The August 9th announcement where fantasy sports and online gambling operators DraftKings acquired Golden Nugget Online Gambling has gotten the entire gambling market and stock traders in the segment buzzing. Those that held shares of Golden Nugget enjoyed a 48% spike in the stock price just overnight courtesy of the merger announcement. Furthermore, the deal also entails that Golden Nugget shareholders receive 0.365 shares of DraftKings stock as well. The agreement means that DraftKings will add another 5 million users to its online gambling brands and can easily expand beyond their specialization of sports betting.

As an investor looking for stocks with returns as promising as Golden Nugget in the near future, we have 4 gambling stocks that you should consider swooping up.

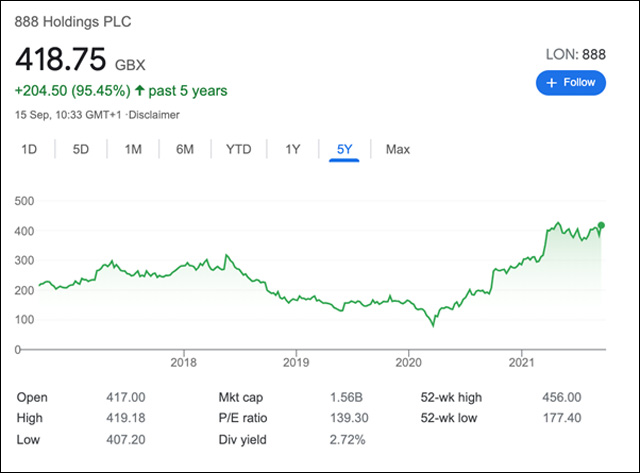

888 Holdings PLC

(LSE:888)

888 Holdings, doing business as 888.com, owns a massive number of leading online gambling brands that include online casinos, online sports book, bingo rooms, poker rooms and more. Currently, the company employs around 1500 people and their reported revenue in the financial year 2020 was US$ 849.7 million. The company headquarters is located in Gibraltar.

888 Holdings is a public company which is listed on the London Stock Exchange and is constituent of the FTSE 250 index. 888 was founded in 1997. Just to give you an idea, the 888-share price in Jan 2016 was around £170 and today, at the time of writing, the stock price is £389.

With recent news breaking just hours ago that 888 has staked $3 billion to buy William Hill and subsidiaries located outside the US, it might just be another Golden Nugget in the making. Considered by many to be the gold standard, 888 now plans their largest listing ever since they went public on the London Stock Exchange almost 20 years ago. Just in 2021, 888 shares have gained 40%.

Penn National Gaming

Penn National Gaming is an American gambling operator based out of Wyoming, Pennsylvania. Currently, they own/lease and operate over 44 land-based gambling parlours/facilities across the United States as well as Canada. Their flagship brand is called Hollywood. They also own 36% stake in American sports digital media company Barstool Sports. Penn National Gaming reported revenue of US$ 3.1 billion in 2017.

Penn National Gaming’s roots date back to 1967 when horse racing with wagering was just made legal. Two separate companies that acted as bookmakers for horse racing were formed in 1968 in order to cater to the exciting new market, and these two companies merged to become Penn National Gaming much later down the line in 1972. Despite their investment in Barstool Sports, as of 2021 start to date, PENN stock is down 17%.

However, the reason to be interested in PENN shares is because the company recently announced that they are going to acquire Score Media and Gambling, a Canadian Sports Betting company, for US$2 billion.

Do you think PENN stocks will shoot up after their take over of Score Media? Could this be the break the company has been seeking to diversify and expand? Time will tell.

Flutter Entertainment

(LSE:FLTR)

The name Flutter Entertainment may not ring a bell, but you would probably immediately recognize it when you find out it was previously known as Paddy Power Betfair plc. Flutter Entertainment was formed when British bookmaking giants Paddy Power and Betfair merged and then took over The Stars Group. The company is publicly traded on the London Stock Exchange as a constituent of the FTSE 100 index.

Founded in Feb. 2016, Flutter Entertainment owns and operates several world-famous gambling brands such as BetEasy, Betfair, FanDuel, Full Tilt Poker, Paddy Power, Pokerstars, Sky Bet, Sportsbet.com.au, Timeform and TVG Network. The group has its headquarters in Dublin, Ireland.

After the 2016 merger, Flutter operates different brands in the UK, Ireland and Italy. They also operate an online betting exchange platform under the Betfair brand. Flutter brands have a good footprint in both retail and online sectors in the US as well as Australia.

The stock is currently down by 7% as of year-to-date. However, instead of looking at this as a setback, it could be the best time to buy while the share prices are at a low. With sports making a come back since the pandemic began, the company is set to profit from the regular sporting calendar. Their most successful and exciting brand at this time is FanDuel which is one of the only real competitors of FanDuel when it comes to online sports betting.

Caesars Entertainment

Caesars is one of the pioneer companies in the world of gambling. They have a rich history dating back to 1937 when the company was founded. Currently, they are arguably the most well established and long standing gambling companies in the world. They own over 50 casinos and hotels and their stock which is listed as CZR on NASDAQ is a great long-term option which is stable and steadily rising. Year-to-date, CZR stock has gained 14%. With the travel, tourism and entertainment sectors bouncing back from the pandemic restrictions, CZR shares might start to soar high very soon.

However, there is reason to believe that they might be selling one of their biggest brands, William Hill, to 888 Holdings plc., in an effort to clear their current $3.5 billion debt.

Hot Features

Hot Features