Max Resource Reports 3.7-km

High-Grade Copper-Silver Zone at CONEJO, Northeastern

Colombia

Vancouver B.C., November 3, 2021 –

InvestorsHub NewsWire - MAX RESOURCE CORP. ("Max" or the

"Company") (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) is

pleased to report high-grade assay results at CONEJO, located along

the CESAR North 90-kilometre-long copper-silver belt, within the

wholly-owned CESAR project in North Eastern Colombia (refer to

Figure 1).

-

The CONEJO high-grade zone now

extends over 3.7-km with average grade of 4.9% copper using 2%

cutoff (refer to Figure 2).

-

To date, 13 rock samples returned

values greater than 8.0% copper; 53 returned values greater than

5.0% copper; 93 returned values of 2.0% copper and above; 36

returned values greater than 20 g/t silver over widths ranging from

0.5 to 20.0m. Highlight values of 12.5 % copper and 126 g/t silver

(refer to Table 1).

-

In addition, composite results

include 7.5% copper and 86 g/t silver over widths of 6.0m (878814

to 878816); 5.2% copper

and 46 g/t silver over widths of 10.0m (878820 to 878824) and 3.2%

copper and 32 g/t silver over widths of 10.0m (878804 to 878808)

(refer to Figures 2 to 8).

Highlights:

-

9.9% copper and 50 g/t silver over widths of 2.0m chip

channel (878823)

-

9.3% copper and 126 g/t silver over widths of 2.0m chip

channel (878814)

-

7.5% copper and 93 g/t silver over widths of 2.0m chip

channel (878839)

-

7.3% copper and 100 g/t silver over widths of 2.0m chip

channel (878816)

-

7.0% copper and 56 g/t silver over widths of 2.0m chip

channel (878751)

Highlights 2021:

-

12.5% copper and 84 g/t silver over 5.0m by 5.0m panel

(878335)

-

10.5% copper and 50 g/t silver over 3.0m by 2.0m panel

(878603)

-

10.4% copper and 95 g/t silver over 5.0m by 5.0m panel

(878338)

-

10.2% copper and 62 g/t silver over 5.0m by 5.0m panel

(878334)

-

10.0% copper and 80 g/t silver over 5.0m by 5.0m panel

(878363)

-

8.6% copper and 89 g/t silver over 5.0m by 5.0m panel

(878336)

-

8.4% copper and 60 g/t silver over 5.0m by 5.0m panel

(878337)

The CONEJO mineralization is hosted in a stockwork within

igneous host rock and is associated with the presence of epidote.

Observed minerals include: chalcocite, native copper, cuprite and

copper oxides.

"The presence of high-grade copper in both the stratabound

horizon and within the igneous hosted stockwork cutting the copper

horizon suggest CONEJO to be a significant stand alone

copper target capable of hosting a substantial copper

deposit," commented Max CEO, Brett Matich.

"In addition, the Max technical team has commenced a targeted

exploration program over the 48-km² URU zone, located 30-km south

of CONEJO," he continued.

"In 20 years, BloombergNEF says copper miners need to double

the amount of global copper production, just to meet the demand for

a 30% penetration rate of electric vehicles from the current 20Mt a

year to 40Mt. Max shareholders are well positioned to take

advantage, with significant potential for district-scale

discoveries throughout the CESAR basin," he concluded.

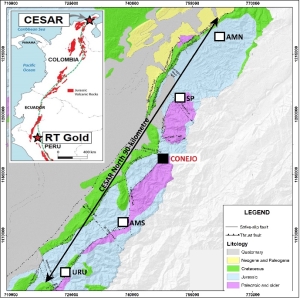

Figure

1: CONEJO

Location

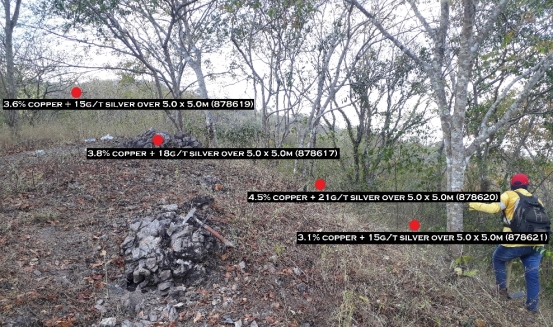

Figure

2: CONEJO 3.7-km >2.0%

copper (refer to Table 1)

Figure 3: (878814-816) and (878820-824)

Figure 4:

(878804-808)

