Vancouver, British Columbia, Canada -- December 5, 2023 --

InvestorsHub NewsWire -- International Lithium Corp. (TSXV:

ILC) (OTCQB: ILHMF) (FSE: IAH) (the

"Company" or "ILC") is pleased to

announce a positive Preliminary Economic Assessment ("PEA") for a

proposed lithium mining operation to produce spodumene concentrate

at Raleigh Lake, 25 kilometres west of Ignace, Ontario. The PEA

relies on recent metallurgical test work (Phase 1) which indicates

that a spodumene concentrate containing 6% Li2O ("SC6")

can be produced using a simple crushing circuit and heavy liquid

separation techniques. In the Phase 1 tests lithium recoveries were

above 81% while iron oxide content remained within acceptable

limits. As originally foreshadowed, the very near proximity of

Raleigh Lake to existing service infrastructure along the

Trans-Canada Highway corridor affords significant logistical and

economic advantages to the project.

This PEA only considers spodumene concentrate, i.e. lithium, as

a revenue source. The Company continues to investigate the

potential value associated with the extraction of rubidium from the

microcline zone within the spodumene deposit.

PEA Highlights

Economics (discounted at 8% p.a., CAD$)

-

Pre-tax Cashflow = CAD$709.4 million, NPV = CAD$385.1 million,

IRR = 46.5% p.a.

-

After-tax Cashflow = CAD$634.0 million, NPV = CAD$342.9 million,

IRR = 44.3% p.a.

-

Price assumptions: CAD$3,139/tonne for 6% Li2O

concentrate (USD$2,325/tonne)

CAPEX/OPEX

-

Total pre-production capital costs: CAD$111.9 million

-

Total sustaining capital: CAD$17.5 million

-

Total life of mine ("LoM") operating costs: CAD$381 million

(including concentrate transport)

-

Average operating costs: CAD$94.38/tonne milled, CAD$993/tonne

SC6

Mining Method

-

Traditional open pit drilling and blasting followed by load and

haul

-

The plant feed production rate is proposed to be 540,000 tonnes

per year ("tpy")

-

This LoM mine plan is proposed to mine 57 million tonnes ("Mt")

of material over the mine life, which will be comprised of 4Mt of

mill feed and 53Mt of waste with an average strip ratio of

13.2:1

-

Life of mine is forecast at nine years; project duration is 11

years

Process Plant

-

The base case process plant is designed to crush 1,500 tonnes

per day ("tpd") and process 1,500 tpd in a dense media separation

("DMS") plant to produce a nominal 56,000 tpy of 6% Li2O

at 81% recovery

-

Process engineering and design were developed to a scoping level

based on the results of the SGS laboratory testing. The SGS lab

tests obtained 22.9 weight percentages of 6% Lithium Concentrate

and estimated 81% lithium recovery

-

A design factor of 10% is applied on nominal requirements to

ensure that the process equipment has enough capacity to take care

of the expected feed variation

-

Total production for LoM is 414,904 tonnes of 6% Li2O

spodumene concentrate ("SC6")

Raleigh Lake is 100% owned by ILC and there are no overriding

royalties. The Company's vision for Raleigh Lake is a low-risk,

low-impact, small-scale mining operation that can begin to provide

critical minerals necessary to fulfil Canada's Critical Mineral

Strategy in a shorter time frame than would be required for a much

larger scale, longer duration and more remotely located project.

Revenues from the mine production would continue to feed back into

exploration work to expand ILC's drive to become a significant

Critical Minerals supplier in North America.

Executive

Comment

John Wisbey, Chairman and CEO of

ILC commented:

"It is very pleasing for ILC to have delivered its first PEA at

Raleigh Lake, Ontario with highly respectable numbers of CAD$385.1

million pre-tax NPV and 46.5% IRR (post-tax CAD$342.9 million and

44.3% IRR) despite the significant fall in the lithium price this

year. This reflects, to a considerable extent, our good access to

infrastructure at Raleigh Lake, which has a very beneficial effect

on our projected costs. It should be noted that this PEA only

relates to the 600 hectare Zone 1 out of our 48,500 hectares of

claims at Raleigh Lake. It is also important to note that at this

stage these numbers only relate to the lithium at Raleigh Lake and

not to the separately declared rubidium resource. Given the high

market price of rubidium, this leaves appreciable upside.

This year's fall in the lithium price has of course depressed

these numbers versus what they would have been only a few months

ago. For example, a major Canadian lithium company produced a

feasibility report in August 2023, using a price assumption of USD$

4,699 (CAD$6,109) per tonne for 6% spodumene concentrate. Had we

applied this same number to the spreadsheet that ERM have used for

ILC's PEA, our own NPV would have been CAD$1,137 million pre-tax

and CAD$906 million post-tax. These numbers are more than 2.6 times

the NPV numbers that we are now reporting. Of course, what this

means is that, as for every mining company, there is a high level

of operational gearing in our business. It is also very important

that, when comparing different companies in the sector, investors

and analysts compare like price assumptions with like.

