Galaxy Entertainment Group Q2 and Interim Results 2024

Q2 2024 Group Adjusted EBITDA of $3.2

Billion,

Up 28% Year-on-Year & Up 12%

Quarter-on-Quarter

Announced Interim Dividend of $0.50 Per

Share

Payable in October 2024

Announced Capella at Galaxy Macau to Open

in Mid-2025

HONG KONG, Aug. 15, 2024 (GLOBE NEWSWIRE) --

Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx

stock code: 27) today reported results for the three-month and

six-month periods ended 30 June 2024. (All amounts are expressed in

Hong Kong dollars unless otherwise stated).

Dr. Lui Che Woo, Chairman of GEG

said:

“I would like to provide you with a

broad market overview and review of GEG’s financial performance for

the second quarter and first half of 2024. For the first half

of 2024, Group Net Revenue up 37% year-on-year to $21.5 billion and

Adjusted EBITDA up 37% year-on-year to $6.0 billion. In Q2 2024,

Group Adjusted EBITDA of $3.2 billion, up 28% year-on-year and up

12% quarter-on-quarter. We continued to drive every segment of our

business and further improve our resorts. We are very pleased to

report that for both Q2 and the first half 2024, our resort hotels

reported virtually 100% occupancy.

“Our balance sheet continued to be healthy

and liquid with total cash and liquid investments of $29.0 billion

and the net position was $25.2 billion after debt of $3.8 billion.

Our strong balance sheet allows us to return capital to

shareholders through dividends and to fund our longer-term

development plans and international ambitions. Subsequently the

Group announced an interim dividend of $0.50 per share to

be paid on or about 25 October 2024. These dividends

demonstrate our confidence in the positive long-term outlook for

Macau and for the Company.

“During the quarter, the Central Government

continued to show support for Macau by expanding the Individual

Visit Scheme (IVS) to 59 eligible cities with a total combined

population of approximately 500 million people. Additionally, the

Government relaxed visa requirements to allow multiple entries into

Macau for group tour visitors from Hengqin and for people from

various sectors.

“We are well advanced with the

implementation of smart tables. Recently we completed the backend

systems integration and customer database transfer. We also

successfully completed live back-of-house pilot testing of smart

tables. And in early July, we commenced the rollout of smart tables

across Galaxy Macau™’s main gaming floor. We anticipate to

complete the full rollout by year end.

“On the development front, we continue to

move forward with the fitting out of the Capella at Galaxy Macau

and Phase 4, which has a strong focus on non-gaming, primarily

targeting entertainment, family facilities and also includes

gaming.

“We are very pleased to welcome the

75th anniversary of the founding of

the People’s Republic of China and the

25th anniversary of Macau’s return to

the Motherland this year. We hope that the industry will continue

to receive the full support of the Central Government and the Macau

SAR Government. As always GEG will support these important

milestones with a range of supportive promotional activities and

events.

“Last but not least, I would like to thank

all of our team members who deliver ‘World Class, Asian Heart’

service each and every day and contribute to the success of the

Group.”