Figure 5: (878603)

Figure 6:

(876823)

Figure 7:

(878617,619,620,621)

Figure 8:

(878751)

|

Copper (%)

|

Silver (g/t)

|

Width (m)

|

Sample Type

|

Sample No.

|

|

9.9

|

50

|

2.0

|

Chip channel

|

878823

|

|

9.3

|

126

|

2.0

|

Chip channel

|

878814

|

|

7.5

|

93

|

2.0

|

Chip Channel

|

878839

|

|

7.4

|

75

|

1.2

|

Chip Channel

|

878830

|

|

7.3

|

100

|

2.0

|

Chip channel

|

878816

|

|

7.0

|

56

|

2.0

|

Chip Channel

|

878751

|

|

6.9

|

29

|

2.0

|

Chip channel

|

878821

|

|

6.6

|

66

|

1.2

|

Chip Channel

|

878801

|

|

6.5

|

49

|

1.2

|

Chip channel

|

878810

|

|

5.7

|

32

|

2.0

|

Chip channel

|

878815

|

|

5.6

|

57

|

2.0

|

Chip Channel

|

876804

|

|

5.3

|

66

|

2.0

|

Chip Channel

|

878836

|

|

4.7

|

52

|

1.2

|

Chip Channel

|

876836

|

|

4.3

|

46

|

1.6

|

Chip Channel

|

878831

|

|

4.0

|

43

|

1.0

|

Chip channel

|

878818

|

|

3.5

|

44

|

0.6

|

Chip channel

|

878826

|

|

3.5

|

30

|

0.5

|

Chip Channel

|

876840

|

|

3.4

|

66

|

2.0

|

Chip Channel

|

878820

|

|

3.4

|

54

|

2.0

|

Chip channel

|

878822

|

|

3.4

|

54

|

1.5

|

Chip Channel

|

878757

|

|

3.4

|

28

|

0.5

|

Chip Channel

|

876171

|

|

3.1

|

38

|

2.0

|

Chip Channel

|

876806

|

|

3.1

|

35

|

1.5

|

Chip Channel

|

876809

|

|

2.9

|

27

|

2.0

|

Chip Channel

|

876807

|

|

2.6

|

36

|

2.0

|

Chip Channel

|

876805

|

|

2.6

|

28

|

1.7

|

Chip Channel

|

876834

|

|

2.5

|

23

|

5.0

|

Chip Channel

|

878807

|

|

2.4

|

18

|

0.5

|

Chip Channel

|

876839

|

|

2.3

|

23

|

3.0

|

Chip Channel

|

878804

|

|

2.3

|

10

|

2.0

|

Chip channel

|

878824

|

|

2.1

|

16

|

2.0

|

Chip channel

|

878809

|

|

|

|

|

|

|

|

12.5

|

84

|

5.0 x 5.0

|

Panel

|

878335

|

|

10.7

|

52

|

1.0 x 1.0

|

Panel

|

878389

|

|

10.5

|

50

|

3.0 x 2.0

|

Panel

|

878603

|

|

10.4

|

95

|

5.0 x 5.0

|

Panel

|

878338

|

|

10.2

|

62

|

5.0 x 5.0

|

Panel

|

878334

|

|

10.0

|

80

|

5.0 x 5.0

|

Panel

|

878363

|

|

9.5

|

120

|

1.0 x 1.0

|

Panel

|

878390

|

|

9.0

|

67

|

1.0 x 1.0

|

Panel

|

878391

|

|

8.8

|

66

|

1.0 x 1.0

|

Panel

|

878386

|

|

8.6

|

89

|

5.0 x 5.0

|

Panel

|

878336

|

|

8.4

|

60

|

5.0 x 5.0

|

Panel

|

878337

|

|

7.9

|

21

|

5.0 x 5.0

|

Panel

|

878368

|

|

7.7

|

84

|

5.0 x 5.0

|

Panel

|

878373

|

|

7.4

|

47

|

5.0 x 5.0

|

Panel

|

878333

|

|

7.3

|

80

|

3.0 x 3.0

|

Panel

|

878394

|

|

7.0

|

45

|

5.0 x 5.0

|

Panel

|

878352

|

|

6.0

|

29

|

5.0 x 5.0

|

Panel

|

878356

|

|

5.8

|

16

|

5.0 x 5.0

|

Panel

|

878348

|

|

5.5

|

84

|

1.0 x 1.0

|

Panel

|

878388

|

|

