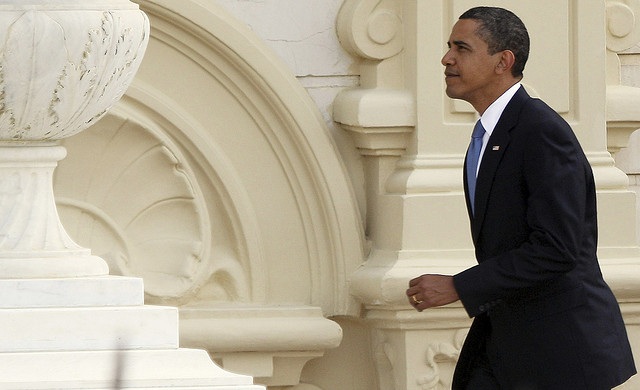

Fiscal cliff talks between US President Barack Obama and Republican House speaker John Boehner, have been continuing both sides have said. With the end of year deadline looming, both parties are under pressure to ensure an agreement is reached.

Deep spending cuts and tax rises due to take effect on 1 January, threaten to halt US and global economic growth. Christine Lagarde, head of the International Monetary Fund, warned of the negative global impact if US lawmakers are not able to agree to a deal.

White House press secretary, Jay Carney, told reporters the President believed a deal could be reached to avert the fiscal cliff, but criticised Republicans for not offering a detailed plan on new revenue. Carney said “While there has been encouraging statements from individual lawmakers about the realisation that rates will go up on the top 2 per cent, we haven’t seen anything specific from Republicans with regard to that”.

A spokesman for Mr Boehner said “The Republican offer made last week remains the Republican offer, and we continue to wait for the President to identify the spending cuts he’s willing to make as part of the balanced approach he promised the American people”. The Republican offer would aim to collect $800bn in revenue by closing tax loopholes and deductions. It would also reduce government spending by $1.4tn, raising from 65 to 67 the age of eligibility for Medicare.

President Obama in a Michigan speech on Monday evening, attempted to raise support for his plans to raise taxes on the rich, whilst also extending tax cuts for middle class families. The US President promised spending cuts, but didn’t mention any specific areas. Mr Obama said “That’s the bare minimum we should be doing in order to grow the economy. But we can do more . I understand people have a lot of different views, and I’m willing to compromise a little bit”.

Markets were also awaiting definitive news regarding the fiscal cliff. David Bianco, US equity strategist at Deutsche Bank, said: “Averting the cliff before Christmas will probably rally the S&P 500 to 1500 by year-end or early January, provided the 2013 fiscal drag does not exceed 1.5 per cent and is not mostly tax hikes”.

The most likely outcome according to some analysts is a one year extension for tax cuts. Geoff Krueger, an analyst at Guggenheim Partners, said “Congress is likely to pass a one-year extension of the tax cuts for the middle class”.

Hot Features

Hot Features