UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended June 30, 2023

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ______________ to ______________

Commission

File Number: 333-214469

| CAMBELL INTERNATIONAL HOLDING CORP. |

| (Exact name of issuer as specified in its charter) |

| Nevada | | 98-1310024 |

| (State or other jurisdiction of | | (I.R.S. employer |

| incorporation or organization) | | identification number) |

1-17-1 Zhaojia Road

Xinglongtai District Panjin City, Liaoning Province

Beijing, PRC | | 124000 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s

telephone number, including area code +86 15842767931

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| N/A | | | | |

Securities

registered pursuant to Section 12(g) of the Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☒ No ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (Sec. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging Growth Company | ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

If securities are registered pursuant

to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect

the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any

of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the

registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the 1,250,750 shares

of common stock held by non-affiliates of the registrant as of December 31, 2022 (the last business day of the registrant’s most

recently completed second fiscal quarter) was $7,491,993 based on the last sale price of the registrant’s common stock on such date

of $4.99 per share on the OTC Market. Shares of the registrant’s common stock held by each executive officer and director and by

each person who holds 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates.

This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of October 1, 2023, the registrant had 7,250,750

shares of common stock, par value $0.001 per share, issued and outstanding.

TABLE

OF CONTENTS

TO

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED JUNE 30, 2023

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

report, including, without limitation, statements under the sections entitled “Business,” “Risk Factors,” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” includes forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities

Exchange Act of 1934 (the “Exchange Act”). These statements involve known and unknown risks, uncertainties, and other factors

which may cause our actual results, performance, or achievements to be materially different from any historical results and future results,

performances, or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are

not limited to, the following factors:

| |

● |

Our independent registered

auditors have expressed substantial doubt about our ability to continue as a going concern. |

| |

|

|

| |

● |

We may continue to incur

losses in the future, and may not be able to return to profitability, which may cause the market price of our shares to decline. |

| |

|

|

| |

● |

Our business plan is based

on a relatively new model that may not be successful and we may not successfully implement our business strategies. |

Forward-looking

statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties.

Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements

represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference

and filed as exhibits to the report completely and with the understanding that our actual future results may be materially different

from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update

the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information

becomes available in the future.

USE

OF CERTAIN DEFINED TERMS

Unless

the context otherwise requires and, for the purposes of this Annual Report only, references to:

| |

● |

“Baijiakang Consulting”

or “WFOE” are to Baijiakang (Liaoning) Health Information Consulting Services Co., Ltd. (WFOE) a limited liability company

organized under the laws of the PRC, which is wholly-owned by BJK Holding; |

| |

● |

“BJK Holding”

is to BJK Holding Group Limited, a Hong Kong company and wholly-owned subsidiary of Win&win; |

| |

● |

“Cambell International Holding Corp.,” “KAFC,” “our Company,” “we,” “us,” or “our” are to the combined business of Cambell International Holding Corp., formerly known as Bitmis Corp., a Nevada corporation, and its subsidiaries and other consolidated entities; |

| |

● |

“Cambell International”

is to Cambell International Holding Limited, a British Virgin Islands company and wholly-owned subsidiary of Cambell International

Holding Corp.; |

| |

|

|

| |

● |

“China” and

“the PRC” are to the People’s Republic of China, excluding, for the purposes of this report only, Hong Kong, Macau

and Taiwan; |

| |

|

|

| |

● |

“Exchange Act”

are to the Securities Exchange Act of 1934, as amended; |

| |

● |

“Liaoning Kangbaier” or “VIE” are to Liaoning Kangbaier Biotechnology Development Co., Ltd, a limited liability company organized under the laws of the PRC, which we control via a series of contractual arrangements (the “VIE Agreements”) among WFOE, Liaoning Kangbaier and the shareholders of Liaoning Kangbaier; |

| ● | “MOFCOM”

is to the Ministry of Commerce of the People’s Republic of China; |

| ● | “NDRC”

is to the National Development and Reform Commission of the People’s Republic of China; |

| ● | “PRC

operating entities” are to our mainland China-based subsidiary, Baijiakang Consulting, our VIE, and the VIE’s subsidiaries; |

| ● | PRC

laws and regulations are to the laws and regulations of China; |

| ● | “Renminbi”

and “RMB” refer to the legal currency of China; |

| ● | “SAFE”

is to the State Administration of Foreign Exchange of the People’s Republic of China; |

| ● | “SEC”

is to the U.S. Securities and Exchange Commission; |

| ● | “Securities

Act” is to the Securities Act of 1933, as amended; |

| ● | “U.S.

dollars,” “dollars,” and “$” are to the legal currency of the United States; |

| ● | “VIE”

is to the variable interest entity or Liaoning Kangbaier, as the case may be; |

| |

● |

“VIE Agreements” are to a series of contractual arrangements, including the “Consulting Service Agreement,” the “Business Operation Agreement,” the “Proxy Agreement,” the “Equity Disposal Agreement,” and the “Equity Pledge Agreement,” as described herein. |

| |

|

|

| |

● |

“Win&win” are to Win&win Industrial Development

Company Ltd, a British Virgins Islands company and wholly-owned subsidiary of Cambell International; |

| ● | “WFOE”

is to Baijiakang Consulting, our wholly foreign-owned enterprise. |

Part

I

ITEM

1. BUSINESS

Regulatory

Overview – Summary Legal and Operational Risks

Cambell International Holding

Corp., formerly known as Bitmis Corp. (the “Company”) is not a Chinese operating company but rather a Nevada holding company

with no operations of its own. We conduct our operations through Baijiakang (Liaoning) Health Information Consulting Service Cop. Ltd.

(“Baijiakang Consulting”), our wholly foreign-owned enterprise (“WFOE”), which conducts its operations through

contractual agreements with a variable interest entity (“VIE”), Liaoning Kangbaier Biotechnology Development Co. Ltd. (“Liaoning

Kangbaier”), and its wholly-owned subsidiaries, Doron Kangbaier Biotechnology Co. Ltd. (“Doron”) and Liaoning Baijiakang

Health Technology Co. Ltd. (“Liaoning”), as discussed in greater detail below. See “-Corporate History and Structure

- Contractual Arrangements,” below.

The

VIE structure involves unique risks to shareholders and investors. It is used to provide investors with contractual exposure to foreign

investment in China-based companies where Chinese law prohibits or restricts direct foreign investment in the operating companies. Due

to PRC legal restrictions on foreign ownership in certain businesses, we do not have any equity ownership of the VIE or its subsidiary;

instead, we receive the economic benefits of the VIE’s business operations through certain contractual arrangements.

As a result of such series

of contractual arrangements, Baijiakang Consulting is the primary beneficiary of the VIE for accounting purposes and the VIE is a PRC

consolidated entity under U.S. GAAP. The Company consolidates the financial results of the VIE and its subsidiaries in its consolidated

financial statements in accordance with U.S. GAAP. Neither the Company nor its investors own any equity interest in, have direct foreign

investment in, or control the VIE through any such ownership or investment. As a result, investors in the Company’s common stock

are not purchasing an equity interest in the VIE or in its subsidiary, but instead are purchasing an equity interest in KPIL, the Nevada

holding company. These contractual arrangements have not been tested in a court of law in the PRC.