5.5

|

64

|

1.0 x 1.0

|

Panel

|

878393

|

|

5.3

|

19

|

5.0 x 5.0

|

Panel

|

878349

|

|

5.0

|

54

|

1.0 x 1.0

|

Panel

|

878604

|

|

4.9

|

36

|

5.0 x 5.0

|

Panel

|

878625

|

|

4.9

|

11

|

5.0 x 5.0

|

Panel

|

878347

|

|

4.7

|

32

|

5.0 x 5.0

|

Panel

|

878362

|

|

4.6

|

29

|

5.0 x 5.0

|

Panel

|

878351

|

|

4.5

|

21

|

5.0 x 5.0

|

Panel

|

878620

|

|

4.4

|

26

|

5.0 x 5.0

|

Panel

|

878614

|

|

4.2

|

41

|

1.0 x 1.0

|

Panel

|

878387

|

|

4.1

|

16

|

5.0 x 5.0

|

Panel

|

878381

|

|

3.9

|

31

|

5.0 x 5.0

|

Panel

|

878353

|

|

3.8

|

18

|

5.0 x 5.0

|

Panel

|

878617

|

|

3.8

|

4.6

|

1.0 x 0.5

|

Panel

|

878602

|

|

3.6

|

15

|

5.0 x 5.0

|

Panel

|

878619

|

|

3.5

|

19

|

3.0 x 3.0

|

Panel

|

878359

|

|

3.5

|

19

|

5.0 x 5.0

|

Panel

|

878364

|

|

3.4

|

17

|

3.0 x 3.0

|

Panel

|

878358

|

|

3.3

|

5

|

15.0

|

Representative

|

876847

|

|

3.3

|

8

|

5.0 x 5.0

|

Panel

|

878427

|

|

3.3

|

29

|

3.0 x 3.0

|

Panel

|

878360

|

|

3.1

|

15

|

5.0 x 5.0

|

Panel

|

878621

|

|

3.0

|

23

|

1.0 x 1.0

|

Panel

|

878469

|

|

3.0

|

45

|

1.0 x 1.0

|

Panel

|

878496

|

|

2.9

|

23

|

1.0 x 1.0

|

Panel

|

878605

|

|

2.8

|

13

|

20.0

|

Representative

|

876823

|

|

2.7

|

8

|

5.0 x 5.0

|

Panel

|

878346

|

|

2.7

|

20

|

5.0 x 5.0

|

Panel

|

878361

|

|

2.6

|

30

|

5.0 x 5.0

|

Panel

|

878606

|

|

2.6

|

29

|

5.0 x 5.0

|

Panel

|

878607

|

|

2.5

|

21

|

5.0 x 5.0

|

Panel

|

878610

|

|

2.5

|

15

|

5.0 x 5.0

|

Panel

|

878354

|

|

2.4

|

3

|

5.0 x 5.0

|

Panel

|

878382

|

|

2.4

|

13

|

5.0 x 5.0

|

Panel

|

878345

|

|

2.4

|

14

|

5.0 x 5.0

|

Panel

|

878000

|

|

2.3

|

13

|

1.0 x 1.0

|

Panel

|

878460

|

|

2.3

|

3

|

5.0 x 5.0

|

Panel

|

878424

|

|

2.1

|

6

|

1.0 x 1.0

|

Panel

|

878601

|

|

2.1

|

6

|

1.0 x 1.0

|

Panel

|

878461

|

|

2.0

|

6

|

5.0 x 5.0

|

Panel

|

878419

|

|

2.0

|

21

|

5.0 x 5.0

|

Panel

|

878379

|

|

2.0

|

13

|

5.0 x 5.0

|

Panel

|

878628

|

|

2.0

|

5

|

1.0 x 1.0

|

Panel

|

878551

|

Table 1. Rock

assays >2.0% copper collected from the 3.7-km high-grade zone

(refer to Figure 2 to 8). Max cautions investors that panel and

representative grab sampling can be selective and may not be

representative of mineralization at CESAR.

Max interprets the CONEJO sediment-hosted stratabound

copper-silver mineralization in the Cesar basin to be analogous to

both the Central African Copper Belt (CACB). Almost 50% of the copper

known to exist in sediment-hosted deposits is contained in the

CACB, including Ivanhoe Mines Ltd (TSX: IVN) 95-billion-pound

Kamoa-Kakula copper deposits in the Congo.

