Crucial events of the last week

- Prime Minister Boris Johnson and his Conservative Party win in the UK elections

- The United States and China reached phase one trade agreement

- Central banks left rates unchanged, with the Fed signaling no rate change is expected in 2020

- United States-Mexico-Canada Agreement was reached

Macro data of the week

- S. import prices rose 0.2 percent in November

- The price index for U.S. exports rose 0.2 percent in November following a 0.1-percent drop in October and a 0.3-percent decrease in September. Higher agricultural prices led the November increase. Overall export prices declined 1.3 percent over the past year; price decreases for nonagricultural exports more than offset rising agricultural prices.

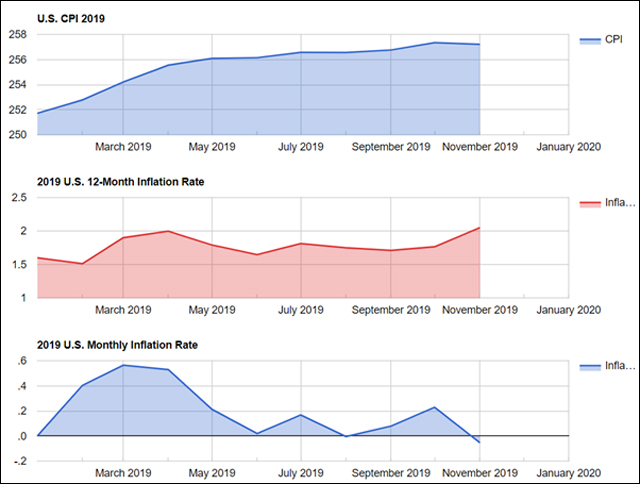

- The Consumer price index increased 0.3% last month as households paid more for gasoline. The CPI advanced 0.4% in October. In the 12 months through November, the CPI rose 2.1% after gaining 1.8% in October.

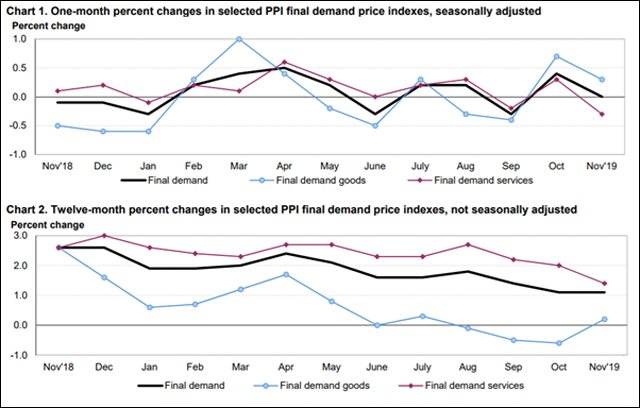

- The Producer Price Index for final demand was unchanged in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices increased 0.4 percent in October and fell 0.3 percent in September. On an unadjusted basis, the final demand index advanced 1.1 percent for the 12 months ended in November.

- Retail sales increased only 0.2% in November and holiday sales only increased 0.1%

- Canadian Building Permits m/m Actual -1.5% (Forecast 2.9%, Previous -6.5%, Revision -5.9%)

Last week’s market performance snapshot

Events, releases, speeches to follow this week

- Purchasing Managers’ Indices (PMI) data from Australia, Japan, the Eurozone, UK, and US.

- Two bank meetings to pay attention to: Bank of Japan and Bank of England.

- Industrial Production data from China, together with Fixed Asset Investment and Retail Sales YoY

- RBA Monetary Policy Meeting Minutes and Employment Change from Australia

- Average Earnings Index, Jobless Claims, CPI and other inflation measures, and Retail Sales and BoE rate decision from the UK.

- CPI and Retail Sales from Canada

- The latest Housing Starts, Building Permits, Industrial Production, JOLTS Job Openings and IBD/TIPP Economic Optimism from the US. In addition, we will know Final GDP, Core PCE Price Index, Personal Spending and Personal Income.

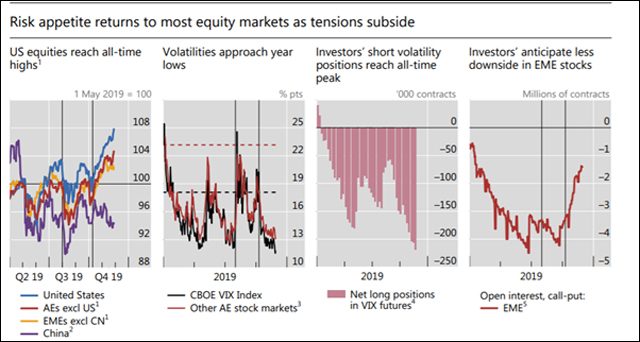

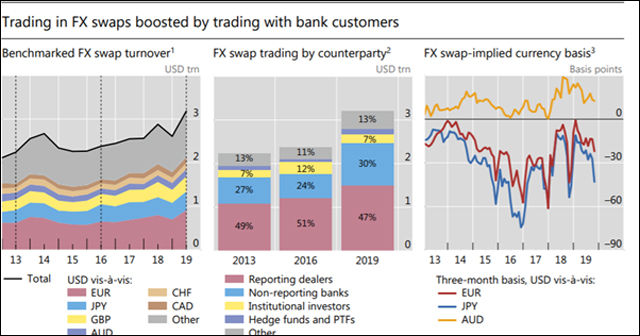

FYI: International banking and financial market developments quarterly review (December 2019)

Hot Features

Hot Features