For those delving into the world of cryptocurrency, Bitcoin often takes center stage.

Yet, there’s always a toll for direct Bitcoin acquisition, presented in the form of fees. Unfortunately, these costs aren’t uniform across platforms, prompting discerning investors to scout for the most economical options.

Securing a platform with low Bitcoin purchasing fees transcends mere penny-pinching; it’s a strategic move to bolster long-term profitability. Fees wield substantial influence over your bottom line, particularly for investors consistently engaging in transactions over extended periods.

Bitcoin Acquisition Costs

Consider how fees impact an investment horizon spanning two decades.

Navigating various crypto exchanges reveals three primary fee categories: trading, withdrawal, and deposit.

Trading fees, levied per transaction, fluctuate based on platform dynamics and transaction volume. Some exchanges adopt tiered fee structures, granting reduced trading fees to more active traders—an appealing incentive for institutional players, though less consequential for smaller-scale investors.

Withdrawal fees arise when transferring Bitcoin from an exchange to a private wallet. Typically, these fees manifest as fixed amounts of BTC rather than proportional to the transaction value (although exceptions exist).

Deposit fees come into play when injecting liquidity (funds) into your crypto exchange account, be it fiat or crypto. Generally, bank transfers offer a cheaper alternative compared to credit or debit cards, the latter incurring elevated fees owing to processing overheads. Payment method selection significantly impacts Bitcoin acquisition costs, with each avenue accompanied by its fee schedule.

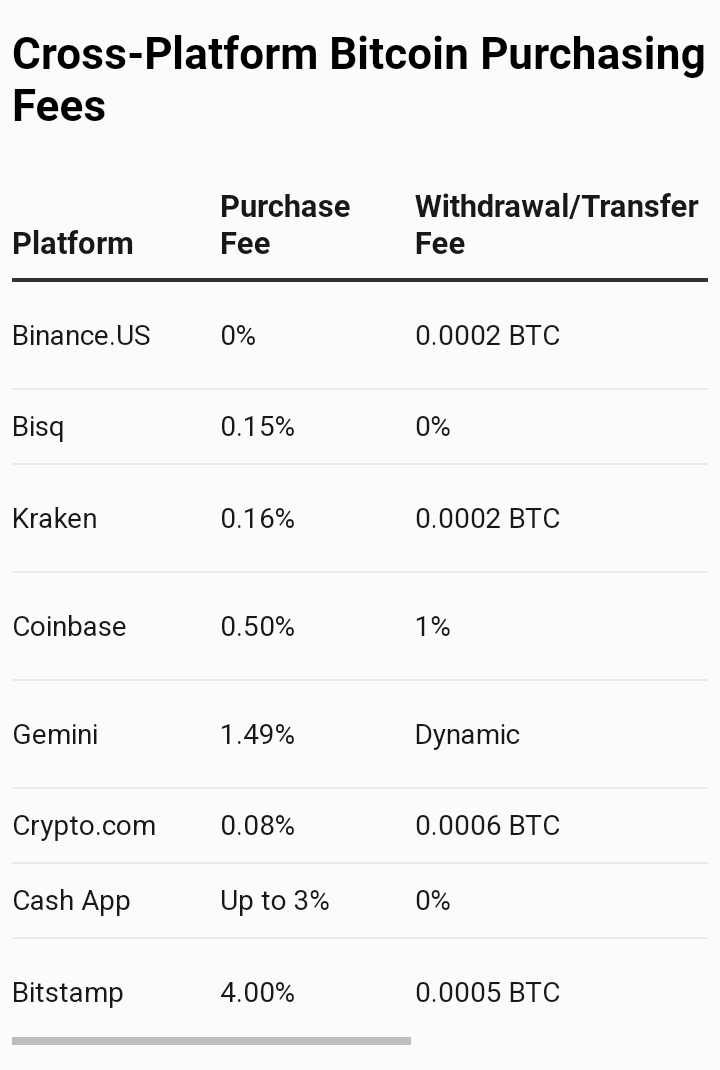

Comparing Fees Across Different Platforms

Reduced fees herald promising prospects for investors, bolstering yields, catering to modest transactions, and streamlining efficient portfolio adjustments. Below, we present snapshots of trading fees across a variety of platforms.