Q2 & INTERIM 2024 RESULTS HIGHLIGHTS

GEG: Well Positioned for Future

Growth

- 1H Group Net Revenue of $21.5 billion, up 37% year-on-year

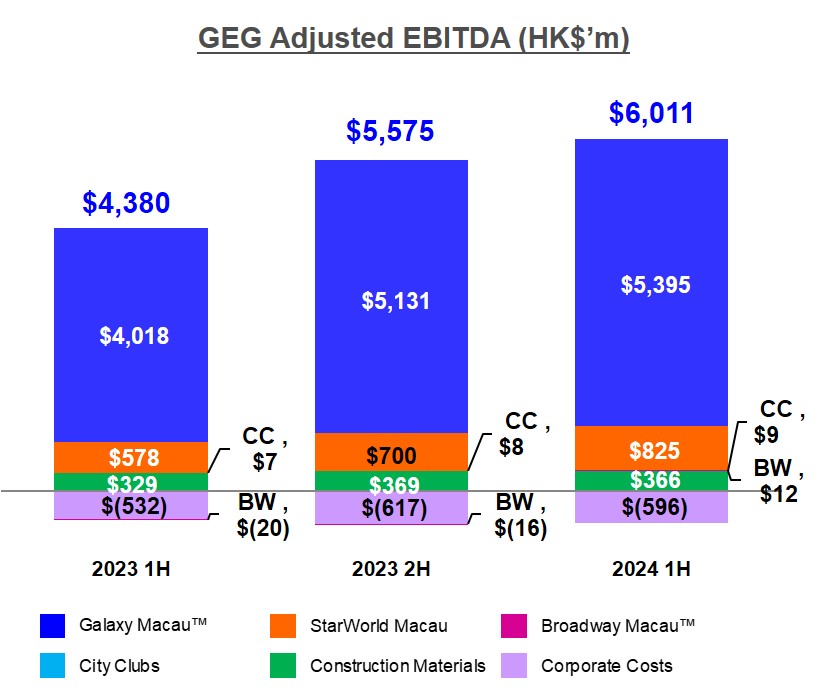

- 1H Group Adjusted EBITDA of $6.0 billion, up 37%

year-on-year

- 1H Net Profit Attributable to Shareholders (“NPAS”) of $4.4

billion, up 52% year-on-year

- Q2 Group Net Revenue of $10.9 billion, up 26% year-on-year and

up 3% quarter-on-quarter

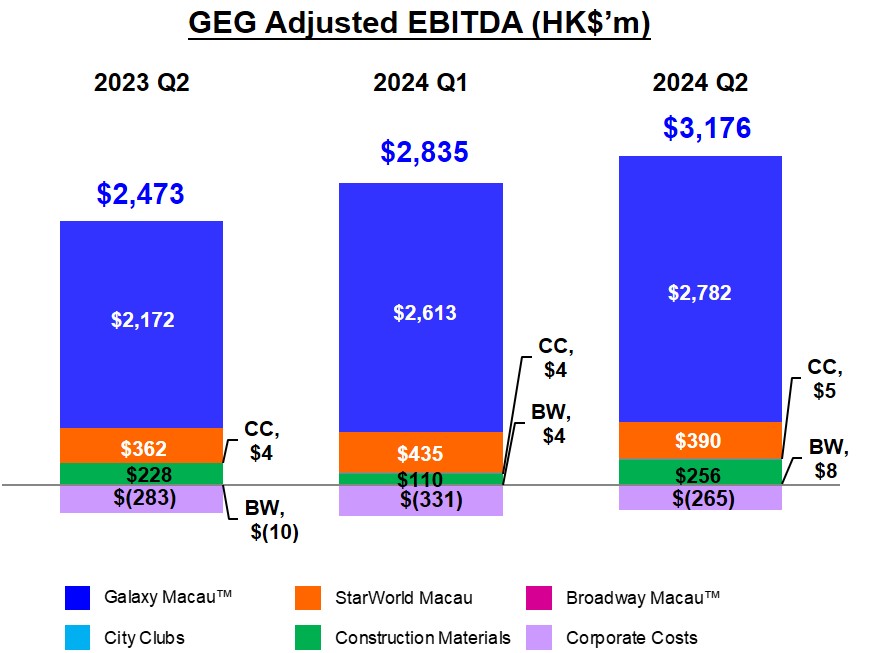

- Q2 Group Adjusted EBITDA of $3.2 billion, up 28% year-on-year

and up 12% quarter-on-quarter

- Normalized Q2 Adjusted EBITDA was $3.2 billion after adjusting

for bad luck of $20 million

- Latest twelve months Adjusted EBITDA of $11.6 billion, up 219%

year-on-year and up 6% quarter-on-quarter

Galaxy Macau™: Well Positioned for Future

Growth

- 1H Net Revenue of $17.0 billion, up 43% year-on-year

- 1H Adjusted EBITDA of $5.4 billion, up 34% year-on-year

- Q2 Net Revenue of $8.6 billion, up 32% year-on-year and up 4%

quarter-on-quarter

- Q2 Adjusted EBITDA of $2.8 billion, up 28% year-on-year and up

6% quarter-on-quarter

- Normalized Q2 Adjusted EBITDA was $2.8 billion after adjusting

for bad luck of $53 million

- Hotel occupancy for Q2 across the seven hotels was 98%

StarWorld Macau: Well Positioned for

Future Growth

- 1H Net Revenue of $2.7 billion, up 25% year-on-year

- 1H Adjusted EBITDA of $825 million, up 43% year-on-year

- Q2 Net Revenue of $1.3 billion, up 8% year-on-year and down 3%

quarter-on-quarter

- Q2 Adjusted EBITDA of $390 million, up 8% year-on-year and down

10% quarter-on-quarter

- Normalized Q2 Adjusted EBITDA was $357 million after adjusting

for good luck of $33 million

- Hotel occupancy for Q2 was 100%

Broadway Macau™, City Clubs and Construction Materials

Division (“CMD”)