The omission of rubidium from this initial PEA reflects the fact

that we and our consultants need to do more work on the real size

of the rubidium market. Our measured and indicated contained tonnes

of rubidium at Raleigh Lake are 822 tonnes and the inferred 521

tonnes. The market price for >99% rubidium carbonate as at end

November 2023 was USD$ 1,159.38 per kg, meaning USD$ 1.16 million

per tonne. However, if world annual demand for rubidium is and

remains much smaller than our resource there, our ability in future

to sell at the rate we can produce would be affected, as could the

market price."

PEA Summary

Environmental Resource Management ("ERM") was retained by

International Lithium Corp. ("ILC" or the "Company") to prepare a

Preliminary Economic Assessment ("PEA") in accordance with National

Instrument 43-101 (NI 43-101) for the Raleigh Lake Project (the

"Project") located near Ignace, Ontario, Canada.

The Raleigh Lake Project is roughly 25 kilometres west of Ignace

and 235 kilometres west of Thunder Bay in the northwestern part of

Ontario within the Kenora Mining District. It is adjacent to the

Trans-Canada Highway (Hwy 17) with CN Rail, TC Energy natural gas

pipeline and Hydro One 235kV power lines transcending the Property.

It is owned 100% by International Lithium Canada Ltd., a 100% owned

subsidiary of ILC. There are no royalties or other encumbrances on

the Property.

ILC identified the opportunity at Raleigh Lake in 2016 but did

not begin actively pursuing work on the project until 2021 when an

initial test drilling campaign was conducted along with regional

lithogeochemical sampling. In 2022 the Company completed sufficient

drilling to define a maiden Mineral Resource Estimate ("MRE") with

resources reported in the measured, indicated, and inferred

categories (see below and Company press releases dated March 1 and

April 13, 2023). Upon analyzing the MRE the Company embarked upon

some initial metallurgical and economic studies that culminated in

the results presented here. It is the Company's opinion that the

results to date provide a good basis to pursue a mining operation

at Raleigh Lake and such an operation can be considered low impact

due to the existence of well-developed and utilized infrastructure

and the path to environmental permitting and eventual production

would be shorter than if the project were to be more remotely

located. The entire operation could be significantly more

sustainable than remote operations and have direct economic

benefits for the nearby and surrounding communities.

The proposed open pit mining operation would extract 57Mt of

material over the mine life, which will be comprised of 4Mt of mill

feed and 53Mt of waste with an average strip ratio of 13.2:1. The

proposed PEA level mine plan is based around work at a proposed

plant feed production rate of 540,000 tpy producing a total of

414,904 tonnes of SC6 concentrate over the mine life. The average

mill feed grade is 0.70% Li2O (Table 1).

Table 1: Summary of Base Case Cash Flow Modelling and Project

Financial Analysis.

|

Parameter

|

Value

|

Unit

|

|

Project Schedule

|

|

Overall project life

|

11

|

years

|

|

Mine life

|

9

|

years

|

|

Mining, Processing and Economic Parameters

|

|

Total mill feed

|

4.4

|

Mt

|

|

Average mill feed grade

|

0.70

|

% Li2O

|

|

Open pit mining rate

|

1,500

|

tpd

|

|

Process recovery

|

81.0

|

%

|

|

Total concentrate produced - 6% TG Li2O

|

414,904

|

T

|

|

Commodity price - 6% TG Li2O

|

$2,325

|

USD/t

|

|

Exchange Rate

|

1.35

|

CAD/USD

|

A summary of the base case capital and operating costs

calculated and used in the economic analysis exercise is shown in

Table 2 below. Total costs are based on unit cost rates per tonne

mill feed multiplied by the total tonnes of mill feed (4.37Mt).

Table 2: Summary of Base Case Capital and Operating Costs.

|

Parameter

|

Value

|

Unit

|

|

Unit Operating Costs -Production Phase

|

|

Mining

|

CAD$3.55

|

/t mined

|

|

Mining

|

CAD$40.98

|

/t mill feed

|

|

Milling

|

CAD$28.53

|

/t mill feed

|

|

G & A

|

CAD$17.74

|

/t mill feed

|

|

Concentrate transportation

|

CAD$7.13

|

/t mill feed

|

|

Total

|

CAD$94.38

|

/t mill feed

|

|

Project Operating and Sustaining Capital

Costs

|

|

Total operating costs

|

CAD$381.0 million

|

|

Total sustaining capital costs

|

CAD$17.5 million

|

|

All operating and capital costs

|

CAD$398.6 million

|

A summary of the base case revenues used in the economic

analysis exercise is shown in Table 3 and a summary of the pre- and

post-tax economic analysis results is shown in Table 4.

Table 3: Summary of Base Case Revenues.

|

Parameter

|

Value

|

|

Project Revenue, Profit and Pre/Post Tax Cash

Flows

|

|

Concentrate sales revenue

|

CAD$1,302.3 million

|

|

Concentrate transportation costs

|

CAD$31.1 million

|

|

Net operating revenue

|

CAD$1,271.2 million

|

|

Operating and sustaining capital costs

|

CAD$398.6 million

|

|

EBITDA

|

CAD$872.6 million

|

|

Payable taxes

|

CAD$75.5 million

|

|

Net profit after taxes (NPAT)

|

CAD$797.1 million

|

|

Total pre-production capital costs

|

CAD$163.1 million

|

Table 4: Summary of Pre- and Post-tax Economic Analysis

Results.