Summary

Risks Related to our VIE Structure

| |

● |

PRC laws and regulations prohibit or restrict foreign ownership of companies that operate Internet information and content, value added telecommunications, and certain other businesses in which we are engaged or could be deemed to be engaged. Consequently, our operations and business in the PRC are conducted through contractual arrangements (“VIE Agreements”) with Liaoning Kangbaier. If the Chinese government should disallow or limit the use of the VIE, it could materially and adversely affect our business, which could result in your shares significantly declining in value or becoming worthless. |

| |

|

|

| |

● |

Although we believe that the ownership structures of our PRC subsidiary and the Liaoning Kangbaier VIE in China do not violate any applicable PRC law, regulation, or rule currently in effect and that the VIE Agreements are valid, binding, and enforceable in accordance with their terms and applicable PRC laws and regulations currently in effect, but that such ownership structures have not been tested in court, we face uncertainty with respect to future actions by the PRC government that could significantly affect the enforceability of the VIE Agreements, Baijiakang Consulting’s financial performance, and the value of our shareholders’ shares of common stock. |

| |

|

|

| |

● |

Although the PRC’s Ministry of Commerce and its National Development and Reform Commission have announced new edicts regarding the use of VIEs for new overseas offerings, they have indicated that such new requirements will not affect the foreign ownership of companies already listed overseas. Nonetheless, there can be no assurance that such new rules and regulations will not be applied retroactively which may have a substantial negative impact on our business and consequently on the value of our securities. |

| |

● |

On March 15, 2019, the National People’s Congress promulgated the Foreign Investment Law, which took effect on January 1, 2020. Since it is relatively new, substantial uncertainties exist in relation to its interpretation and implementation including future laws, administrative regulations, or provisions of the State Council to provide for contractual arrangements as a form of foreign investment. Therefore, it is uncertain whether our contractual arrangements would be deemed to be in violation of the market access requirements for foreign investment in the PRC, and if they are deemed to be in violation, how our contractual arrangements should be dealt with. |

| |

● |

Neither the Company nor its shareholders have a direct equity ownership interest in Baijiakang Consulting, our WFOE, or Liaoning Kangbaier, the VIE. The Company’s relationship to the VIE is defined by the VIE Agreements. Therefore, should the Chinese government disallow or limit the use of the VIE, it could result in your shares significantly declining in value or becoming worthless. |

Summary

Risks Associated with Doing Business in China

| |

● |

Regulatory authorities in China have recently implemented regulations concerning privacy and data protection and more stringent laws and regulations may be introduced in China. The PRC Cybersecurity Law provides that personal information and important data collected and generated by operators of critical information infrastructure in the course of their operations in the PRC should be stored in the PRC, and the law imposes heightened regulation and additional security obligations on operators of critical information infrastructure. The Measures for Cybersecurity Review (2021) stipulate that operators of critical information infrastructure purchasing network products and services and online platform operators (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing activities that affect or may affect national security shall conduct a cybersecurity review, and any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country. We do not believe that our Company constitutes an Operator pursuant to the Cybersecurity Review (2021) that became effective in February 2022 nor do we control more than one million users’ personal information. However, the interpretation and application of consumer and data protection laws in China are often uncertain, in flux, and complicated, including differentiated requirements for different groups of people or different types of data, and there can be no assurance that in the future our operations may not be subject to these regulations which could have a significant material impact on our financial performance and the value of our securities. |

| |

|

|

| |

● |

The Company relies on dividends and other distributions on equity paid by our subsidiaries to fund our cash and financing requirements, and any limitation on the ability of our subsidiaries to make payments to us could have a material adverse effect on our financial position. Baijiakang Consulting and its VIE’s ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiary to pay dividends to its shareholders only out of its accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, our PRC subsidiary is required to set aside at least 10% of their after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of their registered capital. This reserve is not distributable as cash dividends. To the extent that cash derived from our VIE’s businesses is in the PRC or Hong Kong, or in a PRC or Hong Kong entity, the funds may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations by the PRC government on the ability of our PRC or Hong Kong subsidiaries, or of our VIE, to transfer cash. The inability of our Hong Kong or PRC subsidiaries to pay dividends, for whatever reason, could have a material adverse effect on our financial position and, in turn, on the value of our common stock. |

| |

|

|

| |

● |

To address persistent capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China and the State Administration of Foreign Exchange, or SAFE, implemented a series of capital control measures in the subsequent months, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments, and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiary’s dividend payments and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, Baijiakang Consulting and our VIE may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from their profits, if any. Furthermore, if our PRC subsidiary incurs debt on its own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. |

| |

● |

The Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the tax agreement between Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the relevant tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiary. This withholding tax will reduce the amount of dividends we may receive from our PRC subsidiary. |

| |

|

|

|

|

● |

A downturn in the Chinese or global economy or a change in economic and political policies of China could materially and adversely affect our VIE’s businesses and financial condition. Any deterioration in our VIE’s businesses could have a negative impact on the Company’s financial position and, in turn, on the value of its common stock. |

| |

|

|

| |

● |

Our business operations are conducted in China

through Baijiakang Consulting, our VIE, and its subsidiaries. If we should become subject to the recent scrutiny, criticism, and negative

publicity involving U.S. listed China-based companies, we may have to expend significant resources to investigate and/or defend negative

allegations. If such allegations cannot be addressed and resolved favorably, it could result in a material change in the business operations

of our PRC subsidiary, significantly limit our ability to obtain financing through the sale of additional securities, and cause our securities

to significantly decline in value or be worthless. See “Item 1A. Risk Factors - Risks Relating to Doing Business

in China - The recent joint statement by the SEC, proposed rule changes submitted by Nasdaq, and an act passed by the U.S. Senate and

the U.S. House of Representatives, all call for additional and more stringent criteria to be applied to emerging market companies. These

developments could add uncertainties to our business operations, common stock price, and reputation.”

|

| |

● |

Our business is subject to

complex and evolving laws and regulations regarding privacy and data protection. These laws and regulations can be complex and

stringent, and many are subject to change and uncertain interpretation, which could result in claims, changes to its data and other

business practices, regulatory investigations, penalties, increased cost of operations, or declines in user growth or engagement, or

otherwise affect its business. Although we believe we currently are not required to obtain clearance from the Cyberspace

Administration of China under the recently enacted or proposed regulations or rules, we face uncertainties as to the interpretation

or implementation of such regulations or rules, and if required, whether such clearance can be timely obtained, or at all. See “Item 1A. Risk Factors - Risks Relating to Doing Business in China - Our business is subject to complex

and evolving laws and regulations regarding privacy and data protection.” |

| |

|

|

| |

● |

There are political risks associated with conducting business in Hong Kong and China. |

| |

|

|

| |

● |

The HFCAA prohibits foreign companies from listing their securities on U.S. exchanges if the company’s auditor has been unavailable for PCAOB inspection or investigation for two consecutive years beginning in 2021. If our auditor’s work papers were to become located in China or Hong Kong, and if the PCAOB were to issue new determinations based on its inability to inspect or investigate completely registered public accounting firms headquartered in mainland China or Hong Kong because of a position taken by an authority in those jurisdictions, our common stock could be delisted and prohibited from trading on a U.S. exchange. |

| |

|

|

| |

● |

The Chinese government may choose to exercise significant oversight and discretion over the conduct of our business operations in China and may intervene in or influence our operations at any time, which could result in a material change in our and our VIE’s operations and/or the value of your shares. |

For

additional risks related to our VIE structure, see “Item 1A. Risk Factors - Risks Relating to our Commercial Relationship with

our VIE” starting on page 49. For additional risks related to doing business in China, see “Item 1A. Risk Factors –

Risks Relating to Doing Business in China” starting on page 53.