- Broadway Macau™: Q2 Adjusted EBITDA was $8 million, versus

$(10) million in Q2 2023 and $4 million in Q1 2024

- City Clubs: Q2 Adjusted EBITDA was $5 million, up 25%

year-on-year and up 25% quarter-on-quarter

- CMD: Q2 Adjusted EBITDA was $256 million, up 12% year-on-year

and up 133% quarter-on-quarter

Balance Sheet: Healthy and Liquid Balance

Sheet

- As at 30 June 2024, cash and liquid investments were $29.0

billion and the net position was $25.2 billion after debt of $3.8

billion

- Announced an interim dividend of $0.50 per share payable on or

about 25 October 2024

Development Update:

Opening Capella at Galaxy Macau in mid-2025; Ramping up

GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau;

Progressing with Phase 4

- Announced the opening of Capella at Galaxy Macau in

mid-2025

- Cotai Phase 3 – Ramping up GICC, Galaxy Arena, Raffles at

Galaxy Macau and Andaz Macau

- Cotai Phase 4 – Our efforts are firmly focused on the

development of Phase 4. Phase 4 has a strong focus on non-gaming,

primarily targeting entertainment, family facilities and also

includes gaming

|

|

|

Macau Market Overview

Based on DICJ reporting, Macau’s Gross Gaming

Revenue (“GGR”) for the first half of 2024 was up 42% year-on-year

to $110.4 billion. Q2 2024 GGR was up 24% year-on-year and down 2%

quarter-on-quarter to $54.8 billion.

In the first half of 2024, visitor arrivals to

Macau were 16.7 million, up 44% year-on-year, in which overnight

visitors grew at 29% year-on-year and same-day visitors grew by 59%

year-on-year. Mainland visitor arrivals to Macau were 11.5 million,

up 53% year-on-year. Visitors from overseas were a combined 1.2

million, up 146% year-on-year. In Q2 2024, visitor arrivals to

Macau were 7.8 million, up 17% year-on-year and recovering to 79%

of Q2 2019. Mainland visitor arrivals were 5.2 million, up 22%

year-on-year.

Group Financial Results

1H 2024

In 1H 2024, Net Revenue was $21.5 billion, up

37% year-on-year. Adjusted EBITDA was $6.0 billion, up 37%

year-on-year. NPAS was $4.4 billion, up 52% year-on-year. Galaxy

Macau™’s Adjusted EBITDA was $5.4 billion, up 34% year-on-year.

StarWorld Macau’s Adjusted EBITDA was $825 million, up 43%

year-on-year. Broadway Macau™’s Adjusted EBITDA was $12 million,

versus $(20) million in 1H 2023.

In 1H 2024, GEG experienced good luck in its

gaming operation, which increased its Adjusted EBITDA by

approximately $43 million. Normalized 1H 2024 Adjusted EBITDA was

$6.0 billion, up 38% year-on-year.

The Group’s total GGR in 1H 2024 was $20.0

billion, up 45% year-on-year. Mass GGR was $16.0 billion, up 43%

year-on-year. Rolling chip GGR was $2.7 billion, up 56%

year-on-year. Electronic GGR was $1.3 billion, up 61%

year-on-year.

Group Key Financial Data |

|

|

|

|

|

|

|

(HK$'m) |

1H 2023 |

1H 2024 |

|

Revenues: |

|

|

|

Net Gaming |

11,912 |

16,776 |

|

Non-gaming |

2,296 |

3,089 |

|

Construction Materials |

1,507 |

1,605 |

|

Total Net Revenue |

15,715 |

21,470 |

Adjusted EBITDA |

4,380 |

6,011 |

| |

|

|

|

Gaming Statistics1 |

|

|

|

(HK$'m) |

1H 2023 |

1H 2024 |

|

Rolling Chip Volume2 |

50,602 |

84,612 |

|

Win Rate % |

3.4% |

3.2% |

|

Win |

1,725 |

2,690 |

|

|

|

|

|

Mass Table Drop3 |

46,929 |

63,841 |

|

Win Rate % |

23.9% |

25.1% |

|

Win |

11,219 |

16,019 |

|

|

|

|

|

Electronic Gaming Volume |

20,203 |

41,413 |

|

Win Rate % |

3.9% |

3.0% |

|

Win |

780 |

1,258 |

|

|

|

|

|

Total GGR Win4 |

13,724 |

19,967 |

|

|

|

|

Q2 2024

In Q2 2024, Group Net Revenue was $10.9 billion,

up 26% year-on-year and up 3% quarter-on-quarter. Adjusted EBITDA

was $3.2 billion, up 28% year-on-year and up 12%

quarter-on-quarter. Galaxy Macau™’s Adjusted EBITDA was $2.8

billion, up 28% year-on-year and up 6% quarter-on-quarter.

