Recurring Other Expense (1) | |

| 18 | | |

| 468 | | |

| 433 | | |

| 1,030 | |

Adjusted

EBITDA without Non-recurring Other Expense | |

$ | 28,329 | | |

$ | 25,270 | | |

$ | 55,014 | | |

$ | 48,731 | |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of Net Income (Loss) Attributable to Common Shareholders to Funds from Operations |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income (Loss) Attributable

to Common Shareholders | |

$ | 527 | | |

$ | (4,418 | ) | |

$ | (5,737 | ) | |

$ | (9,715 | ) |

| Depreciation Expense | |

| 15,001 | | |

| 13,751 | | |

| 29,742 | | |

| 27,124 | |

| Depreciation Expense from

Unconsolidated Joint Venture | |

| 204 | | |

| 166 | | |

| 401 | | |

| 325 | |

| (Gain) Loss on Sales of

Investment Property and Equipment | |

| 10 | | |

| (5 | ) | |

| 13 | | |

| (37 | ) |

| (Increase) Decrease in

Fair Value of Marketable Securities | |

| (3,338 | ) | |

| 2,548 | | |

| 2,031 | | |

| 4,943 | |

| Loss

on Sales of Marketable Securities, net | |

| 3,778 | | |

| 1 | | |

| 3,778 | | |

| 43 | |

| Funds

from Operations Attributable to Common Shareholders (“FFO”) | |

| 16,182 | | |

| 12,043 | | |

| 30,228 | | |

| 22,683 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Amortization of Financing

Costs | |

| 607 | | |

| 538 | | |

| 1,163 | | |

| 1,056 | |

| Non-

Recurring Other Expense (1) | |

| 18 | | |

| 468 | | |

| 433 | | |

| 1,030 | |

Normalized

Funds from Operations Attributable to Common Shareholders (“Normalized FFO”) | |

$ | 16,807 | | |

$ | 13,049 | | |

$ | 31,824 | | |

$ | 24,769 | |

| |

(1) |

Consists of non-recurring

one-time legal fees ($18 and $51, respectively), and costs associated with the liquidation/sale of inventory in a particular sales

center ($0 and $382, respectively) for the three and six months ended June 30, 2024. Consists of special bonus and restricted stock

grants for the August 2020 groundbreaking Fannie Mae financing, which were being expensed over the vesting period ($431 and $862, respectively)

and non-recurring expenses for the joint venture with Nuveen ($3 and $50, respectively), one-time legal fees ($30 and $50, respectively),

fees related to the establishment of the OZ Fund ($4 and $37, respectively), and costs associated with an acquisition that was not

completed ($0 and $31, respectively) for the three and six months ended June 30, 2023. |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 7 |

Market

Capitalization, Debt and Coverage Ratios

(in

thousands) (unaudited)

| | |

Six Months Ended | | |

Year Ended | |

| | |

June 30, 2024 | | |

June 30, 2023 | | |

December 31, 2023 | |

| Shares Outstanding | |

| 72,750 | | |

| 63,072 | | |

| 67,978 | |

| Market Price Per Share | |

$ | 15.99 | | |

$ | 15.98 | | |

$ | 15.32 | |

| Equity Market Capitalization | |

$ | 1,163,272 | | |

$ | 1,007,888 | | |

$ | 1,041,422 | |

| Total Debt | |

| 668,876 | | |

| 726,862 | | |

| 690,017 | |

| Preferred | |

| 295,757 | | |

| 265,032 | | |

| 290,180 | |

| Total Market Capitalization | |

$ | 2,127,905 | | |

$ | 1,999,782 | | |

$ | 2,021,619 | |

| | |

| | | |

| | | |

| | |

| Total Debt | |

$ | 668,876 | | |

$ | 726,862 | | |

$ | 690,017 | |

| Less: Cash and Cash Equivalents | |

| (39,457 | ) | |

| (41,484 | ) | |

| (57,320 | ) |

| Net Debt | |

| 629,419 | | |

| 685,378 | | |

| 632,697 | |

| Less: Marketable Securities at Fair Value (“Securities”) | |

| (28,673 | ) | |

| (36,701 | ) | |

| (34,506 | ) |

| Net Debt Less Securities | |

$ | 600,746 | | |

$ | 648,677 | | |

$ | 598,191 | |

| | |

| | | |

| | | |

| | |

| Interest Expense | |

$ | 14,845 | | |

$ | 16,969 | | |

$ | 32,475 | |

| Capitalized Interest | |

| 2,378 | | |

| 2,699 | | |

| 5,032 | |

| Preferred Dividends | |

| 9,385 | | |

| 7,887 | | |

| 16,723 | |

| Total Fixed Charges | |

$ | 26,608 | | |

$ | 27,555 | | |

$ | 54,230 | |

| | |

| | | |

| | | |

| | |

| Adjusted EBITDA excluding Non-Recurring Other Expenses | |

$ | 55,014 | | |

$ | 48,731 | | |

$ | 101,780 | |

| | |

| | | |

| | | |

| | |

| Debt and Coverage Ratios | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Net Debt / Total Market Capitalization | |