Holding

Foreign Companies Accountable Act

The

HFCAA, as originally passed, prohibited foreign companies from listing their securities on U.S. exchanges if the company’s auditor

has been unavailable for PCAOB inspection or investigation for three consecutive years beginning in 2021. On December 29, 2022, as part

of the Consolidated Appropriations Act, 2023, the time period for the delisting of foreign companies under the HFCAA was reduced from

three consecutive years to two consecutive years.

On

December 16, 2021, the PCAOB issued a Determination Report, which found that the PCAOB was unable to inspect or investigate completely

registered public accounting firms headquartered in (i) mainland China of the People’s Republic of China because of a position

taken by one or more authorities in mainland China; and (ii) Hong Kong, a Special Administrative Region of the PRC, because of a position

taken by one or more authorities in Hong Kong. In addition, the Determination Report identified specific registered public accounting

firms subject to these determinations. On August 26, 2022, the PCAOB signed a Statement of Protocol with the China Securities Regulatory

Commission and the Ministry of Finance of the PRC (the “SOP”), taking the first step toward opening access for the PCAOB

to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong completely, consistent with

U.S. law. Pursuant to the SOP, the PCAOB has independent discretion to select any issuer audits for inspection or investigation and has

the unfettered ability to transfer information to the SEC. The determinations as to mainland China and Hong Kong were vacated by the

PCAOB as of December 15, 2022 as a result of the PCAOB’s having been able to conduct extensive and thorough inspections and investigations

of mainland China and Hong Kong firms in 2022 under the SOP; however, if the PCAOB encounters any impediment, in the future, to conducting

an inspection or investigation of auditors in mainland China or Hong Kong as a result of a position taken by an authority in either jurisdiction,

it may issue new determinations consistent with the HFCAA.

We have engaged WWC, PPC (“WWC”)

as our independent registered public accounting firm, whose principal office is located in San Mateo, California, as our new independent

registered public accounting firm. Since WWC is not located in China or Hong Kong, WWC would not be subject to any determinations announced

by the PCAOB in the future with respect to auditors located in China or Hong Kong. We believe that the PCAOB’s inspectors and investigators

will have consistent access to the audit work performed by WWC for us. Therefore, we do not expect to be affected by the HFCAA at this

time.

However, to the extent that

our auditor’s work papers may, in the future, become located in mainland China or in Hong Kong, such work papers may not be available

for inspection by the PCAOB if authorities in the PRC or Hong Kong were to take a position at that time that would prevent the PCAOB from

continuing to inspect or investigate completely registered public accounting firms headquartered in mainland China or Hong Kong. If such

lack of inspection were to extend for the requisite period of time under the HFCAA, and if the PCAOB were then to issue new determinations

based on its inability to inspect or investigate completely registered public accounting firms headquartered in mainland China or Hong

Kong because of a position taken by an authority in those jurisdictions, our shares of common stock could be delisted and prohibited from

trading on a U.S. exchange. In addition, inspections of certain other firms that the PCAOB has conducted outside of China have identified

deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process

to improve future audit quality. Therefore, in addition to subjecting our securities to the possibility of being prohibited from trading

or delisted from a U.S. exchange, the inability of the PCAOB to conduct inspections of our auditors’ work papers in China or Hong

Kong would make it more difficult to evaluate the effectiveness of our auditor’s audit procedures or quality control procedures

as compared to auditors that are subject to PCAOB inspections. As a result, our investors would be deprived of the benefits of the PCAOB’s

oversight of our auditor through such inspections and they may lose confidence in our reported financial information and procedures and

the quality of our financial statements. Also, we cannot assure you that U.S. regulatory authorities will not apply additional or more

stringent criteria to us. Such uncertainty could cause the market price of our shares of common stock to be materially and adversely affected.

See “Item 1A. Risk Factors – Risks Related to Our Company - To the extent that our independent registered public accounting

firm’s audit documentation related to their audit reports for the Company may, in the future, be located in China or in Hong Kong,

our common stock could be delisted and prohibited from trading on a U.S. exchange”.

Implications

of Being a Holding Company - Transfers of Cash to and from Our Subsidiaries

As a holding company, we will

rely on dividends and other distributions on equity paid by our subsidiaries for our cash and financing requirements. Neither the Company

nor any of its subsidiaries maintain cash management policies or procedures that dictate how funds are transferred. The Company is permitted

under the laws of the State of Nevada and its articles of incorporation (as amended from time to time) to provide funding to its subsidiaries

through loans or capital contributions. Our subsidiaries are permitted under the respective laws of China, Hong Kong, and the British

Virgin Islands to provide funding to us through dividends without restrictions on the amount of the funds, other than as limited by the

amount of their distributable earnings. However, to the extent that cash is in our PRC or Hong Kong subsidiaries, there is a possibility

that the funds may not be available to fund our operations or for other uses outside of the PRC or Hong Kong due to interventions or the

imposition of restrictions and limitations by the PRC or the Hong Kong government on their ability to transfer cash. If any of

our subsidiaries incur debt on their own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends

to us.

As of the date of this Annual

Report, our subsidiaries have not experienced any difficulties or limitations on their ability to transfer cash between each other; nor

do they maintain cash management policies or procedures dictating the amount of such funding or how funds are transferred. None of our

subsidiaries have paid any dividends or other distributions or transferred assets to the Company as of the date of this Annual Report.

In the future, cash proceeds raised from overseas financing activities may be transferred by the Company to its subsidiaries via capital

contribution or shareholder loans, as the case may be. As of the date of this Annual Report, the Company has not made any transfers, paid

any dividends, or made any distributions to U.S. investors. See “ – Cash Flows,” below.

See “Item 1A. Risk

Factors - Risks Related to Doing Business in China - We rely on dividends and other distributions on equity paid by our PRC subsidiary

to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiary to make payments to

us could have a material and adverse effect on our ability to conduct our business.”

Contractual Arrangements among Baijiakang Consulting,

our WFOE, Liaoning Kangbaier, the VIE,

and Liaoning Kangbaier’s Shareholders

While we do not have any equity

interest in our consolidated affiliated entities, we have been and are expected to continue to be dependent on them to operate our business

as long as there is limitation or prohibition in the interpretation and application by local governments of regulations concerning foreign

investments in companies such as our consolidated affiliated entities. We rely on our consolidated affiliated entities to maintain or

renew their respective qualifications, licenses, or permits necessary for our business in China. We believe that under the VIE Agreements,

we have substantial control over our consolidated affiliated entities and their respective shareholders to renew, revise, or enter into

new contractual arrangements prior to the expiration of the current arrangements on terms that would enable us to continue to operate

our business in China after the expiration of the current arrangements, or pursuant to certain amendments and changes of the current applicable

PRC laws, regulations, and rules on terms that would enable us to continue to operate our business in China legally. While we currently

do not anticipate any changes to PRC laws in the near future that may impact our ability to carry out our business in China, no assurances

can be made in this regard. For a detailed description of the risks associated with our corporate structure and the contractual arrangements

that support our corporate structure, see “Item 1A. Risk Factors - Risks Relating to our Commercial Relationship with our VIE.”

