VANCOUVER,

BC, Sept. 26, 2024 /CNW/ - MCF Energy

Ltd. (TSX.V: MCF; FRA: DC6; OTCQX: MCFNF) ("MCF", "MCF Energy"

or the "Company") is pleased to announce the planned well testing

program for the Welchau-1 discovery in the ADX-AT-II exploration

licence in Upper Austria. MCF is a non-operator and holds a

25% economic interest in the Welchau Exploration Area and ADX

Energy Ltd.("ADX") is the operator.

Background

The Welchau-1 well targeted the reservoirs

encountered in the nearby, downdip Molln-1 discovery well that

tested condensate rich gas in 1989. The Welchau-1 well intersected

three primary carbonate reservoirs that are considered promising

for testing and ongoing appraisal. The well was suspended on the

28th of March 2024 for

future well testing after running and cementing 7-inch casing down

to the well total depth ("TD") at 1,733 metres measured depth

(refer to figure 1).

Operations were suspended to comply with the

conditions of environmental permits limiting drilling and testing

operations to the Austrian winter months from 1 October 2023 to 31 March

2024. At the conclusion of drilling hydrocarbon shows were

still being encountered at the bottom of the well. Further

exploration potential may be accessible by deepening the Welchau 1

well after testing.

Data recovered from the well included hydrocarbon

shows, wellbore inflows during drilling, formation cuttings,

petrophysical borehole log data, formation fluid sampling and

formation coring. Pressurized formation fluid sample chambers run

in the well recovered small amounts of liquid hydrocarbons (gas

condensate to very light oil with 43.6° API gravity).

Detailed analysis of data recovered from the

Welchau-1 well together with available data from the historic

(1989) Molln-1 gas condensate well have been used to assess the

potential of the Welchau discovery and design a suitable test

program. The formations of interest and their

thickness are Reifling (128 metres), Steinalm (118 metres) and

Guttenstein (111 metres) of Triassic age (around 240 million

years).

In preparation for testing the operator, ADX has

undertaken the necessary planning, permitting, procurement and

contracting to execute an extended testing program on Welchau-1.

The target date to commence operations is 15

October 2024. The Welchau-1 well test program is designed to

confirm the hydrocarbon characteristics, determine well

productivity, the potential connected volumes and ultimately an

estimate of recoverable resource volumes from future potential

development wells.

Conclusions from Work to

Date

Based on the data analysis to date, it is most

likely that Welchau is a high API hydrocarbon liquid (or light oil)

and associated gas discovery rather than a liquids rich gas

discovery as was predicted prior to drilling.

Due to the uncertain nature of Welchau reservoir

performance prior to testing MCF does not believe it is appropriate

to provide a definitive resource range until the first tests are

completed.

Economic Significance of Oil versus

Gas

The predicted light oil (43.6° API) at Welchau-1

could be very valuable in commercial quantities given shallow drill

depth and onshore setting which is proximal to infrastructure. The

development cycle for oil is much shorter than gas. Any commercial

discovery can be developed incrementally as it is appraised thereby

minimising funding requirements as well as enhancing economics and

payback time frames.

Austria has a

state-of-the-art refinery located near Vienna. A significant light oil discovery is

likely to provide an important economic contribution to the

Austrian state given that Austria

imports approximately 92% of its crude oil requirements (approx.

130,000 Bpd) and the refined product demand (approx. 170,000 Bpd)

exceeds refinery production capacity by approximately 20%. A light

oil such as that recovered from sampling at Welchau-1 is likely to

be highly valued in Europe where

condensates are scarce due to the high proportion of imported dry

gas either by pipeline or LNG.

Data Analysis

MCF and the operator have analysed data recovered

from the Welchau-1 well to determine the likely reservoir

hydrocarbons present and characterise the reservoir in terms of

storage capacity and flow capacity for each of the potential

reservoirs intersected in the well.