| 29.6 | % | |

| 34.3 | % | |

| 31.3 | % |

| | |

| | | |

| | | |

| | |

| Net Debt Plus Preferred / Total Market Capitalization | |

| 43.5 | % | |

| 47.5 | % | |

| 45.7 | % |

| | |

| | | |

| | | |

| | |

| Net Debt Less Securities / Total Market Capitalization | |

| 28.2 | % | |

| 32.4 | % | |

| 29.6 | % |

| | |

| | | |

| | | |

| | |

| Net Debt Less Securities Plus Preferred / Total Market Capitalization | |

| 42.1 | % | |

| 45.7 | % | |

| 43.9 | % |

| | |

| | | |

| | | |

| | |

| Interest Coverage | |

| 3.2x | | |

| 2.5x | | |

| 2.7x | |

| | |

| | | |

| | | |

| | |

| Fixed Charge Coverage | |

| 2.1x | | |

| 1.8x | | |

| 1.9x | |

| | |

| | | |

| | | |

| | |

| Net Debt / Adjusted EBITDA excluding Non-Recurring Other Expense | |

| 5.7x | | |

| 7.0x | | |

| 6.2x | |

| | |

| | | |

| | | |

| | |

| Net Debt Less Securities / Adjusted EBITDA excluding Non-Recurring Other Expense | |

| 5.5x | | |

| 6.7x | | |

| 5.9x | |

| | |

| | | |

| | | |

| | |

| Net Debt Plus Preferred / Adjusted EBITDA excluding Non-Recurring Other Expense | |

| 8.4x | | |

| 9.8x | | |

| 9.1x | |

| | |

| | | |

| | | |

| | |

| Net Debt Less Securities Plus Preferred / Adjusted EBITDA excluding Non-Recurring Other Expense | |

| 8.1x | | |

| 9.4x | | |

| 8.7x | |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 8 |

Debt

Analysis

(in

thousands) (unaudited)

| | |

Six Months Ended | | |

Year Ended | |

| | |

June 30, 2024 | | |

June 30, 2023 | | |

December 31, 2023 | |

| Debt Outstanding | |

| | | |

| | | |

| | |

| Mortgages Payable: | |

| | | |

| | | |

| | |

| Fixed Rate Mortgages | |

$ | 495,219 | | |

$ | 449,126 | | |

$ | 501,135 | |

| Unamortized Debt Issuance Costs | |

| (4,189 | ) | |

| (4,329 | ) | |

| (4,652 | ) |

| | |

| | | |

| | | |

| | |

| Mortgages, Net of Unamortized Debt Issuance Costs | |

$ | 491,030 | | |

$ | 444,797 | | |

$ | 496,483 | |

| Loans Payable: | |

| | | |

| | | |

| | |

| Unsecured Line of Credit | |

$ | 50,000 | | |

$ | 100,000 | | |

$ | 70,000 | |

| Other Loans Payable | |

| 28,846 | | |

| 83,753 | | |

| 24,683 | |

| | |

| | | |

| | | |

| | |

| Total Loans Before Unamortized Debt Issuance Costs | |

| 78,846 | | |

| 183,753 | | |

| 94,683 | |

| Unamortized Debt Issuance Costs | |

| (1,479 | ) | |

| (1,319 | ) | |

| (1,204 | ) |

| | |

| | | |

| | | |

| | |

| Loans, Net of Unamortized Debt Issuance Costs | |

$ | 77,367 | | |

$ | 182,434 | | |

$ | 93,479 | |

| Bonds Payable: | |

| | | |

| | | |

| | |

| Series A Bonds | |

$ | 102,670 | | |

$ | 102,670 | | |

$ | 102,670 | |

| Unamortized Debt Issuance Costs | |

| (2,191 | ) | |

| (3,039 | ) | |

| (2,615 | ) |

| Bonds, Net of Unamortized Debt Issuance Costs | |

$ | 100,479 | | |

$ | 99,631 | | |

$ | 100,055 | |

| | |

| | | |

| | | |

| | |

| Total Debt, Net of Unamortized Debt Issuance Costs | |

$ | 668,876 | | |

$ | 726,862 | | |

$ | 690,017 | |

| | |

| | | |

| | | |

| | |

| % Fixed/Floating | |

| | | |

| | | |

| | |

| Fixed | |

| 91.9 | % | |

| 75.0 | % | |

| 90.0 | % |

| Floating | |

| 8.1 | % | |

| 25.0 | % | |

| 10.0 | % |

| Total | |

| 100.0 | % | |

| 100.0 | % | |

| 100.0 | % |

| | |

| | | |

| | | |

| | |

| Weighted Average Interest Rates (1) | |

| | | |

| | | |

| | |

| Mortgages Payable | |

| 4.17 | % | |

| 3.88 | % | |

| 4.17 | % |

| Loans Payable | |

| 6.81 | % | |

| 7.42 | % | |

| 6.98 | % |

| Bonds Payable | |

| 4.72 | % | |

| 4.72 | % | |

| 4.72 | % |

| Total Average | |

| 4.56 | % | |

| 4.88 | % | |

| 4.63 | % |

| | |

| | | |

| | | |

| | |

| Weighted Average Maturity (Years) | |

| | | |

| | | |

| | |

| Mortgages Payable | |

| 4.8 | | |

| 5.2 | | |

| 5.3 | |

| |

(1) |

Weighted

average interest rates do not include the effect of unamortized debt issuance costs. |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 9 |

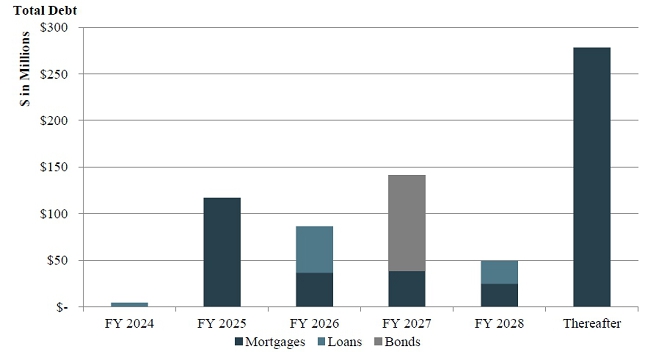

Debt

Maturity

(in

thousands) (unaudited)

| As of June 30, 2024: | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| Year Ended | |