StarWorld Macau’s Adjusted EBITDA was $390 million, up 8%

year-on-year and down 10% quarter-on-quarter. Broadway Macau™’s

Adjusted EBITDA was $8 million versus $(10) million in Q2 2023 and

$4 million in Q1 2024.

Latest twelve months Group Adjusted EBITDA was

$11.6 billion, up 219% year-on-year and up 6%

quarter-on-quarter.

In Q2 2024, GEG experienced bad luck in its

gaming operations which decreased Adjusted EBITDA by approximately

$20 million. Normalized Q2 2024 Adjusted EBITDA was $3.2 billion,

up 29% year-on-year and up 15% quarter-on-quarter.

Summary Table of GEG Q2 & 1H 2024

Adjusted EBITDA and Adjustments:

|

in HK$'m |

Q2

2023 |

Q1

2024 |

Q2

2024 |

YoY |

QoQ |

|

1H

2023 |

1H

2024 |

|

Adjusted EBITDA |

2,473 |

2,835 |

3,176 |

28% |

12% |

|

4,380 |

6,011 |

|

Luck5 |

4 |

63 |

(20) |

- |

- |

|

63 |

43 |

|

Normalized Adjusted EBITDA |

2,469 |

2,772 |

3,196 |

29% |

15% |

|

4,317 |

5,968 |

| |

|

|

|

|

|

|

|

|

The Group’s total GGR in Q2 2024 was $10.3

billion, up 35% year-on-year and up 7% quarter-on-quarter. Mass GGR

was $8.3 billion, up 32% year-on-year and up 7% quarter-on-quarter.

Rolling chip GGR was $1.4 billion, up 49% year-on-year and up 7%

quarter-on-quarter. Electronic GGR was $657 million, up 48%

year-on-year and up 10% quarter-on-quarter.

Group Key Financial Data

|

|

|

|

|

|

|

(HK$'m) |

|

|

|

|

|

|

|

Q2 2023 |

Q1 2024 |

Q2 2024 |

1H 2023 |

1H 2024 |

|

Revenues: |

|

|

|

|

|

|

Net Gaming |

6,589 |

8,181 |

8,595 |

11,912 |

16,776 |

|

Non-gaming |

1,263 |

1,606 |

1,483 |

2,296 |

3,089 |

|

Construction Materials |

809 |

765 |

840 |

1,507 |

1,605 |

|

Total Net Revenue |

8,661 |

10,552 |

10,918 |

15,715 |

21,470 |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

2,473 |

2,835 |

3,176 |

4,380 |

6,011 |

|

|

|

|

|

|

|

|

Gaming Statistics6 |

|

|

|

|

|

|

(HK$'m) |

|

|

|

|

|

|

|

|

Q2 2023 |

Q1 2024 |

Q2 2024 |

1H 2023 |

1H 2024 |

|

Rolling Chip Volume7 |

29,054 |

38,457 |

46,155 |

50,602 |

84,612 |

|

Win Rate % |

3.2% |

3.4% |

3.0% |

3.4% |

3.2% |

|

Win |

931 |

1,299 |

1,391 |

1,725 |

2,690 |

|

|

|

|

|

|

|

|

Mass Table Drop8 |

26,254 |

31,471 |

32,370 |

46,929 |

63,841 |

|

Win Rate % |

23.9% |

24.6% |

25.6% |

23.9% |

25.1% |

|

Win |

6,285 |

7,728 |

8,291 |

11,219 |

16,019 |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

11,627 |

19,043 |

22,370 |

20,203 |

41,413 |

|

Win Rate % |

3.8% |

3.1% |

2.9% |

3.9% |

3.0% |

|

Win |

443 |

600 |

658 |

780 |

1,258 |

|

|

|

|

|

|

|

|

Total GGR Win9 |

7,659 |

9,627 |

10,340 |

13,724 |

19,967 |

| |

|

|

|

|

|

Balance Sheet and Dividend

The Group’s balance sheet remains healthy and

liquid. As of 30 June 2024, cash and liquid investments were $29.0

billion and the net position was $25.2 billion after debt of $3.8

billion. Our strong balance sheet combined with substantial cash

flow provides us with valuable flexibility in managing our ongoing

operations and allows us to continue investing in our longer-term

development plans and fund our international development ambitions.