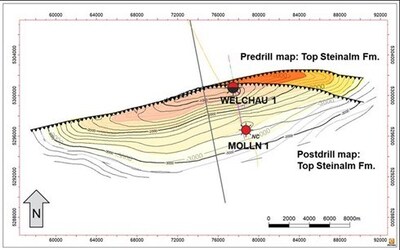

At this stage, the post-drill structure at

Welchau remains largely unchanged. The Welchau-1 well is confirmed

to be at or near the crest of an east-west trending, asymmetric

anticline, in line with the pre-drill structural model. The slight

change in the strike of the fold axis makes the structure less

cylindrical than predicted (in the Eastern part of the Welchau

anticiline). Welchau-1 intersected four reservoirs

including the main Steinalm formation. The reservoir intersection

at Welchau-1 is significantly greater than in the Molln-1. Given

that oil was recovered at Welchau-1 up dip of Molln-1 which tested

gas and condensate, it is now interpreted that Molln-1 is in a

separate accumulation to Welchau-1. Figure 4, cross section view

below shows more details on the thrusting and faulting resulting in

a potential boundary between Molln-1 and Welchau-1 wells, as shown

in the figure below 2.

The Steinalm fluid sample recovered from a down

hole sampling tool (Modular Dynamics Tester, MDT) was analysed at

the OMV Petroleum Analysis Laboratories in Vienna. The analysis revealed a light oil was

recovered with associated gas. The oil having an API gravity of

43.60 with a gas-to-oil ratio of 1,080 Scf/Bbl.

The analysis of the downhole pressure data has

highlighted the limitations in obtaining representative downhole

pressures in permeable fractured carbonate reservoirs. This data

was further compromised with mud loss invasion into the fracture

system. The conclusions that can be made with certainty are the

Steinalm reservoir is over-pressured and a light oil is

present.

MCF and the operator were able to determine a

range in potential oil-water-contact for the Welchau structure

which were utilised in the estimate of Welchau Prospective

Resources. The confirmation of the reservoir fluid type, the

productivity and connectivity can only be assessed with the planned

well test.

Detailed fracture and fault analysis was

conducted using the Welchau-1 image log data, the core calibrated

open hole log data, core analysis and core measurements, together

with the dynamic drilling data (i.e. mud losses to the formation

and gas shows from the formation). The Welchau carbonates are

characterised as a tight matrix fracture enhanced

reservoir1. In Welchau-1 the fracture porosity has been

solution-enhanced providing both increased storage capacity and

better fluid flow pathways that can be expected to deliver high

productivity.

1Fractures and

solution-enhanced fracture porosity provide both storage capacity

and fluid-flow pathways. Karstification and hydrothermal

dissolution are common diagenetic processes and serve to enlarge

pre-existing fracture networks and create cavernous channel and

breccia porosity. Fracture networks are generally extensive,

consisting of both small-scale microfractures and larger scale

intersections.

Other features identified with flow

characteristics of permeable fractures are 'reactivated beddings'

associated with folding of the rock which are also expected to

contribute to well storage, flow and recovery.

While there may be some contribution from the

matrix porosity into the higher permeability fractures, the

fractures will provide the primary flow pathways through the

reservoir to the well bore.

The frequency, extent and connectivity of the

open fracture networks are at its most intense in the Steinalm

Formation (See figure 3 below). It can be expected that these

networks can be better connected at the Welchau-1 wellbore through

selective acidization to maximise well productivity. It is also

expected that the well test will provide some answers on the

potential recovery per well, which is an important factor for

onshore field commerciality.

In addition to the above, the flow

characteristics of the reservoir have been analysed from down hole

sampling tool (MDT) flow data to determine likely flow performance

from fractures in the well. This data has been used to develop a

suitable testing program for Welchau-1.

Testing Operations

Overview

Testing operations at Welchau-1 are expected to

commence in mid-October following the anticipated receipt of an

environmental clearance for testing operations and the mobilisation

of a workover rig required to run a test string which includes

tubing and down hole packer system into the cased and suspended

well.

The environmental clearance will allow for up to

six months of continuous (24 hour) testing operations providing MCF

and the operator with ample time to carry out an extensive testing

program.