Mortgages | | |

Loans | | |

Bonds | | |

Total | | |

%

of Total | |

| 2024 | |

$ | -0- | | |

$ | 4,487 | | |

$ | -0- | | |

$ | 4,487 | | |

| 0.6 | % |

| 2025 | |

| 117,008 | | |

| -0- | | |

| -0- | | |

| 117,008 | | |

| 17.3 | % |

| 2026 | |

| 36,567 | | |

| 50,000 | (1) | |

|

-0- | | |

| 86,567 | | |

| 12.8 | % |

| 2027 | |

| 38,524 | | |

| -0- | | |

| 102,670 | (2) | |

| 141,194

| | |

| 20.9 | % |

| 2028 | |

| 24,900 | | |

| 24,359 | | |

| -0- | | |

| 49,259 | | |

| 7.3 | % |

| Thereafter | |

| 278,220 | | |

| -0- | | |

| -0- | | |

| 278,220 | | |

| 41.1 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Debt Before Unamortized Debt Issuance

Cost | |

| 495,219 | | |

| 78,846 | | |

| 102,670 | | |

| 676,735 | | |

| 100.0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unamortized Debt Issuance

Cost | |

| (4,189 | ) | |

| (1,479 | ) | |

| (2,191 | ) | |

| (7,859 | ) | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total

Debt, Net of Unamortized Debt Issuance Costs | |

$ | 491,030 | | |

$ | 77,367 | | |

$ | 100,479 | | |

$ | 668,876 | | |

| | |

| (1) |

Represents

$50.0 million balance outstanding on the Company’s Line of Credit due November 7, 2026,

with an additional one-year option.

|

| (2) |

Represents

$102.7 million balance outstanding of the Company’s Series A Bonds due February 28, 2027. |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 10 |

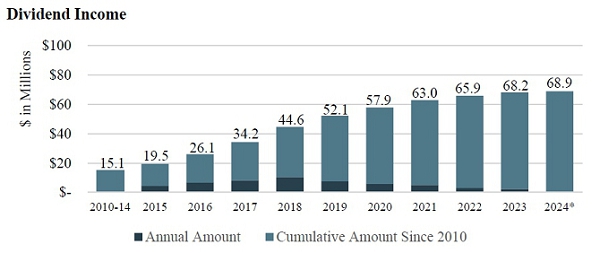

Securities

Portfolio Performance

(in

thousands) (unaudited)

| Year

Ended | |

Securities

Available for Sale | | |

Dividend

Income | | |

Net

Realized Gain (Loss) on Sale of Securities | | |

Net

Realized Gain (Loss) on Sale of Securities & Dividend Income | |

| 2010-2014 | |

| 63,556 | | |

$ | 15,066 | | |

$ | 14,414 | | |

$ | 29,480 | |

| 2015 | |

| 75,011 | | |

| 4,399 | | |

| 204 | | |

| 4,603 | |

| 2016 | |

| 108,755 | | |

| 6,636 | | |

| 2,285 | | |

| 8,921 | |

| 2017 | |

| 132,964 | | |

| 8,135 | | |

| 1,747 | | |

| 9,882 | |

| 2018 | |

| 99,596 | | |

| 10,367 | | |

| 20 | | |

| 10,387 | |

| 2019 | |

| 116,186 | | |

| 7,535 | | |

| -0- | | |

| 7,535 | |

| 2020 | |

| 103,172 | | |

| 5,729 | | |

| -0- | | |

| 5,729 | |

| 2021 | |

| 113,748 | | |

| 5,098 | | |

| 2,342 | | |

| 7,440 | |

| 2022 | |

| 42,178 | | |

| 2,903 | | |

| 6,394 | | |

| 9,297 | |

| 2023 | |

| 34,506 | | |

| 2,318 | | |

| 183 | | |

| 2,501 | |

| 2024* | |

| 28,673 | | |

| 722 | | |

| (3,778 | ) | |

| (3,056 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

$ | 68,908 | | |

$ | 23,811 | | |

$ | 92,719 | |

*

Financial Information is as of and for the six months ended June 30, 2024.

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 11 |

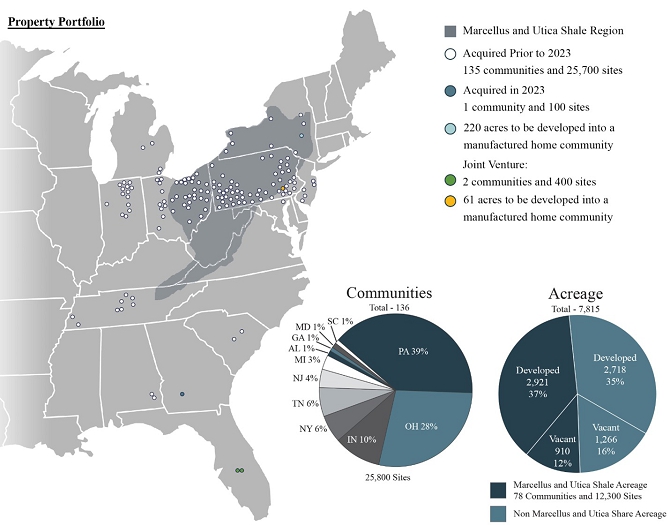

Property

Summary and Snapshot

(unaudited)

