Every time you buy, sell, or transfer crypto, a small fee is paid. These fees can be a gold mine of information, potentially revealing a project’s true growth and potential. Since rising fees can hint at lucrative investment opportunities, here is a compiled list of the top crypto companies raking in the most transaction fees. Dive in and discover which projects are seeing the most activity and, potentially, the most success!

Ethereum

Think of Ethereum as a “world computer” for running shared applications. Users pay transaction fees, known as gas fees, to use the network. The busier the network, the more fees it generates.

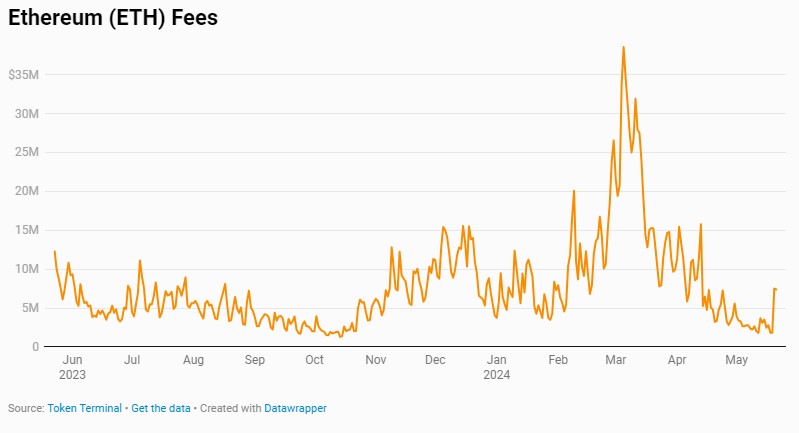

As illustrated in the chart below, Ethereum fees have remained relatively stable over the past year, except in March 2024, when Ethereum completed its Dencun upgrade.

Gas fees can skyrocket due to network congestion, especially during major events. This is why Layer-2 solutions are gaining traction—they offload some work to alternate blockchains, which then record transactions on Ethereum more cost-effectively.

In the long run, Layer-2 solutions benefit Ethereum by reducing fees and speeding up transactions, though they do consume some of Ethereum’s fee revenue.

Tron

Tron, the Ethereum challenger, boasts a decentralized network humming with smart contracts and dApps. Unlike flat fees, Tron charges users based on “energy,” “bandwidth,” and transaction type, tailoring costs to individual needs. February 2024 saw Tron’s fee revenue reach a scorching $1.8 million, fueled by a clever tactic: regular token-burning events. Here’s the twist: a chunk of these fees goes towards buying back and burning TRX tokens, permanently removing them from circulation. This “burning” act reduces overall supply, potentially pushing the value of remaining TRX tokens higher. It’s a win-win for Tron, generating revenue while strategically influencing the value of its native currency.

Bitcoin

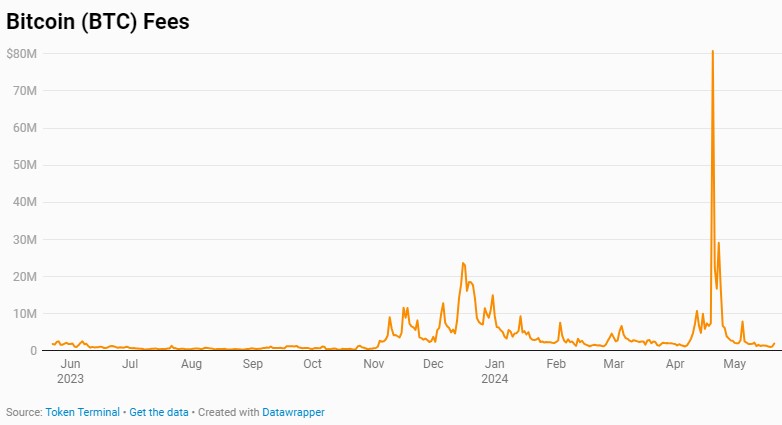

The origin of crypto, Bitcoin, takes a unique approach to fees. Measured in “satoshis” (the smallest Bitcoin sliver) per byte, fees depend on transaction size and competition for space in a block. Think of it as a bidding war: miners prioritize transactions with higher fees, incentivizing them to secure the network. Our graph below reveals a wild ride for Bitcoin fees in March and April 2024. April 20th saw a record high of $128 per transaction, coinciding with two major events: the Bitcoin halving (reducing new coin creation) and the launch of Runes, a new token protocol. However, the Runes craze fizzled out quickly, leading to a dramatic drop in fees the following month. This tale highlights the dynamic nature of Bitcoin fees, influenced by both network activity and innovative projects on the blockchain.

Lido Finance

Lido Finance tackles the complexities of Ethereum staking, offering a user-friendly platform for anyone to earn rewards. Forget locking up your ETH for months—Lido’s innovative liquid staking solution lets you participate while keeping your crypto readily available. There’s a small catch, though: a flat 10% fee gets split between the network’s operators and Lido’s community treasury. This fee can be adjusted through a democratic process, ensuring transparency and community control. While fees have remained steady over the past year, there were temporary bumps in March–April 2024 as the Lido token’s value skyrocketed. The biggest spikes, however, occurred in March and May 2023, when the long-awaited ETH withdrawal feature became available, leading to a flurry of activity.

Uniswap

Uniswap cuts the middleman, enabling peer-to-peer crypto trading through a network of virtual vaults called liquidity pools. These pools brim with digital assets, managed by automated market makers to ensure smooth trade execution. To keep the engine running, Uniswap collects a small fee on every transaction, a portion of which goes back to liquidity providers who keep the pools stocked. In April 2024, Uniswap strategically raised its fees from 0.15% to 0.25%, aiming to secure a war chest for potential legal battles and fuel ongoing development, ensuring its continued reign as a decentralized exchange leader.

The Health of Crypto Projects: The Fee Factor

Forget price charts; transaction fees are the new crystal ball for crypto investors. These tiny tolls collected with every buy, sell, or transfer act as a pulse check for a project’s health. High fees signal strong demand and user engagement, a sweet spot for any crypto venture. Furthermore, projects raking in hefty fees demonstrate financial stability, boasting a reliable income stream to fuel growth. So, ditch the guesswork and delve into our list of the top fee-generating crypto companies. This data-driven approach empowers you to identify potentially undervalued gems and make smarter investment decisions.

Hot Features

Hot Features