|

Parameter

|

Value

|

Unit

|

|

Economic Analysis Results

|

|

Discount Rate

|

8.0

|

% p.a.

|

|

Pre-Tax Cashflow

|

$709.5

|

CAD$ million

|

|

Pre-Tax NPV

|

$385.1

|

CAD$ million

|

|

Pre-Tax IRR

|

46.5

|

% p.a.

|

|

Post-Tax Cashflow

|

$634.0

|

CAD$ million

|

|

Post-Tax NPV

|

$342.9

|

CAD$ million

|

|

Post-Tax IRR

|

44.3

|

% p.a

|

Resource

Estimate

The MRE for the Raleigh Lake project that the current PEA study

was based on was produced by Nordmin Engineering Ltd. ("Nordmin"),

based in Thunder Bay, Ontario, who prepared an independent lithium

(spodumene-hosted) and rubidium (microcline-hosted) MRE for the

Project and Technical Report, "NI 43-101 TECHNICAL REPORT AND

MINERAL RESOURCE ESTIMATE FOR THE RALEIGH LAKE LITHIUM PROJECT,

IGNACE, ONTARIO" (the " MRE Report") consistent with the standards

and guidelines set out by the Canadian Institute of Mining,

Metallurgy and Petroleum ("CIM") and in accordance with National

Instrument 43-101 - Standards of Disclosure for Mineral

Projects.

In preparation of the MRE and MRE Report, Nordmin applied

processes that were appropriate for lithium pegmatite-style

deposits. The Report is available on SEDAR. The effective date for

the Report was April 13, 2023.

Detailed summaries of the MRE Report can be found in Company

news releases dated March 1 and April 13, 2023. A tabulated listing

of the MRE for both lithium in spodumene and rubidium in microcline

is given in Table 5 and Table 6 respectively.

Table 5: Lithium Open Pit and Underground MRE.

|

Area

|

Resource Category

|

Mass (kt)

|

Grade

|

Contained

Li (t)

|

|

Li (ppm)

|

Li2O

(%)

|

|

Open Pit

650ppm

Li Cut-off

|

Measured

|

80

|

3,887

|

0.84%

|

313

|

|

Indicated

|

2,021

|

2,919

|

0.63%

|

5,897

|

|

Measured + Indicated

|

2,101

|

2,956

|

0.64%

|

6,210

|

|

Inferred

|

3,247

|

2,595

|

0.56%

|

8,427

|

|

Underground

2,000ppm

Li Cut-off

|

Measured

|

3

|

2,560

|

0.55%

|

8

|

|

Indicated

|

189

|

3,203

|

0.69%

|

606

|

|

Measured + Indicated

|

192

|

3,192

|

0.69%

|

614

|

|

Inferred

|

655

|

3,162

|

0.68%

|

2,073

|

|

Total

|

Measured + Indicated

|

2,293

|

2,976

|

0.64%

|

6,824

|

|

Inferred

|

3,902

|

2,691

|

0.58%

|

10,499

|

Refer to notes on Mineral Resources below.

Table 6: Rubidium Open Pit and Underground MRE.

|

Area

|

Resource Category

|

Mass (kt)

|

Grade

|

Contained

Rb (t)

|

|

Rb (ppm)

|

Rb2O

(%)

|

|

Open Pit

4,000ppm

Rb Cut-off

|

Measured

|

5

|

5,412

|

0.59%

|

29

|

|

Indicated

|

90

|

6,073

|

0.66%

|

547

|

|

Measured + Indicated

|

95

|

6,036

|

0.66%

|

576

|

|

Inferred

|

18

|

3,005

|

0.33%

|

53

|

|

Underground

4,000ppm

Rb Cut-off

|

Measured

|

5

|

6,547

|

0.72%

|

35

|

|

Indicated

|

33

|

6,474

|

0.71%

|

211

|

|

Measured + Indicated

|

38

|

6,484

|

0.71%

|

246

|

|

Inferred

|

106

|

4,427

|

0.48%

|

468

|

|

Total

|

Measured + Indicated

|

133

|

6,163

|

0.67%

|

822

|

|

Inferred

|

123

|

4,224

|

0.46%

|

521

|

Refer to notes on Mineral Resources below.

Notes on Mineral Resources

-

The MRE was prepared by Christian Ballard, P.Geo., of Nordmin,

who is the Qualified Person ("QP") as defined by NI 43-101 and is

independent of ILC.

-

Mineral Resources, which are not Mineral Reserves, do not have

demonstrated economic viability. The above Inferred Mineral

Resources are subject to potential upgrade to Indicated and

Measured Mineral Resources with continued drilling. There is no

guarantee that any part of the Mineral Resources discussed herein

will be converted to another category or to a Mineral Reserve in

the future. The estimate of Mineral Resources may be materially

affected by environmental, permitting, legal, marketing, or other

relevant issues.

-

The Mineral Resources in this report were estimated using the

Canadian Institute of Mining, Metallurgy and Petroleum standards on

Mineral Resources and reserves, definitions, and guidelines

prepared by the CIM standing committee on reserve definitions and

adopted by the CIM council (CIM 2014 and 2019).

-

The MRE is developed with data from diamond drill holes totaling

13,821 m.