Subsequently the Group announced an interim dividend of $0.50 per

share to be paid on or about 25 October 2024.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to the

Group’s revenue and earnings. Net Revenue in 1H 2024 was $17.0

billion, up 43% year-on-year. Adjusted EBITDA was $5.4 billion, up

34% year-on-year. In 1H 2024, Galaxy Macau™ experienced bad luck in

its gaming operations which decreased its Adjusted EBITDA by

approximately $5 million. Normalized 1H 2024 Adjusted EBITDA was

$5.4 billion, up 37% year-on-year.

In Q2 2024, Galaxy Macau™’s Adjusted EBITDA was

$2.8 billion, up 28% year-on-year and up 6% quarter-on-quarter. In

Q2 2024, Galaxy Macau™ experienced bad luck in its gaming

operations which decreased its Adjusted EBITDA by approximately $53

million. Normalized Q2 2024 Adjusted EBITDA was $2.8 billion, up

31% year-on-year and up 11% quarter-on-quarter.

The combined seven hotels occupancy was 97% for

1H 2024 and 98% for Q2 2024.

Galaxy Macau™ Key Financial Data

|

|

(HK$'m) |

Q2 2023 |

Q1 2024 |

Q2 2024 |

1H 2023 |

1H 2024 |

|

Revenues: |

|

|

|

|

|

|

Net Gaming |

5,430 |

6,887 |

7,347 |

9,872 |

14,234 |

|

Hotel / F&B / Others |

726 |

1,056 |

971 |

1,196 |

2,027 |

|

Mall |

394 |

371 |

326 |

830 |

697 |

|

Total Net Revenue |

6,550 |

8,314 |

8,644 |

11,898 |

16,958 |

|

Adjusted EBITDA |

2,172 |

2,613 |

2,782 |

4,018 |

5,395 |

|

Adjusted EBITDA Margin |

33% |

31% |

32% |

34% |

32% |

|

|

|

|

|

|

|

|

Gaming Statistics10 |

|

|

|

|

|

|

(HK$'m) |

Q2 2023 |

Q1 2024 |

Q2 2024 |

1H 2023 |

1H 2024 |

|

Rolling Chip Volume11 |

29,054 |

37,433 |

44,577 |

50,602 |

82,010 |

|

Win Rate % |

3.2% |

3.3% |

2.9% |

3.4% |

3.1% |

|

Win |

931 |

1,243 |

1,287 |

1,725 |

2,530 |

|

|

|

|

|

|

|

|

Mass Table Drop12 |

19,146 |

24,472 |

24,647 |

34,270 |

49,119 |

|

Win Rate % |

26.3% |

26.2% |

28.6% |

26.3% |

27.4% |

|

Win |

5,038 |

6,406 |

7,047 |

9,008 |

13,453 |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

8,414 |

12,779 |

14,772 |

14,704 |

27,551 |

|

Win Rate % |

4.5% |

3.8% |

3.5% |

4.6% |

3.7% |

|

Win |

379 |

487 |

524 |

670 |

1,011 |

|

|

|

|

|

|

|

|

Total GGR Win |

6,348 |

8,136 |

8,858 |

11,403 |

16,994 |

| |

|

|

|

|

|

StarWorld Macau

StarWorld Macau’s Net Revenue was $2.7 billion

in 1H 2024, up 25% year-on-year. Adjusted EBITDA was $825 million,

up 43% year-on-year. In 1H 2024, StarWorld Macau experienced good

luck in its gaming operations which increased its Adjusted EBITDA

by approximately $48 million. Normalized 1H 2024 Adjusted EBITDA

was $777 million, up 34% year-on-year.

In Q2 2024, StarWorld Macau’s Adjusted EBITDA

was $390 million, up 8% year-on-year and down 10%

quarter-on-quarter. In Q2 2024, StarWorld Macau experienced good

luck in its gaming operations which increased its Adjusted EBITDA

by approximately $33 million. Normalized Q2 2024 Adjusted EBITDA

was $357 million, down 1% year-on-year and down 15%

quarter-on-quarter.