| | |

June

30, 2024 | | |

June

30, 2023 | | |

%

Change | |

| | |

| | |

| | |

| |

| Communities (1) | |

| 136 | | |

| 135 | | |

| 0.7 | % |

| Total Sites | |

| 25,787 | | |

| 25,729 | | |

| 0.2 | % |

| Occupied Sites | |

| 22,526 | | |

| 22,096 | | |

| 430

sites, 1.9 | % |

| Occupancy % | |

| 87.4 | % | |

| 85.9 | % | |

| 150

bps | |

| Total Rentals | |

| 10,136 | | |

| 9,632 | | |

| 5.2 | % |

| Occupied Rentals | |

| 9,630 | | |

| 9,048 | | |

| 6.4 | % |

| Rental Occupancy % | |

| 95.0 | % | |

| 93.9 | % | |

| 110

bps | |

| Monthly Rent Per Site | |

$ | 531 | | |

$ | 509 | | |

| 4.3 | % |

| Monthly Rent Per Home Rental Including Site | |

$ | 960 | | |

$ | 905 | | |

| 6.1 | % |

| State | |

Number | | |

Total

Acreage | | |

Developed

Acreage | | |

Vacant

Acreage | | |

Total

Sites | | |

Occupied Sites | | |

Occupancy

Percentage | | |

Monthly

Rent Per Site | | |

Total

Rentals | | |

Occupied

Rentals | | |

Rental

Occupancy

Percentage | | |

Monthly

Rent Per Home

Rental | |

| | |

| | | |

(2) | | |

| | | |

(2) | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

(3) | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Alabama | |

| 2 | | |

| 69 | | |

| 62 | | |

| 7 | | |

| 325 | | |

| 132 | | |

| 40.6 | % | |

$ | 193 | | |

| 107 | | |

| 101 | | |

| 94.4 | % | |

$ | 1,045 | |

| Georgia | |

| 1 | | |

| 26 | | |

| 26 | | |

| -0- | | |

| 118 | | |

| 10 | | |

| 8.5 | % | |

$ | 450 | | |

| 10 | | |

| 10 | | |

| 100.0 | % | |

$ | 1,057 | |

| Indiana | |

| 14 | | |

| 1,105 | | |

| 908 | | |

| 197 | | |

| 4,022 | | |

| 3,602 | | |

| 89.6 | % | |

$ | 491 | | |

| 1,946 | | |

| 1,855 | | |

| 95.3 | % | |

$ | 983 | |

| Maryland | |

| 1 | | |

| 77 | | |

| 29 | | |

| 48 | | |

| 63 | | |

| 61 | | |

| 96.8 | % | |

$ | 621 | | |

| -0- | | |

| -0- | | |

| N/A | | |

| N/A | |

| Michigan | |

| 4 | | |

| 241 | | |

| 222 | | |

| 19 | | |

| 1,088 | | |

| 917 | | |

| 84.3 | % | |

$ | 498 | | |

| 385 | | |

| 357 | | |

| 92.7 | % | |

$ | 998 | |

| New Jersey | |

| 5 | | |

| 390 | | |

| 226 | | |

| 164 | | |

| 1,265 | | |

| 1,219 | | |

| 96.4 | % | |

$ | 705 | | |

| 44 | | |

| 38 | | |

| 86.4 | % | |

$ | 1,253 | |

| New York | |

| 8 | | |

| 698 | | |

| 327 | | |

| 371 | | |

| 1,367 | | |

| 1,188 | | |

| 86.9 | % | |

$ | 633 | | |

| 485 | | |

| 462 | | |

| 95.3 | % | |

$ | 1,130 | |

| Ohio | |

| 38 | | |

| 2,044 | | |

| 1,515 | | |

| 529 | | |

| 7,302 | | |

| 6,407 | | |

| 87.7 | % | |

$ | 488 | | |

| 2,973 | | |

| 2,847 | | |

| 95.8 | % | |

$ | 910 | |

| Pennsylvania | |

| 53 | | |

| 2,392 | | |

| 1,901 | | |

| 491 | | |

| 7,968 | | |

| 6,961 | | |

| 87.4 | % | |

$ | 558 | | |

| 3,130 | | |

| 2,955 | | |

| 94.4 | % | |

$ | 957 | |

| South Carolina | |

| 2 | | |

| 63 | | |

| 55 | | |

| 8 | | |

| 322 | | |

| 195 | | |

| 60.6 | % | |

$ | 211 | | |

| 140 | | |

| 121 | | |

| 86.4 | % | |

$ | 1,027 | |

| Tennessee (1) | |

| 8 | | |

| 710 | | |

| 368 | | |

| 342 | | |

| 1,947 | | |

| 1,834 | | |

| 94.2 | % | |

$ | 548 | | |

| 916 | | |

| 884 | | |

| 96.5 | % | |

$ | 963 | |

Total

as of June 30, 2024 (1) | |

| 136 | | |

| 7,815 | | |

| 5,639 | | |

| 2,176 | | |

| 25,787 | | |

| 22,526 | | |

| 87.4 | % | |

$ | 531 | | |

| 10,136 | | |

| 9,630 | | |

| 95.0 | % | |

$ | 960 | |

| (1) |

As

of January 1, 2024, includes Duck River Estates, a newly constructed community. |

| (2) |

Total

and Vacant Acreage of 220 for Mountain View Estates property is included in the above summary. |

| (3) |

Includes

home and site rent charges. |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 12 |

Same

Property Statistics

(in

thousands) (unaudited)

| | |

Three Months

Ended | | |

Six Months

Ended | |

| | |

June

30, 2024 | | |

June

30, 2023 | | |

Change | | |

%

Change | | |

June

30, 2024 | | |

June

30, 2023 | | |

Change | | |

%

Change | |

| Same Property Community Net Operating Income (“NOI”) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Rental and Related

