VANCOUVER, BC,

Oct. 1,

2024 /CNW/ - New Pacific Metals Corp.

(TSX: NUAG) (NYSE-A: NEWP) ("New Pacific"

or the "Company") is pleased to report

the results of its Preliminary Economic Assessment ("PEA") for the

Carangas project (the "Project") in Oruro Department, Bolivia. The PEA is based on the Mineral

Resource Estimate (the "MRE") for the Project, which was reported

on September 5, 2023, and prepared in

accordance with National Instrument 43‐101- Standards of

Disclosure for Mineral Projects ("NI 43‐101").

Highlights from the PEA are as follows (all figures in US

Dollars):

- Post-tax net present value ("NPV") (5%) of $501 million and internal rate of return ("IRR")

of 26% at a base case price of $24.00/oz silver, $1.25/lb zinc, and $0.95/lb lead;

- NPV and IRR of $748 million and

34%, respectively, at $30/oz

silver;

- 16-year life of mine ("LOM"), excluding 2-years of

pre-production, producing approximately 106 million oz ("Moz") of

payable silver, 620 million pounds ("Mlbs") of payable zinc and 382

Mlbs of payable lead;

- Payable silver production of approximately 8.5 Moz per year in

years one through six; with LOM average silver production exceeding

6.5 Moz per year;

- Initial capital costs of $324

million and a post-tax payback of 3.2 years;

- Average LOM all-in sustaining cost ("AISC") of $7.60/oz silver, net of by-products; and

- Approximately 500 direct permanent jobs to be created from the

Project.

"The PEA for the Carangas project marks a significant

milestone for our company, outlining a robust, high-margin project

with strong economics. By focusing our efforts on a discrete, near

surface, subset of silver rich material we were able to define a

project with a post-tax NPV of $501 million, an

IRR of 26% and an initial capital expenditure of $324 million," stated Andrew Williams, CEO and President.

"This study not only underscores the quality of this asset

but also highlights the exceptional work of our team who discovered

this greenfield project only three years ago. While Silver

Sand remains our flagship asset, Carangas has become a significant

standalone project for our Company. Carangas provides balance and

scale to our portfolio of quality silver projects in Bolivia. We are grateful for the collaboration

with the local community and government that has brought us to this

point and look forward to continuing this partnership as we advance

the Project and unlock value for all stakeholders."

Economic Results and Sensitivities

Table 1 shows key assumptions and summarizes the projected

production and economic results of the PEA. Tables 2 and 3 show

sensitivities to silver prices and operating and capital costs.

Table 1: Carangas Open Pit Mining – Key

Economic Assumptions and Results

|

Item

|

Unit

|

Value

|

|

Silver Price

|

$/oz

|

24

|

|

Zinc Price

|

$/lb

|

1.25

|

|

Lead Price

|

$/lb

|

0.95

|

|

Total Mill

Feed

|

Mt

|

64.4

|

|

Open Pit Strip

Ratio1

|

t:t

|

1.7

|

|

Annual Processing

Rate

|

Mtpa

|

4.0

|

|

Average Silver

Grade2

|

g/t

|

63

|

|

Average Silver Grade in

first 6 years

|

g/t

|

83

|

|

Silver

Recovery

|

%

|

87.3

|

|

Total Payable

Silver

|

Moz

|

106

|

|

Total Payable

Zinc

|

Mlbs

|

620

|

|

Total Payable

Lead

|

Mlbs

|

382

|

|

Mine

Life3

|

Yrs

|

16.2

|

|

Average Annual

Payable Silver Metal over LOM

|

Moz

|

6.6

|

|

Annual Payable Silver

Metal in first 6 years

|

Moz

|

8.5

|

|

Total

Revenue

|

$M

|

3,296

|

|

Total Revenue

Contribution from Silver

|

%

|

76

|

|

Total Operating Costs

(net of by-products)4

|

$/oz

|

4.25

|

|

Government

Royalties

|

$/oz

|

1.79

|

|

AISC (net of

by-products)5

|

$/oz

|

7.60

|

|

Initial Capital

Costs

|

$M

|

324

|

|

Sustaining Capital

Costs6

|

$M

|

128

|

|

Payback Period

(post-tax)7

|

Yrs

|

3.2

|

|

Cumulative Net Cash

Flow (pre-tax)

