As the world takes strides toward embracing renewable energy sources, the enigmatic realm of Bitcoin mining beckons scrutiny. How exactly does Bitcoin power its digital pursuits? In a unique collaboration with HIVE Digital, we embark on a visual journey through data provided by the Cambridge Centre for Alternative Finance and Ember, a visionary energy think tank committed to climate preservation. Together, we dissect the intricate tapestry of Bitcoin’s energy sources, shedding light on its environmental footprint. This inaugural installment marks the beginning of our ‘How Green is Bitcoin?’ series, an exploration into the sustainability of this pioneering cryptocurrency.

Navigating the Bitcoin Landscape: A Global Hashrate Odyssey

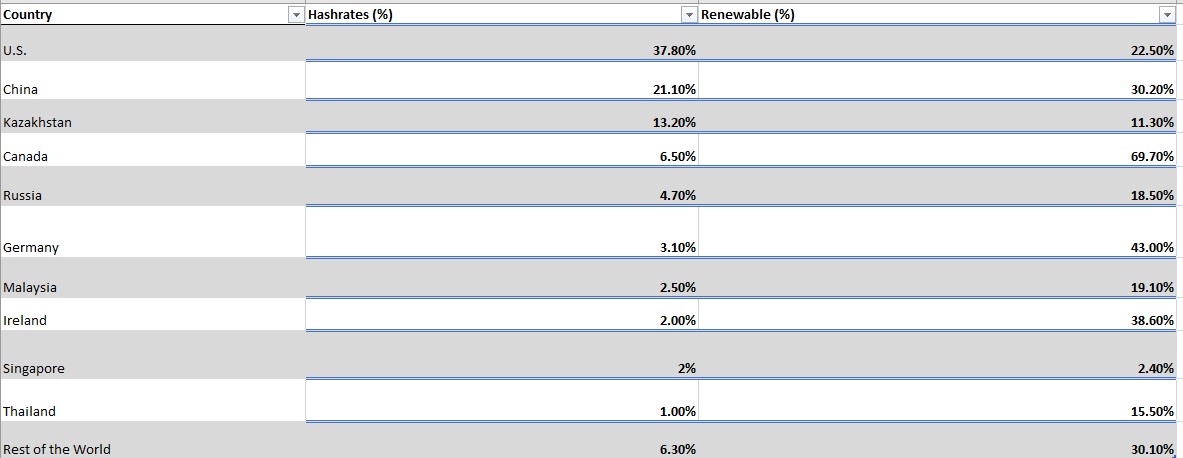

In the vast realm of Bitcoin mining, a select group of nations has firmly established dominance, collectively commanding 93.8% of the network’s computational prowess. At the forefront of this digital frontier are the United States, China, and Kazakhstan, each playing pivotal roles in the network’s operation. As the calendar flipped to 2022, these three powerhouses continued to oversee nearly three-quarters of the Bitcoin network, exemplifying their remarkable influence in this evolving digital ecosystem.

Once a Bitcoin mining behemoth, China ruled with up to 75% of global capacity, but a seismic crackdown in the summer of 2021 left its dominance in ruins, reducing its share to a mere memory in just a couple of months. Many miners embarked on a journey to nearby Kazakhstan, enticed by its affordable electricity, lax regulatory environment, and perceived political stability. The United States also beckoned to some, becoming a new home for those seeking greener pastures. In the aftermath of the chaos, a clandestine mining scene has blossomed in China, carefully concealed from the public eye.

Towards the tail end of the top 10 list, we find Ireland, Singapore, and Thailand, collectively accommodating a modest 4.9% of the network. However, it’s essential to view these figures with a grain of skepticism, as Ireland’s reported share—and similarly for Germany, in the sixth position—is believed to be a substantial overstatement, masking the true locations of miners who have chosen to keep their operations shrouded in secrecy.

Green Energy on the Global Stage

When it comes to the use of renewable energy in Bitcoin mining, a nation-specific breakdown reveals intriguing insights. In the United States, China, and Kazakhstan, renewables accounted for 22.5%, 30.2%, and 11.3%, respectively. To put this in perspective, renewable sources constituted 30% of the world’s electricity production in 2022, a figure that excludes nuclear energy.

Kazakhstan’s relatively meager reliance on renewables can be attributed to its heavy dependence on coal, which accounts for a significant 60% of its energy mix. This reliance is further amplified by the country’s status as a major coal exporter in the Central Asian region. In contrast, China shares a similar reliance on coal, which constitutes 61% of its energy generation. However, the critical difference lies in their proactive expansion of wind and solar power, which bolsters their overall renewable energy share, painting a promising path toward sustainability in this energy-intensive sector.

As the urgent call to combat climate change steers us toward renewable energy solutions, an increasing number of Bitcoin miners are scrutinizing the origins of their power sources. This paradigm shift might explain the notable ascent of Canada in the rankings. With its abundant reserves of hydroelectric power, Canada has quietly climbed from a meager presence of less than one percent in the network in 2019 to a substantial six-and-a-half percent by the close of 2021.

However, it’s essential to keep perspective in mind. Even though top-ranking renewable energy champions like Iceland, Paraguay, and Norway collectively accounted for slightly over one percent of the global network, there remains a vast expanse of untapped potential, beckoning the cryptocurrency industry toward further sustainable growth.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features