Income | |

$ | 50,939 | | |

$ | 46,722 | | |

$ | 4,217 | | |

| 9.0 | % | |

$ | 100,639 | | |

$ | 91,711 | | |

$ | 8,928 | | |

| 9.7 | % |

Community Operating

Expenses | |

| 20,022 | | |

| 18,863 | | |

| 1,159 | | |

| 6.1 | % | |

| 39,690 | | |

| 37,872 | | |

| 1,818 | | |

| 4.8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Same

Property Community

NOI | |

$ | 30,917 | | |

$ | 27,859 | | |

$ | 3,058 | | |

| 11.0 | % | |

$ | 60,949 | | |

$ | 53,839 | | |

$ | 7,110 | | |

| 13.2 | % |

| | |

June

30, 2024 | | |

June

30, 2023 | | |

Change | |

| | |

| | |

| | |

| |

| Total Sites | |

| 25,457 | | |

| 25,405 | | |

| 0.2 | % |

| Occupied Sites | |

| 22,333 | | |

| 21,953 | | |

| 380

sites, 1.7 | % |

| Occupancy % | |

| 87.7 | % | |

| 86.4 | % | |

| 130

bps | |

| Number of Properties | |

| 133 | | |

| 133 | | |

| N/A | |

| Total Rentals | |

| 9,980 | | |

| 9,513 | | |

| 4.9 | % |

| Occupied Rentals | |

| 9,485 | | |

| 8,939 | | |

| 6.1 | % |

| Rental Occupancy | |

| 95.0 | % | |

| 94.0 | % | |

| 100

bps | |

| Monthly Rent Per Site | |

$ | 534 | | |

$ | 509 | | |

| 4.9 | % |

| Monthly Rent Per Home Rental Including Site | |

$ | 958 | | |

$ | 903 | | |

| 6.1 | % |

Same

Property includes all properties owned as of January 1, 2023, with the exception of Memphis Blues and Duck River Estates.

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 13 |

Acquisitions

Summary

(dollars

in thousands)

Year of

Acquisition | |

Number

of Communities | | |

Sites | | |

Occupancy

% at

Acquisition | | |

Purchase Price | | |

Price Per

Site | | |

Total

Acres | |

| 2021 | |

3 | | |

543 | | |

| 59 | % | |

$ | 18,300 | | |

$ | 34 | | |

113 | |

| 2022 | |

7 | | |

1,480 | | |

| 65 | % | |

$ | 86,223 | | |

$ | 58 | | |

461 | |

| 2023 | |

1 | | |

118 | | |

| -0- | % | |

$ | 3,650 | | |

$ | 31 | | |

26 | |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 14 |

Definitions

Investors

and analysts following the real estate industry utilize funds from operations available to common shareholders (“FFO”), normalized

funds from operations available to common shareholders (“Normalized FFO”), Community NOI, Same Property Community NOI, and

earnings before interest, taxes, depreciation, amortization and acquisition costs (“Adjusted EBITDA excluding Non-Recurring Other

Expense”), variously defined, as supplemental performance measures. While the Company believes net income (loss) available to common

shareholders, as defined by accounting principles generally accepted in the United States of America (U.S. GAAP), is the most appropriate

measure, it considers Community NOI, Same Property Community NOI, Adjusted EBITDA excluding Non-Recurring Other Expense, FFO and Normalized

FFO, given their wide use by and relevance to investors and analysts, appropriate supplemental performance measures. FFO, reflecting

the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of U.S. GAAP depreciation

and amortization of real estate assets. FFO also adjusts for the effects of the change in the fair value of marketable securities and

gains and losses realized on marketable securities. Normalized FFO reflects the same assumptions as FFO except that it also adjusts for

amortization of financing costs and certain one-time charges. Community NOI and Same Property Community NOI provide a measure of rental

operations and do not factor in depreciation and amortization and non-property specific expenses such as general and administrative expenses.

Adjusted EBITDA excluding Non-Recurring Other Expense provides a tool to further evaluate the ability to incur and service debt and to

fund dividends and other cash needs. In addition, Community NOI, Same Property Community NOI, Adjusted EBITDA, excluding Non-Recurring

Other Expense, FFO and Normalized FFO are commonly used in various ratios, pricing multiples, yields and returns and valuation of calculations

used to measure financial position, performance and value.

FFO,

as defined by The National Association of Real Estate Investment Trusts (“Nareit”), is calculated to be equal to net income

(loss) applicable to common shareholders, as defined by U.S. GAAP, excluding gains or losses from sales of previously depreciated real

estate assets, impairment charges related to depreciable real estate assets, the change in the fair value of marketable securities, and

the gain or loss on the sale of marketable securities plus certain non-cash items such as real estate asset depreciation and amortization.

Included in the Nareit FFO White Paper - 2018 Restatement, is an option pertaining to assets incidental to our main business in the calculation

of Nareit FFO to make an election to include or exclude gains and losses on the sale of these assets, such as marketable equity securities,

and include or exclude mark-to-market changes in the value recognized on these marketable equity securities. In conjunction with the

adoption of the FFO White Paper - 2018 Restatement, for all periods presented, we have elected to exclude the gains and losses realized

on marketable securities and change in the fair value of marketable securities from our FFO calculation. Nareit created FFO as a non-GAAP

supplemental measure of REIT operating performance.

Normalized

FFO is calculated as FFO excluding amortization and certain one-time charges.

Normalized

FFO per Diluted Common Share is calculated using diluted weighted shares outstanding of 71.9 million and 70.7 million shares for

the three and six months ended June 30, 2024, respectively, and 61.8 million and 60.8 million shares for the three and six months ended

June 30, 2023, respectively. Common stock equivalents resulting from stock options in the amount of 466,000 shares for the three months

ended June 30, 2024, were included in the computation of Diluted Net Income per Share. Common stock equivalents resulting from stock

options in the amount of 409,000 for the six months ended June 30, 2024, and 524,000 and 658,000 for the three and six months ended June

30, 2023, respectively, were excluded from the computation of Diluted Net Loss per Share as their effect would have been anti-dilutive.