-

The pit constrained mineral resources were defined using a

parented block model, within an optimized pit shell with average

pit slope angles of 45° in rock and 30° in overburden, a 9.8 strip

ratio (waste material: mineralized material) and a revenue factor

of 1.0. The pit optimization shells were created using

Deswik.AdvOPM software.

-

The lithium resource pit optimization parameters include: 5.5%

Li2O spodumene concentrate; US$1,800 Li2O

spodumene concentrate price; exchange rate of CAD$1.30/USD$1;

concentrate transportation and offsite charges of CAD$175/t, mining

cost of CAD$6/t, processing plus general and administration cost of

CAD$41/t; and a process recovery of 75%. Only lithium value was

used to generate the resource optimized pit shell.

-

Underground constrained mineral resources were defined within 5

x 5 x 5 m minable shape optimization wireframes. The mineable shape

optimization constraining wireframes were created using Deswik.SO

software.

-

The lithium resource underground minable shape optimization

parameters include: 5.5% Li2O spodumene concentrate;

US$1,800 Li2O spodumene concentrate price; exchange rate

of CAD 1.30/USD 1; concentrate transportation and offsite charges

of CAD$175/t, mining cost of CAD$80/t, processing plus general and

administration cost of CAD$50/t; and a process recovery of 75%.

-

The rubidium resource was constrained above market value due to

the current limited world market. A 4,000 ppm rubidium cut-off

grade was selected. The rubidium resource was excluded from (i.e.

neither taken into account nor used as a credit for) the

underground and open pit lithium resource.

-

A default density of 2.668 g/cm3 was used for the mineralized

zones.

-

All figures are rounded to reflect the relative accuracy of the

estimates; totals may not add correctly.

-

The effective date of the MRE was February 16, 2023. The

effective date for the MRE Report was April 13, 2023, and is

available on SEDAR.

Preliminary Economic

Assessment

The Project:

-

Is 100% owned by ILC and is not subject to any off-take

agreements, partnerships, or royalties.

-

Consists of 48,500 hectares (485 square kilometres) of adjoining

mineral claims.

-

Is located approximately 25 kilometres west of the Township of

Ignace, Ontario.

-

Distinguishes itself from other lithium projects in Canada by

being very well situated near to major public infrastructure,

including:

Figure 1: Major public infrastructure relative to the Raleigh

Lake project.

-

The Trans-Canada Highway, with direct access to Thunder Bay on

Lake Superior, is less than six kilometers north of the

Project;

-

The Canadian Pacific Railway, natural gas pipelines, and Hydro

One power transmission lines (115 and 230 kV) are just a few

kilometres from the Project.

Mining Methods

The mining method selected for this project will use traditional

open pit drilling and blasting followed by load and haul. The

primary mining production will be executed using hydraulic

excavators, front shovels, and/or wheel loaders as appropriate to

the terrain and depending on the major production equipment

available for the project. The material will be hauled from the

bench to the crusher, ROM stockpiles or waste dump depending on the

material type. Furthermore, ancillary equipment, such as

bulldozers, graders, and a range of vehicles, is employed to

perform functions related to maintenance, support, services, and

utilities.

The proposed PEA level mine plan is based around work at a

proposed plant feed production rate of 540,000 tpy.

This LoM mine plan is proposed to mine 57Mt of material over the

mine life, which will be comprised of 4Mt of mill feed and 53Mt of

waste with an average strip ratio of 13.2:1 (Table 7).

The open pit created for the Raleigh Lake deposit covers about

800 metres in length and 450 metres in width at the surface (Figure

2). The pit's lowest point extends to a depth of 330 metres above

sea level, while the entrance to the pit is positioned at 475

metres above sea level. The pit incorporates two entrance ramps,

with the first granting access to the southern section of the pit

and the second facilitating entry to the northern part.

The approach selected for the storage of tailings generated at

the concentrator and the waste rock from the mine will be

co-disposal. This co-disposal method involves containing filtered

tailings within designated waste rock cells. This approach offers

the benefit of enhancing overall stockpile stability and the

efficiency of water drainage. The primary goal is to guarantee

long-term physical and geochemical stability.