Top Platforms Offering Bitcoin with Competitive Fees

Binance.US

Purchase Fee: $0

Withdrawal/Transfer Fee: 0.0002 BTC

Minimum Purchase: 0.00001 BTC

Binance.US serves as the United States branch of Binance, one of the globe’s largest cryptocurrency exchanges. It implements tiered pricing based on trading volume and crypto pairs. Their Tier 0 category eliminates trading fees, with no prerequisites for minimum trading volume or holdings. Bitcoin resides within its Tier 0 roster of tradable assets and incurs no fees for trading.

Advantages:

1. Bitcoin trades are fee-free.

2. Low withdrawal fees

Disadvantages:

1. Funding accounts are limited to cryptocurrency.

Bisq

Purchase Fee: 0.15%

Withdrawal/Transfer Fee: $0

Minimum Purchase: 0.061 BTC

Bisq stands apart from the centralized exchanges featured in this compilation. Embodying cryptocurrency ideals, it leverages peer-to-peer networks for trading facilitation. Think of it as procuring cryptocurrency akin to transactions on eBay or Craigslist rather than traditional retail outlets.

Due to its decentralized nature, Bisq boasts some of the lowest fees on this list. Transaction fees are pegged at 0.15%, with no minimum withdrawal or transfer charges. However, users must maintain a balance of at least 0.061 bitcoin in their accounts to cover transaction fees and security deposits.

Advantages :

1. A decentralized and community-driven model results in some of the most competitive fees.

2. Robust security measures.

3. Users enjoy a degree of anonymity unmatched elsewhere.

Disadvantages:

1. All transactions necessitate Bitcoin as a starting point.

2. Limited customer support

Kraken

Purchase Fee: 0.16%

Withdrawal/Transfer Fee: 0.0002 BTC

Minimum Purchase: 0.00001 BTC

Kraken caters predominantly to seasoned traders, offering competitive fees for derivatives and high-volume trading.

Kraken implements tiered pricing for its fees. For trade volumes below $50,000, fees commence at 0.16% for makers and 0.26% for takers. Notably, trading fees for margins and futures are notably lower, starting at 0.0200% for makers and 0.0500% for takers.

Advantages:

1. Access to over 100 tradable tokens.

2. Significantly lower fees for margins and futures.

Disadvantages:

1. Unavailable in New York or Washington

2. Higher fees for low trade volumes (below $50,000).

Other Considerations When Acquiring Bitcoin

Before settling on a particular exchange, it’s vital to consider more than just fees.

Aside from transaction expenses, evaluate the platform’s security measures, user interface, customer support, and reputation.

Security features are paramount in the cryptocurrency realm. Two-factor authentication, cold storage solutions, and cutting-edge encryption protocols safeguard your assets.

A sleek and user-friendly interface simplifies trade execution and navigation. Bonus points if the exchange offers a robust mobile app, granting investors access to advanced trading tools without the need for a desktop platform.

Customer support is another pivotal aspect influencing your overall trading experience. Ensure the exchange provides round-the-clock support and ample channels for assistance.

Conclusion

Fees can swiftly erode profits, regardless of their size. Opt for reputable exchanges with minimal purchase and withdrawal fees. Exchanges committed to cost-efficiency can also attract a larger user base, potentially driving down fees over time in response to increased volume.

When selecting a platform to buy Bitcoin, remember that fees represent just one facet of the equation. Prioritize trustworthiness, longevity, customer support, and security.

Learn from market wizards: Books to take your trading to the next level.

Hot Features

Hot Features