Hotel occupancy was 100% for 1H 2024 and 100%

for Q2 2024.

|

StarWorld Macau Key Financial Data |

|

|

|

(HK$’m) |

Q2 2023 |

Q1 2024 |

Q2 2024 |

1H 2023 |

1H 2024 |

|

Revenues: |

|

|

|

|

|

|

Net Gaming |

1,103 |

1,235 |

1,190 |

1,931 |

2,425 |

|

Hotel / F&B / Others |

115 |

128 |

128 |

220 |

256 |

|

Mall |

5 |

6 |

5 |

10 |

11 |

|

Total Net Revenue |

1,223 |

1,369 |

1,323 |

2,161 |

2,692 |

|

Adjusted EBITDA |

362 |

435 |

390 |

578 |

825 |

|

Adjusted EBITDA Margin |

30% |

32% |

29% |

27% |

31% |

|

|

|

|

|

|

|

|

Gaming Statistics13 |

|

|

|

|

|

|

(HK$'m) |

Q2 2023 |

Q1 2024 |

Q2 2024 |

1H 2023 |

1H 2024 |

|

Rolling Chip Volume14 |

NIL |

1,024 |

1,578 |

NIL |

2,602 |

|

Win Rate % |

NIL |

5.5% |

6.5% |

NIL |

6.1% |

|

Win |

NIL |

56 |

104 |

NIL |

160 |

|

|

|

|

|

|

|

|

Mass Table Drop15 |

6,842 |

6,756 |

7,467 |

12,131 |

14,223 |

|

Win Rate % |

17.6% |

19.0% |

16.2% |

17.6% |

17.5% |

|

Win |

1,206 |

1,283 |

1,207 |

2,132 |

2,490 |

|

|

|

|

|

|

|

|

Electronic Gaming Volume |

2,250 |

5,045 |

6,325 |

3,656 |

11,370 |

|

Win Rate % |

2.1% |

1.8% |

1.8% |

2.2% |

1.8% |

|

Win |

48 |

93 |

113 |

80 |

206 |

|

|

|

|

|

|

|

|

Total GGR Win |

1,254 |

1,432 |

1,424 |

2,212 |

2,856 |

| |

|

|

|

|

|

Broadway Macau™

Broadway Macau™ is a unique family friendly,

street entertainment and food resort supported by Macau SMEs.

Broadway Macau™’s Net Revenue was $100 million for 1H 2024, up 144%

year-on-year. Adjusted EBITDA was $12 million for 1H 2024 versus

$(20) million in 1H 2023. In Q2 2024, Broadway Macau™’s Adjusted

EBITDA was $8 million, versus $(10) million in Q2 2023 and $4

million in Q1 2024.

City Clubs

City Clubs contributed $9 million of Adjusted

EBITDA to the Group’s earnings for 1H 2024, up 29% year-on-year. Q2

2024 Adjusted EBITDA was $5 million, up 25% year-on-year and up 25%

quarter-on-quarter.

Construction Materials Division

(“CMD”)

CMD contributed Adjusted EBITDA of $366 million

in 1H 2024, up 11% year-on-year. The results were predominantly

driven by the strength in demand for construction materials in Hong

Kong and Macau. In Q2 2024, CMD’s Adjusted EBITDA was $256 million,

up 12% year-on-year and up 133% quarter-on-quarter.

The demand for ready-mixed concrete in Hong Kong

and Macau was strong due to the accelerating demand to catch up on

the completion timeline of the Hong Kong International Airport’s

three runway project and the development works in Macau’s Zone A

reclamation area. Demand for construction materials in Mainland

China remained weak due to the soft property market and slow

infrastructure investment. Oversupply in cement resulted in high

levels of inventory which depressed prices. It is anticipated that

CMD’s businesses in Mainland China will remain challenging in 2H

2024.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive

enhancements to our resorts to ensure that they remain competitive

and appealing to our guests with a particular focus on adding new

and innovative F&B and retail offerings. At StarWorld Macau we

are evaluating a range of major upgrades, that includes the main

gaming floor, the lobby arrival experience and increasing the

F&B options.

Cotai – The Next Chapter

The targeted opening of Capella at Galaxy Macau

is in mid-2025. The 17-storey property offers approximately 100

ultra-luxury sky villas and suites. Each Sky Villa features a

light-filled balcony with a transparent infinity-edge pool, outdoor

lounge, sunroom and hidden winter garden, among others. Capella at

Galaxy Macau promises to bring a new level of elegance and luxury

to Macau.

We are ramping up GICC, Galaxy Arena, Raffles at

Galaxy Macau and Andaz Macau. We are now firmly focused on the

development of Phase 4, which is already well under way. Phase 4

will include multiple high-end hotel brands new to Macau, together

with an up to 5000-seat theater, extensive F&B, retail,

non-gaming amenities, landscaping, a water resort deck and a

casino. Phase 4 is approximately 600,000 square meters of

development and is scheduled to complete in 2027. We remain highly

confident about the future of Macau where Phases 3 & 4 will

support Macau’s vision of becoming a World Centre of Tourism and

Leisure.