The

Company is the primary beneficiary of a variable interest entity (“VIE’), Liaoning Kangbaier. Under U.S. GAAP, the Company

is required to consolidate the assets and liabilities of our VIE on its consolidated financial statements. When we obtain a variable interest

in another entity, we assess at the inception of the relationship and upon the occurrence of certain significant events whether the entity

is a VIE and, if so, whether we are the primary beneficiary of the VIE based on our power to direct the activities of the VIE that most

significantly impact the VIE’s economic performance and our obligation to absorb losses or the right to receive benefits from the

VIE that could potentially be significant to the VIE.

To

determine whether a variable interest that we hold could potentially be significant to the VIE, we consider both qualitative and quantitative

factors regarding the nature, size, and form of our involvement with the VIE. To assess whether we have the power to direct the activities

of a VIE that most significantly impact the VIE’s economic performance, we consider all the facts and circumstances, including our

role in establishing the VIE and our ongoing rights and responsibilities. This assessment includes identifying the activities that most

significantly impact the VIE’s economic performance and identifying which party, if any, has power over those activities. In general,

the parties that make the most significant decisions affecting the VIE (management and representation on the Board of Directors) and have

the right to unilaterally remove those decision-makers are deemed to have the power to direct the activities of a VIE. To assess whether

we have the obligation to absorb losses of the VIE or the right to receive benefits from the VIE that could potentially be significant

to the VIE, we consider all of our economic interests that are deemed to be variable interests in the VIE. This assessment requires us

to apply judgment in determining whether these interests, in the aggregate, are considered potentially significant to the VIE.

There

are uncertainties associated with the VIE structure as the PRC has not yet ruled on its legality as follows:

| (i) | Our

contractual arrangements may not be as effective in providing us with operational control,

and shareholders of the VIE may fail to perform their obligations under the contractual arrangements. |

| (ii) | We

may incur substantial costs to enforce the terms of the arrangements with the VIE. |

| |

(iii) |

The legality and enforceability of the contractual arrangements by and between our PRC subsidiary and the VIE have not been tested in a court of law in China. |

| |

(iv) |

The equity holders, directors, and executive officers of the VIE as well as our employees who execute other strategic initiatives may have potential conflicts of interest with our Company |

| |

(v) |

There are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations, and rules regarding the status of our Nevada holding company with respect to the contractual arrangements with the VIE. |

| (vi) | It

is uncertain whether any new PRC laws or regulations relating to VIE structures will be adopted

or, if adopted, what they would provide. |

| (vii) | If

we or our VIE is found to be in violation of any existing or future PRC laws or regulations,

or fail to obtain or maintain any of the required licenses, permits, registrations, or approvals,

the relevant PRC regulatory authorities would have broad discretion to take action in dealing

with such violations or failures. |

| (viii) | If

the PRC government finds that the agreements that establish the VIE structure for operating

our business do not comply with PRC laws and regulations, or if these regulations or their

interpretations change in the future, we would be subject to severe penalties or be forced

to relinquish our interest in those operations. |

Corporate

History and Structure

Cambell

International Holding Corp., formerly known as Bitmis Corp.

Bitmis

Corp. was founded in the State of Nevada on June 6, 2016. The Company originally intended to commence operations in the business of consulting

in Thailand, but it was not successful.

2020

Transaction. On February 24, 2020, Anna Varlamova, the then president, treasurer, secretary, and director of the Company sold

5,000,000 shares of our common stock, representing 80% of its total issued and outstanding shares of common stock, in a private transaction

(the “2020 Transaction”). The shares were sold to: (i) Li Wen Chen (1,250,000 shares); (ii) Bi Feng Zhao (1,000,000 shares);

(iii) Heng Jian Yang (1,000,000 shares); (iv) Kin Chiu Leung (1,000,000 shares); (v) Jin Jia Mai (750,000 shares); and (vi) Zhong Xiong

Chen (500,000) (collectively, the “Purchasers”) for an aggregate purchase price of $395,000. The share ownership of the Purchasers

represented, respectively, 20%, 16%, 16%, 12%, 8%, and 8% of the total issued and outstanding shares of common stock of the Company.

In

connection with the 2020 Transaction, on February 24, 2020, Anna Varlamova resigned from her positions as a director, president, treasurer,

and secretary of the Company. Effective February 24, 2020, Kin Chiu Leung, Bi Feng Zhao, Li Wen Chen, Heng Jian Yang, and Zhong Xiong

Chen were each appointed to the Board of Directors of the Company. On February 24, 2020, the Board of Directors appointed: (i) Kin Chiu

Leung as the Company’s President and Chairman; (ii) Bi Feng Zhao as the chief executive officer of the Company; (iii) Li Wen Chen

as the chief financial officer and treasurer of the Company; and (iv) Jian Li as the Secretary of the Company.

During

2020, the Company’s business was severely negatively impacted by the COVID-19 pandemic, which resulted in quarantines, travel

restrictions, shelter-in-place, and other restrictions, as management was unable to visit and meet with clients in China for

potential merger and acquisition projects. The pandemic also caused a significant disruption of global financial markets, thereby

reducing our ability to access capital and negatively affecting our liquidity.

In

addition, on July 8, 2020, the Board of Directors received resignation letters from Mr. Zhong Xiong Chen, a member of the Board, and Ms.

Li Wen Chen, a member of the Board and Chief Financial Officer of the Company, both citing personal reasons and both effective on July

8, 2020.

The Company became dormant

in July 2020.

Custodianship. On

April 12, 2022, the Eighth Judicial District Court in Clark County, Nevada Case No: A-22-849683-B appointed Custodian Ventures LLC, a

Wyoming limited liability company of which Mr. David Lazar was managing member (“Custodian Ventures”), as the Company’s

custodian. Upon Custodian Ventures' appointment, all of the remaining former officers and directors of the Company resigned.

David Lazar, 31, a private

investor, served as CEO and Chairman of the Company commencing December 9, 2021.

2022 Transaction. On

September 22, 2022, as a result of a private transaction (the “2022 Transaction”), 10,000,000 shares of the Company’s

series A preferred stock, $0.001 par value per share, were transferred from Custodian Ventures to Xiaoyan Yuan (the “Purchaser”)

for a cash consideration of $430,000 constituting personal funds of the Purchaser. As a result, the Purchaser became the holder of 90%

of the voting rights of the issued and outstanding share capital of the Company.

On September 22, 2022, David

Lazar resigned from all of his positions with the Company. Concurrently, and effective on the date of the transfer, Xiaoyan Yuan consented

to act as the Company’s Chief Executive Officer, President, Chief Financial Officer, and sole director and also assumed the positions

of Secretary and Treasurer.

Share Exchange with

Cambell International Holding Limited. On December 30, 2022, we entered into a share exchange agreement (“Share Exchange

Agreement”) with (i) Cambell International Holding Limited (“Cambell International”), a limited liability company incorporated

in the British Virgin Islands on September 23, 2020; (ii) the shareholders of Cambell International (the “Cambell Shareholders”);

and (iii) Ms. Xiaoyan Yuan, the holder of all of our outstanding shares of preferred stock, to acquire all the issued and outstanding

capital stock of Cambell International in exchange for the issuance to the Cambell Shareholders of an aggregate of 1,000,000 shares (the

“Shares”) of our common stock and the transfer by Ms. Yuan to the Cambell Shareholders of 9,000,000 shares of our series

A preferred stock owned by her (“Reverse Acquisition”). The Reverse Acquisition was closed on December 30, 2022.