Source: Central African Belt Descriptive models,

grade-tonnage relations, and databases for the assessment of

sediment-hosted copper deposits with emphasis on deposits in the

Central Africa Copperbelt, Democratic Republic of the Congo and

Zambia by USGS 2010. Kamoa-Kakula by OreWin March 2020. Max

cautions investors that the presence of copper mineralization of

the Central African Copper Belt are not necessarily indicative of

similar mineralization at CESAR.

QUALITY

ASSURANCE

All CESAR rock chip samples are shipped to ALS Lab's sample

preparation facility in Medellin, Columbia. Sample pulps are then

sent to Lima, Peru, for analysis. All samples are analyzed using

ALS procedure ME-MS41, a four-acid digestion with inductively

coupled plasma finished. Over-limit copper and silver are

determined by ALS procedure OG-62, a four-acid digestion with an

atomic absorption spectroscopy finish. ALS Labs is independent from

Max.

Max uses standard chip and channel sampling where possible,

but also relies on composite grab sampling. Max considers composite

grab samples to be representative but cautions investors that

individual grab samples can be selective and may not be

representative of continuous mineralization at CESAR.

QUALIFIED

PERSON

The Company's disclosure of a technical or scientific nature

in this news release has been reviewed and approved by Tim

Henneberry, P Geo (British Columbia), a member of the Max Resource

Advisory Board, who serves as a qualified person under the

definition of National Instrument 43:101.

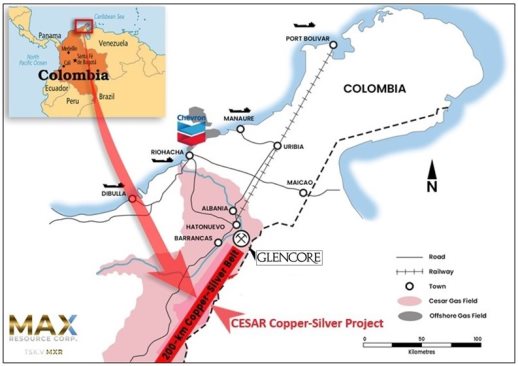

CESAR

COPPER-SILVER PROJECT IN COLOMBIA – OVERVIEW

CESAR lies along the copper-silver rich 200-kilometre-long

Cesar Basin in northeastern Colombia. This region enjoys major

infrastructure resulting from oil & gas and mining operations,

including Cerrejon, the largest coal mine in Latin America, now

held by global miner Glencore (refer to Figures 1 and

5).

Figure 9. CESAR

Project location.

Due to the district-scale and copper-silver prospectivity of

the Cesar Basin, Max has implemented a multi-faceted exploration

program for 2021:

Advanced Drill Core Analysis and Modelling: ongoing

interpretation of seismic sections and analysis of historical drill

holes are all being integrated into our structural modelling of the

Cesar Basin, in collaboration with Ingeniería Geológica Universidad

Nacional de Colombia ("IGUN") in Medellín (January 7, 2021 NR).

Geochemical and Mineralogical: research programs by the

University of Science and Technology ("AGH") of Krakow, Poland. AGH

bring their extensive knowledge of KGHM's world renowned

Kupferschiefer sediment-hosted copper-silver deposits in Poland to

the CESAR project.

Geophysical: Fathom Geophysics is interpreting seismic data,

funded by the Company in collaboration with one of the world's

leading copper producers.

Proprietary Field Exploration & Techniques: Max's

in-country exploration teams continue to target new copper-silver

stratabound mineralized zones.

CESAR North

90-kilometre-long-copper-silver belt:

-

In 2020, Max discovered both the copper-silver rich AMS

(previously named AM South) zone and the AMN (previously named AM

North) zone 40-km north, collectively spanning over 45-km².

Highlight values of 1.0 to 34.4% copper and 5 to 305 g/t silver.

Intervals range 0.5 to 25.0m

-

In March 2021, Max's announced the CONEJO discovery, now

spanning 3.7-km of strike and open in all directions. To date, 13

rock samples returned values greater than 8.0% copper; 53 returned

values greater than 5.0% copper; 93 returned values 2.0% copper and

above; 36 returned values greater than 20 g/t silver over widths

ranging from 0.5 to 20.0m. Highlight values are 12.5 % copper and

126 g/t silver CONEJO (November 3, 2021 NR):

