Honeywell: Detecting And Cleansing

The Air Of COVID-19

- There is growing evidence that COVID-19 can spread through the

air. This is concerning as society tries to get back to normal and

open schools, stores and restaurants.

- Honeywell has produced its Healthy Buildings solutions to help

manage virus outbreaks within an enclosed space.

- Two microcap companies named Kontrol Energy and Manganese X are

also developing their own solutions for detecting and cleansing

COVID-19.

Much of the focus of traders and investors with respect to

managing the COVID-19 pandemic has been on developing a vaccine,

testing, hand hygiene, personal protective equipment and contact

tracing. But one area that I believe might be relatively overlooked

is building management. The Centers for Disease Control revised its

COVID-19 guidelines earlier this month. The CDC has announced that the

virus “can linger in the air for minutes to hours and travel

farther than six feet". This poses serious issues for containing

the virus, particularly as society tries to get back to normal with

schools, retail outlets and bars and restaurants opening up. This

also presents an opportunity for companies that are developing HVAC

COVID management solutions.

Honeywell International Inc. (HON)

recognized this problem and opportunity months ago, launching its Healthy

Buildings solutions in May. The company is able to combine its air

quality, safety and security products with advanced analytics in

order to provide building managers with personalized service to

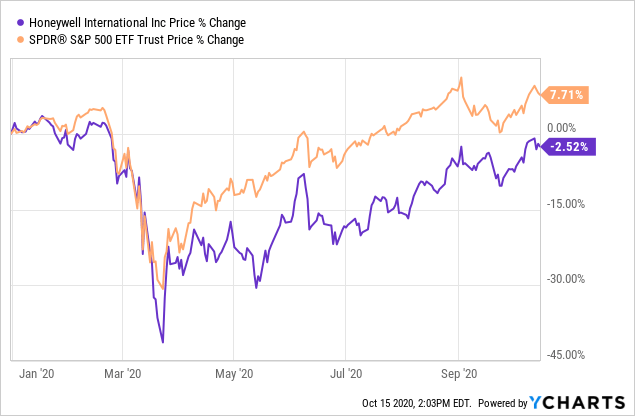

monitor for and minimize any potential virus outbreak. The stock

has underperformed the market since the virus outbreak despite the

launch of this solution and its heavy involvement in distributing

PPE. So investors who are looking for an under-the-radar stock that

has benefited from the coronavirus economy might have one in

HON.

Data by YCharts

A temporary win on virus management could lead to permanent new

revenue streams in a variety of industries

Honeywell's opportunity is enormous and varied, as evidenced by

a recently

announced collaboration with the Carolina Panthers NFL

team to manage the safe return of fans back to the team's home

stadium. The Healthy Buildings solutions will continuously monitor

the air quality within Bank Of America Stadium and Honeywell will

provide fans with Panthers-branded hygiene and protective gear such

as masks, hand gel and cleaning wipes. Given the resistance of some

people in the United States to obeying safety protocols which has

led to further spread of the virus, the branded gear might help to

encourage proper use.

Once the threat of COVID-19 subsides, the Honeywell solution can

morph into an IoT building management service. In addition to

monitoring for the virus, it will identify and correct building

controls issues such as carbon dioxide levels, temperature and

humidity. The Healthy Buildings dashboard can manage aspects of

building management like fan capacity and cleaning tracking. This

can lead to cost savings and service improvements as resources and

employees such as janitors can be more timely and efficiently

deployed. The virus acts like a door-opener for Honeywell's

building management solutions that could lead to permanent new

business that might otherwise have been a harder sell without the

immediate urgency.

Other companies looking to capitalize by detecting and

cleansing the air of COVID-19

While Honeywell will be a major benefactor in this sector, there

are smaller companies that offer a more "pure play" speculative

upside approach to COVID building management than a $100 billion

company.