|

$M

|

1,447

|

|

Cumulative Net Cash

Flow (post-tax)

|

$M

|

867

|

|

Post-tax NPV

(5%)

|

$M

|

501

|

|

Post-tax

IRR

|

%

|

26

|

|

NPV (5%) to Initial

Capex Ratio

|

$:$

|

1.5

|

|

Notes

|

|

1.

|

LOM average strip

ratio.

|

|

2.

|

LOM average.

|

|

3.

|

Excludes 2 years

pre-production period.

|

|

4.

|

Includes mining costs,

processing costs, tailing costs, G&A costs, and selling

costs.

|

|

5.

|

Includes total

operating costs, royalties, sustaining capital costs, and closure

costs.

|

|

6.

|

Excludes mine closure

costs of $39 M.

|

|

7.

|

The payback period is

measured from the beginning of production after construction is

completed.

|

Table 2: Carangas Project Economic Sensitivity

Analysis for Silver Prices – Post-Tax

|

Silver Price

Sensitivity

|

|

Silver

Price (US$/oz)

|

$18.00

|

$21.00

|

$24.00 (Base

Case)

|

$27.00

|

$30.00

|

|

Results (post-tax NPV

$M / IRR)

|

254/17%

|

378/22%

|

501/26%

|

625/30%

|

748/34%

|

|

Note: Inputs for the base case (100%) are

listed in Table 1. Table 2 presents how the Project's post-tax NPV

and IRR are affected by varying the selling price of silver. For

example, if the silver price increases by $3/oz (from $24.00 to

$27.00/oz) while other Inputs remain as the "Base Case", then the

NPV becomes $625 M and the IRR is 30%. NPV values are

discounted at a rate of 5%. Zinc and lead prices are kept constant

at $1.25/lb and $0.95/lb respectively.

|

Table 3: Carangas Project Economic Sensitivity Analysis for

Costs – Post-Tax

|

Cost

Sensitivity

|

|

Sensitivity

Items

|

-20 %

|

-10 %

|

100%

(Base Case)

|

+10 %

|

+20 %

|

|

Mining Cost

(post-tax NPV $M /

IRR)

|

534/27%

|

518/26%

|

501/26%

|

485/25%

|

468/25%

|

|

Process Cost

(post-tax NPV $M

/ IRR)

|

563/28%

|

532/27%

|

501/26%

|

470/25%

|

439/24%

|

|

Life-of-Mine

Capex

(post-tax NPV $M /

IRR)

|

558/32%

|

530/29%

|

501/26%

|

473/23%

|

444/21%

|

|

Note: Inputs for

the base case (100%) are listed in Table 1. Table 3 lists

sensitivity analysis for three "Input" variables. For

example, if LOM Capex increases by 20% (+20%), while silver price,

mine operating cost, and process operating cost remain the same as

the "Base Case" input, the NPV becomes $444M and IRR is 21%. NPV

values are discounted at a rate of 5%.

|

Capital and Operating Costs

The Project, as outlined in the PEA, is anticipated to include

an open-pit operation, with mining to be carried out by a contract

mining company, supplying mill feed to a flotation plant, producing

silver-lead and zinc concentrates. The PEA anticipates the Project

will have several capital and operating cost advantages:

- Mineralized material is flat-lying and near-surface, which is

anticipated to result in a shallow pit with a final depth of

approximately 230 meters below surface and a low LOM average strip

ratio of 1.7:1;

- It is proposed that the mine will be operated by a contractor

with current operations in Bolivia, eliminating the need for the Company

to procure a mining fleet and sustain capital for fleet

replacement;

- Bond ball mill work index (BWi) averaging 12 and a Bond

abrasion index (Ai) averaging 0.06, therefore it is anticipated

that processing mineralized material will require modest power

consumption and low grinding media consumption;

- Test work shows that total silver recoveries are favorable at

87.3%, with the Pb concentrate containing a high silver content

expected to exceed 3,500 g/t, along with an absence of deleterious

elements to enhance smelter terms;

- It is expected that the mine will be connected to the national

electricity grid, providing low-cost power at $0.05/kWh to the processing plant and other

on-site infrastructure;

- The site can be accessed via national highways and all-season

local roads; and

- The Project could be a major supplier for a proposed

government-operated zinc smelter in Oruro.