-

12.5% copper + 84 g/t silver over 5.0m by 5.0m

-

10.5% copper + 50 g/t silver over 3.0m by 2.0 m

-

10.4% copper + 95 g/t silver over 5.0m by 5.0m

-

10.2% copper + 62 g/t silver over 5.0m by 5.0m

-

10.0% copper + 80 g/t silver over 5.0m by 5.0m

-

9.9% copper and 50 g/t silver over widths of 2.0m

-

9.3% copper and 126 g/t silver over widths of 2.0m

-

The 2021 URU discovery is located 30-km south of CONEJO, now

expanded to 48-km² and open in all directions. URU appears to have

major-scale potential; Highlight values of 0.5 to

14.8% copper and 5 to 132 g/t silver. Widths range 1.0 to

10.0m (October 7, 2021

NR):

-

14.8% copper and 132 g/t silver outcrop over 1.5m x

0.8m

-

6.5% copper and 6 g/t silver outcrop over widths of

1.0m

-

5.6% copper and 87 g/t silver outcrop over 1.0m by

1.0m

-

4.3% copper and 8 g/t silver outcrop over widths of

10.0m

-

3.9% copper and 7 g/t silver outcrop over widths of

10.0m

-

3.6% copper and 12 g/t silver outcrop over widths of

10.0m

-

3.0% copper and 6 g/t silver outcrop over widths of

10.0m

-

3.0% copper and 37 g/t silver outcrop over widths of

10.0m

-

By late April 2021, at CESAR North 90-km belt MAX had

identified five copper discoveries URU, CONEJO, SP, AMN and

AMS

-

The new SP target reconnaissance composite grab sampling over

a 25.0m outcrop averaging 4.8% copper and 51 g/t silver is

considered very significant (September 7, 2021 NR)

-

Exploration continues on the CONEJO and URU zones

-

In addition, Max has initiated the process of mineral claim

approval

ABOUT MAX

RESOURCE CORP.

Max Resource Corp. is a copper and precious metals

exploration company, engaged in advancing both the newly discovered

district-scale CESAR copper-silver project (100% owned) in Colombia

and the newly acquired RT Gold project (100% earn-in) in Peru. Both

projects have potential for the discovery of large-scale mineral

deposits; both stratabound-type copper-silver in Colombia and

high-grade gold porphyry and massive sulfide in Peru.

Max Resource was awarded a Top 10 Ranked Company in the

Mining Sector on the TSX Venture 50™ for 2021, achieving a market

cap increase of 1,992% and a share price increase of 282% in

2020.

For more information visit: https://www.maxresource.com/

For more information visit: www.tsx.com/venture50

TSX Venture 50™ for 2021 video: MAX Resource Corp.

(TSXV: MXR) - 2021 TSX Venture 50 - YouTube

For additional information contact:

Max Resource Corp.

Tim McNulty

E: info@maxresource.com

T: (604) 290-8100

*The Venture 50 ranking is provided

by TSX Venture Exchange Inc. ("TSXV") for information purposes

only. Neither TMX Group Limited nor any of its

affiliated companies guarantees the completeness of this

information and are not responsible for any errors or omissions in

or any use of, or reliance on, this information. The Venture 50

program is not an invitation to purchase securities listed on TSX

Venture Exchange. TSXV and its affiliates do not endorse or

recommend any of the referenced securities or issuers, and this

information should not be construed as providing any trading,

legal, accounting, tax, investment, business, financial or other

advice and should not be relied on for such purposes"

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release

Except for statements

of historic fact, this news release contains certain

"forward-looking information" within the meaning of applicable

securities law.

Forward-looking

information is frequently characterized by words such as "plan",

"expect", "project", "intend", "believe", "anticipate", "estimate"

and other similar words, or statements that certain events or

conditions "may" or "will" occur.

Forward-looking

statements are based on the opinions and estimates at the date the

statements are made and are subject to a variety of risks and

uncertainties and other factors that could cause actual events or

results to differ materially from those anticipated in the

forward-looking statements including, but not limited to delays or

uncertainties with regulatory approvals, including that of the

TSXV.

There are

uncertainties inherent in forward-looking information, including

factors beyond the Company's control.

There are no

assurances that the commercialization plans for Max Resources Corp.

described in this news release will come into effect on the terms

or time frame described herein.

The Company undertakes

no obligation to update forward-looking information if

circumstances or management's estimates or opinions should change

except as required by law.

The reader is

cautioned not to place undue reliance on forward-looking

statements.

Additional information

identifying risks and uncertainties that could affect financial

results is contained in the Company's filings with Canadian

securities regulators, which filings are available at

www.sedar.com