A testing program has been developed focussing on

the following objectives:

- Determine reservoir fluid type present in key reservoirs;

- Determine the flow capacity in key reservoirs; and

- Determine the reserves potential of the reservoirs

It is planned to test the two major reservoirs,

starting with the deeper Steinalm and then the shallower Reifling.

For each test a number of flow periods and shut in periods are

planned to determine the pressure response with down hole pressure

gauges. Well performance will be monitored to determine reservoir

damage from drilling and cementing of the well. In each test the

well may be acidized, if necessary, to optimise well performance.

Data collection during testing will include flow measurement,

surface and down hole pressure measurement as well as both surface

and down hole fluid sampling.

The planned sequence of operations for testing

for the Steinalm formation and expected testing program duration

for the Steinalm formation is between 6 to 10 weeks.

MCF and the operator will ensure sufficient oil

storage capacity is available on site in anticipation of oil flow.

If good flow performance is achieved, the Steinalm test may be

extended to obtain longer term flow data noting that under Austrian

legislation it is permitted to produce up to 30,000 barrels from a

long-term testing operation. The use of a workover rig for the

Welchau-1 test program along with other operator synergies provides

operational flexibility to vary the program without significantly

increasing costs.

MCF and the operator will provide more detail on

well testing operations nearer to the test commencement date,

followed by regular updates throughout the testing program.

Follow-up Exploration

Potential

The Welchau-1 well has confirmed a highly

prospective hydrocarbon play. The well has confirmed the existence

of hydrocarbon liquids and associated gas across multiple extensive

carbonate reservoir intervals, trapped by a large hydrocarbon

charged seal in a structural setting capable of containing large

volumes of hydrocarbons.

MCF and the operator have already identified

several follow up target structures in the same gross trend as

Welchau. An example is the Rossberg lead which has similar

anticline structure and shallow drill depths to Welchau (see figure

4 below). Rossberg is located approximately 6 km north-west of

Welchau-1. The Rossberg structure has been identified from surface

imaging, dynamic structural balancing techniques as well as surface

geology mapping. As was the case with Welchau some 2D seismic may

help to detail the closure. Additional detailed field work is being

undertaken to mature this prospect as a potential follow up

exploration well.

Based on current structural modelling there

remains over 1,000 metres of exploration potential located below

the current Welchau-1 well total depth. The opportunity to deepen

the Welchau-1 well after testing the existing zones of interest is

being assessed in conjunction with ongoing structural modelling of

the Welchau-1 discovery.

Economic Participation in the Welchau

Investment Area

MCF has executed an Energy Investment Agreement

(EIA) with ADX to fund 50% of Welchau-1 well costs up to a well

cost cap of EUR 5.1 million to earn a

25% economic interest in the Welchau Investment Area, which is part

of ADX's ADX-AT-II licence in Upper Austria. The Welchau Investment

Area contains the Welchau discovery well and other emerging oil and

gas prospects. MCF has met its funding and earning obligations to

ADX and it holds MCF's 25% economic interest in the Welchau

Investment Area with MCF obliged to pay 25% of ongoing well

costs.

James Hill, CEO

and Director of MCF Energy, stated, "After months of engineering

work and planning, I am very excited to begin testing on the

Welchau-1 well in Austria. This project could make a major

contribution to the energy stability of the country. I am

grateful for the continued support of our shareholders while the

Company strives to enhance value and meet our operational

objectives. The fourth quarter of 2024 will be busy and

impactful for the Company, and we expect to be providing many

updates in the coming months as these projects proceed."

About MCF Energy

MCF Energy was established in 2022 by leading

energy executives to strengthen Europe's energy security through responsible

exploration and development of natural gas resources within the

region. The Company has secured interests in several significant

natural gas exploration projects in Austria and Germany with additional concession

applications pending. MCF Energy is also evaluating additional

opportunities throughout Europe.

