U.S. stocks took a breather last week, registering so-called “sideway movements”. Thanksgiving Day has not pushed the U.S. President to decline the Hong Kong bill but helped stock markets to finish the week on a positive note in terms of volatility and new record highs. One of the main reasons is good U.S. data including a positive revision in economic growth in the third quarter and better than expected earnings season.

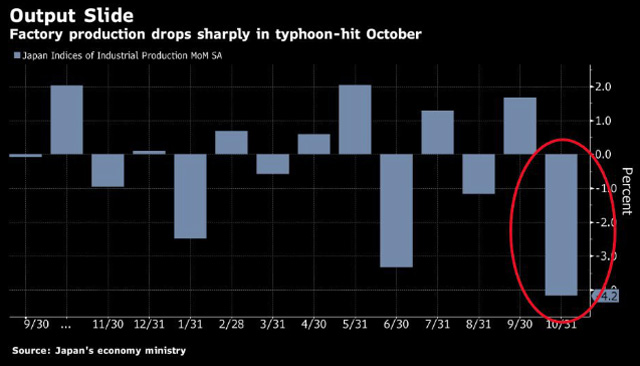

However, not every country was so lucky. For example, Japan’s factory output posted the largest fall in almost two years. Japan’s jobless rate, in turn, stayed at 2.4% in October, unchanged from the previous month, as well as job availability. Thus, the data may and will affect the Japanese Yen.

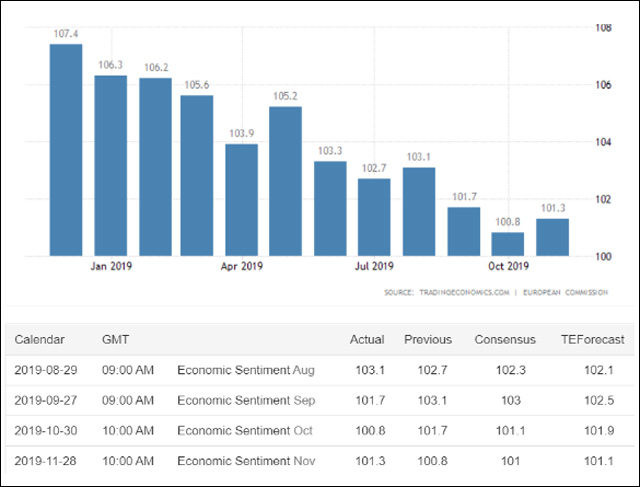

Nevertheless, according to European Commission, the Eurozone economic sentiment indicator rose 0.5 points from a month earlier to 101.3 in November 2019, beating market expectations of 101.0, boosted by improved confidence among manufacturers (-9.2 vs -9.5 in October), consumers (-7.2 vs -7.6), service providers (9.3 vs 9.0) and retailers (-0.2 vs -0.9). Meanwhile, morale among constructors deteriorated (3.1 vs 4.4). Economic Optimism Index in the Euro Area averaged 100.82 from 1985 until 2019, reaching an all time high of 118.10 in May of 2000 and a record low of 68.30 in March of 2009.

In terms of companies, Saudi Aramco’s IPO has reached total bids of 166 billion Saudi riyals (the equivalent of $44,3 billion) both from institutional and retail investors. It is worth reminding that the Saudi government expects to raise at least $25 billion by selling a 1,5% stake in the company at a valuation of around $1,7 trillion. In this context, we might see another increase in the oil price.

Can-Fite BioPharma, a biotechnology company advancing a pipeline of proprietary small molecule drugs that address cancer, liver, and inflammatory diseases, surged over 60% after reporting Q3 results and disclosing that it reached an agreement with the FDA on Phase III liver cancer study design during Q3. Besides, they entered into strategic agreement with Univo Pharmaceuticals to develop cannabinoid-based pharmaceuticals and assays.

In the case of currencies, the won weakened after the Bank of Korea kept the policy rate unchanged. The Chilean peso set a record low. In the past two months, the dollar rose against the Chilean peso for almost 20%. The scariest thing is that the same story is happening to almost all the currencies of Latin America.

Next week’s major macroeconomic reports

Monday

- ECB President Lagarde Testifies at European Parliament

- RBC Canadian Manufacturing PMI (NOV)

- ISM Employment (NOV) – In the case of a strong divergence with expectations, markets can see a significant movement

- ISM Manufacturing (NOV) – Once again, ISM tends to be one of the biggest market moving economic releases.

- Markit Mexico PMI Mfg (NOV) – the previous number was above 50 (growth point), so it is crucial to see how the data have changed. It may also influence on the trade negotiations between Mexico and the U.S.

Tuesday

- JPY Monetary Base (YoY) (NOV) –it can indicate the future direction of inflation. Remember that Japan raised the national sales tax from 8% to 10% on October 1, something that is already negatively affecting the Japanese economy due to a slump in exports and production and as other factors drag on the consumer sector. According to the latest data, Japan’s retail sales saw the deepest slump since 2015 as tax hike hits demand.

- RBA Cash Rate Target (DEC 3)

- Markit/CIPS UK Construction PMI (NOV)

- Unit Labor Costs (YoY) (2Q)

Wednesday

- Australian Gross Domestic Product (YoY) (3Q)

- Caixin China PMI Composite (NOV)

- Caixin China PMI Services (NOV)

- US MBA Mortgage Applications (NOV 29)

- Bank of Canada Rate Decision (DEC 4)

- US ISM Non-Manufacturing/Services Composite (NOV)

Thursday

- RBNZ Announces Bank Capital Review Decisions

- German Factory Orders n.s.a. (YoY) (OCT)

- Markit Germany Construction PMI (NOV)

- USA Initial Jobless Claims (NOV 30)

- USA Trade Balance (OCT)

Friday

- JPY Labor Cash Earnings (YoY) (OCT)

- CAD Net Change in Employment (NOV)

- USD Change in Non-farm Payrolls (NOV)

- USD U. of Mich. Sentiment (DEC P)

Hot Features

Hot Features