Table 4: Total Operating Cost Estimate

|

Item

|

Cost ($/t

milled)

|

|

Mining1

|

6.00

|

|

Processing

|

9.00

|

|

General and

Administration

|

3.60

|

|

Total operating

cost

|

18.60

|

|

Note

|

|

1.

|

Mining cost is $2.48/t

mined.

|

A summary of capital costs is shown in Table 5.

Table 5: Total Capital Cost Estimate

|

Item1

|

Cost

($M)

|

|

Mine

development

|

43

|

|

Processing

plant

|

188

|

|

Site

infrastructure2

|

68

|

|

Tailings Storage

Facility ("TSF")3

|

14

|

|

Owner's cost

|

11

|

|

Initial

capital

|

324

|

|

Life of mine sustaining

capital4

|

167

|

|

Note

|

|

1.

|

Includes direct,

indirect, and contingency costs. Contingency costs total

approximately $43 M.

|

|

2.

|

Includes $37 M for a

200km 115 kV power line.

|

|

3.

|

Tailings capital

includes initial earthworks, liners/membranes, and a water

management facility.

|

|

4.

|

Sustaining capital

costs include expansion of the TSF, refurbishment and replacement

of processing equipment, and mine closure of $39 M.

|

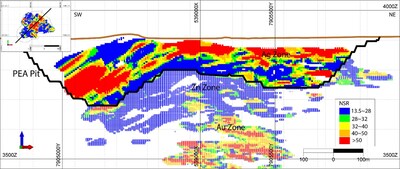

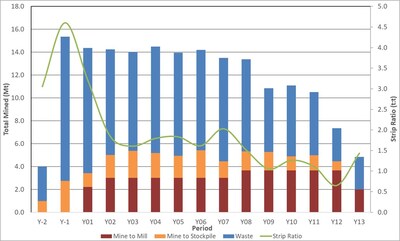

Mining

It is anticipated that the deposit will be mined using a

conventional open pit approach. This entails drilling and

blasting, with loading by hydraulic excavators and haulage by

off-highway rear dump haul trucks. The PEA pit is designed to be

relatively shallow, resulting in comparatively short hauls for both

mill feed and waste. A SW-NE cross section showing the resource

model grades and pit is illustrated in Figure 1. The mine

production schedule is illustrated in Figure 2.

Mill feed tonnes and grade are a subset of the Mineral Resource

Estimate, accounting for planned mining dilution and recovery. A

mining net smelter return ("NSR") cutoff grade of $28/t was applied and all mined material below

this cutoff grade is treated as waste. The mining cutoff

grade was chosen to cover all operating costs as well as a built-in

economic margin for the Project.

The PEA assumes that mill feed will be hauled to the primary

crusher or a run-of-mine ("ROM") stockpile near the crusher. A

portion of the oxides and lower grade resources mined in the early

years are planned to be stockpiled and processed over the life of

mine. Waste rock will be hauled to waste storage facilities. It is

anticipated that mine operations will be conducted by a contractor

with current operations in Bolivia.