The Company's leaders have extensive experience in the European

energy sector and are working to develop a cleaner, cheaper, and

more secure natural gas industry as a transition to renewable

energy sources. MCF Energy is a publicly traded company (TSX.V:

MCF; FRA: DC6; OTCQX: MCFNF) and headquartered in Vancouver, British Columbia. For further

information, please visit: www.mcfenergy.com.

Additional information on the Company is

available at www.sedarplus.ca under the Company's profile.

Cautionary

Statements:

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES

OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE

ADEQUACY OR ACCURACY OF THIS RELEASE.

Advisories:

Forward-Looking Information

This press release contains forward-looking

statements and forward-looking information (collectively

"forward-looking information") within the meaning of applicable

securities laws relating to the Company's plans and other aspects

of our anticipated future operations, management focus, strategies,

financial, operating and production results, industry conditions,

commodity prices and business opportunities. In addition, and

without limiting the generality of the foregoing, this press

release contains forward-looking information regarding the

anticipated timing of development plans and resource potential with

respect to the Company's right to assets in Austria. Forward-looking information typically

uses words such as "anticipate", "believe", "project", "expect",

"goal", "plan", "intend" or similar words suggesting future

outcomes, statements that actions, events or conditions "may",

"would", "could" or "will" be taken or occur in the future.

The forward-looking information is based on

certain key expectations and assumptions made by MCF Energy's

management, including expectations and assumptions noted

subsequently in this press release under oil and gas advisories,

and in addition with respect to prevailing commodity prices which

may differ materially from the price forecasts applicable at the

time of the respective Resource Audits conducted by GCA, and

differentials, exchange rates, interest rates, applicable royalty

rates and tax laws; future production rates and estimates of

operating costs; performance of future wells; resource volumes;

anticipated timing and results of capital expenditures; the success

obtained in drilling new wells; the sufficiency of budgeted capital

expenditures in carrying out planned activities; the timing,

location and extent of future drilling operations; the state of the

economy and the exploration and production business; results of

operations; performance; business prospects and opportunities; the

availability and cost of financing, labour and services; the impact

of increasing competition; the ability to efficiently integrate

assets and employees acquired through acquisitions, the ability to

market natural gas successfully and MCF's ability to access

capital. Although the Company believes that the expectations and

assumptions on which such forward-looking information is based are

reasonable, undue reliance should not be placed on the

forward-looking information because MCF Energy can give no

assurance that they will prove to be correct. Since forward-looking

information addresses future events and conditions, by its very

nature they involve inherent risks and uncertainties. MCF Energy's

actual results, performance or achievement could differ materially

from those expressed in, or implied by, the forward-looking

information and, accordingly, no assurance can be given that any of

the events anticipated by the forward-looking information will

transpire or occur, or if any of them do so, what benefits that we

will derive therefrom. Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this press release in order to provide securityholders

with a more complete perspective on future operations and such

information may not be appropriate for other purposes.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. These forward-looking statements are

made as of the date of this press release and we disclaim any

intent or obligation to update publicly any forward-looking

information, whether as a result of new information, future events

or results or otherwise, other than as required by applicable

securities laws.

Oil & Gas Advisories

|

Abbreviations:

|

|

|

Bcf

|

billion cubic

feet

|

|

Bcfe

|

billion cubic feet

of natural gas equivalent

|

|

Bbl

|

barrels

|

|

Boe

|

barrels of oil

equivalent

|

|

M

|

thousand

|

|

MM

|

million

|

|

MMbbls

|

million barrels of

oil

|

|

MMBOE

|

million barrels of

oil equivalent

|

|

MMBC

|

million barrels of

condensate

|

|

MMcf

|

million cubic feet

of natural gas

|

|

Mcfe

|

thousand cubic feet

of natural gas equivalent

|

|

MMcfe/d

|

million cubic feet

equivalent per day

|

|

Scf

|

standard cubic

feet

|

|

Tcf

|

trillion cubic

feet

|

|

Km2

|

square

kilometres

|

|

€

|

Euros

|

SOURCE MCF Energy Ltd.