Selected Major Awards in 1H 2024

AWARD

|

PRESENTER |

|

GEG |

|

|

Sustainability Award |

International Gaming Awards 2024 |

|

Casino Operator of the Year |

Global Gaming Awards Asia-Pacific 2024 |

|

2024 Macao International Environmental Co-operation Forum &

Exhibition - Green Booth Award |

Macau Fair & Trade Association |

|

GALAXY MACAU™ |

MICHELIN One-Star Restaurant

- 8½ Otto e Mezzo BOMBANA

- Lai Heen

Selected Restaurants

- Terrazza Italian Restaurant

- The Ritz-Carlton Cafe

- Saffron

|

The MICHELIN Guide Hong Kong Macau 2024 |

Five Star Hotel

- Galaxy

HotelTM

- Hotel Okura Macau

- Banyan Tree Macau

- The Ritz-Carlton Macau

Five-Star Restaurant

- 8½ Otto e Mezzo BOMBANA

- Lai Heen

Five-Star Spa

- The Ritz-Carlton Spa, Macau

- Banyan Tree Spa Macau

|

2024 Forbes Travel Guide |

|

Black Pearl Restaurant Guide 2024 – One Diamond – 8½ Otto e Mezzo

BOMBANA |

Mei Tuan |

|

Macau Energy Saving Activity 2023 – Energy Saving Concept Award –

Galaxy Macau |

CEM - Companhia de Electricidade de Macau |

EarthCheck Gold Certification

EarthCheck Silver Certification

- Galaxy Hotel™

- Hotel Okura Macau

|

EarthCheck |

Tatler Dining Awards 2024 – Tatler Dining 20 Macau Awards

- 8½ Otto e Mezzo BOMBANA

- Lai Heen

- Saffron

|

Tatler Dining |

|

Macao Green Hotel Awards – Gold Award – Galaxy Hotel™ |

Environmental Protection Bureau of the Macau SAR Government |

Wine Spectator’s 2024 Restaurant Best of Award of Excellence (Two

Glasses)

- Terrazza Italian Restaurant

- Urban Kitchen

|

Wine Spectator’s Restaurant Awards |

|

STARWORLD MACAU |

|

MICHELIN Two-Star Restaurant – Feng Wei Ju |

The MICHELIN Guide Hong Kong Macau 2024 |

|

Black Pearl Restaurant Guide 2024 – One Diamond – Feng Wei

Ju |

Mei Tuan |

|

SCMP 100 Top Tables 2024 – Feng Wei Ju |

South China Morning Post |

|

Tatler Dining Awards 2024 – Tatler Dining 20 Macau Awards – Feng

Wei Ju |

Tatler Dining |

Broadway Macau™

|

|

Macau Energy Saving Activity 2023 – Energy Saving Award (Hotel

Group B) – 1st Runner Up – Broadway Macau |

CEM - Companhia de Electricidade de Macau |

|

Construction Materials Division |

|

Caring Company Scheme – 20 Years Plus Caring Company Logo |

The Hong Kong Council of Social Service |

Outlook

Macau continues to collect accolades as a

destination of choice which will continue to drive tourism demand.

Since the border reopened in 2023, the Macau Government Tourism

Office (MGTO) and the six concessionaries have jointly promoted

Macau’s diverse “tourism +” offerings and status as a UNESCO

Creative city of Gastronomy across Mainland China and Asia. This

collaborative effort has resulted in Macau being voted the number

one destination of choice for Mainland Chinese travelers in the

Chinese Tourism Academy’s latest satisfaction survey.

GEG continues to collaborate closely with MGTO

to actively promote Macau and further develop international tourism

to support this initiative we have opened overseas business

development offices in Tokyo, Seoul and Bangkok. This demonstrates

our commitment to the Macau Government’s initiative to increase the

number and flow of high value international visitors.

The Macau Government continues to work hard to

diversify Macau’s economy. To attract a more diverse tourism base

they are planning to develop a 50,000 seat, open air venue that can

host a range of large-scale entertainment and sporting events. It

is anticipated that the arena will be opened in the first quarter

of 2025.

We remain confident in the outlook for Macau.

The reasons for this confidence include the ongoing improvement in

transportation infrastructure making it easier to travel to and

from Macau, as well as within it. The Central Government recently

transferred a land site from Zhuhai to Macau to enable construction

of transportation infrastructure adjacent to the Gongbei checkpoint

that will facilitate a connection to the Macau’s light rail

network. Furthermore, the newly opened Jinhai Bridge directly

connects Zhuhai Airport to Hengqin and Macau by both car and rail.

