TORONTO, July 18, 2019 /CNW/ - Granite Real Estate

Investment Trust ("Granite") (TSX: GRT.UN / NYSE: GRP.U)

announced today that it has acquired two income producing

properties and has agreed to acquire a third property, together

comprising approximately 1.4 million square feet ("SF") at a

combined purchase price of approximately C$120 million, representing an in-going weighted

average yield of approximately 5.8%. The properties are fully

leased with a weighted average lease term of 5.4 years and will be

immediately accretive to funds from operations and adjusted funds

from operations per unit. In addition, Granite has acquired,

through a joint venture with NorthPoint Development, a 191 acre

parcel of land in Houston, Texas

for the development of a multi-phased business park comprising a

total of approximately 2.5 million SF.

1901 Beggrow Street, Columbus,

Ohio, USA

Granite has acquired 1901 Beggrow Street, a 802,390 SF, 36'

clear height distribution centre situated on 51.1 acres of land in

Columbus, Ohio. This state of the

art facility was completed in 2018 and is 100% leased to a

subsidiary of Pepsico, Inc. for a remaining lease term of 4.7

years. The acquisition was previously announced on April 11, 2019 and closed on May 23, 2019.

The property is well located within the major southeast

Columbus industrial market,

benefiting from a strong labour pool and providing access to nearly

60% of the U.S. and Canadian population within a day's drive. The

property is also strategically located within two miles of the

Rickenbacker International Airport, one of the only cargo-dedicated

airports in the world. Further broadening the property's

appeal, the building can be expanded by approximately

200,000 SF providing attractive site flexibility and growth

potential.

Heirweg 3 Born, Netherlands

Granite has acquired Heirweg 3, a 259,388 SF distribution centre

situated on 7.4 acres of land in Born, Netherlands. Constructed in 2008, the property

is 100% leased to Broekman Logistics for a remaining lease term of

7.6 years. The acquisition closed on July 8,

2019.

The property is well located in an established business

park in Born. Its strategic location and close proximity to an

inland port, rail and the A2 motorway provide excellent

distribution access serving the local Dutch market as well as

broader European markets.

1222 Commerce Parkway, Horn

Lake, Mississippi, USA

Granite has agreed to acquire 1222 Commerce Parkway, a 300,145

SF, 32' clear height distribution centre situated on 20.9 acres of

land in Horn Lake, Mississippi.

The property was constructed in 2018 and is 100% leased to DSV

Solutions and EPE Industries for a remaining weighted average lease

term of 4.8 years. The acquisition is subject to customary closing

conditions and is expected to close in the third quarter of

2019.

The property is located within the DeSoto County submarket, less than 15 miles

from downtown Memphis, Tennessee.

The property offers exceptional access to Interstate 55 and

proximity to the Memphis

International Airport which is home to the FedEx World Hub, the

busiest air cargo airport in the United

States.

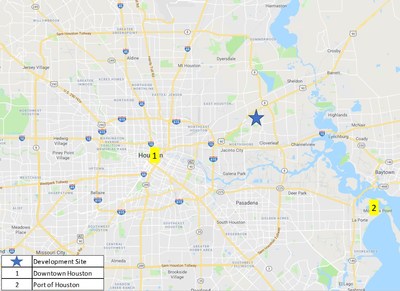

Houston, Texas

Development

On July 1, 2019, Granite, in

partnership with NorthPoint Development, acquired a 191 acre

greenfield site in Houston, Texas

for C$33.9 million for the future

development of a 2.5 million SF multi-phased business park capable

of accommodating buildings ranging from 250,000 SF to 1.2 million

SF. Speculative construction of the initial phase, consisting

of two buildings totaling 625,000 SF, is anticipated to begin in Q3

2019. The project is expected to generate a development yield

spread of greater than 200 basis points. Granite's partner

NorthPoint Development, will act as development manager for the

project.

The site is strategically located within Houston's northeast submarket, approximately

12 miles from downtown Houston and

10 miles from the Port of Houston,

the largest export port in the United

States. The property, located directly on U.S. Highway 90,

benefits from exceptional access to Houston's extensive interstate system, the

city's three class I railroads and the Houston International Airport.

Granite funded the completed acquisitions and expects to fund

the Mississippi acquisition with

existing cash on hand.

Kevan Gorrie, Granite's President

and CEO, commented that, "These acquisitions and development will

further advance our strategy of acquiring and developing leading

core product in key e-commerce and distribution markets in

North America and Europe. Collectively, we expect these

transactions to further enhance the quality of our portfolio,

generate stable and growing cash flow and provide an opportunity to

create significant net asset value growth for our

unitholders.

The acquisition of the Heirweg 3 property in the Netherlands represents our first

acquisition following the opening of our new office in Amsterdam. This office will increase our

presence in a key target market and enhance our ability to execute

on a strong pipeline of opportunities in Europe.

Finally, we are pleased to launch our first partnership with

NorthPoint Development, a leading developer of new generation

distribution properties in the U.S. The Houston project will enable us to build scale

in a strategic location in one of our target U.S. markets and the

project is expected to generate superior returns and net asset

value growth, both important components of our investment

strategy."