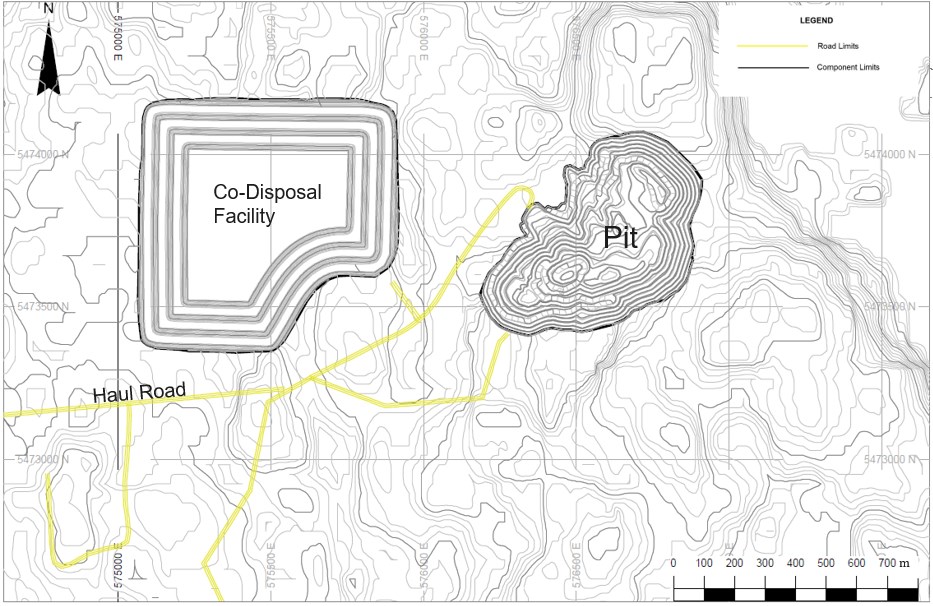

Figure 2: General arrangement of the mine site layout for

Raleigh Lake showing the final open pit (right) and co-disposal

facility (left).

Table 7: Proposed mine production schedule for Raleigh Lake.

|

Project Year

|

-1

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

9

|

Total

|

|

Mill Feed (tonnes)

|

54,037

|

324,183

|

539,881

|

540,107

|

539,899

|

539,895

|

540,305

|

539,713

|

540,312

|

208,721

|

4,367,053

|

|

Measured (tonnes)

|

0

|

0

|

5,566

|

0

|

6,338

|

27,854

|

0

|

8,927

|

23,584

|

2,725

|

74,994

|

|

Indicated (tonnes)

|

20,659

|

112,928

|

365,731

|

298,367

|

265,030

|

250,939

|

41,048

|

152,832

|

278,257

|

115,990

|

1,901,781

|

|

Inferred (tonnes)

|

33,378

|

211,254

|

168,584

|

241,741

|

268,531

|

261,103

|

499,257

|

377,954

|

238,471

|

90,005

|

2,390,278

|

|

Grade Li2O (%)

|

0.67

|

0.67

|

0.71

|

0.94

|

0.83

|

0.79

|

0.49

|

0.54

|

0.68

|

0.65

|

0.70

|

|

Measured (Li2O%)

|

0.00

|

0.00

|

0.30

|

0.00

|

0.63

|

1.19

|

0.00

|

1.13

|

0.78

|

0.66

|

0.92

|

|

Indicated (Li2O%)

|

0.47

|

0.51

|

0.70

|

0.93

|

0.67

|

0.75

|

0.47

|

0.63

|

0.67

|

0.58

|

0.70

|

|

Inferred (Li2O%)

|

0.79

|

0.75

|

0.75

|

0.94

|

0.99

|

0.79

|

0.49

|

0.48

|

0.68

|

0.75

|

0.70

|

|

Waste (tonnes)

|

7,572,425

|

8,641,731

|

8,930,422

|

9,147,177

|

8,855,024

|

4,651,476

|

2,979,449

|

1,530,607

|

864,285

|

509,626

|

53,682,222

|

|

Concentrate (tonnes)

|

0

|

34,194

|

51,828

|

68,321

|

60,532

|

57,726

|

35,668

|

38,988

|

49,323

|

18,324

|

414,904

|

Mineral Processing

The Raleigh Lake Orebody contains two metallurgical domains, the

lithium spodumene domain and the rubidium microcline domain. These

two separate domains represent zones in the Raleigh Lake orebody

that require customized process flowsheets to be developed for each

zone. For the lithium domain, the objective is the recovery of

spodumene to 6% Li2O concentrate grade, while the

rubidium bearing microcline domain objective is to develop a

flowsheet for extraction of the rubidium from the microcline.

The current focus was to perform mineralogy and mineral

processing testing to develop the flowsheet for the lithium zone

(Li-Head) and do a literature review to begin to investigate the

flowsheet development of the rubidium zone (Rb Head). Samples of

the lithium and rubidium domains were sent to SGS Canada in August

of 2023, to perform phase one mineralogy tests with follow-up

mineral processing testing and literature review. The Li Head and

Rb Head were collected from the Raleigh Lake Deposit and were

received by the SGS Lakefield Canada Advanced Mineralogy Facility

for mineralogy. Mineralogy was conducted to determine liberation,

mineral assemblages which would help to support and guide the

metallurgical test work.

The lithium Li head sample assayed 1.59% Li2O and

0.56% Fe2O3, while the rubidium head sample

graded 6,580 g/t Rb (equivalent to 0.72% Rb2O) with

0.12% Li2O and 0.24% Fe2O3.

The main objective of the phase one scoping level mineral

processing test investigation was to provide a preliminary

indication of the lithium beneficiation of the Li head by heavy

liquid separation (HLS).

The metallurgical target was the preparation of spodumene

concentrate grading >6.0% Li2O while maximizing

lithium recovery.

The pegmatite Li Head sample was initially stage-crushed to 100%

passing 12.7 mm, homogenized, and split into 10 kg test charges.

One of the 10 kg charges was sub-sampled 500 g for head assays and

the remaining was screened at 16 mesh to remove the -1 mm fraction

for mineralogy.

From the 10kg charges, the minus 12.7 mm +1 mm fraction was

further screened at 1/4" (6.3 mm) to generate two fractions of

-12.7 mm +6.3 mm and -6.3 mm +1 mm. The two coarse fractions, -12.7

mm +6.3 mm and -6.3 mm +1 mm, were submitted for Heavy Liquid

Separation (HLS) testing.

