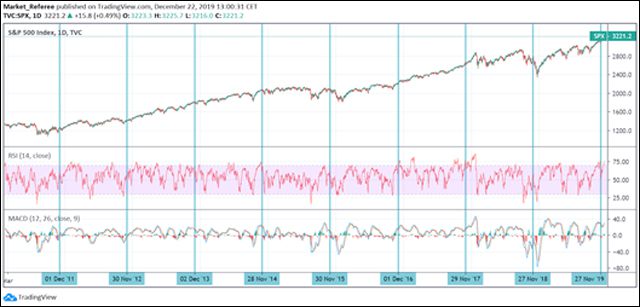

Despite the House’s impeachment of President Trump, which in reality did little to detract from broader economic optimism, the last week was marked by the continuation of positive/bullish trends not only in the U.S. but also in European equity markets. However, it was to be expected for two reasons: as we learned in 1998, markets do not care about Impeachment and, historically, December was the month of bulls as, over the past 59 years, the SPX suffered declines in the final month of the year only 16 times.

Now, investors just hope that the recent progress on Brexit, U.S.-China and USMCA trade agreements will reduce negative sentiment, by diminishing headwinds to global growth.

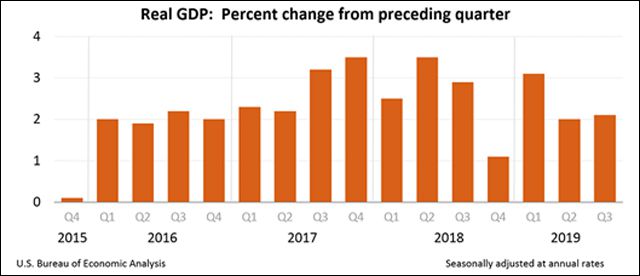

In this context, it is important to mention the recent Bureau of Economic Analysis report by the U.S Department of Commerce, which suggests that the economy is slowly recovering.

- Real gross domestic income (GDI) increased 2.1 percent in the third quarter, compared with an increase of 0.9 percent in the second quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 2.1 percent in the third quarter, compared with an increase of 1.4 percent in the second quarter.

- Current-dollar GDP increased 3.8 percent, or $202.3 billion, in the third quarter to a level of $21.54 trillion. In the second quarter, GDP increased by 4.7 percent, or $241.4 billion.

- The price index for gross domestic purchases increased 1.4 percent in the third quarter, compared with an increase of 2.2 percent in the second quarter. The PCE price index increased 1.5 percent, compared with an increase of 2.4 percent. Excluding food and energy prices, the PCE price index increased 2.1 percent, compared with an increase of 1.9 percent.

Nevertheless, in terms of corporate profits, the situation was not as straightforward.

- Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) decreased $4.7 billion in the third quarter, in contrast to an increase of $75.8 billion in the second quarter (table 10).

- Profits of domestic financial corporations decreased $4.7 billion in the third quarter, in contrast to an increase of $2.5 billion in the second quarter. Profits of domestic nonfinancial corporations decreased $5.5 billion, in contrast to an increase of $34.7 billion. Rest-of-the-world profits increased $5.5 billion, compared with an increase of $38.7 billion. In the third quarter, receipts decreased $10.0 billion, and payments decreased $15.5 billion.

Recent key economic releases

- The Manufacturing PMI ticked down to 52.5 in December’s preliminary reading from 52.6 in November and came in below the market expectation of 52.5

- Consumer spending increased 0.4% m/o/m.

- Personal income rose 0.5% m/o/m, above prior increases.

- Housing starts came in better than expected at 1.365M.

- Industrial production rose 1.1% m/o/m, above expectations.

- Consumer sentiment hits 99.3 for December, above expectations.

- Same-store sales rose 4.6% w/o/w, below last month.

- Existing home sales fell from 5.440M to 5.350M.

- PMI Composite came in at 52.2 for December, below expectations.

- Jobless claims fell 18k w/o/w from 252k to 234k.

- Home mortgage apps fell 2.0% w/o/w, below a prior decrease of 0.4%.

The previous week in the markets

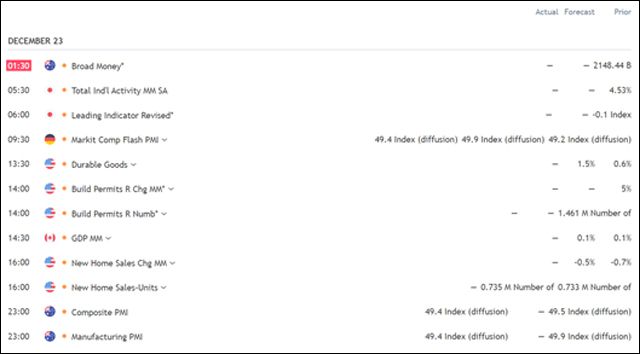

It will be a relatively quiet week for economic data, even though we find it important to highlight the most important macro releases.

On Monday, we will know New Home Sales data from the U.S. and GDP for October from Canada.

On Tuesday, durable goods orders and the Richmond Fed Manufacturing Index will be released.

Finally, on Thursday, we will know the latest unemployment rate and industrial production data from Japan.

Hot Features

Hot Features