Community

NOI is calculated as rental and related income less community operating expenses such as real estate taxes, repairs and maintenance,

community salaries, utilities, insurance and other expenses.

Same

Property Community NOI is calculated as Community NOI, using all properties owned as of January 1, 2023, with the exception of Memphis

Blues and Duck River Estates.

Adjusted

EBITDA excluding Non-Recurring Other Expense is calculated as net income (loss) plus interest expense, franchise taxes, depreciation,

the change in the fair value of marketable securities and the gain (loss) on sales of marketable securities, adjusted for non-recurring

other expenses.

Community

NOI, Same Property Community NOI, Adjusted EBITDA excluding Non-Recurring Other Expense, FFO and Normalized FFO do not represent

cash generated from operating activities in accordance with U.S. GAAP and are not necessarily indicative of cash available to fund cash

needs, including the repayment of principal on debt and payment of dividends and distributions. Community NOI, Same Property Community

NOI, Adjusted EBITDA excluding Non-Recurring Other Expense, FFO and Normalized FFO should not be considered as substitutes for net income

(loss) applicable to common shareholders (calculated in accordance with U.S. GAAP) as a measure of results of operations, or cash flows

(calculated in accordance with U.S. GAAP) as a measure of liquidity. Community NOI, Same Property Community NOI, Adjusted EBITDA excluding

Non-Recurring Other Expense, FFO and Normalized FFO as currently calculated by the Company may not be comparable to similarly titled,

but variously calculated, measures of other REITs.

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 15 |

Press

Release Dated August 6, 2024

| FOR

IMMEDIATE RELEASE |

August

6, 2024 |

| |

Contact:

Nelli Madden |

| |

732-577-9997 |

UMH

PROPERTIES, INC. REPORTS RESULTS FOR THE SECOND QUARTER ENDED JUNE 30, 2024

FREEHOLD,

NJ, August 6, 2024........ UMH Properties, Inc. (NYSE:UMH) (TASE:UMH) reported Total Income for the quarter ended June 30, 2024 of

$60.3 million as compared to $55.3 million for the quarter ended June 30, 2023, representing an increase of 9%. Net Income Attributable

to Common Shareholders amounted to $527,000 or $0.01 per diluted share for the quarter ended June 30, 2024 as compared to a Net Loss

of $4.4 million or $0.07 per diluted share for the quarter ended June 30, 2023. Normalized Funds from Operations Attributable to Common

Shareholders (“Normalized FFO”), was $16.8 million or $0.23 per diluted share for the quarter ended June 30, 2024, as compared

to $13.0 million or $0.21 per diluted share for the quarter ended June 30, 2023, representing a 10% per diluted share increase.

A

summary of significant financial information for the three and six months ended June 30, 2024 and 2023 is as follows (in thousands

except per share amounts):

| | |

Three Months

Ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Total Income | |

$ | 60,328 | | |

$ | 55,290 | |

| Total Expenses | |

$ | 49,307 | | |

$ | 46,371 | |

| Net Income (Loss) Attributable to Common Shareholders | |

$ | 527 | | |

$ | (4,418 | ) |

| Net Income (Loss) Attributable to Common Shareholders per Diluted Common Share | |

$ | (0.01 | ) | |

$ | (0.07 | ) |

| FFO (1) | |

$ | 16,182 | | |

$ | 12,043 | |

| FFO (1) per Diluted Common Share | |

$ | 0.23 | | |

$ | 0.19 | |

| Normalized FFO (1) | |

$ | 16,807 | | |

$ | 13,049 | |

| Normalized FFO (1)

per Diluted Common Share | |

$ | 0.23 | | |

$ | 0.21 | |

| Basic Weighted Average Shares Outstanding | |

| 71,418 | | |

| 61,236 | |

| Diluted Weighted Average Shares Outstanding | |

| 71,884 | | |

| 61,760 | |

| | |

Six Months

Ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Total Income | |

$ | 118,008 | | |

$ | 107,897 | |

| Total Expenses | |

$ | 97,715 | | |

$ | 91,611 | |

| Net Loss Attributable to Common Shareholders | |

$ | (5,737 | ) | |

$ | (9,715 | ) |

| Net Loss Attributable to Common Shareholders

per Diluted Common Share | |

$ | (0.08 | ) | |

$ | (0.16 | ) |

| FFO (1) | |

$ | 30,228 | | |

$ | 22,683 | |

| FFO (1) per Diluted Common Share | |

$ | 0.43 | | |

$ | 0.37 | |

| Normalized FFO (1) | |

$ | 31,824 | | |

$ | 24,769 | |

| Normalized FFO (1)

per Diluted Common Share | |

$ | 0.45 | | |

$ | 0.41 | |

| Basic Weighted Average Shares Outstanding | |

| 70,291 | | |

| 60,186 | |

| Diluted Weighted Average Shares Outstanding | |

| 70,700 | | |

| 60,844 | |

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 16 |

A

summary of significant balance sheet information as of June 30, 2024 and December 31, 2023 is as follows (in thousands):

| | |

June

30, 2024 | | |

December

31, 2023 | |

| | |

| | |

| |

| Gross Real Estate Investments | |

$ | 1,574,196 | | |

$ | 1,539,041 | |

| Marketable Securities at Fair Value | |

$ | 28,673 | | |

$ | 34,506 | |

| Total Assets | |

$ | 1,441,295 | | |

$ | 1,427,577 | |

| Mortgages Payable, net | |

$ | 491,030 | | |

$ | 496,483 | |

| Loans Payable, net | |

$ | 77,367 | | |

$ | 93,479 | |

| Bonds Payable, net | |

$ | 100,479 | | |

$ | 100,055 | |

| Total Shareholders’ Equity | |

$ | 743,980 | | |

$ | 706,794 | |

Samuel

A. Landy, President and CEO, commented on the results of the second quarter of 2024.

“We

are pleased to announce another solid quarter of operating results. During the quarter, we:

