The FX Reserves; which is the money or other assets held by a central bank or other monetary authorities has deteriorated to $117.3 Billion in December 2016 from $118.2 Billion in November 2016 in the United States. In other words, the FX Reserves in the US averaged $534.3 Billion from 1957 until 2016. The all-time high US FX Reserves were in September 2012, with $153.7 Billion.

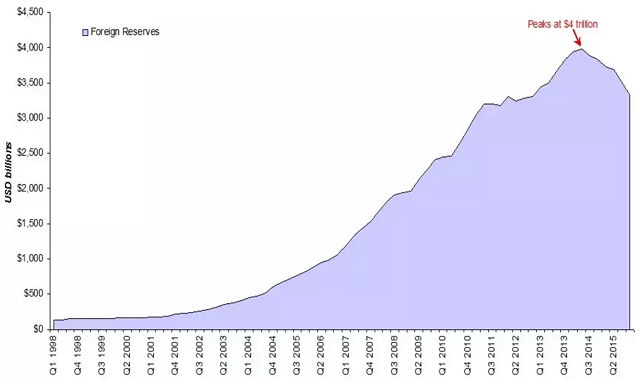

For China FX Reserves, we can say that their reserves have been enormous and it was mainly due to the result of accretion of many years of positive BOP (Balance of Payment). The last quarter of 2013 was the peak point of China FX Reserves at $4 trillion and started to stumble since. Their reserves fell below $3 trillion for the first time in 7 years. In 2015, it fell by $513 billion and in 2016 by $320 billion.

How did China manage to maintain a positive BOP all those years?

Simple-

1. The foreign direct investment

2. Development of China’s export sector

3. Trade surpluses and repression of a financial nature

4. The Chinese community loving to speculate

Can China use its reserves to create an impact on the value of the US dollar?

For us to see a huge impact on the value of the US dollar, China should use a big chunk of its reserves but they also won’t be able to do that; as they need to hold massive amounts of foreign reserve assets. Many people often mistake the FX reserves being high as a sign of strength. If the RMB becomes a powerful reserve currency, signifying a higher level of economic influence, China’s FX reserve balance will presumably be lower than where it is today; like the US: the most powerful economy in the world, holding only $116 billion.

Hot Features

Hot Features