It is anticipated that open-pit mining will commence in the

first year of construction. The mine plan anticipates that

19 Mt of waste and oxide material will be mined, with the

oxides stockpiled, over a two-year pre-production period. Peak

open-pit production is expected to be 15 Mt per year. The planned

open pit contains a total of 176 Mt of material (mineralized

material and waste) which is scheduled to be mined out by Year

13 of milling operations. 24 Mt of oxide and lower grade material

is planned to be processed throughout the mine, with years 14-17

processing stockpiles exclusively.

|

Notes: Net

Smelter Prices ("NSP") and metallurgical recoveries are used to

define the NSR cutoff grade. NSPs include market price assumptions

of $23.0/oz Ag, $0.95/lb Pb, $1.25/lb Zn. Various smelter and

refining terms, offsite costs, and a 6% royalty derive NSPs of

$20.5/oz Ag, $0.64/lb Pb, and $0.74/lb Zn. Metallurgical

recoveries of 90% Ag, 83% Pb, and 58% Zn are applied. The metal

prices, smelter terms, and recoveries for the economic analysis are

slightly different from the values described here. Checks have been

made by the qualified person to ensure that the PEA mine plan would

not be materially altered by revising these inputs to the final PEA

values.

|

Mineral Processing

The Project is designed to

process 4.0 Mt of mineralized material per year. The

overall production schedule is illustrated in Figure 3. The

processing facility will use conventional comminution

circuits followed by selective sequential flotation to

produce a lead/silver concentrate and a zinc/silver concentrate.

This is planned to include primary crushing, followed by a SAG-Ball

milling circuit ("SABC") and sequential sulfide

flotation to separate silver/lead and zinc while rejecting pyrite

and non-sulfidic gangue minerals. Tailings would

then be thickened and pumped to a conventional storage

facility.

Mineral Resource Estimate

The MRE, which used

conceptual open pit mining constraints for reporting purposes, was

previously reported by the Company in a news release dated

September 5, 2023. The MRE, stated at

a 40 g/t AgEq cut‐off, is shown in Table 6.

To minimize upfront capital while maximizing the Project's

return, the Company based the PEA on a 64 Mt subset of the

near-surface, higher-grade material within the Upper Silver Zone of

the MRE, as illustrated in Figure 1. This is anticipated to

preserve the optionality to mine and process the remainder of the

MRE at a later date.

Table 6: Mineral Resource as of August

25, 2023

|

Domain

|

Category

|

Tonnage

|

Ag

|

Au

|

Pb

|

Zn

|

AgEq

|

|

Mt

|

g/t

|

Mozs

|

g/t

|

Kozs

|

%

|

Mlbs

|

%

|

Mlbs

|

g/t

|

Mozs

|

|

Upper Silver

Zone

|

Indicated

|

119.2

|

45

|

171.2

|

0.1

|

216.4

|

0.3

|

916.6

|

0.7

|

1,729.6

|

85

|

326.8

|

|

Inferred

|

31.3

|

43

|

43.3

|

0.1

|

104.6

|

0.3

|

202.4

|

0.5

|

350.0

|

80

|

80.8

|

|

Middle Zinc

Zone

|

Indicated

|

43.4

|

11

|

15.0

|

0.1

|

77.4

|

0.4

|

343.6

|

0.8

|

739.4

|

56

|

78.1

|

|

Inferred

|

9.3

|

9

|

2.6

|

0.1

|

15.6

|

0.4

|

74.1

|

0.8

|

162.3

|

54

|

16.2

|

|

Lower Gold

Zone

|

Indicated

|

52.3

|

11

|

19.1

|

0.8

|

1,294.4

|

0.2

|

184.7

|

0.2

|

184.7

|

92

|

154.9

|

|

Inferred

|

4.4

|

13

|

1.8

|

0.7

|

97.5

|

0.2

|

21.4

|

0.2

|

21.4

|

91

|

12.8

|

|

Source: compiled by

RPMGlobal, 2023

|

|

Notes:

|

|

1.

|

CIM Definition

Standards (2014) were used for reporting the Mineral

Resources.

|

|

2.

|

The qualified person

(as defined in NI 43-101) for the purposes of the MRE is Anderson

Candido, FAusIMM, Principal Geologist with

RPMGlobal.

|

|

3.

|

Mineral Resources

are constrained by an optimized pit shell at a metal price of

US$23.00/oz Ag, US$1,900.00/oz Au, US$0.95/lb Pb, US$1.25/lb Zn,

recovery of 90% Ag, 98% Au, 83% Pb, 58% Zn and Cut-off grade of 40

g/t AgEq.