None of Cambell International’s

stockholders is a U.S. Person (as that term is defined in Regulation S of the Securities Act) and Cambell International acquired our shares

in the Reverse Merger outside of the United States.

In issuing these securities

to Cambell International’s stockholders, we relied upon the exemption from the registration requirements of the Securities Act,

provided by Section 4(a)(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering, and/or Regulation

S promulgated by the U.S. Securities and Exchange Commission (the “SEC”). Among other things, the offer or sale was made in

an offshore transaction and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective

affiliates, or any person acting on behalf of any of the foregoing. In addition, each of the recipients of the shares certified that he/she/it

is not a U.S. Person and is not acquiring the securities for the account or benefit of any U.S. Person and agreed to resell such securities

only in accordance with the provisions of Regulation S, pursuant to registration under the Act, or pursuant to an available exemption

from registration; and agreed not to engage in hedging transactions with regard to such securities unless in compliance with the Securities

Act.

Accounting Treatment;

Change of Control. Pursuant to the Reverse Acquisition, Cambell International is deemed to be the acquirer. Consequently, the

assets and liabilities and the historical operations that will be reflected in the financial statements prior to the business combination

will be those of Cambell International and its consolidated subsidiaries and will be recorded at the historical cost basis of Cambell

International and retroactively restated. The consolidated financial statements after consummation of the business combination will include

the assets and liabilities of Cambell International and its subsidiaries and VIE, historical operations of Cambell International and its

subsidiaries and VIE, and operations of Bitmis Corp., now known as Cambell International Holding Corp., from the closing date of the Reverse

Acquisition.

Pursuant to the business combination,

a change of control of Bitmis Corp. occurred as of the closing date. Except as described in this Annual Report, no arrangements or understandings

exist among present or former controlling shareholders with respect to the election of members of our Board and, to our knowledge, no

other arrangements exist that might result in a change of control of Bitmis Corp., now known as Cambell International Holding Corp.

We

continue to be a “smaller reporting company,” as defined under the Exchange Act, following the Reverse Acquisition.

Amendments

to Articles of Incorporation

Name

Change to Campbell International Holding Corp. Effective as of May 25, 2023, our Board of Directors and majority consenting shareholders

signed a joint written consent (the “Campbell Joint Written Consent”), approving an amendment to our articles of incorporation

to change our name and trading symbol. The Campbell Joint Written Consent was approved by all members of the Board of Directors and by

a majority of our shareholders holding of record an aggregate of 10,406,400 shares of our common stock.

On

June 29, 2023, an amendment to the articles of incorporation was filed with the Nevada Secretary of State (the “Campbell Certificate

of Amendment”) to effect the change of name from “Bitmis Corp.” to “Campbell International Holding Corp.”

(the “Campbell Company Name Change”). On July 10, 2023, the Company also filed an issuer notification form with FINRA (the

“Issuer Notification”) reflecting the Campbell Company Name Change and requesting a change in its trading symbol from “BITM”

to “KAFC” or such other trading symbol as may be available. The Campbell Certificate of Amendment to the Corporation’s

Articles of Incorporation was effective as of the date of acceptance by the Secretary of State of the State of Nevada or June 29, 2023.

The

foregoing description of the Campbell Certificate of Amendment and Campbell Joint Written Consent do not purport to be complete and are

qualified in their entirety by reference to the full text of the Campbell Certificate of Amendment and Campbell Joint Written Consent,

which were filed as Exhibit 3.1 and Exhibit 99.1, respectively, to the Current Report on Form 8-K with the Securities and Exchange Commission

on July 11, 2023.

Name

Change to Cambell International Holding Corp. Effective as of July 19, 2023, our Board of Directors and majority consenting shareholders

signed a joint written consent (the “Cambell Joint Written Consent”), approving an amendment to the articles of incorporation

to change the name of the Company and the Company’s trading symbol. The Cambell Joint Written Consent was approved by all members

of our Board of Directors and by the majority of our shareholders holding of record an aggregate of 10,406,400 shares of our common stock.

On

July 25, 2023, a further amendment to our articles of incorporation was filed with the Nevada Secretary of State to effect the change

of name from “Campbell International Holding Corp.” to “Cambell International Holding Corp.” (the “Cambell

Certificate of Amendment”). The Cambell Certificate of Amendment to our articles of incorporation was effective as of the date of

acceptance by the Secretary of State of the State of Nevada on July 25, 2023.

The

foregoing description of the Cambell Certificate of Amendment and Cambell Joint Written Consent do not purport to be complete and are

qualified in their entirety by reference to the full text of the Cambell Certificate of Amendment and Cambell Joint Written Consent,

which were filed as Exhibit 3.1 and Exhibit 99.1 to the Current Report on Form 8-K with the Securities and Exchange Commission on August

10, 2023.

Current

Corporate Structure

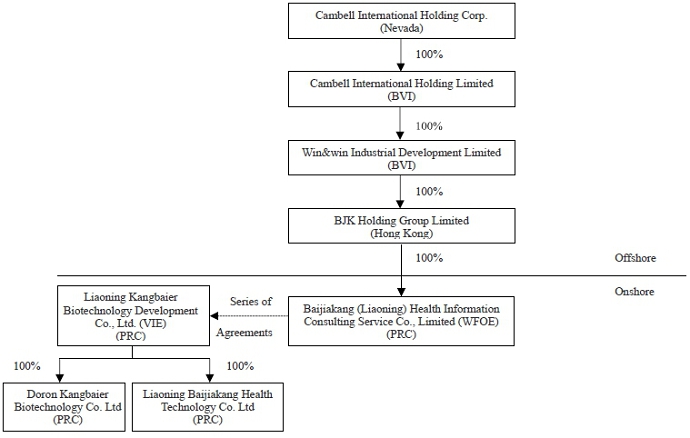

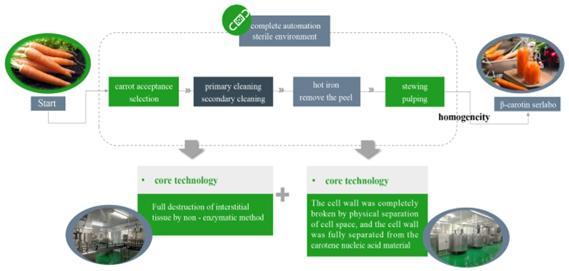

Following

the consummation of the Reverse Acquisition, we engage in the research and development of extraction processes of natural β -carotene,

the planting and harvesting of raw materials as well as the production, distribution, marketing, and sales of natural β -carotene

health food products. Natural β -carotene is a safe source of vitamin A which is an essential nurturant important for vision, growth,

cell division, reproduction, and immunity as well as containing antioxidant properties which offer protection from diabetes, heart disease,

and cancer.

