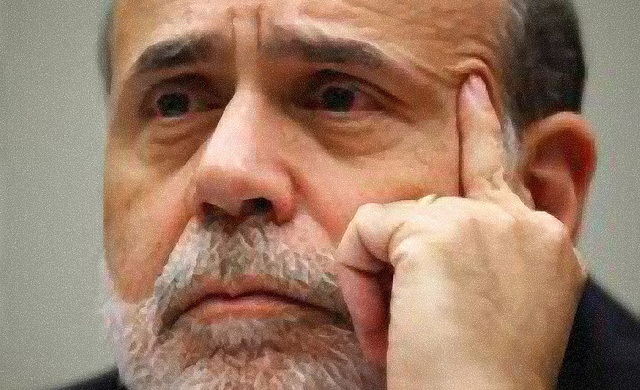

Has Bernanke done us a favour?

By

Clem Chambers

PUBLISHED:

Sep 17 2012 @ 06:37

|

Comments (2)

|

More info about Clem Chambers

Much against the run of play my portfolio is now up over 26% so far this year.

Since I didn’t start rebuilding before October I’m happy to take 25% as this year’s profit, which of course is extremely good. However, this is what I get year in and out. The cycle of the years tends to be75,40,25, 15 out for a year, but I’m just trying to get 25%.

This year’s return highlights a few investment basics:

- Stick to your idea if nothing disproves it.

- Your profits come quickly and often unexpectedly.

- Long term investing works.

- You can’t pick the bottom and you can’t get the top.

I’m out of Pace and I noticed a stupid RNS from them saying a discussion with BT isn’t going to materially affect things. It’s a poor sign when a management suppresses what is a fairly low share price. It should not be for them to tell the market what it should think; it’s for them to get on with the business.

My friend Bernanke has done us all a favour with QE3. He is pumping money into our portfolios. What a nice guy! It will all end in gnashing of teeth but if you see that coming you can doge that bullet when it comes in 2014-15.

CLICK HERE TO REGISTER FOR FREE ON ADVFN, the world's leading stocks and shares information website, provides the private investor with all the latest high-tech trading tools and includes live price data streaming, stock quotes and the option to access 'Level 2' data on all of the world's key exchanges (LSE, NYSE, NASDAQ, Euronext etc).

This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Plc. ADVFN Plc does not monitor, approve, endorse or exert editorial control over these articles and does not therefore accept responsibility for or make any warranties in connection with or recommend that you or any third party rely on such information. The information available at ADVFN.com is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Authors may or may not have positions in stocks that they are discussing but it should be considered very likely that their opinions are aligned with their trading and that they hold positions in companies, forex, commodities and other instruments they discuss.

Hot Features

Hot Features

I have been browsing on-line greater than three hours today, yet I by no means found any interesting article like yours. It is pretty price sufficient for me. In my view, if all site owners and bloggers made excellent content material as you did, the web will be a lot more helpful than ever before.

Thanks shareyt, thats appreciated.