Ever since the Fed started tightening monetary policy in December 2015, expectations of a resurgence in banking stocks took root. Such activity is to be expected. Consider that the federal funds rate (FFR) has been raised multiple times since the devastation caused by the global financial crisis. Today, the federal funds rate stands at 1.25% – 1.50%. The value of this economic indicator – the interest rate – is significant for the US economy and the global economy. The Federal Reserve Bank – the chief monetary authority of the US – is tasked with maintaining price stability and full employment. To achieve its objectives, the Fed has set an inflation rate target of 2%.

The US economy is currently on track in that regard, and that’s precisely why we are seeing interest rate increases with growing alacrity. According to the CME Group FedWatch tool, the probability of an interest rate hike on March 21, 2018 is currently sitting at 83.1%. This indicates that the likelihood of a 25-basis point rate hike is high, and further monetary tightening is coming sooner rather than later. The next time the Fed FOMC and the Fed chair meets will be Wednesday, 21 March 2018. At that time, the Fed chair and the Federal Open Market Committee will have their say on the direction of monetary tightening. There is a strong possibility that rates are going to rise in March.

What Impact Will Rate Hikes Have on Bank Stocks and the Broader US Economy?

Interest rate hikes have the effect of removing excess money from circulation. Every time the Fed hikes rates, the interest-related expense on lines of credit increases. Companies that are listed on the Dow Jones, the NASDAQ, the S&P 500, the New York Stock Exchange will then have to pay more money in interest on their outstanding loans and lines of credit. This reduces their profitability, and also makes them less attractive to investors. There is another component of interest rate hikes that impacts listed companies: customers have lower levels of disposable income which leads to lower levels of spending on the goods and services of listed companies. For these reasons, rate hikes are not good for most components of the financial market.

Olsson Capital trading expert Nathaniel Burns believes that traders need to understand the correlation between bank stocks and interest rates. ‘There is an exception to the rule however, and it comes in the form of banking and financial stocks. Since banks are in the business of lending money, it stands to reason that they will be generating higher levels of profit when interest rates rise. Bank of America (BAC) is possibly one of the best exponents of the interest rate impact on banking and financial stocks.’

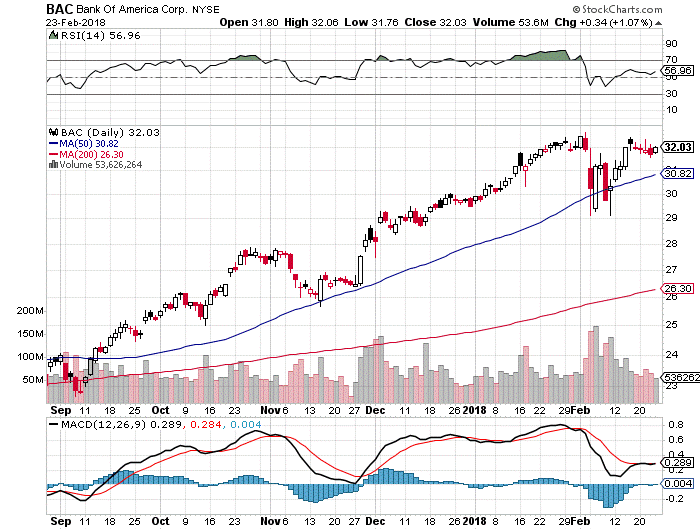

The above graphic indicates the nearly uninterrupted ascent of BAC over time. Note that Bank of America Corporation stock is currently trading at $32.03 per share, above its 50-day moving average of $30.82 per share, and significantly higher than its 200-day moving average of $26.30 per share. These are reflective of bullish price movements with this banking stock. If another interest rate is implemented in March, May, June, August, September, November, or December 2018, we can expect bank and financial stocks like BAC, WFC, C, MS, Visa, MasterCard to rally uninterrupted. While the performance of BAC has been exemplary over time, the same cannot be said of other companies like WFC which has been plagued by scandal over time. Nonetheless, the trend for this category of equities is bullish for 2018. The safe money is on call options, or outright purchases of stocks as a long-term, viable investment strategy.

Hot Features

Hot Features