|

|

4.

|

Drilling results up

to June 1, 2023.

|

|

5.

|

The numbers may not

compute exactly due to rounding.

|

|

6.

|

Mineral Resources

are reported on a dry in-situ basis.

|

|

7.

|

Mineral resources

are not Mineral Reserves and have not demonstrated economic

viability.

|

Next Steps

With the completion of the PEA, New Pacific

intends to continue its efforts to secure the necessary permits for

the Project. The Company will only proceed with a feasibility

study, expected to take 12-18 months, once it has confidence in a

favorable and timely permitting outcome. This is anticipated to

include securing a comprehensive mine development agreement with

the local community, converting the Company's exploration license

into a mining license, substantially progressing an

Environmental Impact Assessment Study ("EIA") and obtaining legal

certainty for the Project's location within 50 kilometers of the

Bolivian border with Chile. The

Company anticipates being in such a position no earlier than the

second half of 2025.

Significant progress has been made towards these milestones over

the past year. For the EIA, the Company has completed baseline

environmental data collection for both the dry and wet seasons and

has recently secured community consent to begin the primary

socioeconomic baseline data collection, which is expected to take

several months to complete. This baseline data will help refine the

Project's design, assess potential environmental and social impacts

and will help inform agreements with the local community.

The Company is encouraged by the strong support from both the

Oruro Department and the federal government in advancing the

Project. Through its recently formed Oruro Mining Task Force, the

Government of Bolivia has

established a pathway for transitioning from an exploration license

to a mining license, with Carangas set to become the first project

to do so under Bolivia's 2014

mining code. The Company believes that continued collaboration and

support from governmental authorities are crucial for the Project's

success and its potential to become a key source of raw material

for a zinc plant under construction by the Bolivian government in

Oruro.

Qualified Persons

The qualified persons for the

PEA are Mr. Marcelo del Giudice,

FAusIMM, Principal Metallurgist with RPMGlobal, Mr. Pedro Repetto, SME, P.E., Principal

Civil/Geotechnical Engineer with RPMGlobal, Mr. Gonzalo Rios, FAusIMM, Executive Consultant -

ESG with RPMGlobal, Mr. Jinxing Ji,

P.Eng., Metallurgist with JJ Metallurgical Services, and Mr.

Marc Schulte, P.Eng., Mining

Engineer with Moose Mountain Technical Services. The specific

sections for which each qualified person is responsible will be

outlined in the NI 43-101 PEA Technical Report. This is in addition

to Mr. Anderson Candido, FAusIMM,

Principal Geologist with RPMGlobal who estimated the Mineral

Resource. All such qualified persons have reviewed the technical

content relevant to the sections of the PEA for which they are

responsible included in this news release for the deposit at the

Project and have approved its dissemination.

Further details supporting the PEA will be available in an NI

43‐101 Technical Report which will be posted under the Company's

profile at sedarplus.com within 45 days of this news release.

This news release has been reviewed and approved by Alex Zhang, P.Geo., Vice President of

Exploration of New Pacific Metals Corp. who is the designated

qualified person for the Company.

Conference Call and Webcast Details

The Company

will host a conference call and presentation webcast at

8:00 am Pacific Time / 11:00 am Eastern Time on Wednesday, October 2nd,

2024, to provide further information. Participants are advised to

dial in five minutes prior to the scheduled start time of the call.

A presentation will be made available on the Company's website

prior to the webcast. Webcast details:

Date: Wednesday, October

2nd, 2024, 8:00 am Pacific

Time / 11:00 am Eastern

Time

Toll-free Canada/USA:

1-844-763-8274

International: 1-647-484-8814

Webcast:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=plP25uTi

About New Pacific Metals

New Pacific is a

Canadian exploration and development company with three precious

metal projects in Bolivia. The

Company's flagship Silver Sand project has the potential to be

developed into one of the world's largest silver mines. The Company

is also advancing its robust, high-margin silver-lead-zinc

Carangas project. Additionally a discovery drill program was

completed at Silverstrike in 2022.

