Ethereum has emerged as the undisputed king of proof-of-stake blockchains. With a staggering $111 billion worth of ether staked as of July 2024, nearly 28% of the total ETH supply is locked up to secure the network. While this substantial “security budget” is essential for protecting Ethereum from attacks, it has also led to unexpected challenges.

The allure of staking rewards, coupled with the convenience of liquid staking solutions, has driven a surge in staking participation that has exceeded developers’ projections. This rapid growth has prompted discussions about potential adjustments to the network’s issuance policies.

This report delves into the intricacies of Ethereum staking, examining the types of stakers, the associated risks and rewards, and the implications of the growing staking rate. We will also explore proposed changes to Ethereum’s issuance model as developers grapple with this unprecedented staking phenomenon.

Different Types of Ethereum Stakers

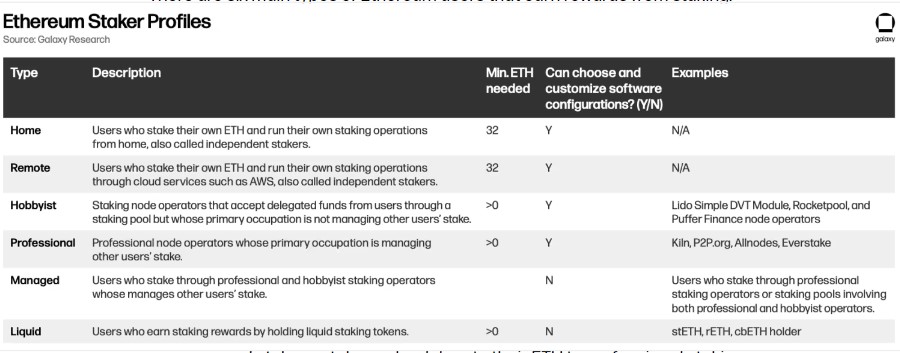

The Ethereum staking ecosystem is composed of diverse actors, each playing a distinct role in securing the network. This section categorizes these participants and explores their relative influence on the staking landscape.

Source: https://www.galaxy.com/

While the majority of ETH is staked through managed services, professional staking node operators hold the lion’s share of staked assets. However, the emergence of liquid staking protocols has significantly reshaped the industry, introducing intermediary entities that facilitate staking for a wider audience.

It’s crucial to recognize the pivotal role of liquid staking platforms like Lido, which dominate the market. Understanding the mechanics and risks associated with these platforms is essential for navigating the complexities of Ethereum staking.

The Risks of Ethereum Staking

Staking on Ethereum offers potential rewards but also carries inherent risks depending on the method chosen.

Direct staking provides maximum control but involves technical challenges and risks like downtime penalties and slashing, which can result in significant ETH loss. Delegated staking is more hands-off but introduces counterparty risk and technological vulnerabilities.

Liquid staking offers liquidity but adds complexity and risks, including the potential for de-pegging, where the value of the liquid staking token diverges from the underlying ETH.

Additionally, regulatory uncertainty, especially for delegated and liquid staking, poses compliance challenges. The Ethereum protocol also imposes penalties for various infractions, from minor offline penalties to severe slashing events impacting a validator’s entire stake. Understanding these risks is crucial for making informed staking decisions.

Staking Rewards

Ethereum stakers are compensated through newly minted ETH, transaction fees, and Maximal Extractable Value (MEV). Historically, rewards have averaged around 4% APY but are decreasing. The increase in validators dilutes issuance rewards, as more ETH locked in staking reduces the share of newly minted coins for each validator. Declining on-chain activity has also decreased transaction fees and MEV opportunities.

MEV, contributing about 20% of overall rewards, has become significant, though its exact calculation is debated due to its overlap with transaction fees. Despite these challenges, staking remains attractive, but stakers must stay aware of the evolving Ethereum ecosystem dynamics.

Projecting the Staking Rate

Given the relentless growth of Ethereum staking over the past two years, it’s reasonable to anticipate a staking rate surpassing 30% by the end of 2024. However, this rapid expansion has profound implications for staker rewards. The dilution of issuance rewards as more ETH is locked up becomes increasingly pronounced.

Liquid staking platforms have accelerated this trend by offering seamless access to staking benefits. The demand for these platforms can create imbalances between the value of liquid staking tokens and the underlying staked ETH, leading to temporary premiums. Conversely, the process of on-boarding new validators onto the Ethereum network is subject to significant delays, as only a limited number of validators can be added per epoch. This bottleneck could hinder the pace of staking growth, potentially extending the time required to reach a 50% staking rate to over a year.

While recent data suggests a slight cooling in staking demand, the long-term outlook remains bullish. Factors such as restaking, increased DeFi activity, and evolving regulatory landscapes are expected to reignite interest in Ethereum staking.

Conclusion: A Dynamic Staking Landscape

Ethereum’s shift to a proof-of-stake model has revolutionized network participation. Since the Beacon Chain’s inception, the staking ecosystem has rapidly evolved, marked by milestones like the Merge and the enabling of withdrawals. These developments have expanded staker opportunities, but the landscape remains fluid, with ongoing protocol changes affecting validator dynamics and reward structures. This necessitates a vigilant approach to staking due to shifting risks and rewards.

The interplay between stakers, exchanges, and infrastructure providers has created a complex ecosystem. As Ethereum matures, balancing the interests of these diverse stakeholders will become increasingly critical. The staking economy on Ethereum is still in its infancy, and its full potential and challenges will become clearer as the network evolves.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features