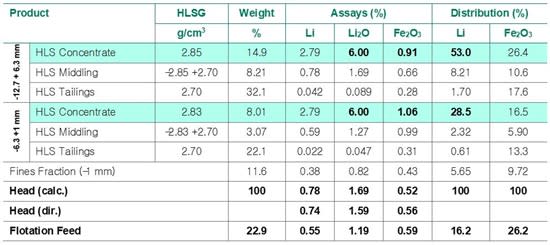

The HLS testing results at SG 2.85, 6.0% Li2O

concentrate grade of 14.9 weight % with global lithium recovery of

53.0% was obtained in the fraction of -12.7 mm/+6.3 mm.

The HLS Testing results interpolated to SG 2.83, a 6.0%

Li2O concentrate grade of 8.0 wt% with a global lithium

recovery of 28.5 % was obtained in the -6.3 mm/+1 mm fraction.

Combining the 6% Li2O concentrates from the two

fractions of -12.7 mm/+6.3 mm and 6.3 mm/+1 mm (highlighted in cyan

in Table 8) generated a combined global lithium recovery of

81.5%.

Above a tailings SG-cut point of 2.70, the HLS middling from

each sample contained between 1.27 - 1.69% Li2O with 2.3

- 8.2% of the global lithium distribution. Therefore, the HLS

middling can potentially be stage crushed then mixed with the minus

1 mm fines fraction to produce a flotation feed (or gravity feed)

grading 1.19 % Li2O and 0.59%

Fe2O3.

The combined HLS middling and fines fraction contained 16.2% of

the lithium distribution graded 1.19% Li2O. This is

potential feed for a roll crusher and screening, for flotation

feed, or a ultrafines DMS gravity circuit to increase the lithium

recovery.

The grade of iron in the spodumene concentrate was ~1%

Fe2O3, which is acceptable, however, this

would likely be reduced by treating the concentrate by magnetic

separation.

Table 8: Summary of HLS Global Mass Balance (Interpolated @ 6.0%

Li2O).

Recovery Methods

The lithium zone flowsheet development test work showed a viable

flowsheet to crush to minus 12.7 mm and screen at 1 mm, followed by

screening again at 6.3 mm to make two streams (-12.7 mm plus 6.3 mm

and -6.3 mm plus 1mm) for HLS (plant DMS). The minus 1 mm fines and

HLS middlings (DMS plant middlings) would be stored for future

processing and recovery of additional lithium, and other minerals

of interest. HLS floats (DMS floats) may also be considered for

road construction projects. The flowsheets developed for Project

are shown in Figure 3.

The base case process plant is designed to crush 1,500tpd and

process 1,500tpd in a DMS plant to produce a nominal 56,000 tpy of

6% Li2O at 81% recovery.

Engineering and design were developed to a scoping level based

on the results of the SGS laboratory testing. The SGS lab tests

obtained 22.9 weight percentages of 6% Lithium Concentrate and

estimated 81% lithium recovery.

A design factor of 10 % is applied on nominal requirements to

ensure that the process equipment has enough capacity to take care

of the expected feed variation.

Environmental

The preliminary analysis of the Project indicates it will be

subject to multiple Class Environmental Assessments under the

Ontario provincial Environmental Assessment Act. The Project is not

anticipated to trigger a federal impact assessment under the Impact

Assessment Act. Several other permits, approvals or authorizations

will be required to continue Project development beyond early

exploration, including advanced exploration through closure.

At the time of filing, environmental and socio-economic studies

have not been initiated for the Project though will be necessary to

support and inform environmental assessment(s) and permitting

applications. These studies are required to characterize the

existing environmental setting of the Project and to inform design

and/or process considerations.

Figure 3: Crushing area flowsheet (A) and DMS area flowsheet (B)

for the Raleigh Lake project.

Once Project approvals are secured, ILC will be required to

comply with any terms and conditions associated with

Project-specific authorizations issued by provincial or federal

authorities, as well as relevant environmental law and

regulation.

First Nation's and Metis communities are situated near the

Raleigh Lake property and consider the area part of their

traditional territory. ILC has identified Indigenous groups that

may have an interest in the Project and has initiated engagement.

The lands and community of the Wabigoon Lake Ojibway Nation (WLON)

are the closest to the Project, WLON has been the foremost

community for communication and involvement by Company

representatives.

Capital Costs

The Raleigh Lake Preliminary Economic Analysis Study (PEA)

involves the development of an open pit mine, the construction of

on-site processing facilities and all infrastructure required to

support those activities.

The capital cost estimate for the Raleigh Lake has been prepared

to an accuracy of + 30% / - 20% based on a 10% to 40% engineering

completion ratio to conform with the requirements for an American

Association of Cost Engineers (AACE) Class 3 Estimate.

All capital cost estimates are based on Q4 2023 Canadian Dollars

(CAD$) and an assumed US to Canadian Dollar ratio of $1 USD = $1.35

CAD.

Total pre-production capital costs will be CAD $111.9 million as

shown in Table 9, which include capitalized operating costs

incurred before the open pit mine moves into the production

phase.