The Company owns 100% of the

issued and outstanding capital stock of Cambell International Holding Limited, which was incorporated on September 23, 2020 under the

law of the British Virgin Islands. Cambell International Holding Limited is a holding company holding the following entities:

| Win&win Industrial Development Limited |

● |

A British Virgin Islands company |

|

100% |

| (“Win&win”) |

● |

Principal activities: investment holding |

|

|

| |

|

|

|

|

| BJK Holding Group Limited |

● |

A Hong Kong company |

|

100% |

| (“BJK Holding”) |

● |

Principal activities: investment holding |

|

|

| |

|

|

|

|

| Baijiakang (LiaoNing) Health Information Consulting Service Co., Ltd |

● |

A PRC limited liability company and deemed a wholly foreign-invested enterprise |

|

100% |

| (“Baijiakang Consulting”) |

● |

Principal activities: consultancy and information technology support |

|

|

| |

|

|

|

|

| LiaoNing KangBaiEr Biotechnology Development Co., Ltd. |

● |

A PRC limited liability company |

|

VIE by contractual

arrangements |

| (“Liaoning Kangbaier”) |

● |

Incorporated on September 22, 2015 |

|

|

| |

● |

Principal activities: research and development of extraction processes of natural β - carotene, the planting and harvesting of raw materials, and the production, distribution, marketing, and sales of natural β -carotene health food products. |

|

|

| |

|

|

|

|

| Doron KangBaier Biotechnology Co. LTD (“Doron”) |

● |

A PRC limited liability company |

|

100% owned by LiaoNing KangBaiEr |

| |

● |

Principal activities: research and support |

|

|

| |

|

|

|

|

| LiaoNing BaiJiaKang Health Technology Co. LTD (“Liaoning”) |

●

● |

A PRC limited liability company

Principal activities: promotion and support |

|

100% owned by LiaoNing KangBaiEr |

Cambell

International Holding Limited

Cambell

International Holding Limited (“Cambell International”) was incorporated in the British Virgin Islands on September 23, 2020.

On December 30, 2022, Cambell

International entered into the Share Exchange Agreement with Bitmis Corp., now known as Cambell International Holding Corp., and the shareholders

of Cambell International to acquire all the issued and outstanding capital of Cambell International in exchange for the issuance by Bitmis

Corp. of an aggregate of 1,000,000 shares of our common stock to those shareholders (“Reverse Acquisition”). As a condition

of closing of the Reverse Acquisition, Ms. Xiaoyan Yuan transferred to the Cambell Shareholders 9,000,000 shares of Bitmis’ series

A preferred stock, $0.001 par value per share (the “Preferred Shares”) owned by her. After the Reverse Acquisition, Cambell

International became a wholly-owned subsidiary of Bitmis Corp. on December 30, 2022.

Win&win

Industrial Development Company Ltd.

Win&win Industrial Development

Company Ltd, a British Virgin Islands company formed on November 3, 2020 (“Win&win”), is a wholly owned subsidiary of

Cambell International, which was established in connection with our intent to become listed.

BJK

Holding Group Limited

BJK Holding Group Limited,

a Hong Kong company, (“BJK Holding”) is a wholly owned subsidiary of Win&win formed on November 30, 2020. Originally incorporated

as Yangtze River Holding Group Limited, it changed its name to Baijiakang Holding Group Limited on August 31, 2021.

Baijiakang

(Liaoning) Health Information Consulting Services Co., Ltd.

Baijiakang (Liaoning) Health

Information Consulting Services Co., Ltd. (“Baijiakang Consulting”), a wholly owned

subsidiary of BJK Holding, was formed on February 16, 2022 as a limited company pursuant to PRC law (WFOE).

Liaoning

Kangbaier Biotechnology Development Co., Ltd

Liaoning Kangbaier Biotechnology

Development Co., Ltd. (“Liaoning Kangbaier”), the VIE, was formed under the laws of the PRC on September 22, 2015. We operate

our research, development, production, and marketing business of natural B-carotene based nutritional products through Liaoning Kangbaier

and its wholly owned subsidiaries, Doron Kangbaier Biotechnology Co. Ltd., and Liaoning BaiJiaKang Health Technology Co. Ltd., in China.

Pursuant to PRC law, each

entity formed under PRC law must have a business scope as submitted to the Administration for Market Regulation or its local counterpart.

Depending on the particular business scopes, approval by the relevant competent regulatory agencies may be required prior to commencement

of business operations. Since the sole business of our WFOE is to provide Liaoning Kangbaier with technical support, consulting services,

and other management services relating to its day-to-day business operations and management in exchange for a service fee approximately

equal to all pre-tax profits of Liaoning Kangbaier and its subsidiaries (minus any accumulated losses (if any) of Liaoning Kangbaier and

its subsidiaries in the previous fiscal year, and the amount required for operating funds, expenditures, taxes, and other statutory contributions

in any particular fiscal year), such business scope is appropriate under PRC law. Liaoning Kangbaier, on the other hand, is also able

to, pursuant to its business scope, conduct the business of manufacturing nutritional products. Liaoning Kangbaier is approved by the

Market Regulation Bureau of Panjin to engage in its business.

We

control Liaoning Kangbaier through a series of contractual arrangements, or “VIE Agreements,” which are described under “Contractual

Arrangements among WFOE, Liaoning Kangbaier, and Liaoning Kangbaier Shareholders.” The VIE Agreements are designed so that the

operations of the VIE are solely for the benefit of WFOE and ultimately, the Company. As such, under U.S. GAAP, the Company is deemed

to have a controlling financial interest in, and be the primary beneficiary of, the VIE for accounting purposes only and must consolidate

the VIE because we meet the conditions under the U.S. GAAP to consolidate the VIE.

The

following diagram illustrates our corporate structure as of the date of this Annual Report:

Contractual Arrangements among WFOE, Liaoning Kangbaier, and

Liaoning Kangbaier’s Shareholders

While we do not have any equity

interest in our consolidated affiliated entities, we have been and are expected to continue to be dependent on them to operate our business

as long as there is limitation or prohibition in the interpretation and application by local governments of regulations concerning foreign

investments in companies such as our consolidated affiliated entities. We rely on our consolidated affiliated entities to maintain or

renew their respective qualifications, licenses, or permits necessary for our business in China. We believe that under the VIE Agreements,

we have substantial control over our consolidated affiliated entities and their respective shareholders to renew, revise, or enter into

new contractual arrangements prior to the expiration of the current arrangements on terms that would enable us to continue to operate

our business in China after the expiration of the current arrangements, or pursuant to certain amendments and changes of the current applicable

PRC laws, regulations, and rules on terms that would enable us to continue to operate our business in China legally. While we currently

do not anticipate any changes to PRC laws in the near future that may impact our ability to carry out our business in China, no assurances

can be made in this regard. See “Item 1A. Risk Factors-Risks Related to Doing Business in China.” For a detailed description

of the risks associated with our corporate structure and the contractual arrangements that support our corporate structure, see “Item

1A. Risk Factors - Risks Relating to our Commercial Relationship with our VIE.”

The following is a summary

of the VIE Agreements among the WFOE, Liaoning Kangbaier, and Liaoning Kangbaier’s Shareholders.

