The chairman of Glencore (LSE: GLEN) and Genel Energy (LSE: GENL) has defended his firm’s current strategy to reduce greenhouse gas emissions following intense criticism from climate activists.

Tony Hayward, who rose to international prominence as the CEO of BP during the Deepwater Horizon oil spill, rebuffed criticism that miners such as Glencore are not doing enough to reduce emissions, stating: “I don’t want to get into a debate about semantics between projections and targets.

Flencore PLC

“The projection we have made is a direct consequence of the capital allocation we are making and I think it’s much more robust than the so-called targets that other people have out there.”

Earlier in May, Norway’s $1trn (£810bn, €900bn) wealth fund blacklisted Glencore and Anglo American, along with a number of smaller miners, citing their continued role in the production and use of coal.

While coal power still supplies almost a quarter of the world’s primary energy and two-fifths of global electricity, pressure from the green lobby and a series of Western governments has mounted on miners to gradually end their coal operations.

With Glencore’s annual general meeting set for 2 June, the company’s senior leadership are currently attempting to calm the tumult triggered by the Norwegian Government Pension Fund Global’s divestiture announcement.

As the ‘Oil Fund’ holds around 1.5 per cent of globally listed shares and is closely followed by both institutional and retail investors, there are fears that its decision could just be the start of a longer-term exodus.

Hayward himself is under pressure ahead of the meeting, with shareholders advisor Pensions & Investment Research Consultants (Pirc) actively opposing his re-election as chairman due to his leadership of BP during the Deepwater Horizon crisis of 2010.

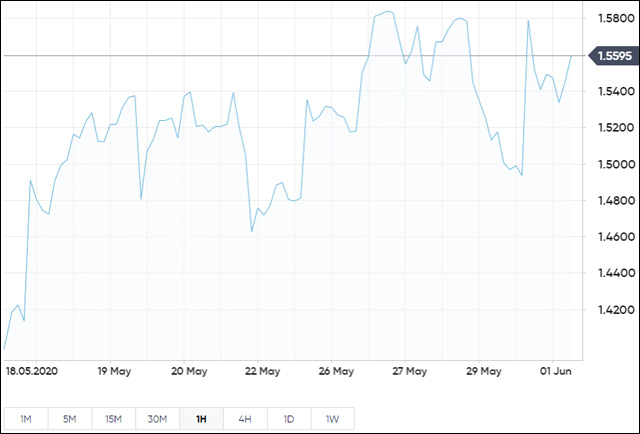

By late-morning trading, Glencore stock stands down 3.37 per cent at 151.94 pence, having fallen over 35 per cent in the year to date.

Hot Features

Hot Features