On behalf of New Pacific Metals Corp.

Andrew Williams

Director and CEO

For Further Information

New Pacific Metals Corp.

Phone: (604) 633‐1368 Ext. 223

U.S. & Canada toll-free:

1-877-631-0593

E-mail: invest@newpacificmetals.com

For additional information and to receive company news by

e-mail, please register using New Pacific's website at

www.newpacificmetals.com.

CAUTIONARY NOTE REGARDING RESULTS OF PRELIMINARY ECONOMIC

ASSESSMENT

The results of the PEA prepared in accordance

with NI 43-101 titled "Carangas Deposit - Preliminary

Economic Assessment" with an anticipated effective date of

October 1, 2024 and prepared by

certain qualified persons associated with RPMGlobal are preliminary

in nature and are intended to provide an initial assessment of the

Project's economic potential and development options of the

Project. The PEA mine schedule and economic assessment includes

numerous assumptions and is based on both indicated and Inferred

Mineral Resources. Inferred resources are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as Mineral

Reserves, and there is no certainty that the preliminary economic

assessments described herein will be achieved or that the PEA

results will be realized. The estimate of Mineral Resources may be

materially affected by geology, environmental, permitting, legal,

title, socio-political, marketing or other relevant issues. Mineral

resources are not Mineral Reserves and do not have demonstrated

economic viability. Additional exploration will be required to

potentially upgrade the classification of the Inferred Mineral

Resources to be considered in future advanced studies. RPMGlobal

(mineral resource, infrastructure, tailings, water management,

environmental and financial analysis) was contracted to conduct the

PEA in cooperation with Moose Mountain Technical Services (mining),

and JJ Metallurgical Services (Metallurgy). The qualified persons

for the PEA for the purposes of NI 43-101 are Mr. Marcelo del Giudice, FAusIMM, Principal

Metallurgist with RPMGlobal, Mr. Pedro Repetto, SME, P.E., Principal

Civil/Geotechnical Engineer with RPMGlobal, Mr. Gonzalo Rios, FAusIMM, Executive Consultant -

ESG with RPMGlobal, Mr. Jinxing Ji,

P.Eng., Metallurgist with JJ Metallurgical Services, and Mr.

Marc Schulte, P.Eng., Mining

Engineer with Moose Mountain Technical Services., in addition to

Mr. Anderson Candido, FAusIMM,

Principal Geologist with RPMGlobal who estimated the Mineral

Resources. All qualified persons for the PEA have reviewed the

disclosure of the PEA herein. The PEA is based on the MRE, which

was reported on September 5, 2023.

The effective date of the MRE is August 25,

2023. Mineral Resources are constrained by an optimized pit

shell at a metal price of US$23.00/oz

Ag, US$1,900.00/oz Au, US$0.95/lb Pb, US$1.25/lb Zn, recovery of 90% Ag, 98% Au, 83%

Pb, 58% Zn and Cut-off grade of 40 g/t AgEq. Assumptions made to

derive a cut-off grade included mining costs, processing costs, and

recoveries were obtained from comparable industry situations.

CAUTIONARY NOTE REGARDING FORWARD‐LOOKING

INFORMATION

Certain of the statements and information in

this news release constitute "forward-looking statements" within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and "forward-looking information" within the

meaning of applicable Canadian provincial securities laws. Any

statements or information that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, or future events or performance (often,

but not always, using words or phrases such as "expects", "is

expected", "anticipates", "believes", "plans", "projects",

"estimates", "assumes", "intends", "strategies", "targets",

"goals", "forecasts", "objectives", "budgets", "schedules",

"potential" or variations thereof or stating that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved, or the negative of any of these terms

and similar expressions) are not statements of historical fact and

may be forward-looking statements or information. Such statements

include, but are not limited to statements regarding: the results

of the PEA and the timing of the filing of the PEA; expectations

regarding the Project; estimates regarding Mineral Reserves and

Mineral Resources; anticipated exploration, drilling, development,

construction, and other activities or achievements of the Company;

timing of receipt of permits and regulatory approvals; and

estimates of the Company's revenues and capital expenditures; and

other future plans, objectives or expectations of the Company.