Kontrol Energy Corp. (OTCQB:KNRLF) (KNR.C) recently created what

it calls BioCloud technology in order to manage the pandemic. This

wall-mounted unit detects the presence of COVID-19 in the air and

triggers an alert system to warn building managers so moves can be

made to control an outbreak before it occurs.

Last month, the company was featured in an

article by the CBC (Canada's government-owned national

news media outlet), causing the stock to more than double in price

after it already had a good run. It currently has a market cap of

approximately $110 million. The immediate target market will be

schools, hospitals, long-term care homes and mass transit. The

company estimates a $12,000 price tag for each unit and says it has

secured the manufacturing capacity to produce up to 20,000 units

per month. The technology was independently tested so the next step

would be securing contracts.

In addition to BioCloud, the company recently procured a new

order for its SmartSuite® smart building technology across four

apartment buildings located in Ontario, Canada. So much like how

Honeywell is able to leverage its virus management solutions into

an IoT building management contract, Kontrol may be able to do the

same thing on a smaller scale.

While Kontrol has developed a virus tracker and early warning

system, Manganese X Energy Corp. (OTCPK:MNXXF) (MN.V) is looking to go

one step further and outright kill the virus once detected in a

building. Earlier this month, its subsidiary Disruptive Battery

Corp. signed an MOU with

PureBiotics to acquire a significant equity share of up to 50% in a

PureBiotics Environmental Air Quality Control Company. Even though

it's still in the MOU phase, PureBiotics' CEO Lino

Morris recently joined the

company's Advisory Board.

The two companies are combining forces to develop a product that

will circulate air disinfection agents through a building's HVAC

distribution system. It leverages Manganese X's patented

disinfection apparatus system with PureBiotics' existing product

lines and technologies in order to cleanse buildings of COVID-19

and any other pathogens. Lino Morris has over 40 years experience

in the pharmaceutical industry. That experience will come in handy

as he will be the one spearheading additional testing and

validation of the product. He is reaching out to universities to

test the air quality control delivery system. Just like Kontrol,

Manganese X wants that third party validation of its product.

Manganese X sits at around a $25 million market cap, a fraction

of Kontrol's valuation as the additional hurdle of validation needs

to take place. If validation is successful, Kontrol represents a

demonstrated upside for Manganese X shareholders. The stock has

already moved up healthily over summer prices and has experienced

volatility recently. Hype over Tesla's (TSLA) recent inclusion of Manganese in

its battery and desire to source battery materials is the primary

reason for the increase. Manganese X owns the Battery Hill

Manganese project situated just north of the U.S. border in New

Brunswick. I briefly outlined it and the company's familial

connection to Tesla in a previous article.

Manganese X shareholders have a reduced risk from diversification

built in due to these two disparate lines of business. Should one

not pan out, that has absolutely no impact on the probability of

success for the other.

Without getting too heavily into speculation, assuming that both

solutions from Kontrol and Manganese X progress as hoped, it would

make a lot of sense for a building manager to have both products on

hand. BioCloud to detect COVID-19 and the Manganese X solution to

cleanse the virus through the HVAC system.

While Honeywell offers a virus building management play for

conservative investors, these type of small cap companies are more

attractive to risk-tolerant small cap investors such as myself.

Both Kontrol and Manganese X have moved up a lot in the past few

months, so speculative investors are no longer "buying low" and

have to be prepared for volatility. Early stage investors who are

in at lower prices might choose to take their profits along the

way. But based on Kontrol's market cap of approximately $110

million and Manganese X's market cap of approximately $25 million,

they leave a lot of room for upside. I will continue to monitor the

small cap sector for indoor virus management opportunities such as

Kontrol Energy and Manganese X.

Disclosure: I am/we are

long MNXXF. I wrote this article myself, and it expresses my

own opinions. I am not receiving compensation for it (other than

from Seeking Alpha). I have no business relationship with any

company whose stock is mentioned in this article.

Edward Vranic, CFA

Manganese X Energy (TSXV:MN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Manganese X Energy (TSXV:MN)

Historical Stock Chart

From Dec 2023 to Dec 2024