Table 9: Pre-production Capital Costs.

|

Cost Centre

|

Description

|

Cost

|

|

(CAD$ million)

|

|

Direct CAPEX Costs

|

|

1000

|

Open Pit Mining

|

18.2

|

|

3000

|

Mineral Processing

|

38.5

|

|

4000

|

Power, Electrical and Instrumentation

|

3.8

|

|

5000

|

Site Infrastructure and Support Services

|

11.5

|

|

6000

|

Water Management Systems

|

2.0

|

|

7000

|

Tailings and Mine Waste Management Facilities

|

1.8

|

|

Total Direct CAPEX Costs

|

75.8

|

|

Owner and Indirect CAPEX Cost Summary

|

|

8000

|

Reclamation and Closure

|

10.0

|

|

9000

|

Indirect and Owner Costs

|

18.6

|

|

Total Indirect CAPEX Costs

|

28.6

|

|

9600

|

Contingency

|

7.6

|

|

Total Pre-Production CAPEX Costs

|

111.9

|

Total sustaining capital costs over the mine production phase

will be CAD$17.5 million (Table 10).

Table 10: Total Sustaining Capital Costs (SUSEX).

|

Cost Centre

|

Description

|

Cost

|

|

(CAD$ million)

|

|

Direct SUSEX Costs

|

|

1000

|

Open Pit Mining

|

9.1

|

|

6000

|

Water Management Systems

|

0.2

|

|

7000

|

Tailings and Mine Waste Management Facilities

|

3.8

|

|

Total Direct SUSEX Costs

|

13.0

|

|

Owner and Indirect SUSEX Cost Summary

|

|

9000

|

Indirect and Owner Costs

|

3.2

|

|

Total Indirect Costs

|

3.2

|

|

9600

|

Contingency

|

1.3

|

|

Total SUSEX

|

17.5

|

Operating Costs

The operating cost estimate (Table 11) is based on the total

amount of labour, materials and consumables that will be required

to fully execute the mining and processing plans as described

above.

The total operating costs incurred over the life of the project

are based on sufficient mill feed material being available to begin

processing plant operations in Year 1 of the overall project

schedule, which will include the processing of 54,037 tonnes of

mill feed stockpiled in Year -1 of the pre-production schedule.

Total operating costs for the operation will primarily be those

for mining and processing.

The total LoM operating cost is estimated to be CAD $412.1

million.

The total LoM operating cost of mining is estimated to be CAD

$179 million.

The total LoM operating cost of processing is estimated to be

CAD $124.6 million.

The total LoM operating cost of G&A is estimated to be CAD

$77.5 million.

The total LoM operating cost of concentrate transport is

estimated to be CAD $31 million.

Road Transportation Costs

Road transportation costs incurred over the production life of

the project assume that the final technical grade concentrate would

be transported by truck to a conversion plant located in Winnipeg

or Thunder Bay.

A total cost of CAD$75 per tonne of concentrate was assumed

based on a conservative truck haulage cost of CAD$60 per tonne and

total loading/unloading costs of CAD$15 per tonne of concentrate

produced, or CAD$7.13 per tonne of mill feed for a total LoM cost

of CAD$31.1 million.

Table 11: Unit Operating and Overall Project Costs.

|

Parameter

|

Value

|

Unit

|

|

Unit Operating Costs - Production Phase

|

|

Mining

|

CAD$3.55

|

/t mined

|

|

Mining including Waste (Strip Ratio = 13.2:1)

|

CAD$40.98

|

/t mill feed

|

|

Milling

|

CAD$28.53

|

/t mill feed

|

|

G & A

|

CAD$17.74

|

/t mill feed

|

|

Concentrate transportation

|

CAD$7.13

|

/t mill feed

|

|

Total

|

CAD$94.38

|

/t mill feed

|

|

Overall Project Costs

|

|

Total Mining Cost*

|

CAD$179 million

|

|

|

Total Milling Costs

|

CAD$124.6 million

|

|

|

Total G&A Costs

|

CAD$77.5 million

|

|

|

Total Concentrate Transport Costs

|

CAD$31 million

|

|

|

Total Operating Costs

|

CAD$412.1 million

|

|

* Does not include capitalized waste mining pre-production

Project Economics

The economic analysis of the Raleigh Lake project is based on

cost models prepared for each major component of the overall

project, which includes an open pit mine, crushing and processing

plants, supporting surface infrastructure and a waste rock /

tailings co-disposal facility.

The assumed technical grade 6% spodumene concentrate product and

cost calculations are all expressed in Canadian dollars unless

otherwise noted, with an exchange rate of 1.35 CAD/USD being used

for currency conversions.

The calculated internal rate of return (IRR) of the project does

not include potential external financing costs and assumes that all

required funding will be equity based. The net present value (NPV)

calculations assumed a discounting rate of 8% p.a.

The discounted cash flow model includes revenues, costs, taxes,

and other known factors directly related to the project but

excludes indirect factors such as financing costs, sunk costs, and

corporate obligations.

The results of the economic analysis yielded a post-tax NPV of

CAD$342.9 million, an IRR of 44.3% p.a. and a payback period of 4

years after construction begins or 2 years after the start of the

production phase of the project.

About International Lithium Corp.

International Lithium Corp. believes that the world faces a

significant turning point in the energy market's dependence on oil

and gas and in the governmental and public view of climate change.