| |

● |

Increased Rental and Related

Income by 9%; |

| |

● |

Increased Sales of Manufactured Homes by 7%; |

| |

● |

Increased Community Net Operating Income (“NOI”)

by 11%; |

| |

● |

Increased Same Property NOI by 11%; |

| |

● |

Increased Same Property Occupancy by 130 basis

points from 86.4% to 87.7%; |

| |

● |

Improved our Same Property expense ratio by

110 basis points from 40.4% in the second quarter of 2023 to 39.3% at quarter end; |

| |

● |

Amended our unsecured credit facility to expand

available borrowings by $80 million from $180 million to $260 million syndicated with BMO Capital Markets Corp., JPMorgan Chase Bank,

NA and Wells Fargo, N.A; |

| |

● |

For the fourth time since 2020, raised our

quarterly common stock dividend by $0.01 representing a 4.9% increase to $0.215 per share or $0.86 annually; |

| |

● |

Issued and sold approximately 2.4 million

shares of Common Stock through our At-the-Market Sale Program at a weighted average price of $15.46 per share, generating gross proceeds

of $36.9 million and net proceeds of $36.1 million, after offering expenses; |

| |

● |

Issued and sold approximately 29,000 shares

of Series D Preferred Stock through our At-the-Market Sale Program at a weighted average price of $23.18 per share, generating gross

proceeds of $670,000 and net proceeds of $659,000, after offering expenses; |

| |

● |

Subsequent to quarter end, issued and sold

approximately 765,000 shares of Common Stock through our At-the-Market Sale Program at a weighted average price of $16.94 per share,

generating net proceeds of $12.8 million, after offering expenses; and |

| |

● |

Subsequent to quarter end, issued and sold

approximately 150,000 shares of Series D Preferred Stock through our At-the-Market Sale Program at a weighted average price of $23.01

per share, generating net proceeds of $3.4 million, after offering expenses.” |

Mr.

Landy stated, “UMH is pleased to report that Normalized FFO for the second quarter increased to $0.23 from $0.21 last year, representing

an increase of approximately 10%. Sequentially, Normalized FFO increased from $0.22 to $0.23, representing an increase of approximately

5%. UMH has intentionally acquired value-added communities with vacant sites over the past 10 years. We have been improving the communities

through our capital improvements, adding approximately 800 homes per year and selling 200 homes per year. These investments have added

to the supply of affordable housing and generated best-in-class operating results.

“Our

same property operating results continue to demonstrate the effectiveness of our business plan. Same property NOI increased by 11.0%

for the quarter and 13.2% for the first six months, compared to the corresponding prior year periods. UMH has now increased same property

NOI by double digits for four consecutive quarters. This increase was driven by an increase in rental and related income of 9.0% and

9.7% for the three and six months, respectively, partially offset by an increase in same property expenses of 6.1% and 4.8%, respectively.

The growth in rental and related income is primarily attributed to a strong increase in occupancy of 380 units and rental rate increases

of 4.9%.

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 17 |

“Our

sales for the quarter increased from $8.2 million to $8.8 million, representing an increase of 7%. Notably, our gross margin increased

from 30% last year to 38% this year. Sales demand remains strong, and we anticipate another solid quarter of profitable home sales in

the third quarter.

“We

are initiating guidance for the remainder of 2024, with Normalized FFO in a range of $0.91-0.95 per diluted share for the full year,

or $0.93 at the midpoint. This represents approximately 8% annual normalized FFO growth at the midpoint over full year 2023 Normalized

FFO of $0.86 per diluted share.

“UMH

continues to execute on our long-term business plan of acquiring communities. Our high-quality communities continue to experience strong

demand for our products, which is translating to growing occupancy, net operating income and property value. Our 3,300 vacant sites and

2,200 acres of vacant land give us a runway to generate earnings growth for years to come. We maintain a strong balance sheet to ensure

that we can execute our organic growth plan and be prepared when external acquisition opportunities become available. This strategy has

allowed us to build a first-class portfolio of manufactured housing communities that deliver shareholders a resilient and growing dividend,

greater scale, and improved net asset value per share.”

UMH

Properties, Inc. will host its Second Quarter 2024 Financial Results Webcast and Conference Call. Senior management will discuss the

results, current market conditions and future outlook on Wednesday, August 7, 2024, at 10:00 a.m. Eastern Time.

The

Company’s 2024 second quarter financial results being released herein will be available on the Company’s website at www.umh.reit

in the “Financials” section.

To

participate in the webcast, select the webcast icon on the homepage of the Company’s website at www.umh.reit, in the Upcoming Events

section. Interested parties can also participate via conference call by calling toll free 877-513-1898 (domestically) or 412-902-4147

(internationally).

The

replay of the conference call will be available at 12:00 p.m. Eastern Time on Wednesday, August 7, 2024, and can be

accessed by dialing toll free 877-344-7529 (domestically) and 412-317-0088 (internationally) and entering the passcode 7242441. A

transcript of the call and the webcast replay will be available at the Company’s website, www.umh.reit.

UMH

Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 136 manufactured home communities containing

approximately 25,800 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana,

Maryland, Michigan, Alabama, South Carolina and Georgia. UMH also has an ownership interest in and operates two communities in Florida,

containing 363 sites, through its joint venture with Nuveen Real Estate.

