When it just seemed that things were going smoothly, global financial markets were hit by the Coronavirus fears. There is no doubt that sooner or later a vaccine will be released, however, until then, companies will continue losing money, whilst countries their growth momentum.

Europe

In fact, Europe and its major economies already publish disappointing economic data, with France and Italy literally shrinking last quarter. New data revealed the Eurozone’s economy gained just 0,1% last quarter – whereas investors were expecting at least 0,2%. In the case of France, the reason for the poor economic data is quite obvious – endless protests and strikes.

French Finance Minister Bruno Le Maire even blamed the pension protests for the slowdown. Analysts at British bank Barclays instead believe that this is likely to be a one-off, thus remaining confident in cautiously optimistic outlook.

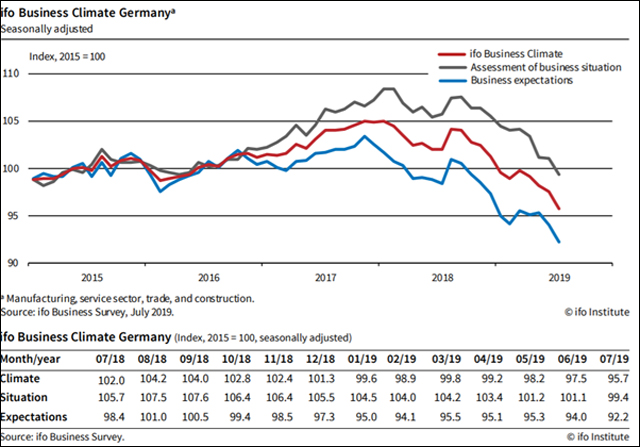

Another European country that disappointed investors was Germany. The ifo Business Climate Index fell in July from 97.5 (Revised value due to seasonal adjustment) to 95.7 points. Companies were less satisfied with their current business situation and are also looking ahead with increased skepticism. The German economy is navigating troubled waters.

Spain was the only country to register some improvement in terms of economic growth, but even that was it weakest since 2014. In this context, may investors believe that the weak data might encourage Europe’s Central Bank to cut interest rates, and that is despite increasing inflation.

U.S.

In the U.S., we also got a couple of crucial news and events:

- The U.S. economy grew 2,3% last year. Despite some enthusiasm on the part of investors, the number is still below 2018’s 2,9% increase. The future is also not very optimistic: growth is forecast to slow to just 1,8%…Nevertheless, the Federal Reserve left its interest rate target unchanged, as expected, mentioning the desire to return to the 2% inflation target. Interest rate on excess reserves hiked by 5bps to 1.60% Vs 1.55%. Reverse repo rate, in turn, was lifted to 1.5% from 1.45%. Besides that, FED stated that it would continue Treasury bill purchases at least into the second quarter, as well as overnight repurchase operations at least through April.

- Some key yield curves also re-inverted, reflecting the growing fears of a deflationary economic slowdown. To be more precise, the 3-month/10-year treasury curve reinverted for the first time since early October.

- On the side of energy markets, S. energy firms reduced the number of oilrigs operating for the first time in three weeks as producers follow through on plans to slash spending on new drilling for a second consecutive year in 2020. According to Baker Hughes Co, drillers cut one oilrig in the week to Jan. 31, bringing the total count down to 675. Interesting fact: in the same week a year ago, there were 847 active rigs.

China

This week the World Health Organization declared the Wuhan coronavirus outbreak a public health emergency of international concern. Tens of companies entered lockdown mode amid new fears, including hotels, restaurants, the car industry, manufacturers, multinational corporations and fast-food chains. Without any doubt, it will have a direct effect on the global economy.

Some people already believe that this whole situation will likely push China to step up stimulus. “We expect Beijing to introduce a raft of measures to provide liquidity and credit support for the economy,” said Ting Lu, chief China economist at Nomura, said in an email to CNBC.

“However, we don’t think these (monetary and fiscal policy) measures would turn the economy around in the near term, as the virus outbreak may further weaken domestic demand and thus render the upcoming policy easing less effective,” he added.

The previous week in the markets

Energy futures

Currency Indices

On Monday, we will know the ISM Manufacturing Index for January (in case of a positive scenario we might see a bullish sign for equities) and Construction Spending for December.

On Tuesday, Factory Orders for December will be released.

On Wednesday, ADP Employment Change for January together with International Trade (Trade Balance) for December will be published.

On Thursday, we will pay attention to Initial Jobless Claims and Productivity and Costs for Q4.

On Friday, Monthly Employment Reports for January, ISM Services Index for January and Wholesale Inventories for December will be provided.

Hot Features

Hot Features