ABOUT GRANITE

Granite is a Canadian-based REIT engaged in the acquisition,

development, ownership and management of industrial, warehouse and

logistics properties in North

America and Europe. Granite

owns over 80 rental income properties representing approximately 34

million square feet of leasable area.

ABOUT NORTHPOINT

NorthPoint Development is a privately held development firm

based in Kansas City. Their focus

is development in the industrial and self-storage markets within

the central part of the United

States. They are currently active in 21 states

including Kansas, Missouri,

Texas, Illinois, Tennessee, Ohio, Indiana, Kentucky, Michigan, Pennsylvania, California, Arizona, Washington, New

York, Georgia, and

Florida. NorthPoint Development is

one of the most active industrial development firms in the country

having developed over 67,300,000 square feet of Class A industrial

product since 2012.

OTHER INFORMATION

Copies of financial data and other publicly filed documents

about Granite are available through the internet on the Canadian

Securities Administrators' Systems for Electronic Document Analysis

and Retrieval (SEDAR) which can be accessed at www.sedar.com and on

the United States Securities and Exchange Commission's Electronic

Data Gathering, Analysis and Retrieval System (EDGAR) which can be

accessed at www.sec.gov. For further information, please see our

website at www.granitereit.com or contact Teresa Neto, Chief Financial Officer, at

647-925-7560 or Andrea Sanelli,

Manager, Legal & Investor Services, at 647-925-7504.

FORWARD LOOKING STATEMENTS

This press release may contain statements that, to the extent

they are not recitations of historical fact, constitute

"forward-looking statements" or "forward-looking information"

within the meaning of applicable securities legislation, including

the United States Securities Act of 1933, as amended, the

United States Securities Exchange Act of 1934, as amended,

and applicable Canadian securities legislation. Forward-looking

statements and forward-looking information may include, among

others, statements regarding the proposed acquisition of 1222

Commerce Parkway, Horn Lake,

Mississippi, (the "Mississippi Acquisition") on the terms

and conditions described herein, the expected timing of the closing

of the Mississippi Acquisition, Granite's intended source of funds

for the Mississippi Acquisition, the potential expansion of the

building on the acquired property at 1901 Beggrow Street,

Columbus, Ohio (the "Ohio

Property"), the expected construction on and development yield of

the acquired greenfield site in Houston,

Texas, the expected impact of the acquisitions on Granite's

funds from operations and adjusted funds from operations per unit,

net asset value and cash flow growth, Granite's ability to make

future investments, and Granite's plans, goals, strategies,

intentions, beliefs, estimates, costs, objectives, economic

performance, expectations, or foresight or the assumptions

underlying any of the foregoing. Words such as "may", "would",

"could", "will", "likely", "expect", "anticipate", "believe",

"intend", "plan", "forecast", "project", "estimate", "seek",

"objective" and similar expressions are used to identify

forward-looking statements and forward-looking information.

Forward-looking statements and forward-looking information should

not be read as guarantees of the closing of the Mississippi

Acquisition on the terms described herein, the date on which

closing is expected to occur, Granite's intended source of funds

for the Mississippi Acquisition, Granite's intention or ability to

expand the building on the acquired site, the potential expansion

of the building on the Ohio Property, the expected construction on

and development yield of the acquired greenfield site in

Houston, Texas, the expected

impact of the acquisitions on Granite's funds from operations and

adjusted funds from operations per unit, net asset value and cash

flow growth, Granite's ability to make future investments, or other

events, performance or results and will not necessarily be accurate

indications of whether or the times at or by which such impact of

the acquisitions or other events or performance will be

achieved. Undue reliance should not be placed on such

statements. Forward-looking statements and forward-looking

information are based on information available at the time and/or

management's good faith assumptions and analyses made in light of

its perception of historical trends, current conditions and

expected future developments, as well as other factors management

believes are appropriate in the circumstances, and are subject to

known and unknown risks, uncertainties and other unpredictable

factors, many of which are beyond Granite's control, that could

cause actual events or results to differ materially from such

forward-looking statements and forward-looking information.

Important factors that could cause such differences include, but

are not limited to, the risks set forth in the annual information

form of Granite Real Estate Investment Trust and Granite REIT

Inc. dated March 6, 2019 (the "Annual

Information Form"). The "Risk Factors" section of the Annual

Information Form also contains information about the material

factors or assumptions underlying such forward-looking statements

and forward-looking information. Forward-looking statements

and forward-looking information speak only as of the date the

statements and information were made and unless otherwise required

by applicable securities laws, Granite expressly disclaims any

intention and undertakes no obligation to update or revise any

forward-looking statements or forward-looking information contained

in this press release to reflect subsequent information, events or

circumstances or otherwise.

View original content to download

multimedia:http://www.prnewswire.com/news-releases/granite-announces-new-acquisitions-and-development-and-closing-of-previously-announced-acquisition-300887759.html

View original content to download

multimedia:http://www.prnewswire.com/news-releases/granite-announces-new-acquisitions-and-development-and-closing-of-previously-announced-acquisition-300887759.html

SOURCE Granite Real Estate Investment Trust