In addition, we have seen the clear and increasingly urgent wish by

the USA and Canada to safeguard their supplies of critical battery

metals and to become more self-sufficient. Our Canadian projects

are strategic in that respect.

Our key mission in the next decade is to make money for our

shareholders from lithium and rare metals while at the same time

helping to create a greener, cleaner planet and less polluted

cities. This includes optimizing the value of our existing projects

in Canada and Ireland as well as finding, exploring and developing

projects that have the potential to become world class lithium and

rare metal deposits. We have announced separately that we regard

Zimbabwe as an important strategic target market for ILC, and we

hope to be able to make announcements over the next few weeks and

months.

A key goal has been to become a well-funded company to turn our

aspirations into reality, and following the disposal of the Mariana

project in Argentina in 2021 and the Mavis Lake project in Canada

in January 2022, the Board of the Company considers that ILC is now

well placed in that respect with a strong net cash position.

The Company's interests in various projects now consists of the

following, and in addition the Company continues to seek other

opportunities:

|

Name

|

Location

|

Area (Hectares)

|

Current Ownership Percentage

|

Future Ownership percentage if options exercised or work

carried out

|

Operator or JV Partner

|

|

Raleigh Lake

|

Ontario

|

48,500

|

100%

|

100%

|

ILC

|

|

Wolf Ridge

|

Ontario

|

5,700

|

0%

|

100%

|

ILC

|

|

Avalonia

|

Ireland

|

29,200

|

45%

|

21%

|

Ganfeng Lithium

|

|

Mavis Lake

|

Ontario

|

2,600

|

0%

|

0%

(carries an extra earn-in payment of CAD $0.7 million if resource

targets met)

|

Critical Resources Ltd (ASX:CRR)

|

|

Forgan Lake & Lucky Lake

|

Ontario

|

< 500

|

0%

|

1.5% Net Smelter Royalty

|

Ultra Lithium Inc. (TSX.V:ULT)

|

The Company's primary strategic focus at this point is on the

Raleigh Lake Project's lithium and rubidium project in Canada and

on identifying additional properties in Canada and Zimbabwe.

The Raleigh Lake Project consists of 48,500 hectares (485 square

kilometres) of mineral claims in Ontario and is ILC's most

significant project in Canada. Drilling has so far been on less

than 1,000 hectares of our claims. The exploration results there so

far, which are on only about 8% of ILC's current claims, have shown

significant quantities of rubidium and caesium in the pegmatite as

well as lithium. Raleigh Lake is 100% owned by ILC, is not subject

to any encumbrances, and is royalty free.

With the increasing demand for high tech rechargeable batteries

used in electric vehicles and electrical storage as well as

portable electronics, lithium has been designated "the new oil",

and is a key part of a green energy sustainable economy. By

positioning itself with projects with significant resource

potential and with solid strategic partners, ILC aims to be one of

the lithium and rare metals resource developers of choice for

investors and to continue to build value for its shareholders in

the '20s, the decade of battery metals.

Patrick McLaughlin, P. Geo., and Garth Liukko P.Eng., are

Qualified Persons as defined by NI 43-101 and have verified the

disclosed technical information and have reviewed and approved the

contents of this news release.

On behalf of the Company,

John Wisbey

Chairman and CEO

www.internationallithium.ca

For further information concerning this news release please

contact +1 604-449-6520.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding Forward-Looking

Information

Except for statements of historical fact, this news release

or other releases contain certain "forward-looking information"

within the meaning of applicable securities law. Forward-looking

information or forward-looking statements in this or other news

releases may include: the effect of results of anticipated

production rates, the timing and/or anticipated results of drilling

on the Raleigh Lake or Wolf Ridge or Avalonia projects, the

expectation of resource estimates, preliminary economic

assessments, feasibility studies, lithium or rubidium or caesium

recoveries, modeling of capital and operating costs, results of

studies utilizing various technologies at the company's projects,

budgeted expenditures and planned exploration work on the Company's

projects, increased value of shareholder investments, and

assumptions about ethical behaviour by our joint venture partners

or third party operators of projects. Such forward-looking

information is based on assumptions and subject to a variety of

risks and uncertainties, including but not limited to those

discussed in the sections entitled "Risks" and "Forward-Looking

Statements" in the interim and annual Management's Discussion and

Analysis which are available at www.sedar.com. While

management believes that the assumptions made are reasonable, there

can be no assurance that forward-looking statements will prove to

be accurate. Should one or more of the risks, uncertainties or

other factors materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

in forward-looking information. Forward-looking information herein,

and all subsequent written and oral forward-looking information are

based on expectations, estimates and opinions of management on the

dates they are made that, while considered reasonable by the

Company as of the time of such statements, are subject to

significant business, economic, legislative, and competitive

uncertainties and contingencies. These estimates and assumptions

may prove to be incorrect and are expressly qualified in their

entirety by this cautionary statement. Except as required by law,

the Company assumes no obligation to update forward-looking

information should circumstances or management's estimates or

opinions change.

International Lithium (TSXV:ILC)

Historical Stock Chart

From Nov 2024 to Dec 2024

International Lithium (TSXV:ILC)

Historical Stock Chart

From Dec 2023 to Dec 2024