The train journey takes approximately 15 minutes and the Zhuhai

airport will have capacity of 27.5 million passengers per annum by

the end of 2024. Lastly, the fourth Macau-Taipa bridge is expected

to open later this year, further improving travel within Macau.

GEG continues to expand its capacity in Macau to

match the widening tourist demand from both Greater China and Asia.

We are currently fitting-out Capella at Galaxy Macau. The property

will offer approximately 100 ultra-luxury sky villas and suites and

is targeted to open in mid-2025. We are also firmly focused on the

development of Phase 4 which is well under way. Phase 4 will

include multiple high-end hotel brands new to Macau, together with

an up to 5000-seat theater, extensive F&B, retail, non-gaming

amenities, landscaping, a water resort deck and a casino. Phase 4

is approximately 600,000 square meters of development and is

scheduled to complete in 2027.

Under the new concession, GEG has committed

non-gaming investment of over MOP$33 billion to further diversify

Macau’s tourism attraction. In the meanwhile, we will continue to

seek opportunities in the Greater Bay Area and explore attractive

overseas development opportunities, and we will evaluate

international opportunities on a case by case basis. GEG is

committed to supporting the Macau Government’s vision to develop

Macau into the World Centre of Tourism and Leisure.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group Limited (“GEG” or the

“Company”) and its subsidiaries (“GEG” or the “Group”) is one of

the world’s leading resorts, hospitality and gaming companies. The

Group primarily develops and operates a large portfolio of

integrated resort, retail, dining, hotel and gaming facilities in

Macau. GEG is listed on the Hong Kong Stock Exchange and is a

constituent stock of the Hang Seng Index.

GEG through its subsidiary, Galaxy Casino S.A.,

is one of the three original concessionaires in Macau when the

gaming industry was liberalized in 2002. In 2022, GEG was awarded a

new gaming concession valid from January 1, 2023, to December 31,

2032. GEG has a successful track record of delivering innovative,

spectacular and award-winning properties, products and services,

underpinned by a “World Class, Asian Heart” service philosophy,

that has enabled it to consistently outperform the market in

Macau.

The Group operates three flagship destinations

in Macau: on Cotai, Galaxy Macau™, one of the world’s largest

integrated destination resorts, and the adjoining Broadway Macau™,

a unique landmark entertainment and food street destination; and on

the Peninsula, StarWorld Macau, an award-winning premium

property.

The Group has the largest development pipeline

of any concessionaire in Macau. When The Next Chapter of its Cotai

development is completed, GEG’s resorts footprint on Cotai will be

more than 2 million square meters, making the resorts,

entertainment and MICE precinct one of the largest and most diverse

integrated destinations in the world. GEG also considers

opportunities in the Greater Bay Area and internationally. These

projects will help GEG develop and support Macau in its vision of

becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in

Société Anonyme des Bains de Mer et du Cercle des Étrangers à

Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of

iconic luxury hotels and resorts in the Principality of Monaco. GEG

continues to explore a range of international development

opportunities with Monte-Carlo SBM.

GEG is committed to delivering world class unique experiences to

its guests and building a sustainable future for the communities in

which it operates.

For more information about the Group, please

visit www.galaxyentertainment.com

__________________________________

1 Gaming statistics are presented

before deducting commission and incentives.

2 Represents sum of promotor and inhouse premium

direct.

3 Mass table drop includes the amount of table drop plus

cash chips purchased at the cage.

4 Total GGR win includes gaming win from City Clubs.

5 Reflects luck adjustments associated with our rolling

chip program.

6 Gaming statistics are presented before deducting

commission and incentives.

7 Represents sum of promotor and inhouse premium

direct.

8 Mass table drop includes the amount of table drop plus

cash chips purchased at the cage.

9 Total GGR win includes gaming win from City Clubs.

10 Gaming statistics are presented before deducting

commission and incentives.

11 Represents sum of promotor and inhouse premium

direct.

12 Mass table drop includes the amount of table drop

plus cash chips purchased at the cage.

13 Gaming statistics are presented before deducting

commission and incentives.

14 Represents sum of promotor and inhouse premium

direct.

15 Mass table drop includes the amount of table drop

plus cash chips purchased at the cage.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6b87deaa-64cc-46e4-ace3-c57a06dc8ef6

https://www.globenewswire.com/NewsRoom/AttachmentNg/16f95e83-f692-4f94-b7c7-35e368d4c466

Galaxy Entertainment (TG:KW9A)

Historical Stock Chart

From Dec 2024 to Jan 2025

Galaxy Entertainment (TG:KW9A)

Historical Stock Chart

From Jan 2024 to Jan 2025