On November 27, 2022, Baijiakang

Consulting, Liaoning Kangbaier, and Liaoning Kangbaier’s Shareholders. entered into a series of contractual agreements for Liaoning

Kangbaier to qualify as a variable interest entity or VIE (the “VIE Agreements”). The VIE Agreements consist of the following:

| |

(1) |

Consulting Service Agreement |

| |

(2) |

Business Operation Agreement |

| |

(4) |

Equity Disposal Agreement |

| |

(5) |

Equity Pledge Agreement |

Consulting

Service Agreement. Pursuant to the terms of the Exclusive Consulting and Service Agreement dated November 27, 2022, between Baijiakang

Consulting and Liaoning Kangbaier (the “Consulting Service Agreement”), Baijiakang Consulting is the exclusive consulting

and service provider to Liaoning Kangbaier to provide business-related software research and development services; design, installation,

and testing services; network equipment support, upgrade, maintenance, monitor, and problem-solving services; employees training services;

technology development and sublicensing services; public relations services; market investigation, research, and consultation services;

short to medium term marketing plan-making services; compliance consultation services; marketing events and membership related activities

planning and organizing services; intellectual property permits; equipment and rental services; and business-related management consulting

services. Pursuant to the Consulting Service Agreement, the service fee is the remaining amount after Liaoning Kangbaier’s profit

before tax in the corresponding year deducts Liaoning Kangbaier’s losses, if any, in the previous year, the necessary costs, expenses,

taxes, and fees incurred in the corresponding year, and the withdraws of the statutory provident fund. Liaoning Kangbaier agreed not

to transfer its rights and obligations under the Consulting Service Agreement to any third party without prior written consent from Baijiakang

Consulting. In addition, Baijiakang Consulting may transfer its rights and obligations under the Consulting Service Agreement to Baijiakang

Consulting’s affiliates without Liaoning Kangbaier’s consent, but Baijiakang Consulting shall notify Liaoning Kangbaier of

such transfer. This Agreement is valid for a term of 10 years subject to any extension requested by Baijiakang Consulting unless terminated

by Baijiakang Consulting unilaterally prior to the expiration.

Business Operation Agreement.

Pursuant to the terms of the Business Operation Agreement dated November 27, 2022, among Baijiakang Consulting, Liaoning Kangbaier,

and the shareholders of Liaoning Kangbaier (the “Business Operation Agreement”), Liaoning Kangbaier has agreed to subject

the operations and management of its business to the control of Baijiakang Consulting. According to the Business Operation Agreement,

Liaoning Kangbaier is not allowed to conduct any transactions that has substantial impact upon its operations, assets, rights, obligations,

and personnel without the Baijiakang Consulting’s written approval. The shareholders of Liaoning Kangbaier and Liaoning Kangbaier

will take Baijiakang Consulting’s advice on appointment or dismissal of directors, employment of Liaoning Kangbaier’s employees,

regular operation, and financial management of Liaoning Kangbaier. The shareholders of Liaoning Kangbaier have agreed to transfer any

dividends, distributions, or any other profits that they receive as the shareholders of Liaoning Kangbaier to Baijiakang Consulting without

consideration. The Business Operation Agreement is valid for a term of 10 years or longer upon the request of Baijiakang Consulting prior

to the expiration thereof. The Business Operation Agreement may be terminated earlier by Baijiakang Consulting with a 30-day written notice.

Proxy

Agreement. Pursuant to the terms of the Proxy Agreements dated November 27, 2022, among Baijiakang Consulting, and the shareholders

of Liaoning Kangbaier (each, the “Proxy Agreement”, collectively, the “Proxy Agreements”), each shareholder of

Liaoning Kangbaier has irrevocably entrusted his/her shareholder rights as Liaoning Kangbaier’s shareholder to Baijiakang Consulting

, including but not limited to, proposing the shareholder meeting, accepting any notices with regard to the convening of shareholder

meeting and any other procedures, conducting voting rights, and selling or transferring the shares held by such shareholder, for 10 years

or earlier if the Business Operation Agreement was terminated for any reasons.

Equity

Disposal Agreement. Pursuant to the terms of the Equity Disposal Agreement dated November 27, 2022, among Baijiakang Consulting,

Liaoning Kangbaier , and the shareholders of Liaoning Kangbaier (the “Equity Disposal Agreement”), the shareholders of Liaoning

Kangbaier granted Baijiakang Consulting or its designees an irrevocable and exclusive purchase option (the “Option”)

to purchase Liaoning Kangbaier’s all or partial equity interests and/or assets at the lowest purchase price permitted by PRC laws

and regulations. The option is exercisable at any time at Baijiakang Consulting’s discretion in full or in part, to the extent

permitted by PRC law. The shareholders of Liaoning Kangbaier agreed to give Liaoning Kangbaier the total amount of the exercise price

as a gift, or in other methods upon Baijiakang Consulting’s written consent to transfer the exercise price to Liaoning Kangbaier.

The Equity Disposal Agreement is valid for a term of 10 years or longer upon the request of Baijiakang Consulting.

Equity

Pledge Agreement. Pursuant to the terms of the Equity Pledge Agreement dated November 27, 2022, among Baijiakang Consulting and

the shareholders of Liaoning Kangbaier (the “Pledge Agreement”), the shareholders of Liaoning Kangbaier pledged all of their

equity interests in Liaoning Kangbaier to Baijiakang Consulting, including the proceeds thereof, to guarantee Liaoning Kangbaier’s

performance of its obligations under the Business Operation Agreement, the Consulting Service Agreement and the Equity Disposal Agreement

(each, an “Agreement”, collectively, the “Agreements”). If Liaoning Kangbaier or its shareholders breach its

respective contractual obligations under any Agreements, or cause to occur one of the events regards as an event of default under any

Agreements, Baijiakang Consulting, as pledgee, will be entitled to certain rights, including the right to dispose of the pledged equity

interest in Liaoning Kangbaier. During the term of the Pledge Agreement, the pledged equity interests cannot be transferred without Baijiakang

Consulting’s prior written consent. The Pledge Agreement is valid until all the obligations due under the Agreements have been

fulfilled.

The foregoing summaries of

the VIE Agreements do not purport to be complete and are subject to, and qualified in their entirety by, the respective VIE Agreement,

which are filed as Exhibits 10.2 through 10.6 to the Current Report on Form 8-K/A filed with the Securities and Exchange Commission on

January 11, 2023.

Cash

Flows

Our

Company is a holding company, and we will rely on dividends and other distributions on equity paid by our Hong Kong and China subsidiaries

for our cash and financing requirements. Any funds we may transfer to Baijiakang Consulting, either as a loan or as an increase in registered

capital, are subject to approval by or registration with relevant government authorities in China, regardless of the amount of the transfer.

According to the relevant PRC regulations, capital contributions to our PRC subsidiary are subject to the submission of reports of changes

through the enterprise registration system and registration with a local bank authorized by SAFE. In addition, any foreign loan procured

by our PRC subsidiary is required to be registered with SAFE, and such loan is required to be registered with the NDRC. We may not be

able to complete such registrations or obtain necessary approvals on a timely basis with respect to future capital contributions or foreign

loans by us to our PRC subsidiary. If we fail to complete such registration or other procedures, our ability to maintain our corporate

structure while capitalizing our PRC subsidiary’s operations may be negatively affected, which could adversely affect our liquidity

and our ability to fund and expand our business.

Substantially all of our revenue

is earned by our PRC subsidiary, Baijiakang Consulting, and Liaoning Kangbaier, the VIE. Neither we nor Baijiakang Consulting own any

equity interest in Liaoning Kangbaier. In accordance with the terms of the Consulting Service Agreement, Baijiakang Consulting is entitled

to receive payments from Liaoning Kangbaier as the VIE in the form of a service fee which, in turn, may be distributed to us as dividends.