Forward-looking statements or information are subject to a

variety of known and unknown risks, uncertainties and other factors

that could cause actual events or results to differ from those

reflected in the forward-looking statements or information,

including, without limitation, risks relating to: global economic

and social impact of public health crisis; fluctuating equity

prices, bond prices, commodity prices; calculation of resources,

reserves and mineralization, general economic conditions, foreign

exchange risks, interest rate risk, foreign investment risk; loss

of key personnel; conflicts of interest; dependence on management,

uncertainties relating to the availability and costs of financing

needed in the future, environmental risks, operations and political

conditions, the regulatory environment in Bolivia and Canada, risks associated with community

relations and corporate social responsibility, and other factors

described under the heading "Risk Factors" in the Company's annual

information form for the year ended June 30,

2024 and its other public filings. This list is not

exhaustive of the factors that may affect any of the Company's

forward-looking statements or information.

The forward-looking statements are necessarily based on a number

of estimates, assumptions, beliefs, expectations and opinions of

management as of the date of this news release that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies. These estimates, assumptions, beliefs, expectations

and options include, but are not limited to, those related to the

Company's ability to carry on current and future operations,

including: public health crisis on our operations and workforce;

development and exploration activities; the timing, extent,

duration and economic viability of such operations; the accuracy

and reliability of estimates, projections, forecasts, studies and

assessments; the Company's ability to meet or achieve estimates,

projections and forecasts; the stabilization of the political

climate in Bolivia; the Company's

ability to obtain and maintain social license at its mineral

properties; the availability and cost of inputs; the price and

market for outputs; foreign exchange rates; taxation levels; the

timely receipt of necessary approvals or permits, including the

ratification and approval of the Mining Production Contract with

Corporación Minera de Bolivia, the

Bolivian state mining corporation, by the Plurinational Legislative

Assembly of Bolivia; the ability

of the Company's Bolivian partner to convert the exploration

licenses at the Company's Carangas project to Administrative

Mining Contract; the ability to meet current and future

obligations; the ability to obtain timely financing on reasonable

terms when required; the current and future social, economic and

political conditions; and other assumptions and factors generally

associated with the mining industry.

Although the forward-looking statements contained in this news

release are based upon what management believes are reasonable

assumptions, there can be no assurance that actual results will be

consistent with these forward-looking statements. All

forward-looking statements in this news release are qualified by

these cautionary statements. Accordingly, readers should not place

undue reliance on such statements. Other than specifically required

by applicable laws, the Company is under no obligation and

expressly disclaims any such obligation to update or alter the

forward-looking statements whether as a result of new information,

future events or otherwise except as may be required by law. These

forward-looking statements are made as of the date of this news

release.

CAUTIONARY NOTE TO US INVESTORS

This news release has

been prepared in accordance with the requirements of the securities

laws in effect in Canada which

differ from the requirements of United

States securities laws. The technical and scientific

information contained herein has been prepared in accordance with

NI 43-101, which differs from the standards adopted by the U.S.

Securities and Exchange Commission (the "SEC"). Accordingly, the

technical and scientific information contained herein, including

any estimates of Mineral Reserves and Mineral Resources, may not be

comparable to similar information disclosed by United States companies subject to the

disclosure requirements of the SEC.

Additional information relating to the Company, including the

AIF, can be obtained under the Company's profile on SEDAR+ at

www.sedarplus.ca, on EDGAR at www.sec.gov, and on the Company's

website at www.newpacificmetals.com.

View original content to download

multimedia:https://www.prnewswire.com/news-releases/new-pacific-metals-delivers-strong-economics-for-carangas-in-preliminary-economic-assessment-302264776.html

View original content to download

multimedia:https://www.prnewswire.com/news-releases/new-pacific-metals-delivers-strong-economics-for-carangas-in-preliminary-economic-assessment-302264776.html

SOURCE New Pacific Metals Corp.