The latest round of talks between Britain and the European Union over a future trading relationship kicks off tomorrow with both sides, in effect, urging the other to “get real”.

Reports suggest both sides are deadlocked on key issues, although informed sources suggested there could be “wriggle room” allowing London and Brussels to reach a compromise.

London financial markets certainly seemed to be looking on the bright side, with the blue-chip FTSE 100 index up 1.33% in early trading to stand at 6,157.58 and the FTSE 250, the more domestically-focussed index, 1.60% higher at 17,315.88.

FTSE100

Fishing and courts are key issues

This was part of a wider trend across Europe, with stocks higher in Amsterdam, Paris and Madrid. Frankfurt markets were closed for the Whit Monday bank holiday.

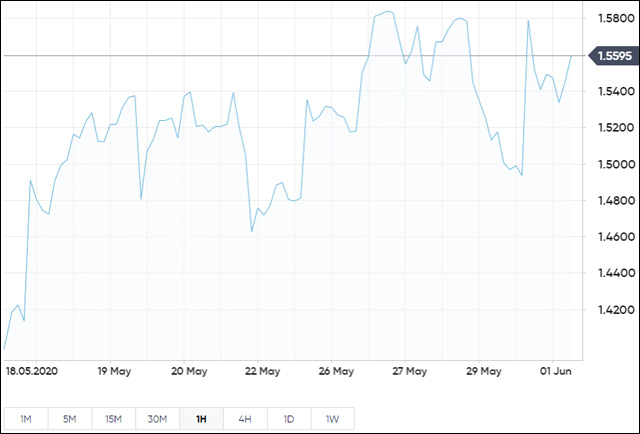

Sterling was up against major reserve currencies. It traded 0.20% higher against the euro at €1.1144 and was 0.05% up against the yen, at 133.205 yen. In dollar terms, it was 0.40% higher at $1.2400.

The looming resumption of UK-EU talks coincides with today’s loosening of some of the restrictions imposed on Britain’s economy and society as a result of the coronavirus epidemic. This, in turn, may bring parts of business and industry out of the deep freeze and revive consumer spending and commercial investment.

As before, the talks will be conducted via video-link, with Michel Barnier leading for the European Commission and David Frost for the UK. Three of the major stumbling blocks to have emerged are UK acceptance of EU regulations when exporting into the single market; EU insistence on an oversight role for European judges, and continued access to UK fishing grounds for EU vessels.

A clash of philosophies

Mr Barnier says it would be unfair for Britain to be given access to the European market unless it is competing on a level playing field with the other 27 countries. Britain’s response is that the UK did not leave the EU on 31 January in order to stay bound to its rules, nor to take instructions from its judges.

Fishing, despite being a relatively small industry in Britain, is a hugely emotive topic, given accusations that the then government “sold out” the trawlermen when negotiating UK entry in the early Seventies. This has strong resonance in a country with a long maritime tradition.

The gulf between the two sides is, in part, a result of different views of the nature of trade between countries. For the EU, it is a process requiring safeguards and rules in order to stop any one party gaining a competitive advantage. The classic English economic tradition has long held that free trade is a process in which everyone can win and which requires little by way of regulation, although no British government has pursued such a policy in its purest form since the early part of the 20th Century.

Hot Features

Hot Features