Key Support Levels: 0.8800, 0.8600, 0.8400

EUR/GBP Price Long-term Trend: Bullish

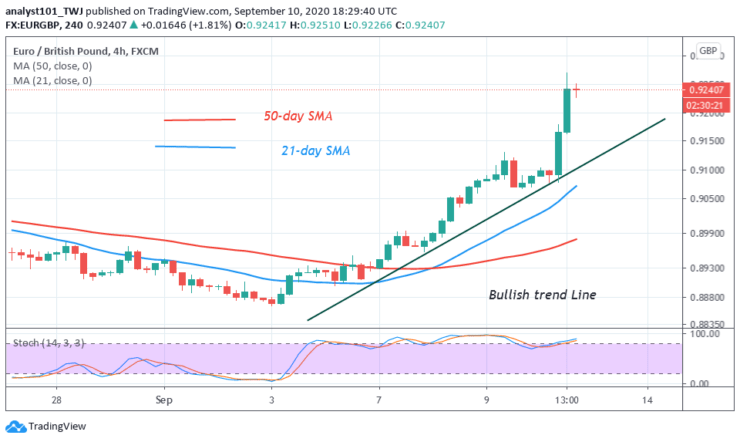

The EUR/GBP pair is on an upward move since September 3. The price has broken level 0.9150 and reached a high of level 0.9250. The price reached the overbought region. Sellers may emerge to push prices downward. In the trend market, an overbought condition may not hold.

Daily Chart Indicators Reading:

The 50-day and 21-day SMAs are sloping upward indicating the uptrend. The pair is at level 71 of the Relative Strength Index period 14. This indicates that price has reached the overbought region.

EUR/GBP Medium-term Trend: Bullish

On the 4-hour chart, the EUR/GBP pair is in an uptrend. The price is breaking the resistance at level 0.9250. A break above level 0.9250 will mean a further upward move.

4-hour Chart Indicators Reading

The 50-day SMA and 21-day SMA are sloping upward. It indicates the present uptrend. The pair is above the 80% range of the daily stochastic. It is in the overbought region of the market. The pair is now in a strong bullish momentum.

General Outlook for EUR/GBP

The EUR/GBP pair is now in an upward move. The pair is likely to move up as the current resistance at 0.9250 has been broken.

Source: https://learn2.trade

Hot Features

Hot Features