As a holding company, we will rely on dividends and other distributions on equity paid by our BVI, Hong Kong, and PRC subsidiaries for

our cash and financing requirements. Our Hong Kong and PRC subsidiaries are permitted under the respective laws of China and Hong Kong

to provide funding to us through dividends without restrictions on the amount of the funds, other than as limited by the amount of their

distributable earnings. However, to the extent that cash is in our Hong Kong or PRC subsidiaries, there is a possibility that the funds

may not be available to fund our operations or for other uses outside of the PRC or Hong Kong due to interventions or the imposition of

restrictions and limitations by the PRC or the Hong Kong government on the ability to transfer cash. If any of our subsidiaries

incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us.

After

investors’ funds enter the Company, the funds can be directly transferred to Cambell International in accordance with the laws

of the State of Nevada, which will then directly transfer the funds to Win&win in accordance with the laws of the British Virgin

Islands. Win&win can then transfer the funds to BJK Holding, which can subsequently transfer funds to Baijiakang Consulting. If the

Company intends to distribute dividends, Baijiakang Consulting will transfer funds received from Baijiakang Consulting, the VIE, as dividends

to BJK Holding in accordance with the laws and regulations of China. BJK Holding will then transfer the funds to Win&win in accordance

with the laws of Hong Kong, Win&win will transfer the funds to Cambell International, and Cambell International will then transfer

the funds to the Company in accordance with the laws of the BVI. The Company will then distribute the dividends to all of its shareholders

respectively in proportion to the shares they hold in accordance with the laws and regulations of the State of Nevada, regardless of

whether the shareholders are U.S. investors or investors in other countries or regions.

Under

the Companies Ordinance of Hong Kong, dividends may only be paid out of distributable profits (that is, accumulated realized profits

less accumulated realized losses) or other distributable reserves. Dividends cannot be paid out of share capital. There are no restrictions

or limitation under the laws of Hong Kong imposed on the conversion of HK dollars into foreign currencies and the remittance of currencies

out of Hong Kong, nor is there any restriction on foreign exchange to transfer cash between our Company and its subsidiaries, across

borders and to U.S investors, nor on distributing earnings from our Hong Kong subsidiary’s business to our Company and U.S. investors

and amounts owed. Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect

of dividends.

Under

PRC laws, rules and regulations, our PRC subsidiary and VIE are required to set aside at least 10% of their after-tax profits each year

after making up for previous years’ accumulated losses, if any, to fund certain statutory reserves, until the aggregate amount

of such fund reaches 50% of their registered capital. However, there can be no assurance that the PRC government will not intervene or

impose restrictions on their ability to transfer or distribute cash within our organization or to foreign investors, which could result

in an inability or prohibition on making transfers or distributions outside of China and may adversely affect our business, financial

condition, and results of operations.

As

of the date of this Annual Report, our subsidiaries have not experienced any difficulties or limitations on their ability to transfer

cash between each other; nor do they maintain cash management policies or procedures dictating the amount of such funding or how funds

are transferred. None of our subsidiaries have paid any dividends, other distributions or transferred assets to our holding company as

of the date of this Annual Report. In the future, cash proceeds raised from overseas financing activities may be transferred by us to

our Hong Kong or PRC subsidiaries via capital contribution or shareholder loans, as the case may be. As of the date of this Annual Report,

we have not made any transfers, paid any dividends, or made any distributions to U.S. investors.

Neither

the Company nor its Hong Kong subsidiary or its PRC subsidiary have paid dividends or made distributions to U.S. investors. No funds

have been transferred by the holding companies to the Hong Kong subsidiary, the PRC subsidiary, or the VIE for the fiscal years ended

June 30, 2023 or 2022, and through the date of this Annual Report, to fund their business operations. In the future, any cash proceeds

raised from overseas financing activities may be transferred by us to our Hong Kong or PRC subsidiaries via capital contribution or shareholder

loans, and to Baijiakang Consulting as loans.

See

“Condensed Consolidating Schedule,” below and “Item 8. Financial Statements and Supplementary Data - Consolidated Financial

Statements and Footnotes” on page 96;

Condensed

Consolidating Schedule

Set

forth below is the condensed consolidated balance sheet information as of June 30, 2023, condensed consolidated statements of operations

and cash flows for the fiscal year ended June 30, 2023, and showing financial information for the parent company, Cambell International

Holding Limited, the non-VIE subsidiaries (as defined below), the VIE (as defined below), eliminating entries, and consolidated information

(in dollars). In the tables below, the column headings correspond to the following entities in the organizational diagram on page 13.

For

the purposes of this section:

“Parent

entity” refers to Cambell International Holding Corp.

“Non-VIE

subsidiaries” refers to the following entities:

| |

● |

Cambell International Holding Limited (“Cambell

International”) |

| |

|

|

| |

● |

Win&win Industrial Development Limited (“Win&win”) |

| |

|

|

| |

● |

BJK Holding Group Limited (“BJK Holding)”) |

| |

|

|

| |

● |

Baijiakang (Liaoning) Health Information Consulting

Services Co. Ltd. (“Baijiakang Consulting”) |

“VIE”

refers to Liaoning Kangbaier Biotechnology Development Co., Ltd (“Liaoning Kangbaier”).

Condensed

Consolidated Balance Sheets

As

of June 30, 2023

| | |

Parent | | |

Non-VIE Subsidiaries Consolidated | | |

VIE | | |

Elimination Entries and Reclassification Entries | | |

Consolidated | |

| Cash and cash equivalent | |

$ | - | | |

$ | - | | |

$ | 286,272 | | |

$ | - | | |

$ | 286,272 | |

| Intercompany receivables-current | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Total Current Assets | |

| - | | |

| - | | |

| 844,615 | | |

| - | | |

| 844,615 | |

| Intercompany receivables-noncurrent | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Total Non-current Assets | |

| - | | |

| - | | |

| 354,944 | | |

| - | | |

| 354,944 | |

| Total assets | |

| - | | |

| - | | |

| 1,199,559 | | |

| - | | |

| 1,199,559 | |

| Intercompany payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Total current liabilities | |

| - | | |

| - | | |

| 3,909,576 | | |

| - | | |

| 3,909,576 | |

| Total noncurrent liabilities | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Total Liabilities | |

| - | | |

| - | | |

| 3,909,576 | | |

| - | | |

| 3,909,576 | |

| Total Shareholders’ Deficit | |

| - | | |

| - | | |

| (2,710,017 | ) | |

| - | | |

| (2,710,017 | ) |

| Non-controlling interest | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Total Deficit | |

| - | | |

| - | | |

| (2,710,017 | ) | |

| - | | |

| (2,710,017 | ) |

Intercompany receivables from

non-VIE entities and intercompany payables to VIE represent a loan to non-VIE entities for working capital purposes.

Condensed

Consolidated Statements of Operations Data

| | |

For the year ended June 30, 2023 | |

| | |

Parent Only | | |

Non-VIE Subsidiaries Consolidated | | |

VIE | | |

Eliminating

adjustments | | |

Consolidated

Totals | |

| Revenue | |

$ | - | | |

$ | - | | |

$ | 463,076 | | |

$ | - | | |

$ | 463,076 | |

| Intercompany revenue | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Cost of revenue and related tax | |

| - | | |

| - | | |

| 371,455 | | |

| - | | |

| 371,455 | |

| Gross profit | |

| - | | |