Certain

statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current

expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking

statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and

uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual

report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation

to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 18 |

Note:

| |

(1) |

Non-GAAP Information: We

assess and measure our overall operating results based upon an industry performance measure referred to as Funds from Operations Attributable

to Common Shareholders (“FFO”), which management believes is a useful indicator of our operating performance. FFO is used

by industry analysts and investors as a supplemental operating performance measure of a REIT. FFO, as defined by The National Association

of Real Estate Investment Trusts (“NAREIT”), represents net income (loss) attributable to common shareholders, as defined

by accounting principles generally accepted in the United States of America (“U.S. GAAP”), excluding gains or losses from

sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, the change in the

fair value of marketable securities, and the gain or loss on the sale of marketable securities plus certain non-cash items such as

real estate asset depreciation and amortization. Included in the NAREIT FFO White Paper - 2018 Restatement, is an option pertaining

to assets incidental to our main business in the calculation of NAREIT FFO to make an election to include or exclude gains and losses

on the sale of these assets, such as marketable equity securities, and include or exclude mark-to-market changes in the value recognized

on these marketable equity securities. In conjunction with the adoption of the FFO White Paper - 2018 Restatement, for all periods

presented, we have elected to exclude the gains and losses realized on marketable securities investments and the change in the fair

value of marketable securities from our FFO calculation. NAREIT created FFO as a non-U.S. GAAP supplemental measure of REIT operating

performance. We define Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), as FFO

excluding certain one-time charges. FFO and Normalized FFO should be considered as supplemental measures of operating performance used

by REITs. FFO and Normalized FFO exclude historical cost depreciation as an expense and may facilitate the comparison of REITs which

have a different cost basis. However, other REITs may use different methodologies to calculate FFO and Normalized FFO and, accordingly,

our FFO and Normalized FFO may not be comparable to all other REITs. The items excluded from FFO and Normalized FFO are significant

components in understanding the Company’s financial performance. |

| |

|

|

| |

|

FFO

and Normalized FFO (i) do not represent Cash Flow from Operations as defined by U.S. GAAP; (ii) should not be considered as alternatives

to net income (loss) as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii)

are not alternatives to cash flow as a measure of liquidity. FFO and Normalized FFO, as calculated by the Company, may not be comparable

to similarly titled measures reported by other REITs.

|

| |

|

|

| |

|

The

diluted weighted shares outstanding used in the calculation of FFO per Diluted Common Share and Normalized FFO per Diluted Common Share

were 71.9 million and 70.7 million shares for the three and six months ended June 30, 2024, respectively, and 61.8 million and 60.8 million

shares for the three and six months ended June 30, 2023, respectively. Common stock equivalents resulting from stock options in the amount

of 409,000 for the six months ended June 30, 2024, were excluded from the computation of the Diluted Net Loss per Share as their effect

would be anti-dilutive. Common stock equivalents resulting from employee stock options to purchase 4.0 million shares of common stock

amounted to 466,000 shares, for the three months ended June 30, 2024, were included in the computation of Diluted Net Income per Share.

Common stock equivalents resulting from stock options in the amount of 524,000 and 658,000 shares for the three and six months ended

June 30, 2023, respectively, were excluded from the computation of the Diluted Net Loss per Share as their effect would be anti-dilutive.

|

| |

|

|

| |

|

The

reconciliation of the Company’s U.S. GAAP net income (loss) to the Company’s FFO and Normalized FFO for the three and six

months ended June 30, 2024 and 2023 are calculated as follows (in thousands):

|

| | |

Three

Months Ended | | |

Six

Months Ended | |

| | |

June 30, 2024 | | |

June 30, 2023 | | |

June 30, 2024 | | |

June 30, 2023 | |

| Net Income (Loss) Attributable

to Common Shareholders | |

$ | 527 | | |

$ | (4,418 | ) | |

$ | (5,737 | ) | |

$ | (9,715 | ) |

| Depreciation Expense | |

| 15,001 | | |

| 13,751 | | |

| 29,742 | | |

| 27,124 | |

| Depreciation Expense from Unconsolidated Joint

Venture | |

| 204 | | |

| 166 | | |

| 401 | | |

| 325 | |

| (Gain) Loss on Sales of Depreciable Assets | |

| 10 | | |

| (5 | ) | |

| 13 | | |

| (37 | ) |

| (Increase) Decrease in Fair Value of Marketable

Securities | |

| (3,338 | ) | |

| 2,548 | | |

| 2,031 | | |

| 4,943 | |

| Loss on Sales of Marketable

Securities, net | |

| 3,778 | | |

| 1 | | |

| 3,778 | | |

| 43 | |

| FFO Attributable to Common

Shareholders | |

| 16,182 | | |

| 12,043 | | |

| 30,228 | | |

| 22,683 | |

| Amortization of Financing Costs | |

| 607 | | |

| 538 | | |

| 1,163 | | |

| 1,056 | |

| Non-Recurring

Other Expense (a) | |

| 18 | | |

| 468 | | |

| 433 | | |

| 1,030 | |

| Normalized

FFO Attributable to Common Shareholders | |

$ | 16,807 | | |

$ | 13,049 | | |

$ | 31,824 | | |

$ | 24,769 | |

(a)

Consists of non-recurring one-time legal fees ($18 and $51, respectively), and costs associated with the liquidation/sale of inventory

in a particular sales center ($0 and $382, respectively) for the three and six months ended June 30, 2024. Consists of special bonus

and restricted stock grants for the August 2020 groundbreaking Fannie Mae financing, which are being expensed over the vesting period

($431 and $862, respectively) and non-recurring expenses for the joint venture with Nuveen ($3 and $50, respectively), one-time legal

fees ($30 and $50, respectively), fees related to the establishment of the OZ Fund ($4 and $37, respectively), and costs associated with

an acquisition that was not completed ($0 and $31, respectively) for the three and six months ended June 30, 2023.

| UMH Properties, Inc. | Second Quarter FY 2024 Supplemental Information | 19 |

The